Overview

Home equity loans offer a lump sum with fixed interest rates and predictable monthly payments. This makes them suitable for substantial one-time expenses, providing a sense of security when planning for large financial needs. On the other hand, HELOCs present a revolving line of credit with variable interest rates, allowing for flexible borrowing as needed. This flexibility can be invaluable when unexpected expenses arise.

We know how challenging it can be to navigate these options. The article highlights the distinctions between these two choices by detailing their respective advantages and disadvantages. It emphasizes the importance of understanding your financial goals and maintaining discipline when choosing between the two. By doing so, you can make a decision that truly aligns with your needs and aspirations.

Ultimately, we’re here to support you every step of the way as you consider your options. Understanding the nuances of home equity loans and HELOCs can empower you to take control of your financial future.

Introduction

Navigating the landscape of home financing can feel overwhelming, especially when trying to grasp the differences between home equity loans and home equity lines of credit (HELOCs). We understand how challenging this can be. These financial tools provide homeowners with unique opportunities to tap into their property’s value for various purposes, such as renovations, education, or unexpected expenses.

However, the decision between a lump sum payment and a revolving line of credit brings important considerations to the forefront. Homeowners must think about budgeting, interest rates, and their long-term financial strategies.

What factors should you keep in mind to make the most informed choice for your financial future? We’re here to support you every step of the way.

Define Home Equity Loans and HELOCs

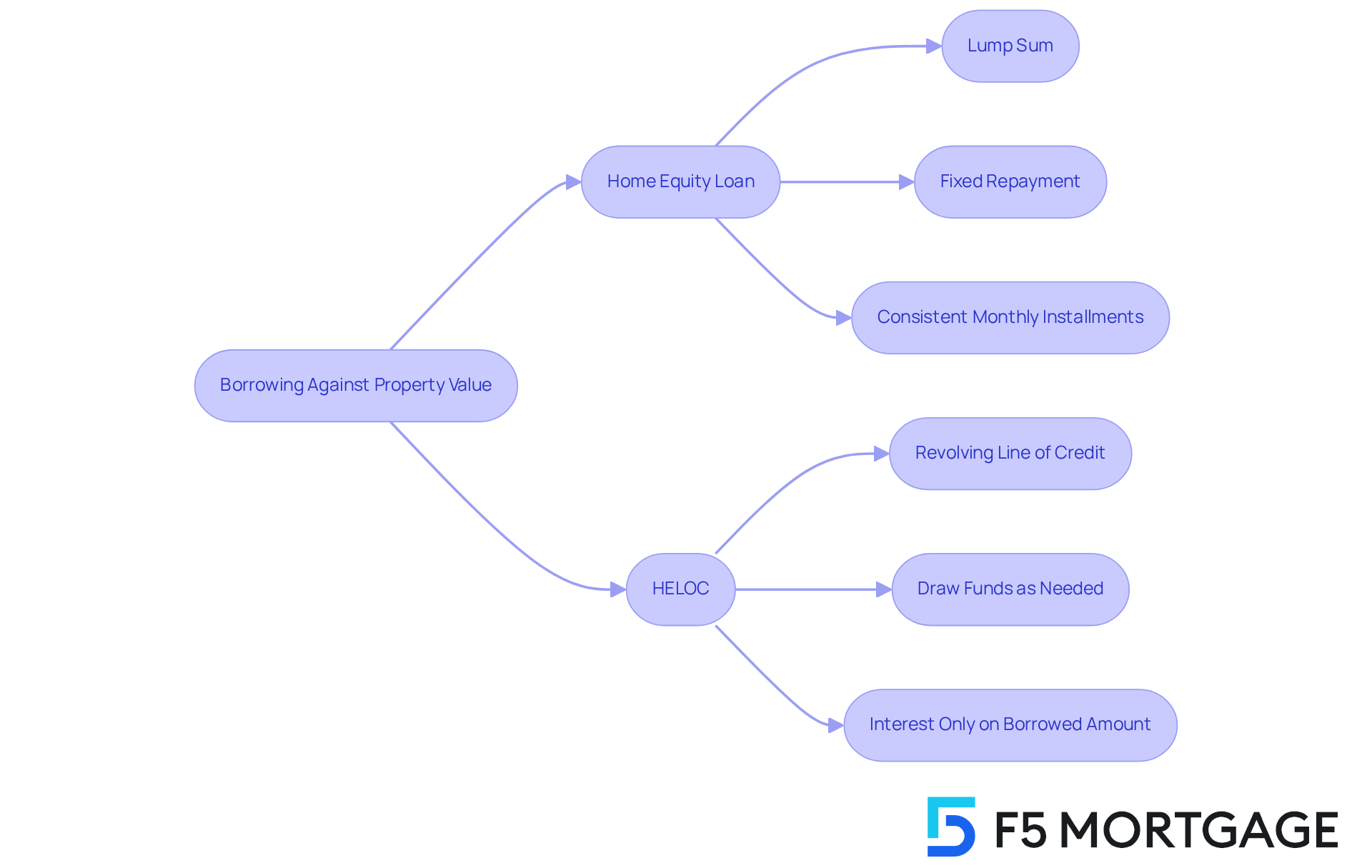

A property value loan is a type of loan that allows homeowners to borrow against the value of their residence. This option provides a lump sum, which is repaid over a set period through consistent monthly installments. We understand how important it is to have access to cash, especially during the refinancing process. This can be a valuable resource for homeowners looking to fund renovations or cover other expenses.

On the other hand, the difference between home equity loan and HELOC offers a different approach. It functions as a revolving line of credit, enabling homeowners to borrow against their property value as needed—much like using a credit card. Borrowers can draw funds up to a predetermined limit and only pay interest on the amount borrowed during the draw period, which usually lasts several years.

Understanding the difference between home equity loan and HELOC is crucial when evaluating refinancing. We know how challenging this can be, and understanding these choices can help maximize your property value while enhancing your financial flexibility. Remember, we’re here to support you every step of the way as you navigate these important decisions.

Compare Key Features of Home Equity Loans and HELOCs

-

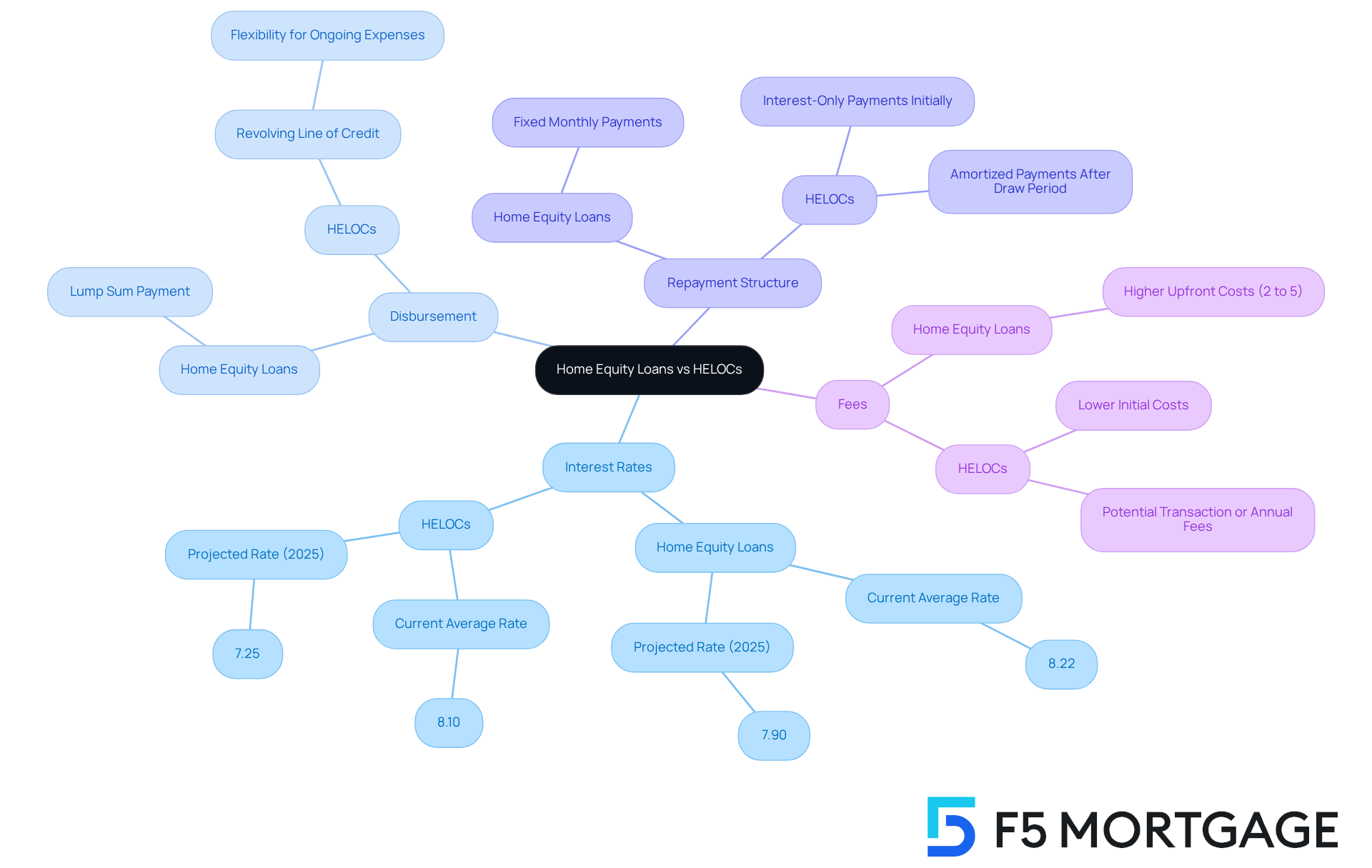

Interest Rates: We understand that navigating financing options can be daunting. The difference between home equity loan and HELOC is that home collateral financing typically features fixed interest rates, providing the comfort of consistency in your monthly payments. On the other hand, HELOCs often come with variable rates that can change over time, potentially increasing your costs if rates rise. As we look ahead to 2025, the average rate for home collateral financing is projected to be around 7.90%, while HELOCs are expected to average 7.25%. Currently, the average HELOC rate stands at 8.10%, reflecting recent market fluctuations.

-

Disbursement: When it comes to immediate financial needs, home collateral funding can be a lifeline, offering a lump sum payment at closing. This makes it ideal for large, urgent expenses. The difference between home equity loan and HELOC is that HELOCs act as a revolving line of credit, giving homeowners the flexibility to borrow as needed. For instance, a homeowner might tap into a HELOC to support ongoing expenses like a child’s college education, allowing for a more manageable approach to financial planning over time.

-

Repayment Structure: We know that budgeting can be a challenge. The difference between home equity loan and HELOC is that home value financing requires fixed monthly payments, ensuring a reliable repayment schedule. However, HELOCs may offer the option for interest-only payments during the initial draw period, which can then transition into principal and interest payments. After this draw period ends, the financing is amortized over roughly 20 years, which might complicate budgeting for some borrowers.

-

Fees: Understanding the costs involved is crucial. Home value loans often come with higher upfront costs, including closing charges that can range from 2% to 5% of the loan amount. Conversely, while HELOCs may present lower initial costs, they could incur fees for accessing funds, such as transaction or annual fees, which can add to the overall expense of borrowing. We’re here to support you every step of the way in making the best choice for your financial future.

Evaluate Pros and Cons of Home Equity Loans and HELOCs

Home Equity Loans:

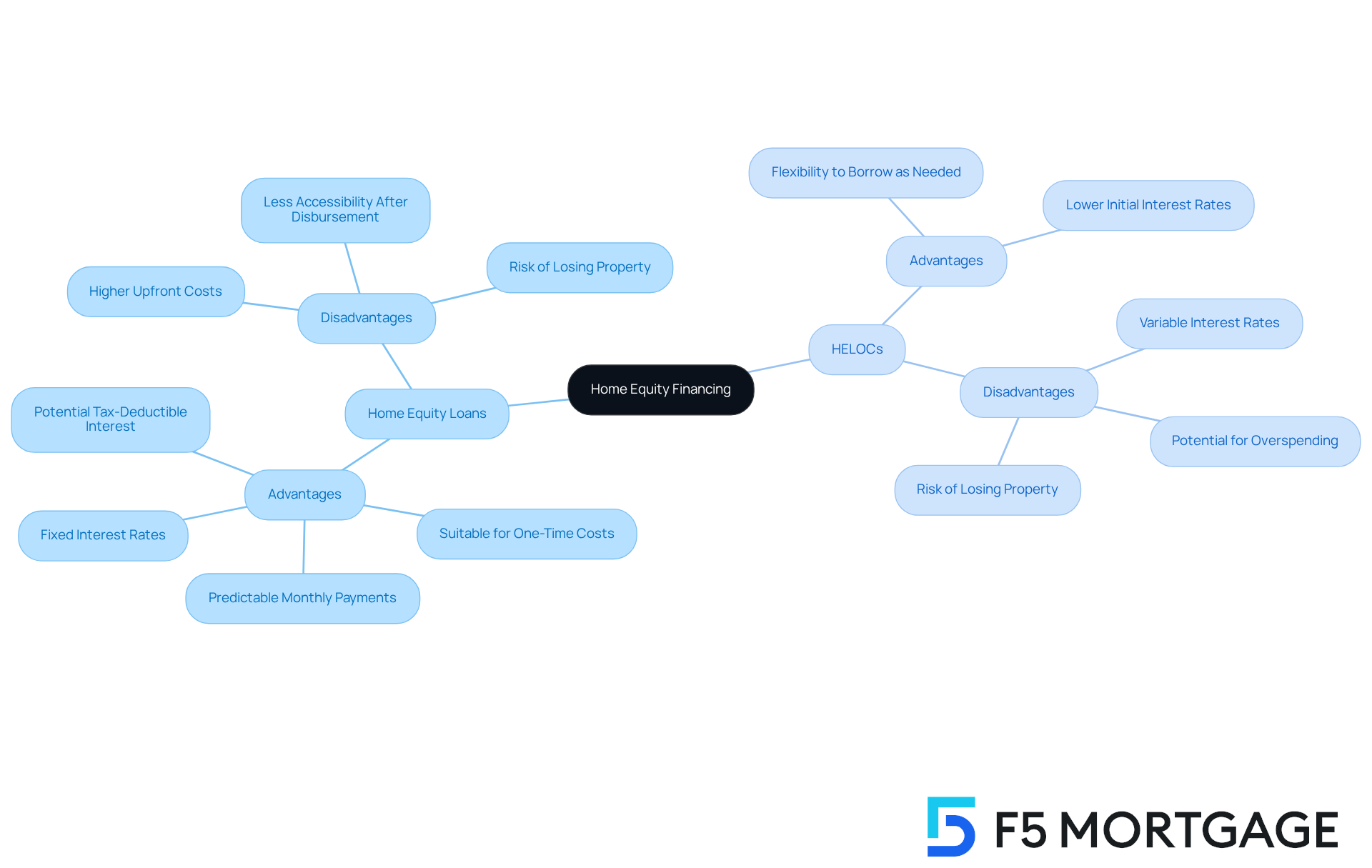

Advantages:

- Fixed interest rates ensure predictable monthly payments, making budgeting easier for families.

- They are perfect for substantial, one-time costs like property renovations, enabling homeowners to utilize their equity efficiently.

- Additionally, interest payments might be tax-deductible if used for home enhancements, offering potential economic benefits.

Disadvantages:

- However, these loans typically come with higher upfront costs and closing fees, which can range from 2% to 5% of the loan amount.

- Once the funds are disbursed, they become less accessible, limiting flexibility for future financial needs.

HELOCs:

Advantages:

- HELOCs offer the flexibility to borrow as needed, making them suitable for ongoing expenses like home improvements or unexpected costs.

- They usually provide reduced initial interest rates compared to property value borrowing, making them an appealing choice for short-term financing.

Disadvantages:

- On the downside, interest rates are variable, which can lead to fluctuating monthly payments and complicate budgeting.

- The ease of access to funds may encourage overspending, potentially leading to financial strain if not managed carefully.

As we look ahead to 2025, the typical initial expenses for property value loans are expected to remain higher than those for HELOCs. This highlights the distinct frameworks and objectives of these financial products. Understanding the difference between home equity loan and HELOC is essential for homeowners who aim to make informed choices about utilizing their residential value.

It’s important to remember that both residential collateralized financing options and HELOCs carry the risk of losing property if payments are missed. A strong credit score is typically necessary to qualify for secured financing. We know how challenging this can be, and we’re here to support you every step of the way.

Guide to Choosing Between Home Equity Loans and HELOCs

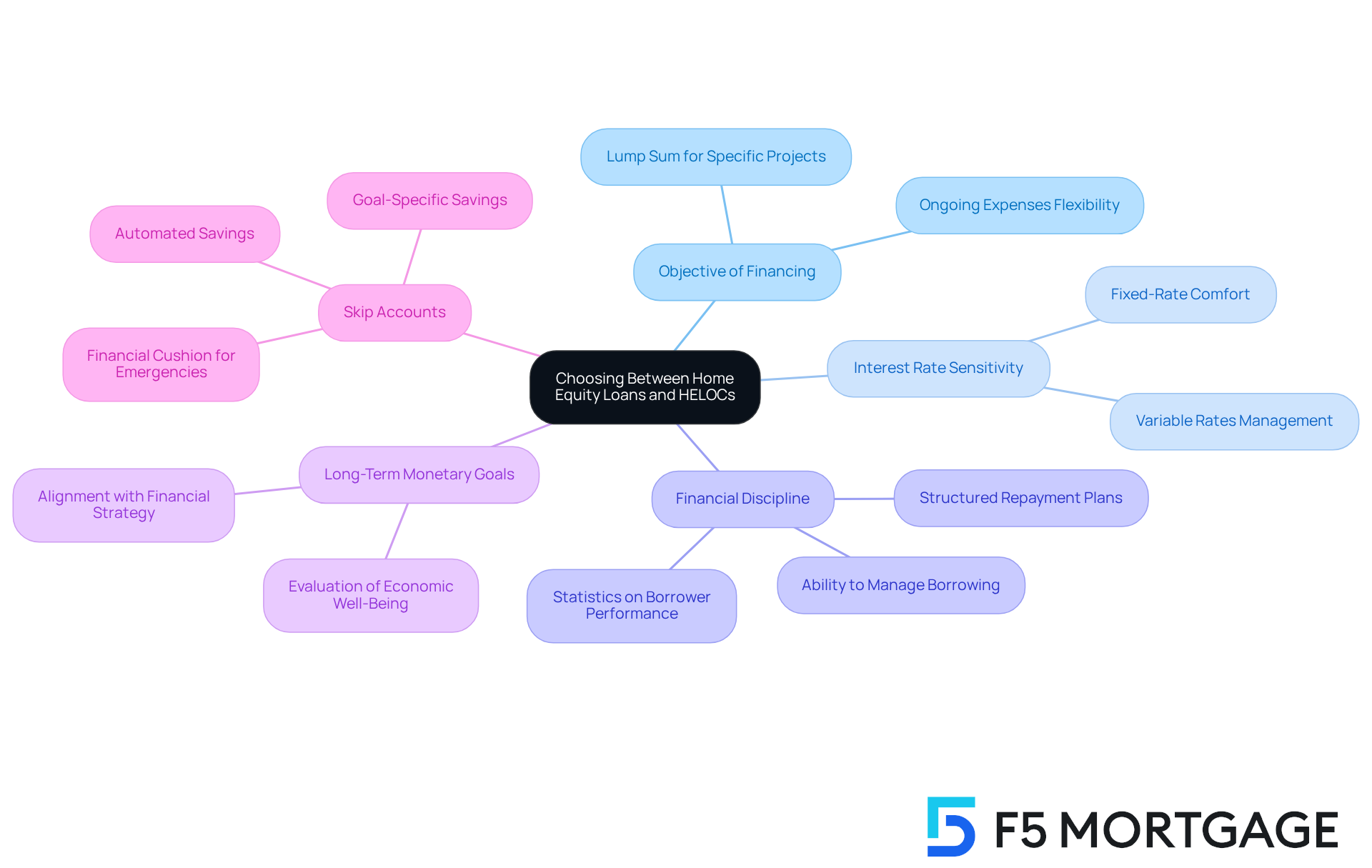

When deciding between a home equity loan and a HELOC, it’s important to consider a few key factors that can impact your financial journey:

-

Objective of the Financing: Are you looking for a lump sum to tackle a specific project? A property-backed financing option might be the right fit for you. On the other hand, if you have ongoing expenses, a HELOC offers the flexibility you need. We understand how crucial it is to evaluate the intended use of the funds to ensure they align with your monetary objectives.

-

Interest Rate Sensitivity: If you prefer the comfort of consistent payments, a fixed-rate property financing option is ideal. However, if you’re open to managing variable rates, a HELOC might save you money initially. We know that understanding your comfort level with interest rate fluctuations is vital in making this decision.

-

Financial Discipline: Think about your ability to manage borrowing. If you’re concerned about overspending, knowing the difference between home equity loan and HELOC can help you find a more structured repayment plan. Statistics show that borrowers with solid monetary discipline tend to perform better with HELOCs, as they can effectively handle variable payments and avoid excessive debt. Real-life examples illustrate that individuals who establish clear budgets and stick to them can successfully utilize HELOCs for substantial economic advantages.

-

Long-Term Monetary Goals: It’s essential to align your choice with your long-term monetary strategy, considering how you plan to use the funds and your repayment capabilities. Monetary advisors emphasize the significance of evaluating your overall economic well-being and future objectives before making a choice.

Additionally, incorporating strategies like skip accounts can help you manage your finances effectively when considering home equity loans or HELOCs. These accounts allow for disciplined saving and can provide a financial cushion for unexpected expenses, enhancing your overall financial wellness. Remember, we’re here to support you every step of the way as you navigate these important decisions.

Conclusion

Understanding the distinction between home equity loans and HELOCs is essential for homeowners looking to leverage their property value effectively. We know how challenging this can be, and both options offer unique benefits and drawbacks. It’s crucial to choose the one that aligns with your individual financial goals and circumstances. By recognizing the specific characteristics of each, you can make informed decisions that enhance your financial flexibility and support your long-term objectives.

In this article, we’ve explored the key features of home equity loans and HELOCs, including their interest rates, disbursement methods, repayment structures, and associated fees. Home equity loans provide a lump sum with fixed payments, making them ideal for significant expenses. On the other hand, HELOCs offer a revolving line of credit, allowing for flexible borrowing as needed. Each option presents its own set of advantages and disadvantages, emphasizing the importance of evaluating your personal financial situation and preferences when making a choice.

Ultimately, the decision between a home equity loan and a HELOC should be guided by a clear understanding of your financial goals, comfort with interest rate fluctuations, and the ability to manage borrowing responsibly. By carefully considering these factors, you can navigate the complexities of these financing options and make choices that will bolster your financial well-being. Taking the time to assess all aspects of home equity financing can lead to significant benefits, ensuring that the right choice is made for a secure financial future.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a type of loan that allows homeowners to borrow against the value of their residence, providing a lump sum that is repaid over a set period through consistent monthly installments.

What is a HELOC?

A HELOC, or Home Equity Line of Credit, is a revolving line of credit that enables homeowners to borrow against their property value as needed, similar to using a credit card. Borrowers can draw funds up to a predetermined limit and only pay interest on the amount borrowed during the draw period.

How does a home equity loan differ from a HELOC?

The main difference is that a home equity loan provides a lump sum that is repaid in fixed monthly installments, while a HELOC allows for borrowing as needed with interest paid only on the amount borrowed during the draw period.

What are the typical uses for home equity loans and HELOCs?

Home equity loans and HELOCs can be valuable resources for homeowners looking to fund renovations or cover other expenses.

Why is it important to understand the differences between a home equity loan and a HELOC?

Understanding the differences is crucial when evaluating refinancing options, as it can help maximize property value and enhance financial flexibility.