Overview

This article serves as a compassionate guide for families looking to eliminate Private Mortgage Insurance (PMI) costs. We understand how challenging this can be, so we emphasize key steps such as:

- Assessing loan-to-value ratios

- Maintaining a solid payment history

- Initiating the cancellation process with lenders

By detailing eligibility criteria and necessary documentation, we aim to empower you with the knowledge needed to navigate this process. Additionally, we explore alternative strategies like:

- Refinancing

- Making extra mortgage contributions

These strategies can effectively help homeowners reduce or eliminate PMI expenses.

We’re here to support you every step of the way, making the journey towards financial relief more manageable and less daunting.

Introduction

Private Mortgage Insurance (PMI) can often feel like a hidden financial burden for homeowners, adding hundreds of dollars to monthly mortgage payments. We know how challenging this can be, and understanding how to navigate the complexities of PMI removal can not only alleviate this cost but also enhance your overall financial health.

So, what steps can families take to successfully eliminate PMI? What alternative strategies might you explore to achieve this goal?

In this guide, we’re here to support you every step of the way as we delve into the essential processes and considerations for homeowners eager to reclaim their financial freedom.

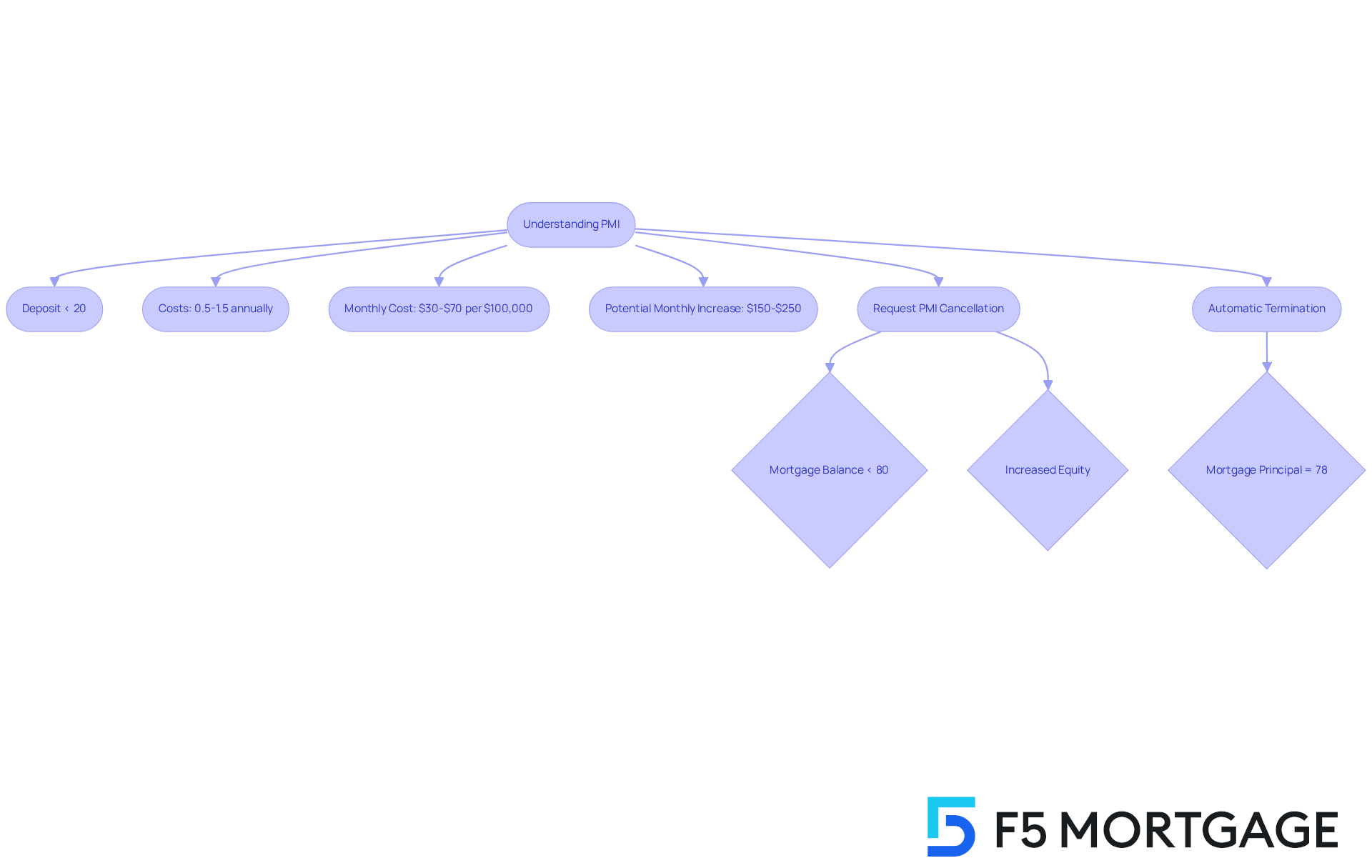

Understand Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is an important consideration for property owners who provide a deposit of less than 20% of their home’s purchase price. This insurance safeguards lenders in case of borrower default, often making it a necessary requirement for conventional loans. For 2025, PMI costs generally range from 0.5% to 1.5% of the original loan amount annually. This translates to monthly premiums of about $30 to $70 for every $100,000 borrowed. Consequently, this can significantly increase monthly mortgage costs, with property owners potentially facing an additional $150 to $250 in expenses each month if PMI is required.

Understanding how PMI works is crucial for property owners looking to ease their financial burden. For instance, homeowners can request PMI cancellation once their mortgage balance falls below 80% of the original property value. This is often achievable through increased equity or timely payments. A relatable example includes homeowners who, after living in their home for at least two years and maintaining a solid financial record, successfully eliminated PMI by demonstrating they had reached the necessary equity level.

Additionally, lenders automatically terminate PMI when the mortgage principal balance reaches 78% of the initial property value, provided the borrower remains current on payments. This automatic cancellation can bring significant relief, as it lowers monthly expenses without requiring additional effort from the homeowner. Financial advisors emphasize the importance of monitoring property values and loan amounts. Many property owners may not realize they qualify for PMI removal until they take the initiative to evaluate their situation. By grasping the implications of PMI, property owners can take proactive measures to alleviate this cost and improve their overall financial well-being.

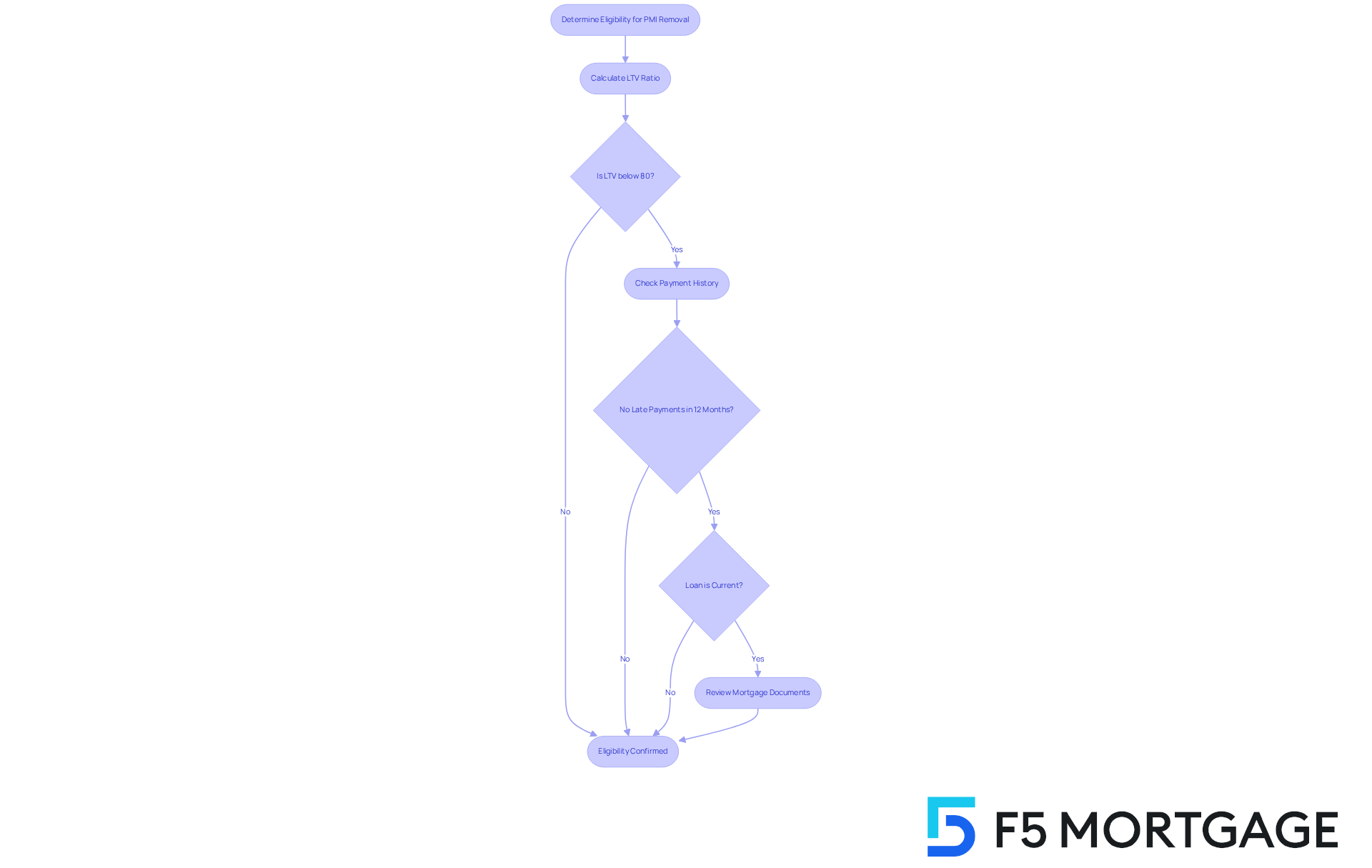

Determine Eligibility for PMI Removal

To determine your eligibility for PMI removal, it’s important to first assess your loan-to-value (LTV) ratio. We understand how challenging this can be, and we’re here to support you every step of the way. PMI removal can typically be initiated when your LTV ratio falls below 80%, which signifies that you have at least 20% equity in your home. To calculate your current LTV, simply divide your remaining mortgage balance by your property’s current appraised value. For instance, if your remaining mortgage balance is $200,000 and your home is valued at $250,000, your LTV ratio would be 80% (200,000 / 250,000).

In addition to the LTV ratio, lenders often require you to have a solid payment history. This generally means:

- No late payments in the past 12 months

- Your loan is current

It’s also wise to review your mortgage documents for any specific terms related to PMI cancellation. Understanding these criteria is essential, as it empowers you to take proactive steps toward PMI removal of unnecessary expenses. Remember, we know how important it is to save money, and taking these steps can lead you toward financial relief.

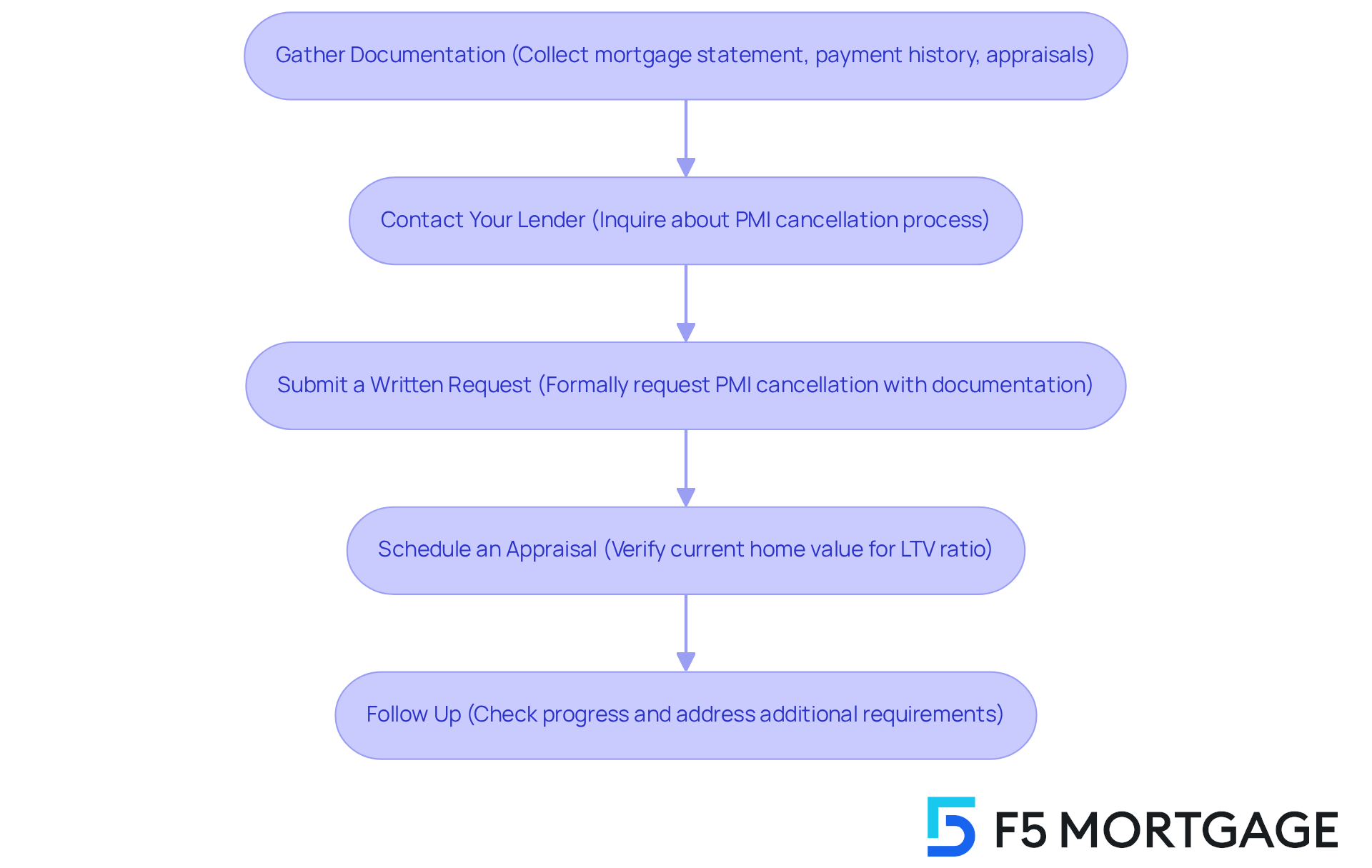

Initiate the PMI Removal Process

To begin the PMI removal process, we recognize the significance of homeowners feeling supported. Here are some essential steps to guide you through:

-

Gather Documentation: Start by collecting necessary documents, such as your mortgage statement, proof of timely payment history, and any recent property appraisals. This documentation is crucial for demonstrating your eligibility for PMI removal.

-

Contact Your Lender: Reach out to your mortgage servicer to inquire about their specific PMI cancellation process. Each lender may have different requirements, so it’s important to understand their guidelines.

-

Submit a Written Request: Formally request PMI cancellation in writing, including all relevant documentation. Be aware that some lenders may require specific forms to be completed.

-

Schedule an Appraisal: If needed, organize for a property appraisal to verify the current value of your residence. This appraisal is vital for confirming that your loan-to-value (LTV) ratio is below 80%, which is a key threshold for the removal of PMI.

-

Follow Up: After submitting your request, follow up with your lender to ensure the process is progressing and to address any additional requirements they may have. Staying proactive can help expedite the cancellation process and alleviate any potential delays.

As Greg McBride, CFA, Chief Financial Analyst, wisely states, “As long as you’re not taking an FHA loan, you’re not married to the PMI.” This highlights the importance of understanding your options regarding PMI. We’re here to support you every step of the way.

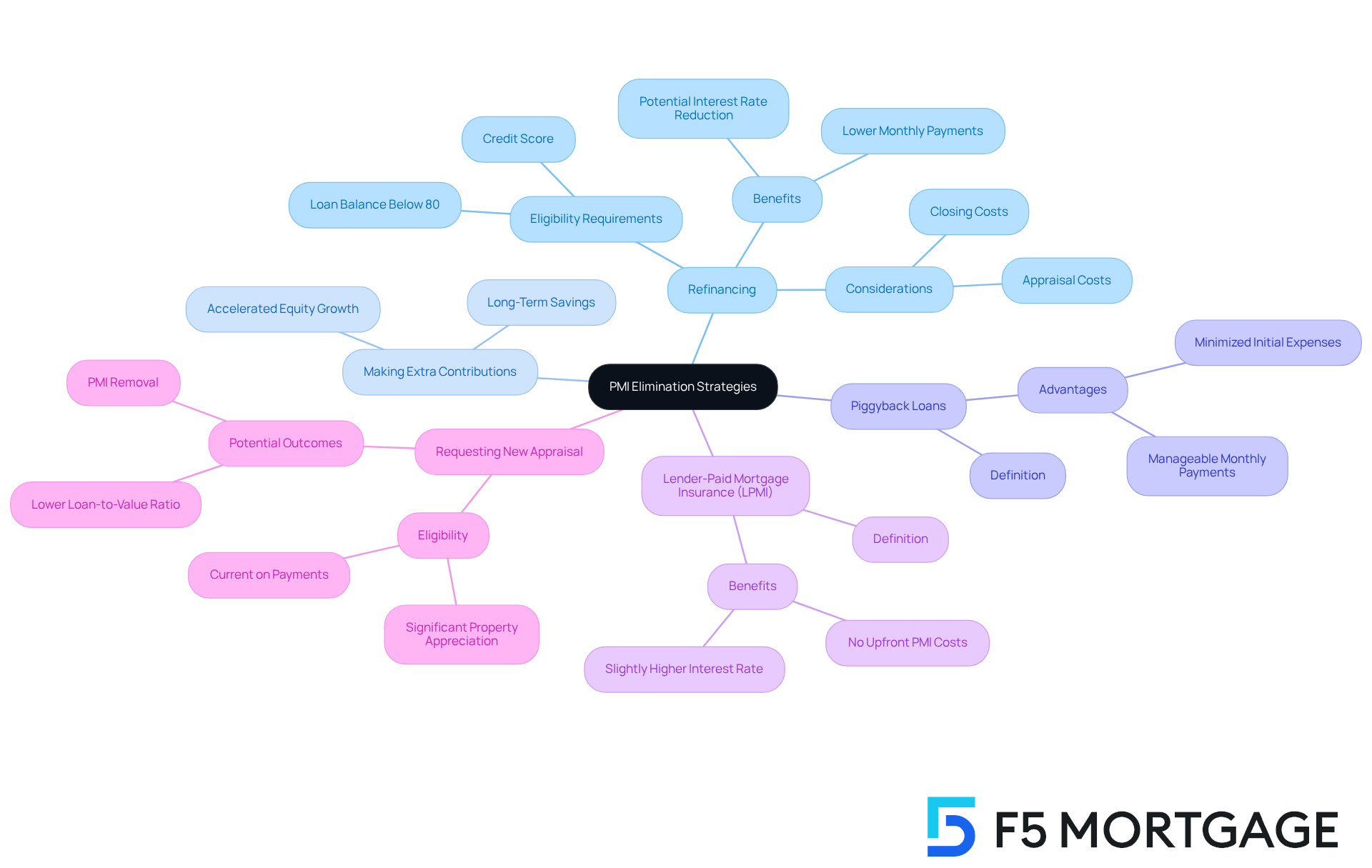

Explore Alternative Strategies for PMI Elimination

Homeowners seeking PMI removal often face challenges, but there are several alternative strategies to consider if the standard cancellation process isn’t feasible.

-

Refinancing can be a powerful option. With property values on the rise in Colorado, refinancing allows homeowners to secure a new loan with a reduced balance, which could lead to PMI removal altogether. This is especially beneficial if the new loan balance falls below 80% of the home’s current value. It’s important to keep in mind the eligibility requirements for different loan types: conventional loans generally require a credit score of at least 740, FHA loans are accessible with a minimum credit score of 580, and VA loans are available to military members and their spouses. Additionally, homeowners should consider refinancing costs, such as closing fees and appraisal costs, when evaluating this option.

-

Another approach is Making Extra Contributions. By increasing mortgage payments, homeowners can significantly accelerate equity growth. Paying down the principal faster means reaching the 20% equity threshold sooner, facilitating PMI removal. Financial specialists emphasize that even modest extra contributions can lead to substantial savings over time.

-

Piggyback Loans are another strategy to explore. This involves obtaining a second mortgage to cover part of the upfront cost, helping to avoid PMI on the primary mortgage. It can be particularly advantageous for buyers looking to minimize initial expenses while keeping monthly payments manageable.

-

Consider Lender-Paid Mortgage Insurance (LPMI) as well. Some lenders offer this option, where they pay the PMI in exchange for a slightly higher interest rate. This arrangement can be appealing for borrowers who wish to avoid upfront PMI costs while still securing favorable loan terms.

-

If the property has appreciated significantly, homeowners can request a new appraisal to potentially lower their loan-to-value (LTV) ratio. This could qualify them for PMI removal, provided they meet the lender’s requirements. For instance, homeowners may remove PMI if their home value rises or if they refinance, as long as they are current on their payments.

By exploring these strategies, homeowners can take proactive steps toward achieving PMI removal. This not only decreases monthly costs but also enhances financial flexibility. Remember, maintaining a good payment history is crucial for PMI cancellation, as lenders require borrowers to be current on payments to qualify. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Understanding and effectively managing Private Mortgage Insurance (PMI) is crucial for homeowners looking to alleviate unnecessary financial burdens. We know how challenging this can be, and by recognizing the implications of PMI and the steps required for its removal, property owners can significantly reduce their monthly mortgage expenses and improve their overall financial health.

This article outlines essential strategies for PMI removal. Start by:

- Determining eligibility based on loan-to-value ratios

- Maintaining a solid payment history

- Initiating the cancellation process with lenders

Additionally, consider alternative methods such as:

- Refinancing

- Making extra contributions

- Exploring lender-paid mortgage insurance

These options provide homeowners with various avenues to eliminate PMI costs. Each approach emphasizes the importance of proactive financial management and awareness of property value changes.

Ultimately, the journey to PMI removal is not just about reducing costs; it is about empowering homeowners to take control of their financial futures. By staying informed and actively pursuing these strategies, families can enhance their financial flexibility and achieve greater peace of mind in their homeownership journey. Taking action today can lead to substantial long-term savings and a more secure financial position.

Frequently Asked Questions

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) is insurance that protects lenders in case a borrower defaults on their loan, typically required for conventional loans when the down payment is less than 20% of the home’s purchase price.

What are the typical costs associated with PMI?

For 2025, PMI costs generally range from 0.5% to 1.5% of the original loan amount annually, resulting in monthly premiums of about $30 to $70 for every $100,000 borrowed. This can add an extra $150 to $250 to monthly mortgage expenses.

How can homeowners cancel PMI?

Homeowners can request PMI cancellation once their mortgage balance falls below 80% of the original property value, which can be achieved through increased equity or consistent payments.

When is PMI automatically terminated?

PMI is automatically terminated when the mortgage principal balance reaches 78% of the initial property value, as long as the borrower is current on their payments.

Why is it important for property owners to monitor their PMI status?

Monitoring property values and loan amounts is crucial because many property owners may not realize they qualify for PMI removal until they evaluate their situation, allowing them to alleviate this cost and improve their financial well-being.