Overview

This article aims to shed light on mobile home loan rates, recognizing that understanding these rates can be challenging for many families. We know how overwhelming it can feel to navigate the complexities of financing your dream home. By exploring the key factors that influence these rates, we hope to empower you with the knowledge needed to make informed decisions.

One crucial aspect we’ll discuss is the difference between chattel financing and traditional mortgages. It’s essential to understand how elements like your credit score, down payment, and the type of loan you choose can significantly impact your borrowing costs. We’re here to support you every step of the way as you consider your options.

As you delve into the world of mobile home loans, remember that securing competitive rates is possible. By being aware of the factors at play, you can take actionable steps towards achieving favorable terms. Let’s explore these strategies together, ensuring you feel confident in your financial journey.

Introduction

Navigating the world of mobile home financing can feel overwhelming, especially with the many options available. We understand how challenging this can be. As families increasingly consider manufactured homes as a viable housing solution, grasping the nuances of mobile home loan rates becomes essential. This article explores key factors and strategies that can help you secure favorable financing terms.

However, with so many choices and potential pitfalls, how can you effectively navigate this complex landscape to make informed decisions that align with your financial goals? We’re here to support you every step of the way.

Explore the Basics of Mobile Home Loans

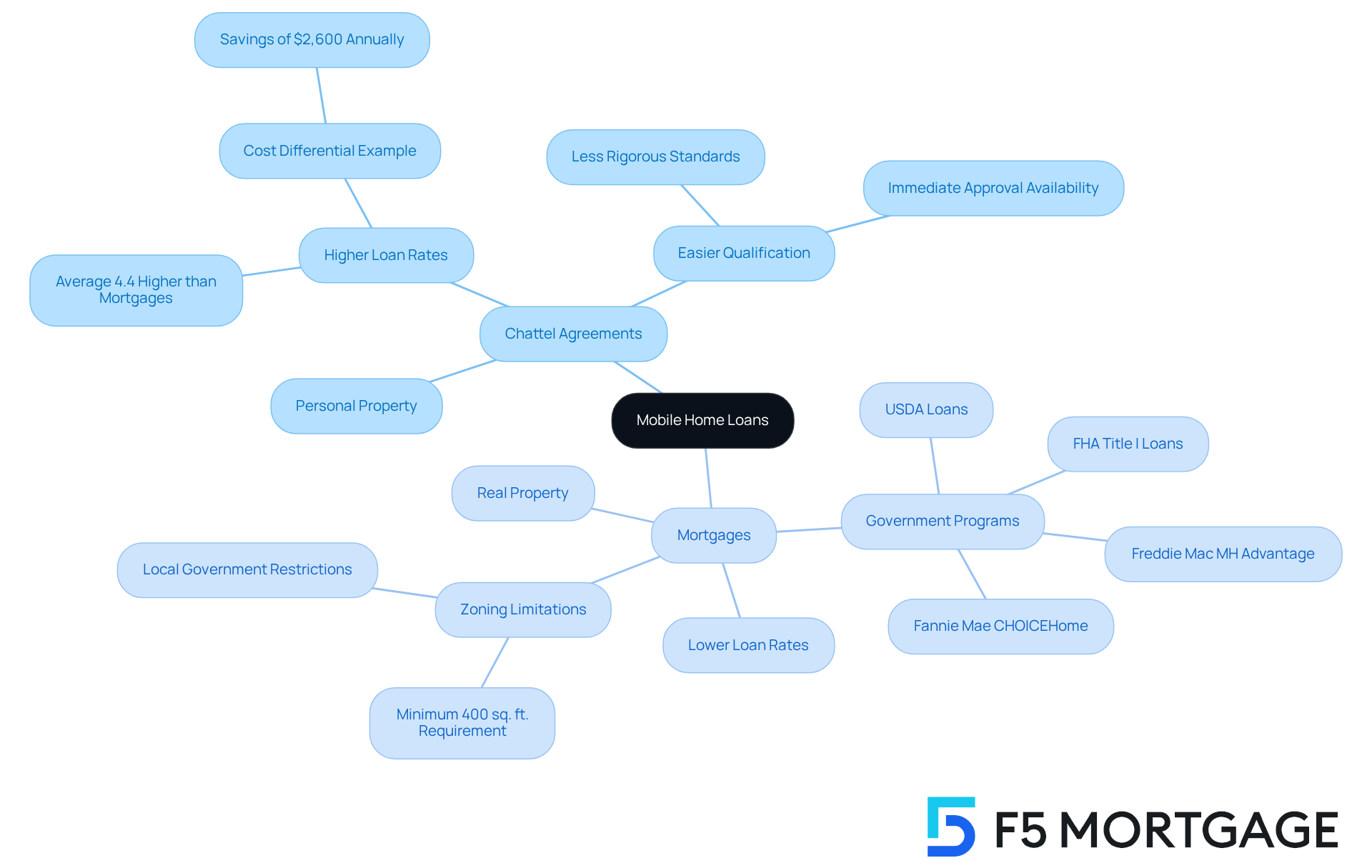

Mobile home loan rates are specialized financing options designed to help families acquire manufactured residences. Understanding the different financing options, such as mobile home loan rates, is essential for making an informed decision. These financial agreements primarily fall into two categories: chattel agreements and mortgages.

Chattel financing is typically used for residences that aren’t permanently attached to land, qualifying them as personal property. In contrast, mobile home loan rates apply to manufactured homes classified as real property, which must be permanently fixed to a foundation and owned alongside the land. We know how challenging this can be, and understanding these distinctions is crucial for buyers to select the financing option that best suits their circumstances.

While chattel financing is often simpler to secure, it generally carries higher mobile home loan rates—averaging 4.4 percentage points more each year than conventional mortgage products. This cost differential can significantly influence long-term financial obligations. For instance, transitioning from chattel financing to a mortgage could save consumers approximately $2,600 annually on an $80,000, 20-year arrangement. That’s a substantial portion of a typical family’s income, and it’s important to consider these factors when making a choice.

Looking ahead to 2025, the landscape of mobile home financing is evolving. Government-supported loans are providing low initial costs and competitive mobile home loan rates. Some programs even permit no initial cost, which is especially appealing for first-time purchasers. Programs from Freddie Mac and Fannie Mae, such as the MH Advantage and CHOICEHome, offer pathways for buyers to secure mortgages at mobile home loan rates with down payments as low as 3%. However, many mobile property purchasers still opt for chattel financing due to the challenges of qualifying for mortgages, particularly when the residence is not classified as real estate.

Additionally, numerous chattel borrowers may not meet the more rigorous qualifying standards for mortgages. This reality can lead them to choose the easier chattel financing option, despite its elevated expenses. As the demand for manufactured housing continues to grow, comprehending the intricacies of mobile home loan rates becomes increasingly essential.

Purchasers should also be aware of possible zoning limitations that may impact where manufactured residences can be situated. It’s crucial to note that manufactured structures must have a minimum of 400 square feet of living area to be eligible for most financing. With proper upkeep, manufactured residences can even increase in value, making them a viable investment option.

We’re here to support you every step of the way. As you explore these specialized financing options, be sure to perform comprehensive research and contemplate your long-term financial objectives. Taking these steps will empower you to make the best decision for your family.

Identify Different Types of Mobile Home Loans

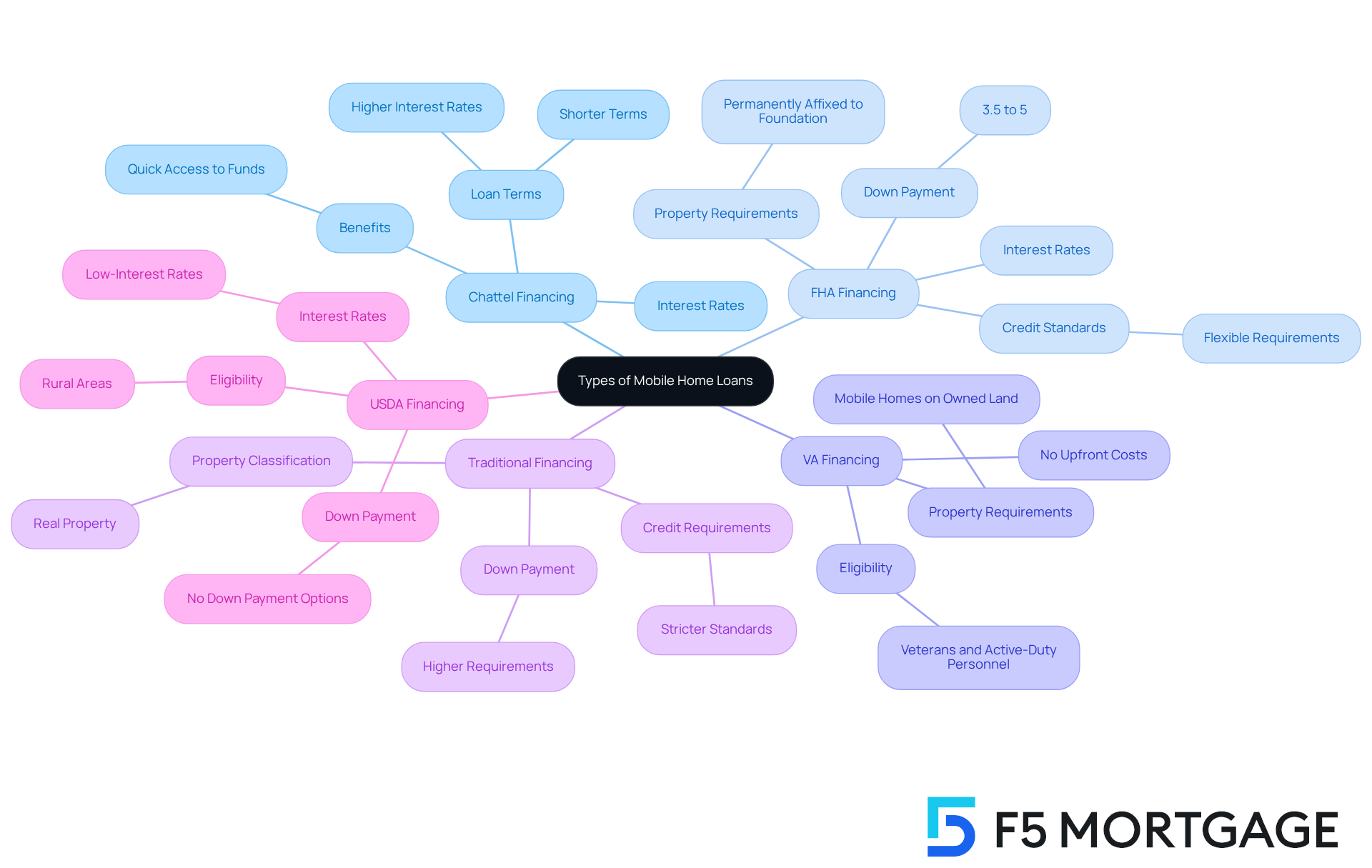

Navigating the world of mobile home loan rates can feel overwhelming, but understanding your options is the first step towards achieving your homeownership dreams. Here’s a look at various forms of financing that can meet distinct monetary needs:

-

Chattel Financing: If you’re considering a mobile residence that isn’t permanently attached to land, chattel financing might be on your radar. While these personal property credits can provide quick access to funds, they often come with shorter terms and higher interest rates, which may not be ideal for long-term financing.

-

FHA Financing: The Federal Housing Administration offers a lifeline for those looking to finance manufactured structures that meet specific criteria, such as being permanently affixed to a foundation. FHA mortgages typically require lower initial contributions—ranging from 3.5% to 5%—and provide more flexible credit standards, making them accessible for a broader range of borrowers.

-

VA Financing: For our veterans and active-duty military personnel, VA financing is a wonderful option. It can fund mobile homes on owned land with advantageous conditions, including no upfront costs. This can significantly reduce the initial financial burden for qualified borrowers, allowing them to focus on what truly matters—making a home.

-

Traditional Financing: In contrast to government-supported options, traditional financing may come with stricter credit and down payment requirements. This type is often used for mobile residences classified as real property, which can complicate the financing process for some buyers. We understand that this can be daunting, but it’s important to explore all avenues.

-

USDA Financing: If you’re looking to buy in rural areas, USDA financing could be a great fit. It offers funding for mobile residences with low-interest rates and no down payment options, making it especially beneficial for those seeking to settle in less populated regions.

By comprehending these financing types, especially mobile home loan rates, you empower yourself to make informed choices that align with your financial situation and homeownership goals. Remember, we’re here to support you every step of the way as you embark on this journey.

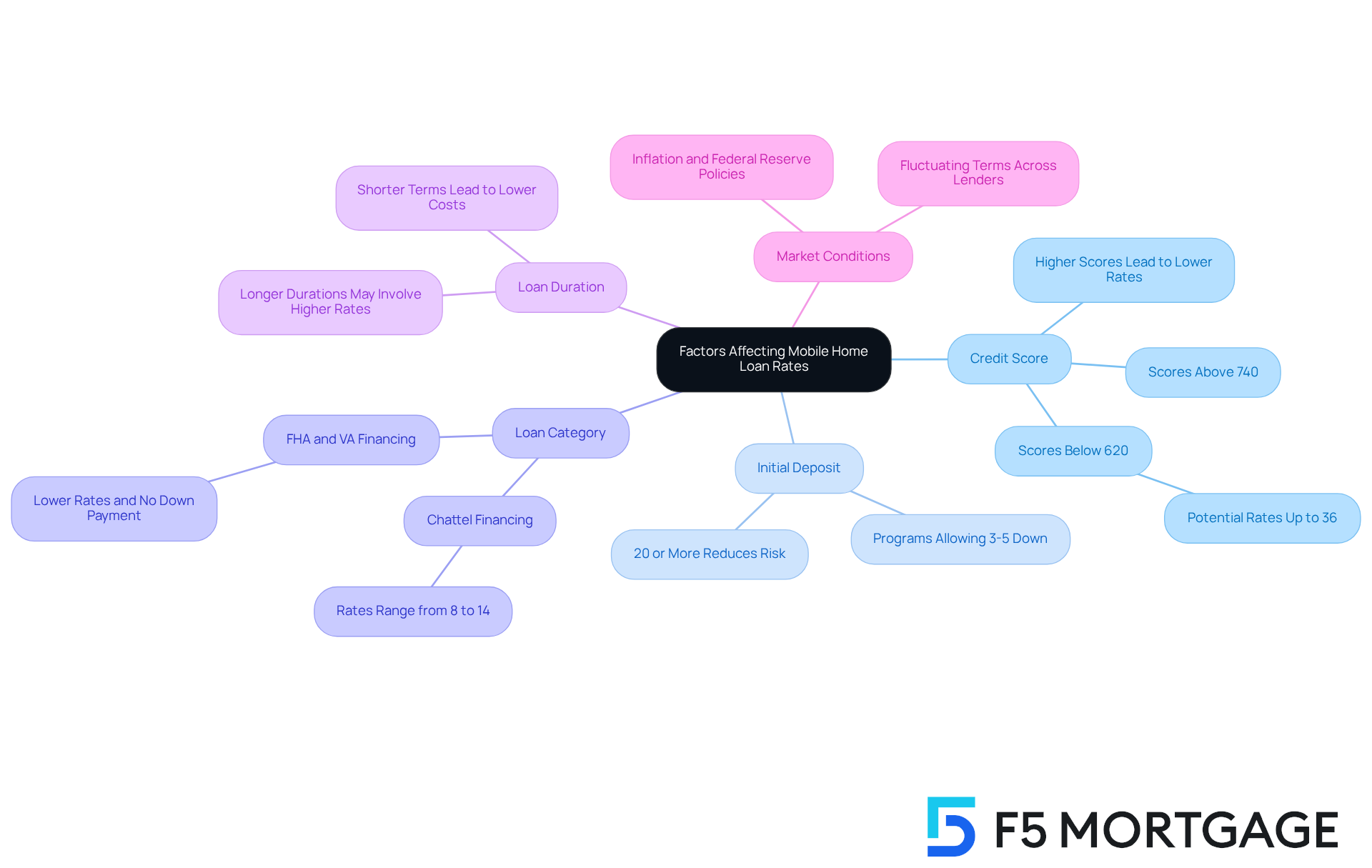

Examine Factors Affecting Mobile Home Loan Rates

Understanding mobile home loan rates can be overwhelming, but several key factors can significantly impact your borrowing experience.

-

Credit Score: We know how challenging it can be to manage your credit score. A higher score typically results in lower borrowing costs, signaling to lenders that you present less risk. For instance, individuals with scores above 740 often enjoy significantly better terms than those with scores below 620, who may face charges up to 36 percent.

-

Initial Deposit: The amount you can put down initially plays a crucial role in determining your loan amount and interest rate. Generally, a deposit of 20% or more can greatly reduce the lender’s risk, potentially leading to more favorable terms. It’s worth noting that some financing programs allow down payments as low as 3-5% for prefabricated homes, making homeownership more accessible.

-

Loan Category: Different types of financing come with varying interest rates. For example, chattel financing, which supports homes not permanently attached to land, often carries higher costs ranging from 8% to 14%. In contrast, FHA and VA financing, which may not require a down payment, typically offer lower rates, providing more options for families.

-

Loan Duration: The length of your loan can also impact your interest rates. Shorter loan terms generally lead to lower costs, while longer durations may involve higher rates due to increased risk over time. By opting for a shorter repayment period, borrowers can often secure better terms, which can make a significant difference in the long run.

Market conditions, including economic factors like inflation and the Federal Reserve’s interest policies, can greatly affect mobile home loan rates. As market conditions fluctuate, terms may vary across lenders, so it’s essential to stay informed about current trends.

By understanding these elements, you can strategically position yourself to negotiate better financing terms. Remember, we’re here to support you every step of the way, ensuring you find the best financial options available.

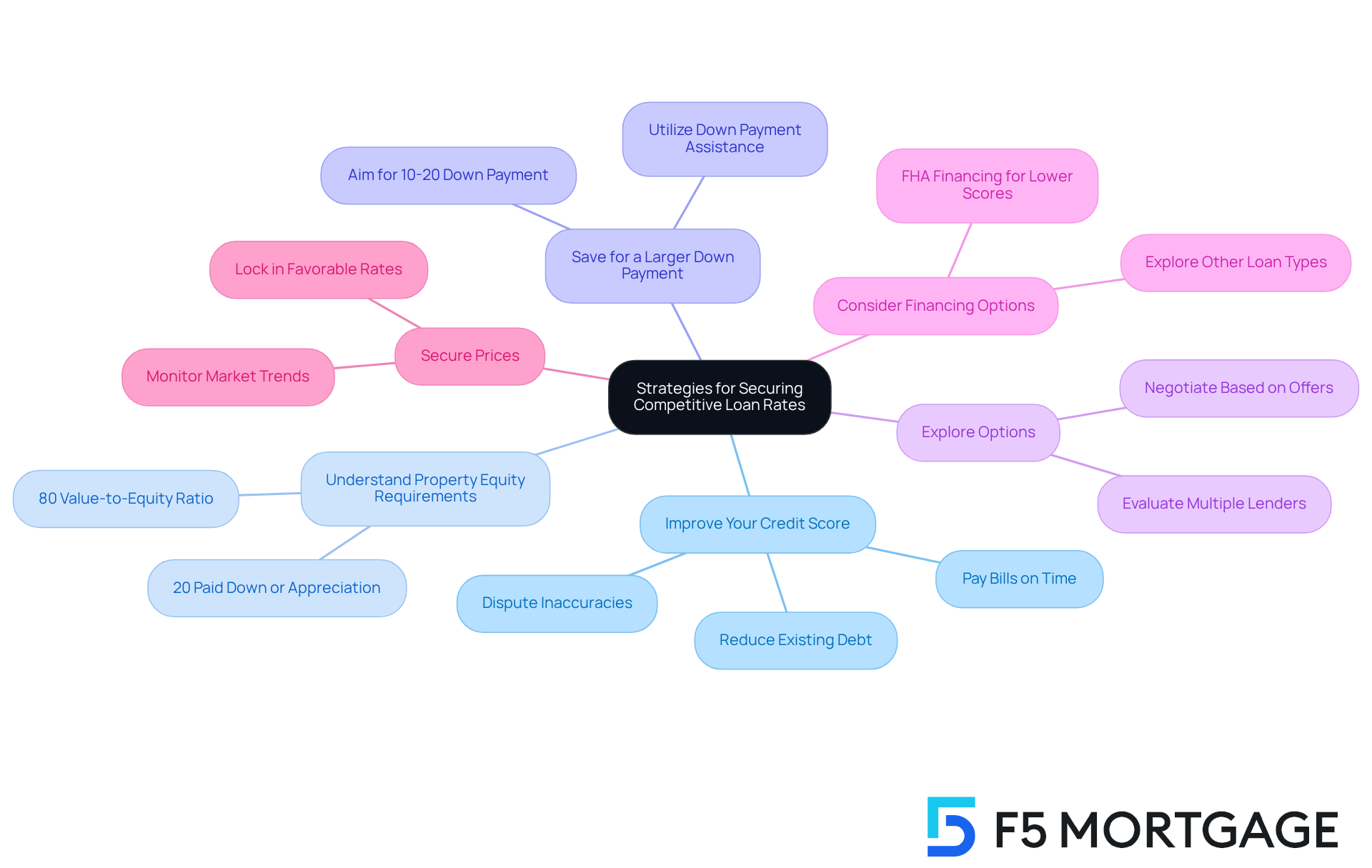

Implement Strategies to Secure Competitive Loan Rates

To secure competitive mobile home loan rates, we understand how important it is to consider the following strategies:

-

Improve Your Credit Score: We know how challenging it can be to manage finances. Enhancing your credit score by consistently paying bills on time, reducing existing debt, and disputing inaccuracies on your credit report can make a significant difference. A higher credit score can lower your interest rates, as lenders view you as a lower risk.

-

Understand Property Equity Requirements: Many lenders require property owners to have at least an 80% value-to-equity ratio. This means you should have paid down at least 20% of your initial borrowing amount or your property should have appreciated in value. Understanding this can help you prepare for the equity needed when applying for a loan.

-

Save for a Larger Down Payment: Aim to save at least 10-20% of the property’s purchase price. For instance, on a $95,000 manufactured home, a 3.5% deposit would total $3,325. A larger initial contribution can decrease your borrowed sum and enhance your likelihood of securing a reduced interest percentage. Additionally, utilizing down payment assistance programs can strengthen your offer, allowing you to compete more effectively in the market.

-

Explore Options: Evaluate financing proposals from various lenders to find the most favorable rates and conditions. Don’t hesitate to negotiate with lenders based on competing offers, as this can lead to more favorable conditions that work for you.

-

Consider Financing Options: Take the time to evaluate various financing options that suit your financial situation. FHA financing, for example, may provide better terms for individuals with lower credit scores, rendering it a viable option for many purchasers.

-

Secure Prices: Once you discover a favorable price, consider securing it to guard against possible hikes before finalizing. This can provide peace of mind and financial stability as you move forward with your purchase.

By implementing these strategies, you can enhance your chances of securing competitive mobile home loan rates, which will make homeownership more affordable. Additionally, if you own land, its equity can act as your down payment, providing an alternative financing option. We’re here to support you every step of the way.

Conclusion

Understanding mobile home loan rates is essential for anyone looking to finance a manufactured home. We know how challenging this can be, and it’s important to distinguish between various financing options, such as chattel loans and mortgages. These choices can significantly impact your long-term financial commitments. With the evolving landscape of mobile home financing, especially with government-supported programs, being informed about your options is crucial.

Key points discussed include:

- The differences between chattel financing and traditional mortgages

- The influence of credit scores on interest rates

- The significance of down payments in securing favorable loan terms

- Understanding zoning regulations and property equity requirements

By employing strategic approaches to improve credit scores, save for larger down payments, and explore various financing options, you can position yourself to secure competitive mobile home loan rates.

Ultimately, the journey to homeownership through mobile home loans requires thorough research and careful consideration of your financial goals. As the demand for manufactured housing continues to rise, being proactive in understanding the intricacies of mobile home financing will empower you to make sound financial decisions. Taking the time to explore available options and implementing effective strategies can lead to a more affordable and successful homeownership experience.

Frequently Asked Questions

What are mobile home loans?

Mobile home loans are specialized financing options designed to help families acquire manufactured residences, with distinct categories such as chattel agreements and mortgages.

What is chattel financing?

Chattel financing is used for residences that aren’t permanently attached to land, qualifying them as personal property.

What distinguishes mobile home loan rates from chattel financing?

Mobile home loan rates apply to manufactured homes classified as real property, which must be permanently fixed to a foundation and owned alongside the land.

How do mobile home loan rates compare to conventional mortgage rates?

Chattel financing typically carries higher mobile home loan rates, averaging 4.4 percentage points more annually than conventional mortgage products.

What is the potential savings when transitioning from chattel financing to a mortgage?

Transitioning from chattel financing to a mortgage could save consumers approximately $2,600 annually on an $80,000, 20-year arrangement.

What government-supported loan programs are available for mobile home financing?

Programs from Freddie Mac and Fannie Mae, such as the MH Advantage and CHOICEHome, offer pathways for buyers to secure mortgages at mobile home loan rates with down payments as low as 3%.

Why do many mobile property purchasers still opt for chattel financing?

Many purchasers choose chattel financing due to challenges in qualifying for mortgages, especially when the residence is not classified as real estate.

What are the zoning limitations for manufactured residences?

There may be zoning limitations that impact where manufactured residences can be situated, and structures must have a minimum of 400 square feet of living area to be eligible for most financing.

Can manufactured residences increase in value?

Yes, with proper upkeep, manufactured residences can increase in value, making them a viable investment option.

What should purchasers consider when exploring mobile home financing options?

Purchasers should perform comprehensive research, consider long-term financial objectives, and understand the intricacies of mobile home loan rates to make informed decisions.