Overview

This article is here to support you with essential tips for securing modular home loans. We understand how challenging this process can be, and we want to help you navigate it with confidence. It’s crucial to grasp your financing options, credit requirements, and the necessary preparation steps to ensure a smoother journey.

We’ll explore various loan types, such as FHA and VA financing, and how your credit score plays a vital role in loan approval. Knowing these details can empower you to make informed decisions. Moreover, thorough financial preparation is key; it can significantly enhance your chances of obtaining favorable loan terms.

By taking these steps, you’re not just securing a loan; you’re investing in your family’s future. Remember, we’re here to support you every step of the way as you embark on this important journey.

Introduction

Navigating the landscape of modular home loans can feel overwhelming, especially as the demand for affordable housing continues to rise. We understand how challenging this can be. With various financing options available, grasping the intricacies of securing a modular home loan is essential for prospective buyers.

This article explores seven essential tips designed to simplify the mortgage process and empower you to make informed decisions that align with your homeownership dreams.

What challenges might arise on this journey? Together, we can explore how buyers can effectively overcome these hurdles to secure the best financing options available.

F5 Mortgage: Personalized Solutions for Modular Home Loans

At F5 Mortgage, we understand how challenging navigating the mortgage process can be, especially for families looking to invest in modular home loans. With the rising popularity of manufactured dwellings amid the affordable housing crisis, our tailored mortgage solutions are designed with you in mind. We prioritize your satisfaction and utilize user-friendly technology to provide customized consultations that simplify the complexities of modular home loans.

Our clients have shared their positive experiences with F5 Mortgage, praising our exceptional service. They appreciate our commitment to making the mortgage process smooth and stress-free. By collaborating with over two dozen top lenders, we offer a diverse array of loan options, ensuring you can find the most suitable financial solutions for your unique needs.

This personalized approach not only simplifies the mortgage process but also empowers you to make informed decisions concerning your financing, ultimately enhancing your chances of approval. Partnering with a lender that specializes in modular home loans means you receive professional advice tailored specifically to your requirements. We’re here to support you every step of the way, making your journey toward homeownership a positive experience.

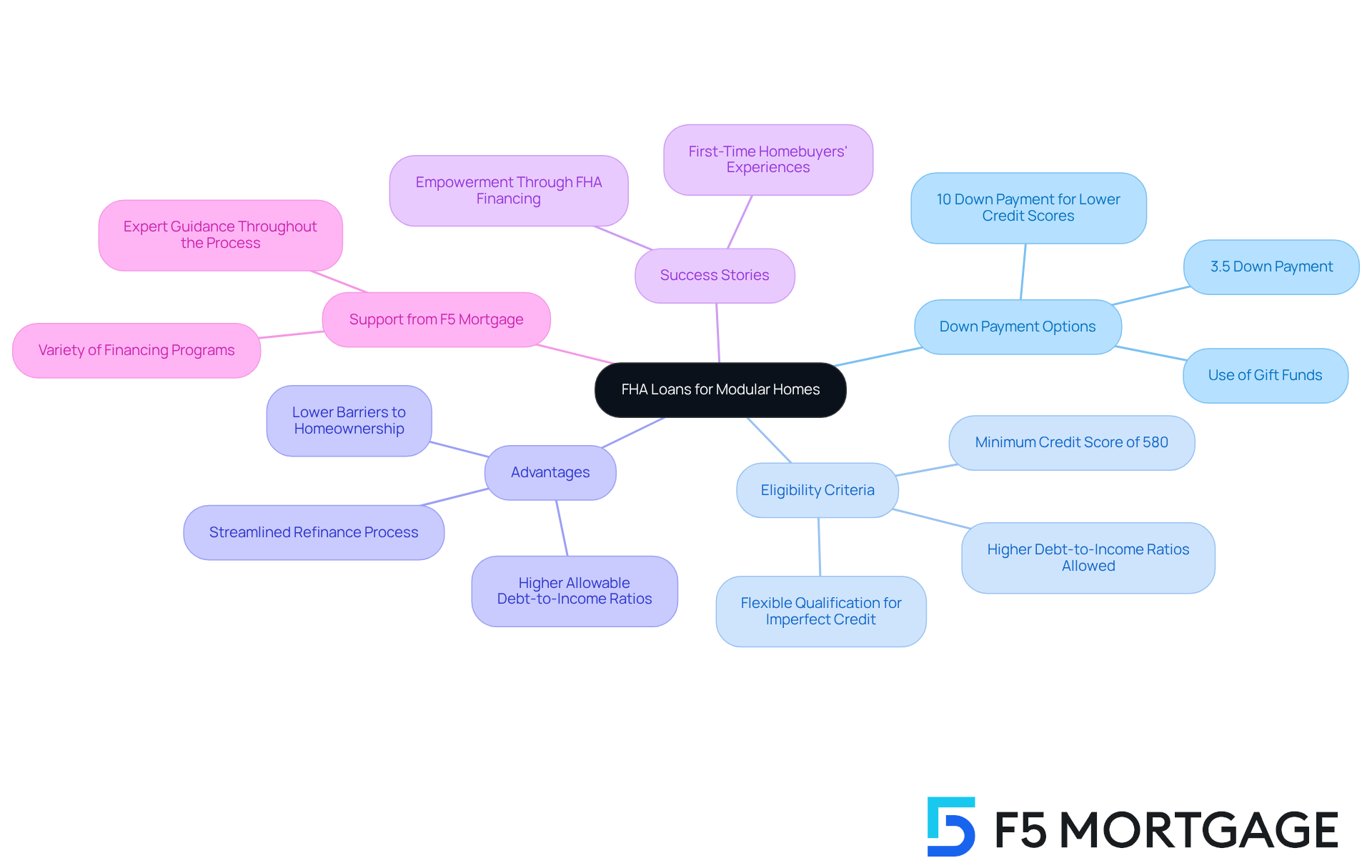

FHA Loans: Accessible Financing for Modular Homes

FHA programs serve as an exceptional funding choice for modular home loans, particularly for those who may struggle with substantial upfront costs. With down payments starting as low as 3.5% for borrowers with a credit score of 580 or above, these financial products significantly lower the barriers to homeownership. At F5 Mortgage, we understand how daunting this process can be, which is why we offer a variety of financing programs, including both standard and nontraditional options, to meet diverse borrower needs. In 2025, approximately 19.68% of home purchasers chose FHA financing, underscoring its popularity among first-time buyers. Financial advisors emphasize that FHA financing options are particularly beneficial for individuals with imperfect credit, as they offer more flexible qualification criteria compared to traditional options.

The advantages of FHA financing go beyond just down payment requirements. They allow for higher debt-to-income ratios, making them suitable for a wider range of financial situations. Importantly, modular home loans can be secured through FHA financing, provided the homes meet specific standards, such as passing an FHA appraisal to ensure safety and habitability. At F5 Mortgage, we also offer a streamlined FHA refinance process that requires no income verification or appraisal, which can be especially helpful for veterans looking for better interest rates.

Success stories abound, with many first-time homebuyers sharing their positive experiences using FHA financing for modular home loans. These narratives highlight how FHA financing has empowered individuals and families to achieve their homeownership dreams, even in challenging financial circumstances. By understanding the eligibility requirements and benefits of FHA financing, including the competitive rates available through F5 Mortgage, prospective buyers can enhance their chances of securing modular home loans for their homes. We’re here to support you every step of the way.

Credit Score Requirements: Key to Securing Your Modular Home Loan

Securing modular home loans can feel daunting, but understanding credit score requirements is a crucial first step. Most lenders typically require a minimum credit score of 580 for FHA financing, while conventional options often demand a higher score, usually around 620 or above. A strong credit score not only boosts your chances of loan approval but can also lead to lower interest costs, ultimately saving you money throughout the life of your loan. For instance, borrowers with credit scores of 760 or higher often qualify for the best mortgage rates. This highlights how important it is to maintain a healthy credit profile.

We know how challenging this can be, so it’s essential for potential purchasers to regularly review their credit reports. Taking proactive measures to enhance your score—like making timely payments, reducing credit utilization, and avoiding new debt—can make a significant difference. Additionally, FHA loans offer options for those with lower credit scores, allowing for scores as low as 500 with a minimum down payment of 10%. By focusing on credit wellness and exploring modular home loans refinancing options, you can position yourself advantageously in the competitive financing landscape for modular housing.

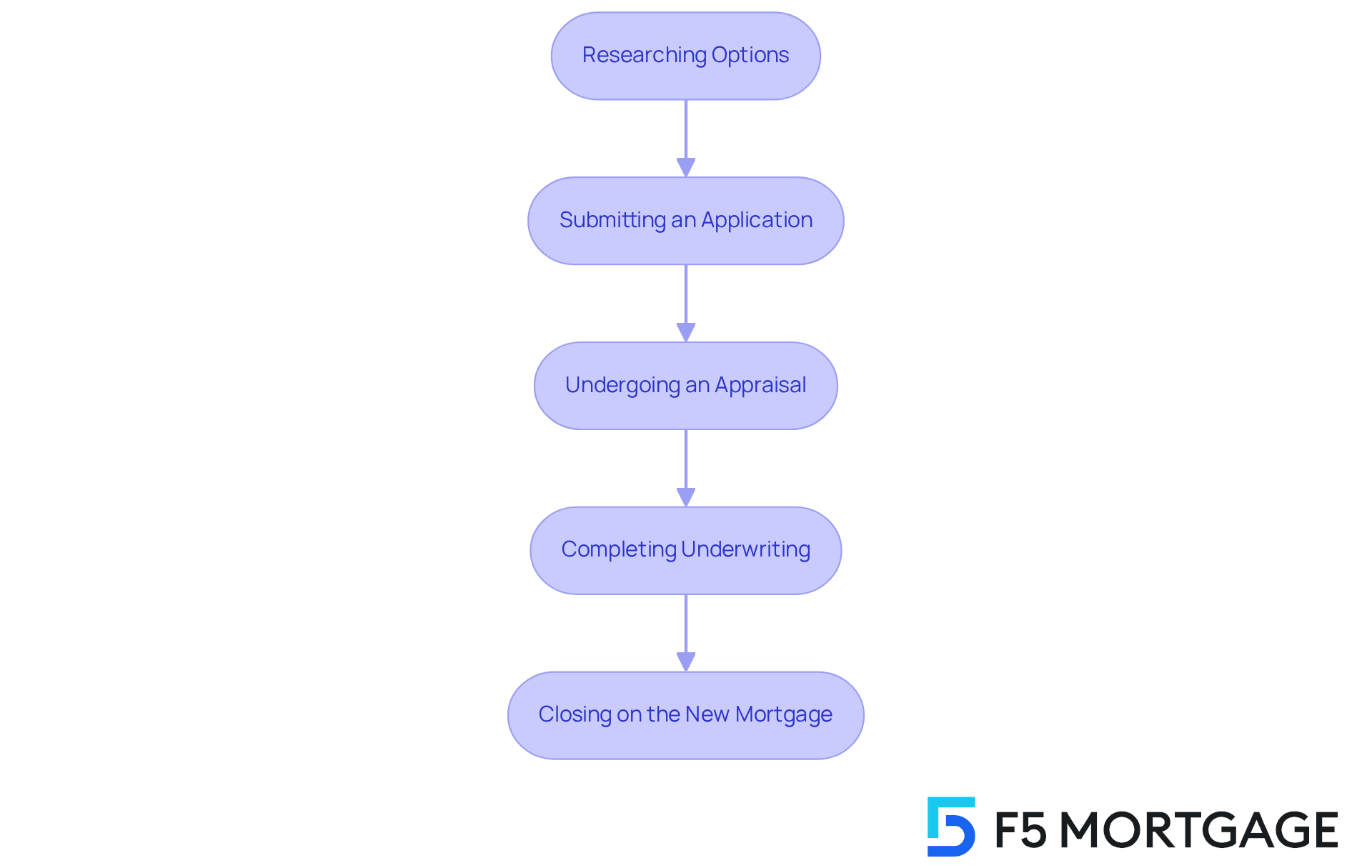

It’s also vital to compare rates, costs, and terms from multiple lenders, including F5 Mortgage, to find the best fit for your financial needs. The refinancing process involves several key steps:

- Researching options

- Submitting an application

- Undergoing an appraisal

- Completing underwriting

- Finally closing on the new mortgage

Understanding these steps can help streamline your refinancing journey. Remember, we’re here to support you every step of the way.

Down Payment Insights: What You Need for Modular Home Financing

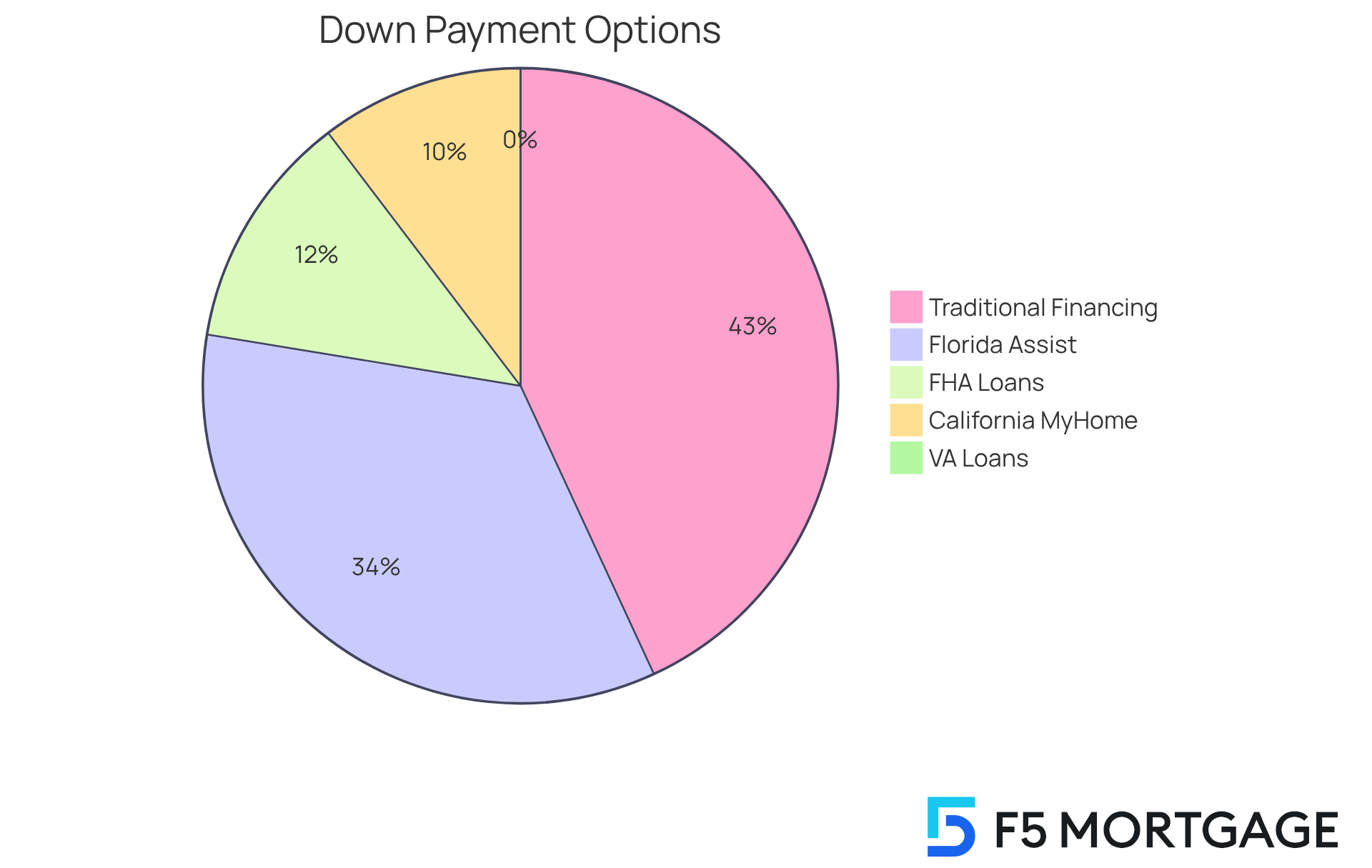

When considering funding for a modular home, we understand how challenging it can be to navigate the deposit requirements associated with modular home loans, which can greatly vary based on the type of financing. FHA financing is particularly accessible, requiring an initial contribution of just 3.5% for borrowers with a credit score of 580 or higher. In contrast, traditional financing typically demands an initial deposit ranging from 5% to 20%, depending on the purchaser’s creditworthiness.

For our active military, veterans, or eligible spouses, VA loans often require no initial contribution at all, making them a highly appealing option for those who qualify. If you’re a first-time homebuyer, various down payment assistance programs can significantly ease financial burdens. For instance, the MyHome Assistance Program in California offers up to 3% of the property’s purchase price, while the Florida Assist program provides as much as $10,000 in aid.

In Texas, the My Choice Texas Home program features a 30-year, low-interest-rate mortgage with up to 5% available for initial costs and closing support. These programs not only enhance purchasing options but are also vital for many families looking to upgrade their homes.

Statistics reveal that over 1 million first-time homebuyers utilize affordable mortgages each year, and approximately 32% of these buyers accessed assistance programs in 2024. This highlights the importance of these resources. Understanding these requirements and available resources—such as the possibility of using land equity as a down payment—is crucial for potential purchasers. This knowledge empowers you to effectively plan your budget for your new home and navigate the complexities of modular home loans. We’re here to support you every step of the way.

Interest Rates: Navigating Costs for Modular Home Loans

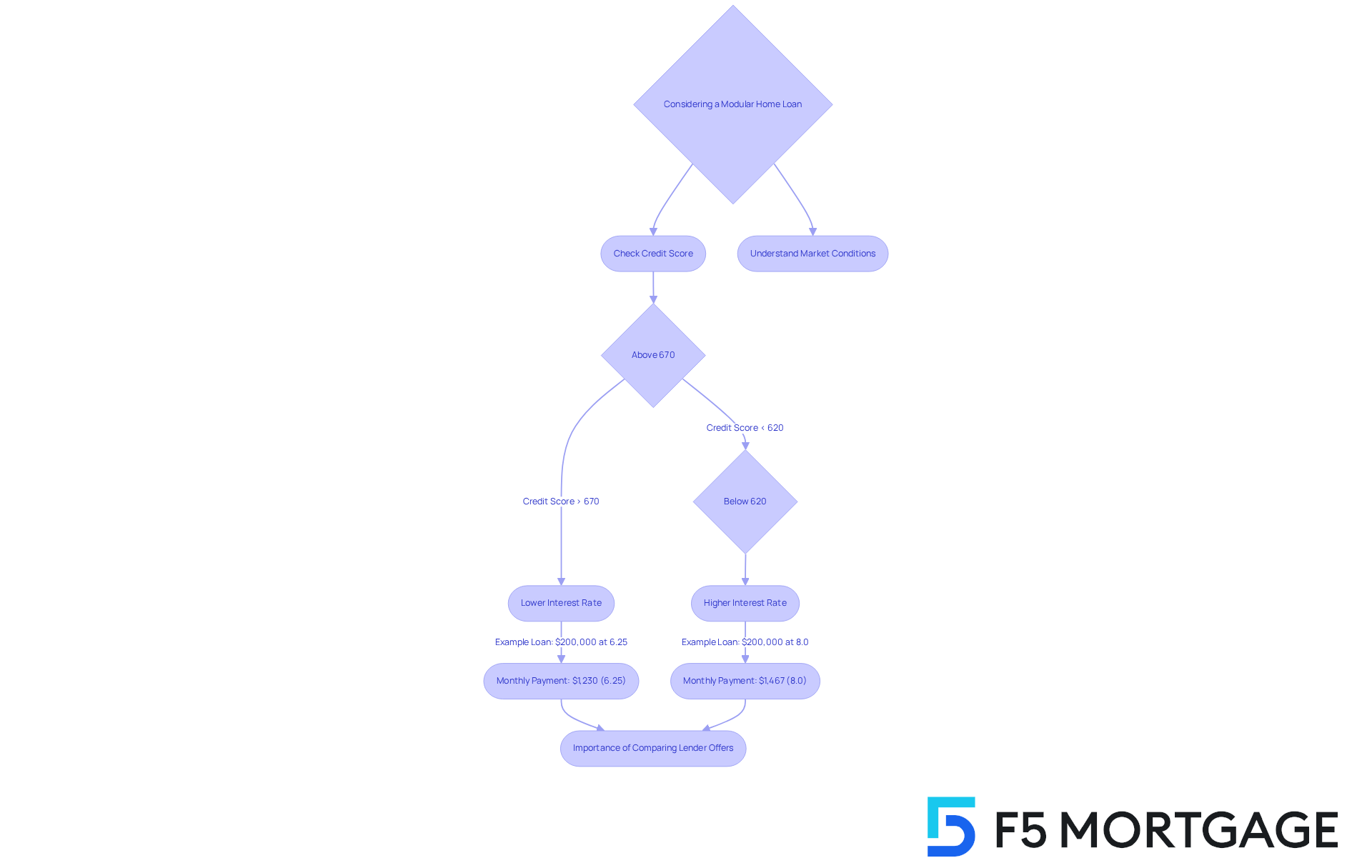

Interest charges for modular home loans can be influenced by several factors, including the type of financing, the borrower’s credit score, and current market conditions. As we approach mid-2025, average interest rates for manufactured home loans range from 6.25% to 8.50%, starting around 6.75%. If you have a higher credit score, you may enjoy reduced interest charges, as lenders perceive less risk. For example, borrowers with credit scores above 670 typically secure more favorable terms compared to those with scores below 620.

Understanding how interest rates impact monthly costs is essential for potential buyers. A lower interest rate can significantly decrease monthly payments, making homeownership more attainable. For instance, a $200,000 loan at a 6.25% interest rate results in a monthly payment of approximately $1,230, while the same loan at 8.0% would cost about $1,467 each month. This difference underscores the importance of securing the best possible deal.

Economists emphasize that market conditions, such as inflation and the Federal Reserve’s policies, play a crucial role in shaping interest rates. We encourage you to explore and compare offers from various lenders, as this can lead to substantial savings over the life of the loan. For instance, one borrower successfully obtained a VA mortgage at 6.0% APR, which is significantly lower than average rates, illustrating the potential benefits of diligent price comparison.

In summary, the impact of interest rates on modular home loans financing is profound, influencing both monthly payments and the overall cost of the mortgage. By grasping these dynamics and actively seeking competitive rates, you can make informed financial decisions that align with your homeownership aspirations. Remember, we’re here to support you every step of the way.

Financing Options: Exploring Choices for Modular Home Buyers

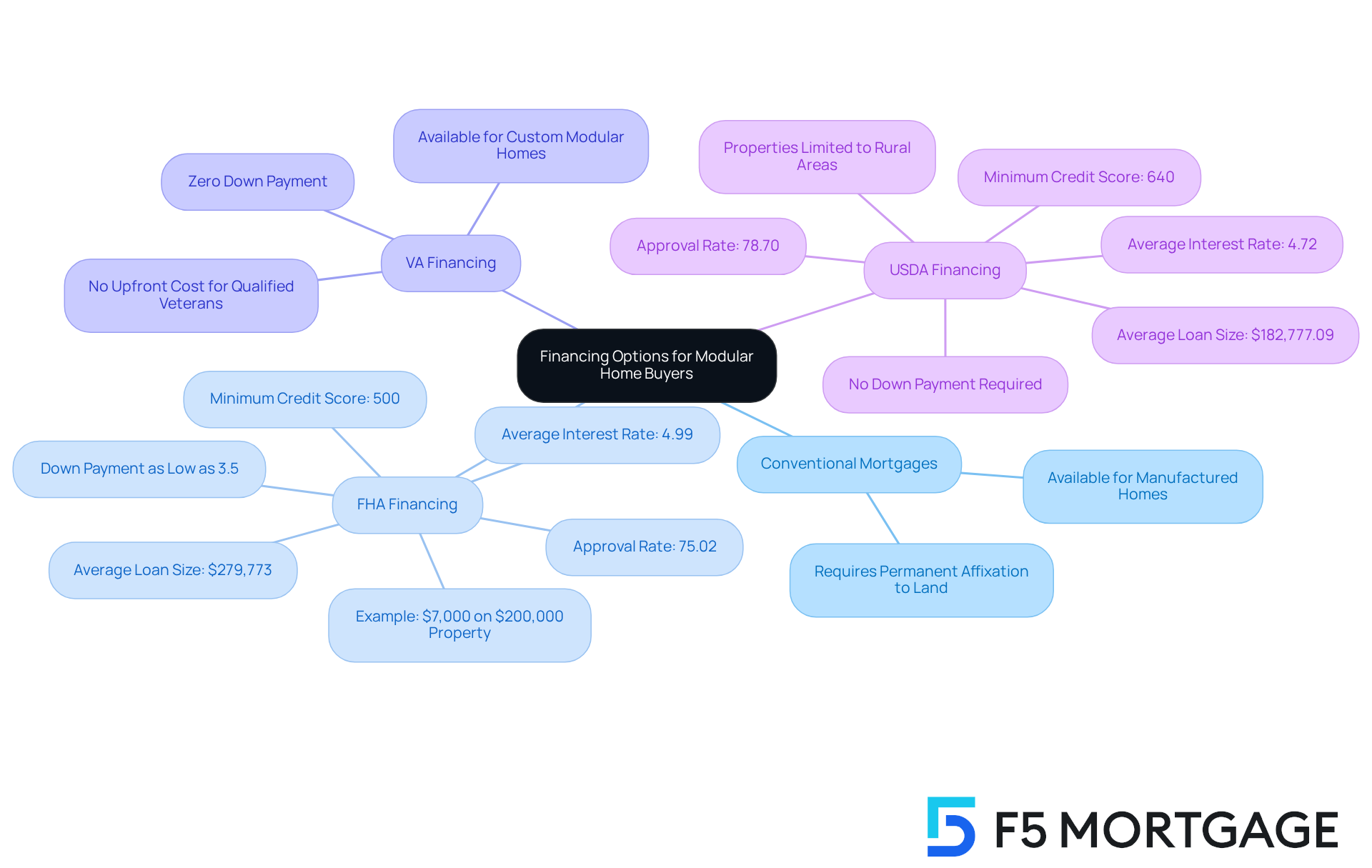

Navigating the world of modular property purchasing can feel overwhelming, but there are various modular home loans available to help you. You might consider:

- Conventional mortgages

- FHA financing

- VA financing

- USDA financing

FHA mortgages, for example, can be obtained with a down payment as low as 3.5%. This means that if you’re looking at a $200,000 property and have good credit, your initial contribution could be around $7,000.

For qualified veterans, VA mortgages offer the significant advantage of no upfront cost, making homeownership more accessible. Additionally, USDA financing provides full funding for properties located in rural areas, which can be a great opportunity for many families. Remember, beyond the down payment, it’s essential to factor in closing costs, which typically range from 2% to 5% of the home’s value.

At F5 Mortgage, we understand how crucial it is to find the right fit for your financial situation, especially when considering modular home loans. We offer a diverse selection of financing programs, including modular home loans alongside both conventional and unconventional options, ensuring that you have access to multiple funding solutions tailored to your needs. To make the most informed decision, we encourage you to explore various financing options and consult with a mortgage expert. We’re here to support you every step of the way, helping you understand how these financial solutions can best meet your homeownership goals.

Loan Terms Explained: What to Expect for Modular Home Financing

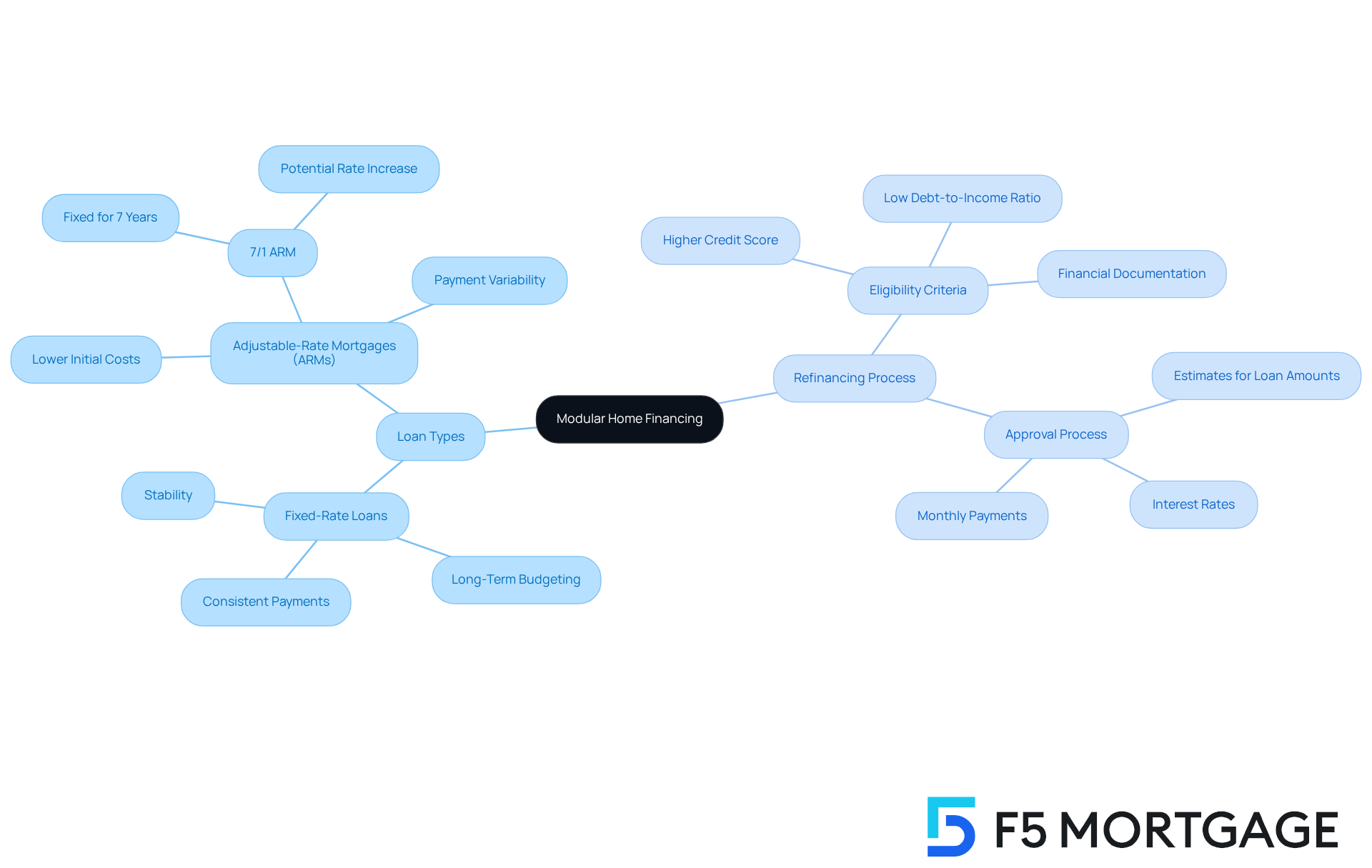

When considering funding for a modular residence, it’s essential for borrowers to familiarize themselves with the standard modular home loans conditions available, which typically range from 15 to 30 years. Fixed-rate loans offer the comfort of stability, providing regular monthly installments that can greatly assist in long-term budgeting. On the other hand, adjustable-rate mortgages (ARMs) often start with lower initial costs, appealing to individuals who may not stay in their home for an extended period. However, it’s important to note that these amounts can fluctuate over time, potentially leading to higher payments once the initial fixed period ends. For instance, a 7/1 ARM offers a fixed interest rate for the first seven years, which can be particularly beneficial for buyers planning to sell within that timeframe. Understanding these terms is crucial for borrowers, as it allows them to select a financial product that aligns with their goals and comfort with risk.

Additionally, for homeowners in Colorado contemplating refinancing, it’s vital to recognize that the refinancing process resembles applying for a new mortgage. Borrowers must meet certain eligibility criteria, such as:

- Maintaining a higher credit score

- A low debt-to-income ratio

- Providing necessary financial documentation to secure favorable terms

At F5 Mortgage, we’re here to support homeowners in navigating these requirements, ensuring they choose the right refinance option based on their unique circumstances. Understanding the approval process is key; it indicates that a lender views you as a suitable candidate for a mortgage, providing estimates for loan amounts, interest rates, and monthly payments. Financial advisors often stress the importance of evaluating personal circumstances when deciding between fixed and adjustable-rate options, as each comes with its own set of advantages and potential drawbacks. Ultimately, this decision should reflect the borrower’s long-term strategy and comfort with payment variability.

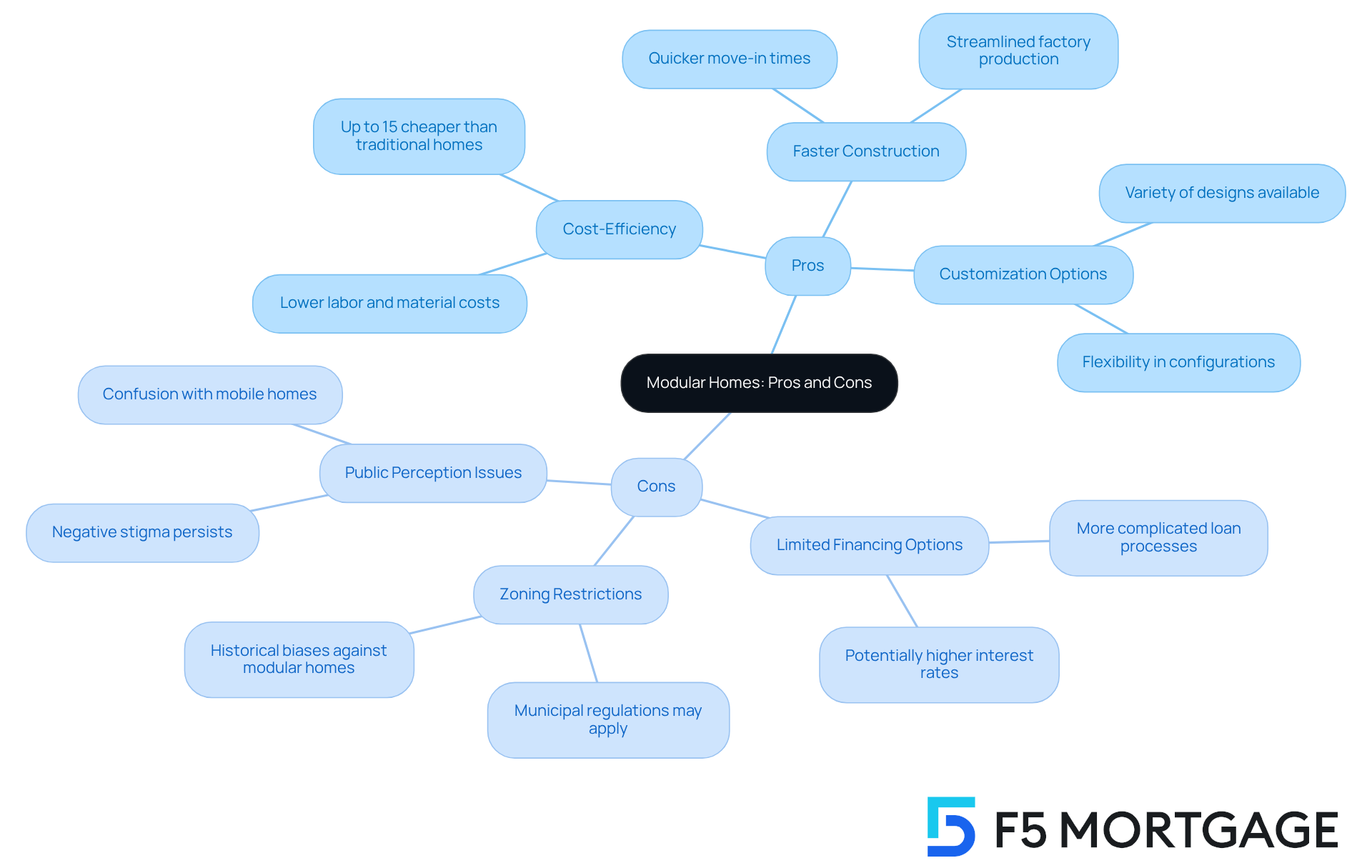

Pros and Cons of Modular Homes: Making Informed Decisions

Modular residences offer a range of benefits that can truly make a difference for families. They are not only cost-efficient but also come with quicker construction timelines and a variety of customization options. In fact, these residences can be up to 15% less expensive than traditional stick-built houses. This cost-effectiveness largely stems from lower labor and material expenses associated with factory production. The streamlined construction process means families can move in sooner, making modular homes especially appealing for those looking to enhance their living situations.

At F5 Mortgage, we understand how important it is for families to achieve homeownership. That’s why we provide fast and flexible mortgage solutions, ensuring competitive rates and exceptional service. Potential buyers can get pre-qualified within just 10 minutes and receive a no-obligation estimate. This quick turnaround is vital for families eager to settle into their new homes swiftly.

However, we know that navigating the home buying process can come with its own set of challenges. Financing options for modular home loans can sometimes be more limited compared to conventional homes. Often, this means that modular home loans are required, which convert to regular mortgages once the home is completed. Additionally, zoning restrictions in certain municipalities may complicate the buying process, as historical biases against modular homes can lead to regulatory hurdles.

Real estate experts emphasize the importance of understanding these dynamics. While modular residences are built to the same high standards as traditional houses, public perception can lag behind, affecting desirability. It’s crucial for buyers to weigh these factors carefully, considering their priorities and long-term plans. By doing so, they can make informed decisions about whether a modular home aligns with their needs and lifestyle.

Moreover, F5 Mortgage is here to support families by providing information on down payment assistance programs available in California, Texas, and Florida. These programs can significantly ease the financial burden for families looking to buy modular residences. Initiatives like the MyHome Assistance Program and the My Choice Texas Home program offer valuable support, making homeownership more attainable. With F5 Mortgage’s commitment to helping families realize their dream of property ownership, navigating the modular home loans financing landscape becomes a more manageable endeavor.

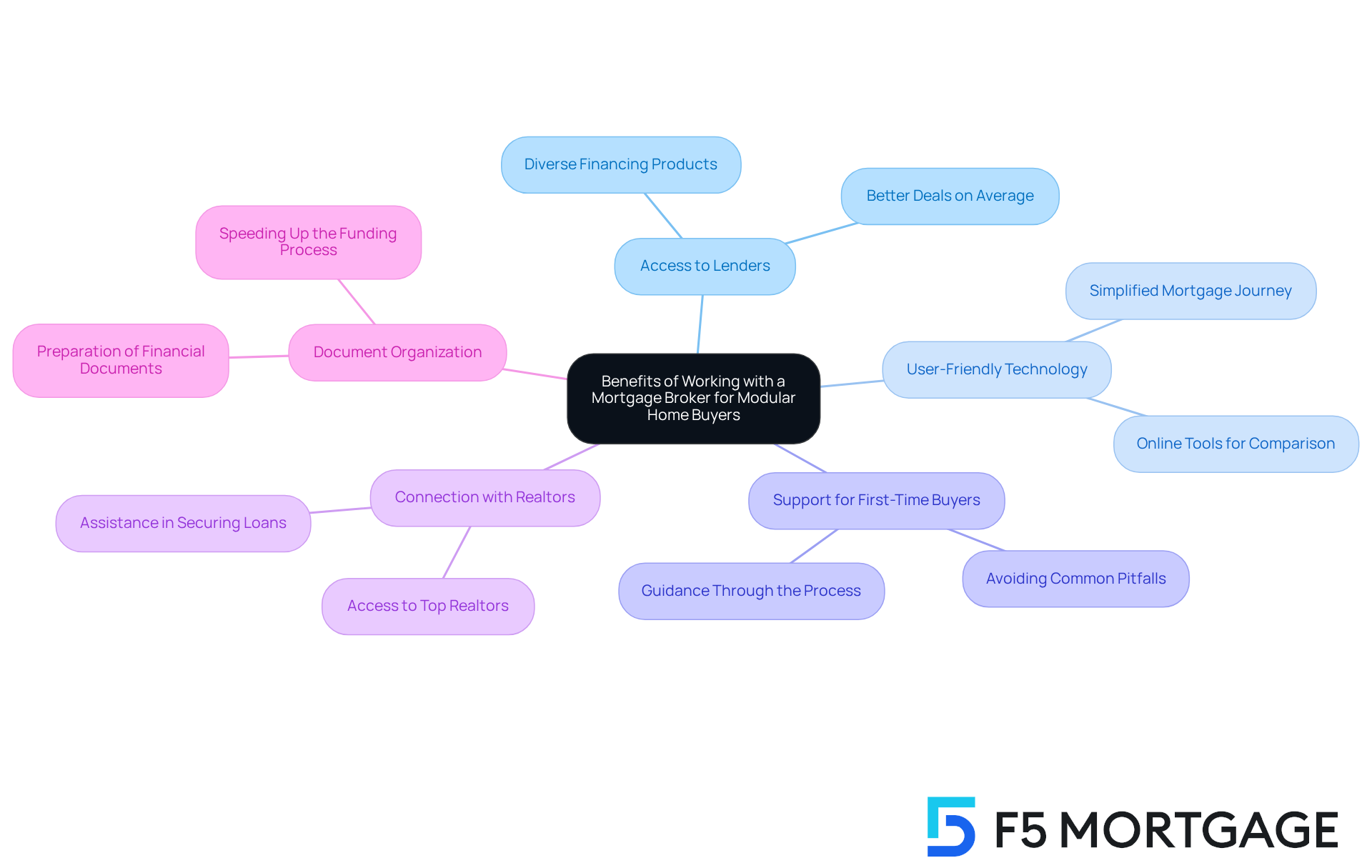

Working with a Mortgage Broker: Benefits for Modular Home Buyers

Navigating the mortgage process can be daunting, especially for those seeking modular home loans. That’s why working with a mortgage broker, like F5 Mortgage, can be a game changer. We understand how challenging this can be, and our brokers have access to a diverse array of lenders and financing products tailored to meet your unique needs.

At F5 Mortgage, we leverage user-friendly technology to simplify the mortgage journey for you. Our goal is to guide you without pressure, ensuring you feel supported every step of the way. This approach is particularly beneficial for first-time homebuyers who might feel overwhelmed by the financing process.

Moreover, we can connect you with top realtors in your area, helping you secure the best modular home loans available. Imagine finalizing your financing in less than three weeks! To make this experience even smoother, we recommend organizing your financial documents in advance. This simple step can significantly speed up the funding process, allowing you to focus on what truly matters—your new home.

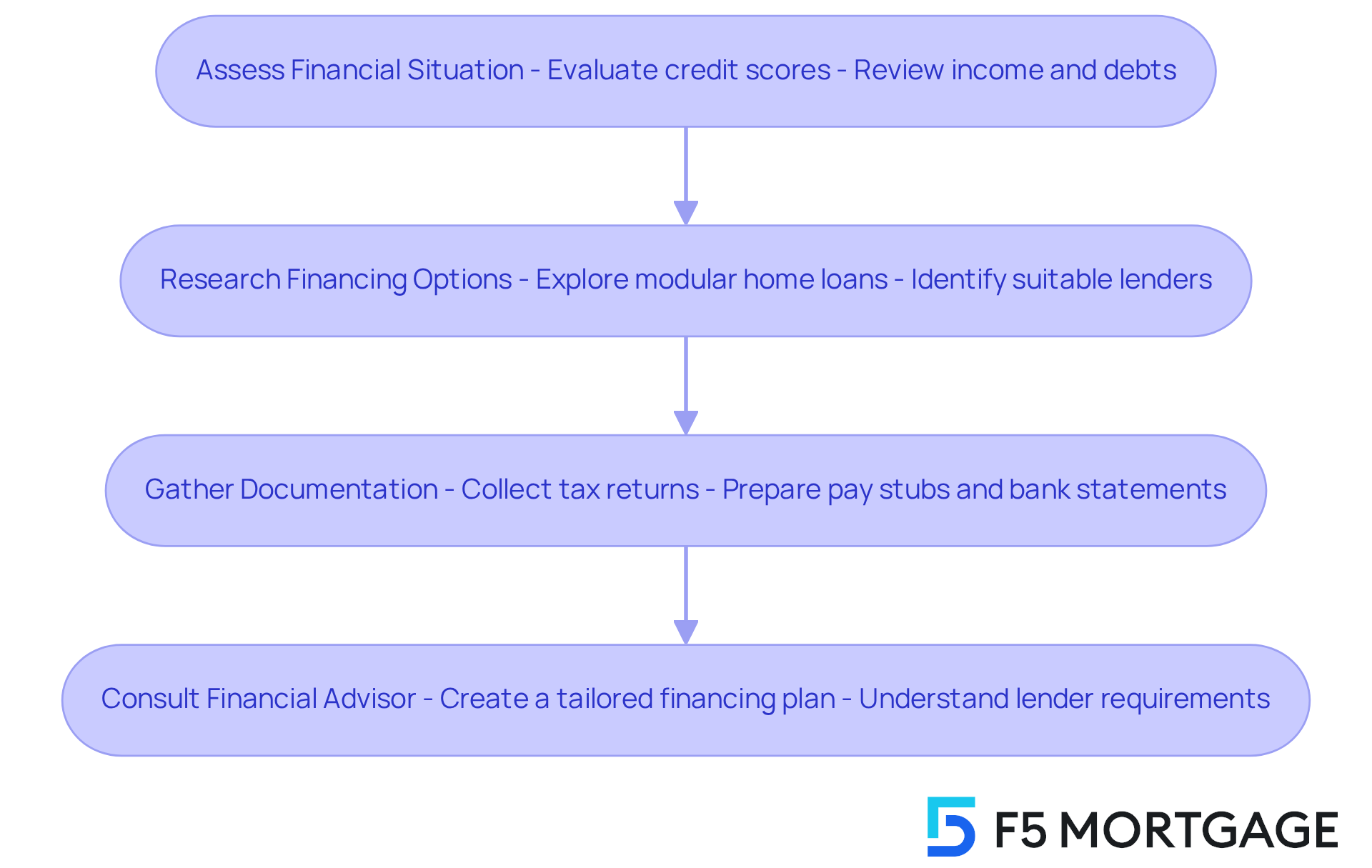

Preparation Tips: Researching Before Securing Your Modular Home Loan

Before obtaining modular home loans, we understand how important it is for prospective buyers to undertake several crucial preparatory steps. First, assessing your financial situation is vital. This includes evaluating credit scores, income, and existing debts. Financial consultants often stress that a clear comprehension of your financial condition can greatly influence your chances of approval. For instance, individuals with a credit score of 580 or above can qualify for FHA mortgages with a down payment as low as 3.5%. Those with scores as low as 500 may still obtain financing but will need a 10% down payment. Furthermore, many creditors require property owners to maintain a minimum 80% value-to-equity ratio, meaning you need to have reduced at least 20% of your initial borrowing amount or your home must have appreciated in value. If you’re considering a cash-out home equity line, be aware that it may have even higher equity requirements. This is crucial to consider when evaluating your financial readiness.

Next, researching different financing options, such as modular home loans, and lenders is essential to identify the best fit for your needs. On average, buyers invest significant time—often several weeks—researching financing options before applying. This effort can lead to more informed decisions. Gathering necessary documentation, such as tax returns, pay stubs, and bank statements, will streamline the application process and demonstrate your financial stability to lenders. It’s also important to note that a maximum of a 43% debt-to-income (DTI) ratio is typically necessary for home financing, whether you are obtaining a traditional mortgage or refinancing an existing one. Improving your DTI can result in more competitive mortgage terms, further enhancing your financing options.

Consider the stories of individuals who effectively utilized land equity as a down payment. This strategy not only enhanced their likelihood of approval but also helped them secure more favorable interest rates. To increase your chances of obtaining favorable loan terms, ensure you are well-prepared and informed about your financial situation and the requirements of lenders. We recommend consulting with a financial advisor to create a tailored plan that aligns with your home financing goals. Remember, we’re here to support you every step of the way.

Conclusion

Securing a modular home loan can be a straightforward process when you have the right knowledge and resources. We know how challenging this can be, but by understanding the various financing options available—such as FHA and VA loans—and recognizing the importance of credit scores and down payment requirements, you can navigate the complexities of modular home financing with confidence. A personalized approach, like that offered by F5 Mortgage, ensures that you receive tailored advice to suit your unique financial situation, ultimately enhancing your chances of approval.

This article highlights several essential tips to empower you on your journey:

- Maintaining a healthy credit profile is crucial.

- Exploring down payment assistance programs is advisable.

- Understanding how interest rates can impact your overall mortgage costs is important.

- Comparing different lenders and financing options can help you make informed decisions that align with your homeownership goals.

- Working with a mortgage broker can streamline the process, providing you access to a variety of loan products and expert guidance.

Ultimately, the journey to homeownership through modular financing is not just about securing a loan; it’s about making informed choices that pave the way for a brighter future. By taking proactive steps—such as researching financing options, improving your credit score, and understanding loan terms—you can achieve your dream of owning a modular home. With support from experienced lenders like F5 Mortgage, navigating this path becomes much more manageable, allowing you to focus on what truly matters: creating a home filled with memories.

Frequently Asked Questions

What services does F5 Mortgage offer for modular home loans?

F5 Mortgage provides personalized mortgage solutions for modular home loans, utilizing user-friendly technology to simplify the mortgage process and ensure client satisfaction.

Why are FHA loans considered a good option for modular home financing?

FHA loans are accessible with down payments as low as 3.5% for borrowers with a credit score of 580 or above, making them an excellent choice for those with limited upfront funds. They also offer flexible qualification criteria and can be secured for modular homes that meet specific standards.

What are the credit score requirements for securing a modular home loan?

Most lenders require a minimum credit score of 580 for FHA financing, while conventional loans typically require a score of around 620 or above. However, FHA loans can be available for scores as low as 500 with a higher down payment.

How does a good credit score affect my mortgage options?

A strong credit score increases the chances of loan approval and can lead to lower interest rates, saving money over the life of the loan. Borrowers with scores of 760 or higher often qualify for the best mortgage rates.

What steps are involved in the refinancing process for modular home loans?

The refinancing process involves several key steps: researching options, submitting an application, undergoing an appraisal, completing underwriting, and finally closing on the new mortgage.

Can FHA financing help first-time homebuyers?

Yes, FHA financing is particularly beneficial for first-time homebuyers, as it offers lower down payment requirements and more flexible qualification criteria, making homeownership more accessible.

How does F5 Mortgage support clients throughout the mortgage process?

F5 Mortgage supports clients by providing tailored consultations, professional advice, and a variety of financing programs to meet diverse borrower needs, ensuring a smooth and stress-free experience.