Overview

Conforming loan limits are crucial for families looking to secure financing for their homes. For 2025, Fannie Mae and Freddie Mac have set this limit at $806,500 for single-family residences, reflecting a 5.2% increase from the previous year. This increase is more than just a number; it represents an opportunity for borrowers to access more favorable financing options.

Imagine being able to secure lower interest rates and relaxed qualification criteria. This is especially important for families in high-cost areas, where limits can reach up to $1,209,750. We understand how challenging it can be to navigate the mortgage process, and this increase in limits can make a significant difference.

As you consider upgrading your home, remember that we’re here to support you every step of the way. Take advantage of this opportunity to explore your options and find the right financing solution for your family’s needs.

Introduction

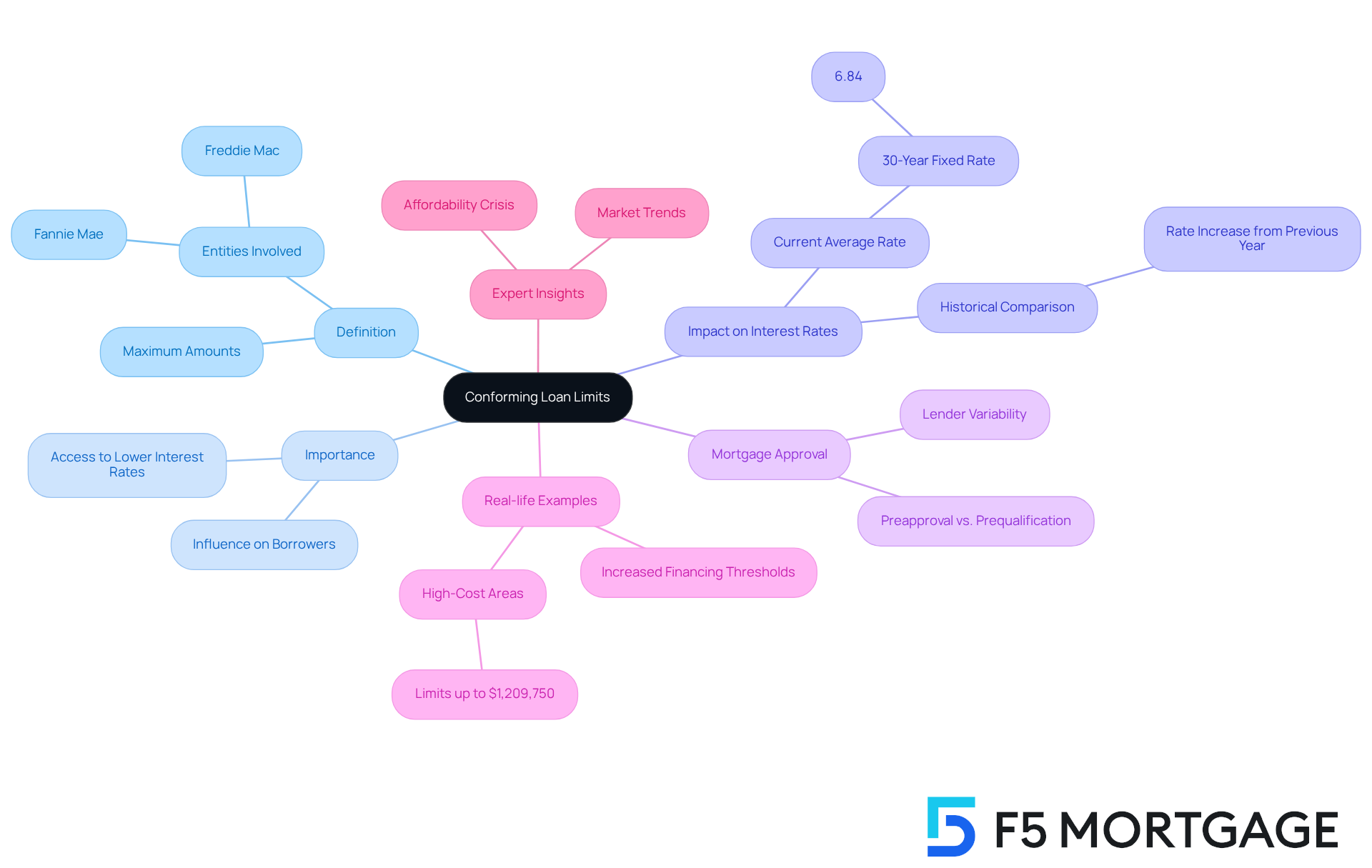

Understanding the nuances of conforming loan limits is essential for anyone looking to navigate the complex landscape of home financing. We know how challenging this can be. As these limits dictate the maximum amount that government-backed entities like Fannie Mae and Freddie Mac are willing to guarantee, they play a crucial role in determining mortgage eligibility, interest rates, and overall borrowing options.

With the conforming loan limit for 2025 set to rise to $806,500, families may find themselves at a crossroads. Should they take advantage of these favorable conditions, or will they be forced to explore more expensive, non-conforming options? This decision can feel overwhelming, but we’re here to support you every step of the way.

Delving into this topic reveals not just the mechanics of conforming loan limits, but also the strategic opportunities they present for aspiring homeowners. By understanding these limits, families can make informed decisions that align with their financial goals.

Define Conforming Loan Limits and Their Importance

Conforming loan limits represent the maximum amounts that Fannie Mae and Freddie Mac, two key government-sponsored entities, are willing to purchase or guarantee. For 2025, the conforming loan limits for a single-family residence are set at $806,500, reflecting a 5.2% increase from the previous year. This adjustment is crucial as it directly affects the types of credit available to borrowers, influencing interest rates and eligibility criteria. By staying within the conforming loan limits, borrowers can typically secure lower interest rates and more favorable financing terms, making homeownership more achievable for many families.

Understanding mortgage approval is vital in this context. An approval signifies that a lender has reviewed your financial information and determined that you are a suitable candidate for a mortgage. This process can differ among lenders, with terms like “preapproval” or “prequalification” often used interchangeably. With F5 Mortgage, families can expect personalized support throughout this journey, ensuring they understand their financing options and the financial benefits of homeownership.

Real-life examples illustrate the benefits of these thresholds. Families looking to improve their homes can take advantage of the increased qualifying financing thresholds, which align with conforming loan limits, to secure funding that meets their needs, especially in high-cost areas where limits can reach up to $1,209,750. This flexibility is essential for first-time homebuyers and those with unique financial situations, as it opens doors to better mortgage options.

Expert insights further highlight the importance of adhering to conforming loan limits. With the average rate on a 30-year fixed mortgage currently at 6.84%, understanding how these limits interact with interest rates can empower families to make informed choices. As housing costs continue to rise—51% above the start of the pandemic—conforming loan limits play a vital role in helping families navigate the complexities of the housing market, ensuring they can pursue their homeownership dreams with confidence.

Explore Criteria for Establishing Conforming Loan Limits

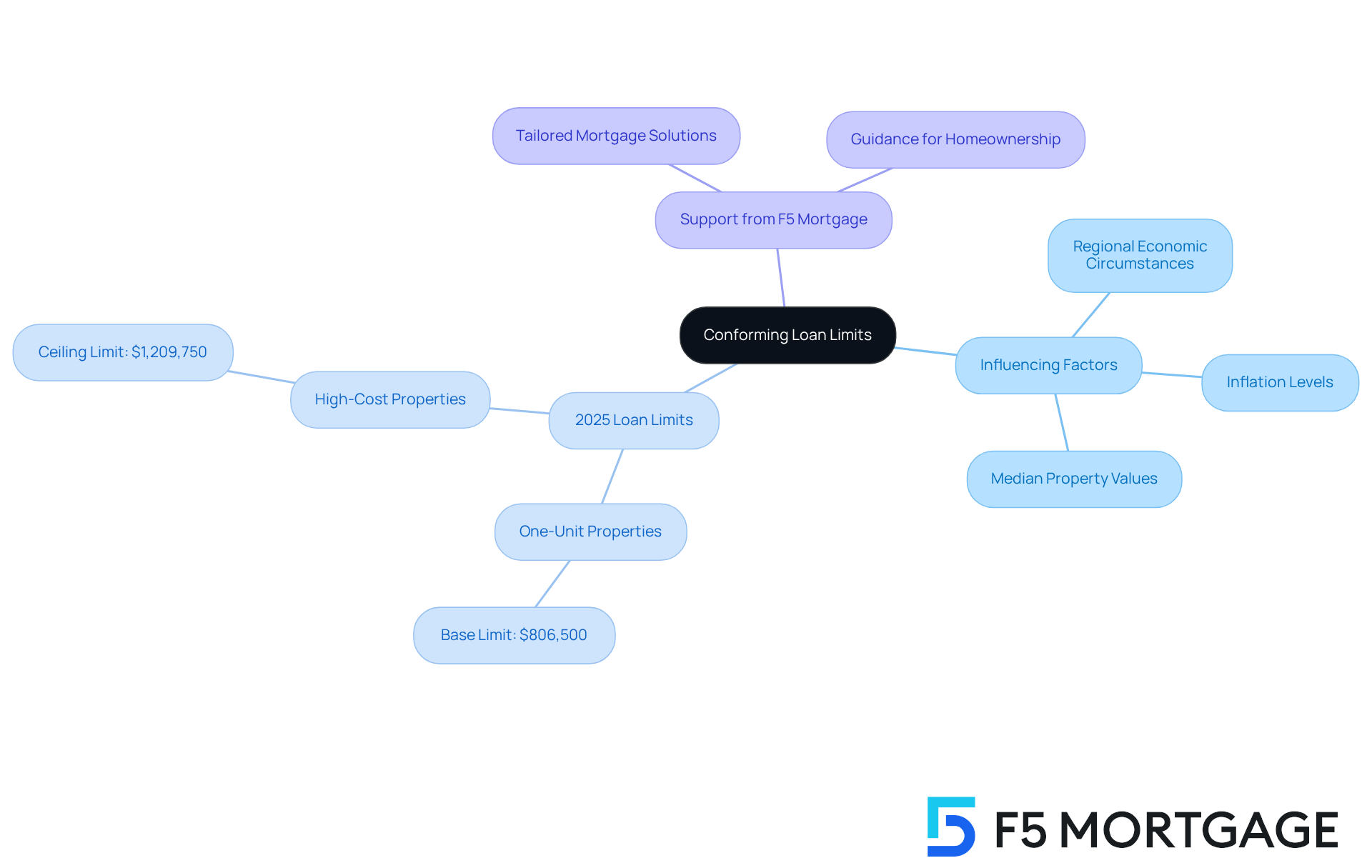

Navigating the world of home financing can be challenging, especially when it comes to understanding the conforming loan limits. These thresholds, established by the Federal Housing Finance Agency (FHFA), are influenced by national average property values and the House Price Index (HPI). Each year, the FHFA evaluates housing market trends and adjusts these thresholds to reflect current conditions.

Key factors that impact acceptable borrowing thresholds include:

- Regional economic circumstances

- Inflation levels

- Variations in median property values

For families in expensive regions, qualifying loan thresholds can be significantly higher, allowing for larger funding amounts. In 2025, the conforming loan limits for one-unit properties will rise to $806,500, reflecting a 5.2% increase from $766,550 in 2024. This change reflects the ongoing rise in average U.S. property prices.

Moreover, the conforming loan limits for high-cost properties will be set at $1,209,750, which is 150% of the baseline amount. This adjustment further facilitates home purchases in areas where housing expenses are elevated.

At F5 Mortgage, we understand how daunting these changes can feel. We’re here to support you every step of the way with tailored mortgage solutions that fit your budget and needs. With our guidance, you can confidently navigate these adjustments and take a significant step toward achieving your dream of homeownership.

Get your free quote today and join the over 1,000 families we’ve helped realize their dream of owning a home.

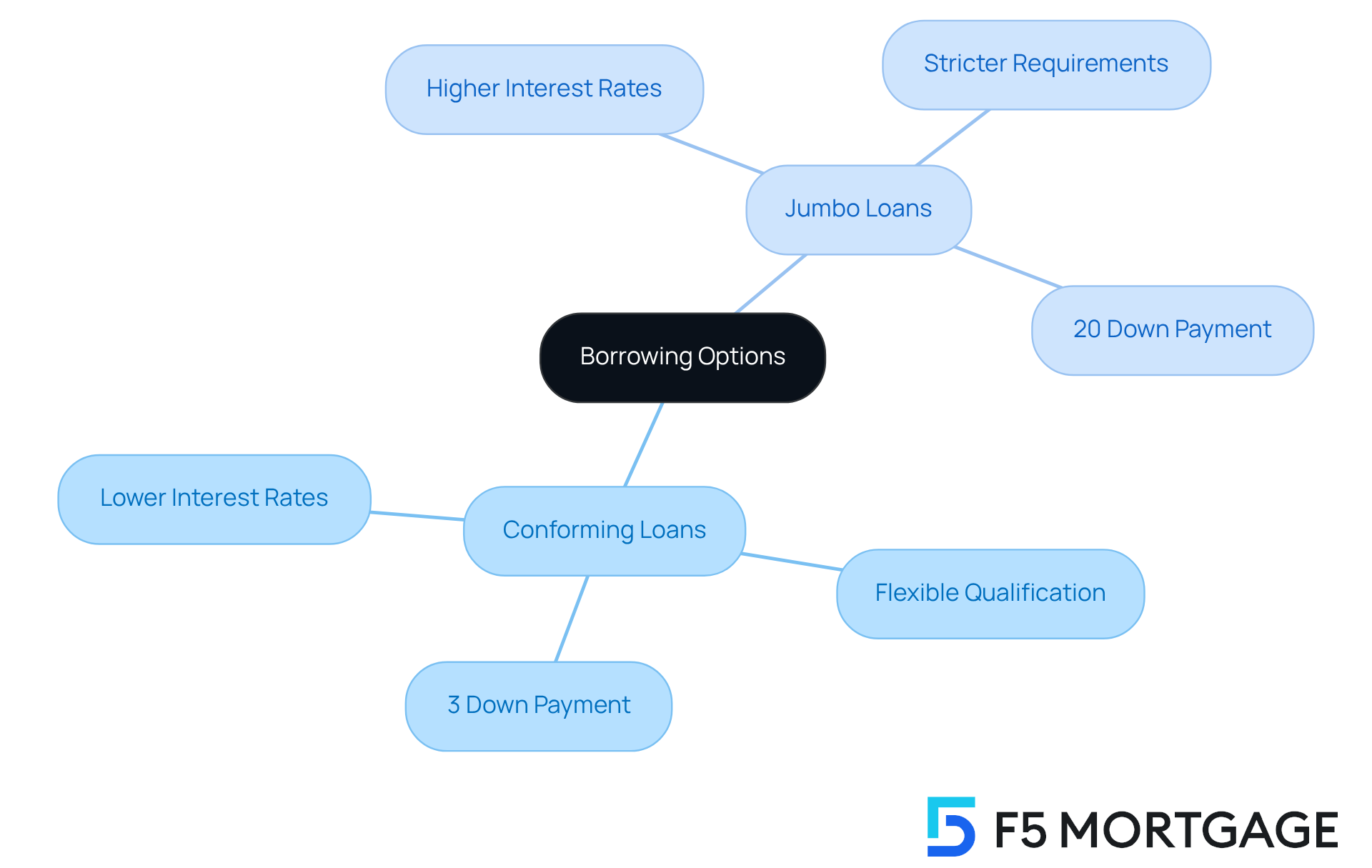

Analyze the Impact of Conforming Loan Limits on Borrowing Options

Understanding borrowing thresholds is crucial for families as they navigate their financing choices. The options available to them can be significantly influenced by conforming loan limits. When borrowers stay within conforming loan limits, they often benefit from lower interest rates and more flexible qualification standards compared to non-conforming options like jumbo mortgages. For instance, with the conforming loan limits set at $806,500 for 2025, families looking to purchase homes in this price range can secure financing under favorable conditions, easing the financial burden of buying a property.

On the other hand, properties priced above this threshold necessitate jumbo financing, which typically comes with stricter credit requirements and higher interest rates. Imagine a family wanting to buy a $1 million home; they would need to explore jumbo financing, which may require a larger down payment and a more thorough financial assessment. Recognizing these differences is vital for families to make informed choices about their home financing options.

Moreover, standard mortgages often allow down payments as low as 3%, making them more accessible for first-time homebuyers. In contrast, jumbo mortgages usually demand down payments of 20% or more, posing a significant hurdle for many families. Additionally, while standard mortgages might require private mortgage insurance (PMI) for down payments under 20%, jumbo loans typically do not, though some lenders may have similar insurance requirements.

Ultimately, the choice between standard and jumbo financing hinges on individual financial situations, property values, and long-term goals. By grasping the nuances of these financing types, families can navigate the complexities of home financing more effectively, empowering them to achieve the best possible outcomes for their home purchases. We understand how challenging this process can be, and we’re here to support you every step of the way.

Guide to Securing Loans Within Conforming Limits

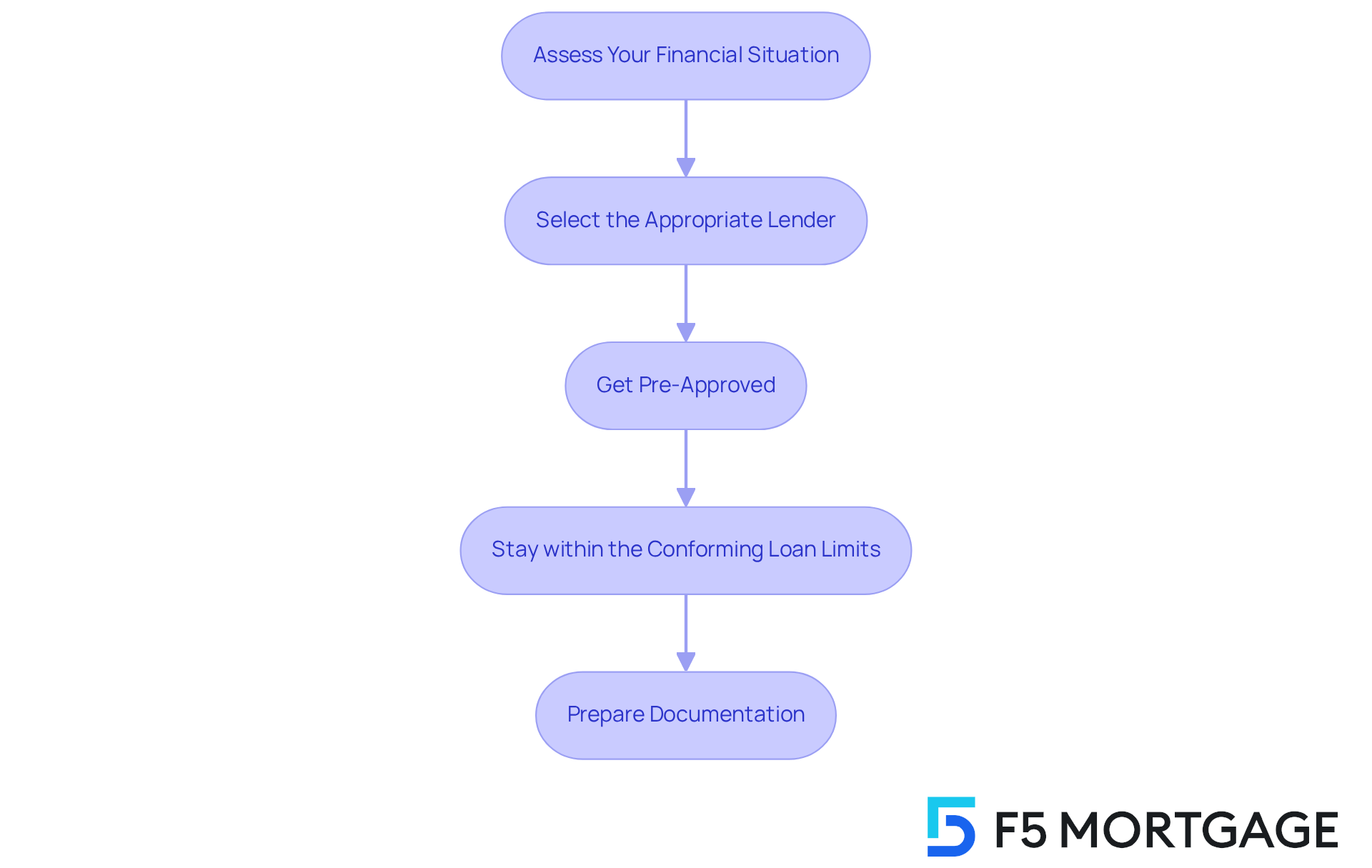

To obtain financing within acceptable limits, we understand how important it is for borrowers to follow these essential steps:

-

Assess Your Financial Situation: Start by reviewing your credit score, debt-to-income (DTI) ratio, and savings for a down payment. Aiming for a credit score of at least 620 and maintaining a DTI ratio below 43% can significantly enhance your eligibility for competitive mortgage rates. An improved DTI can lead to more advantageous terms, especially when considering refinancing options available in Colorado, including conventional mortgages, FHA mortgages, and VA mortgages.

-

Select the Appropriate Lender: Take the time to investigate lenders that offer attractive rates for standard mortgages. Engaging a mortgage broker can simplify your search by providing access to multiple lenders. We recommend visiting three to five lenders to discuss your mortgage options, maximizing your potential savings.

-

Get Pre-Approved: Obtaining a pre-approval letter is a crucial step that clarifies your borrowing capacity and demonstrates your seriousness to sellers. This process is typically free and can be completed with multiple lenders within 30 days, minimizing any impact on your credit score. An approval indicates that, based on your financial information, you are a strong candidate for a mortgage.

-

Stay within the conforming loan limits: Focus on properties priced below the conforming loan limits for your area, which is set at $806,500 for 2025, reflecting a 5.2% increase from the previous limit of $766,550. This adjustment aims to provide broader access to mortgage credit for homebuyers like you.

-

Prepare Documentation: Gather necessary documents such as tax returns, pay stubs, and bank statements to streamline the application process. Additionally, be aware that a minimum down payment of 3% to 5% may be required for conforming loan limits. By following these steps, families can significantly enhance their chances of securing favorable mortgage terms and achieving their homeownership goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding conforming loan limits is essential for families navigating the complexities of home financing. These limits define the maximum loan amounts guaranteed by Fannie Mae and Freddie Mac, and they significantly influence interest rates and borrowing options available to potential homeowners. By staying within these limits, borrowers can access more favorable mortgage terms, making homeownership a more achievable dream.

This article highlights several crucial aspects of conforming loan limits, including their annual adjustments based on property values and economic conditions. The increase to $806,500 for single-family residences in 2025, particularly in high-cost areas, underscores the importance of these thresholds in facilitating access to financing. Moreover, comparing conforming loans with jumbo loans illustrates the advantages of adhering to these limits, such as lower interest rates and more lenient qualification standards.

Ultimately, understanding conforming loan limits empowers families to make informed decisions about their home financing options. By following the outlined steps to secure loans within these limits, families can significantly enhance their chances of achieving their homeownership dreams. As housing costs continue to rise, staying informed about conforming loan limits will be crucial for navigating the housing market and ensuring access to affordable financing solutions. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What are conforming loan limits?

Conforming loan limits represent the maximum amounts that Fannie Mae and Freddie Mac are willing to purchase or guarantee for mortgages. For 2025, the limit for a single-family residence is set at $806,500.

Why are conforming loan limits important?

Conforming loan limits are important because they directly affect the types of credit available to borrowers, influencing interest rates and eligibility criteria. Staying within these limits allows borrowers to secure lower interest rates and more favorable financing terms.

How do conforming loan limits impact mortgage approval?

Conforming loan limits impact mortgage approval by determining the maximum loan amounts that can be financed under favorable terms. This can influence a lender’s decision on whether to approve a mortgage application based on the borrower’s financial situation.

What is the difference between “preapproval” and “prequalification”?

“Preapproval” and “prequalification” are terms often used interchangeably to describe the process where a lender reviews a borrower’s financial information to determine their suitability for a mortgage. However, the specific processes may vary among lenders.

How do conforming loan limits affect first-time homebuyers?

Conforming loan limits provide first-time homebuyers with increased qualifying financing thresholds, allowing them to secure funding that meets their needs, especially in high-cost areas where limits can be higher.

What are the current mortgage rates related to conforming loan limits?

The average rate on a 30-year fixed mortgage is currently at 6.84%. Understanding how conforming loan limits interact with these rates can help families make informed financial decisions.

How have housing costs changed since the pandemic?

Housing costs have risen significantly, with an increase of 51% above the levels at the start of the pandemic. Conforming loan limits play a crucial role in helping families navigate this rising housing market.