Overview

Navigating mortgage applications can be daunting, and we understand how challenging this can be. This article focuses on how to effectively craft your work history to enhance your chances of approval. A clear and stable employment record is essential, as it reflects your financial reliability to lenders. Detailed documentation of your job titles, responsibilities, and consistent income can significantly impact your application.

By presenting a well-organized work history, you not only build trust with lenders but also open the door to better loan conditions. Remember, we’re here to support you every step of the way. Take the time to gather your documentation, and ensure that it tells your financial story clearly and confidently. With the right preparation, you can feel empowered in your mortgage journey.

Introduction

Crafting a compelling work history is essential for anyone looking to secure a mortgage. We know how challenging this can be, as lenders scrutinize employment backgrounds to assess financial reliability. By showcasing consistent employment and demonstrating income stability, you can significantly enhance your chances of approval and potentially unlock better loan terms.

But how can you effectively present your work history to stand out in a competitive market? This article delves into key strategies for organizing and tailoring your work history to meet lender expectations. We’re here to support you every step of the way, ensuring a smoother path to mortgage approval.

Define Your Work History

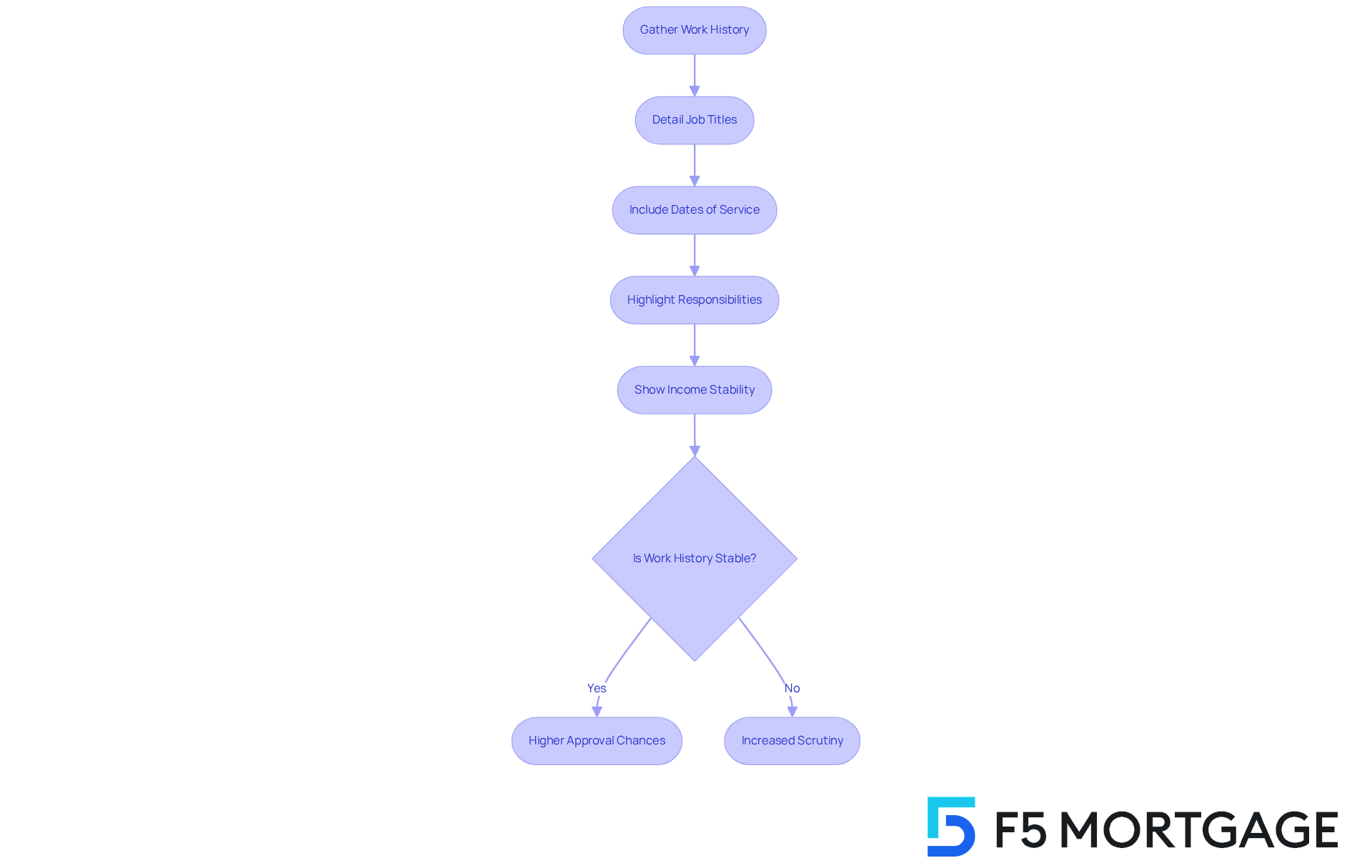

Your work history is a vital factor in your mortgage application. It encompasses all relevant work history, including job titles, organizations, dates of service, and key responsibilities. We understand how important it is to highlight positions that reflect your stability and reliability as a borrower, especially those that demonstrate consistent income. This is particularly significant for self-employed individuals or those with employment gaps, as financial institutions closely examine these factors. A consistent work history signals to creditors that you present a reduced risk, enhancing your chances of approval and potentially leading to better loan conditions.

To effectively present your work history, ensure clarity and detail in your documentation. Providing thorough information that highlights your income stability is crucial, as financial institutions generally require a minimum of two years of work history to assess your economic reliability. For instance, if you have transitioned into a new position, offering evidence of steady income during this time can alleviate concerns from the financial institution. Additionally, if your job aligns with your degree, it may further bolster your approval chances.

Successful mortgage applications often feature applicants with strong work history. Individuals who have sustained consistent employment in their sector are viewed more favorably by financial institutions, as this stability correlates with dependable income and a good credit score. Conversely, frequent job changes or gaps longer than six months may raise red flags, leading to increased scrutiny from lenders.

In summary, presenting a clear and stable work history is crucial for obtaining mortgage approval. By focusing on your job stability and providing thorough documentation, you can significantly enhance your chances of obtaining the funding needed to upgrade your home. We know how challenging this process can be, and we’re here to support you every step of the way.

Gather and Organize Your Employment Information

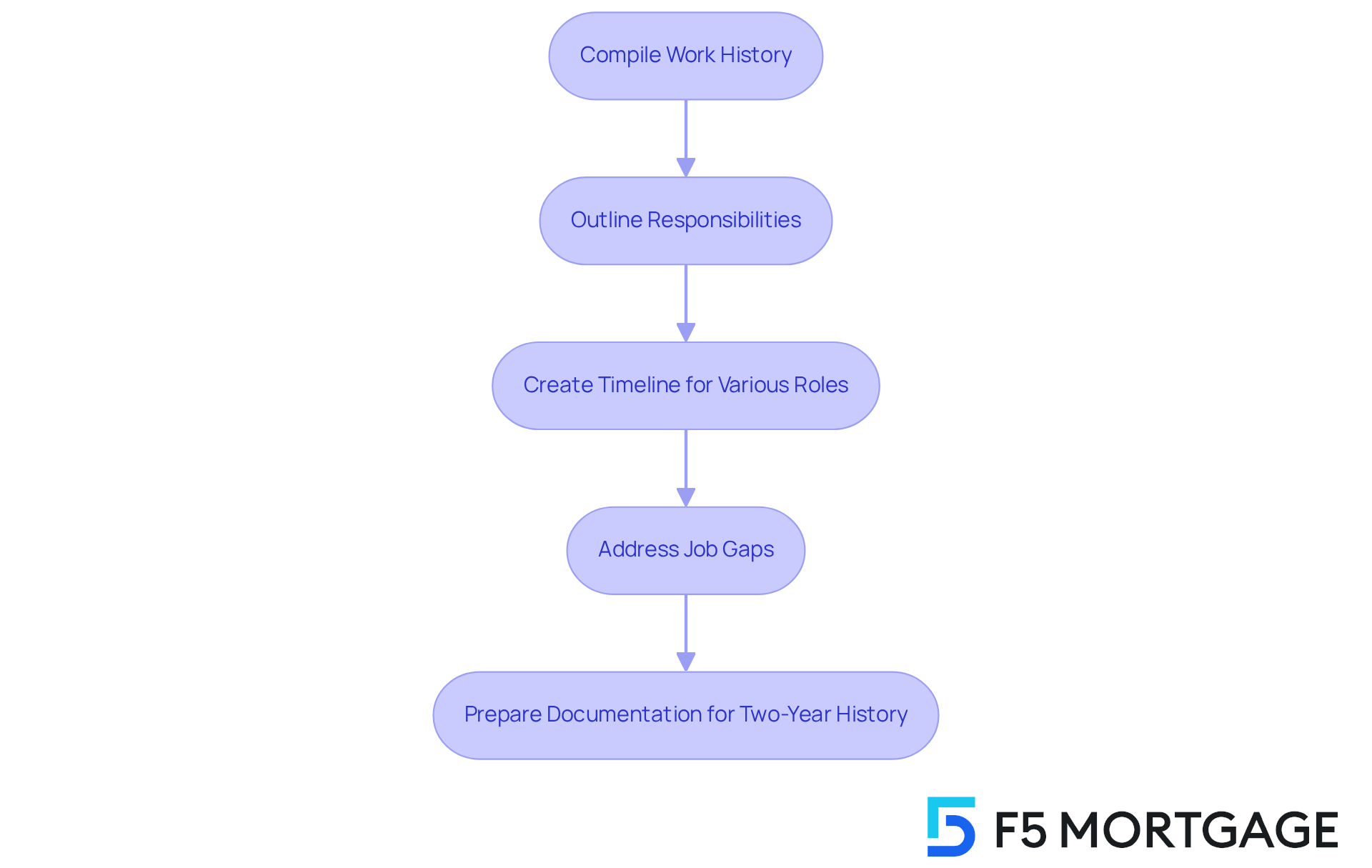

Start by compiling a thorough list of your work history, which includes all your past employers. Include the company name, your job title, and the periods of work. For each role, outline your primary responsibilities and any notable achievements that could strengthen your application. If you’ve held various roles, consider creating a timeline to illustrate your work background. This structured approach not only simplifies the presentation of your work history but also guarantees clarity and conciseness on your mortgage application.

We know how important it is to present a strong profile. Financial institutions generally favor candidates with a steady work history, so emphasizing consistent job tenure and relevant skills can greatly improve your standing. If you’ve encountered any job gaps, be ready to clarify them; acceptable reasons may include maternity leave, temporary disability, or caring for a loved one. Lenders will scrutinize these periods to assess your financial stability, but note that gaps of a month or two may be overlooked.

Furthermore, remember that most financial institutions necessitate a two-year work history. Ensure your documentation represents this duration. As Patrick Boyaggi, CEO and Co-Founder, highlights, “Your job background is one of the elements that financiers examine when they’re evaluating your application to qualify for a mortgage.” We’re here to support you every step of the way as you navigate this process.

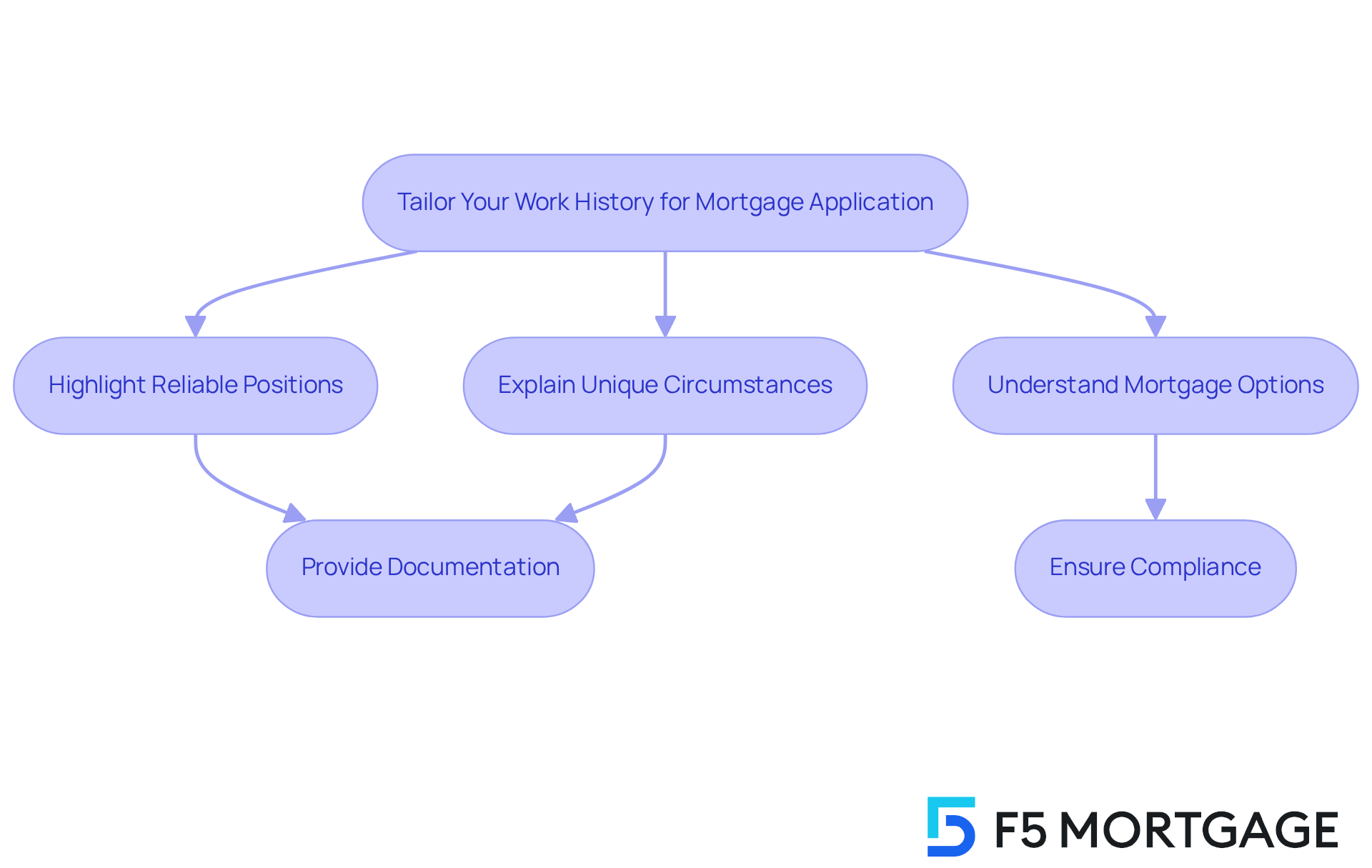

Tailor Your Work History for Each Job Application

When seeking a mortgage, we know how challenging it can be to navigate the lender’s criteria. It’s essential to customize your work history to showcase your financial stability. Highlight positions in your work history that demonstrate your reliability, such as long-term employment or roles with consistent income. A solid work history can positively influence your Debt-to-Income (DTI) ratio, which is a crucial factor in securing favorable mortgage rates.

If you have unique circumstances, like self-employment or freelance work, don’t hesitate to explain how these experiences enrich your overall financial picture. This targeted approach will help financial institutions see you as a strong candidate, especially when considering refinancing options available through F5 Mortgage, including:

- Conventional loans

- FHA loans

- VA loans

Understanding the significance of mortgage approval letters and the underwriting process can further bolster your application. By ensuring compliance, you increase your chances of success. Additionally, be prepared to provide necessary documentation, such as tax returns and bank statements, to complete your refinancing application. Remember, we’re here to support you every step of the way.

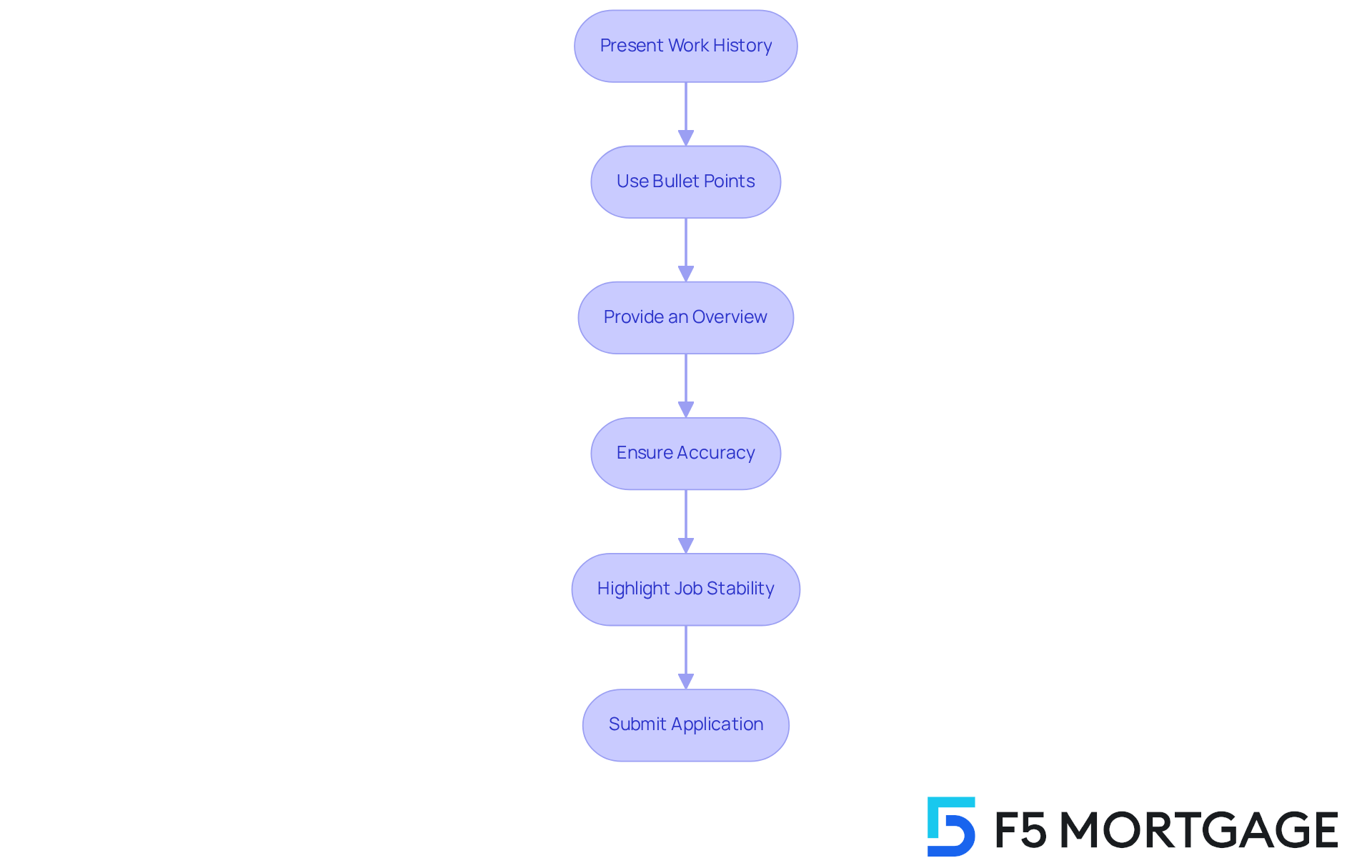

Present Your Work History Effectively

Presenting your employment background in a clean and professional format is crucial for mortgage applications. We understand how overwhelming this process can be, especially when considering the impact of your Debt-to-Income (DTI) ratio, which ideally should be below 43%. Using bullet points can efficiently clarify your duties and accomplishments, making it easier for financial institutions to absorb your information. Remember, accuracy is paramount; any errors can raise concerns and potentially jeopardize your application. By incorporating a brief overview at the beginning of your career background, you can further improve your presentation, highlighting your overall experience and strengths. This summary serves as a quick reference for financial institutions, assisting your application in standing out in a competitive market.

Mortgage professionals emphasize that your chances of approval can be significantly impacted by a well-structured work history, particularly in relation to your DTI ratio. For instance, showcasing a consistent work history not only indicates stability but also assures financial institutions of your ability to repay the loan. Successful candidates often emphasize their job stability and pertinent accomplishments, which can positively affect the financial institution’s perception.

Consider the case of a borrower who meticulously formatted their work history, clearly detailing their roles and accomplishments. This clarity not only aided the financial institution’s review process but also highlighted the borrower’s reliability, ultimately resulting in a favorable loan decision. Additionally, maintaining a good credit score and providing proof of income, such as pay stubs and W-2 forms, is vital to demonstrate stable income to lenders. By prioritizing a professional presentation of your work history and understanding the implications of your DTI ratio, you can enhance your mortgage application and increase your chances of securing the financing you need through F5 Mortgage. Furthermore, exploring various refinancing options available in Colorado can provide additional pathways to favorable mortgage terms.

Conclusion

Presenting a well-crafted work history is essential for securing mortgage approval. We understand how challenging this can be, and by effectively showcasing your employment stability and income reliability, you can significantly enhance your chances of obtaining favorable loan conditions. Financial institutions scrutinize work histories to assess risk, making it crucial to highlight relevant positions and maintain clarity in your documentation.

Throughout this article, we have discussed key strategies that can empower you on this journey:

- Compiling a detailed employment history

- Tailoring it for each application

- Presenting it in a professional format

Emphasizing long-term positions and addressing any employment gaps can further strengthen your application. Additionally, understanding the implications of the Debt-to-Income ratio and providing thorough documentation, such as tax returns and pay stubs, are vital components of a successful mortgage application.

Ultimately, the significance of a solid work history cannot be overstated. It serves as a reflection of financial stability and responsibility, which lenders value highly. By following the outlined steps and ensuring a clear presentation of your work history, you can navigate the mortgage application process with confidence. Remember, we’re here to support you every step of the way, increasing your likelihood of securing the funding needed to achieve your homeownership goals.

Frequently Asked Questions

What is included in my work history for a mortgage application?

Your work history for a mortgage application includes job titles, organizations, dates of service, and key responsibilities that reflect your stability and reliability as a borrower.

Why is work history important for mortgage approval?

Work history is important because it signals to creditors your income stability and reliability, which can enhance your chances of mortgage approval and lead to better loan conditions.

How long of a work history do financial institutions typically require?

Financial institutions generally require a minimum of two years of work history to assess your economic reliability.

What should I do if I have employment gaps or am self-employed?

If you have employment gaps or are self-employed, it’s crucial to highlight positions that demonstrate consistent income and provide thorough documentation to alleviate concerns from financial institutions.

How does job stability affect my mortgage application?

Job stability positively affects your mortgage application, as individuals with consistent employment are viewed more favorably by lenders due to the correlation with dependable income and good credit scores.

What impact do frequent job changes or long gaps have on my mortgage application?

Frequent job changes or gaps longer than six months may raise red flags and lead to increased scrutiny from lenders, potentially affecting your chances of approval.

How can I enhance my chances of mortgage approval?

You can enhance your chances of mortgage approval by presenting a clear and stable work history, focusing on job stability, and providing thorough documentation of your income.