Overview

Zero down payment mortgages offer a compassionate pathway to homeownership, especially for first-time buyers. They allow individuals to purchase homes without needing an upfront contribution, which can be a significant hurdle. We understand how challenging this can be, and that’s why it’s essential to explore various loan options available to you.

This article highlights several loan programs, including:

- VA loans

- USDA loans

- Navy Federal loans

Each of these options comes with specific eligibility criteria that you should be aware of. By understanding these options, you can navigate the application process with confidence and clarity.

We’re here to support you every step of the way as you embark on this journey. Take the time to explore these mortgage solutions, and empower yourself with the knowledge needed to make informed decisions for your future.

Introduction

Navigating the path to homeownership can feel overwhelming, especially for those with limited savings. We understand how challenging this can be. Zero down payment mortgages offer a promising solution, enabling aspiring homeowners to bypass traditional upfront costs and move into their dream homes sooner. This guide will explore the various types of zero down payment financing options, eligibility criteria, and the application process, while also addressing common challenges that may arise.

But what happens when the allure of no down payment meets the complexities of credit scores and documentation? We’re here to support you every step of the way. Understanding this balance is crucial for anyone looking to seize the opportunity of homeownership without the burden of an initial financial commitment.

Understand Zero Down Payment Mortgages

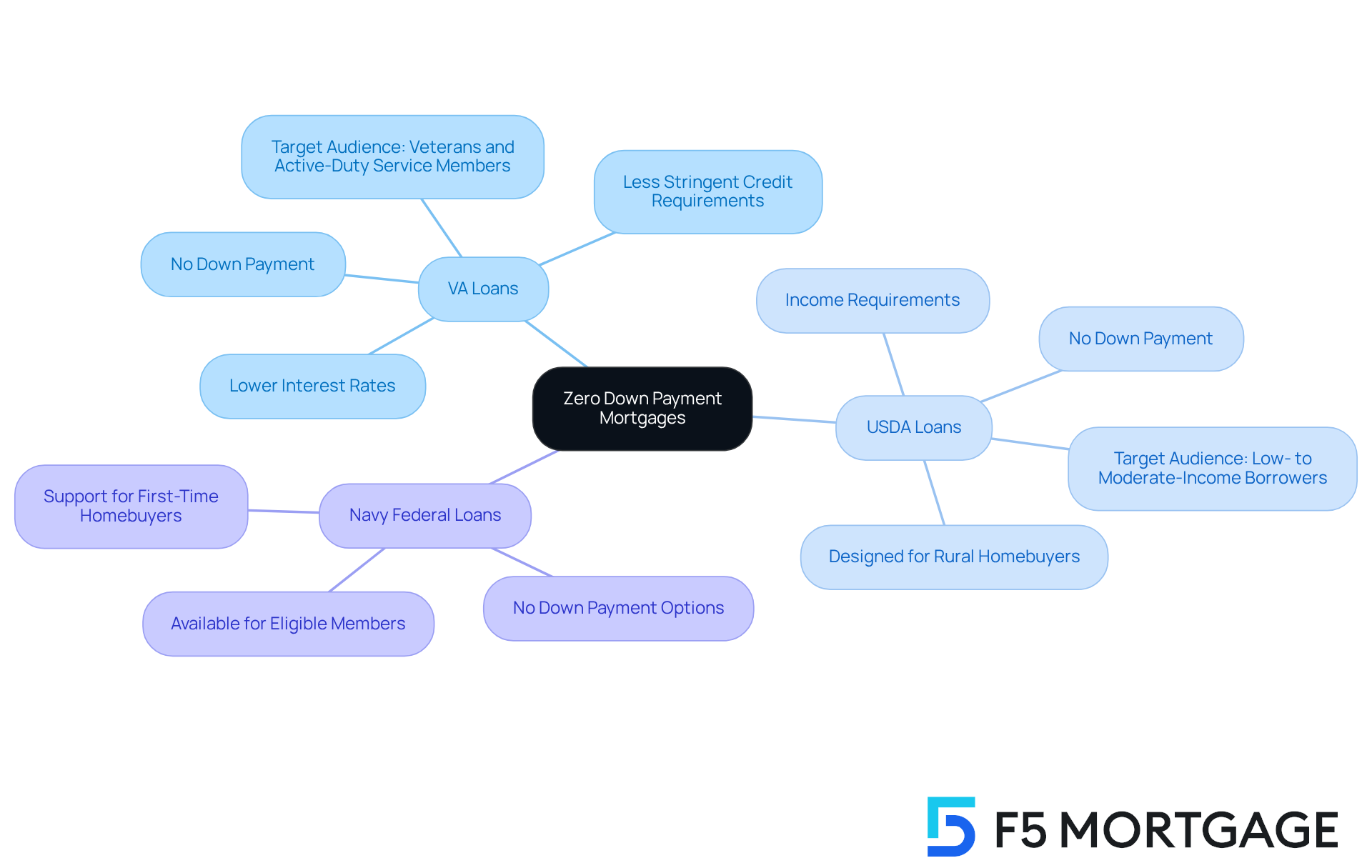

Zero down payment financing options provide a wonderful opportunity for homebuyers, enabling them to cover the entire cost of a home without needing an upfront contribution at closing. This option is particularly beneficial for first-time homebuyers or those with limited savings, as it alleviates some of the financial pressure. Let’s explore some key types of zero down payment mortgages that can help you on your journey to homeownership:

- VA Loans: Exclusively available to eligible veterans and active-duty service members, VA loans require no down payment. They often come with lower interest rates and less stringent credit requirements compared to conventional loans, making them a supportive choice for those who have served.

- USDA Loans: Designed for rural homebuyers, USDA loans provide zero down payment options for individuals who meet specific income requirements. This facilitates homeownership in designated rural areas, helping families find their perfect home.

- Navy Federal Loans: Certain credit unions, like Navy Federal, provide no down financing options for eligible members. This is especially helpful for those who may struggle to save for a traditional down payment.

These options with zero down payment are particularly advantageous for first-time home purchasers. A significant percentage of new buyers utilize such loans to enter the housing market. By offering zero down payment, these loans empower buyers to achieve homeownership more swiftly, fostering stability and the ability to establish roots.

However, it’s essential to understand the implications of starting with no equity, as this can present risks in a fluctuating housing market. In general, zero down payment loans provide a practical path for many hopeful property owners, allowing them to pursue their dreams of homeownership without the immediate financial burden of a deposit. We know how challenging this can be, and we’re here to support you every step of the way.

Determine Eligibility for Zero Down Payment Mortgages

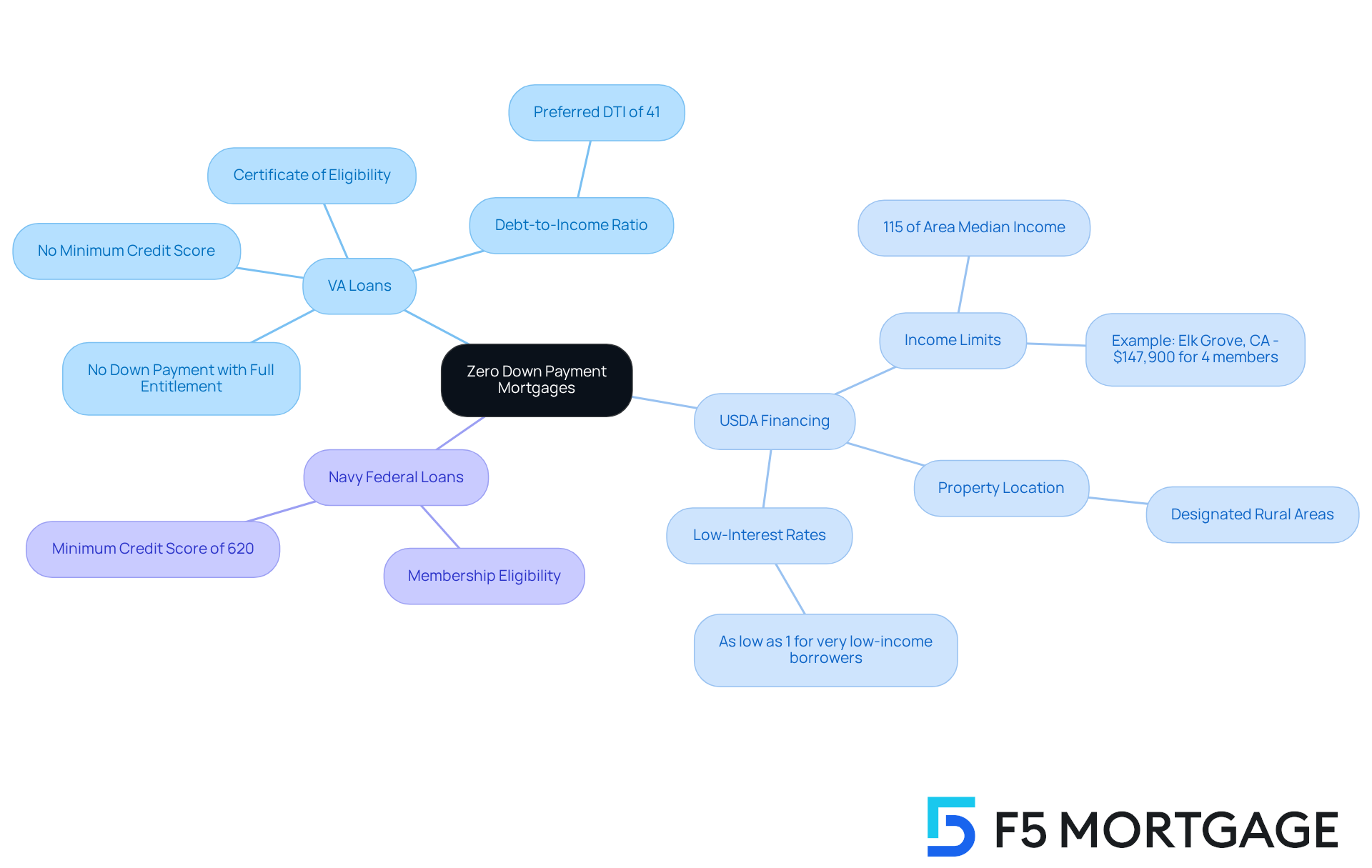

Qualifying for a mortgage with zero down payment can seem daunting, but understanding the specific eligibility criteria can make the process much smoother for potential borrowers. Let’s explore the options available to you, so you can feel empowered in your journey toward homeownership.

-

VA Loans: If you’re a veteran, you’ll need a Certificate of Eligibility from the VA to verify your service record. While there are no minimum credit score requirements, having a favorable credit score can genuinely enhance your loan terms. Additionally, if you’re considering refinancing, the VA Interest Rate Reduction Refinance Option (IRRRL) and VA cash-out refinancing can be beneficial tools to help you manage your financial needs effectively.

-

USDA Financing: For those looking into USDA options, it’s essential to note that your household income should not exceed 115% of the median income for your area. For example, in 2025, a household of four in Elk Grove, California, has an income limit of $147,900. Also, the property must be located in a designated rural area, which is defined as having a population of 20,000 or fewer. The USDA 502 Direct Loan Program offers loans with interest rates as low as 1% for very low-income borrowers, making homeownership more accessible than ever.

-

Navy Federal Loans: If you’re considering Navy Federal Loans, remember that membership eligibility is a prerequisite. Typically, borrowers need a credit score of at least 620 to qualify.

Understanding these criteria is crucial for you, as it can significantly streamline your application process and increase your chances of approval. By meeting these requirements, you can enhance your likelihood of obtaining a loan with zero down payment. Moreover, don’t forget about the importance of a home appraisal; it establishes the current market value of the property and the equity available, which can influence your loan rates and refinancing options.

We know how challenging this can be, but by arming yourself with this knowledge, you’re taking a significant step toward securing the home of your dreams. We’re here to support you every step of the way.

Follow the Step-by-Step Application Process

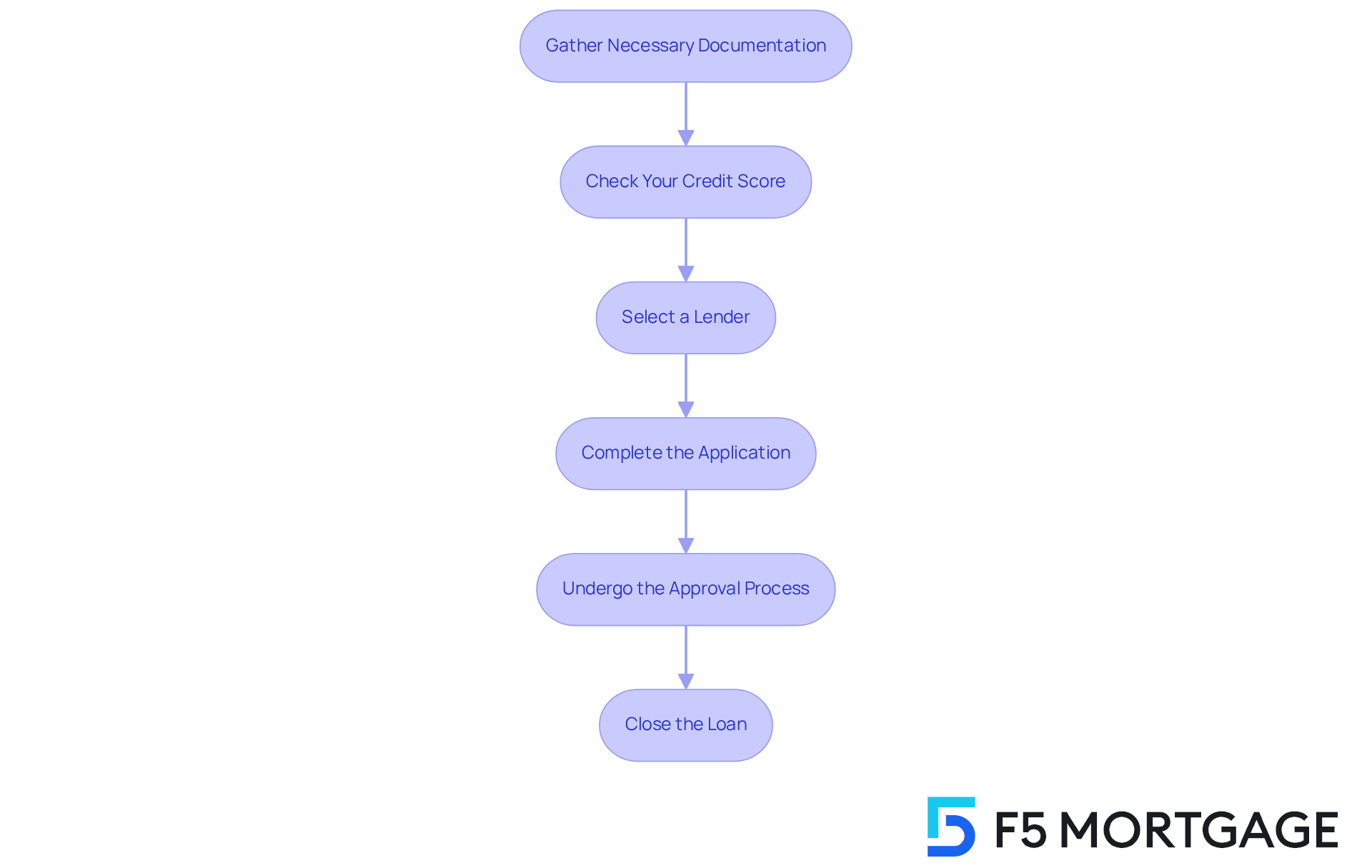

Applying for a mortgage with zero down payment can feel overwhelming, but we’re here to support you every step of the way. By following these key steps, you can ensure a smooth experience:

-

Gather Necessary Documentation: Start by collecting essential documents, such as proof of income, tax returns, bank statements, and a valid form of identification. This preparation is crucial, as lenders require comprehensive information to assess your financial situation.

-

Check Your Credit Score: Review your credit report for any inaccuracies that could impact your score. A credit score of at least 640 is generally required for no down options, so understanding your position is essential.

-

Select a Lender: This offer includes a zero down payment option. Investigate different options that offer zero down payment loans. Compare their terms, interest rates, and customer service to find the best fit for your needs. Local credit unions and community banks often provide personalized service that can be beneficial.

-

Complete the Application: Fill out the loan application form thoroughly, ensuring all required information and documentation are included. This step is critical for a timely review by the lender.

-

Undergo the Approval Process: Once submitted, the lender will review your application, verify your information, and assess your eligibility. This process typically takes 10 to 15 days, during which they may request additional documentation.

-

Close the Loan: If approved, you will receive a closing disclosure detailing the final terms of your loan. Carefully review this document to ensure all terms align with your expectations before signing.

By following these steps, you can navigate the application procedure for a no down financing option with confidence, preparing yourself for successful homeownership.

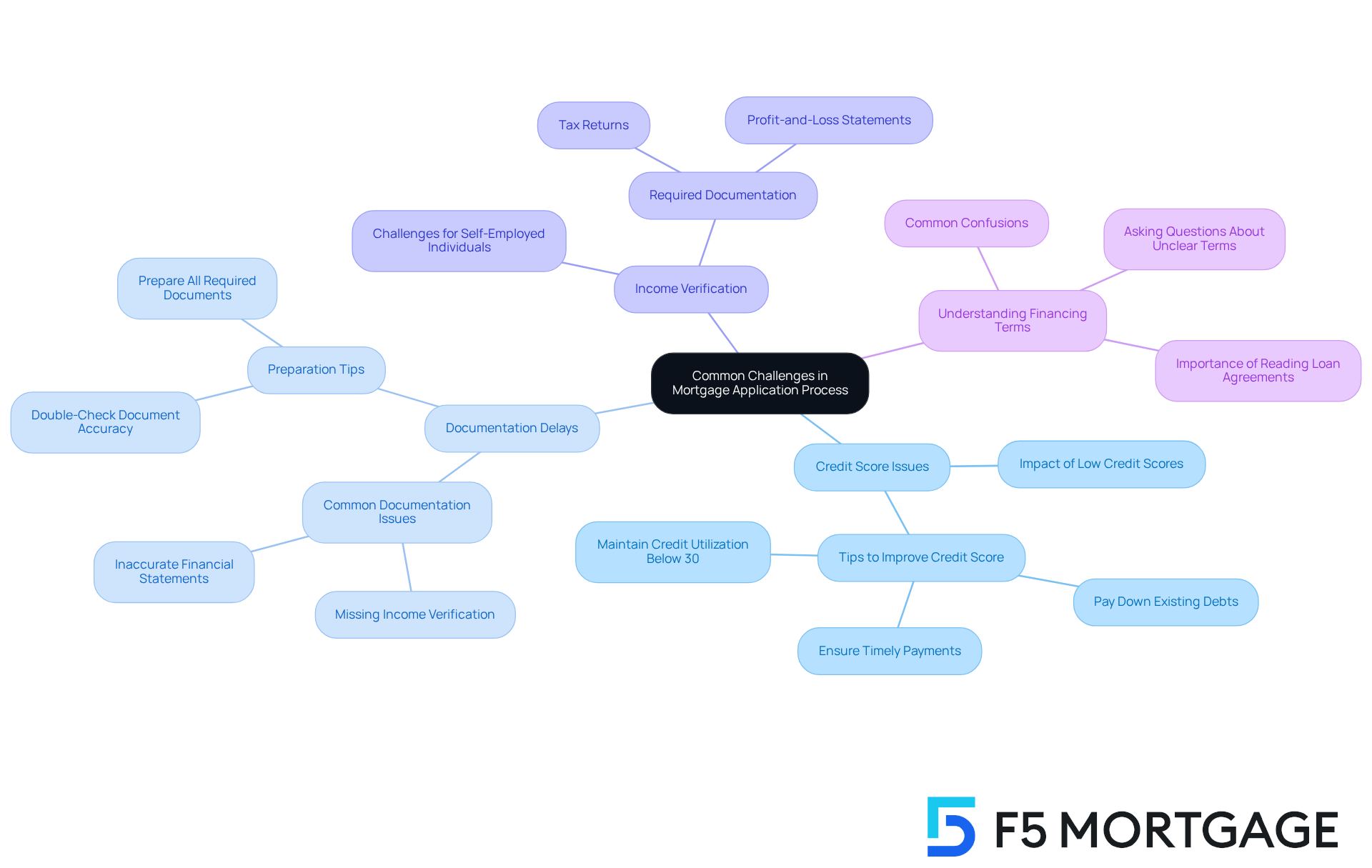

Address Common Challenges in the Application Process

Applying for a mortgage with zero down payment can feel overwhelming at times, but we’re here to support you every step of the way. However, several challenges may arise that require careful attention:

-

Credit Score Issues: We know how challenging it can be to manage your credit score. A low credit score can significantly impact your chances of mortgage approval. Statistics show that higher credit scores lead to better mortgage terms, while lower scores may hinder approval. To improve your score, focus on paying down existing debts and ensuring timely payments. Maintaining a credit utilization rate below 30% is also advisable.

-

Documentation Delays: Incomplete or missing documentation can cause significant delays in the approval process, which can be frustrating. Common issues include not having the necessary income verification or failing to provide accurate financial statements. To avoid these pitfalls, ensure that all required documents are prepared and double-check their accuracy before submission.

-

Income Verification: For many, income verification can be a daunting task, especially for self-employed individuals. Lenders often require extensive proof of income, so be ready to provide additional documentation, such as tax returns and profit-and-loss statements, to demonstrate your financial stability.

-

Understanding Financing Terms: It’s normal to feel confused about financing terms. Many borrowers may not fully grasp the terms of their financing, which can lead to misunderstandings later on. It’s crucial to take the time to read through your loan agreement thoroughly and ask questions about any unclear terms or conditions.

By proactively addressing these challenges and preparing accordingly, you can navigate the mortgage application process more effectively. Remember, taking these steps can significantly increase your chances of securing the financing you need.

Conclusion

Zero down payment mortgages offer a welcoming pathway to homeownership, especially for first-time buyers and those with limited savings. By removing the burden of an upfront payment, these financing options empower individuals to step into the housing market without the immediate financial pressure of a down payment. It’s essential to understand the different types of zero down payment mortgages available, such as VA, USDA, and Navy Federal loans, as this knowledge can help potential homebuyers turn their dream of owning a home into a reality.

In this guide, we’ve shared key insights on eligibility requirements, the application process, and common challenges that may arise when pursuing zero down payment mortgages. By being informed about the necessary documentation, credit score expectations, and potential obstacles, you can navigate this process with confidence. Our step-by-step approach ensures that you are well-prepared and equipped to tackle any issues that might come your way.

As the world of home financing evolves, embracing zero down payment mortgage options can significantly change the journey for many aspiring homeowners. By taking proactive steps, such as improving your credit score and gathering the necessary documentation, you can enhance your chances of securing a loan that aligns with your financial goals. We understand that the journey to homeownership may feel overwhelming, but with the right knowledge and resources, it is entirely within your reach.

Frequently Asked Questions

What are zero down payment mortgages?

Zero down payment mortgages allow homebuyers to finance the entire cost of a home without needing an upfront contribution at closing, making it easier for those with limited savings to purchase a home.

Who can benefit from zero down payment mortgages?

Zero down payment mortgages are particularly beneficial for first-time homebuyers and individuals with limited savings, as they alleviate some financial pressure when purchasing a home.

What types of zero down payment mortgages are available?

The main types of zero down payment mortgages include VA Loans for eligible veterans and active-duty service members, USDA Loans for rural homebuyers meeting specific income requirements, and Navy Federal Loans provided by certain credit unions for eligible members.

What are VA Loans?

VA Loans are exclusively available to eligible veterans and active-duty service members and require no down payment. They typically offer lower interest rates and less stringent credit requirements compared to conventional loans.

What are USDA Loans?

USDA Loans are designed for rural homebuyers and provide zero down payment options for individuals who meet specific income requirements, facilitating homeownership in designated rural areas.

What are Navy Federal Loans?

Navy Federal Loans are offered by certain credit unions, like Navy Federal, and provide no down financing options for eligible members, helping those who may struggle to save for a traditional down payment.

What are the risks of zero down payment mortgages?

Starting with no equity can present risks in a fluctuating housing market, as homeowners may face challenges if property values decline.

How do zero down payment mortgages impact first-time homebuyers?

Zero down payment mortgages empower first-time homebuyers to enter the housing market more swiftly, fostering stability and the ability to establish roots without the immediate financial burden of a deposit.