Overview

Navigating the mortgage shopping process can feel overwhelming, but we’re here to support you every step of the way. This article outlines a compassionate five-step process designed to help you find the right mortgage for your family. First, it’s essential to understand mortgage basics; knowing the different loan types and interest rates can significantly impact your decision.

Next, checking your credit score is crucial. We understand how challenging this can be, but having a clear picture of your financial standing empowers you to take control. Obtaining pre-approval is the third step, providing you with a better idea of your budget and strengthening your position when making offers.

As you compare options, remember that this process is about finding what works best for you. Each lender may offer different terms, so take your time to explore. Finally, selecting a lender is a significant decision; ensure you feel comfortable and supported throughout this journey.

By following these steps, you can secure favorable mortgage terms in a competitive market. We believe that with the right information and support, you can confidently navigate this important milestone.

Introduction

Navigating the mortgage landscape can feel overwhelming. We know how challenging this can be, especially with the ever-changing rates and numerous options available to potential homebuyers. Understanding the intricacies of mortgages—from interest rates to loan types—is crucial for making informed financial decisions. As buyers face the challenge of securing favorable terms in a competitive market, the question arises: how can one effectively shop for a mortgage that aligns with their financial goals and needs?

This guide offers a step-by-step approach to demystifying the mortgage shopping process. We’re here to support you every step of the way, ensuring that prospective homeowners are well-equipped to make the best choices for their future.

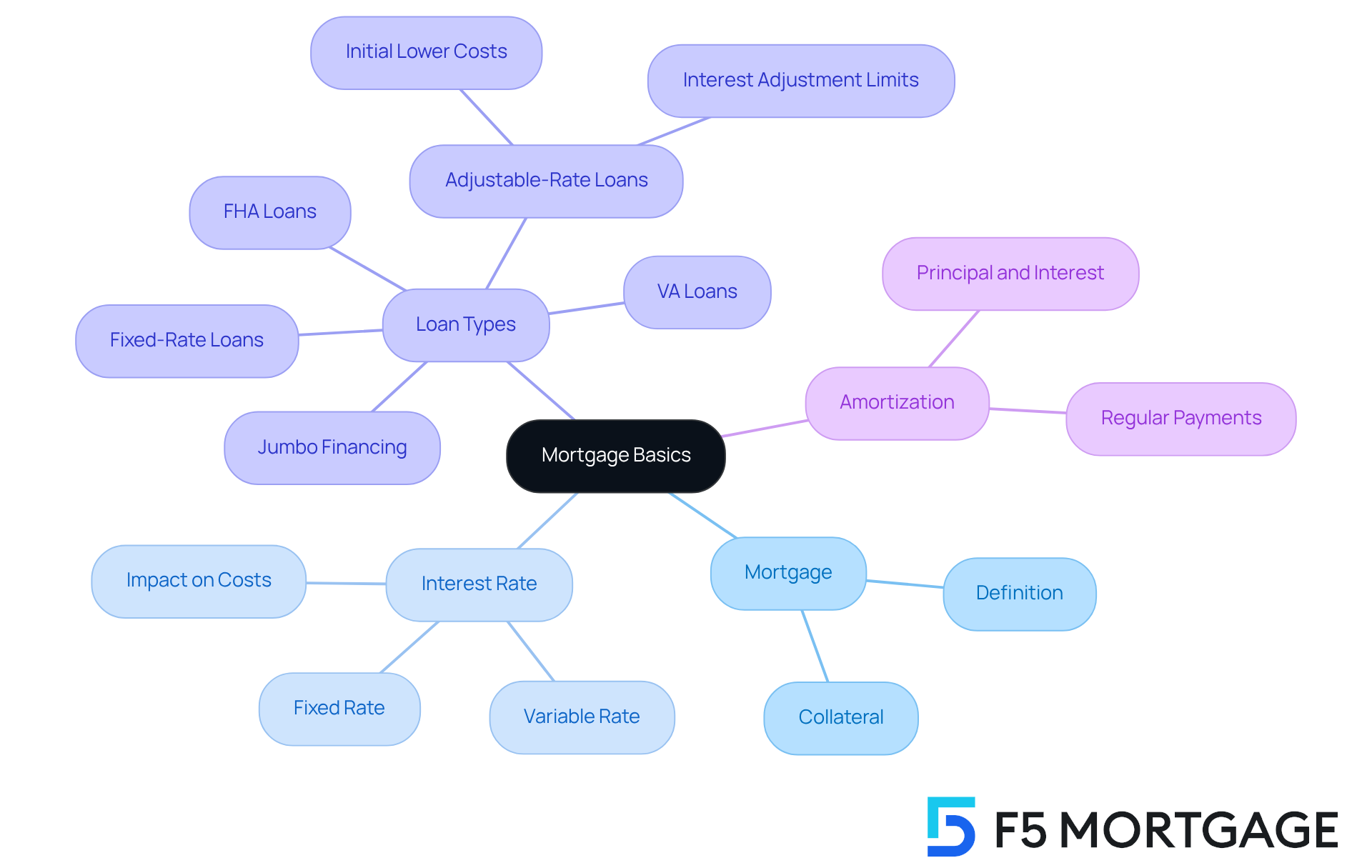

Understand Mortgage Basics

Before embarking on how to shop for a mortgage, it’s essential to grasp some fundamental concepts that will empower you.

-

Mortgage: This is a loan specifically designed for purchasing real estate, with the property itself serving as collateral. Understanding this is the first step toward making informed decisions.

-

Interest Rate: This signifies the cost of borrowing funds, expressed as a percentage of the amount borrowed. Interest rates can be fixed, remaining the same during the term, or variable, changing over time. Knowing the difference can help you choose what’s best for your situation.

-

Loan Types: Familiarity with different types of loans is crucial. Options encompass fixed-rate, adjustable-rate, FHA, VA, and jumbo financing, each showcasing unique characteristics and eligibility criteria. For example, fixed-interest loans provide stability, while adjustable-interest loans usually have lower initial costs that may vary over time. Adjustable Rate Mortgages (ARMs) include interest adjustment limits that assist in shielding borrowers from substantial increases, offering a layer of security amidst the unpredictability of fluctuating costs. Furthermore, you can transition from an ARM to a fixed-rate loan to secure a lower rate or consider flexible refinancing options to modify your loan terms as needed.

-

Amortization: This refers to the process of gradually paying off a loan through regular payments that encompass both principal and interest. Understanding this process is key to managing your finances effectively.

Grasping these fundamentals not only enables you to make knowledgeable choices but also prepares you to understand how to shop for a mortgage in the changing financial landscape. We know how challenging this can be, especially with recent trends showing a gradual decrease in home loan costs. As of September 2025, the typical charge for a 30-year fixed home loan has fallen to 6.50%. This change highlights the significance of being well-informed about loan terms and options, particularly as buyers with higher credit scores are positioned to obtain the most advantageous rates.

Understanding these nuances of loan financing is essential as you learn how to shop for a mortgage while navigating your home buying journey. Remember, we’re here to support you every step of the way.

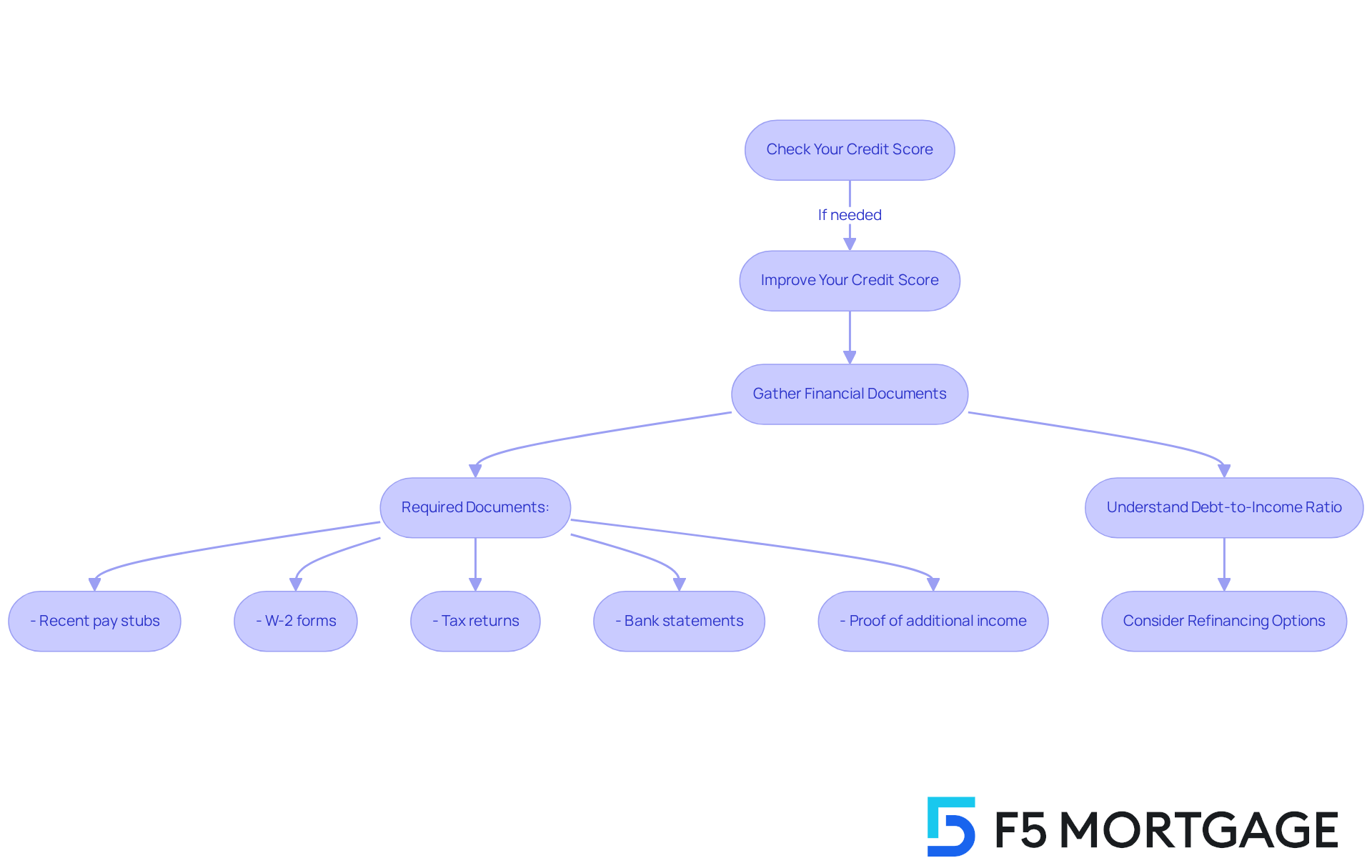

Check Your Credit Score and Prepare Financial Documents

Before applying for a mortgage, we know how challenging this can be, so here are some essential steps to enhance your chances of securing favorable terms:

-

Check Your Credit Score: Start by obtaining your credit report from major credit bureaus—Equifax, Experian, and TransUnion. Understanding your credit status is crucial because a higher score can significantly improve your loan terms. For instance, a score of 760 or higher qualifies you for the best rates available.

-

Improve Your Credit Score: If your score falls short of your target, take proactive measures to enhance it. Strategies include paying down existing debts, ensuring timely payments, and correcting any inaccuracies in your credit report. Remember, even minor improvements can lead to better loan offers.

-

Gather Financial Documents: Prepare the following essential documents to streamline your mortgage application process:

- Recent pay stubs (last 30 days)

- W-2 forms (last two years)

- Tax returns (last two years)

- Bank statements (last two months)

- Proof of additional income (if applicable)

Having these documents organized not only expedites the application process but also demonstrates your financial stability to lenders, which is a key factor in their decision-making. Lenders typically prefer applicants with a credit score of 620 or better, and having your financial documents in order can help you present a strong case. Additionally, keep in mind that your debt-to-income ratio (DTI) should ideally be in the low-40% range or less, as this is another critical factor lenders consider. A maximum DTI ratio of 43% is generally necessary for home financing, and maintaining a lower DTI can lead to more favorable mortgage terms.

Furthermore, exploring refinancing options available through F5 Mortgage can provide additional pathways to secure favorable terms. For example, FHA loans and VA loans offer unique benefits that may align with your financial situation. As Hal Bundrick, a CFP® Senior Writer, observes, “financial institutions view low-credit-score home buyers as posing a greater risk, so you will probably incur a higher interest charge than an individual with a credit score of 620 or above.

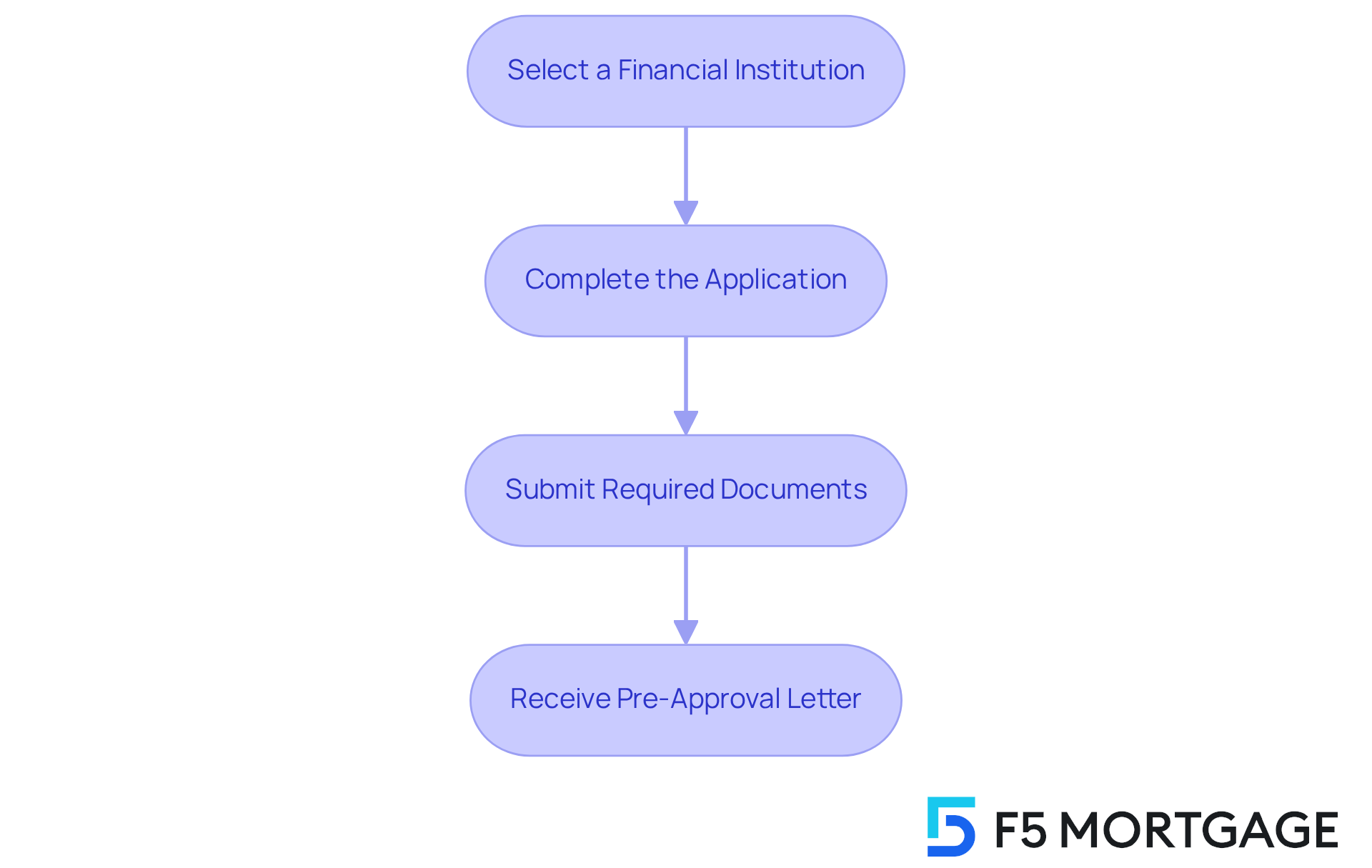

Obtain Mortgage Pre-Approval

To obtain mortgage pre-approval, follow these essential steps:

-

Select a Financial Institution: We know how overwhelming it can be to choose the right provider. Investigate and select a financial institution that offers attractive terms and outstanding customer support. F5 Financing stands out by using technology to provide extremely competitive loan rates, all while avoiding aggressive sales tactics. Additionally, working with a mortgage broker can help you understand how to shop for a mortgage by opening doors to various financial institutions, giving you more options to consider.

-

Complete the Application: Take a deep breath and fill out the pre-approval application. It’s important to provide comprehensive details about your financial situation, including your income, debts, and assets. This step is crucial for getting an accurate assessment of your eligibility.

-

Submit Required Documents: Gather and submit essential financial documents, such as W-2 forms, pay stubs, and tax returns. Don’t hesitate to include any extra information your loan provider may request. We’re here to support you every step of the way.

-

Receive Pre-Approval Letter: Once your application is reviewed, the lender will issue a pre-approval letter that specifies the loan amount you qualify for. This letter is vital when making offers on homes, as it demonstrates your financial capability to sellers.

In 2025, understanding how to shop for a mortgage and securing a loan pre-approval is more essential than ever. It not only clarifies your budget but also significantly boosts your credibility as a buyer in a competitive market. With many desirable homes receiving multiple offers within hours, understanding how to shop for a mortgage and having a pre-approval letter can give you a decisive edge. Currently, a significant percentage of homebuyers are securing pre-approval, reflecting its importance in navigating today’s housing landscape. Lenders are increasingly offering competitive pre-approval letters, which can include interest rate guarantees. This makes it easier for buyers to understand their purchasing power and streamline their home search.

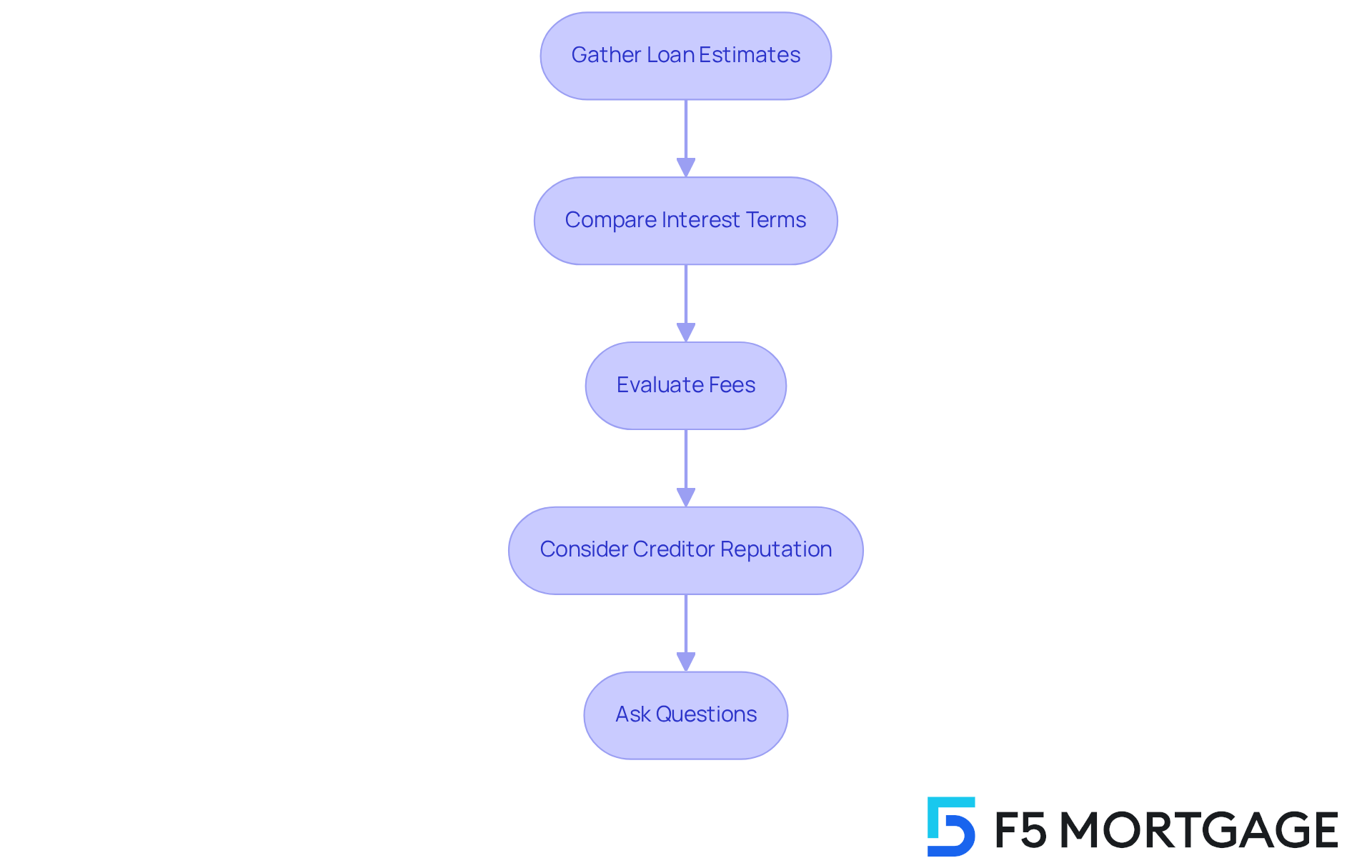

Compare Mortgage Options and Lenders

Begin by comparing mortgage options as a way to understand how to shop for a mortgage that best fits your financial needs. We know how challenging this can be, and we’re here to support you every step of the way.

-

Gather Loan Estimates: Request Loan Estimates from various financial institutions. This document details the loan conditions, interest charges, monthly installments, and closing expenses, offering a clear view of what each lender provides. Consider F5 Mortgage for competitive offers and personalized service that can cater to your specific needs.

-

Compare Interest Terms: While securing the best interest terms is crucial, also consider the type of loan—fixed or adjustable—and how it fits your long-term financial strategy. The typical 30-year fixed loan interest percentage is presently approximately 6.60%, yet the lowest figure may not consistently represent the best overall offer. Securing your mortgage terms with F5 Mortgage can offer peace of mind in an unpredictable market.

-

Evaluate Fees: Pay close attention to origination fees, closing costs, and any additional charges. A lower interest rate can be misleading if accompanied by high fees. Closing costs typically range from 2% to 6% of the loan amount, so understanding these costs is essential for accurate comparisons.

-

Consider Creditor Reputation: Research creditor reviews and customer service ratings. An institution with a strong reputation can significantly enhance your mortgage experience, ensuring smoother communication and support throughout the process. F5 Mortgage is known for its commitment to customer satisfaction, making it a reliable choice.

-

Ask Questions: Don’t hesitate to inquire about loan products, terms, and any special programs that financial institutions may offer. Interacting with financial institutions can clarify any uncertainties and assist you in making a more informed decision.

By thoroughly comparing your options, you will understand how to shop for a mortgage that aligns with your financial goals and budget. Studies show that borrowers who understand how to shop for a mortgage by evaluating various financial institutions can save between $600 and $1,200 each year, highlighting the importance of careful shopping in the loan market. Additionally, it’s advisable to conduct mortgage shopping within a 45-day period to minimize the impact on your credit score from multiple inquiries. As Greg McBride, Chief Financial Analyst at Bankrate, mentions, “You’ll still need to shop around, but when the volatility index is calm, as it is now, you’re unlikely to find dramatic differences in offers from one financial institution to the next.

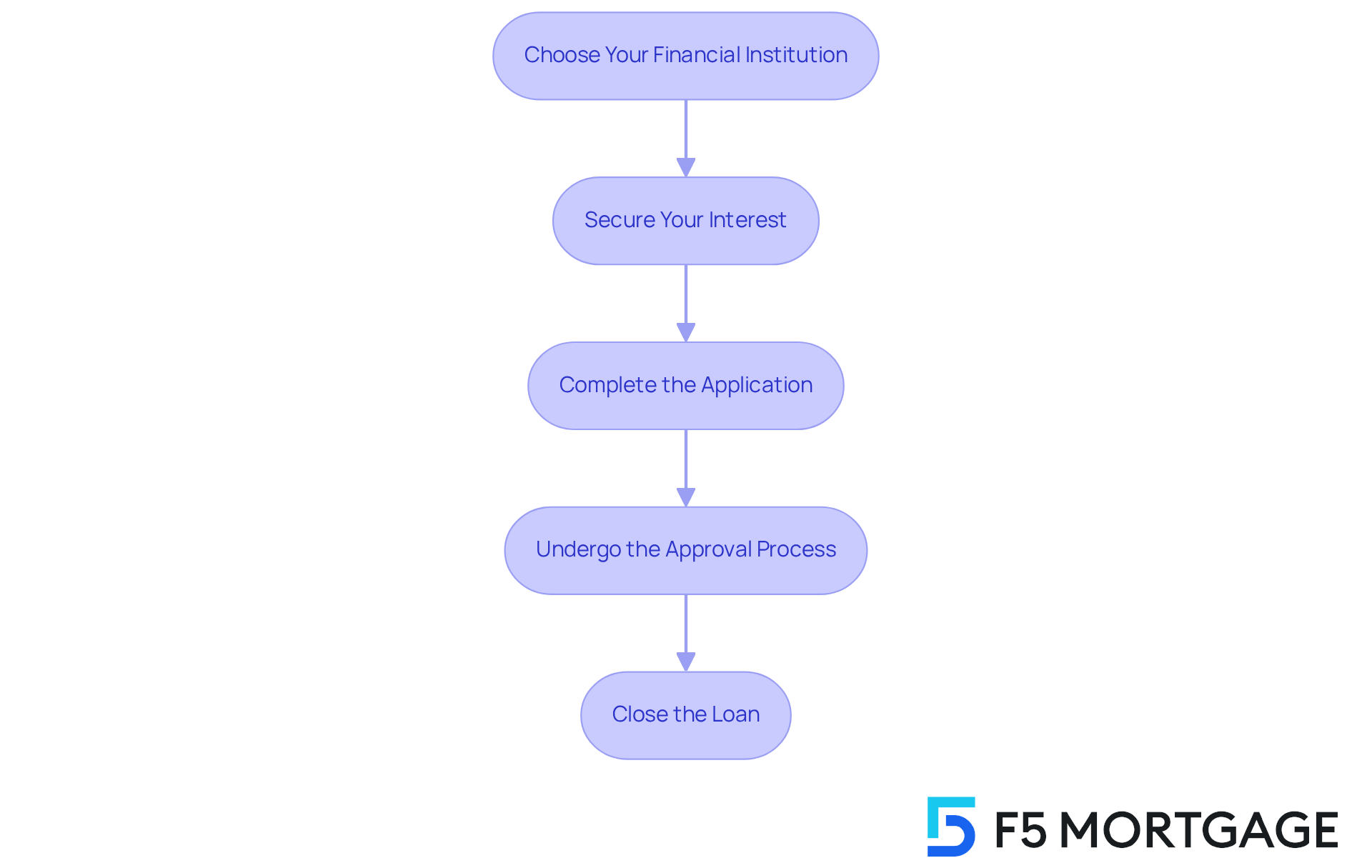

Select a Lender and Secure Your Mortgage

After comparing your options, it’s time to select a lender and secure your mortgage. We know how challenging this can be, but we’re here to support you every step of the way.

-

Choose Your Financial Institution: Based on your comparisons, select the entity that offers the best terms and aligns with your financial needs. Consider aspects like interest levels, fees, and customer support. F5 Mortgage collaborates with over two dozen leading institutions, ensuring you have access to the best offers available.

-

Secure Your Interest: Once you select a lender, discuss fixing your interest. This step is essential as it shields you from potential fluctuations during the financing processing period. With the average percentage on a 30-year fixed refinance at 6.74 percent, securing a beneficial interest can save you substantial amounts over the duration of your loan. For example, securing a 6.5% rate instead of facing a possible rise to 7% might save you around $47,858 in interest over a $400,000 loan.

-

Complete the Application: Submit a formal mortgage application with your chosen financial institution, providing any additional documentation they require. This may include proof of income, credit history, and details about your financial situation. F5 Mortgage is here to guide you through this process, ensuring you have all necessary documents ready.

-

Undergo the Approval Process: The lender will review your application, conduct an appraisal, and verify your financial information. This process is crucial to guarantee you meet the requirements for the funding amount you need. Understanding your home loan approval is essential, as it directly impacts your financing choices and conditions.

-

Close the Loan: Once approved, you’ll receive a closing disclosure outlining the final terms of your loan. Attend the closing meeting to sign documents and finalize your mortgage. Remember, many families have benefited from securing their prices early, especially in a volatile market, ensuring they can finalize without surprises and maintain financial stability. However, be mindful that price locks do not last forever, so it’s important to be aware of the timeline involved. As Matt Schwartz observes, securing a loan interest rate is particularly advantageous for individuals with fixed incomes, offering stability during unpredictable periods.

By following these steps, you will understand how to shop for a mortgage and successfully navigate the mortgage shopping process to secure financing for your new home.

Conclusion

Understanding how to shop for a mortgage effectively is crucial for anyone looking to purchase a home. We know how challenging this can be, but by grasping the fundamentals of mortgages—such as interest rates, loan types, and amortization—you can make informed decisions that align with your financial goals. This knowledge serves as a foundation for navigating the complex world of mortgage financing, especially in a fluctuating market.

The article outlines essential steps to enhance your mortgage shopping experience. Start by:

- Checking your credit scores and preparing financial documents.

- Obtaining mortgage pre-approval.

- Comparing various loan options.

Each step is designed to empower you to secure favorable terms, emphasizing the importance of being well-prepared and informed. By exploring different lenders and understanding the nuances of loan estimates, you can save significantly and choose the best mortgage suited to your needs.

Ultimately, the mortgage shopping process can feel daunting, but it holds immense significance for achieving homeownership. By taking proactive steps and utilizing the resources available, you can navigate this journey with confidence. Embracing these strategies not only facilitates a smoother mortgage experience but also positions you to make sound financial decisions that will benefit you in the long run.

Frequently Asked Questions

What is a mortgage?

A mortgage is a loan specifically designed for purchasing real estate, where the property itself serves as collateral.

What is an interest rate in relation to a mortgage?

The interest rate is the cost of borrowing funds, expressed as a percentage of the amount borrowed. It can be fixed, remaining the same throughout the loan term, or variable, changing over time.

What are the different types of mortgage loans?

Different types of mortgage loans include fixed-rate, adjustable-rate, FHA, VA, and jumbo financing. Each has unique characteristics and eligibility criteria.

What is amortization?

Amortization is the process of gradually paying off a loan through regular payments that include both principal and interest.

Why is it important to check your credit score before applying for a mortgage?

Checking your credit score is crucial because a higher score can significantly improve your loan terms. For example, a score of 760 or higher qualifies you for the best rates available.

How can I improve my credit score before applying for a mortgage?

You can improve your credit score by paying down existing debts, ensuring timely payments, and correcting any inaccuracies in your credit report.

What financial documents do I need to prepare for a mortgage application?

Essential documents include recent pay stubs, W-2 forms from the last two years, tax returns from the last two years, bank statements from the last two months, and proof of additional income if applicable.

What is a debt-to-income ratio (DTI), and why is it important?

The debt-to-income ratio (DTI) is a measure of your monthly debt payments compared to your gross monthly income. Lenders typically prefer a DTI in the low-40% range or less, as it is a critical factor in determining mortgage eligibility and terms.

What are FHA and VA loans?

FHA and VA loans are types of mortgage financing that offer unique benefits and may align with certain financial situations, catering to specific borrower needs.

How can refinancing options help in securing favorable mortgage terms?

Refinancing options can provide pathways to modify your loan terms, potentially leading to better interest rates and payment structures based on your financial situation.