Overview

The 5/1 Adjustable Rate Mortgage (ARM) can be a great option for families looking for affordability. It offers a fixed interest rate for the first five years, which means lower initial payments. This can be especially appealing if you expect to move or refinance within that time.

However, it’s important to understand that after the fixed period, the interest rate will adjust annually based on market conditions. While this structure can lead to savings initially, it also carries the risk of increased payments later on. We know how challenging this can be, and careful financial planning is essential to navigate these changes.

By considering your individual circumstances and future plans, you can make an informed decision. Remember, we’re here to support you every step of the way as you explore your mortgage options.

Introduction

We understand that navigating the world of mortgage options can feel overwhelming, especially when considering adjustable-rate mortgages like the 5/1 ARM. This unique loan structure presents an appealing mix of stability and potential savings, making it a favored choice for families and first-time homebuyers alike. Yet, as the initial fixed-rate period comes to a close and adjustments begin, borrowers may encounter unforeseen challenges that could affect their financial future.

What are the key features and benefits of a 5/1 ARM? How can prospective homeowners effectively navigate the potential risks associated with this mortgage type? We’re here to support you every step of the way, helping you make informed decisions that align with your family’s needs.

Define 5/1 ARM: Key Features and Structure

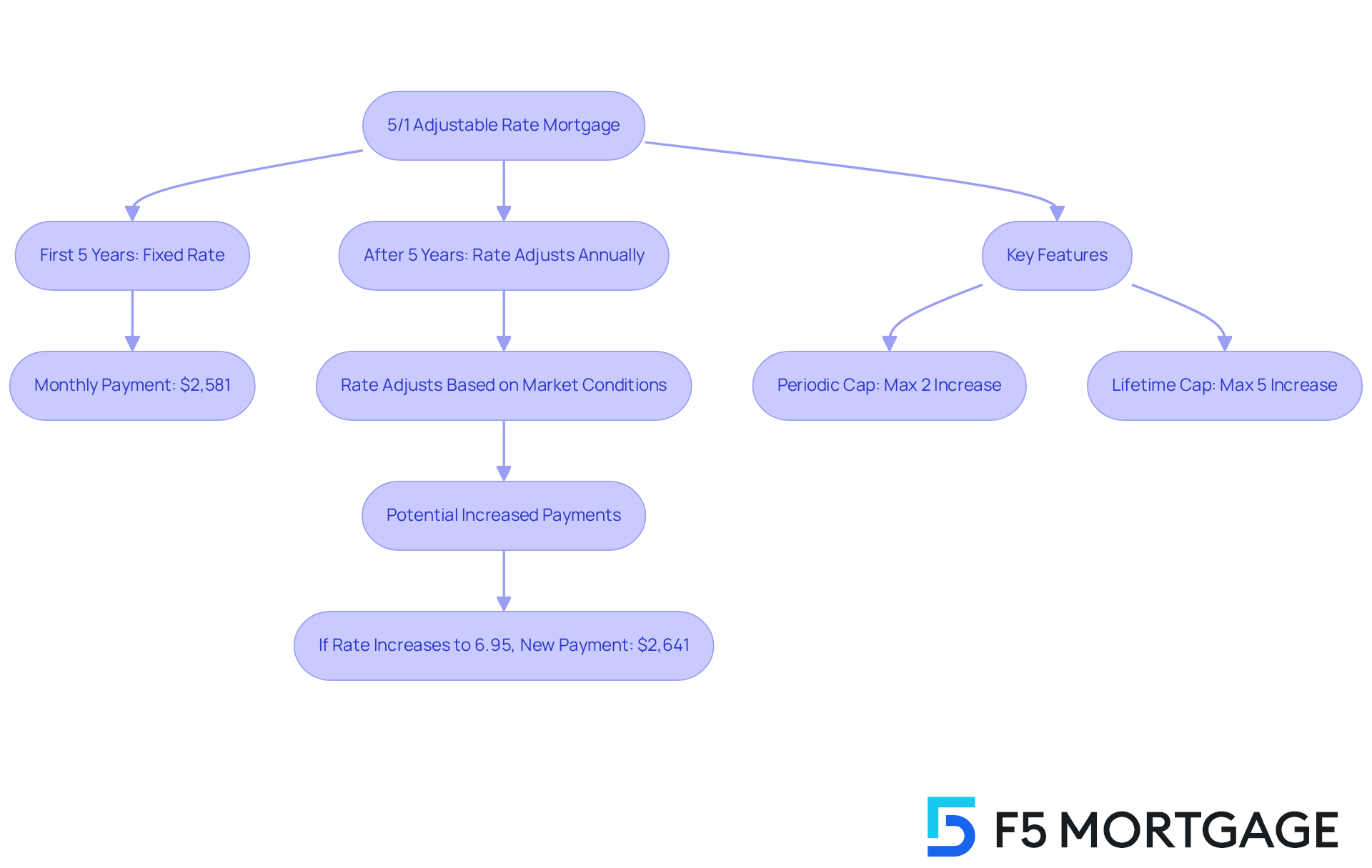

The 5/1 arm meaning indicates that a 5/1 Adjustable Rate Mortgage (ARM) can be a great option for families looking for a home loan. It offers a stable percentage for the first five years, which can ease some of the financial pressure. After that, the rate adjusts each year based on current market conditions. The 5/1 arm meaning indicates that the ‘5’ represents the initial fixed-term period of five years, while the ‘1’ shows that the rate will change once per year thereafter. This structure allows borrowers to enjoy lower initial payments compared to traditional fixed-rate mortgages, making it particularly appealing for those who anticipate relocating or refinancing within a few years.

For instance, if you take out a loan of $400,000 at a 6.7% interest rate, your monthly payment would be around $2,581 for the first five years. After this period, if the rate increases by 0.25%, the new rate would be 6.95%, leading to a monthly payment of approximately $2,641. This potential for increased payments highlights the importance of understanding the adjustable nature of this loan type.

The 5/1 arm meaning includes specific features designed to benefit borrowers like you. It typically includes:

- A periodic cap on the interest rate, which limits how much the rate can increase at each adjustment—often set at 2 percentage points above the previous rate.

- A lifetime cap, usually restricting the maximum rate increase over the life of the loan to about 5 percentage points.

This type of mortgage is becoming increasingly popular among families, especially those who appreciate lower initial payments and are comfortable with the possibility of future adjustments. The appeal of hybrid ARMs, particularly the 5/1 arm meaning, is clear as they offer a more budget-friendly pathway to homeownership in fluctuating financial conditions. However, it’s essential to monitor market trends and evaluate your financial situation carefully. By doing so, you can make informed decisions about the 5/1 arm meaning and how it aligns with your long-term goals. Remember, we’re here to support you every step of the way as you navigate this important decision.

Explain How a 5/1 ARM Works: Interest Rates and Adjustments

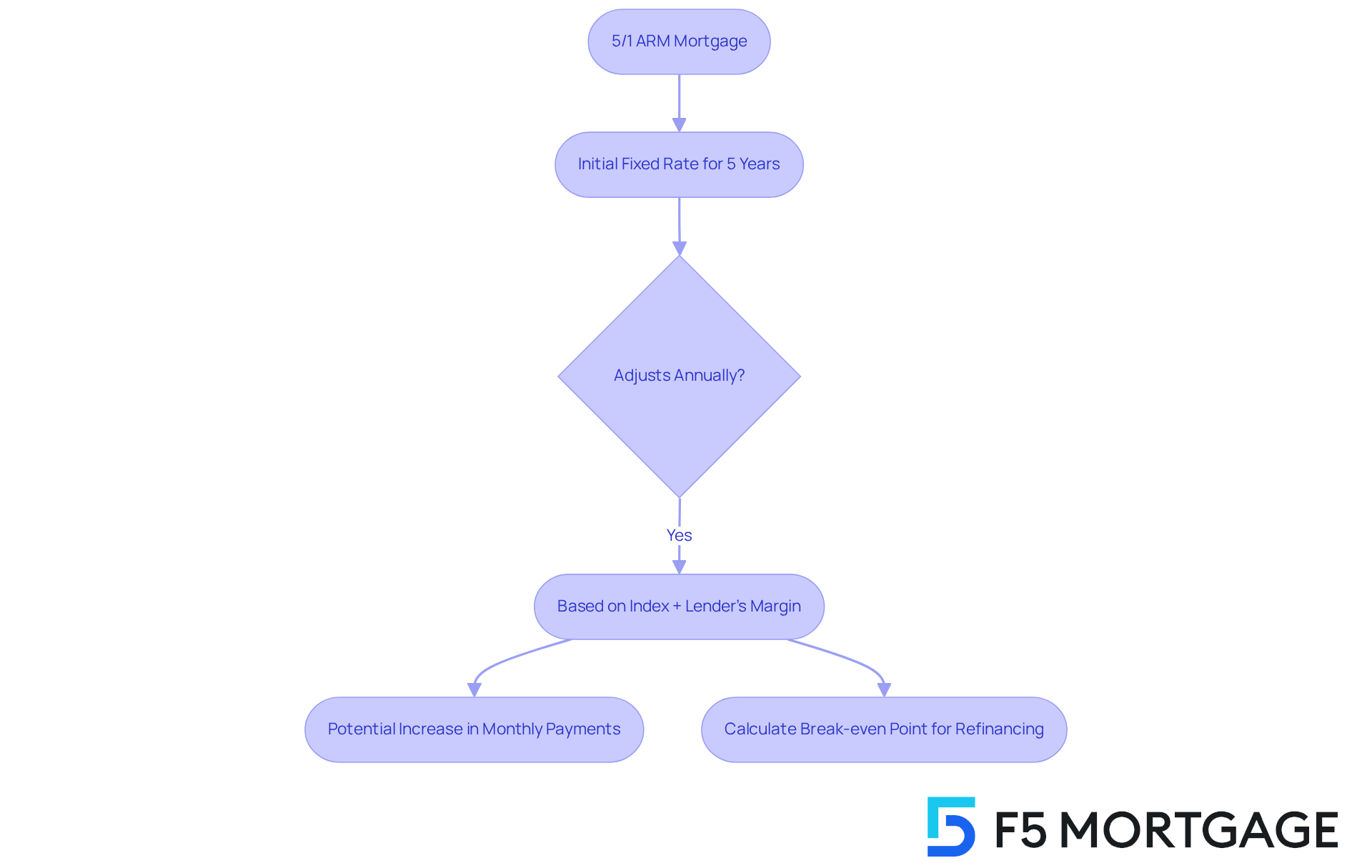

Are you looking into the 5/1 arm meaning? This type of mortgage often starts with lower costs compared to fixed-rate options, leading to significant savings on your monthly payments. For the first five years, you can enjoy the benefits of a fixed rate, providing some peace of mind. However, after that initial period, the rate adjusts annually based on a designated index, such as the LIBOR or the Treasury index, plus a margin set by your lender.

While those early lower payments are certainly appealing, it’s crucial to be prepared for potential increases in your monthly mortgage payments once the adjustment period begins. Understanding how the index and margin work is vital, as these factors influence how much your interest rate—and consequently, your monthly payment—may rise over time. For instance, if you have a $200,000 5/1 ARM, understanding the 5/1 arm meaning is essential as you might experience a noticeable increase in your monthly payment after the first fixed period. This highlights the importance of being financially ready for these changes.

Additionally, calculating your break-even point is essential when considering refinancing options. By determining your refinancing costs and potential monthly savings, you can assess how long it will take to recoup those costs. Remember, we know how challenging this can be, and consulting with F5 Mortgage can provide you with competitive terms and personalized service. We’re here to support you every step of the way, ensuring you navigate the complexities of ARMs effectively.

Evaluate Pros and Cons of 5/1 ARMs: Benefits and Risks

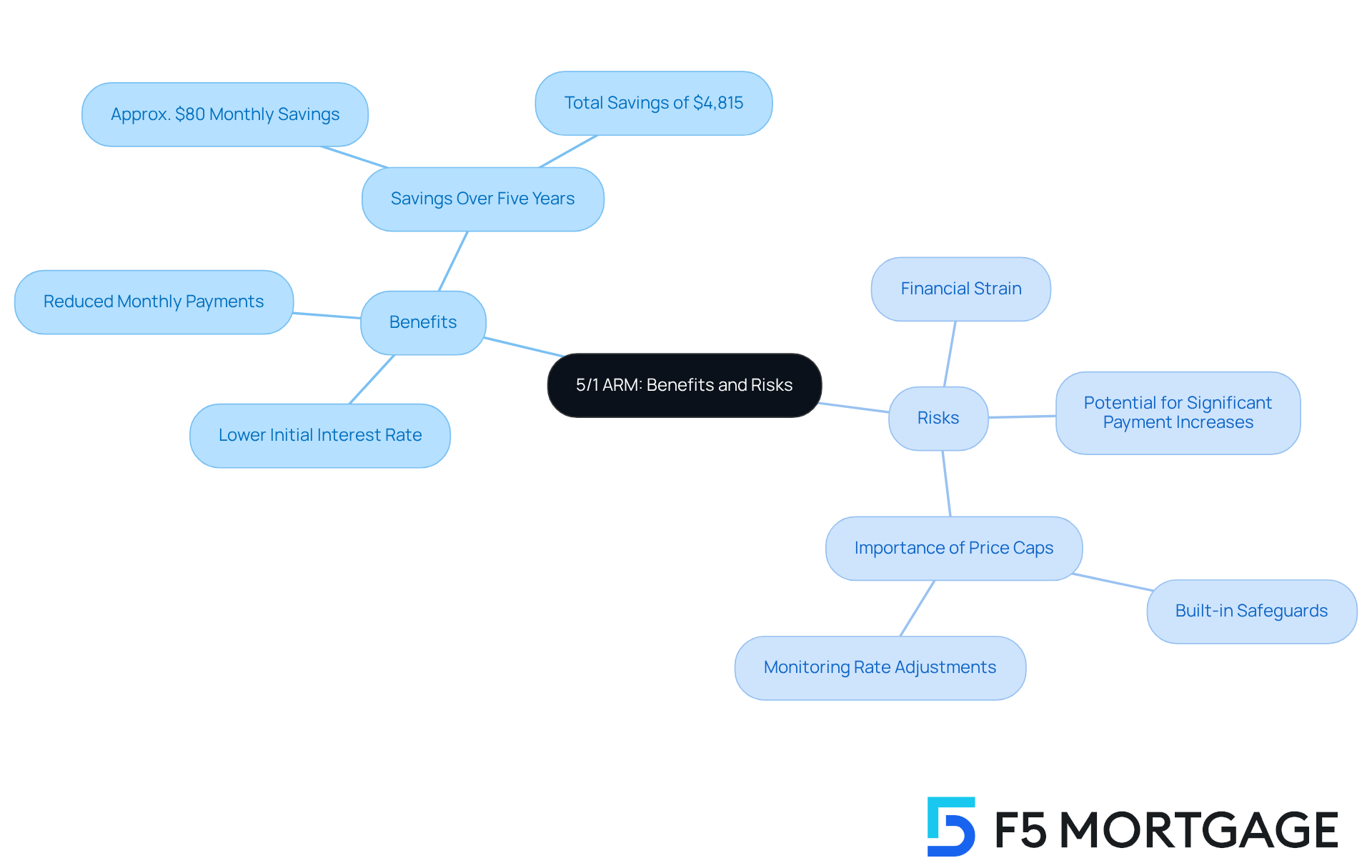

The main benefit of a 5/1 ARM is related to the 5/1 ARM meaning, as it features a lower starting interest rate that can significantly reduce monthly payments during the first five years. This feature is particularly advantageous for first-time homebuyers or those who may plan to relocate or refinance before the adjustment period begins. For instance, a household obtaining a 5/1 ARM with an initial interest rate of 3.9% could save around $80 each month compared to a fixed-rate loan at 4.45%. Over five years, this could result in total savings of approximately $4,815.

However, it’s important to recognize that potential risks accompany these benefits. After the initial fixed period, borrowers may face substantial payment increases, which can lead to financial strain if they are not adequately prepared. Imagine if market borrowing costs rise dramatically—suddenly, the new payments might become unaffordable, creating budgeting challenges. In fact, the break-even point for refinancing costs can stretch to 40 months if monthly savings are only $100 against a refinancing cost of $4,000.

Furthermore, understanding the implications of price caps is essential. Most ARMs have built-in safeguards that limit how much the interest can increase during each adjustment period. Still, borrowers must remain vigilant about the potential for significant increases over time. Therefore, it is vital for potential borrowers to carefully assess their financial circumstances and long-term strategies before committing to the 5/1 ARM meaning. We understand how challenging this can be, and we’re here to support you every step of the way, ensuring you are prepared for both the upfront savings and the possible risks that may arise.

Identify Ideal Candidates for 5/1 ARMs: Who Should Consider This Option?

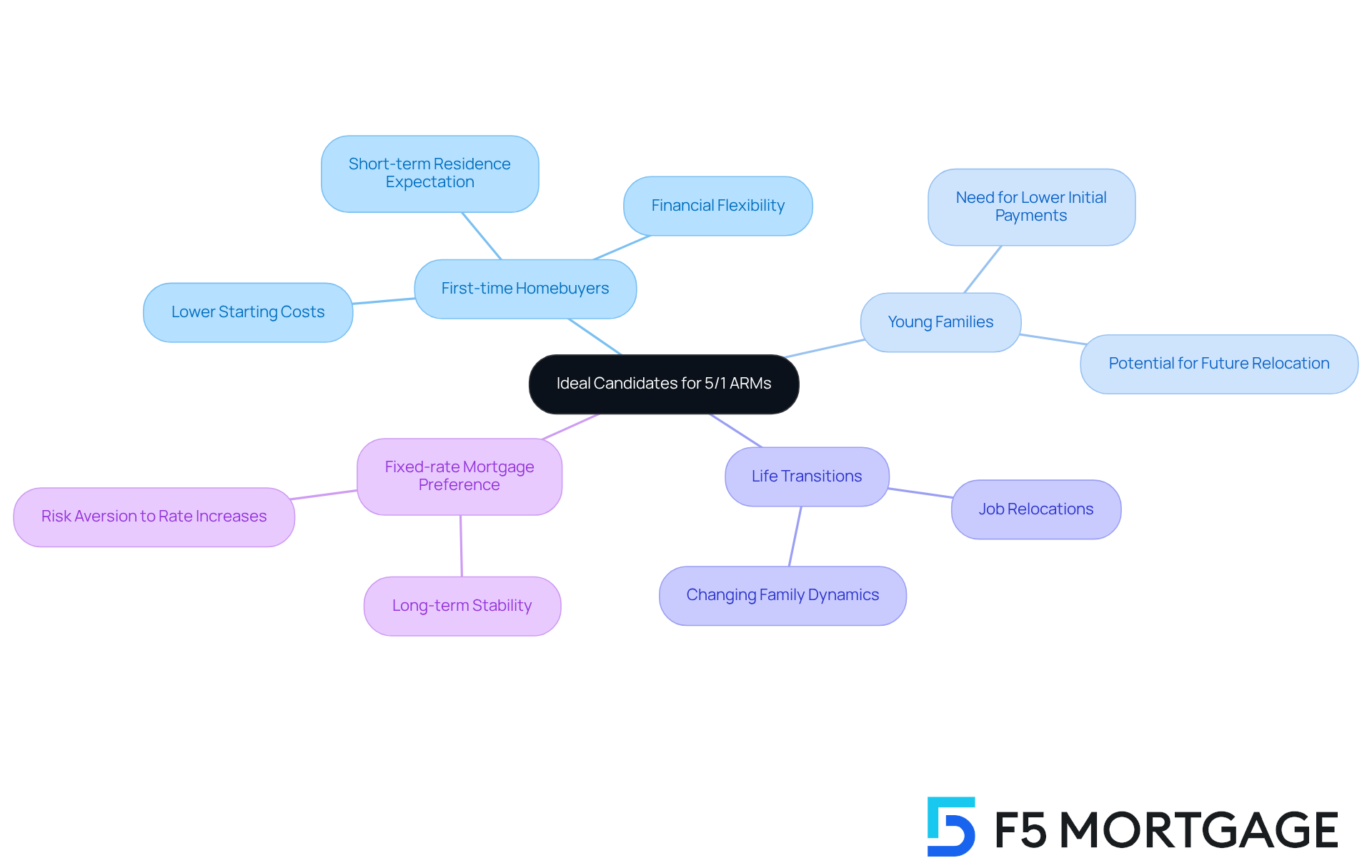

Ideal candidates for a 5/1 Adjustable Rate Mortgage (ARM) often include individuals who understand the 5/1 ARM meaning and expect to live in their home for a shorter duration—typically less than five years. This group frequently consists of:

- First-time homebuyers

- Young families

- Those experiencing life transitions, such as job relocations

For instance, many first-time homebuyers opt for 5/1 ARM meaning because of their lower starting costs, which can significantly ease the financial burden of purchasing a home. Additionally, financially stable borrowers who are prepared for potential payment increases after the fixed period may find the 5/1 ARM meaning to be particularly attractive.

However, we know how crucial it is to recognize that those seeking long-term stability and planning to stay in their homes for many years might be better suited for a fixed-rate mortgage. The unpredictability of interest rate adjustments after the initial five years can introduce risks that may outweigh the initial savings. Therefore, when considering a 5/1 ARM, it is essential to evaluate your personal financial situation and future plans to grasp the 5/1 ARM meaning. We’re here to support you every step of the way in making this important decision.

Conclusion

Understanding the intricacies of a 5/1 Adjustable Rate Mortgage (ARM) is essential for potential homeowners seeking a balance between affordability and long-term financial stability. We know how challenging this can be, and this mortgage type offers a unique structure that combines an initial fixed interest rate for five years with annual adjustments thereafter. This makes it an attractive option for families and first-time buyers who may not intend to stay in one place for long.

Throughout this article, we’ve highlighted key features such as:

- Lower initial payments

- Periodic and lifetime caps on interest rate increases

- The importance of understanding how the adjustment mechanism works

The potential for significant savings during the initial fixed period can be compelling, but it is equally crucial to recognize the risks involved once the adjustments begin. Candidates for a 5/1 ARM typically include those with shorter-term housing plans, such as first-time homebuyers and young families. In contrast, long-term homeowners may find more security in fixed-rate mortgages.

Ultimately, choosing a 5/1 ARM requires careful consideration of personal financial situations and future plans. By weighing the benefits against the risks, prospective borrowers can make informed decisions that align with their long-term goals. Engaging with knowledgeable professionals can provide valuable insights and guidance. Remember, we’re here to support you every step of the way, ensuring that the path to homeownership is both financially sound and strategically aligned with your individual needs.

Frequently Asked Questions

What is a 5/1 Adjustable Rate Mortgage (ARM)?

A 5/1 ARM is a type of mortgage that offers a fixed interest rate for the first five years, after which the rate adjusts annually based on current market conditions.

What do the numbers in 5/1 ARM represent?

The ‘5’ indicates the initial fixed-term period of five years, while the ‘1’ signifies that the interest rate will change once per year after the initial period.

What are the benefits of a 5/1 ARM?

The 5/1 ARM typically offers lower initial payments compared to traditional fixed-rate mortgages, making it appealing for families who may relocate or refinance within a few years.

Can you provide an example of how payments change with a 5/1 ARM?

For example, with a $400,000 loan at a 6.7% interest rate, the monthly payment would be approximately $2,581 for the first five years. If the rate increases by 0.25% after that, the new rate would be 6.95%, resulting in a payment of about $2,641.

What features are included in a 5/1 ARM?

A 5/1 ARM typically includes a periodic cap on interest rate increases, often limited to 2 percentage points per adjustment, and a lifetime cap that restricts the maximum rate increase over the life of the loan to about 5 percentage points.

Who is the 5/1 ARM particularly suitable for?

The 5/1 ARM is suitable for families who appreciate lower initial payments and are comfortable with the possibility of future rate adjustments.

What should borrowers consider before choosing a 5/1 ARM?

Borrowers should monitor market trends and evaluate their financial situation carefully to make informed decisions about how a 5/1 ARM aligns with their long-term goals.