Overview

Navigating the home buying process can be overwhelming, and we know how challenging this can be. This article focuses on FHA appraisal guidelines and their significance in ensuring a successful home purchase. Understanding these guidelines is crucial for homebuyers like you. They help ensure that the property meets essential safety and quality standards, protecting both you and your lender during the mortgage process.

By grasping these guidelines, you empower yourself to make informed decisions. It’s not just about meeting requirements; it’s about ensuring your future home is a safe and sound investment. We’re here to support you every step of the way, helping you understand how these standards protect your interests.

As you embark on this journey, remember that knowledge is your best ally. Familiarizing yourself with FHA appraisal guidelines can pave the way for a smoother mortgage experience. Take the time to explore these essential insights, and feel confident in your ability to navigate the home buying process successfully.

Introduction

Navigating the world of home buying can feel overwhelming, and we understand how challenging this can be, especially when it comes to grasping the nuances of FHA appraisals. These evaluations are not just bureaucratic hurdles; they play a vital role in protecting both lenders and buyers. They ensure that properties meet essential safety and quality standards, giving you peace of mind.

In this article, we will explore the intricacies of FHA appraisal guidelines, providing you with valuable insights to help you prepare for and navigate this essential process. What challenges might arise during an FHA appraisal? We’re here to support you every step of the way, helping prospective homeowners like you overcome these obstacles to secure your dream home.

Define FHA Appraisals and Their Importance

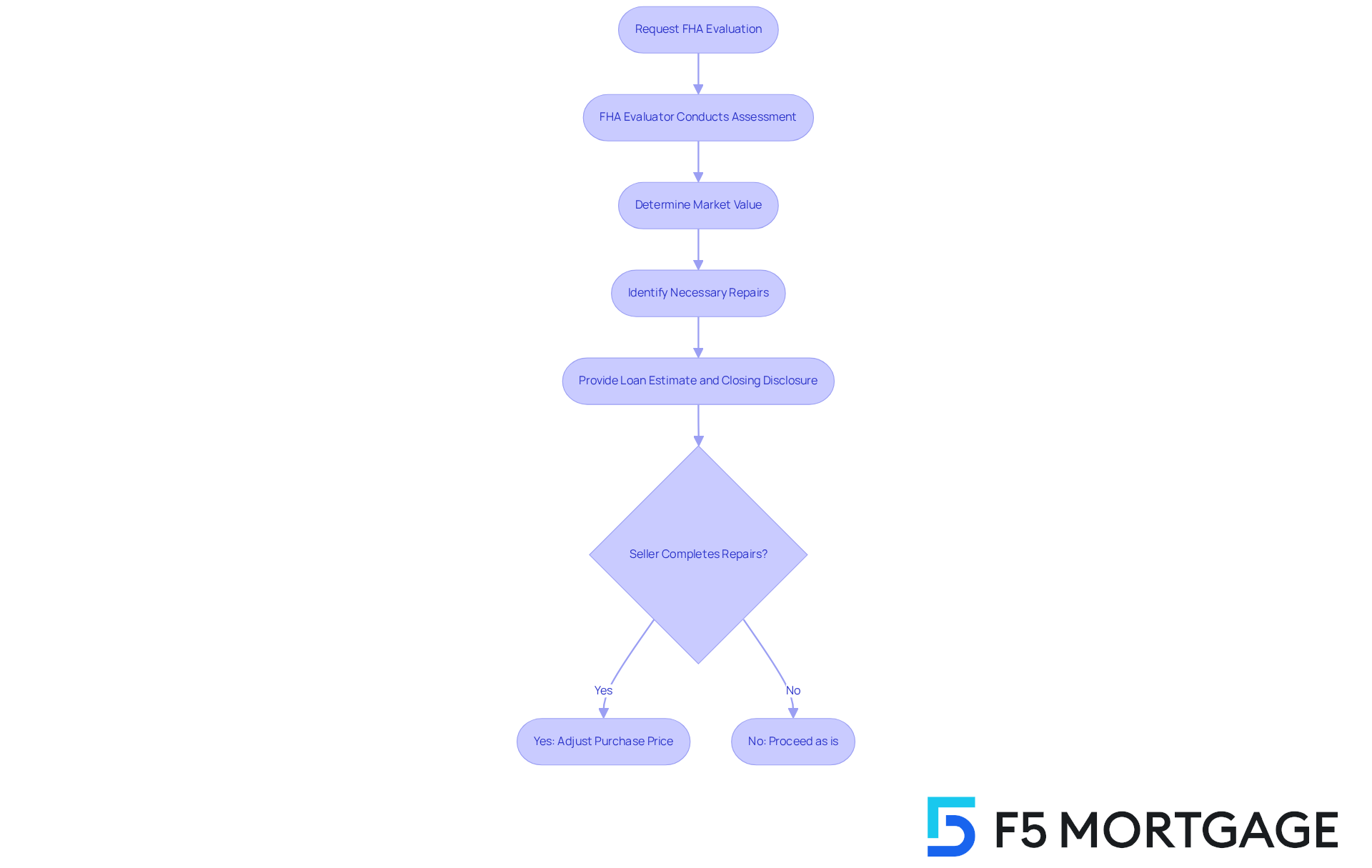

FHA evaluations are essential assessments conducted by FHA-approved evaluators, following FHA appraisal guidelines, to determine the market value of a residence and ensure it meets the Federal Housing Administration’s (FHA) minimum housing standards. For families pursuing FHA loans, these evaluations are crucial. They protect both the lender and the borrower by confirming that the home is a solid investment and safe to occupy. When you request a home evaluation, your lender will assess your property’s current market value, which helps identify your equity and ultimately influences your mortgage rates. After the evaluation, your lender will provide a Loan Estimate that outlines the fees and costs associated with your loan, along with a Closing Disclosure detailing your final numbers before closing.

Understanding the FHA appraisal guidelines is vital for homebuyers. It prepares you for what to expect during this stage. Common repairs required by the FHA appraisal guidelines often include:

- Fixing peeling paint

- Ensuring the roof can function for at least two more years

- Verifying that major systems like plumbing and electrical are operational

Many buyers ask sellers to complete repairs as a condition of purchasing the house, which may also include upgrades like installing new carpet. However, it’s important to consider that such requests could raise the purchase price, so weigh the benefits against potential costs. The evaluation report focuses on significant flaws that could impact safety, rather than common wear and tear, such as worn or stained carpets.

The benefits of FHA evaluations extend beyond mere compliance; they provide families with reassurance, knowing their investment meets recognized safety and quality standards. In stable markets, FHA evaluations can remain valid for up to six months, making transactions smoother. Additionally, the evaluation may reveal critical risks or necessary repairs that should be addressed before closing. By understanding the complexities of the FHA evaluation process and learning how to negotiate repair requests, families can navigate the mortgage landscape more effectively, ensuring a successful property acquisition.

Outline FHA Appraisal Guidelines and Requirements

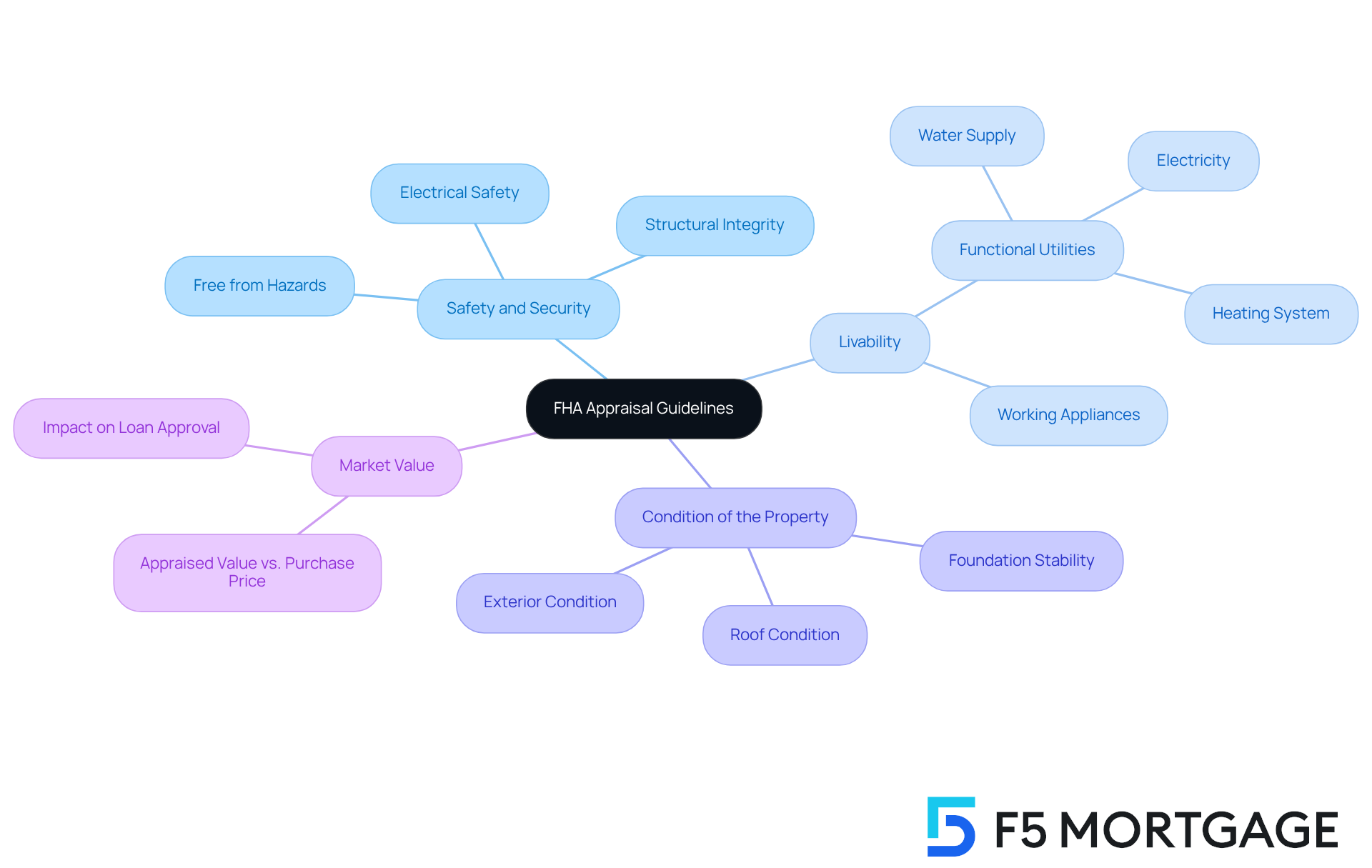

When it comes to FHA appraisal guidelines, it’s important to understand that these guidelines are designed to help you find a safe and suitable home. Let’s explore some key aspects that properties must meet to qualify for FHA financing.

-

Safety and Security: We know how crucial it is for your home to be a safe haven. Properties must be free from hazards that could put occupants at risk, such as exposed wiring, broken stairs, or structural issues. Appraisers are diligent in spotting these risks to ensure that your living environment is secure.

-

Livability: A home should feel comfortable and functional. Basic utilities like water, electricity, and heating need to be operational. During the appraisal, all appliances should work properly, as their condition reflects the overall livability of the property.

-

Condition of the Property: The appraiser will take a close look at the overall condition of the home, focusing on vital areas such as the roof, foundation, and exterior. If there is significant damage or deterioration, it will need to be addressed before moving forward with loan approval.

-

Market Value: It’s essential that the home appraises at or above the purchase price. This protects both you and the lender, ensuring that the loan amount does not exceed the property’s value.

Statistics show that a significant number of homes meet the FHA appraisal guidelines, underscoring the importance of adhering to these standards. Success stories reveal that properties which meet safety and security standards not only pass evaluations but also instill confidence in buyers.

By understanding and preparing for the FHA appraisal guidelines, you can significantly enhance your chances of a successful evaluation. This preparation paves the way for a smoother home buying experience, and remember, we’re here to support you every step of the way.

Identify Common FHA Appraisal Challenges and Solutions

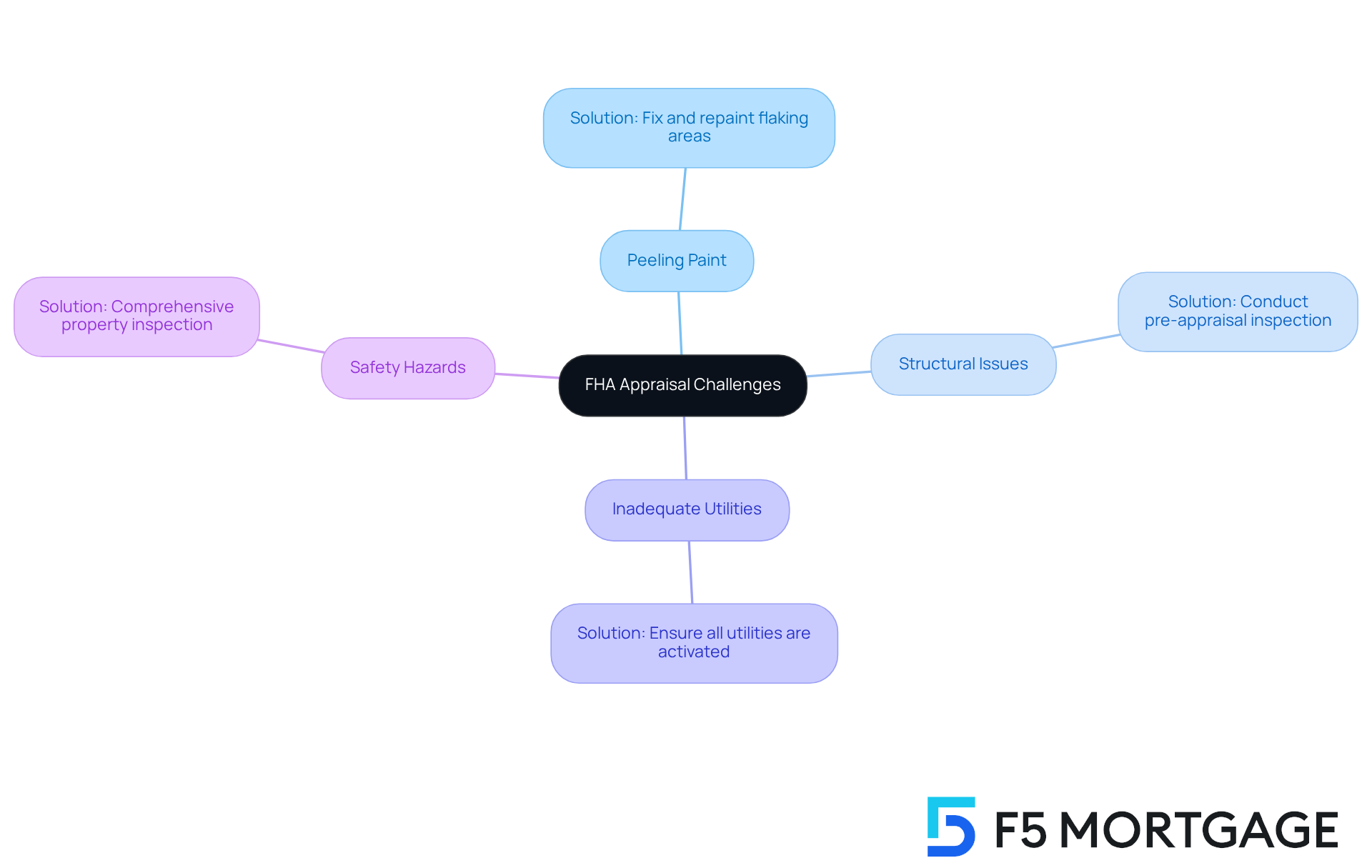

Common challenges during FHA appraisals can feel overwhelming, but understanding them can help ease your concerns:

-

Peeling Paint: If your home was built before 1978, lead-based paint may be present, and it’s essential to address this issue. Solution: Fix and repaint any sections with flaking paint before the evaluation. We know how challenging this can be, but managing peeling paint properly according to FHA appraisal guidelines can prevent valuation failures.

-

Structural Issues: Problems with the foundation or roof can lead to valuation failures, which can be stressful. Solution: Conduct a pre-appraisal inspection to identify and resolve any structural concerns. Statistics show that structural problems account for a significant portion of evaluation failures, highlighting the necessity for thorough inspections.

-

Inadequate Utilities: If utilities aren’t functioning, it can delay the evaluation process. Solution: Ensure all utilities are activated and working during the evaluation. This proactive step can prevent unnecessary complications and give you peace of mind.

-

Safety Hazards: Issues like broken stairs or exposed wiring can lead to an unsuccessful evaluation, which no one wants to face. Solution: Perform a comprehensive inspection of your property to identify and correct any safety hazards before the evaluation. Research indicates that many failures in FHA evaluations are linked to safety issues, emphasizing the importance of adhering to FHA appraisal guidelines to address these concerns.

By recognizing these challenges and their solutions, you can take proactive measures to ensure a smoother evaluation process. For instance, a recent case study illustrated how addressing peeling paint and safety risks led to a favorable evaluation, reinforcing the effectiveness of these solutions. Additionally, collaborating with F5 Mortgage can provide families with competitive rates and personalized service, ensuring you manage the valuation process effectively. As Joe Wallace, an Associate Editor, reminds us, “The Appraiser must report the presence of Externalities so that the Mortgagee can determine eligibility.” This highlights how crucial it is to tackle all potential evaluation challenges together.

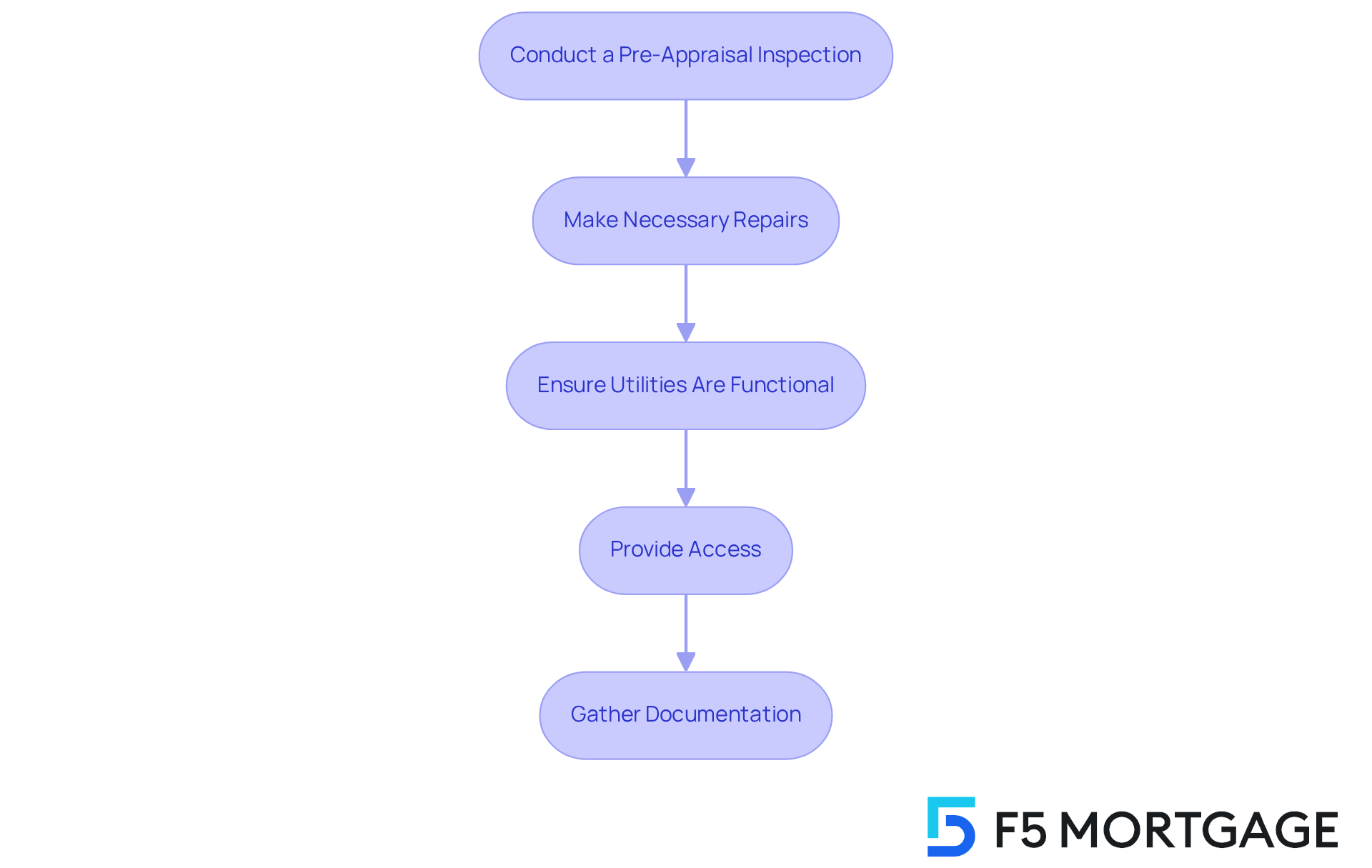

Prepare for Your FHA Appraisal: Best Practices

Preparing for your FHA appraisal can feel daunting, but with a few thoughtful steps, you can navigate this process more smoothly. Here are some best practices to consider:

- Conduct a Pre-Appraisal Inspection: We understand how important it is to feel confident about your appraisal. Engaging a trusted real estate agent or inspector to evaluate your home beforehand can help uncover potential issues that might affect the evaluation result. This proactive approach can provide peace of mind.

- Make Necessary Repairs: Addressing minor repairs, like fixing leaky faucets or repainting areas with peeling paint, can make a significant difference. These small improvements enhance the appraiser’s perception of your property’s condition, which is crucial for a positive outcome.

- Ensure Utilities Are Functional: Confirming that all utilities—water, electricity, and gas—are operational during the appraisal is essential. This allows the appraiser to effectively evaluate your property’s systems and overall functionality, ensuring nothing is overlooked.

- Provide Access: It’s important to ensure that the appraiser has unobstructed access to all areas of your home, including the attic and basement. Clearing clutter will facilitate a thorough inspection, helping your home shine.

- Gather Documentation: Compiling relevant documentation, such as records of recent repairs or upgrades, can be incredibly helpful. By offering this information, you assist in validating your property’s worth during the evaluation process.

By following these best practices, you can enhance the likelihood of a smooth FHA appraisal in accordance with FHA appraisal guidelines. Remember, we’re here to support you every step of the way, ensuring your home meets the necessary requirements for financing.

Conclusion

Understanding the FHA appraisal guidelines is crucial for homebuyers aiming for a successful property acquisition. These evaluations not only determine a home’s market value but also ensure that it adheres to essential safety and quality standards set by the Federal Housing Administration. By navigating this process effectively, families can protect their investments and secure favorable mortgage terms.

We know how challenging this can be, especially when faced with common appraisal hurdles like peeling paint, structural issues, and safety hazards. Proactive measures, such as conducting pre-appraisal inspections and making necessary repairs, can significantly enhance the likelihood of a positive evaluation outcome. Furthermore, understanding the appraisal requirements allows buyers to negotiate effectively and address any concerns that may arise during the process.

In conclusion, mastering FHA appraisal guidelines is not merely about compliance; it’s about ensuring a safe and sound investment for the future. We encourage homebuyers to take a proactive approach by familiarizing themselves with the appraisal process, addressing potential issues in advance, and seeking expert guidance when necessary. By doing so, families can navigate the complexities of the home buying journey with confidence and achieve their dream of homeownership.

Frequently Asked Questions

What are FHA appraisals and why are they important?

FHA appraisals are assessments conducted by FHA-approved evaluators to determine the market value of a residence and ensure it meets the Federal Housing Administration’s minimum housing standards. They are important for families pursuing FHA loans as they protect both the lender and the borrower by confirming the home is a solid investment and safe to occupy.

How does an FHA appraisal affect the mortgage process?

The FHA appraisal helps assess the property’s current market value, which influences equity identification and mortgage rates. After the evaluation, the lender provides a Loan Estimate outlining fees and costs, along with a Closing Disclosure detailing final numbers before closing.

What should homebuyers expect during the FHA appraisal process?

Homebuyers should understand FHA appraisal guidelines, which prepare them for potential repairs that may be required. Common repairs include fixing peeling paint, ensuring the roof can last at least two more years, and verifying that major systems like plumbing and electrical are operational.

Can buyers request repairs from sellers based on the FHA appraisal?

Yes, buyers can ask sellers to complete repairs as a condition of purchasing the house. However, these requests may raise the purchase price, so buyers should weigh the benefits against potential costs.

What types of issues does the FHA appraisal report focus on?

The FHA appraisal report focuses on significant flaws that could impact safety rather than common wear and tear, such as worn or stained carpets.

How long are FHA evaluations valid in stable markets?

In stable markets, FHA evaluations can remain valid for up to six months, which can help make transactions smoother.

What are the benefits of FHA evaluations for families?

FHA evaluations provide reassurance to families, ensuring their investment meets recognized safety and quality standards. They also reveal critical risks or necessary repairs that should be addressed before closing, aiding in effective negotiation and property acquisition.