Overview

Refinancing with bad credit can feel overwhelming, but there are options available that can help you. Programs like FHA and VA financing often have more lenient eligibility criteria, making them a viable choice for many families.

We understand how challenging this process can be, and that’s why preparation is key. Gathering necessary documentation and comparing lenders is crucial. This preparation can significantly enhance your chances of approval and help you secure better financial terms, even with a difficult credit history.

Take the first step today. By understanding your options and being well-prepared, you can navigate this journey with confidence. Remember, we’re here to support you every step of the way.

Introduction

Refinancing a mortgage may feel like a distant dream for those grappling with bad credit, but it has the potential to reshape financial futures. We understand how challenging this can be. By exploring various options, such as FHA and VA loans, you can uncover pathways to better terms and lower payments, even with a rocky credit history.

However, you might wonder: how can you navigate the complexities of refinancing while facing the hurdles of poor credit? This guide is here to support you every step of the way. We will unveil the essential steps to successfully refinance, empowering you to take control of your financial destiny.

Understand Refinancing Basics for Bad Credit

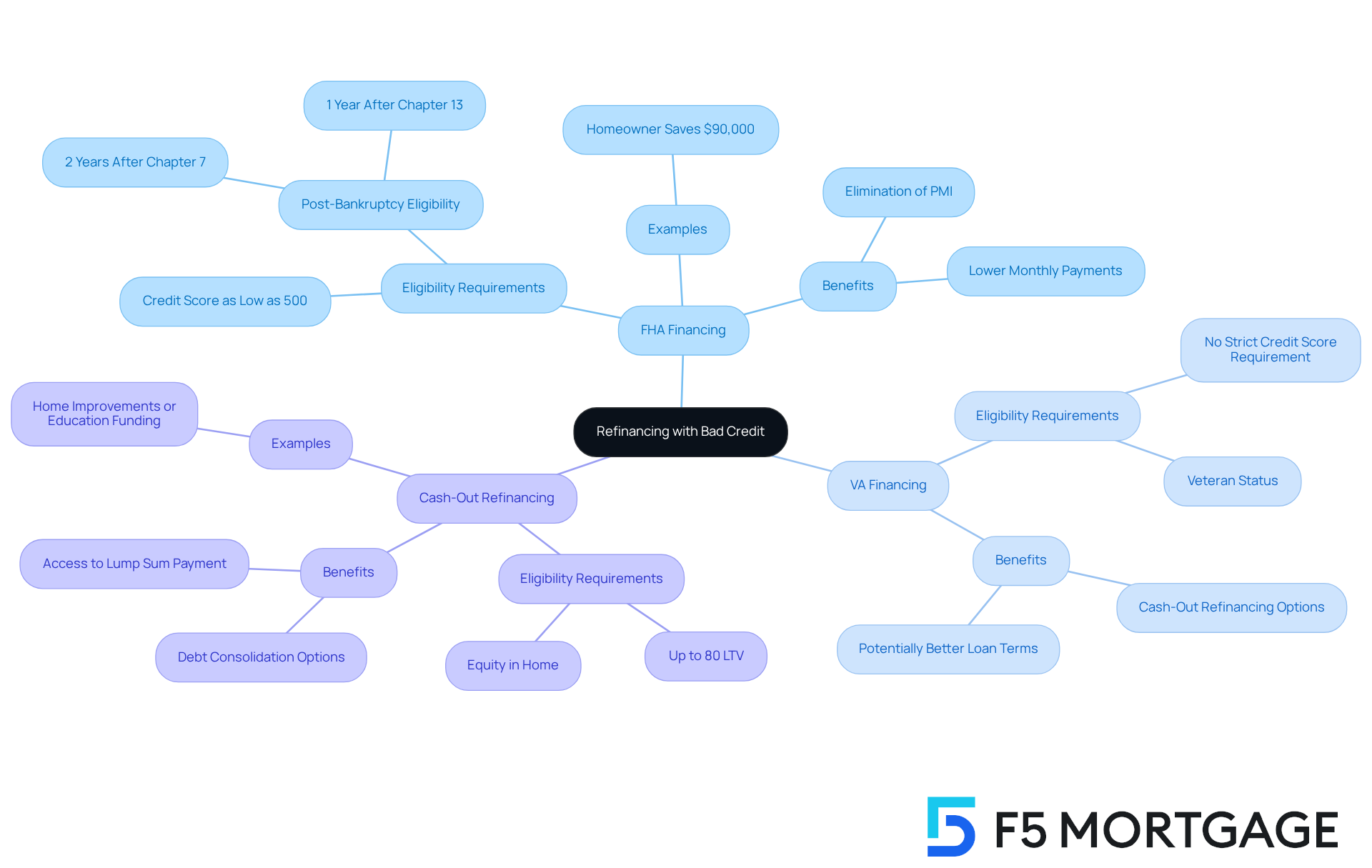

Refinancing can be a beacon of hope, especially when you need to , allowing you to replace your current mortgage with a new one that offers better terms or lower monthly payments. If you’re grappling with a challenging financial history, it’s crucial to understand the available to you. For instance, is designed to be more accessible, enabling borrowers with credit scores as low as 500 to qualify. However, higher scores may lead to even better conditions. Additionally, presents advantageous refinancing options for qualified veterans, often without strict credit score requirements.

Even with the hurdles of poor financial history, there are still viable options to . Recent data reveals that a significant portion of FHA financing is approved for applicants with scores below the conventional benchmark, showcasing the program’s flexibility. emphasize that understanding the basics of can significantly enhance your ability to navigate the process. As one expert noted, “Those with subpar credit may discover assistance by pursuing the , as FHA agreements generally have lower credit score criteria compared to traditional financing.”

There are many successful stories of , particularly among FHA and VA mortgage holders who have leveraged these programs to improve their financial situations. For example, a homeowner who refinanced through an FHA loan was able to lower their monthly payments and eliminate private mortgage insurance (PMI), leading to substantial savings.

Moreover, can provide a lump sum payment, allowing homeowners to tap into their equity for various needs, such as home improvements or debt consolidation. This option is especially beneficial for those who have built equity in their homes, even if their credit scores aren’t perfect.

In summary, while a poor financial history may complicate the loan restructuring landscape, it doesn’t close the door on advantageous options to refinance with bad credit. By familiarizing yourself with the available forms of loan restructuring and seeking guidance, you can take proactive steps toward enhancing your financial situation. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

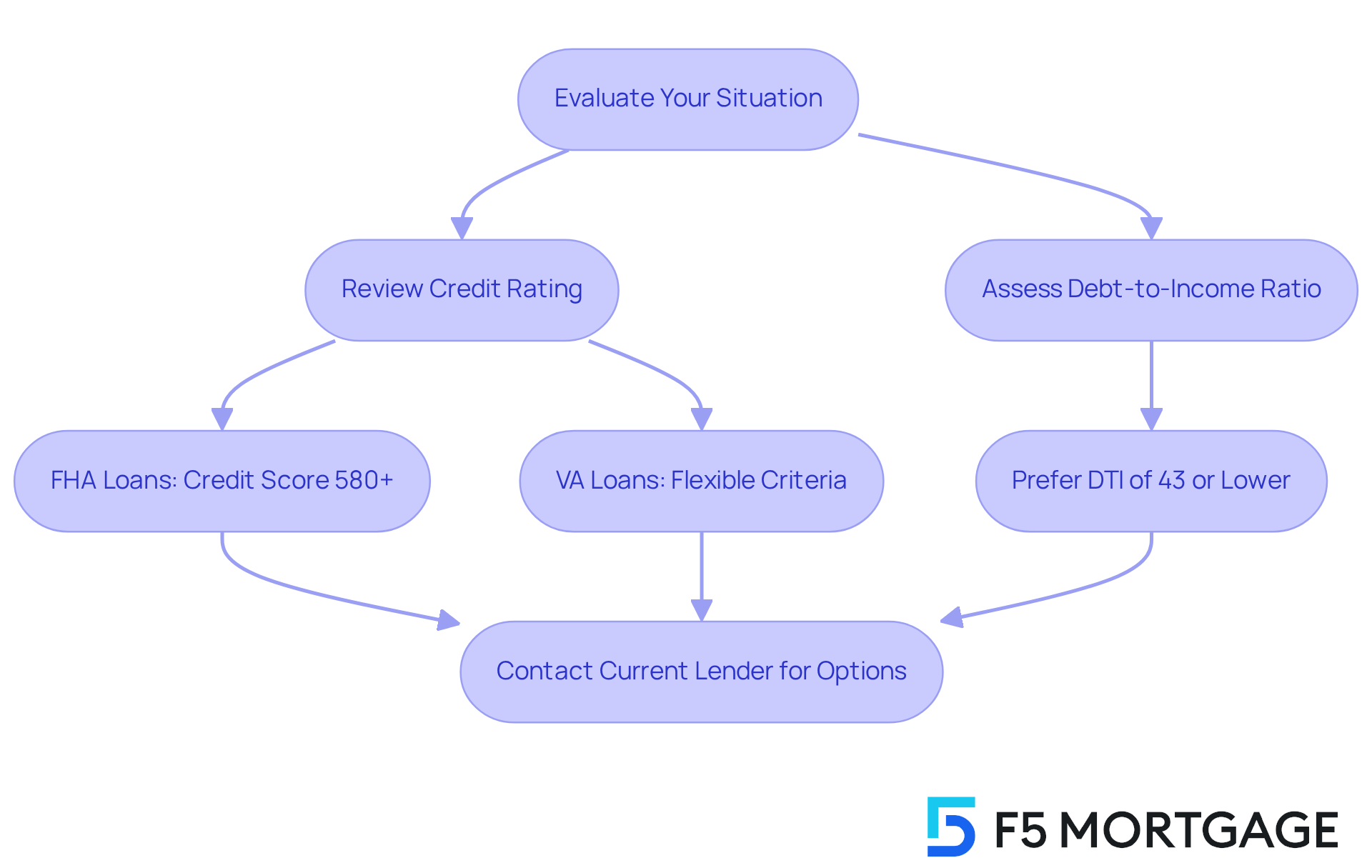

Determine Your Eligibility for Refinancing

If you’re considering a , it’s important to first evaluate your situation. Start by reviewing your and understanding the minimum criteria set by . For , a credit score of at least 580 is typically necessary. On the other hand, often have more flexible criteria, which might be beneficial for you.

Next, assess your . Most financial institutions prefer a DTI of 43% or lower for . We know how challenging this can be, but is a crucial step toward achieving your goals.

If your current mortgage is managed by a lender that offers , consider reaching out to them first. They may have more flexible criteria for existing clients, which can ease your journey. This approach not only simplifies the but may also lead to improved terms that better suit your needs.

Remember, we’re here to support you every step of the way as you navigate this process.

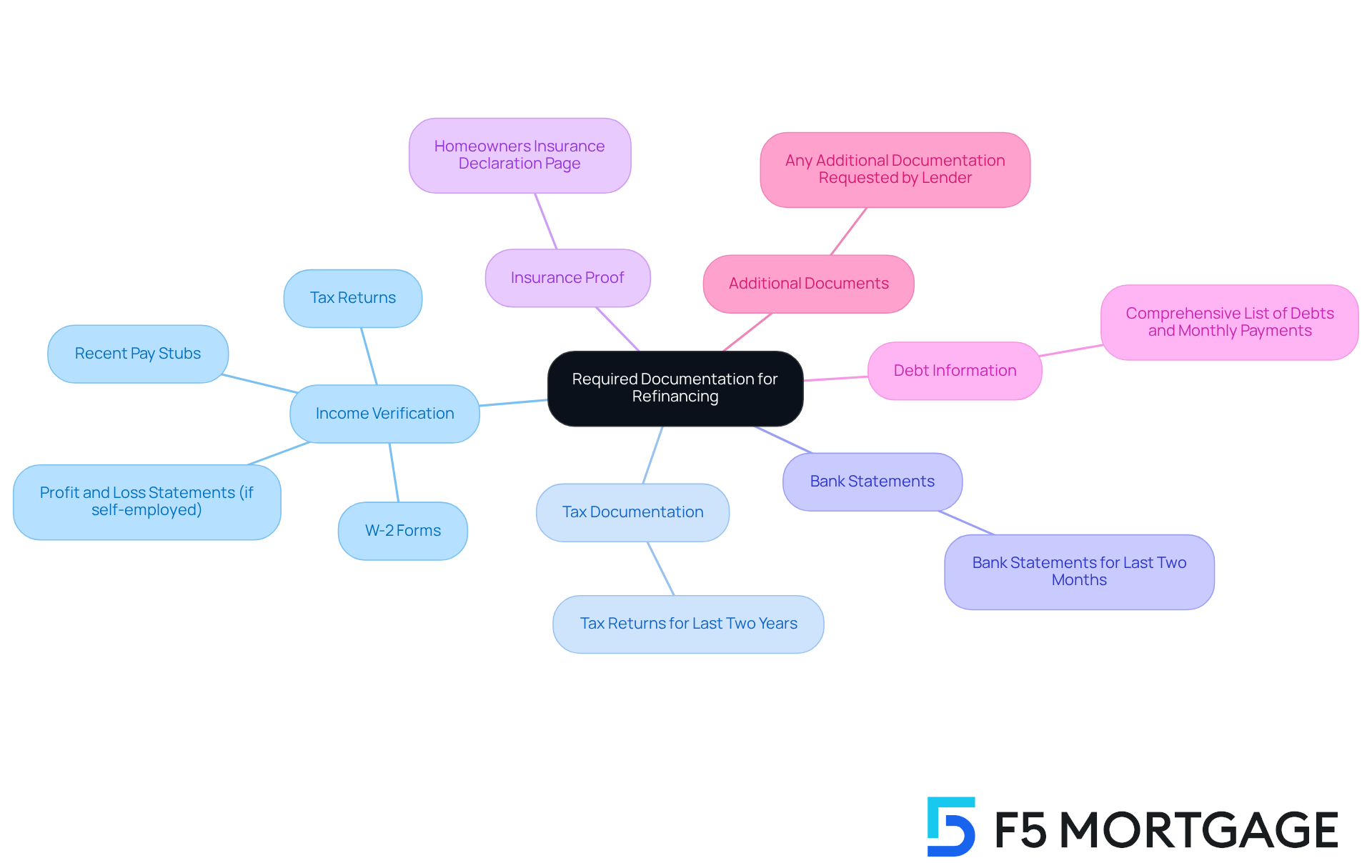

Collect Required Documentation for Your Application

To ensure a smooth , we know how important it is to gather the necessary ahead of time. Here’s a checklist of the :

- Recent pay stubs covering the last 30 days

- W-2 forms from the past two years

- Tax returns for the last two years

- Bank statements for the last two months

- Proof of homeowners insurance, including the declaration page

- A comprehensive list of your debts and monthly payments

- Any additional documentation your lender may request, such as profit and loss statements if self-employed

Having these documents organized not only streamlines your application but also demonstrates your preparedness to . This preparation can significantly , especially for those with . Remember, creditors frequently ask for verification of income and assets to evaluate your , so being meticulous in your documentation is essential.

We understand that navigating this process can feel overwhelming, but numerous emphasize the significance of . This diligence can lead to faster approvals and improved terms, making your journey a little easier.

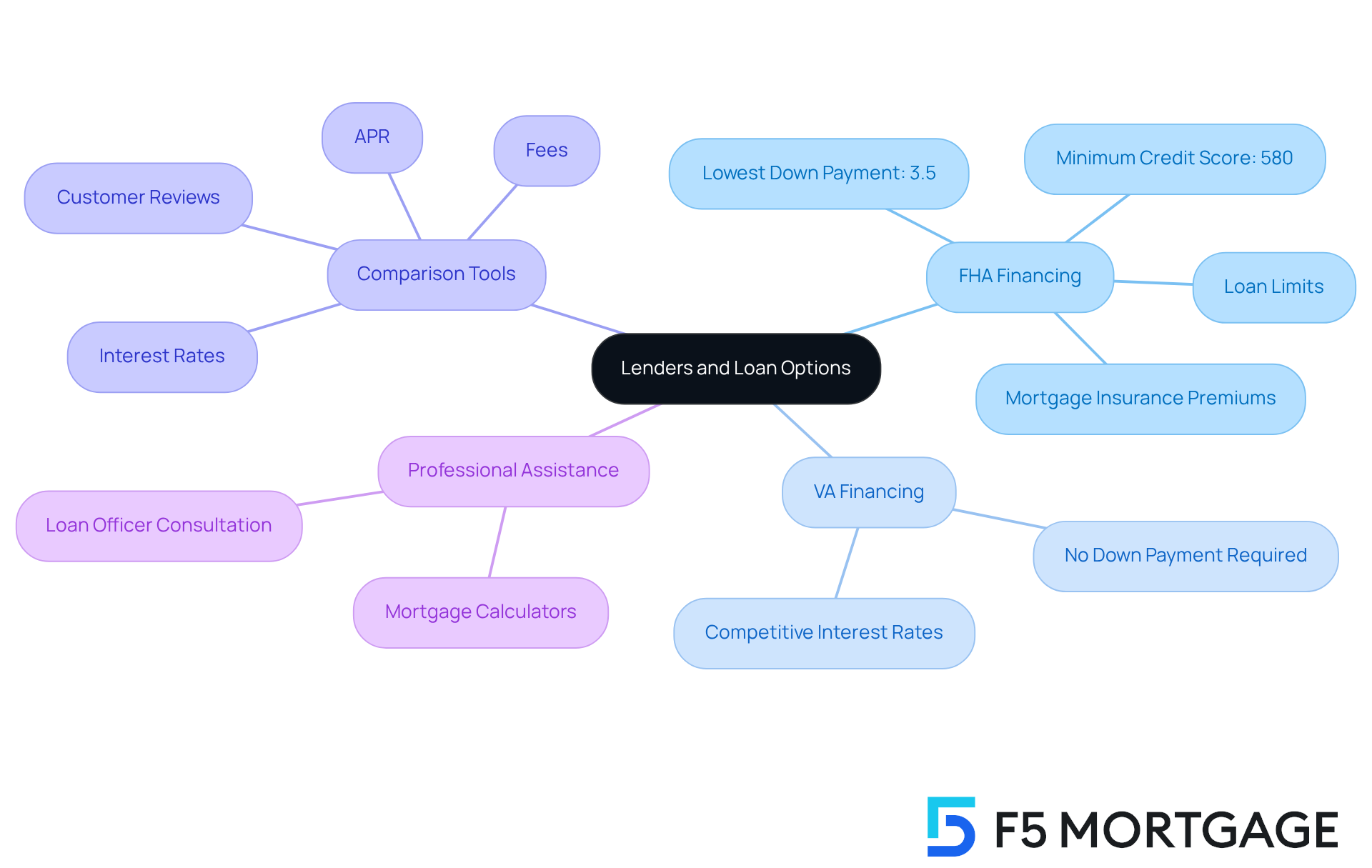

Compare Lenders and Loan Options Effectively

If you’re feeling overwhelmed by your financial history, know that there are lenders who can help you . Look for those that offer , as they often have more lenient eligibility criteria. In Colorado, for instance, FHA mortgages require a for the lowest down payment option of 3.5%. This makes homeownership attainable for many families. Plus, VA financing options , easing the and military families.

To make informed decisions, consider using online comparison tools. They can help you evaluate interest rates, fees, and financing terms, with a focus on the Annual Percentage Rate (APR) to understand the total cost of your financing. Remember, are essential factors; they can significantly shape your refinancing experience.

By exploring various proposals and seeking professional assistance—like the —you could save thousands over the life of your loan. However, it’s also important to be aware of , such as mortgage insurance premiums, which can affect your overall expenses.

With the , you can navigate the with confidence, knowing that we’re here to support you every step of the way.

Submit Your Application and Prepare for Approval

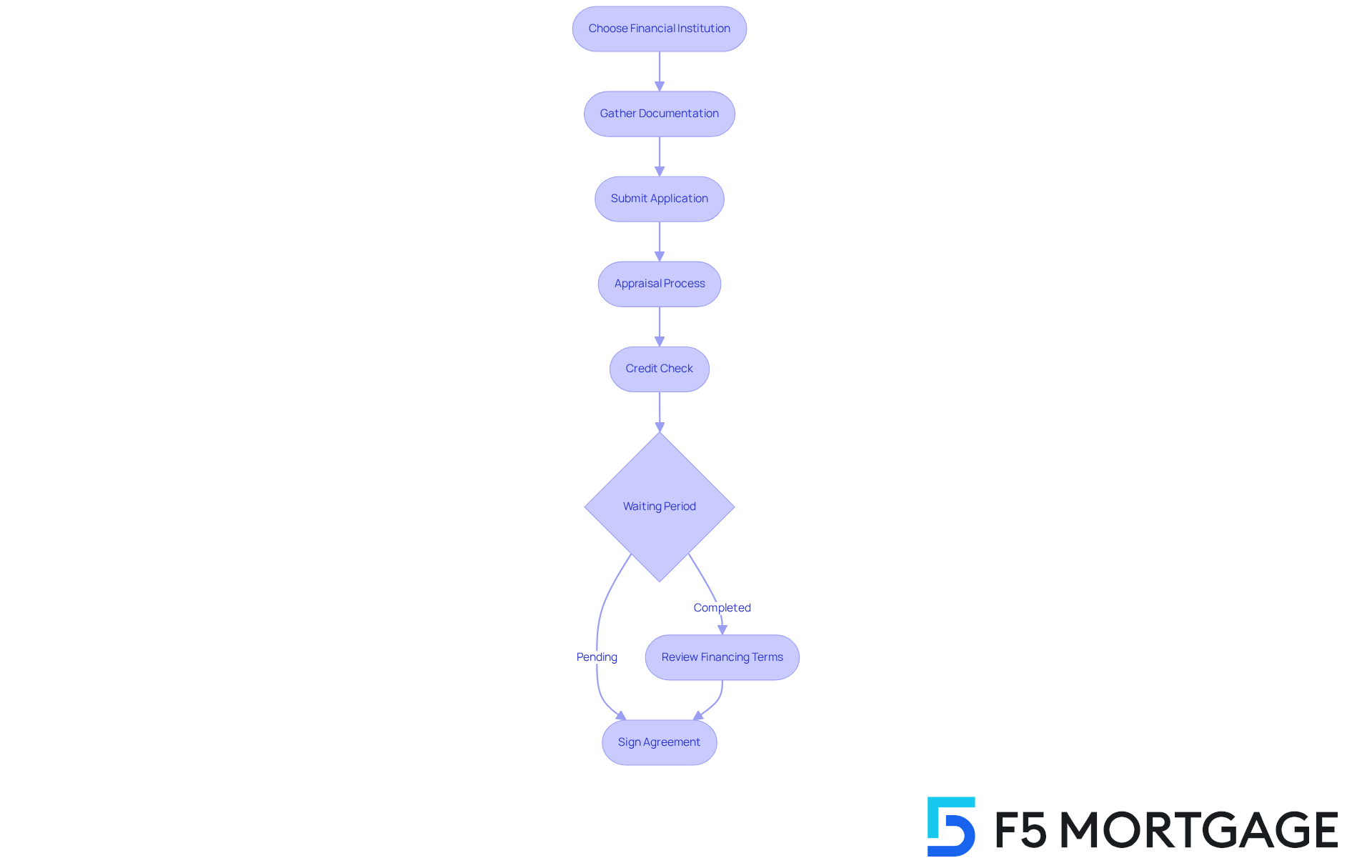

Once you’ve chosen a and gathered your documentation, it’s time to . We know how important this step is, and many financial institutions allow you to apply online, which can speed up the process and ease your worries. After submission, you will undergo an appraisal process where the financial institution evaluates your property’s current value.

Be prepared for the financial institution to and verify your financial information. This can take anywhere from a few days to a few weeks, and we understand that waiting can be stressful. Stay in contact with your financial institution to address any questions or additional documentation they may require.

If authorized, examine the before signing to ensure they align with your financial objectives. Remember, as , the institution your loan finalizes with will be the one you make payments to. during is crucial; statistics indicate that it can enhance the approval experience. This makes it vital to . We’re here to , ensuring you feel confident and informed.

Conclusion

Refinancing with bad credit may feel overwhelming, but it truly opens doors to better financial conditions for those ready to explore their options. We understand how challenging this can be, and knowing about various refinancing programs, like FHA and VA loans, is crucial for navigating the complexities of loan restructuring. These programs not only accommodate lower credit scores but also offer opportunities for significant savings and improved terms, showing that a difficult financial history doesn’t have to be a barrier.

This article outlines essential steps to successfully refinance with bad credit. Start by:

- Assessing your eligibility

- Gathering necessary documentation

- Comparing lenders

Each step is designed to empower you, highlighting the importance of preparation and informed decision-making. By leveraging available resources and understanding the requirements, you can enhance your chances of approval and secure favorable refinancing terms.

Ultimately, the journey to refinancing with bad credit isn’t just about overcoming hurdles; it’s about taking proactive steps toward financial improvement. We’re here to support you every step of the way. For those facing credit challenges, being informed and prepared can lead to transformative outcomes. Embrace the resources and support available, and take that first step toward a brighter financial future today.

Frequently Asked Questions

What is refinancing and how can it help those with bad credit?

Refinancing allows you to replace your current mortgage with a new one that offers better terms or lower monthly payments. For individuals with bad credit, it can provide options to improve their financial situation.

What loan options are available for refinancing with bad credit?

FHA financing is designed to be accessible for borrowers with credit scores as low as 500, while VA financing often has no strict credit score requirements for qualified veterans.

How does FHA financing assist borrowers with poor credit?

FHA financing has more flexible credit score criteria compared to traditional financing, making it easier for those with subpar credit to qualify and potentially secure better loan terms.

What is cash-out refinancing and who can benefit from it?

Cash-out refinancing allows homeowners to access a lump sum payment by tapping into their home equity, which can be used for home improvements or debt consolidation, even if their credit scores are not perfect.

What are the eligibility criteria for FHA and VA loans?

For FHA loans, a credit score of at least 580 is typically required, while VA loans have more flexible criteria that may be beneficial for borrowers.

What is the recommended debt-to-income (DTI) ratio for loan modifications?

Most financial institutions prefer a DTI ratio of 43% or lower for loan modifications to ensure borrowers can manage their debt effectively.

What should I do if my current mortgage lender offers loan modification options?

If your current mortgage is managed by a lender that offers loan modification options, it is advisable to contact them first, as they may have more flexible criteria for existing clients, which can simplify the refinancing process.

How can I prepare for the refinancing process?

Start by reviewing your credit rating, understanding the minimum criteria set by financial institutions, and assessing your debt-to-income ratio to prepare for potential refinancing options.