Overview

Improving your credit score for a home equity loan can feel daunting, but understanding key factors is a great first step. Focus on aspects like:

- Payment history

- Amounts owed

- Credit utilization

We know how challenging this can be, so implementing strategies such as:

- Making timely payments

- Monitoring your credit reports

is essential.

This article outlines specific steps and strategies that emphasize maintaining a good payment history and managing debt effectively. These elements are crucial for achieving a favorable credit score, which can lead to better loan terms. Remember, we’re here to support you every step of the way as you navigate this process.

Introduction

Understanding the intricacies of credit scores is more crucial than ever, especially for those looking to secure a home equity loan. We know how challenging this can be, as a significant portion of the population strives for favorable credit ratings. The journey to achieving a score of 670 or higher may seem daunting, yet it can be incredibly rewarding. This article reveals actionable steps to enhance credit scores, empowering you to unlock better loan terms and financial opportunities.

But what happens when unexpected challenges arise, potentially hindering your progress? We’re here to support you every step of the way. Exploring these strategies could hold the key to overcoming such obstacles and achieving the financial stability you deserve.

Understand Your Credit Score Basics

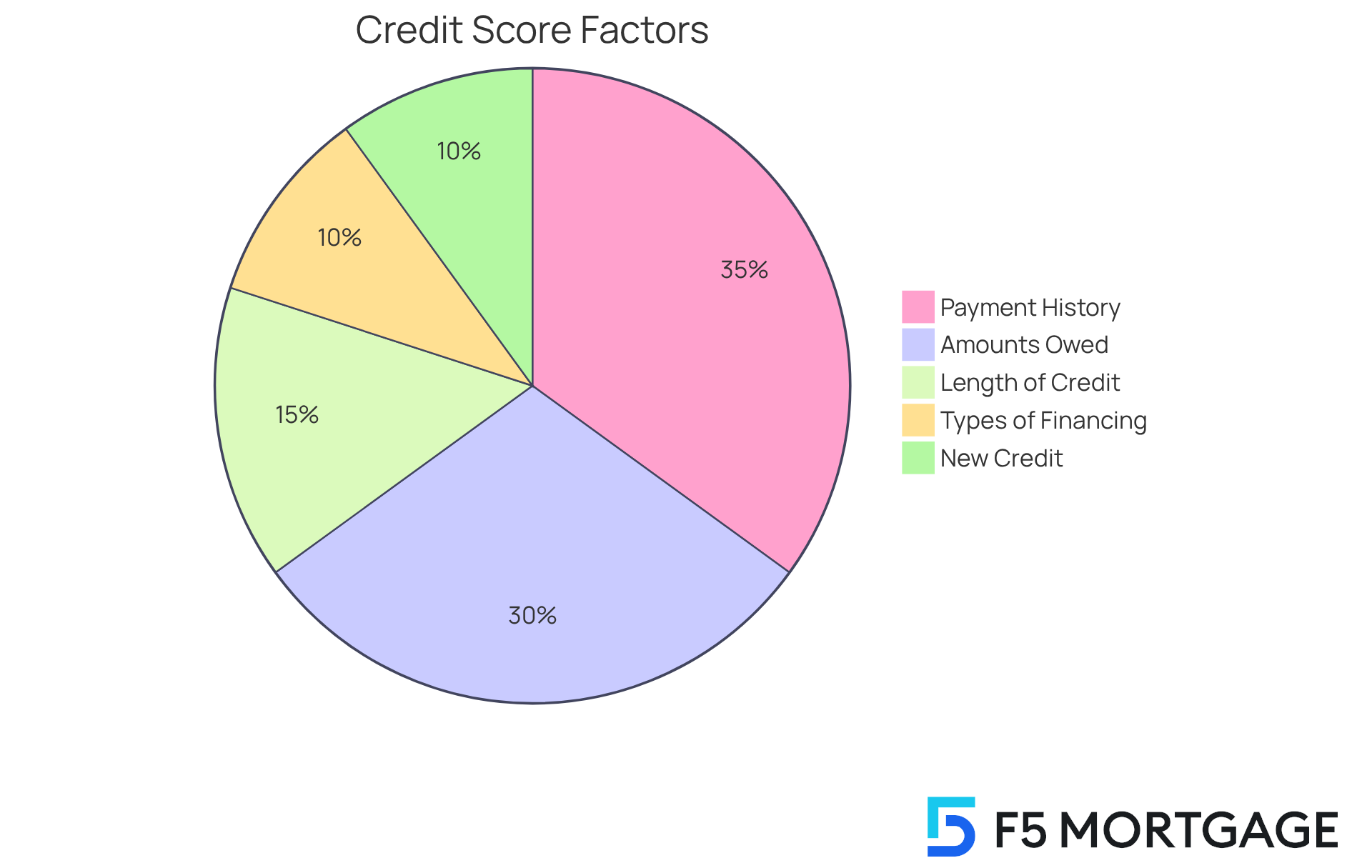

Understanding your credit rating is essential, as it serves as a numerical representation of your creditworthiness, typically ranging from 300 to 850. It’s calculated based on several key factors that can significantly impact your financial future.

-

Payment History (35%): This is the most significant factor influencing your score. We know how challenging it can be to keep track of payments, but on-time contributions can improve your score. Conversely, overdue contributions can have a harmful impact. As we approach 2025, maintaining a clean payment history remains crucial, directly correlating with loan approval rates. According to Experian, a favorable financial history is essential for reliable approval for loans and mortgages.

-

Amounts Owed (30%): This factor pertains to your utilization ratio, which compares the amount you are borrowing to your total available funds. Keeping this ratio under 30% is optimal for a healthy result. As of 2024, the average FICO Score in the U.S. is 715, indicating that individuals are increasingly aware of managing their utilization effectively.

-

Length of Credit History (15%): A longer financial history can positively influence your rating. It showcases to lenders your experience in handling debts responsibly. Stability in average ratings across the U.S. indicates that consumers are keeping their accounts over time, which can be reassuring.

-

Types of Financing (10%): A varied combination of financing categories, such as charge cards and home loans, can improve your rating. This variety demonstrates to lenders that you can manage different types of financing, which is a positive signal.

-

New Credit (10%): While it’s exciting to open new accounts, doing so within a brief period can reduce your rating. This may indicate heightened risk to lenders, so it’s wise to be cautious.

Grasping these elements is crucial for recognizing areas for enhancement as you strive to improve your financial rating. With almost three-quarters of individuals possessing a good or better credit score for home equity loan (670 or higher) in 2024, focusing on these elements can assist you in joining their ranks and obtaining advantageous terms.

Furthermore, as average card interest rates hit new peaks, we understand that consumers are reacting by cutting their card expenditures. This highlights the significance of managing finances efficiently, and we’re here to support you every step of the way.

Assess and Monitor Your Credit Score

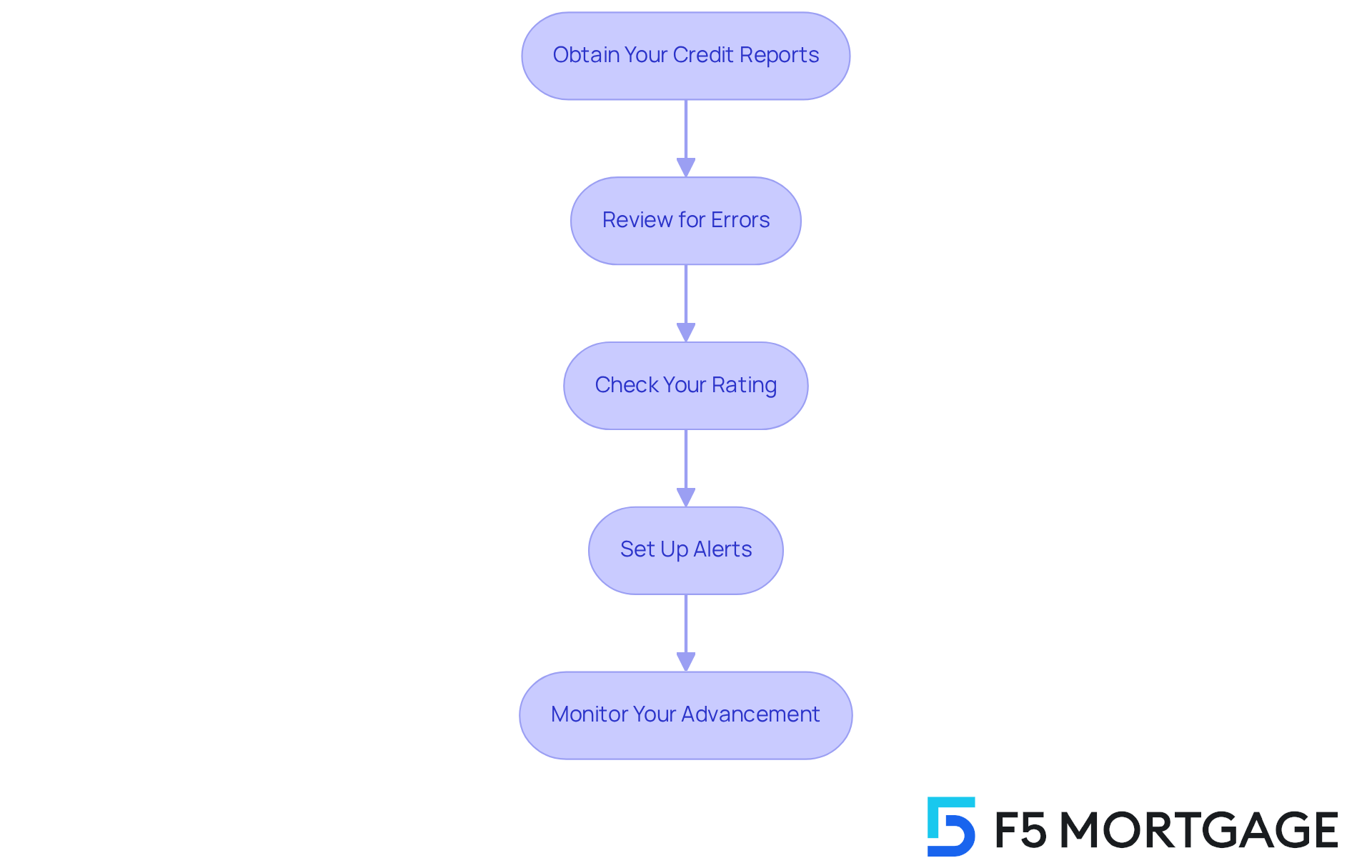

To effectively improve your score, we know how important it is to start by acquiring your report from the three major agencies: Experian, TransUnion, and Equifax. You are entitled to one free report from each bureau annually, which is a great opportunity to begin your journey. Here’s a structured approach to assess and monitor your credit score:

- Obtain Your Credit Reports: Visit AnnualCreditReport.com to request your free reports. This is your first step toward understanding your financial health.

- Review for Errors: Scrutinize each report for inaccuracies, such as incorrect account details or late payments that were actually made on time. If you spot any mistakes, contest them quickly to ensure your report reflects accurate information. Remember, this is your financial story, and it should be told correctly.

- Check Your Rating: Utilize free services like Credit Karma or your bank’s monitoring tools to regularly check your rating. In 2024, 71.2% of individuals had a good or better score (670 or higher). This statistic emphasizes the significance of remaining aware of your financial standing. As Howard Shelanski, Director of the FTC’s Bureau of Economics, stated, ‘These are eye-opening numbers for American consumers,’ highlighting the need for regular report checks.

- Set Up Alerts: Numerous monitoring services offer notifications for important changes to your report, allowing you to stay informed about your status and take action if needed. This proactive approach can make a significant difference.

- Monitor Your Advancement: Keep a log of your rating over time to assess the impact of your attempts to enhance it. Consistent observation is essential, as research indicates that individuals who review their financial ratings frequently are better equipped to handle their economic well-being. Furthermore, the case study on ‘Average Rating Stability in the U.S.’ suggests that average ratings have stayed consistent across most areas, emphasizing the significance of proactive financial management.

By adhering to these steps, you can take charge of your financial profile, rectify any inconsistencies, and strive towards attaining a higher rating. This is crucial for qualifying based on your credit score for home equity loan and other financing alternatives. Remember to be cautious about the expenses linked to monitoring services, as some may require subscriptions that could affect your budget. We’re here to support you every step of the way.

Implement Strategies to Improve Your Credit Score

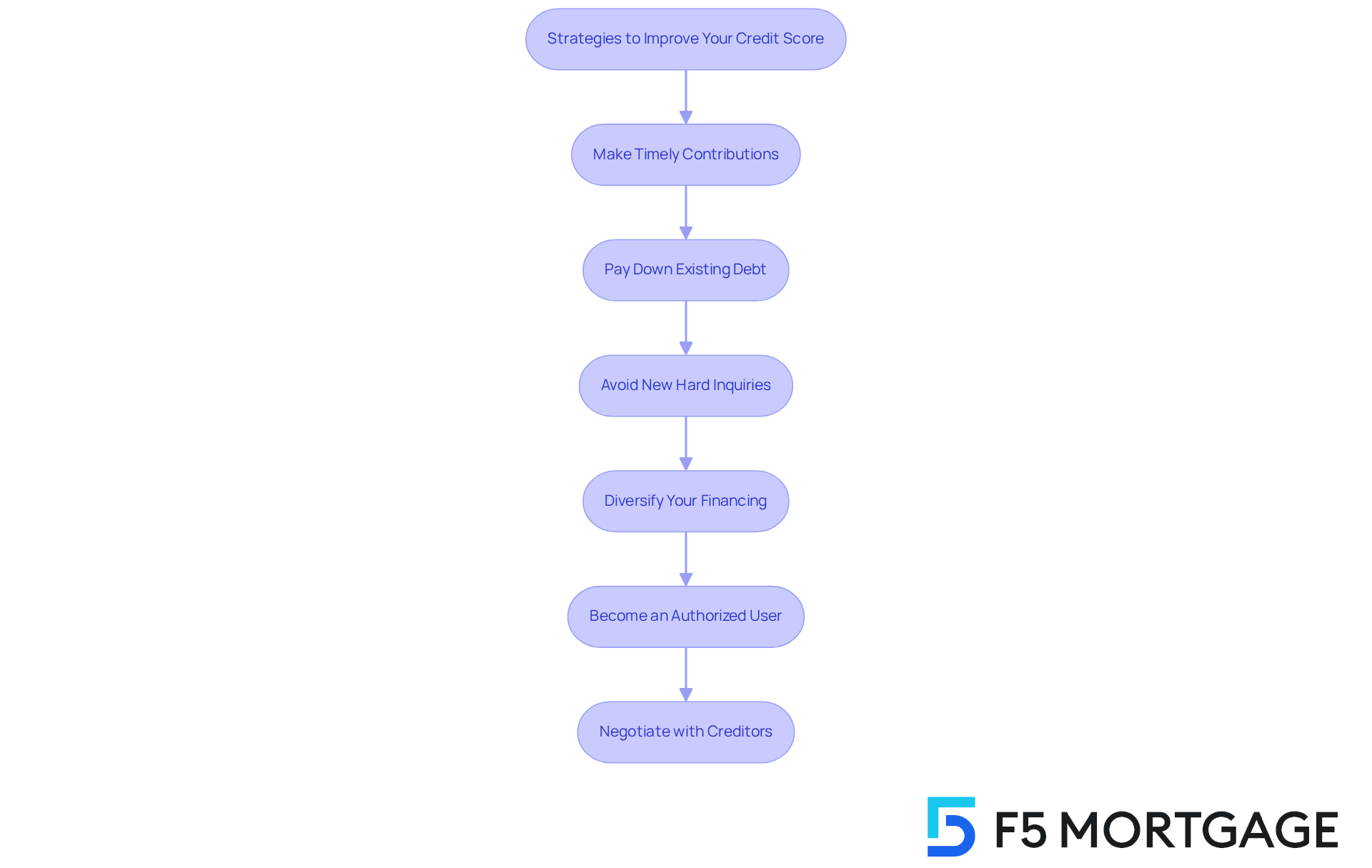

Enhancing your financial rating requires consistent effort and thoughtful planning. We understand how challenging this can be, but here are some effective strategies to help you succeed:

-

Make Timely Contributions: Set up automatic transfers or reminders to ensure you never miss a due date. Timely transactions are the most crucial element affecting your borrowing rating, as they show dependability to lenders. As stated by the Financial Consumer Agency of Canada, “Your history of transactions is the most crucial element for your financial rating.” Maintaining a solid payment history is essential for achieving a positive score.

-

Pay Down Existing Debt: Focus on reducing your card balances to lower your utilization ratio. Aim to keep your utilization below 30%. In 2025, the average debt on cards per individual was approximately $5,500, highlighting the importance of managing debt effectively. Additionally, in 2024, 71.2% of consumers held a good or better rating (670 or higher), underscoring the necessity for sound financial management.

-

Avoid New Hard Inquiries: Limit new loan applications, as each inquiry can temporarily decrease your score. Understanding the difference between hard and soft inquiries can help you manage your financial reputation more effectively.

-

Diversify Your Financing: If possible, consider adding a different type of loan, such as a personal loan, to improve your mix of accounts. A varied loan portfolio can positively influence your rating, showing lenders that you can responsibly handle different kinds of borrowing.

-

Become an Authorized User: If you have a trustworthy friend or family member with a good financial history, ask to be added as an authorized user on their card. This can help enhance your score without needing to use the card, as their positive transaction history will reflect on your report.

-

Negotiate with Creditors: If you have outstanding debts, think about negotiating with creditors for lower balances or payment plans. This proactive approach can alleviate financial stress and improve your overall financial situation.

By applying these strategies, you can significantly improve your credit score for home equity loan, which will make you a more appealing candidate. Remember, we’re here to support you every step of the way.

Maintain and Protect Your Improved Credit Score

Sustaining and safeguarding your enhanced credit score for home equity loan is essential for obtaining advantageous conditions on such loans. We understand how important this is for you, and we want to share some essential practices to consider:

- Keep Tracking Your Ratings: Frequently examine your reports and ratings to stay informed about your financial health. This vigilance helps you catch any discrepancies or potential issues early, ensuring you remain in control.

- Maintain Old Accounts Active: The duration of your borrowing history greatly influences your score, and lenders take this aspect into account when making choices. Avoid closing old accounts, even if they are rarely utilized, as they positively impact your financial profile and reflect your responsible credit management.

- Limit New Loan Applications: Apply for new loans sparingly. Each application can trigger a hard inquiry, which may temporarily lower your score. Being selective aids in preserving your financial standing and helps you make informed choices.

- Practice Good Financial Habits: Consistently making on-time payments, keeping your borrowing utilization low, and managing your debt responsibly are essential for maintaining a healthy financial score. We know how challenging this can be, but these habits will serve you well.

- Consider a Financial Freeze: If you suspect identity theft, placing a financial freeze can prevent unauthorized accounts from being opened in your name, safeguarding your financial integrity and offering you peace of mind.

- Educate Yourself: Stay informed about financial management and monetary literacy. Understanding how borrowing functions enables you to make choices that positively affect your rating, empowering you to take charge of your finances.

Tracking your financial history after enhancements is crucial, especially since nearly 71.2% of individuals now have a favorable credit score for home equity loan (670 or above), which is essential for loan approvals. Moreover, the average score in the U.S. stands at 715, offering context for the current lending landscape. Keeping old accounts can help maintain your financial history, a key factor lenders evaluate. As demonstrated in recent trends, consumers who actively manage their credit score for home equity loan are better positioned to navigate financial challenges and secure favorable loan terms. Remember, we’re here to support you every step of the way.

![]()

Conclusion

Improving your credit score is a vital step toward securing a home equity loan with favorable terms. We understand how challenging this can be, but by grasping the fundamental components of your credit score—like payment history, amounts owed, and the length of your credit history—you can take proactive measures to enhance your financial standing. This journey involves assessing and monitoring your credit, as well as implementing effective strategies and maintaining those improvements over time.

Key strategies to consider include:

- Making timely payments

- Managing debt levels

- Diversifying your credit types

Regularly reviewing your credit reports for errors and setting up alerts can help you stay aware of your financial health. Additionally, practices such as keeping old accounts open and being cautious with new loan applications play a crucial role in sustaining a positive credit profile.

Ultimately, taking charge of your credit score is not just about securing a loan; it’s about empowering yourself financially. By adopting these practices, you can protect your financial future and navigate the complexities of borrowing with confidence. The importance of a good credit score cannot be overstated; it opens doors to better loan conditions and greater financial opportunities. Taking these steps today can pave the way for a more secure tomorrow.

Frequently Asked Questions

What is a credit score and what range does it typically fall within?

A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850.

What are the key factors that influence my credit score?

The key factors that influence your credit score include payment history (35%), amounts owed (30%), length of credit history (15%), types of financing (10%), and new credit (10%).

How does payment history affect my credit score?

Payment history is the most significant factor influencing your score. On-time payments can improve your score, while overdue payments can have a negative impact.

What is the optimal utilization ratio for amounts owed?

Keeping your utilization ratio under 30% is optimal for a healthy credit score.

How does the length of my credit history impact my score?

A longer credit history can positively influence your score by demonstrating to lenders your experience in managing debts responsibly.

Why is it beneficial to have different types of financing?

Having a varied combination of financing types, such as charge cards and home loans, can improve your credit rating by showing lenders that you can manage different financing categories.

How does opening new credit accounts affect my score?

Opening new credit accounts within a short period can reduce your credit score, as it may indicate increased risk to lenders.

What is the significance of maintaining a good credit score?

A good credit score (670 or higher) can help you obtain advantageous terms for loans and mortgages, as well as improve your chances of loan approval.

What trends are affecting consumer credit behavior in 2024?

As average card interest rates reach new peaks, consumers are responding by cutting their card expenditures, highlighting the importance of efficient financial management.