Overview

Understanding HELOC rates can feel overwhelming, but we’re here to support you every step of the way. Several factors influence these rates, including:

- Credit scores

- Loan-to-value ratios

- Market conditions

- Lender types

- Promotional offers

By recognizing these elements, homeowners can secure better rates and make informed financial decisions.

Currently, trends indicate a decrease in average rates, presenting a favorable opportunity for borrowing. This is a moment where families can take charge of their financial futures. We know how challenging this can be, but with the right knowledge, you can navigate these waters confidently and make choices that benefit your household.

Take the time to explore your options and consider how these factors might impact your situation. Together, we can work towards achieving your financial goals.

Introduction

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is essential for homeowners looking to leverage their property’s value. We know how challenging this can be, especially with average HELOC rates fluctuating due to various factors like credit scores and market conditions. This creates a unique opportunity for homeowners to access funds for:

- Renovations

- Debt consolidation

- Unexpected expenses

However, as these rates can change with economic shifts, how can you ensure you secure the best possible terms for your financial needs? We’re here to support you every step of the way.

Define Home Equity Lines of Credit (HELOCs)

A (HELOC) is a flexible financial option that allows homeowners to tap into the equity of their homes. We understand how important it is to have when you need them. Unlike traditional loans that provide a lump sum, a HELOC works much like a credit card, letting you withdraw money as necessary, up to a set limit. This means you can manage your finances in a way that suits your unique situation.

The amount you can borrow depends on your home’s appraised value minus any existing mortgage balances. We know how challenging it can be to navigate these numbers, but rest assured, this option is designed to give you . Typically, HELOCs are associated with that come with variable interest rates, meaning your borrowing costs may fluctuate over time based on market conditions.

This adaptability makes HELOCs a popular choice for homeowners looking to:

- Fund renovations

- Consolidate debt

- Tackle unexpected expenses

We’re here to support you every step of the way as you consider your options and make informed decisions for your family’s future.

Explore Factors Affecting HELOC Rates

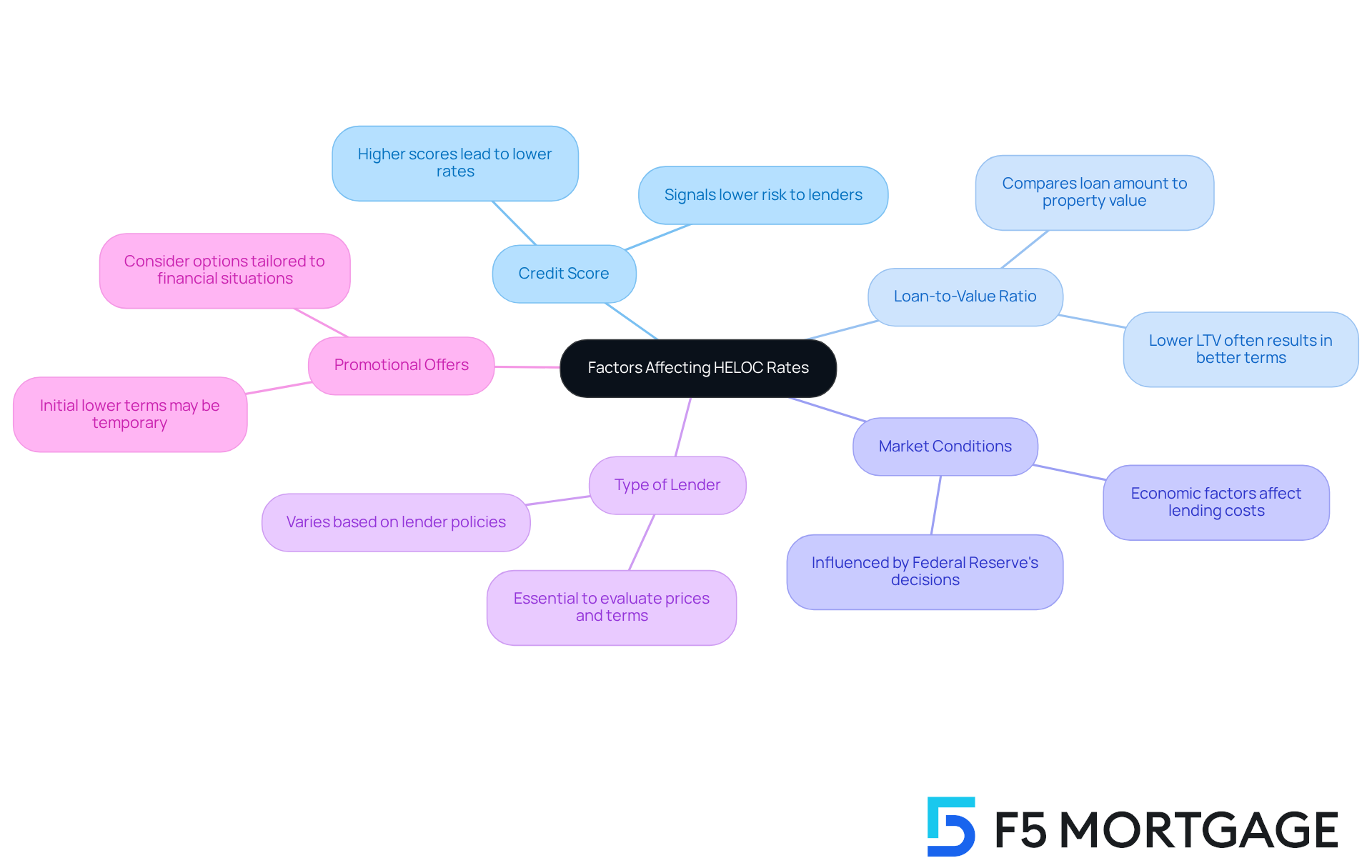

Several key factors influence , and understanding these factors can significantly benefit families navigating their financial options.

- : We know how important your credit score is. A higher score typically results in lower interest rates, as it signals to lenders that you are a less risky borrower.

- (LTV): This ratio compares the amount of your loan to the appraised value of your property. A lower LTV often leads to better terms, so it’s crucial to grasp the importance of home appraisals in determining your property value and equity for mortgage conditions.

- : Economic factors, including the Federal Reserve’s interest decisions, can greatly influence overall lending costs, particularly the average HELOC rates. Staying informed about these changes can help you make .

- Type of Lender: Different lenders may have varying charges based on their policies and risk evaluations. This is why evaluating prices, costs, and terms is essential. At F5 Lending, we pride ourselves on offering attractive terms and personalized support tailored to your family’s needs.

- Promotional Offers: Some lenders may present initial terms that are lower for a limited time, which can affect the total cost of borrowing. By considering , families can ensure they are securing the best possible deal, with options designed specifically for their financial situations. We’re here to support you every step of the way.

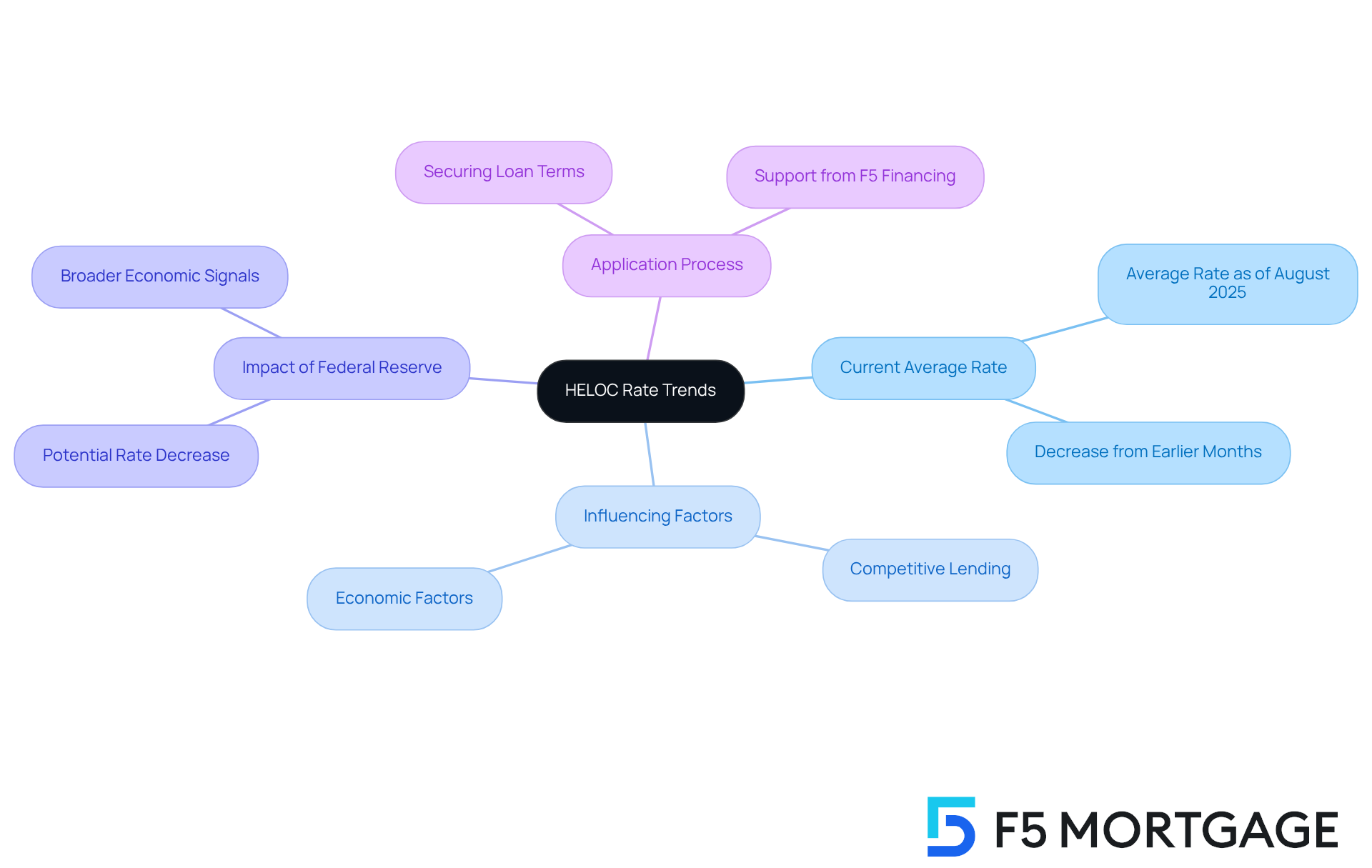

Analyze Current HELOC Rate Trends

As of August 2025, the nationally are approximately 8.13%. This indicates a decrease from earlier months, which is encouraging news for . Recent reports reveal that levels have reached a two-year low, influenced by a mix of competitive lending methods and various economic factors.

is vital for prospective borrowers. Prices can fluctuate based on broader economic signals and lender-specific regulations. For instance, if the Federal Reserve continues to lower interest rates, the average HELOC rates may decrease further. This could create an opportune moment for homeowners to consider applying.

Once your application is approved, it’s essential to with . This step helps protect you from potential market changes during the processing period. Remember, we’re here to support you every step of the way as you navigate this process.

Secure the Best HELOC Rates: Tips and Strategies

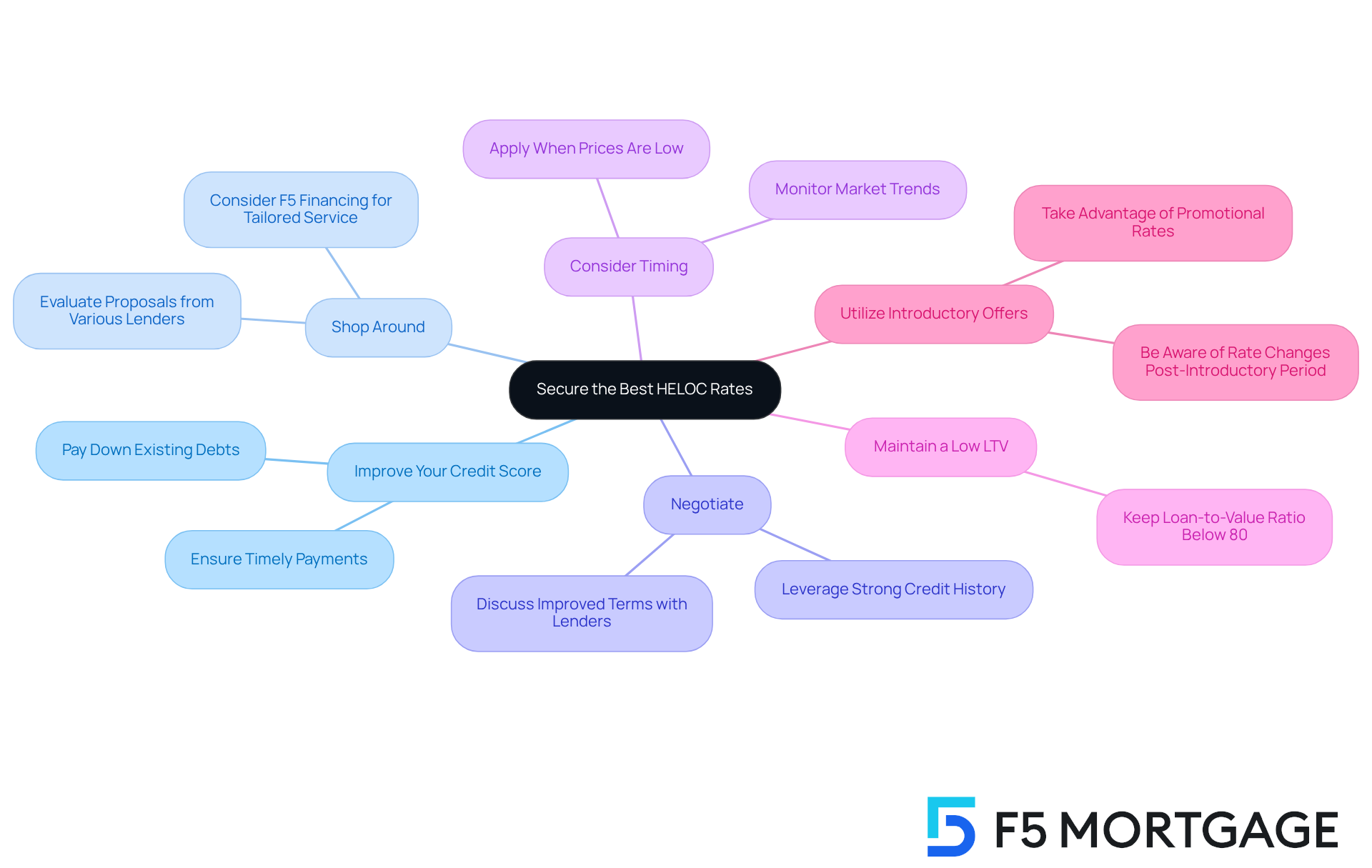

Securing the can feel overwhelming, but we’re here to support you every step of the way. Consider these strategies to help you navigate this process with confidence:

- Improve Your Credit Score: By paying down existing debts and ensuring , you can enhance your credit profile. We know how challenging this can be, but every small step counts.

- Shop Around: Evaluate proposals from various lenders, including F5, to discover the most favorable terms and conditions. is recognized for its tailored service, which can assist you in navigating your options efficiently.

- Negotiate: Don’t hesitate to discuss with lenders for improved terms, especially if you have a strong credit history. F5 Financing encourages open discussions to tailor solutions to your needs, making the process feel more personal.

- Consider Timing: It’s important to monitor market trends and apply when prices are low. Economic predictions can offer insights into possible adjustments, and locking in a figure with can secure your financial advantage.

- Maintain a Low LTV: Aim to keep your below 80% to qualify for improved terms. This can significantly impact the average heloc rates that you receive.

- Utilize Introductory Offers: Take advantage of offered by lenders, but be aware of how rates may change after the introductory period. F5 Mortgage often provides that can benefit your financial planning.

Remember, each of these strategies is a step towards achieving your financial goals, and we’re here to help you along the way.

Conclusion

A comprehensive understanding of Home Equity Lines of Credit (HELOCs) reveals their potential as a flexible financial tool for homeowners. By allowing access to home equity, HELOCs empower individuals to manage their finances effectively, whether for renovations, debt consolidation, or unexpected expenses. We know how challenging it can be to navigate these options, and recognizing the average HELOC rates and the factors that influence them is crucial for making informed financial decisions.

Key arguments outlined in the article emphasize the importance of:

- Credit scores

- Loan-to-value ratios

- Market conditions

- Lender variations

in determining HELOC rates. By improving credit profiles, shopping around for the best offers, and staying informed about economic trends, homeowners can secure favorable borrowing terms. The current trend shows an average HELOC rate of approximately 8.13%. This may present an advantageous opportunity for potential borrowers to explore their options.

Ultimately, understanding how HELOC rates are shaped by multiple factors not only aids in navigating the borrowing process but also highlights the broader significance of financial literacy. We’re here to support you every step of the way as homeowners are encouraged to take proactive steps in managing their financial futures. By utilizing these strategies and remaining informed, families can make empowered decisions that align with their financial goals.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible financial option that allows homeowners to access the equity in their homes, functioning similarly to a credit card by letting you withdraw money as needed, up to a set limit.

How does a HELOC differ from traditional loans?

Unlike traditional loans that provide a lump sum, a HELOC allows you to withdraw funds as necessary, providing more flexibility in managing your finances.

How is the borrowing amount determined for a HELOC?

The amount you can borrow with a HELOC is based on your home’s appraised value minus any existing mortgage balances.

What are the typical interest rates associated with HELOCs?

HELOCs usually come with variable interest rates, meaning that borrowing costs may fluctuate over time based on market conditions.

What are some common uses for a HELOC?

Homeowners commonly use HELOCs to fund renovations, consolidate debt, or tackle unexpected expenses.