Overview

This article is here to guide you through the essential steps and considerations for mastering equity home loans. We understand how important it is to grasp the concept of home equity and the various options available to leverage it effectively. By calculating your equity and exploring the different types of equity loans, you can make informed decisions that enhance your financial well-being.

We know how challenging this can be, which is why we aim to provide clarity on the associated risks. Recognizing these risks is crucial as you navigate your financial journey. Our goal is to empower you with the knowledge you need to address your unique financial needs and ultimately build your wealth.

As you explore this topic, remember that you are not alone. We’re here to support you every step of the way, ensuring that you feel confident in your financial choices.

Introduction

Understanding the value of home equity is crucial for homeowners who wish to leverage their property for financial gain. We know how challenging this can be. By tapping into this asset, individuals can access funds for various purposes—from home renovations to debt consolidation. This unlocks opportunities that can significantly enhance their financial well-being.

However, with these benefits come inherent risks and complexities that can leave many feeling uncertain. We’re here to support you every step of the way. How can homeowners navigate the intricacies of equity home loans while ensuring they make informed decisions that align with their long-term financial goals? Let’s explore this together.

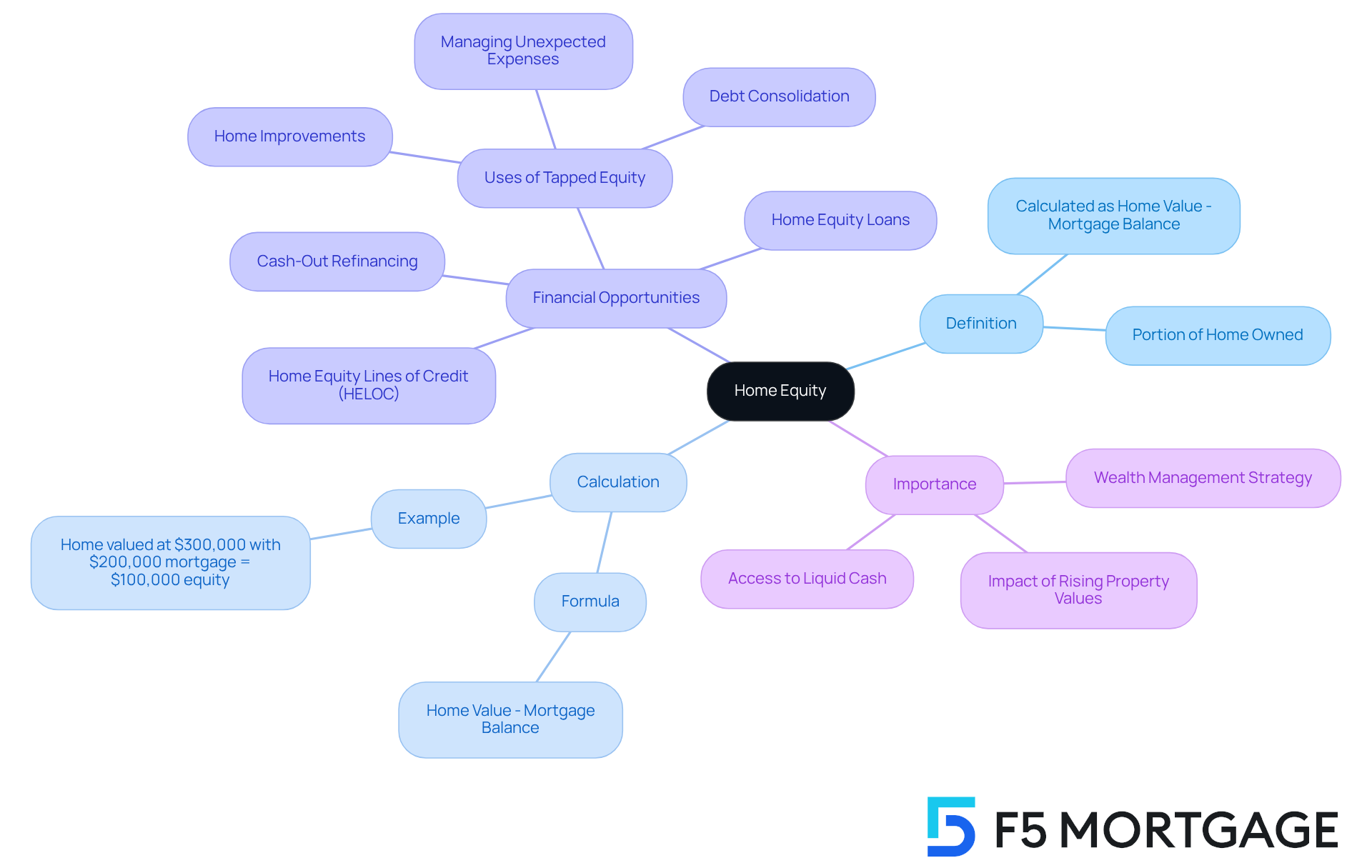

Define Home Equity and Its Importance

Understanding your residential is essential, as it represents the portion of your home that you truly own. This value is calculated by subtracting the remaining balance on your mortgage from your home’s current market worth. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your property value stands at $100,000.

We know how challenging it can be to navigate , but recognizing your property value can unlock significant . Homeowners can tap into this asset through various , such as and . This option allows you to refinance your existing mortgage for a larger amount, giving you access to the difference in cash. Imagine using these funds for , consolidating debt, or managing unexpected expenses.

Furthermore, as property prices rise, the value of your home can increase, making equity home loans a vital component of your . We’re here to support you every step of the way in understanding and leveraging your property value to .

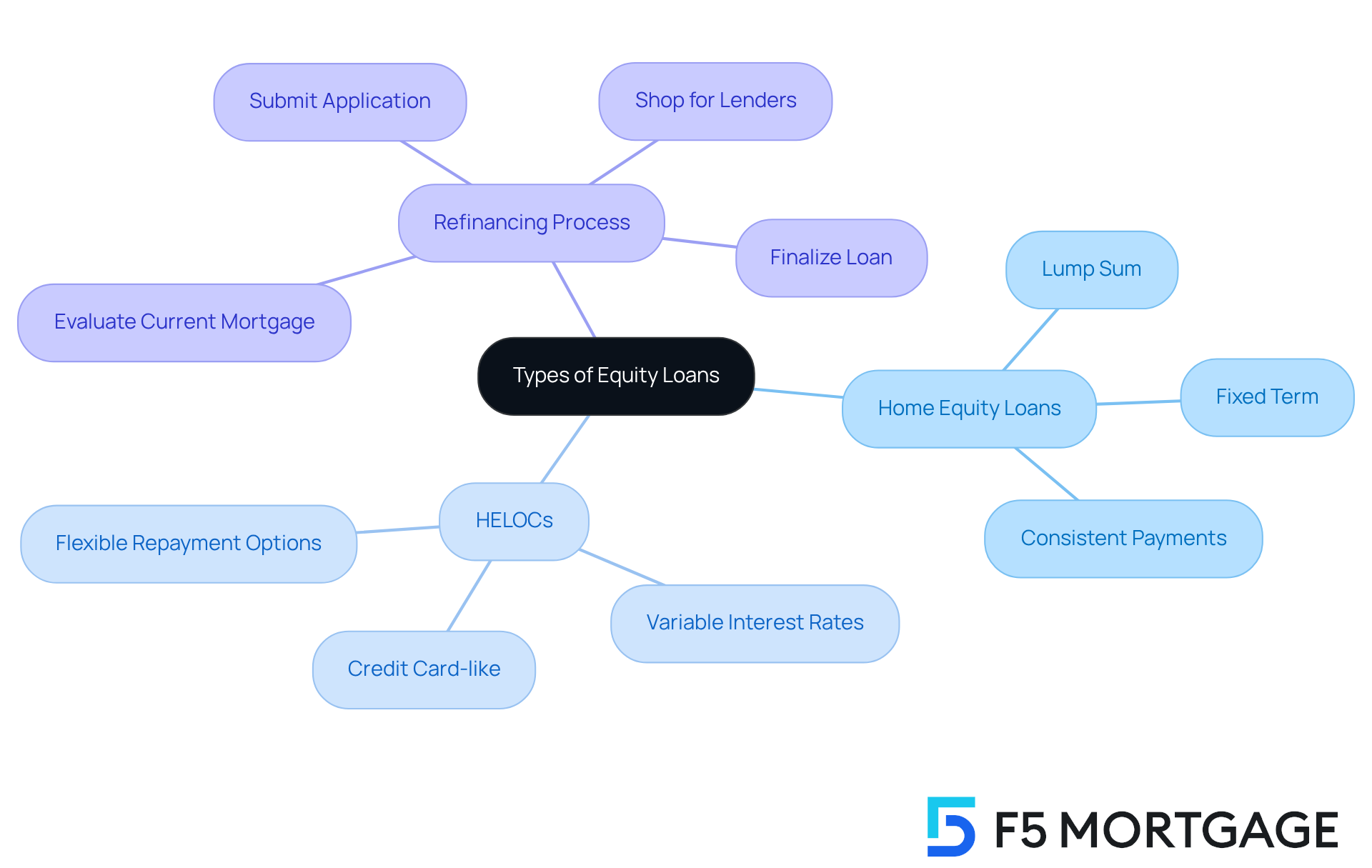

Explore Types of Equity Loans: Home Equity Loans vs. HELOCs

When it comes to securing loans with your property, there are two primary options: and Property Value Lines of Credit (HELOCs). offer a lump sum of money that you repay over a fixed term with consistent monthly payments. This can be a great fit if you need a specific amount for a one-time expense, like a major renovation. In contrast, a , allowing you to borrow against your property’s value as needed, up to a certain limit. With typically variable interest rates and , HELOCs are ideal for ongoing expenses or projects.

If you’re considering these financial options, might be a worthwhile path. We know how daunting this process can be, but taking it step by step can make it manageable. Start by evaluating your existing mortgage conditions and identifying your financial goals. Then, shop around for lenders to find the that suit your needs. Once you’ve selected a lender, submit your application along with the necessary documentation. After approval, you’ll finalize the new loan, which can help lower your monthly payments or allow you to access your property’s value.

It is crucial for homeowners to understand the differences between equity home loans and HELOCs. This knowledge empowers you to choose the most suitable option for your financial needs, especially in the context of refinancing to enhance your property value, particularly as mortgage rates decline. Remember, we’re here to support you every step of the way.

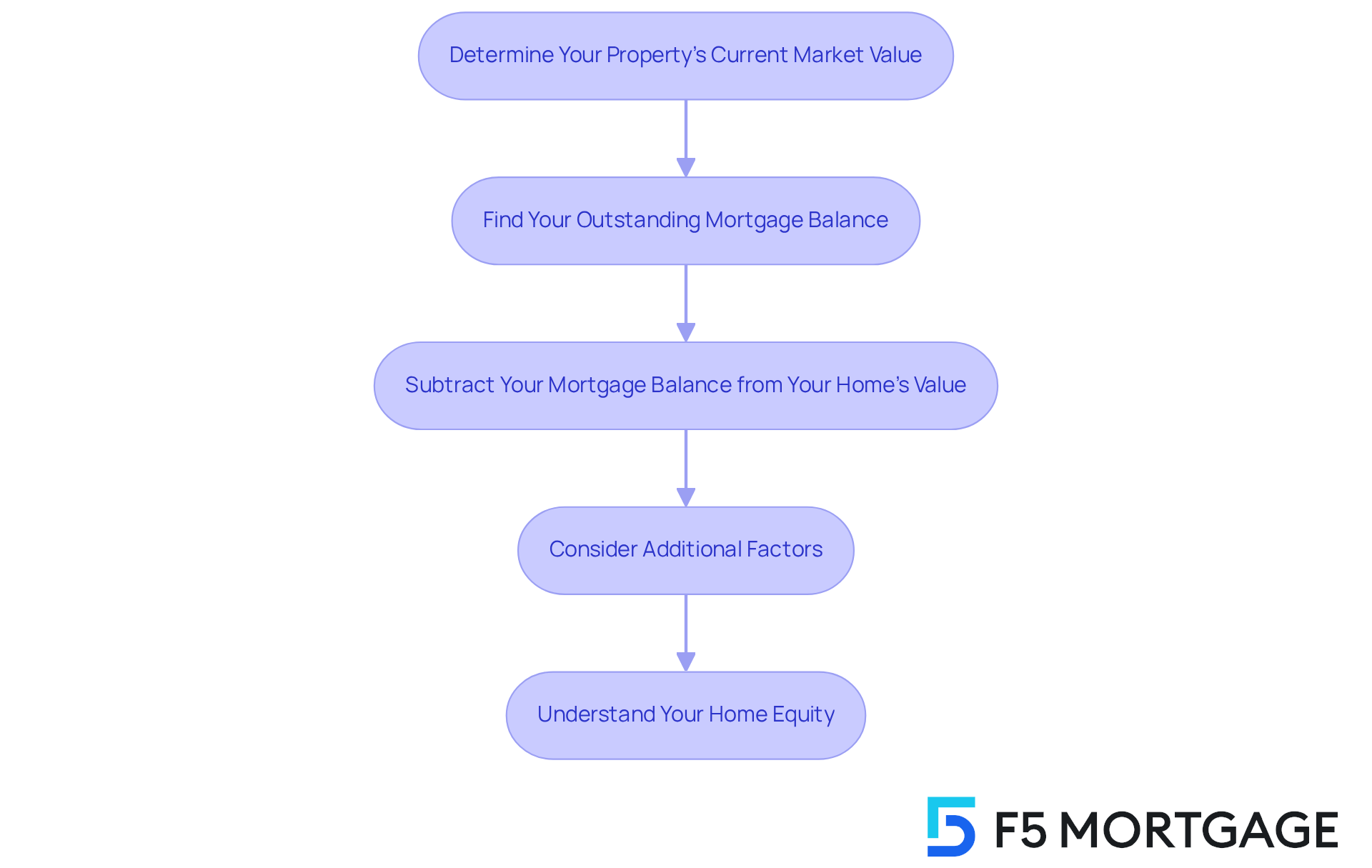

Calculate Your Home Equity: Steps and Considerations

Calculating your equity home loans can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps:

- Determine Your Property’s Current Market Value: It’s important to know how much your home is worth. You can use online real estate platforms, consult a trusted real estate agent, or get a to find this information.

- Find Your : Check your latest mortgage statement or reach out to your lender to find out how much you still owe. This is a crucial piece of the puzzle.

- Subtract Your Mortgage Balance from Your Home’s Value: Now, let’s do the math. Use the formula: = Current Market Value – Outstanding Mortgage Balance. For example, if your home is valued at $350,000 and you owe $250,000, your equity would be $100,000.

- Consider Additional Factors: Remember that . Also, any liens or second mortgages should be factored into your calculations. Many lenders require property owners to maintain a , meaning you should have reduced at least 20% of your original loan amount or that your property should have appreciated in value. Additionally, a maximum DTI ratio of 43% is often necessary for residential loans, which can influence your .

We know how challenging this can be, but is a vital step toward making informed financial decisions for your family.

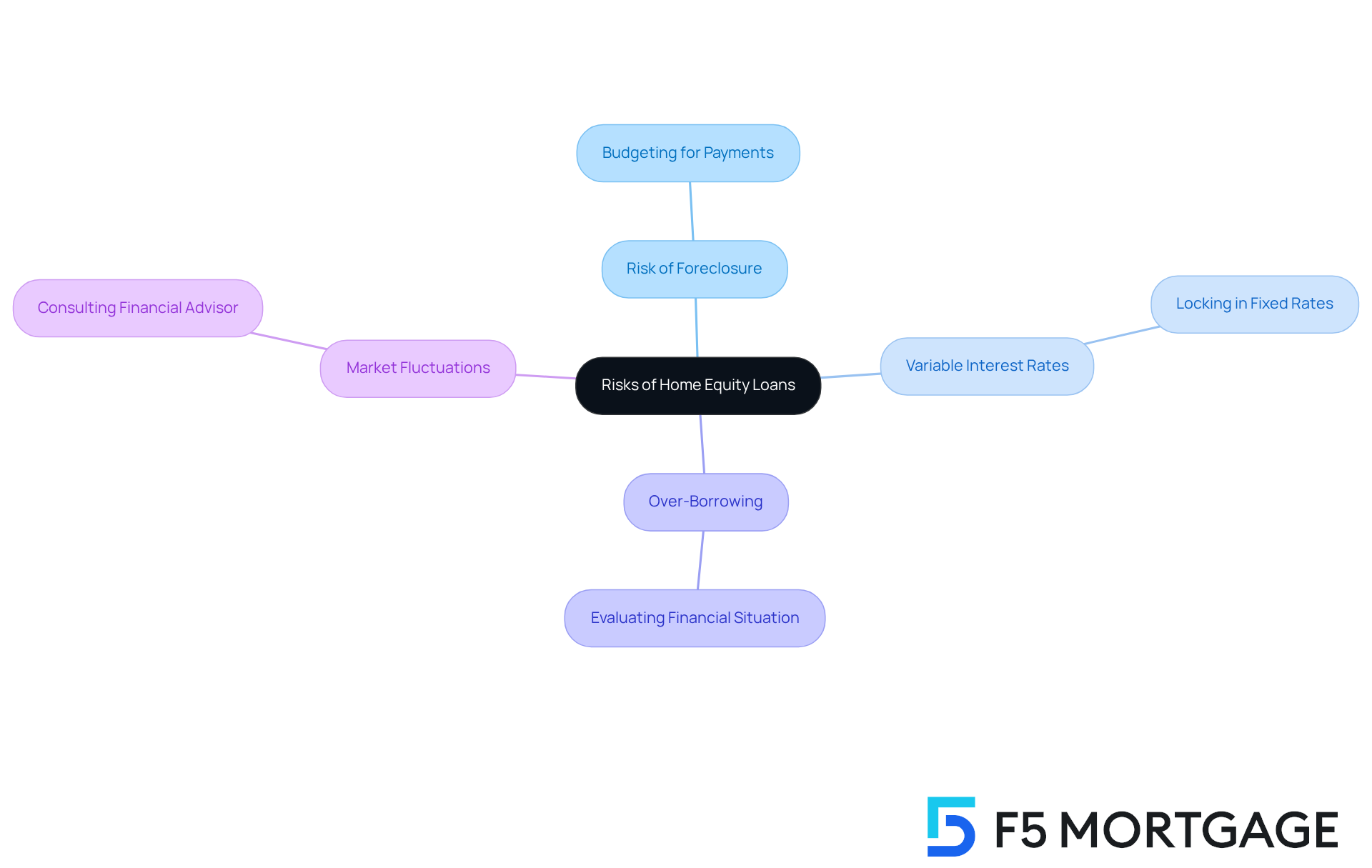

Identify Risks of Home Equity Loans and How to Mitigate Them

While can offer benefits, it’s important to recognize the .

- Risk of Foreclosure: We know how challenging it can be to manage . If you fail to repay the loan, you risk losing your home. To help you navigate this, ensure that your budget comfortably accommodates the monthly payments for .

- : Many Home Equity Lines of Credit (HELOCs) come with variable rates that can increase over time. If possible, consider locking in a fixed rate for peace of mind.

- Over-Borrowing: It’s easy to get carried away and borrow more than you can afford to repay. Always take a moment to evaluate your , especially when considering equity home loans, and only borrow what is truly necessary.

- : A decline in property value can impact your ownership stake. Stay informed about market trends, and we encourage you to consult a financial advisor before making any decisions regarding equity home loans.

Remember, we’re here to support you every step of the way.

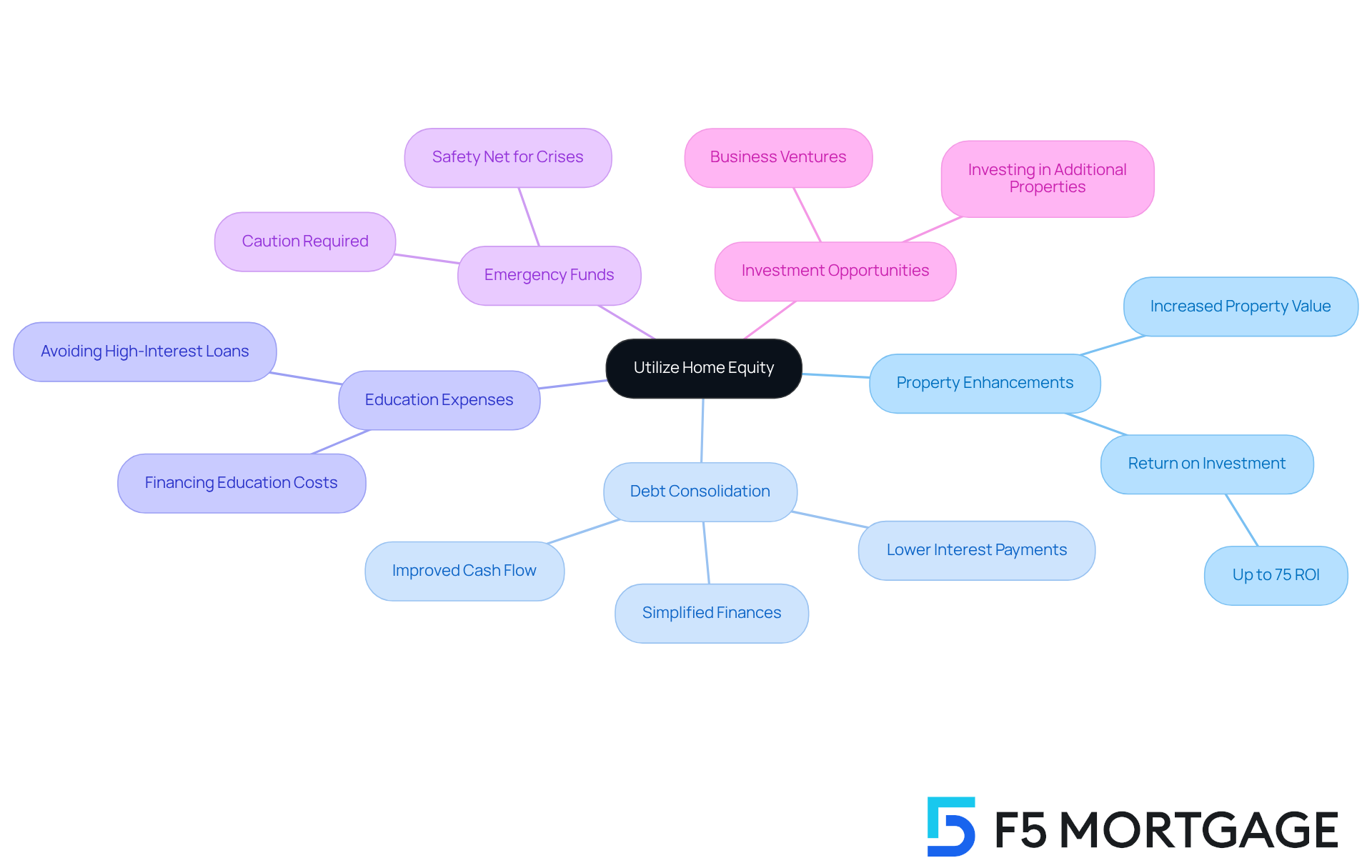

Utilize Home Equity: Common Uses and Benefits

can be leveraged in several impactful ways, offering numerous advantages for homeowners. We know how challenging financial decisions can be, and understanding the potential of your home can provide much-needed support.

- : Leveraging your home’s value for renovations can significantly increase its worth. In 2025, statistics suggest that well-planned enhancements can yield returns of up to 75% on investment. With property prices soaring to an all-time high of £373,000, becomes even more essential in a climbing market. This strategic choice not only boosts your property’s value but also enhances your living space.

- : Many homeowners utilize their property value to combine high-interest debts, which can lead to . This approach simplifies finances and reduces monthly obligations, which can be achieved through equity home loans, allowing for better cash flow management. We’re here to support you in understanding that can greatly .

- : Your home’s value can also serve as a valuable resource for financing education costs. This enables families to invest in their children’s future without incurring high-interest student loans. It’s especially helpful for families looking to evade the economic burden of education expenses.

- : Utilizing your property value can offer a safety net during unexpected situations, such as medical crises or unemployment. This provides reassurance in difficult times. However, it’s crucial to exercise caution, as securing debts against your residence carries risks that must be thoughtfully evaluated.

- : Some homeowners strategically use their assets to invest in additional properties or business ventures, potentially enhancing their wealth. For instance, portfolio landlords have effectively leveraged their assets to broaden their investments, showcasing the practical uses of property value.

Investment consultants frequently highlight the advantages of leveraging property value. They mention that it can serve as a strong instrument for reaching both immediate and future monetary objectives. Real-world examples demonstrate how homeowners have effectively utilized their assets for debt consolidation, enabling them to settle credit cards and loans. This, in turn, enhances their overall financial well-being. By understanding these common uses and benefits, homeowners can make informed decisions about how to best utilize equity home loans. Remember, we’re here to support you every step of the way.

Conclusion

Understanding home equity and its potential can truly transform your personal finance management journey. Home equity represents the financial stake you have in your property, and effectively leveraging this asset can open doors to significant financial opportunities. By grasping the various loan options available, such as home equity loans and HELOCs, you can make informed decisions that align with your financial goals.

Throughout this article, we highlighted key points, including:

- The importance of accurately calculating your home equity

- Recognizing the risks associated with equity loans

- Exploring the myriad of ways to utilize this financial resource

From enhancing your property value through renovations to consolidating debt and investing in education, the strategic use of home equity can greatly enhance your overall financial well-being. Additionally, understanding the differences between fixed-rate loans and variable-rate HELOCs empowers you to choose the best option for your needs.

Ultimately, the significance of home equity in personal finance cannot be overstated. It serves not only as a means of accessing funds but also as a powerful tool for long-term wealth building. We encourage you to take proactive steps in understanding your equity, evaluating your financial situation, and consulting with experts when necessary. By doing so, you can unlock the full potential of your home equity, paving the way for a more secure financial future.

Frequently Asked Questions

What is home equity and why is it important?

Home equity is the portion of your home that you truly own, calculated by subtracting the remaining mortgage balance from your home’s current market value. Understanding your home equity is important as it can unlock financial opportunities, such as accessing funds through equity home loans or cash-out refinancing.

How is home equity calculated?

Home equity is calculated by taking the current market value of your home and subtracting the remaining balance on your mortgage. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your home equity would be $100,000.

What financial opportunities can home equity provide?

Home equity can provide access to various loan options, such as equity home loans and cash-out refinancing. These options can be used for purposes like home improvements, consolidating debt, or managing unexpected expenses.

What are the two primary types of equity loans?

The two primary types of equity loans are equity home loans, which offer a lump sum with fixed monthly payments, and Home Equity Lines of Credit (HELOCs), which allow you to borrow against your property’s value as needed, similar to a credit card.

When should I consider an equity home loan?

An equity home loan is suitable if you need a specific amount for a one-time expense, such as a major renovation, and prefer consistent monthly payments over a fixed term.

When is a HELOC a better option?

A HELOC is ideal for ongoing expenses or projects, as it allows you to borrow against your property’s value as needed, with typically variable interest rates and flexible repayment options.

What steps should I take if I want to refinance my mortgage?

To refinance your mortgage, evaluate your existing mortgage conditions, identify your financial goals, shop around for lenders to find the best rates and terms, submit your application with the necessary documentation, and finalize the new loan after approval.

Why is it important to understand the differences between equity home loans and HELOCs?

Understanding the differences between equity home loans and HELOCs empowers homeowners to choose the most suitable option for their financial needs, especially when considering refinancing to enhance property value.