Overview

Understanding the differences between a second mortgage and a home equity loan can feel overwhelming. We know how challenging this can be. Second mortgages typically offer fixed-rate loans, providing predictability and fixed payments. This makes them suitable for one-time expenses, allowing you to plan your finances with confidence.

On the other hand, home equity lines of credit (HELOCs) offer revolving credit with variable rates. They provide flexibility for borrowing, which can be appealing, but it’s important to consider the fluctuating interest rates and potential payment uncertainties that come with them.

By recognizing these distinctions, you can make an informed decision that best suits your financial needs. We’re here to support you every step of the way as you navigate these options.

Introduction

Navigating the complexities of home financing can feel overwhelming, and we understand how challenging this can be. When it comes to understanding the differences between second mortgages and home equity loans, homeowners often find themselves at a crossroads. As you consider leveraging your property’s value for significant expenses, the choice between these two options becomes increasingly important. What factors should you weigh to ensure you make the right financial decision?

In this article, we will explore the key differences, advantages, and potential pitfalls of second mortgages and home equity loans. Our goal is to equip you with the knowledge needed to make informed choices in an ever-evolving financial landscape. We’re here to support you every step of the way.

Defining Second Mortgages and Home Equity Loans

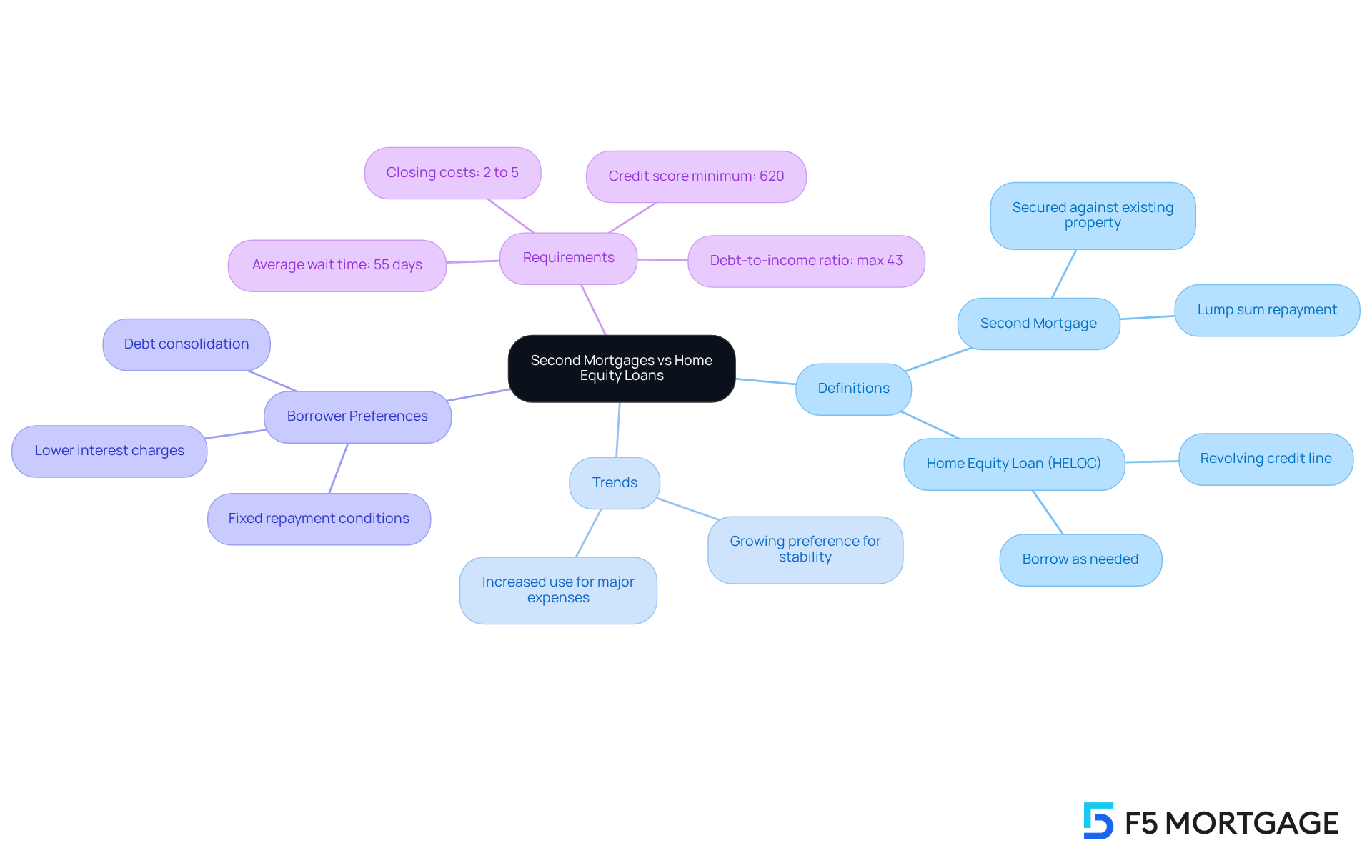

When considering a second mortgage vs home equity loan, it’s important to understand that a second mortgage is a financial agreement secured against a property that already has a primary mortgage, allowing homeowners to access the value they have built up. Home value loans, often classified as second mortgages, provide a lump sum that is repaid over a set period at a stable interest rate, typically ranging from five to 15 years. In contrast, a property value line of credit (HELOC) operates as a revolving credit line, enabling homeowners to borrow as needed up to a set limit, with their residence serving as collateral. Both funding options, when comparing second mortgage vs home equity loan, leverage property value but differ significantly in their arrangement and repayment conditions.

As we look ahead to 2025, trends suggest a growing preference for residential value loans due to their stability and predictability in repayments, especially in an environment of fluctuating interest rates. Property owners are increasingly turning to these financial products for significant expenses like renovations and educational fees. Real-world examples reveal that many families are utilizing a second mortgage vs home equity loan to consolidate debt or finance major life events, reflecting a thoughtful approach to managing their financial needs.

Recent information indicates that a considerable number of property owners are opting for mortgage financing instead of HELOCs, driven by the desire for fixed repayment conditions and lower interest charges. However, it’s important for potential borrowers to be aware that the average wait time for property-backed financing is about 55 days from application to payout, and closing costs typically range from 2% to 5% of the total amount borrowed. Additionally, lenders generally require a credit score of at least 620 to qualify for a second mortgage.

At F5 Mortgage, we understand how challenging this process can be, and with a customer satisfaction rate of 94%, we are here to support you every step of the way in navigating these financing options.

Comparing Structures and Functions of Second Mortgages and Home Equity Loans

Navigating the world of second mortgage vs home equity loan can feel overwhelming, but understanding your options is the first step toward making informed decisions. Second mortgages primarily fall into two categories: fixed-rate property-backed loans and variable-rate lines of credit, known as HELOCs, highlighting the differences in second mortgage vs home equity loan. A property equity credit provides a lump sum that you repay through fixed monthly installments. This predictability can be incredibly helpful in budgeting, especially when planning for significant expenses.

It’s important to note that these borrowed funds typically come with closing costs, which can range from 2% to 5% of the total amount. Additionally, if you use the funds for property enhancements, the interest paid might even be tax-deductible, offering you some financial relief.

On the other hand, a HELOC functions similarly to a credit card, allowing you to access funds as needed. However, keep in mind that it features fluctuating interest rates that can change over time. HELOCs consist of two phases: a draw period, during which you can access funds, and a repayment period, when you begin paying back the principal. This distinction is crucial; property value loans are ideal for one-time expenses, like major renovations or debt consolidation, while understanding the second mortgage vs home equity loan comparison reveals that HELOCs are better suited for ongoing financial needs or projects that require phased funding.

As we look ahead to 2025, it’s helpful to know that average interest rates for residential property financing generally range from 5% to 8%, with terms spanning from 5 to 30 years. HELOCs may start lower, but their rates can vary significantly based on market conditions. We understand how challenging this can be, so comprehending these differences is essential for homeowners like you who aim to utilize your assets effectively. Remember, we’re here to support you every step of the way.

Evaluating the Pros and Cons of Each Option

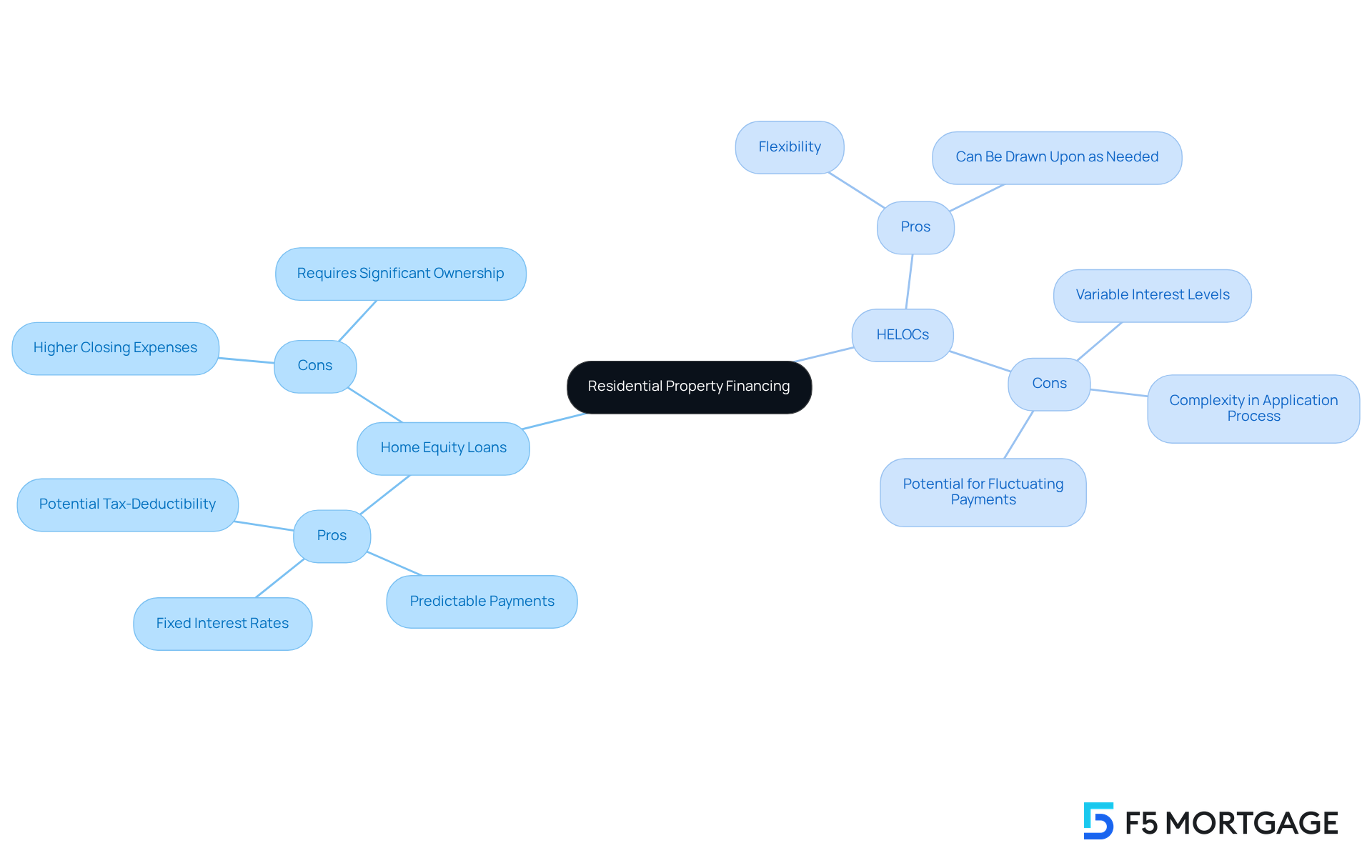

When considering residential property financing, it’s essential to recognize the benefits it offers. Fixed interest rates and consistent monthly payments can provide peace of mind, allowing you to budget effectively. Moreover, the ability to borrow a significant amount based on your property’s value can open doors to new opportunities. If you use your home loan for improvements, you might even find that the interest paid is tax-deductible, adding to the appeal.

However, it’s important to be aware that these loans can come with higher closing costs and typically require at least 20% equity in your home. This can feel daunting, but understanding your options is the first step towards making informed decisions.

On the other hand, when considering second mortgage vs home equity loan, second mortgages, especially Home Equity Lines of Credit (HELOCs), offer flexibility that can be beneficial for ongoing expenses. With a HELOC, you can draw funds as needed, which can be a lifesaver for continuous projects. Yet, keep in mind that they often come with variable interest rates, leading to unpredictable payments. To qualify, a credit score of around 680 is generally required, and the application process can be more complex and time-consuming compared to other financing types.

The second mortgage vs home equity loan options both carry the inherent risk of foreclosure if payments are missed, as they are secured by your property. It’s crucial for homeowners to evaluate their financial situations carefully and consider the long-term implications of taking on additional debt. For instance, a property value loan might suit a one-time expense, while understanding the differences in second mortgage vs home equity loan could be more advantageous for ongoing projects.

Understanding these nuances is vital for making informed choices about utilizing your home’s resources. We know how challenging this can be, but grasping these details empowers you to navigate your options confidently.

Pros and Cons Summary:

-

Home Equity Loans:

- Pros: Fixed interest rates, predictable payments, potential tax-deductibility of interest.

- Cons: Higher closing expenses, requires significant ownership.

-

HELOCs:

- Pros: Flexibility, can be drawn upon as needed.

- Cons: Variable interest levels, complexity in the application process, potential for fluctuating payments.

Choosing the Right Option for Your Financial Needs

Choosing between a second mortgage vs home equity loan can be a daunting task, and we understand how challenging this can be. It’s crucial to thoughtfully assess your financial goals, available capital, and repayment choices. For property owners seeking a lump sum for a specific project, a residential financing option is often the more suitable choice. It provides fixed terms and consistent payments, giving you peace of mind. On the other hand, if you anticipate needing funds over time for recurring expenses, a property value line of credit (HELOC) offers the flexibility you may require, allowing you to access your equity as needed.

Understanding your comfort level with interest rate arrangements is essential. Residential property financing typically has fixed rates, while HELOCs offer variable rates that may fluctuate with market conditions. It’s important to grasp how the differences between a second mortgage vs home equity loan impact your overall financial health. For instance, the average homeowner now holds approximately $400,000 in equity—an increase of 41% since 2020. Strategically leveraging this asset can significantly shape your financial planning.

Mortgage experts recommend clarifying your objective for the financing before making a decision. As Sarah DeFlorio, vice president of mortgage banking at William Raveis Mortgage, wisely noted, “Lenders may be enhancing the conditions of their property financing options to ensure that consumers would favor that product, which also offers greater security against default with built-in amortizing and fixed payments.” This approach ensures that your decision aligns with your long-term financial objectives, whether that means financing property renovations, consolidating debt, or managing other expenses.

Additionally, it’s worth noting that the interest on home equity loans may be tax-deductible if used for home improvements, adding another layer of consideration to your decision-making process. However, we urge you to be mindful of the potential risks associated with HELOCs, such as payment uncertainty due to fluctuating rates, which can affect your budgeting and financial stability. We’re here to support you every step of the way as you navigate these important choices.

Conclusion

Understanding the differences between a second mortgage and a home equity loan is vital for homeowners like you who are looking to leverage your property’s value effectively. Both options provide access to funds tied to home equity, yet they cater to distinct financial needs and repayment preferences. By grasping these nuances, you can make informed decisions that align with your financial goals.

Throughout this article, we highlighted key distinctions, such as the structured repayment of second mortgages versus the flexible draw of home equity lines of credit (HELOCs). The stability of fixed-rate loans appeals to those seeking predictability, while HELOCs offer the advantage of accessing funds as needed, albeit with variable interest rates. Additionally, understanding closing costs, credit requirements, and potential tax benefits is crucial, as these factors further emphasize the complexity of these financial products.

Ultimately, choosing between a second mortgage and a home equity loan should be based on your individual financial circumstances and objectives. It is essential to assess your needs carefully—whether you require a lump sum for a specific project or ongoing access to funds for various expenses. By considering these factors and seeking expert guidance, you can navigate these options confidently and make choices that enhance your financial well-being. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a second mortgage?

A second mortgage is a financial agreement secured against a property that already has a primary mortgage, allowing homeowners to access the value they have built up in their home.

How does a home equity loan differ from a second mortgage?

A home equity loan, often classified as a second mortgage, provides a lump sum that is repaid over a set period at a stable interest rate, typically ranging from five to 15 years.

What is a Home Equity Line of Credit (HELOC)?

A HELOC operates as a revolving credit line, enabling homeowners to borrow as needed up to a set limit, with their residence serving as collateral.

What are the trends regarding second mortgages and home equity loans as we approach 2025?

Trends suggest a growing preference for residential value loans due to their stability and predictability in repayments, especially in an environment of fluctuating interest rates.

Why are homeowners choosing second mortgages over HELOCs?

Homeowners are increasingly opting for second mortgages due to the desire for fixed repayment conditions and lower interest charges.

What is the average wait time for property-backed financing?

The average wait time for property-backed financing is about 55 days from application to payout.

What are the typical closing costs associated with second mortgages?

Closing costs for second mortgages typically range from 2% to 5% of the total amount borrowed.

What credit score is generally required to qualify for a second mortgage?

Lenders generally require a credit score of at least 620 to qualify for a second mortgage.

How can F5 Mortgage assist potential borrowers?

F5 Mortgage offers support throughout the financing process, with a customer satisfaction rate of 94%, helping clients navigate their options for second mortgages and home equity loans.