Overview

Removing Private Mortgage Insurance (PMI) can feel daunting, but we understand how important it is for homeowners to save money. To begin this process, it’s essential to ensure you have at least 20% equity in your home. Maintaining a solid payment history is also crucial, as it reflects your commitment to your mortgage.

We know how challenging this can be, so let’s explore the steps together:

- Start by checking your loan-to-value ratio; this will give you a clear picture of your equity.

- Next, you’ll need to submit a written request to your lender, along with any necessary documentation they require.

By following these steps, you could unlock significant monthly savings once PMI is removed. We’re here to support you every step of the way as you navigate this process and work towards a more financially secure future.

Introduction

We know how challenging understanding the intricacies of Private Mortgage Insurance (PMI) can be for many homeowners. It can feel overwhelming, especially when it adds significant costs to your monthly mortgage payments. This essential guide is here to illuminate your path to removing PMI, revealing how you can save a substantial amount—potentially hundreds of dollars each month—by gaining equity in your property.

However, many homeowners remain unaware of the specific conditions and steps required to achieve this financial relief. What are the key actions you must take to navigate the PMI removal process effectively? How can you ensure that you are not leaving money on the table? We’re here to support you every step of the way as you explore these important questions.

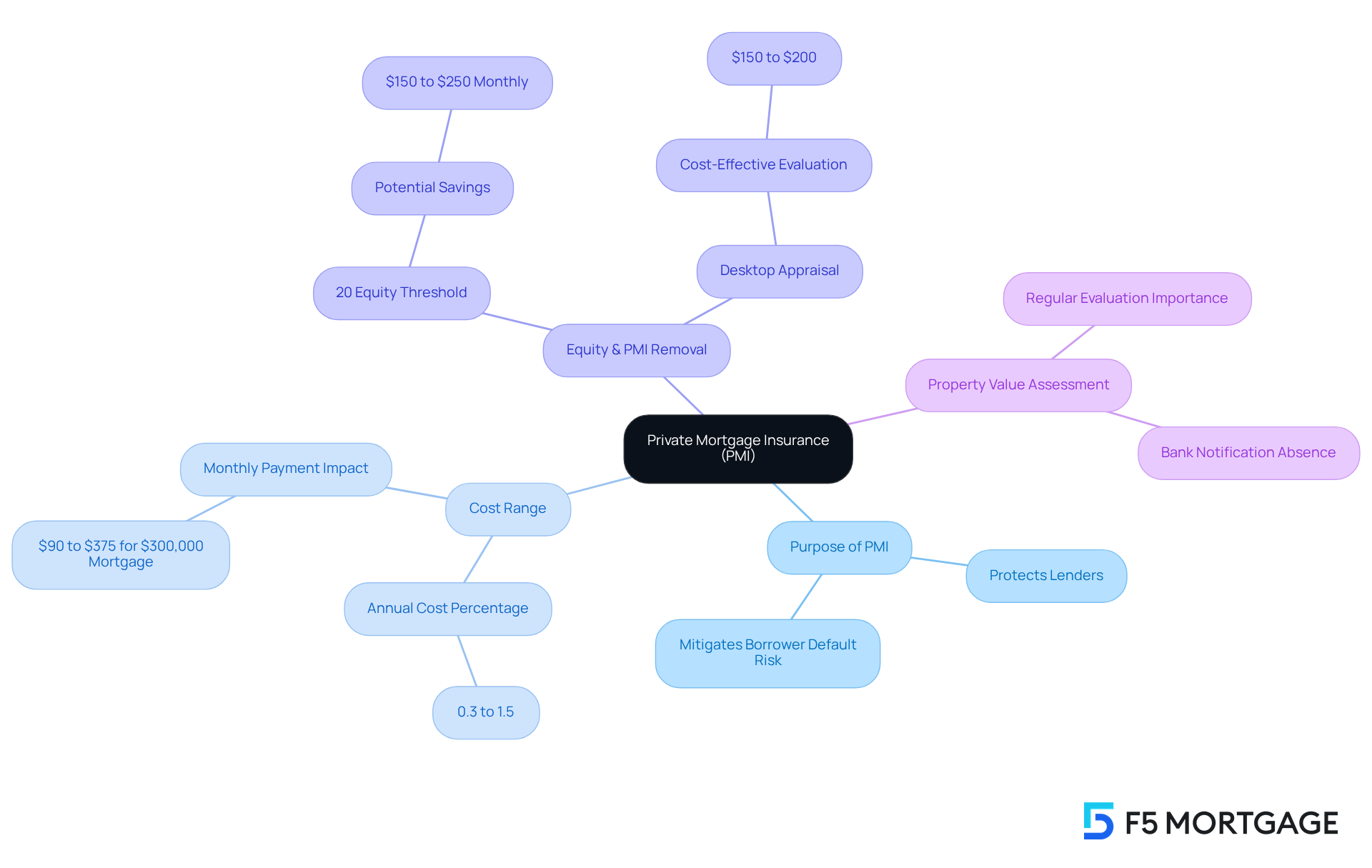

Understand Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is an important aspect for homeowners to understand, especially if you’re taking out a conventional loan with a down payment of less than 20%. We know how challenging this can be, but PMI is designed to protect lenders in case of borrower defaults. However, it can significantly increase your monthly mortgage payments. Typically, PMI costs range from 0.3% to 1.5% of the original loan amount annually. For a $300,000 mortgage, this could mean an additional $90 to $375 each month. Knowing the terms and conditions of your PMI can empower you to learn how to remove PMI effectively.

Many property owners may not realize how to remove PMI once they accumulate 20% equity in their home. This could save you between $150 to $250 each month, which is especially important given the rising costs of property insurance. As financial specialist Julie Lynch reminds us, “the bank isn’t going to contact you and say, ‘Great news, your property worth has risen.’” Therefore, it’s crucial for homeowners to regularly assess their property’s value.

Additionally, you can request a desktop appraisal, a cost-effective way to evaluate your property’s current worth, which may provide insights on how to remove PMI. By understanding PMI and its associated costs, you can develop effective strategies on how to remove PMI, which will lead to significant savings and a more manageable mortgage payment. Remember, we’re here to support you every step of the way.

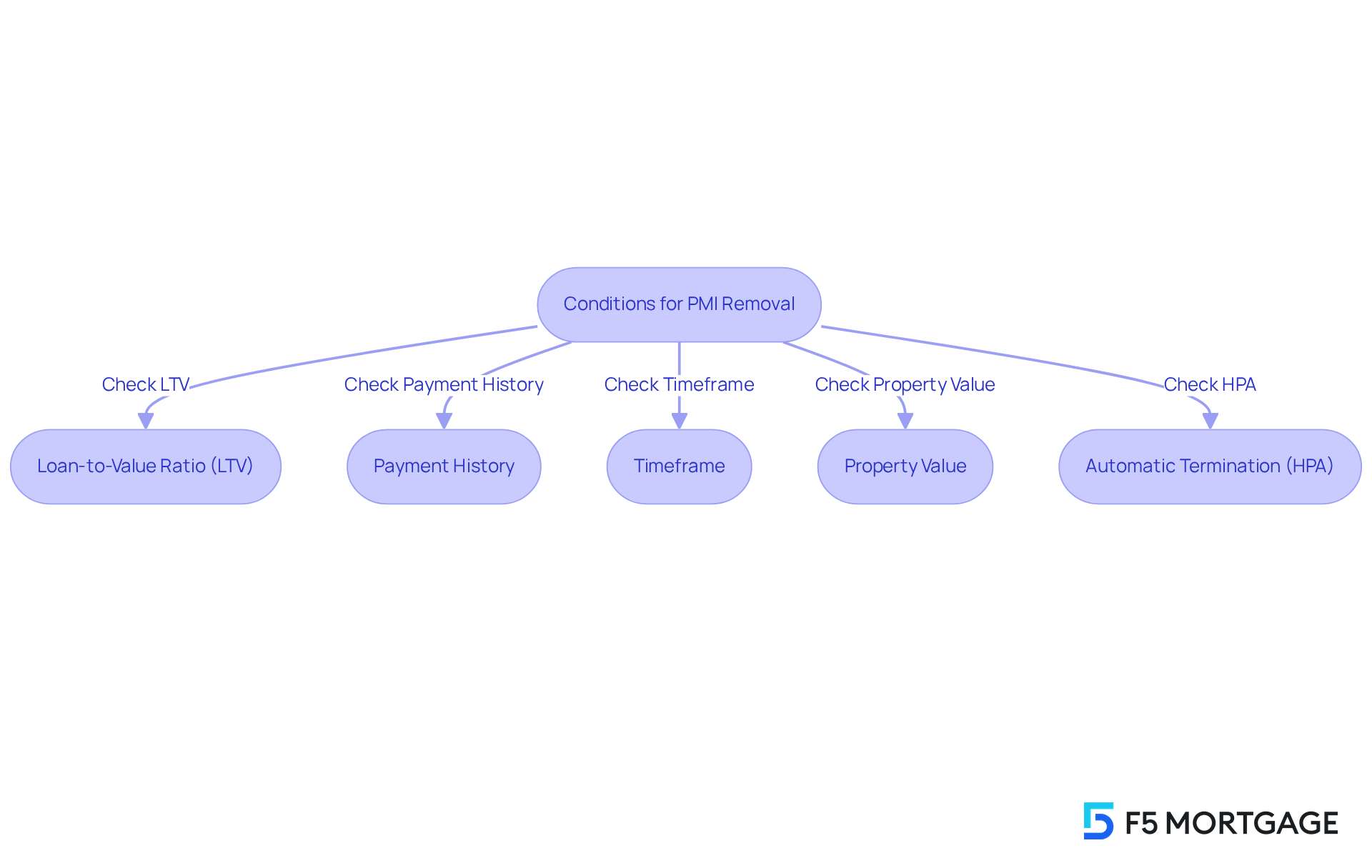

Identify Conditions for PMI Removal

We know how challenging navigating your mortgage can be, especially when it comes to Private Mortgage Insurance (PMI). Homeowners need to understand how to remove PMI by meeting specific conditions. Here’s what you need to know:

-

Loan-to-Value Ratio (LTV): Your LTV must be 80% or lower, which means you have at least 20% equity in your property. This is a crucial threshold for PMI cancellation.

-

Payment History: Maintaining a solid payment history is essential. Typically, this requires no late payments in the past 12 months.

-

Timeframe: PMI can often be removed after a designated period, usually around two years, depending on your lender’s policies.

-

Property Value: If your residence has appreciated significantly, you may qualify for PMI removal sooner than you think. For instance, homeowners who purchased during the pandemic might find that rising real estate prices have allowed them to achieve the required equity level more swiftly.

Additionally, it’s important to note that PMI is automatically terminated when the principal balance reaches 78% of the property’s initial worth, as mandated by the Homeowners Protection Act of 1998 (HPA).

Understanding these conditions empowers you to learn how to remove PMI effectively. This could potentially save you between $150 to $250 monthly, based on the average PMI payment range of $30 to $70 per month for every $100,000 borrowed. We’re here to support you every step of the way in this process.

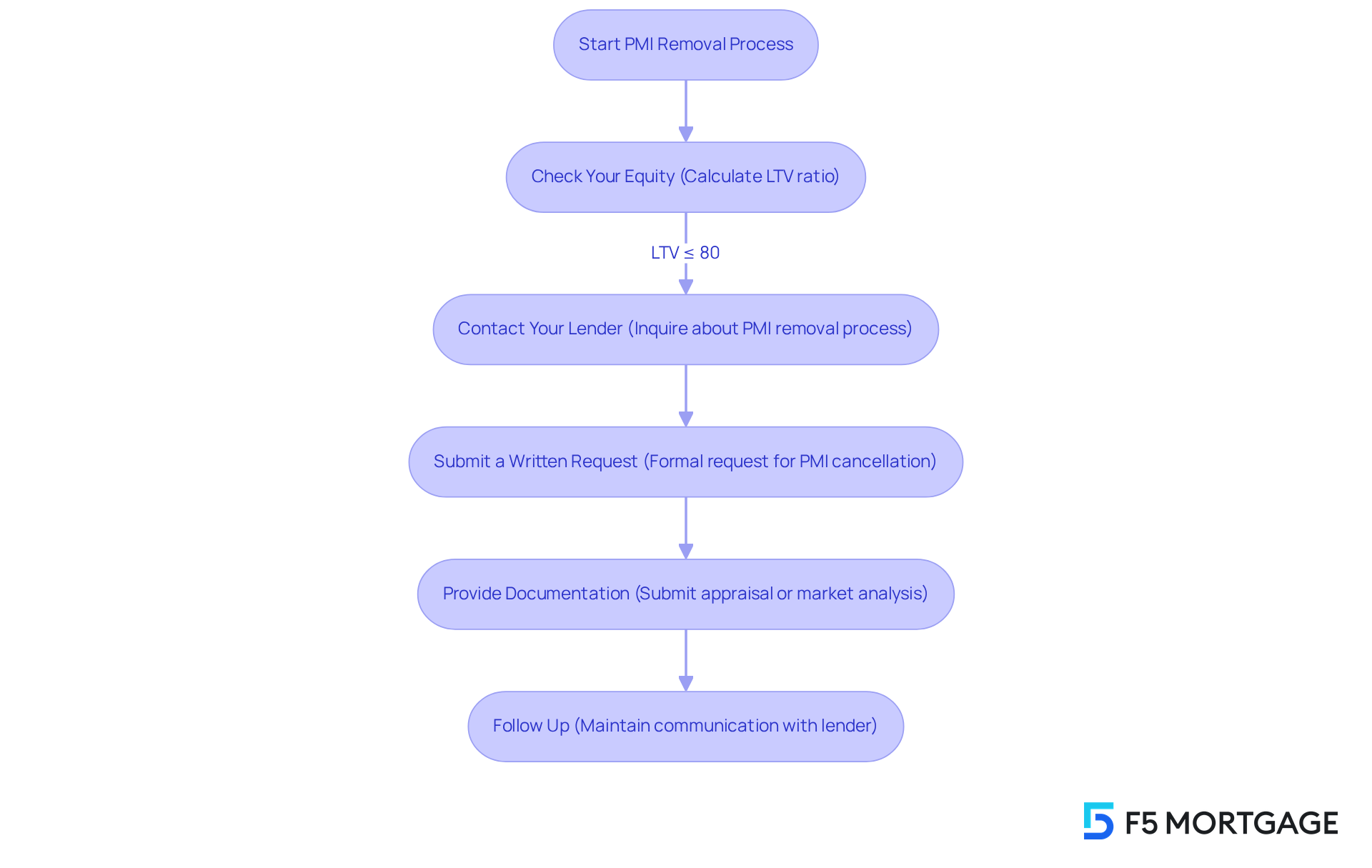

Follow Steps to Remove PMI

To effectively remove PMI, it’s important to follow these essential steps with care:

-

Check Your Equity: Begin by calculating your current loan-to-value (LTV) ratio. This is done by dividing your mortgage balance by your property’s current market worth. If your LTV is 80% or lower, you’re ready to take the next step.

-

Contact Your Lender: Reach out to your mortgage servicer to inquire about their specific PMI removal process. They may have particular forms or unique guidelines that you need to follow.

-

Submit a Written Request: Draft a formal request for PMI cancellation, including your loan details and the rationale behind your request. It’s best to send this letter via certified mail and keep a copy for your records, ensuring you have proof of your communication.

-

Provide Documentation: Be prepared to submit documentation that verifies your equity, such as a recent appraisal or a comparative market analysis. This evidence is crucial for supporting your request and demonstrating your eligibility.

-

Follow Up: After submitting your request, maintain open communication with your lender to ensure that your request is being processed. Keeping records of all interactions will help you track the progress of your PMI cancellation.

We understand that navigating this process can be challenging. Property owners should understand how to remove PMI, since lenders are legally obligated to terminate it when the principal balance reaches 78% of the property’s initial worth, provided that payments are current. Additionally, if you have made extra payments that lower your principal to 80% of the initial amount, you can learn how to remove PMI by requesting cancellation before the scheduled date.

PMI costs typically range from $30 to $70 per month for every $100,000 borrowed, which can add significant costs to your monthly payments. The average time taken to process PMI removal requests can vary, so proactive follow-up is essential. Remember, you have the right to ask your servicer to cancel PMI on the date your principal balance is scheduled to fall to 80% of the original value of your home. We’re here to support you every step of the way.

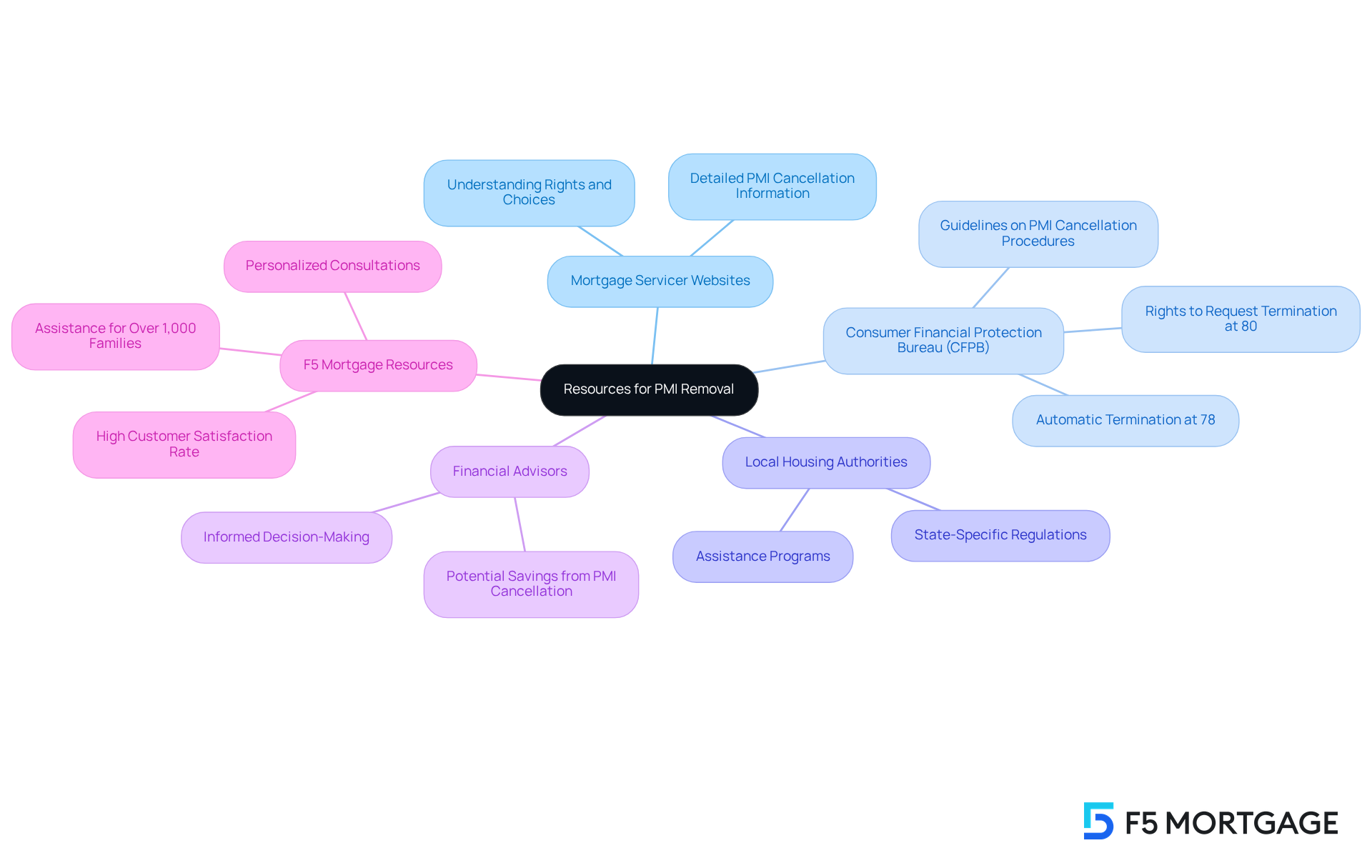

Access Resources and Support for PMI Removal

Homeowners, we understand how to remove PMI can be challenging to navigate. Fortunately, there are a variety of resources available to assist you on this journey:

-

Mortgage Servicer Websites: Many lenders provide detailed information on their sites about PMI cancellation processes. This can help you understand your rights and choices, empowering you to take action.

-

Consumer Financial Protection Bureau (CFPB): The CFPB offers essential resources and guidelines on PMI. They outline specific cancellation procedures that you can follow. Remember, you have the right to request the termination of PMI once your mortgage principal balance hits 80% of your property’s initial worth. Moreover, PMI must be automatically ended when the principal balance reaches 78% of that initial value.

-

Local Housing Authorities: These organizations can provide insights into state-specific regulations and assistance programs related to PMI. They ensure you are informed about local options that may be available to you.

-

Financial Advisors: Consulting with a financial advisor can empower you to make informed decisions regarding your mortgage and PMI. This could lead to significant savings, especially as home values increase and mortgages are paid down.

-

F5 Mortgage Resources: F5 Mortgage LLC offers personalized consultations to help you understand how to remove PMI effectively. With over 1,000 families assisted and a customer satisfaction rate of 94%, F5 Mortgage is dedicated to supporting homeowners like you in achieving financial relief through PMI cancellation.

We’re here to support you every step of the way. Don’t hesitate to explore these resources and take control of your financial future.

Conclusion

Understanding how to effectively remove Private Mortgage Insurance (PMI) is crucial for homeowners looking to reduce their monthly expenses. We know how challenging this can be, and by grasping the intricacies of PMI and the conditions necessary for its removal, you can take proactive steps towards achieving significant financial relief. The journey to eliminate PMI not only enhances cash flow but also empowers you to take control of your mortgage obligations.

Key arguments highlighted in the article include:

- The importance of assessing your equity

- Understanding the conditions for PMI removal

- Following a structured process to request cancellation

We encourage you to:

- Maintain a solid payment history

- Recognize the value of your property

- Utilize available resources such as mortgage servicer websites, the Consumer Financial Protection Bureau, and financial advisors to facilitate the PMI removal process

Ultimately, taking action to remove PMI can lead to considerable savings and a more manageable mortgage. Stay informed and proactive; the financial benefits of eliminating PMI can significantly impact your overall financial health. Engaging with the outlined steps and utilizing the resources available can make this process not only achievable but also empowering, allowing you to focus on your long-term financial goals.

Frequently Asked Questions

What is Private Mortgage Insurance (PMI)?

Private Mortgage Insurance (PMI) is insurance that protects lenders in case of borrower defaults, particularly for homeowners taking out a conventional loan with a down payment of less than 20%.

Why is PMI necessary for some homeowners?

PMI is necessary for homeowners with a down payment of less than 20% because it provides protection to lenders against potential loan defaults.

How much does PMI typically cost?

PMI costs typically range from 0.3% to 1.5% of the original loan amount annually. For a $300,000 mortgage, this could add an additional $90 to $375 to monthly payments.

How can homeowners remove PMI?

Homeowners can remove PMI once they accumulate 20% equity in their home. It is important for homeowners to regularly assess their property’s value to determine when they can request PMI removal.

What financial benefits can come from removing PMI?

Removing PMI can save homeowners between $150 to $250 each month, which is significant given the rising costs of property insurance.

How can homeowners evaluate their property’s current worth?

Homeowners can request a desktop appraisal, which is a cost-effective way to evaluate their property’s current worth and may provide insights on how to remove PMI.

What should homeowners do to stay informed about their PMI status?

Homeowners should regularly assess their property’s value and understand the terms and conditions of their PMI to effectively manage and potentially remove it.