Overview

Navigating the FHA loan pre-approval process can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps to help you secure your FHA loan pre-approval successfully:

- Gathering your financial documents

- Checking your credit report

- Choosing a lender

- Completing the application

Each of these steps is accompanied by practical advice, helping you prepare the necessary documentation and address common issues that may arise. We know how challenging this can be, but with the right guidance, you can approach the pre-approval process with confidence and efficiency.

By understanding these steps and following the advice provided, you can empower yourself to make informed decisions and take control of your mortgage journey.

Introduction

Securing a home is a dream for many, and we know how challenging this can be. The path to homeownership can often feel daunting, especially for low-to-moderate-income families. FHA loans, backed by the Federal Housing Administration, provide a lifeline with their accessible terms, including lower down payments and flexible credit requirements. However, navigating the pre-approval process can present its own set of challenges.

What steps can potential homeowners take to ensure a smooth and successful FHA loan pre-approval experience? We’re here to support you every step of the way.

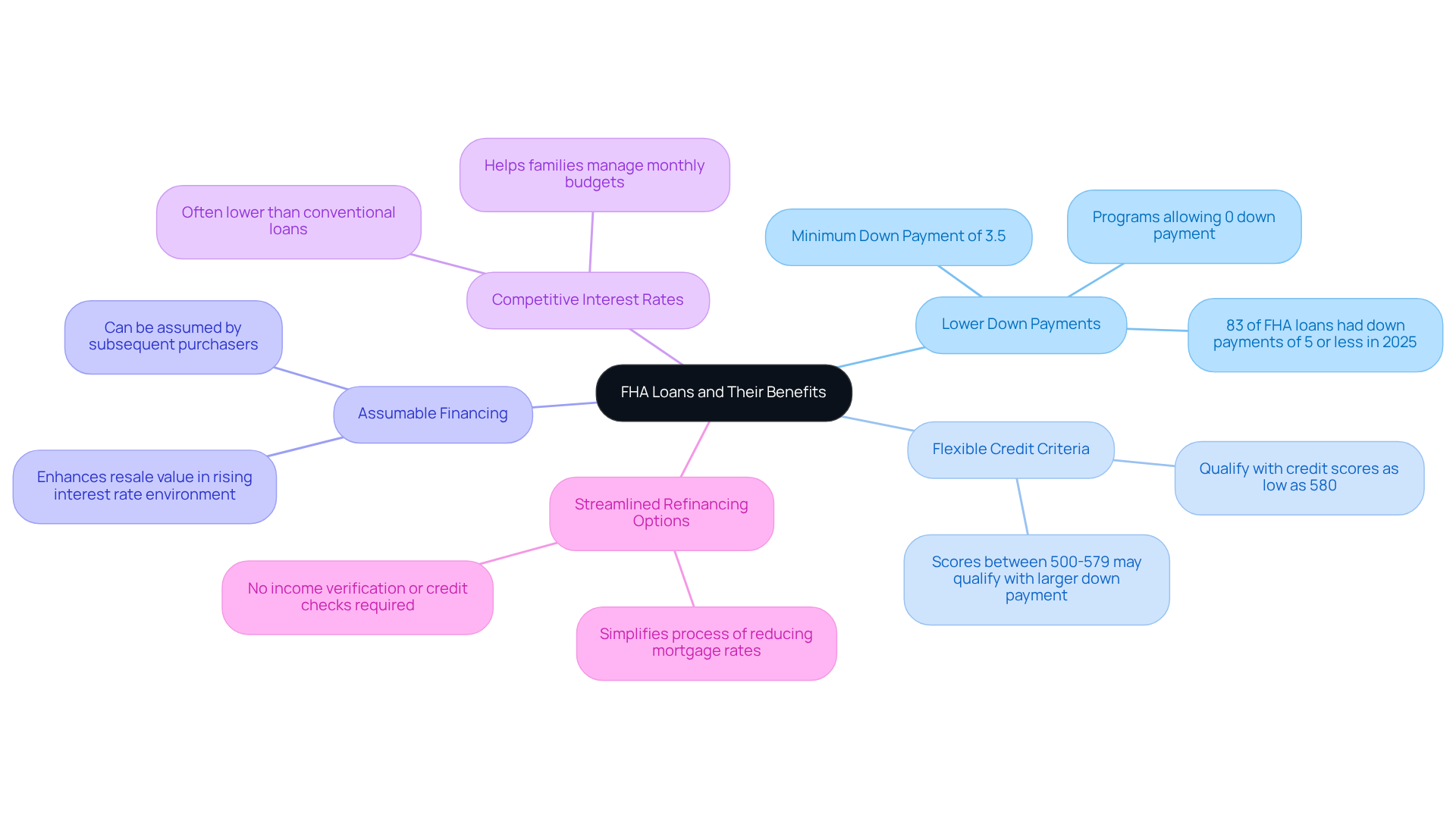

Understand FHA Loans and Their Benefits

FHA mortgages, supported by the Federal Housing Administration, are specifically designed to assist low-to-moderate-income families in achieving their dream of homeownership. We understand how challenging this can be, and here are some key benefits that make FHA loans an attractive option:

- Lower Down Payments: FHA loans typically require a down payment of just 3.5%. This significantly lowers the barrier for first-time homebuyers. In 2025, approximately 83% of FHA mortgages were provided with down contributions of 5% or less, highlighting their accessibility. At F5 Mortgage, we offer various financing choices that might require even less than 5% down, with some programs allowing for 0% down. This flexibility ensures that saving for a deposit doesn’t have to hinder you from owning a home.

- Flexible Credit Criteria: We know that credit scores can be a concern. Borrowers can qualify for FHA mortgages with scores as low as 580. Those with scores between 500 and 579 may still qualify with a larger down payment, making these financing options a viable choice for individuals with imperfect credit.

- Assumable Financing: FHA mortgages can be assumed by subsequent purchasers, which offers a competitive edge in a rising interest rate environment. This feature can enhance the resale value of your home, as it allows buyers to take over your existing financing terms.

- Competitive Interest Rates: FHA loans often come with lower interest rates compared to conventional loans, leading to substantial savings over the life of the loan. This is particularly beneficial for families striving to manage their monthly budgets effectively.

- Streamlined Refinancing Options: FHA streamline refinances simplify the process of reducing mortgage rates and monthly costs. By eliminating the need for income verification, credit checks, or home appraisals, it becomes easier for homeowners to take advantage of lower rates.

In addition to these advantages, F5 Mortgage can assist you in exploring down payment assistance programs available in California, Texas, and Florida. Programs like the MyHome Assistance Program and the Florida Assist Second Mortgage Program can provide extra financial support.

Real-world examples illustrate the impact of FHA financing on families. For instance, the Johnson family, new homeowners, utilized an FHA mortgage to purchase their home with a small upfront cost. This enabled them to allocate resources toward renovations and integrate into their new neighborhood.

Quotes from satisfied clients further emphasize the benefits of working with F5 Mortgage. “Awesome work. I appreciated receiving assistance with my financing through F5 Mortgage. Highly recommend to anyone who is looking for true experts,” shares Bryce Leonard, a happy client.

Understanding these benefits equips you with the knowledge to confidently navigate the FHA loan pre-approval process in the mortgage landscape. We’re here to support you every step of the way. For personalized assistance and to learn more about your options, contact F5 Mortgage today.

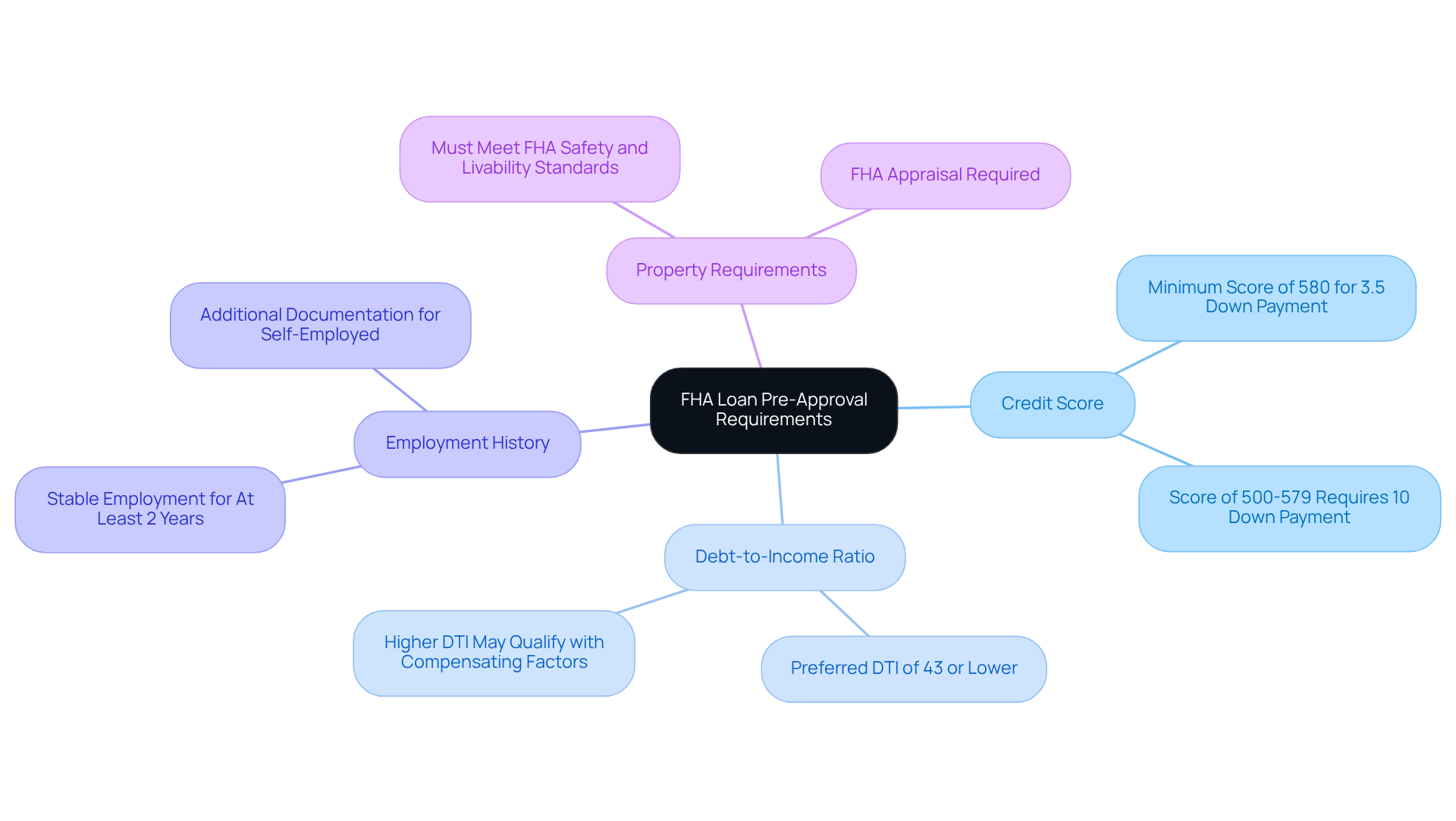

Review FHA Loan Pre-Approval Requirements

Securing FHA loan pre approval can feel overwhelming, but understanding the key requirements can make the process smoother for you and your family. Here are the essential criteria to consider:

-

Credit Score: Generally, a minimum score of 580 is needed for a 3.5% down payment. If your score falls between 500 and 579, a larger initial contribution of 10% will be required. This flexibility allows many families to access home financing, as FHA loans are designed to accommodate borrowers with varying credit profiles.

-

Debt-to-Income Ratio: Lenders typically prefer a debt-to-income (DTI) ratio of 43% or lower. This means your monthly debt payments should not exceed 43% of your gross monthly income, ensuring that you can manage your financial obligations effectively.

-

Employment History: A stable employment history of at least two years is usually required. If you are self-employed, you may need to provide additional documentation to verify your income stability.

-

Property Requirements: The property must meet specific safety and livability standards, as determined by an FHA appraisal. This process protects both you and the lender by ensuring the property is a sound investment.

To make the initial FHA loan pre approval process smoother, it can be incredibly helpful to gather documentation like pay stubs, tax returns, and bank statements in advance. We know how challenging this can be, but with the right preparation, you can navigate this journey with confidence. Remember, we’re here to support you every step of the way.

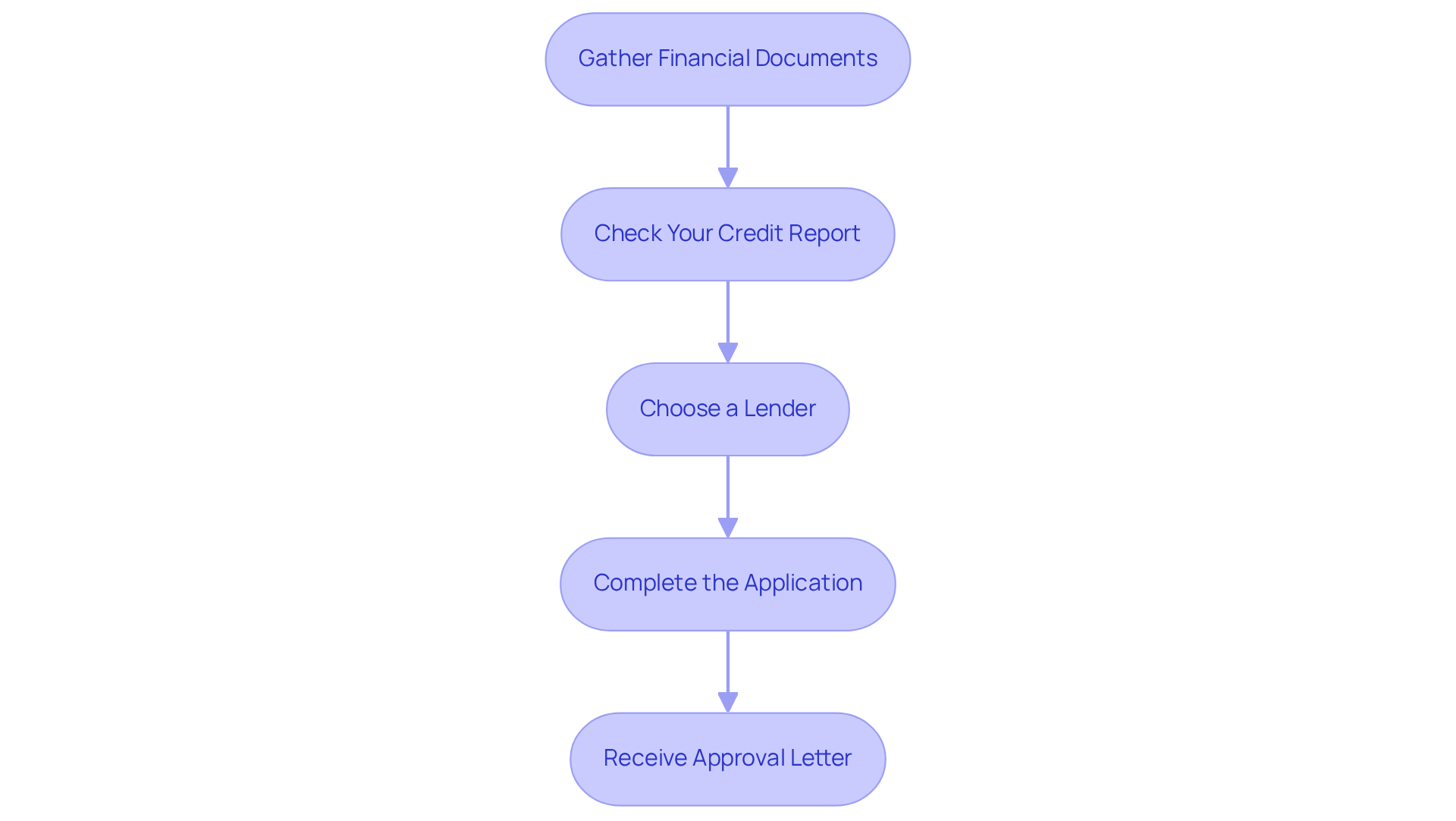

Follow Steps to Obtain FHA Loan Pre-Approval

Securing FHA loan pre-approval can feel overwhelming, but by following these steps, you can navigate the process with confidence:

-

Gather Financial Documents: Begin by collecting essential financial information such as W-2s, pay stubs, bank statements, and tax returns for the past two years. This documentation is vital, as lenders need a complete view of your financial situation to assess your eligibility.

-

Check Your Credit Report: Take a moment to review your credit report for any inaccuracies or issues that might impact your credit score. Addressing these concerns early can significantly enhance your chances of obtaining favorable financing terms.

-

Choose a Lender: Research and select a lender who specializes in FHA financing. Consider their reputation, customer service, and loan offerings to find a partner that truly aligns with your needs. For instance, F5 Mortgage collaborates with over two dozen top lenders, providing diverse options tailored to various financial situations.

-

Complete the Application: Fill out the lender’s application form, ensuring you provide all necessary documentation and accurate information. This step is crucial for a smooth preliminary approval process.

-

Receive Approval Letter: Once your application is assessed, the lender will provide an approval letter if you meet the criteria. This letter details the highest borrowing amount you qualify for, which is essential for house hunting, as most realtors will ask for it before showing properties.

By diligently following these steps, you will be well-positioned for FHA loan pre-approval. This allows you to present offers confidently and efficiently. Many borrowers have obtained prior authorization swiftly, enabling them to submit offers on the same day. This highlights the effectiveness of the process when all documentation is in order. Remember, we’re here to support you every step of the way.

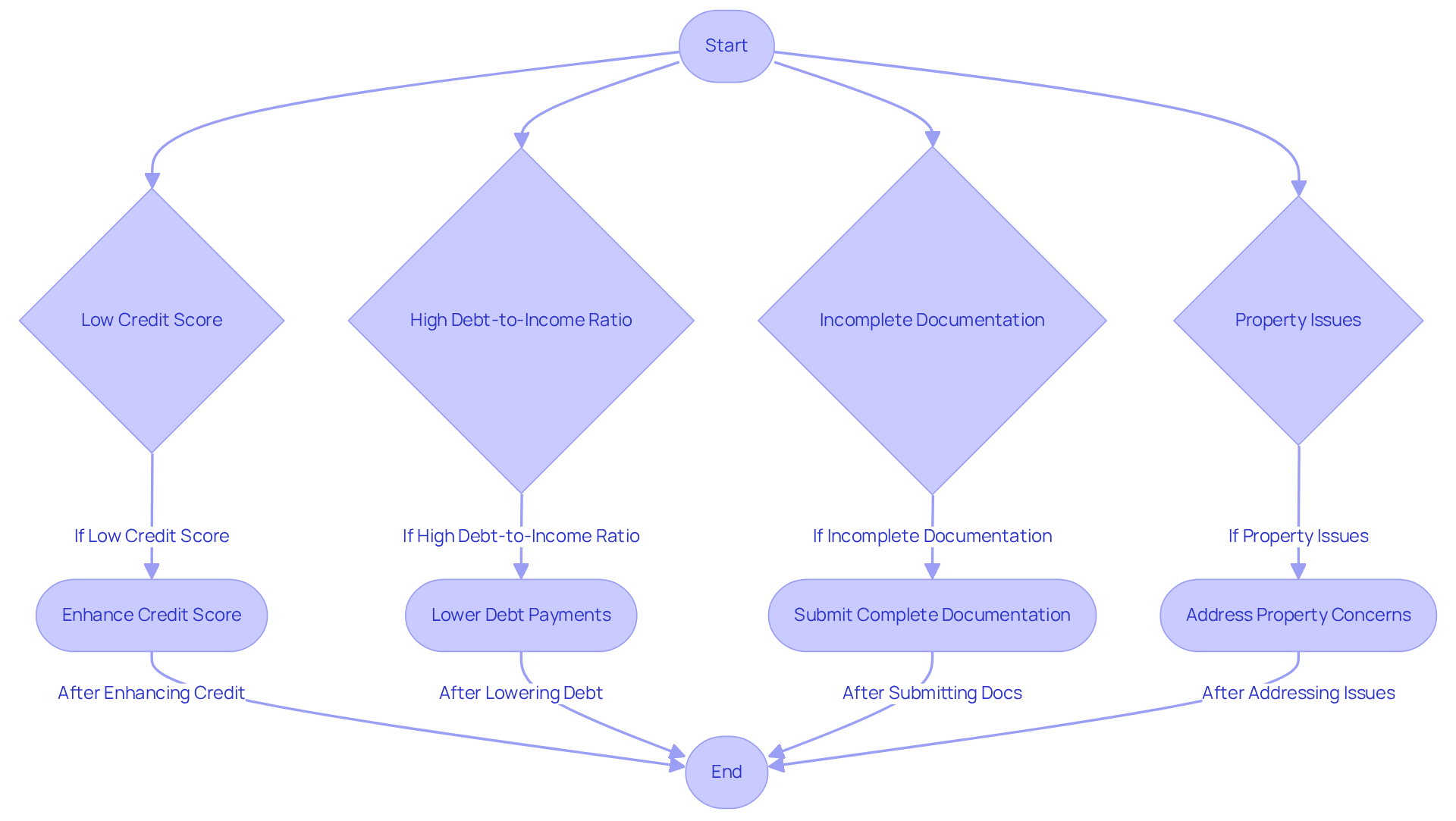

Troubleshoot Common FHA Pre-Approval Issues

Navigating the FHA pre-approval process can be challenging, and we understand how overwhelming it may feel. Here are some common issues you might encounter, along with effective strategies to help you troubleshoot them:

-

Low Credit Score: If your credit score falls below the required threshold, it’s important to take proactive steps to enhance it. Consider reducing your current debts, contesting any errors on your credit report, and ensuring that bills are paid on time. Even small improvements can have a significant impact on your eligibility for FHA financing, which typically requires a minimum score of 500. However, most lenders prefer scores in the range of 580 to 640.

-

High Debt-to-Income Ratio: A debt-to-income ratio that exceeds the acceptable limit can hinder your approval. To improve this ratio, focus on lowering your monthly debt payments. You might consider combining debts or negotiating lower interest rates. Additionally, finding ways to increase your income—such as taking on side jobs or working extra hours—can help balance your financial profile.

-

Incomplete Documentation: Submitting incomplete documentation is a common pitfall that can delay your approval. Make sure to submit all required documents, like tax returns and bank statements, accurately and on time. Double-check your application for completeness before submission to avoid any unnecessary delays.

-

Property Issues: If the property you’re interested in doesn’t meet FHA standards, it may need repairs or improvements. Common issues might include peeling paint, faulty utilities, or inadequate safety features. Addressing these concerns before the appraisal can prevent complications that could jeopardize your loan approval.

By being aware of these potential issues and implementing effective strategies, you can navigate the FHA pre-approval process with greater confidence and ease. Remember, we’re here to support you every step of the way.

Conclusion

Securing an FHA loan pre-approval is a pivotal step toward achieving homeownership, especially for low-to-moderate-income families. This process not only opens the door to affordable financing options but also empowers you with the knowledge and resources necessary to navigate the complexities of the mortgage landscape. We understand how challenging this can be, and knowing the benefits of FHA loans—like lower down payments and flexible credit criteria—positions you for success.

We’ve outlined essential steps to streamline the FHA loan pre-approval process:

- Gather your financial documents

- Check your credit reports

- Select a suitable lender

- Complete the application accurately

It’s common to face issues such as low credit scores and high debt-to-income ratios, but we’re here to support you with practical solutions to overcome these challenges. Each of these steps reinforces the importance of preparation and awareness in securing favorable financing.

Ultimately, pursuing FHA loan pre-approval can transform the dream of homeownership into a reality. By taking proactive measures and seeking guidance from experienced lenders, you can confidently embark on your journey toward owning a home. The FHA loan program not only offers significant advantages but also serves as a vital resource for families striving to build a secure future. Embracing these opportunities can lead to lasting financial stability and a sense of belonging in your new community.

Frequently Asked Questions

What are FHA loans and who do they assist?

FHA loans are mortgages supported by the Federal Housing Administration, specifically designed to help low-to-moderate-income families achieve homeownership.

What is the typical down payment required for an FHA loan?

FHA loans typically require a down payment of just 3.5%, making them more accessible for first-time homebuyers.

How prevalent are low down payments among FHA loans?

In 2025, approximately 83% of FHA mortgages were provided with down contributions of 5% or less, demonstrating their accessibility.

Can borrowers with low credit scores qualify for FHA loans?

Yes, borrowers can qualify for FHA mortgages with credit scores as low as 580. Those with scores between 500 and 579 may still qualify with a larger down payment.

What is assumable financing in relation to FHA loans?

FHA mortgages can be assumed by subsequent purchasers, which can enhance the resale value of a home and provide a competitive edge in a rising interest rate environment.

How do FHA loans compare to conventional loans in terms of interest rates?

FHA loans often come with lower interest rates compared to conventional loans, leading to substantial savings over the life of the loan.

What are streamlined refinancing options for FHA loans?

FHA streamline refinances simplify the process of reducing mortgage rates and monthly costs by eliminating the need for income verification, credit checks, or home appraisals.

Are there down payment assistance programs available for FHA loans?

Yes, F5 Mortgage can assist in exploring down payment assistance programs available in California, Texas, and Florida, such as the MyHome Assistance Program and the Florida Assist Second Mortgage Program.

Can you provide an example of how FHA financing has helped a family?

The Johnson family utilized an FHA mortgage to purchase their home with a small upfront cost, allowing them to allocate resources toward renovations and integrate into their new neighborhood.

How can I get assistance with the FHA loan pre-approval process?

For personalized assistance and to learn more about your options, you can contact F5 Mortgage for support throughout the FHA loan pre-approval process.