Overview

The Texas mortgage calculator serves as a vital resource for potential homebuyers, helping them assess their home affordability. By calculating loan costs based on important factors like loan amount, interest rate, and duration, this tool addresses the concerns many families face.

We understand how challenging navigating the mortgage process can be. That’s why it’s crucial to grasp these calculations, along with additional expenses such as property taxes and insurance. This knowledge empowers you to make informed financial decisions.

Ultimately, we’re here to support you every step of the way as you navigate the complexities of home financing effectively. With the right tools and understanding, you can approach this journey with confidence.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially in a competitive market like Texas. We understand how challenging this can be. That’s where a Texas mortgage calculator comes in as a valuable ally for potential homebuyers. It provides clarity on essential factors such as loan amounts, interest rates, and monthly expenses, helping you make sense of it all.

However, while this calculator can illuminate the path to homeownership, it also raises important questions about affordability and financial readiness. How can you effectively navigate the intricacies of this tool? We’re here to support you every step of the way, ensuring you can make informed decisions and avoid common pitfalls on your journey to owning a home.

Understand the Purpose of a Texas Mortgage Calculator

A Texas loan calculator serves as an essential resource for potential homebuyers, enabling them to assess recurring loan costs based on crucial factors such as loan amount, interest rate, and loan duration. By using this calculator, you gain valuable insights into affordability, a key aspect of effective budgeting and financial planning. Typically, the calculator also factors in additional elements like property taxes, homeowners insurance, and private mortgage insurance (PMI), offering a comprehensive view of monthly expenses. This thorough understanding empowers you to make informed decisions, helping to alleviate financial strain during the home purchasing journey.

Understanding down payments is vital, as they directly affect financing and choice options at F5 Mortgage. A larger initial deposit can lead to lower interest rates and monthly payments, making it easier for families to manage their budgets. The calculator can also assist you in exploring low and no down payment options, which are particularly beneficial for those looking to improve their homes without a hefty initial investment.

Adjustable-rate mortgages (ARMs) can also be an appealing option for homebuyers. They often come with lower initial rates compared to fixed-rate loans, easing the burden of monthly payments. With caps on how much interest rates can increase, ARMs can be a wise choice for those planning to sell or refinance before the adjustment period starts.

Statistics reveal that homebuyers who utilize loan calculators are more likely to stay within their budget, leading to a smoother purchasing experience. Financial advisors emphasize the importance of understanding loan calculators, highlighting that they can significantly enhance your ability to navigate the complexities of home financing. By leveraging the Texas mortgage calculator, you can better evaluate your financial readiness and make strategic decisions in the competitive Texas housing market. Take the first step toward the right mortgage by applying online or over the phone with F5 Mortgage today! We’re here to support you every step of the way.

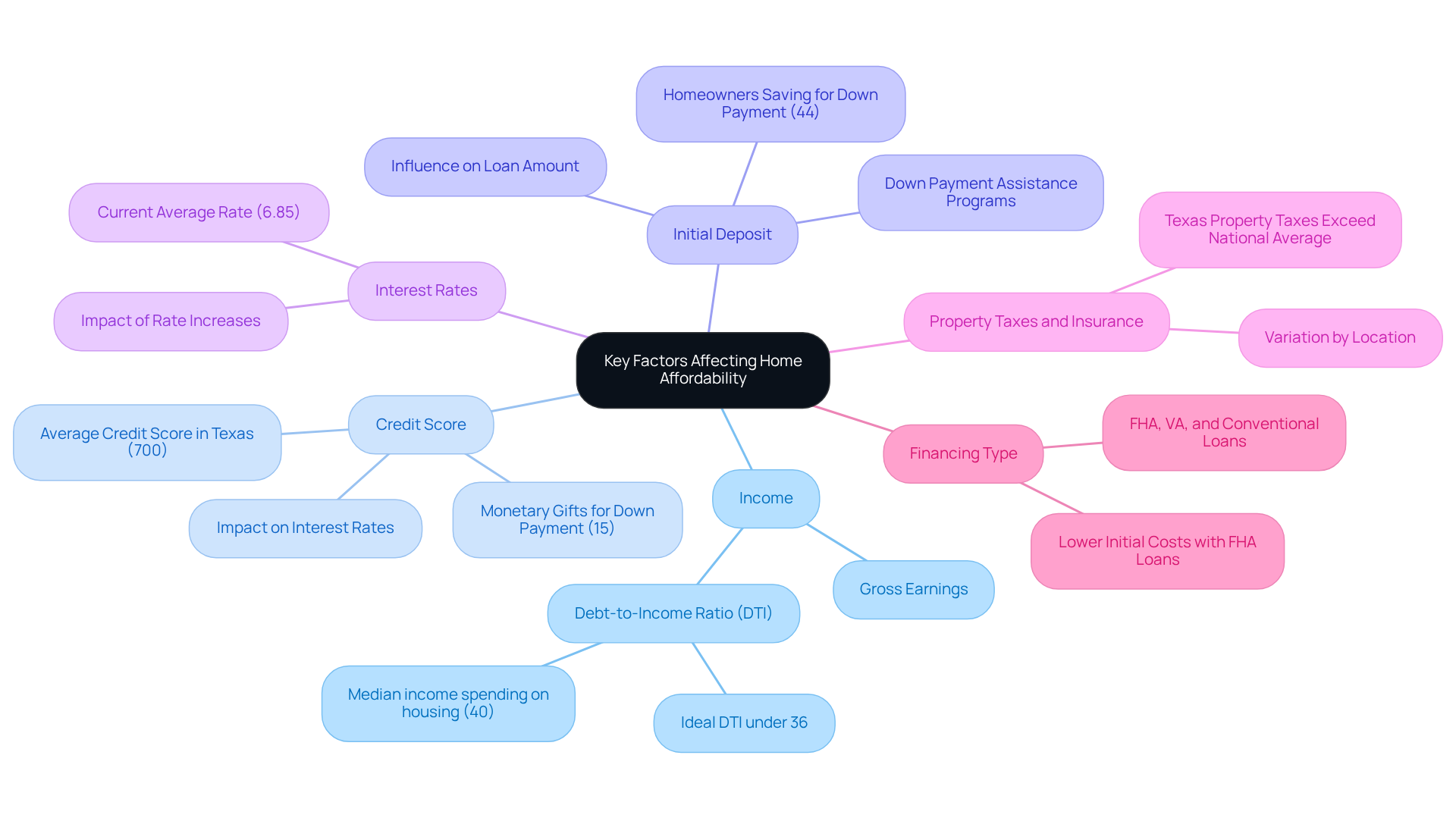

Identify Key Factors Affecting Home Affordability

Several key factors significantly influence home affordability, and understanding these can empower you on your journey to homeownership.

-

Income: Your gross earnings each month play a crucial role in determining what you can afford. Lenders typically assess your financial health using a debt-to-income (DTI) ratio, ideally keeping it under 36% for most credit types. We know how challenging this can be; a family earning the national median income often spends nearly 40% of its income on housing, highlighting the affordability hurdles many face.

-

Credit Score: A higher credit score can lead to better interest rates, which directly impacts your monthly expenses. In Texas, the average credit score for homebuyers is around 700, considered good and can help you secure favorable financing options. Furthermore, about 15% of homeowners have received monetary gifts from family or friends to assist with their down payment, showcasing common financial strategies among buyers.

-

Initial Deposit: The size of your initial deposit affects the total loan amount and may influence mortgage insurance requirements. Many first-time homebuyers in Texas benefit from down payment assistance programs, easing some of the financial burden. Notably, 44% of existing homeowners saved specifically for their down payment and closing costs, underscoring the importance of financial planning. In Ohio, programs like YourChoice!, Grant for Grads, and Ohio Heroes can provide valuable support, making homeownership more attainable.

-

Interest Rates: Current market interest rates play a significant role in your monthly payments. As of mid-2025, average rates for 30-year fixed-rate mortgages are around 6.85%. Even a slight increase in rates can greatly affect affordability, so it’s essential to stay informed.

-

Property Taxes and Insurance: These costs vary by location and must be included in your monthly budget. In Texas, property taxes can exceed the national average, impacting overall affordability.

-

Financing Type: Different financing options, such as FHA, VA, and conventional loans, come with varying requirements and benefits that can influence affordability. For instance, FHA loans may allow for lower initial costs, making them attractive for first-time buyers.

It’s important to note that 81% of aspiring homeowners view down payment and closing costs as significant barriers to homeownership. By understanding these factors and the available support programs, you can better assess your financial situation and make informed decisions when using a loan calculator. We’re here to support you every step of the way.

Utilize the Texas Mortgage Calculator for Accurate Estimates

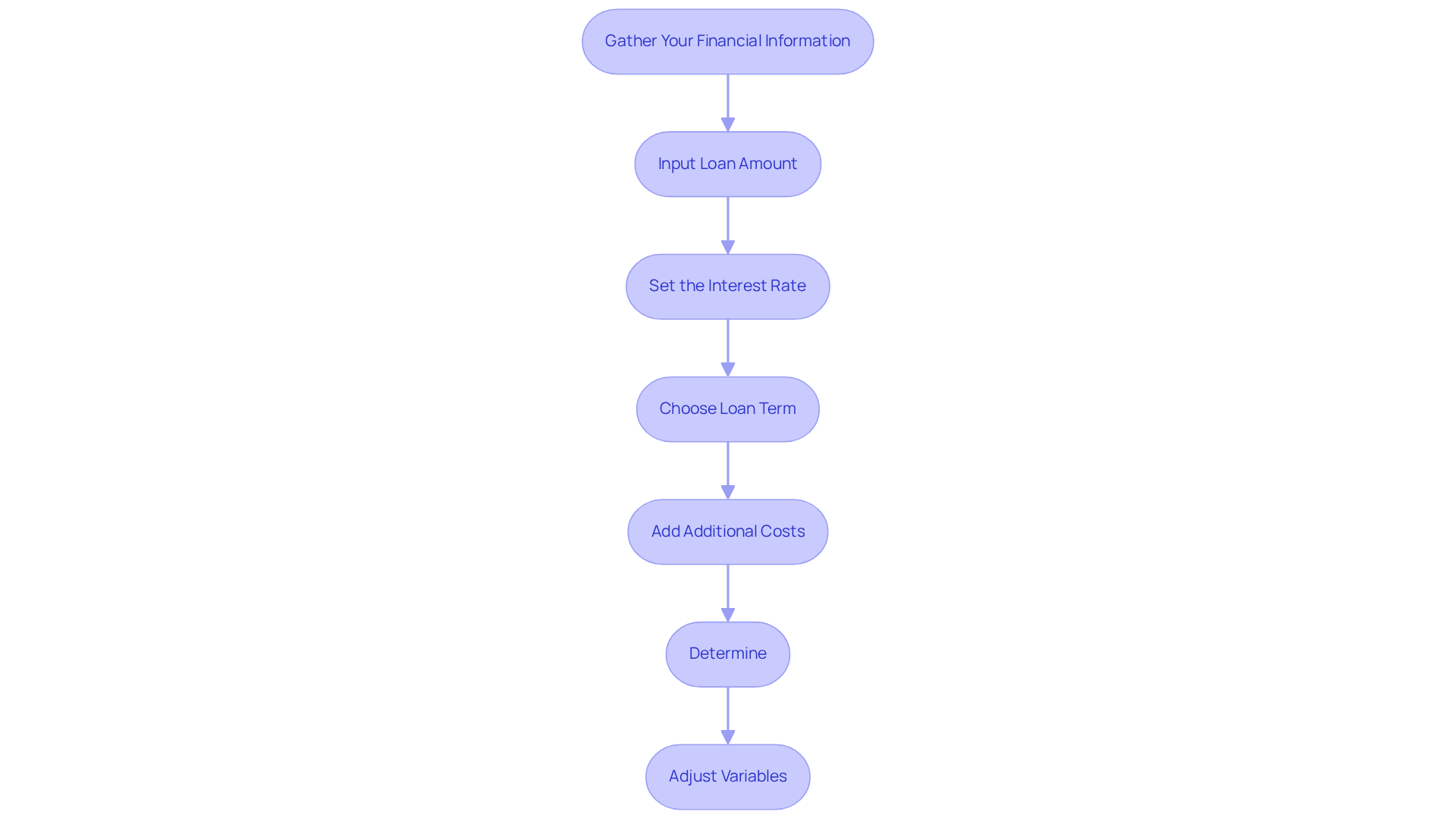

To effectively utilize the Texas mortgage calculator and make informed decisions about your home financing, follow these essential steps:

-

Gather Your Financial Information: We know how challenging it can be to navigate your financial details. Collect your income, monthly debts, and savings for a down payment. Understanding your financial situation is crucial, as it directly impacts your Texas mortgage calculator results.

-

Input Loan Amount: Enter the total sum you intend to borrow, typically the home price minus your down payment. Consider exploring down payment assistance programs available in Texas, like My First Texas Home, which can provide up to 5% assistance for first-time buyers and veterans.

-

Set the Interest Rate: Input the current interest rate for your loan. You can find this information on financial websites or through your lender. This step is essential for accurate calculations with the Texas mortgage calculator.

-

Choose Loan Term: Select the length of your loan, commonly 15 or 30 years. An extended duration can help reduce your regular costs, allowing you to allocate funds for home enhancement projects or increase your savings. Conversely, a shorter duration means you will settle your loan sooner and accumulate equity more rapidly.

-

Add Additional Costs: Include estimates for property taxes, homeowners insurance, and private mortgage insurance (PMI) if applicable. This will provide a more precise estimate of your monthly costs.

-

Determine: Click the calculate button to see your estimated recurring charge. Review the breakdown of principal, interest, taxes, and insurance (PITI). For instance, regular installments for a $350,000 borrowing can vary from $1,756.92 to $2,337.16, based on the loan duration.

-

Adjust Variables: Experiment with different loan amounts, interest rates, and down payments to see how they affect your monthly payment and overall affordability.

By following these steps and utilizing a Texas mortgage calculator, you can gain a clearer understanding of your financing options and make informed decisions. Many home purchasers invest considerable time utilizing loan calculators, demonstrating their significance in the property acquisition process. As noted by satisfied clients of F5 Mortgage, such as Bryce Leonard, who stated, “Awesome work. I appreciated receiving assistance with my loan via F5 Mortgage; these clever financing strategies may help maintain costs as low as possible and ensure an affordable route to homeownership.

Navigate Common Challenges in Home Affordability Calculations

We understand how challenging it can be to navigate various obstacles when utilizing a Texas mortgage calculator. Here are some common challenges you might encounter:

-

Incomplete Information: Having all necessary financial details is crucial. Missing data can lead to significant inaccuracies in your estimates. With the median sales price of an existing home rising by 50% in the last five years, it’s even more important to ensure all information is accurate.

-

Ignoring Extra Expenses: Many users overlook property taxes, insurance, and private mortgage insurance (PMI). These costs can significantly affect your recurring expenses. Always include these factors for a comprehensive view of your financial obligations. Loan experts emphasize that neglecting these expenses can lead to underestimating your overall monthly payment.

-

Misunderstanding DTI Ratios: It’s common for buyers to be unaware of how their debt-to-income (DTI) ratio impacts their borrowing capacity. Aiming for a DTI ratio below 36% can improve your chances of securing financing. Many Texas homebuyers face challenges with DTI ratios, which can greatly influence their mortgage options.

-

Assuming Fixed Rates: Remember that interest rates can change. Regularly check current rates and consider how fluctuations may affect your calculations. Mortgage specialists stress the importance of staying informed about rate changes to avoid unexpected issues during the financing process.

-

Disregarding Credit Type Variations: Each credit category has specific requirements and benefits. It’s essential to research which option aligns best with your financial situation. Many buyers mistakenly assume that all loans have the same terms, which can lead to costly errors.

To effectively navigate these challenges, take your time when entering data, double-check your calculations, and consider using a Texas mortgage calculator while consulting with a mortgage professional for personalized advice. This proactive approach will empower you with a clearer understanding of your home affordability.

Conclusion

Mastering the Texas mortgage calculator is essential for anyone looking to navigate the complexities of home affordability. We understand how challenging this can be, and this tool not only helps prospective buyers assess their financial readiness but also empowers them to make informed decisions throughout the home purchasing process. By leveraging the calculator, potential homeowners can gain valuable insights into their monthly expenses, considering vital factors like loan amount, interest rates, and additional costs such as property taxes and insurance.

Key arguments highlighted in the article emphasize the importance of understanding various elements that influence home affordability. From income and credit scores to down payments and financing types, each factor significantly affects what a buyer can afford. Utilizing the Texas mortgage calculator allows individuals to simulate different scenarios, helping them explore their options and stay within budget. Moreover, recognizing common challenges—such as overlooking additional expenses or misunderstanding DTI ratios—can lead to more accurate calculations and better financial planning.

Ultimately, the journey to homeownership in Texas can feel overwhelming, but with the right tools and knowledge, it becomes much more manageable. Taking the time to understand how to use the Texas mortgage calculator effectively can pave the way for a smoother home-buying experience. We encourage aspiring homeowners to engage with this resource, consult with mortgage professionals, and explore available assistance programs, ensuring they are well-equipped to make informed decisions in the competitive housing market. Embracing these strategies not only enhances financial literacy but also fosters a confident approach to achieving the dream of homeownership.

Frequently Asked Questions

What is the purpose of a Texas mortgage calculator?

A Texas mortgage calculator helps potential homebuyers assess recurring loan costs based on factors like loan amount, interest rate, and loan duration, providing insights into affordability for effective budgeting and financial planning.

What additional elements does the Texas mortgage calculator factor in?

The calculator typically includes additional elements such as property taxes, homeowners insurance, and private mortgage insurance (PMI) to offer a comprehensive view of monthly expenses.

How does understanding down payments affect home financing?

Understanding down payments is vital because a larger initial deposit can lead to lower interest rates and monthly payments, making it easier for families to manage their budgets.

Can the Texas mortgage calculator help with low and no down payment options?

Yes, the calculator can assist in exploring low and no down payment options, which are beneficial for those looking to improve their homes without a significant initial investment.

What are adjustable-rate mortgages (ARMs) and why might they be appealing?

ARMs often come with lower initial rates compared to fixed-rate loans, easing the burden of monthly payments. They can be a wise choice for those planning to sell or refinance before the adjustment period starts, especially with caps on interest rate increases.

How do loan calculators impact homebuyers’ budgeting?

Statistics show that homebuyers who use loan calculators are more likely to stay within their budget, leading to a smoother purchasing experience.

Why is it important to understand loan calculators according to financial advisors?

Financial advisors emphasize that understanding loan calculators can significantly enhance your ability to navigate the complexities of home financing.

How can someone start the mortgage application process with F5 Mortgage?

You can take the first step toward the right mortgage by applying online or over the phone with F5 Mortgage, which provides support throughout the process.