Overview

Home equity loans with fixed rates provide homeowners with a reliable borrowing option. We understand how important it is to access funds while keeping monthly payments consistent throughout the loan term. This predictability not only aids in budgeting but also supports effective financial planning. Fixed rates remain unchanged, even when market fluctuations occur, making them an appealing choice for those who seek long-term financial security. We know how challenging this can be, and we’re here to support you every step of the way.

Introduction

Homeowners are increasingly recognizing the power of their property as a financial asset, and home equity loans are at the forefront of this trend. We understand how significant this decision can be for you and your family. With fixed rates providing a sense of stability and predictability in an ever-changing financial landscape, grasping how these loans function can empower you to make informed decisions about your borrowing options.

However, as market conditions shift and interest rates fluctuate, you may wonder: is a fixed-rate home equity loan the best choice for your situation, or do variable rates offer more enticing benefits? This guide delves into the intricacies of home equity loan fixed rates, exploring their advantages and potential pitfalls. We want to help you navigate the application process, ensuring you feel confident in your financial future. Remember, we’re here to support you every step of the way.

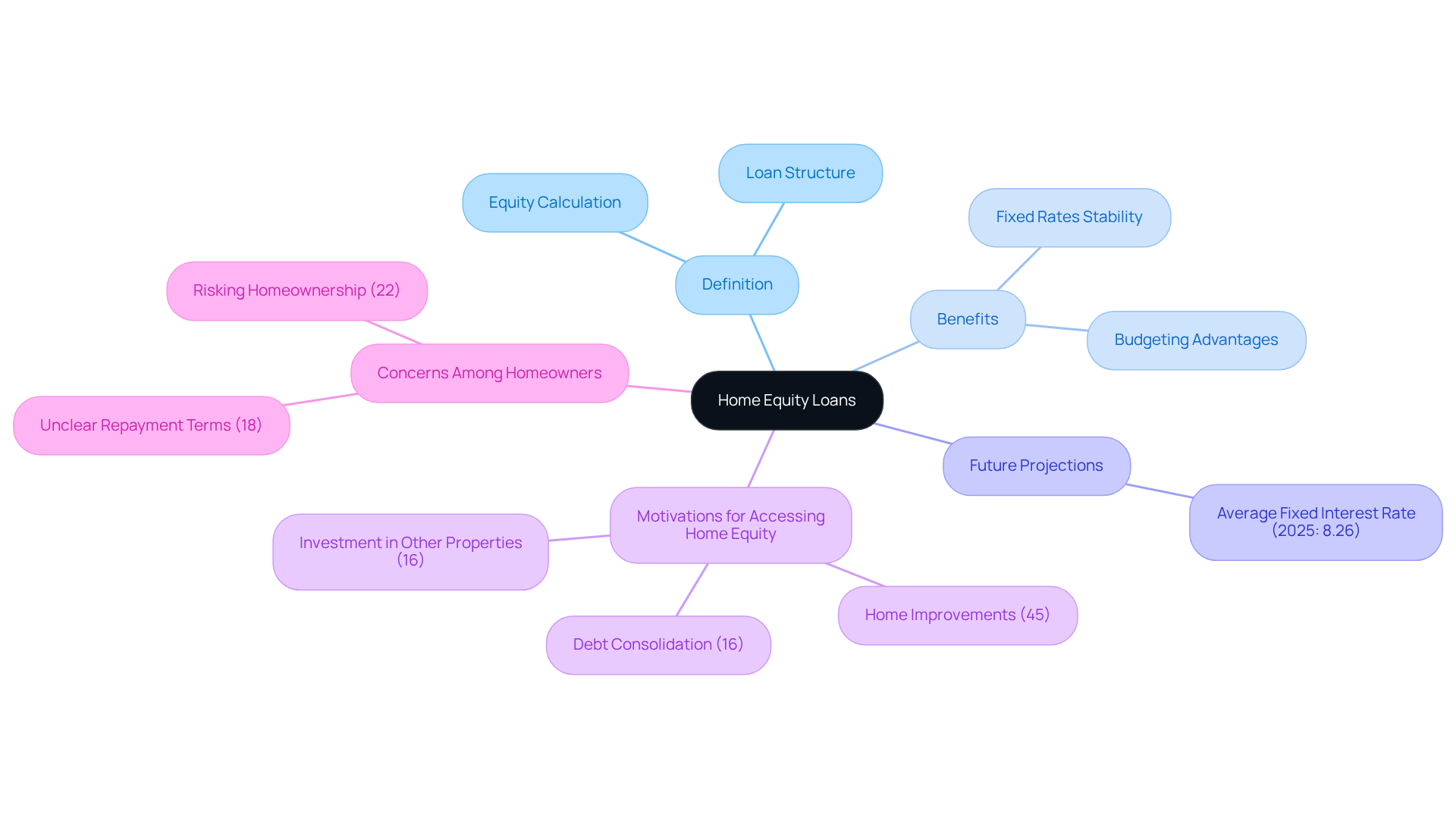

Define Home Equity Loans and Fixed Rates

Home equity financing can be a valuable resource for homeowners looking to leverage the equity in their property. This equity is determined by the difference between your home’s current market value and the outstanding mortgage balance. With these credits, you typically receive a lump sum that you repay over a through steady monthly installments.

One of the greatest advantages of home equity loan fixed rates is the stability it provides. The home equity loan fixed rates remain constant throughout the credit period, ensuring consistency in your monthly expenses and overall borrowing costs. This predictability is especially beneficial for budgeting and financial planning, as it alleviates the uncertainty that often comes with home equity loan fixed rates.

As we look ahead to 2025, the average fixed interest for residential financing is approximately 8.26%, reflecting current market conditions. Understanding these credits and their stable costs is crucial, especially as property owners increasingly view their assets as financial tools. We know how challenging this can be, and comprehending these options empowers you to make informed financial choices. We’re here to support you every step of the way.

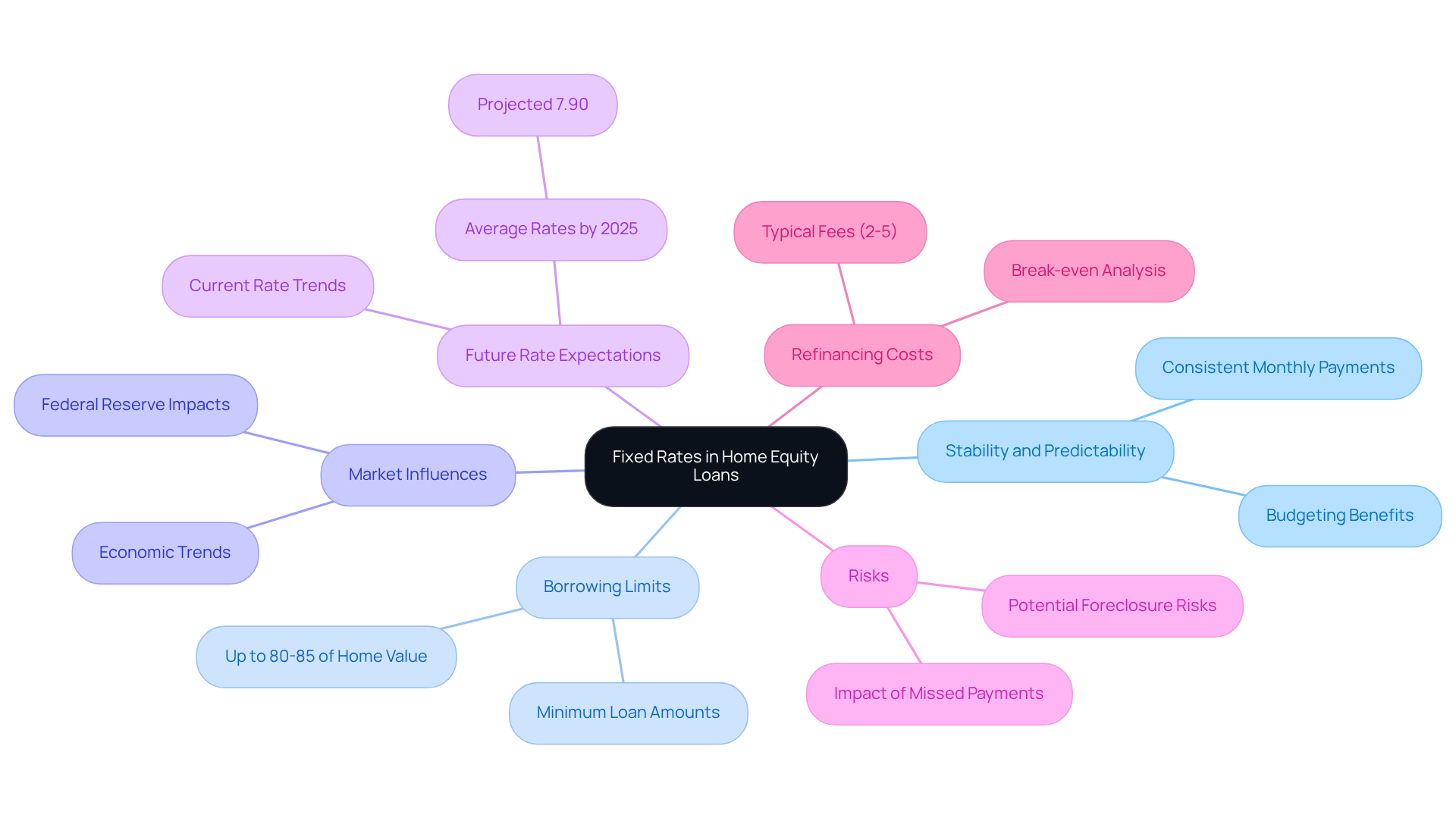

Explain How Fixed Rates Function in Home Equity Loans

Navigating property financing can feel overwhelming, but a fixed-interest arrangement offers a sense of stability. By securing the interest rate at the time of agreement, your monthly payments remain consistent throughout the financing term. This predictability simplifies budgeting, allowing you to plan your finances without the stress of fluctuating payments, especially when considering home equity loan fixed rates.

Home equity financing typically allows you to borrow up to 80 or 85 percent of your home’s assessed value, providing substantial access to funds when you need them most. However, it’s important to recognize that fixed charges can be influenced by various market conditions, including the Federal Reserve’s interest policies and broader economic trends. This means you can feel reassured knowing that fixed-interest options protect you from potential future interest hikes, making them especially appealing for long-term financial strategies.

Looking ahead to 2025, the average fixed-rate property financing is expected to remain competitive. As Greg McBride, Bankrate’s head financial analyst, suggests, residential property financing could average around 7.90% by the end of that year. If you currently have a low-rate mortgage, exploring fixed-rate second mortgages may be particularly beneficial, allowing you to tap into your property value without impacting your primary mortgage’s terms.

Yet, we know how challenging this can be, and it’s essential to be aware of the risks associated with home equity arrangements, such as the possibility of foreclosure if payments are missed. Once your application is approved, consider locking in your mortgage rates with F5 Mortgage. This step can protect you from market fluctuations during processing, ensuring you secure the best possible conditions for your financing.

To fully understand the financial implications, it’s crucial to , which typically range from 2% to 5% of the mortgage amount. These costs can include application fees, origination fees, appraisal fees, and more. Determining the break-even point by assessing refinancing expenses against potential monthly savings can empower you to make informed choices regarding your property financing. Remember, we’re here to support you every step of the way.

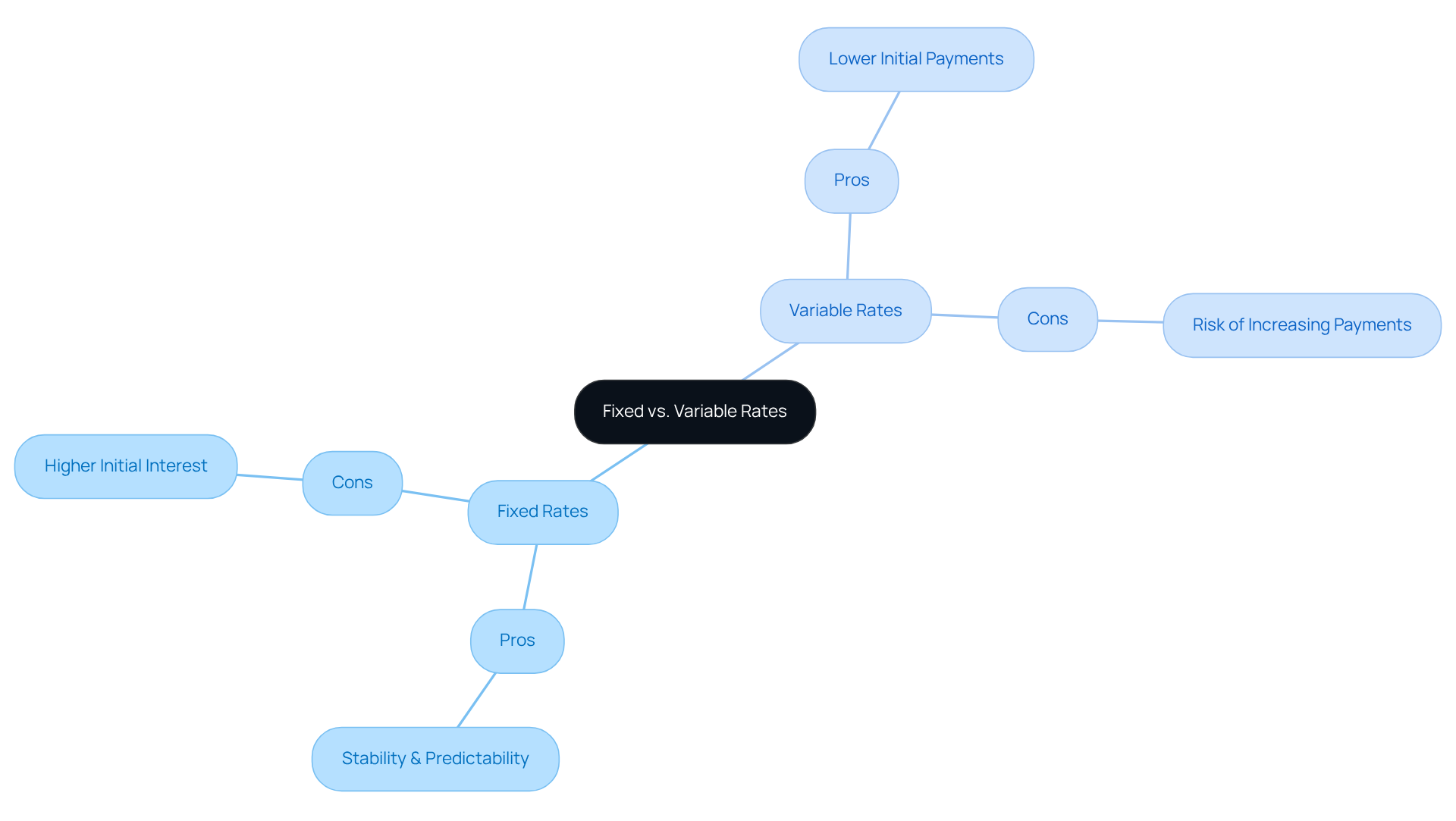

Evaluate Pros and Cons of Fixed Rates vs. Variable Rates

When assessing , we know how challenging it can be to choose between fixed and variable options, each presenting unique benefits and drawbacks. Fixed amounts offer stability and predictability, making it simpler to budget for monthly payments. However, they often start at a higher interest level compared to variable options. On the other hand, adjustable rates usually provide lower initial payments, which can be appealing for those seeking immediate savings. Yet, this choice carries the risk of variable payments that may increase significantly if market values rise, potentially leading to financial pressure.

Current trends indicate that by 2025, the gap between fixed and variable pricing is expected to narrow, shaped by economic conditions and changes implemented by lenders. According to recent surveys, a significant portion of mortgage seekers—62%—favor fixed options for their reliability, while 25% are drawn to variable options, enticed by the potential for lower costs. By the end of 2022, variable-rate mortgages accounted for 25% of Canadian mortgage debt, highlighting their growing popularity despite the inherent risks.

Expert opinions suggest that your decision should hinge on your individual financial circumstances, risk tolerance, and long-term goals. Jamie David, Sr. Director of Marketing and Mortgages, emphasizes, “One of the first decisions home buyers and mortgage shoppers face is whether to select a fixed-rate or variable-rate mortgage.” For those prioritizing stability and a clear repayment strategy, home equity loan fixed rates are often the more sensible choice. Conversely, individuals willing to embrace some risk for the chance of reduced payments may find fluctuating options appealing.

It’s crucial to remember that homeowners must retain at least 15-20% equity beyond the borrowed amount for Home Equity Lines of Credit (HELOCs), adding another layer of financial planning. Additionally, the Bank of Canada adjusts the prime interest rate based on economic conditions, which can significantly impact variable charges. Real-world examples illustrate this dynamic: many homeowners have successfully navigated the choice between fixed and variable options, tailoring their decisions to align with their financial goals and market conditions. However, it’s essential to consider the potential downsides of HELOCs, such as variable interest rates that could rise if market rates increase, as these factors should also be taken into account.

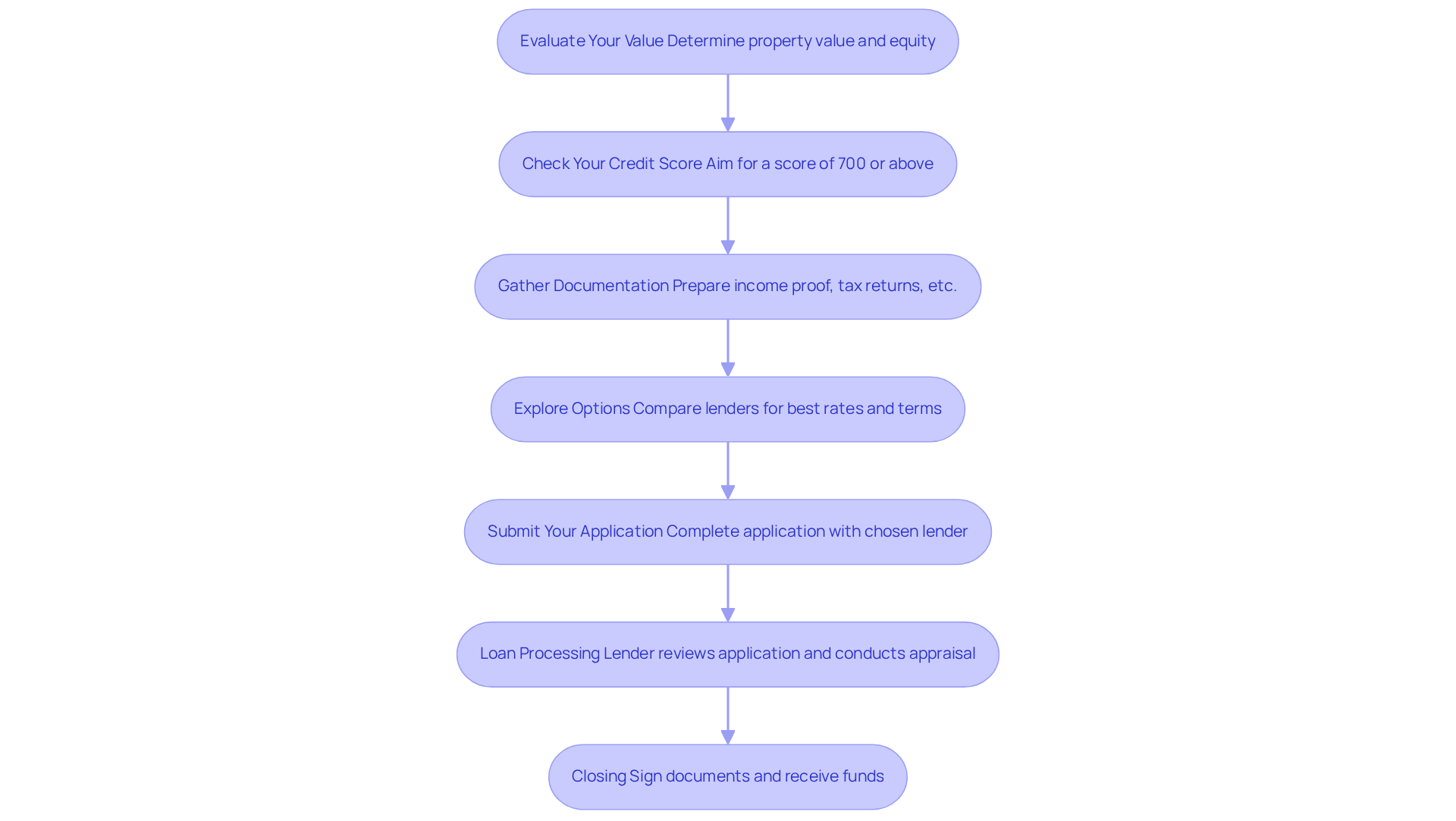

Guide Through the Application Process for Fixed-Rate Home Equity Loans

Applying for a fixed-rate mortgage can feel overwhelming, but understanding the essential steps can make the process smoother for you. Here’s how you can navigate this journey with confidence:

- Evaluate Your Value: Start by determining your property value. Subtract your mortgage balance from your residence’s current market worth. For instance, if your home is assessed at $400,000 and you owe $320,000, you possess 20% equity. This is the minimum needed to qualify for a . Many lenders require homeowners to maintain at least an 80% home-to-value ratio, meaning you should have paid down at least 20% of your original amount or your home must have appreciated in value.

- Check Your Credit Score: A higher credit score can significantly enhance your borrowing conditions. Aim for a score of 700 or above to ensure the best terms. As of mid-2025, many applicants have credit scores in the mid-600s, which may still qualify but could lead to less favorable terms. Remember, improving your credit score can boost your chances of approval for financing.

- Gather Documentation: Prepare necessary documents, such as proof of income, tax returns, bank statements, and details about your debts and assets. This information is crucial for the lender’s assessment. Additionally, check your credit report for errors and dispute any inaccuracies with credit bureaus.

- Explore Options: Evaluate proposals from different lenders to discover the most favorable prices and conditions. With typical residential equity borrowing percentages varying from 8.28% to 9.04% in the second quarter of 2025, it’s essential to assess various choices. Remember, lenders typically do not allow a combined loan-to-value ratio over 85%, and a maximum of a 43% debt-to-income (DTI) ratio is usually required for home loans. A better DTI can lead to more competitive mortgage rates.

- Submit Your Application: Complete the application with your chosen lender, ensuring all required documentation is included. Some lenders may allow online submissions, while others might require in-person meetings. Importantly, you are not obligated to use your current mortgage lender for borrowing equity.

- Loan Processing: The lender will review your application, conduct an appraisal, and verify your financial information. This step is essential for determining your eligibility and ensuring adherence to financial requirements.

- Closing: If approved, you will sign the documents and receive your funds. Most loans at F5 Mortgage close in less than three weeks, making the process efficient and straightforward.

We know how challenging this can be, but understanding these steps can help streamline your experience and ensure you are well-prepared for each phase of the application. We’re here to support you every step of the way.

Conclusion

Home equity loans with fixed rates offer homeowners a reliable way to tap into their property’s value while enjoying the peace of mind that comes with stable monthly payments. We know how challenging it can be to navigate financial decisions, and by understanding how these loans function and the benefits they provide, individuals can make informed choices that align with their financial goals and needs.

Throughout this article, we’ve shared key insights on the mechanics of fixed rates, the advantages of predictable payments, and the potential risks associated with variable rate alternatives. It’s important to evaluate your personal financial situation and the current market conditions when choosing between fixed and variable options. Additionally, we presented a comprehensive guide to the application process for fixed-rate home equity loans, underscoring the necessary steps to secure favorable financing.

Ultimately, leveraging home equity can be a powerful financial strategy, but it requires careful consideration and planning. Homeowners are encouraged to assess their individual circumstances, stay informed about market trends, and seek professional guidance to navigate the complexities of home equity financing. By doing so, you can unlock the benefits of fixed-rate loans while safeguarding your financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a type of financing that allows homeowners to leverage the equity in their property, which is the difference between the home’s current market value and the outstanding mortgage balance.

How does a home equity loan work?

With a home equity loan, you typically receive a lump sum that you repay over a fixed duration through steady monthly installments.

What are the benefits of fixed rates in home equity loans?

The main benefit of fixed rates in home equity loans is the stability they provide, as the interest rate remains constant throughout the loan period, ensuring consistency in monthly expenses and overall borrowing costs.

How does the stability of fixed rates help with financial planning?

The predictability of fixed rates alleviates uncertainty, making it easier for homeowners to budget and plan their finances.

What is the average fixed interest rate for residential financing as of 2025?

The average fixed interest rate for residential financing is approximately 8.26%, reflecting current market conditions.

Why is understanding home equity loans important for property owners?

Understanding home equity loans and their stable costs is crucial for property owners as they increasingly view their assets as financial tools, allowing them to make informed financial choices.