Overview

Calculating your home equity is an important step in understanding your financial landscape. To start:

- Determine your home’s current market value.

- Subtract the total amount owed on your mortgage and any additional liens.

We know how challenging this can be, but this process is essential for your financial planning. By understanding your property’s worth, you can explore potential borrowing options that may be available to you. Remember, we’re here to support you every step of the way.

Introduction

Understanding home equity is not just a financial concept; it’s a vital part of your personal finance journey that can shape your future opportunities. We recognize how overwhelming this can feel, especially as residential property values continue to rise—recently reaching an impressive $17.6 trillion in the U.S. alone. Homeowners like you are increasingly seeing their properties as valuable financial assets.

Yet, the complexities of calculating and leveraging this equity can be daunting. How can you, as a homeowner, effectively navigate these intricacies? We’re here to support you every step of the way, helping you unlock the full potential of your home equity for a brighter financial future.

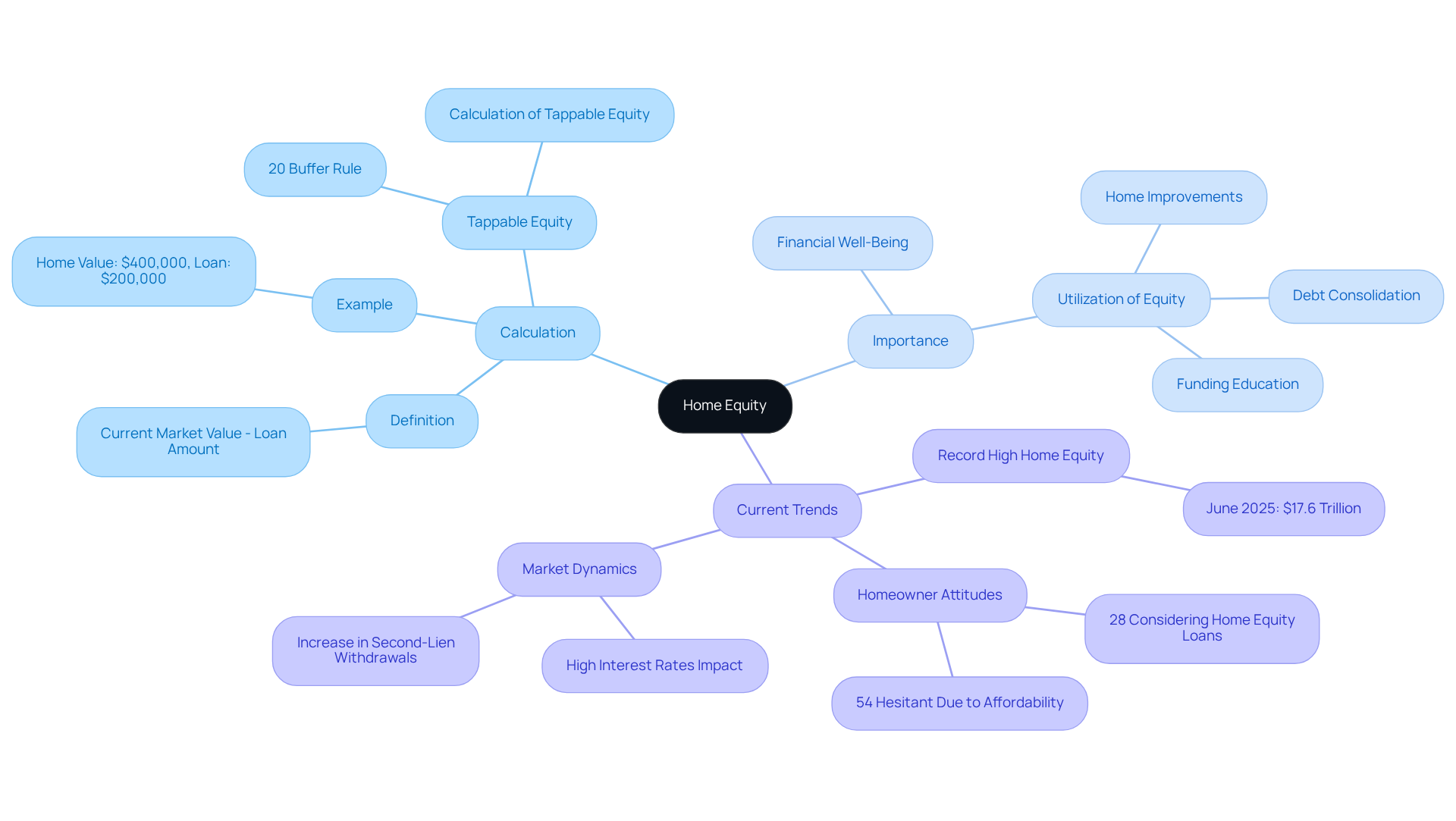

Define Home Equity and Its Importance

Understanding the value of your property is essential, as it significantly impacts your financial well-being. To understand how to calculate home equity, it is determined by the difference between its current market worth and the total amount you owe on your loan. For example, if your home is valued at $400,000 and you owe $200,000, your property value minus liabilities stands at $200,000. This knowledge is crucial because it makes up a considerable part of your net worth and can be utilized for various financial needs, such as home improvements, debt consolidation, or funding education.

In June 2025, residential value in the U.S. reached a record high of $17.6 trillion, highlighting its importance in today’s market. We know how challenging it can be to navigate these financial waters. Around 28% of American homeowners are considering leveraging their home value in the next 12 months, an increase from 21% in 2022. This shift indicates a growing awareness of the worth of their properties. However, it’s important to recognize potential barriers, such as affordability concerns and risks to homeownership, which remain significant considerations for many families.

As Paul Centopani emphasizes, having an open conversation with your lender is crucial. This dialogue helps ascertain how much you can borrow and which type of financing is best for your situation. Understanding the mortgage approval process is vital; approval signifies that you are a suitable candidate for a mortgage based on your financial details, which can directly influence how to calculate home equity. Typically, an approval will include an estimate of your loan amount, interest rate, and potential monthly payment.

Establishing your property’s value over time not only enhances financial security but also opens doors to future investments. At F5 Mortgage, we’re here to support you every step of the way. We are dedicated to educating borrowers, ensuring a smoother mortgage experience, and transforming the mortgage industry by integrating advanced technology—like streamlined application processes and real-time rate comparisons—with personalized service for stress-free property financing.

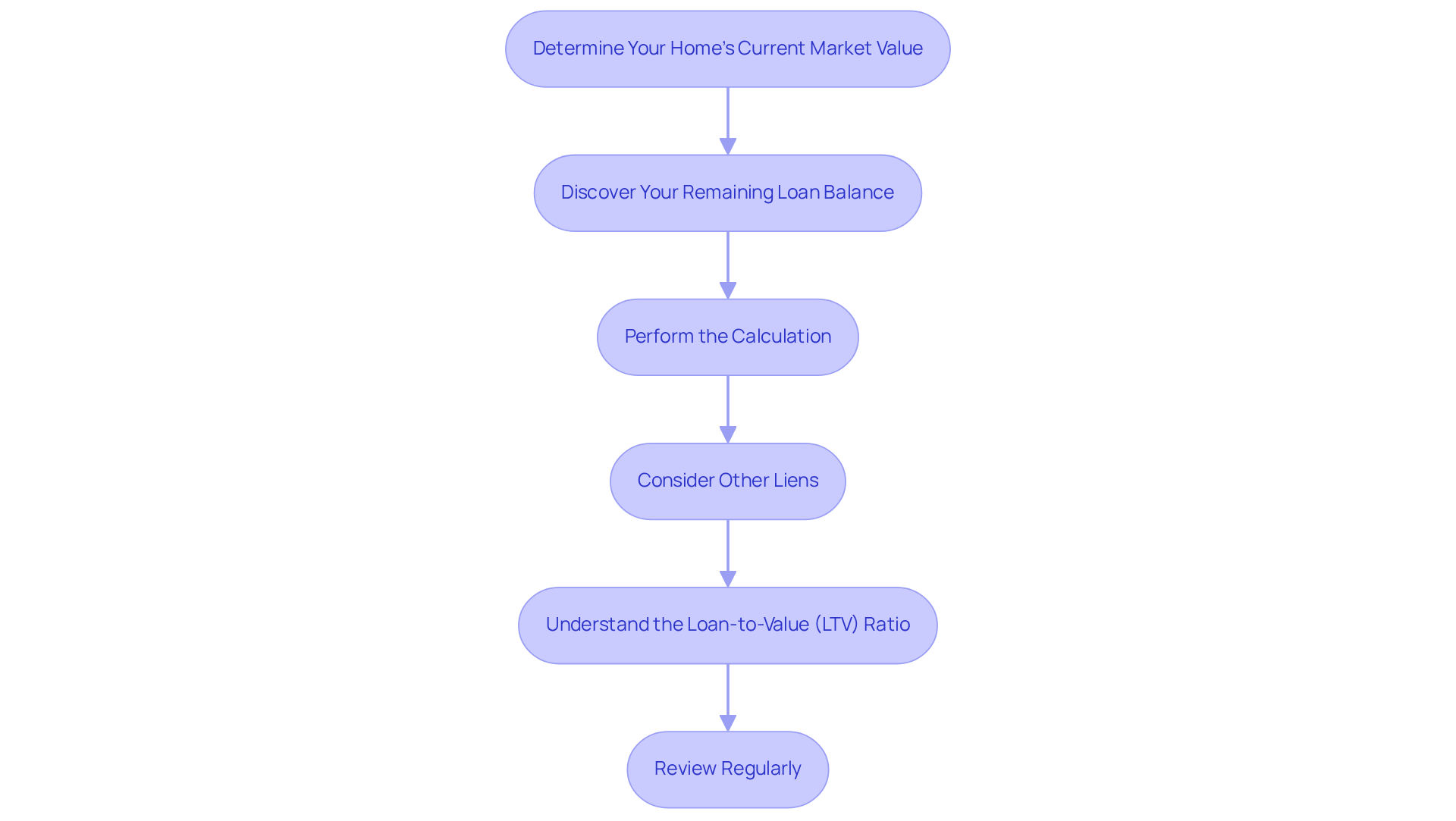

Calculate Your Home Equity: Step-by-Step Process

Learning how to calculate home equity can feel overwhelming, but we’re here to support you every step of the way. To help you navigate this process, follow these steps:

-

Determine Your Home’s Current Market Value: Establishing this value is essential. You can do this through a professional appraisal, a comparative market analysis from a real estate agent, or even online valuation tools. For example, if your residence is appraised at $400,000, this figure will be crucial for your calculations. Understanding how to calculate home equity is vital, as it helps determine how much ownership you possess, which can influence your loan rates.

-

Discover Your Remaining Loan Balance: Take a moment to review your most recent loan statement or reach out to your lender to acquire the precise amount due on your loan. For instance, if your loan balance is $140,000, this will be used in your ownership calculation.

-

Perform the Calculation: Use this straightforward formula:

Home Equity = Current Market Value – Remaining Mortgage Balance

For example, if your home is valued at $400,000 and you owe $140,000, your home equity would be:

$400,000 – $140,000 = $260,000. -

Consider Other Liens: If you have any additional loans backed by your home, such as a second mortgage, remember to deduct those amounts from your value assessment. For instance, if you have a second mortgage of $75,000, your adjusted equity would be:

$260,000 – $75,000 = $185,000. It’s important to note that understanding how to calculate home equity can help you realize that lenders typically allow you to borrow a maximum of 80% to 90% of your available assets, which can influence your borrowing options. Many creditors require property owners to maintain a minimum 80% value-to-debt ratio, meaning you should have reduced at least 20% of your initial borrowing amount or your property has appreciated in value. Additionally, cash-out property financing might have even greater asset prerequisites. -

Understand the Loan-to-Value (LTV) Ratio: This ratio is critical for lenders to assess risk. It is determined by dividing the mortgage balance by the property’s appraised value. A lower LTV ratio can enhance your chances of obtaining an equity line of credit (HELOC) or other financing. Furthermore, a maximum of a 43% debt-to-income (DTI) ratio is typically necessary for residential financing, which refers to the ratio of your existing debt to your income. A better DTI can lead to more competitive mortgage rates.

-

Review Regularly: We know how challenging it can be to keep track of your financial status. That’s why it’s essential to recalculate your property value periodically, especially if you are considering refinancing or taking out a loan against your property. Routine evaluations can help you remain aware of your financial landscape and utilize your assets effectively.

Explore Ways to Access Your Home Equity

Once you have determined your property value, you may be considering how to utilize it for various financial needs. Understanding your options can be empowering, and we’re here to support you every step of the way. Here are some common methods:

-

Property Value Loan: This second mortgage allows you to borrow a lump sum against your property’s value, typically at a fixed interest rate. It’s especially beneficial for significant expenses, such as property renovations or debt consolidation. With home loan interest rates currently in the mid-8% range, this option remains appealing for many homeowners looking to finance enhancements that can increase property value.

-

Home Equity Line of Credit (HELOC): A HELOC functions similarly to a credit card, letting you borrow against your equity as needed, up to a predetermined limit. This flexible option is perfect for ongoing expenses, allowing homeowners to access funds when necessary. However, it’s important to be aware that HELOCs often come with adjustable interest rates, which can change over time.

-

Cash-Out Refinance: This method involves refinancing your current loan for more than you owe and receiving the difference in cash. It can be advantageous if you secure a lower interest rate on your new loan. As of mid-2025, cash-out refinance rates are in the high-6% range, making this a viable choice for those looking to leverage their property value while potentially lowering their overall loan costs.

-

Reverse Mortgage: Available to property owners aged 62 and older, a reverse mortgage allows you to convert part of your home’s value into cash without selling your residence. This can provide additional income during retirement, although it’s crucial to understand the associated fees and implications for your estate.

-

Shared Equity Agreements: In this arrangement, an investor provides you with funds in exchange for a portion of your property’s future appreciation. This option can be beneficial if you need financial support but wish to avoid taking on additional debt. As homeowners increasingly explore alternative financing methods, shared ownership agreements are gaining popularity as a flexible solution.

With home renovations cited by two-thirds of borrowers as a primary reason for applying for home equity loans, understanding these options can empower families to make informed financial decisions. Consulting with financial advisers can further clarify the best approach tailored to your individual circumstances.

Conclusion

Understanding how to calculate home equity is a vital skill for homeowners, as it provides insight into one’s financial standing and potential borrowing power. We know how challenging this can be, but by grasping the difference between a property’s market value and the outstanding mortgage balance, homeowners can unlock opportunities for financial growth and stability. This knowledge not only contributes to a clearer picture of net worth but also empowers homeowners to make informed decisions about leveraging their assets for various financial needs.

The article outlines a straightforward, step-by-step process to determine home equity. It emphasizes the importance of:

- Assessing current market value

- Understanding remaining loan balances

- Considering additional liens

Recognizing the significance of the loan-to-value ratio and the necessity of regular evaluations can help keep track of your financial health.

Furthermore, it explores multiple avenues for accessing home equity, such as:

- Property value loans

- HELOCs

- Cash-out refinancing

- Reverse mortgages

- Shared equity agreements

Each option offers unique benefits tailored to different financial situations, making it easier for you to find the right fit.

Ultimately, comprehending home equity is not just about numbers; it is about taking control of your financial future. Homeowners are encouraged to engage with their lenders and seek professional advice to navigate the complexities of home equity. By doing so, you can effectively leverage your property’s value to achieve personal financial goals—whether that means funding renovations, consolidating debt, or preparing for retirement. Embracing this knowledge can lead to more strategic financial planning and a more secure economic future. We’re here to support you every step of the way.

Frequently Asked Questions

What is home equity?

Home equity is the difference between the current market value of your property and the total amount you owe on your mortgage. It represents a significant portion of your net worth.

How do you calculate home equity?

Home equity is calculated by subtracting the total amount owed on your loan from your home’s current market value. For example, if your home is valued at $400,000 and you owe $200,000, your home equity would be $200,000.

Why is understanding home equity important?

Understanding home equity is important because it plays a considerable role in your financial well-being. It can be utilized for various financial needs, such as home improvements, debt consolidation, or funding education.

What is the current state of residential value in the U.S.?

As of June 2025, residential value in the U.S. reached a record high of $17.6 trillion, indicating the importance of home equity in the market.

What percentage of American homeowners are considering leveraging their home value?

Around 28% of American homeowners are considering leveraging their home value in the next 12 months, an increase from 21% in 2022.

What are some barriers to leveraging home equity?

Potential barriers include affordability concerns and risks to homeownership, which remain significant considerations for many families.

Why is it important to communicate with your lender about home equity?

Having an open conversation with your lender is crucial to ascertain how much you can borrow and to determine which type of financing is best for your situation.

What does mortgage approval signify?

Mortgage approval signifies that you are a suitable candidate for a mortgage based on your financial details, influencing how to calculate home equity. It typically includes an estimate of your loan amount, interest rate, and potential monthly payment.

How can establishing property value over time benefit homeowners?

Establishing your property’s value over time enhances financial security and opens doors to future investments.

What services does F5 Mortgage offer to borrowers?

F5 Mortgage is dedicated to educating borrowers, ensuring a smoother mortgage experience, and transforming the mortgage industry by integrating advanced technology with personalized service for stress-free property financing.