Overview

If you’re looking to claim the First Time Home Buyer Tax Credit for 2024, it’s important to understand that you must meet specific eligibility criteria. We know how challenging this can be, but don’t worry—gathering the necessary documentation and completing the claim process accurately can set you on the right path.

- First, confirm your status as a first-time buyer. This is a vital step that helps you qualify for the credit.

- Next, be sure to adhere to the income limits set forth for this benefit. By doing so, you can maximize your potential benefits and ensure a successful claim.

- Finally, remember to submit Form 5405 along with supporting documents.

We’re here to support you every step of the way, guiding you through this process so you can take full advantage of the tax credit available to you.

Introduction

Navigating the journey to homeownership can be both exhilarating and daunting, especially for first-time buyers. We understand how challenging this can be. The First Time Home Buyer Tax Credit for 2024 offers a valuable opportunity to alleviate some of the financial burdens associated with purchasing a home.

However, the eligibility requirements and claim process can feel complex, leaving many potential homeowners wondering: how can they effectively maximize this benefit? This guide breaks down the essential steps to ensure a smooth application, empowering you to take full advantage of the tax credit and secure your dream home.

We’re here to support you every step of the way.

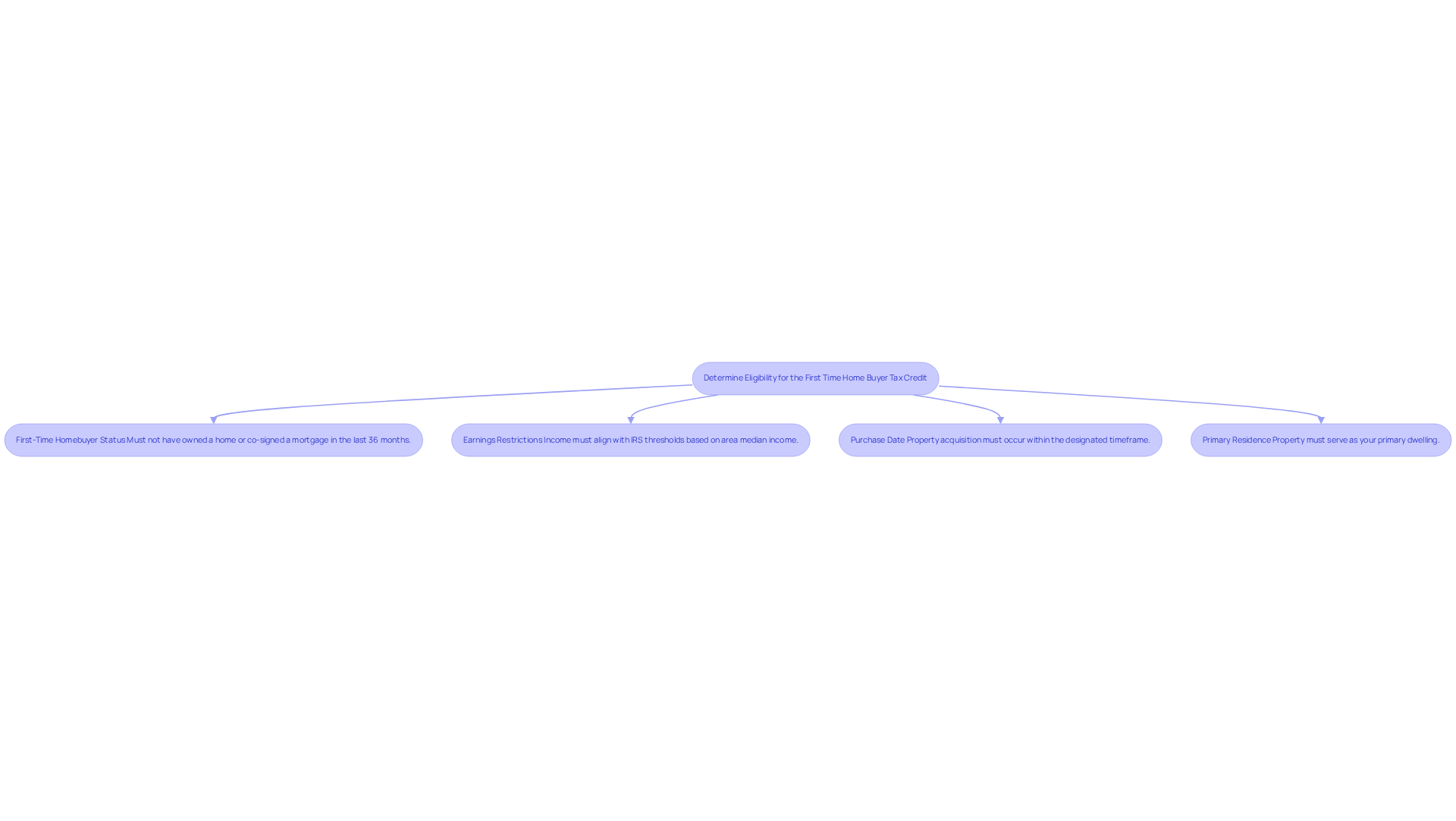

Determine Eligibility for the First Time Home Buyer Tax Credit

We understand that navigating the process of buying your first home can be both exciting and overwhelming. To qualify for the First Time Home Buyer Tax Credit, there are specific criteria you need to meet:

- First-Time Homebuyer Status: You must be classified as a first-time homebuyer. This generally means you have not owned a home or been a co-signer on a mortgage within the last thirty-six months.

- Earnings Restrictions: It’s important to confirm that your earnings align with the IRS thresholds for the first time home buyer tax credit 2024. These limits can vary based on your filing status and the median income for your area.

- Purchase Date: Your property acquisition must occur within the designated timeframe to be eligible for the tax credit.

- Primary Residence: The property must serve as your primary dwelling, not as a rental or vacation property.

For accurate confirmation of your eligibility, we encourage you to consult the IRS guidelines or seek advice from a tax professional. They can tailor their recommendations to your specific circumstances, helping to ensure a smooth application process. Remember, we’re here to support you every step of the way.

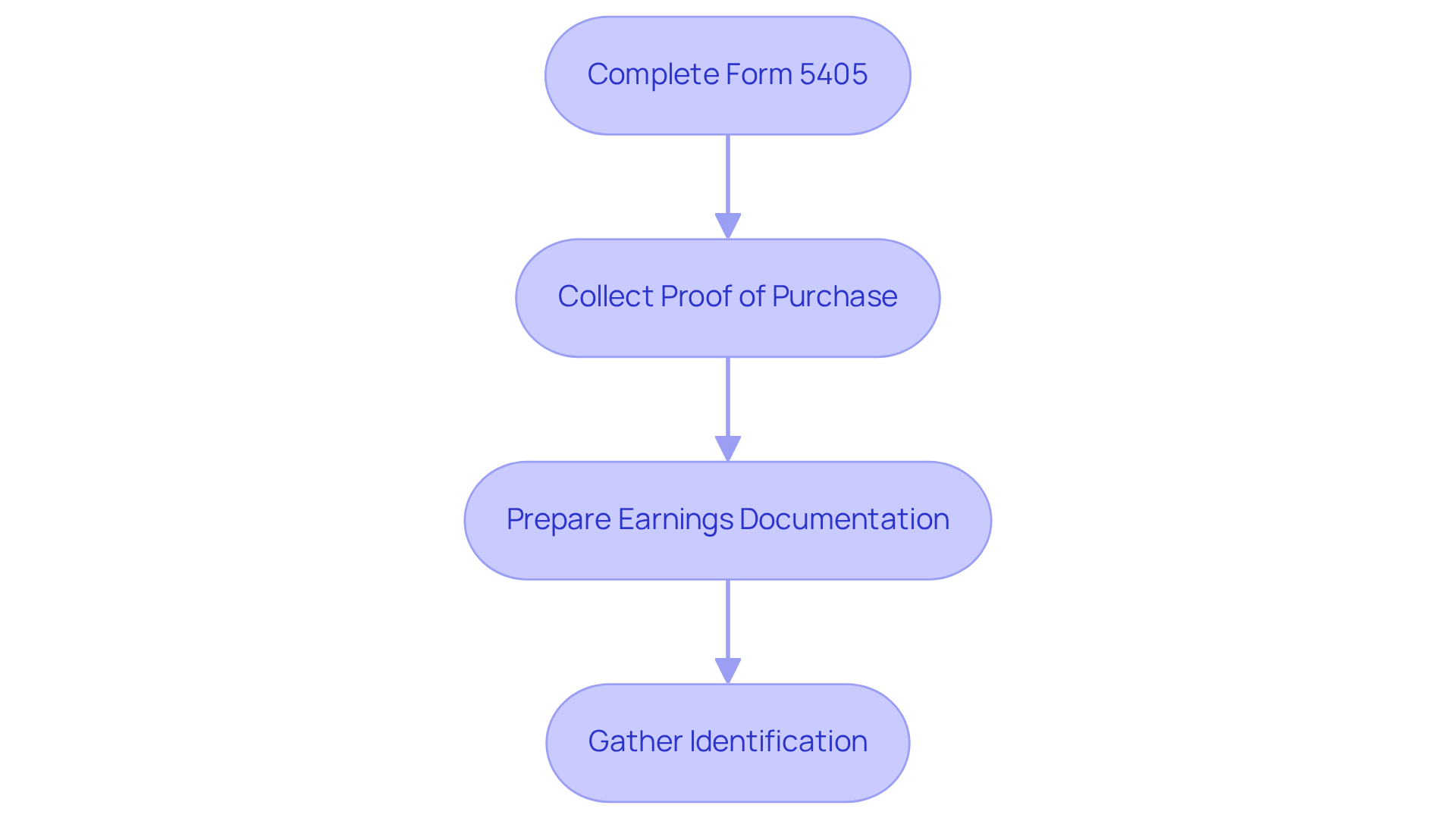

Gather Required Documentation and Forms

Claiming the first time home buyer tax credit 2024 can feel overwhelming, but we’re here to support you every step of the way. To make this process smoother, it’s essential to gather the right documentation:

- Form 5405 is the key form required for claiming the first time home buyer tax credit 2024. Ensure it is filled out accurately to avoid common errors.

- Proof of Purchase: Include a copy of your closing statement or settlement statement, which should clearly indicate the purchase date and price of the home.

- Earnings Documentation: Prepare your tax returns and any additional earnings statements to confirm your eligibility based on the specified earnings limits. We know how challenging this can be, and many claims are delayed due to incomplete income documentation, so double-check these records.

- Identification: Have your Social Security number and any other necessary identification documents readily available.

By organizing these documents ahead of time, you can streamline the claim process, minimizing stress and ensuring a smoother experience. Remember, accurate documentation is crucial; taking the time to prepare will pay off in the long run.

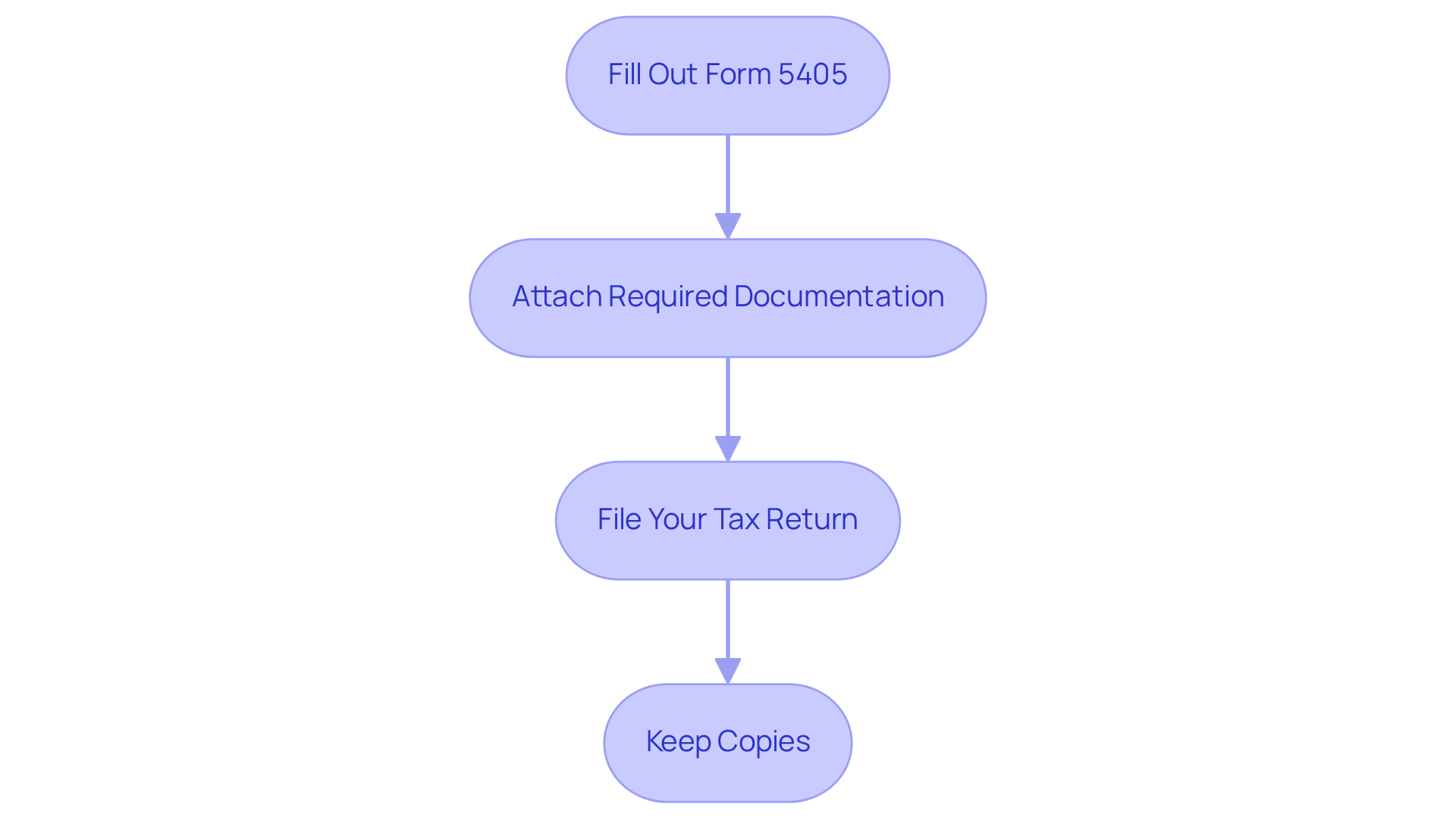

Complete the Tax Credit Claim Process

Claiming the first time home buyer tax credit 2024 can feel overwhelming, but we’re here to support you every step of the way. Follow these essential steps to make the process smoother:

-

Fill Out Form 5405: Make sure to complete all sections of the form accurately. This will help prevent any delays in processing your claim. Remember, the first time home buyer tax credit 2024 is not available, as the first-time homebuyer incentive was offered only from 2008 to 2010 and is no longer accessible for current tax years.

-

Attach Required Documentation: Gather and include all necessary documents that support your claim alongside your tax return. It’s important to maintain these records for as long as they are relevant for federal tax law adherence, especially if you utilized the benefit during its availability, as you may still have responsibilities to repay it.

-

File Your Tax Return: Submit your completed tax return, including Form 5405, to the IRS by the designated tax deadline. This ensures that your claim is processed in a timely manner.

-

Keep Copies: Retain copies of all submitted forms and supporting documents for your records. This is crucial for any future inquiries or audits.

If you encounter any uncertainties during the process, consider consulting a tax professional for guidance. We know how challenging this can be, and having accurate documentation and understanding your obligations are key to a successful claim.

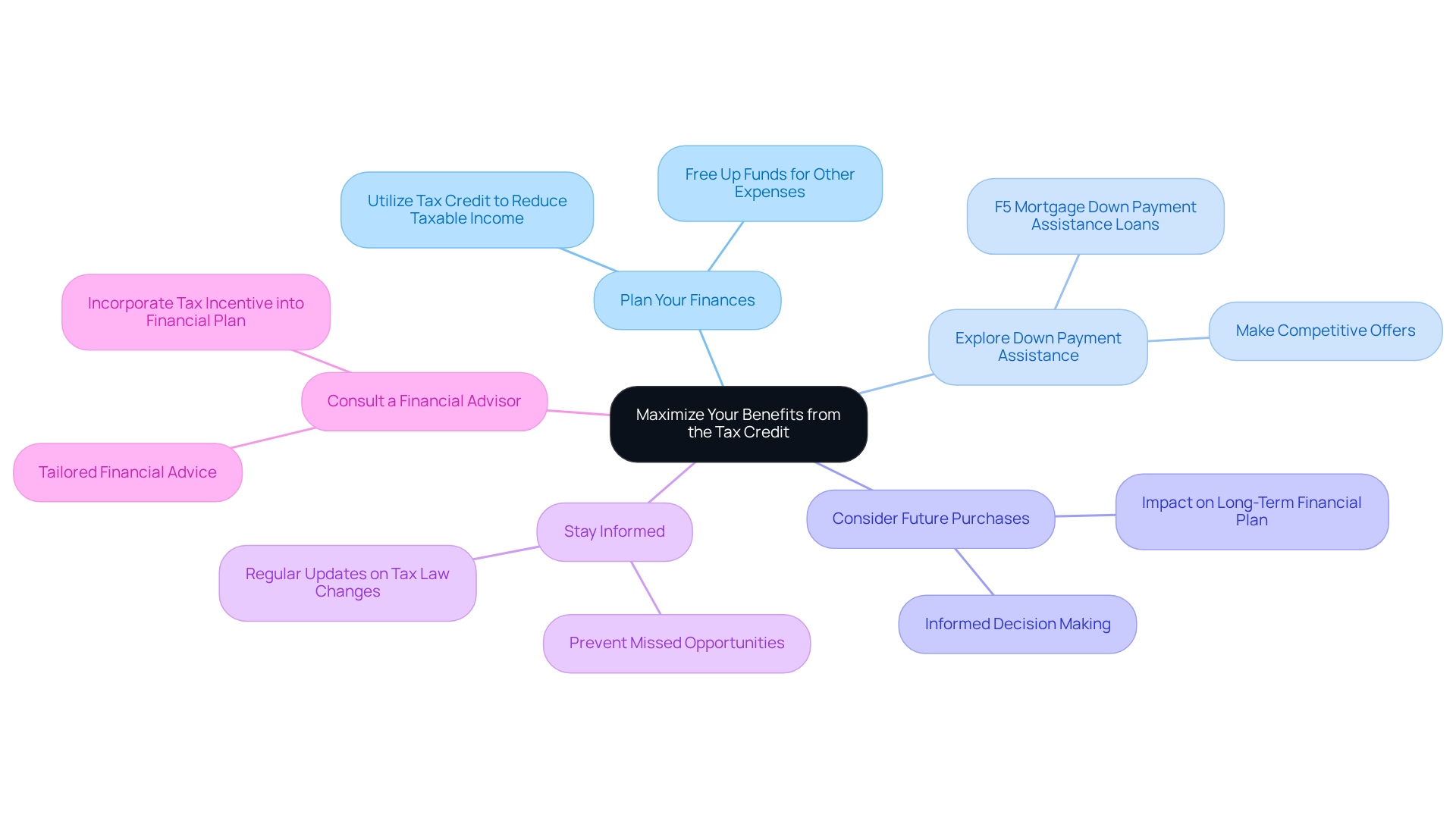

Maximize Your Benefits from the Tax Credit

To maximize your benefits from the First Time Home Buyer Tax Credit, we understand how important it is to consider the following strategies:

- Plan Your Finances: We know how challenging it can be to manage finances. Utilize the first time home buyer tax credit 2024 as a tax incentive to decrease your taxable income, which can significantly reduce your total tax obligation. This can free up funds for other essential expenses or investments, giving you more flexibility.

- Explore Down Payment Assistance: F5 Mortgage offers Down Payment Assistance loans that can help you make a more competitive offer, reduce your loan amount, and lower your mortgage payments. By utilizing these programs, you can purchase a residence sooner, especially in competitive housing markets.

- Consider Future Purchases: If you expect to acquire another residence in the future, think about how this benefit can impact your long-term financial plan. Understanding its implications can help you make informed decisions that align with your goals.

- Stay Informed: It’s crucial to regularly update yourself on any changes in tax laws that may affect your eligibility or the amount of the benefit. Being proactive can prevent missed opportunities that could enhance your financial situation.

- Consult a Financial Advisor: Engaging with a financial professional can provide tailored advice on how to effectively incorporate the tax incentive into your broader financial plan. We’re here to support you every step of the way to ensure you maximize its benefits.

Additionally, consider the Mortgage Credit Certificate program available in Los Angeles County, which provides a dollar-for-dollar reduction of your federal income tax liability. This can further enhance your financial position as a first-time homebuyer.

By applying these strategies, you can fully take advantage of the first time home buyer tax credit 2024, which will improve your financial situation. Notably, first-time homebuyers accounted for 32% of all buyers in 2023, underscoring the significance of understanding and utilizing available credits. Remember, F5 Mortgage can assist you in navigating the complexities of home financing, ensuring you make the most of your opportunities.

Conclusion

Navigating the process of claiming the First Time Home Buyer Tax Credit in 2024 can be a rewarding yet intricate journey. We understand how challenging this can be, and we’re here to support you every step of the way. By grasping eligibility requirements, gathering necessary documentation, and following a structured claim process, you can take full advantage of this financial incentive. With the right information and organization, you can significantly ease your path to homeownership and financial stability.

Key insights discussed in this guide emphasize the importance of confirming eligibility criteria, such as:

- First-time buyer status

- Income restrictions

Additionally, the critical documentation needed to support your claim cannot be overlooked. Completing Form 5405 accurately and submitting it alongside your tax return ensures that your application is processed efficiently. Moreover, consider strategies for maximizing the benefits of the tax credit, including:

- Financial planning

- Seeking professional advice

These strategies can enhance the overall advantages of this opportunity.

Ultimately, the First Time Home Buyer Tax Credit represents a valuable resource for those embarking on homeownership. By staying informed about eligibility requirements and leveraging available benefits, you can make more informed decisions that align with your financial goals. Engaging with financial professionals and remaining proactive about changes in tax laws can further enhance the impact of this credit, ensuring that it serves as a stepping stone toward a secure and prosperous future in homeownership.

Frequently Asked Questions

What is the First Time Home Buyer Tax Credit?

The First Time Home Buyer Tax Credit is a tax benefit available to individuals purchasing their first home, designed to help ease the financial burden of homeownership.

What qualifies someone as a first-time homebuyer?

To be classified as a first-time homebuyer, you must not have owned a home or been a co-signer on a mortgage within the last thirty-six months.

Are there income restrictions for the First Time Home Buyer Tax Credit?

Yes, there are earnings restrictions that must align with IRS thresholds for the tax credit, which can vary based on your filing status and the median income for your area.

When must I purchase my home to qualify for the tax credit?

Your property acquisition must occur within the designated timeframe specified by the IRS to be eligible for the tax credit.

Does the property have to be my primary residence?

Yes, the property must serve as your primary dwelling and cannot be a rental or vacation property.

How can I confirm my eligibility for the tax credit?

For accurate confirmation of your eligibility, it is recommended to consult the IRS guidelines or seek advice from a tax professional who can provide tailored recommendations based on your specific circumstances.