Overview

This article serves as a caring and comprehensive step-by-step guide on effectively using the mortgage calculator in Virginia. We understand how challenging this can be, and we want to emphasize the importance of accurate data input to determine your monthly mortgage payments.

By detailing key components—such as loan amount, interest rate, and additional costs—we aim to empower you in your financial journey. Furthermore, we offer tips on interpreting the results, helping you make informed decisions that align with your family’s needs. Remember, we’re here to support you every step of the way.

Introduction

Navigating the complex world of home financing can feel overwhelming, especially for first-time buyers. We understand how challenging this can be. As more homebuyers turn to digital solutions, the mortgage calculator in Virginia becomes an essential tool to simplify this process. This guide provides a step-by-step approach to mastering the mortgage calculator, empowering you to make informed financial decisions.

But what happens when the numbers reveal unexpected truths about affordability and long-term commitments? Knowing how to interpret these results effectively could mean the difference between a sound investment and a financial misstep. We’re here to support you every step of the way.

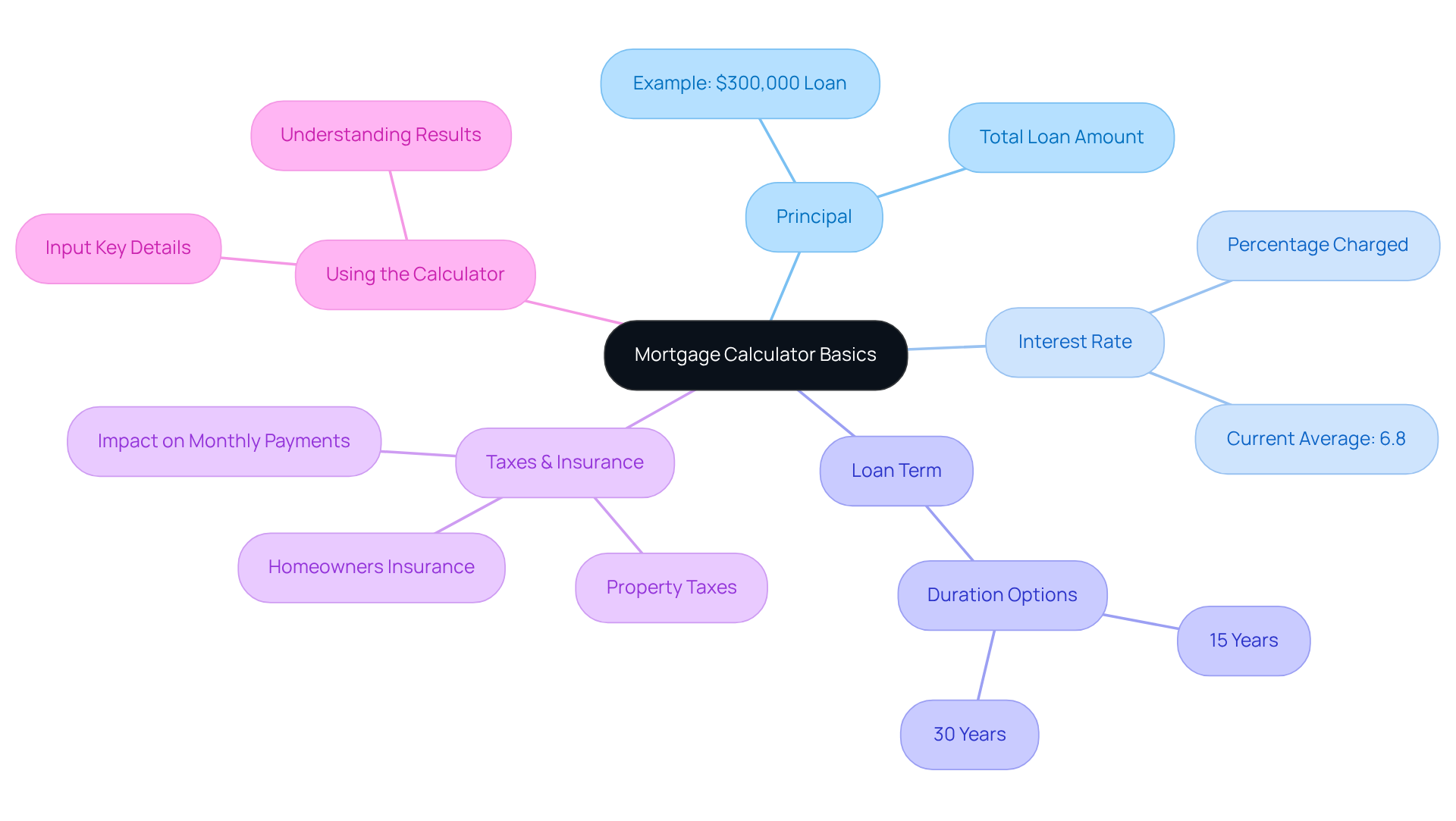

Understand the Basics of Mortgage Calculators

The mortgage calculator Virginia is an essential digital tool that assists prospective homeowners in calculating their monthly payments based on various inputs. In 2025, a significant percentage of homebuyers are expected to use these resources, highlighting the growing trend towards online financial solutions. At F5 Mortgage, we understand how overwhelming this process can be, which is why we leverage advanced technology to ensure our clients can access ultra-competitive loan rates without the pressure of aggressive sales tactics often associated with traditional lenders.

To make the most of a mortgage calculator Virginia, it’s important to enter key details such as the loan amount, interest rate, loan duration, and additional costs like property taxes and homeowners insurance. Understanding how these elements interact is vital for making informed financial decisions.

Key Components of a Mortgage Calculator:

- Principal: The total amount of the loan.

- Interest Rate: The percentage charged on the loan amount.

- Loan Term: The duration over which the loan will be repaid, typically 15 or 30 years.

- Taxes and Insurance: Extra expenses that can greatly influence regular charges.

For example, if a family is considering a $300,000 loan at a 6.8% interest rate over 30 years, they can utilize a mortgage calculator Virginia to help approximate their monthly costs, including taxes and insurance. This estimation empowers families to budget effectively and understand their financial commitments.

At F5 Mortgage, we prioritize personalized support, ensuring that families feel empowered throughout their home buying and refinancing journey. Our financial consultants emphasize the importance of using the mortgage calculator Virginia effectively, as it can provide insights into potential monthly payments and help buyers assess their affordability. By grasping these fundamentals, you’ll be better prepared to navigate the financing tool and interpret its results, ultimately aiding you in your home purchasing process. Remember, we’re here to support you every step of the way.

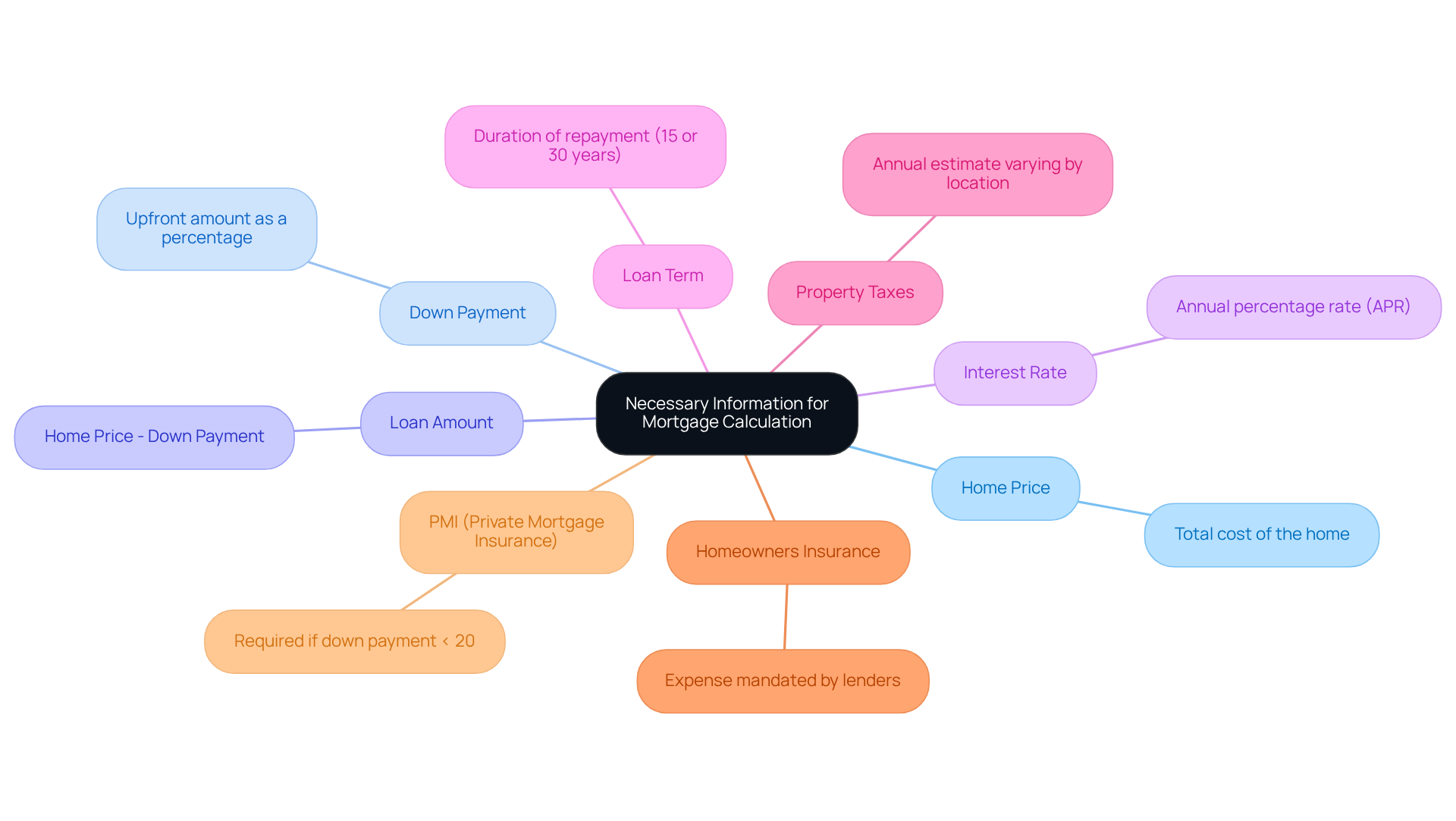

Gather Necessary Information for Calculation

To ensure precise calculations when utilizing a mortgage tool, we know how important it is to gather all the necessary information beforehand. Here’s what you need to consider:

- Home Price: This is the total cost of the home you wish to purchase.

- Down Payment: The upfront amount you can afford, typically expressed as a percentage of the home price.

- Loan Amount: This is determined by deducting your down payment from the home price.

- Interest Rate: The annual percentage rate (APR) you expect to receive from your lender.

- Loan Term: The duration over which you plan to repay the loan, usually 15 or 30 years.

- Property Taxes: An estimate of annual property taxes can vary significantly by location and are often overlooked in online calculators.

- Homeowners Insurance: This is the expense of covering your residence, usually mandated by lenders and incorporated into monthly fees.

- PMI (Private Mortgage Insurance): If your down payment is less than 20%, you may need to factor in PMI, which can add $30 to $70 per month for every $100,000 borrowed.

Gathering this information will simplify the process and lead to more accurate outcomes when using the mortgage calculator Virginia. Ultimately, we’re here to support you every step of the way in making informed choices regarding your housing financing.

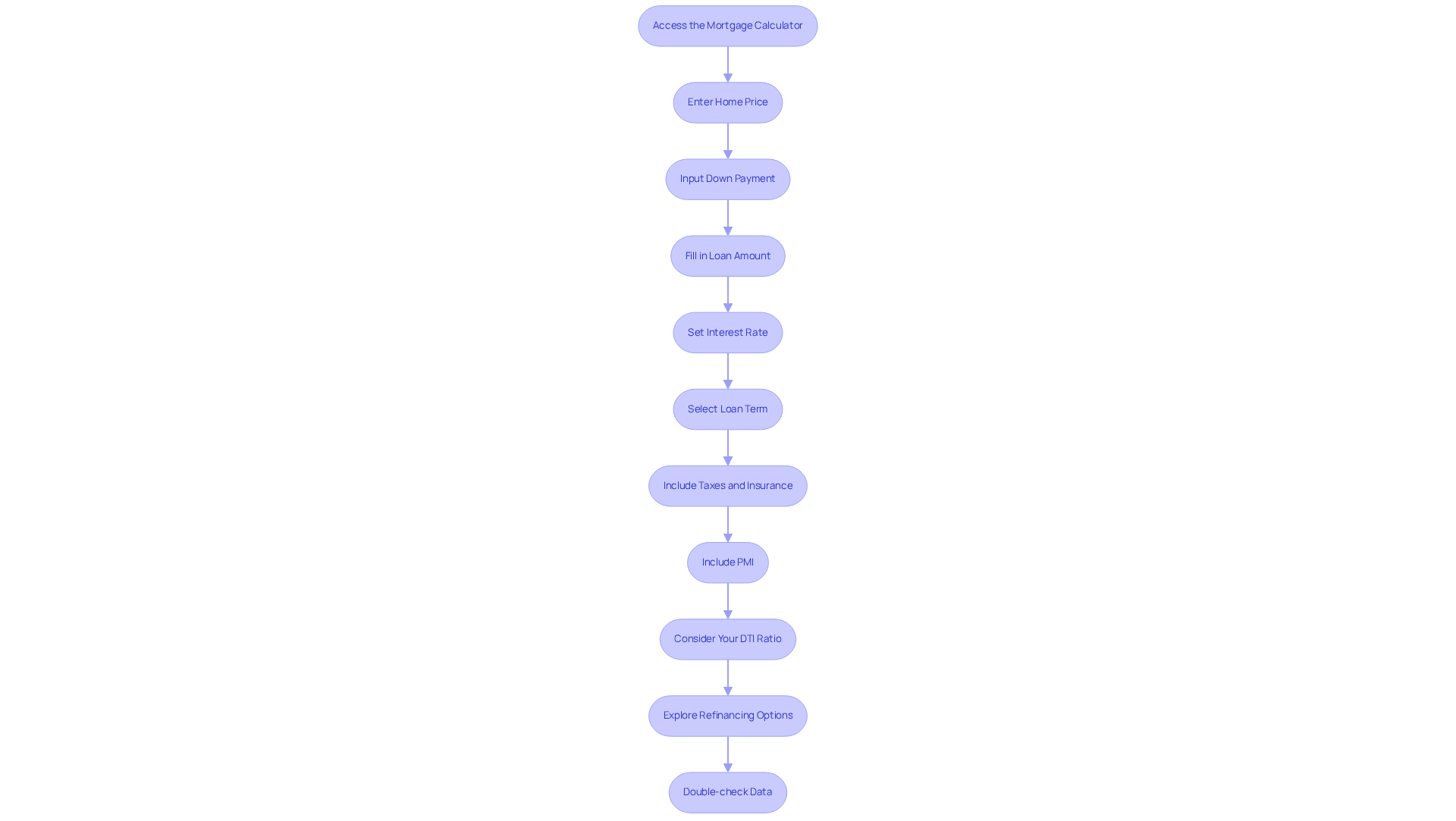

Input Data into the Mortgage Calculator

To effectively use a mortgage calculator Virginia, we understand how important it is to input your data accurately. Here’s a simple guide to help you through the process:

- Access the mortgage calculator Virginia: Start by visiting a reliable online loan calculator, like the one offered by F5 Mortgage, which is designed to provide tailored estimates for your needs.

- Enter Home Price: Input the total price of the home you wish to purchase in the designated field. This figure is crucial as it sets the foundation for your calculations.

- Input Down Payment: Enter the amount you plan to pay upfront. If you’re uncertain, consider calculating it as a percentage of the home price, typically ranging from 3% to 20%.

- Fill in Loan Amount: This figure is usually computed automatically based on the home price and down payment. However, ensure it aligns with your expectations and financial plans.

- Set Interest Rate: Input the interest rate you anticipate receiving. For the most accurate estimate, check current market rates or consult your mortgage broker for guidance.

- Select Loan Term: Choose the duration of your loan, which is typically either 15 or 30 years, depending on your financial goals. Understanding the benefits of longer versus shorter terms can help you make an informed decision.

- Include Taxes and Insurance: If relevant, provide estimates for property taxes and homeowners insurance, as these can greatly influence your regular expenses.

- Include PMI: If your down payment is below 20%, make sure you factor in Private Mortgage Insurance (PMI) in your calculations, as this will affect your overall cost.

- Consider Your DTI Ratio: We know how challenging this can be, but keeping your Debt-to-Income (DTI) ratio in mind is important, as lenders typically prefer a DTI of 43% or lower. This ratio is determined by dividing your total debt expenditures by your gross income for the month. A reduced DTI can result in improved loan rates.

- Explore Refinancing Options: If you’re considering refinancing, F5 Mortgage offers various options tailored to Colorado residents, including conventional loans and FHA loans, which may have different DTI requirements and benefits.

After entering all the data in the mortgage calculator Virginia, double-check for accuracy before proceeding to calculate your estimated monthly payment. Precise data input is crucial, as even minor mistakes can result in considerable differences in your loan estimates, affecting your financial planning. Furthermore, think about utilizing F5 Mortgage’s attractive rates and tailored service to improve your loan experience. With a commitment to simplifying the home buying process and ensuring customer satisfaction, F5 Mortgage offers a fast closing process that can help you secure your mortgage efficiently.

Interpret the Results and Make Informed Decisions

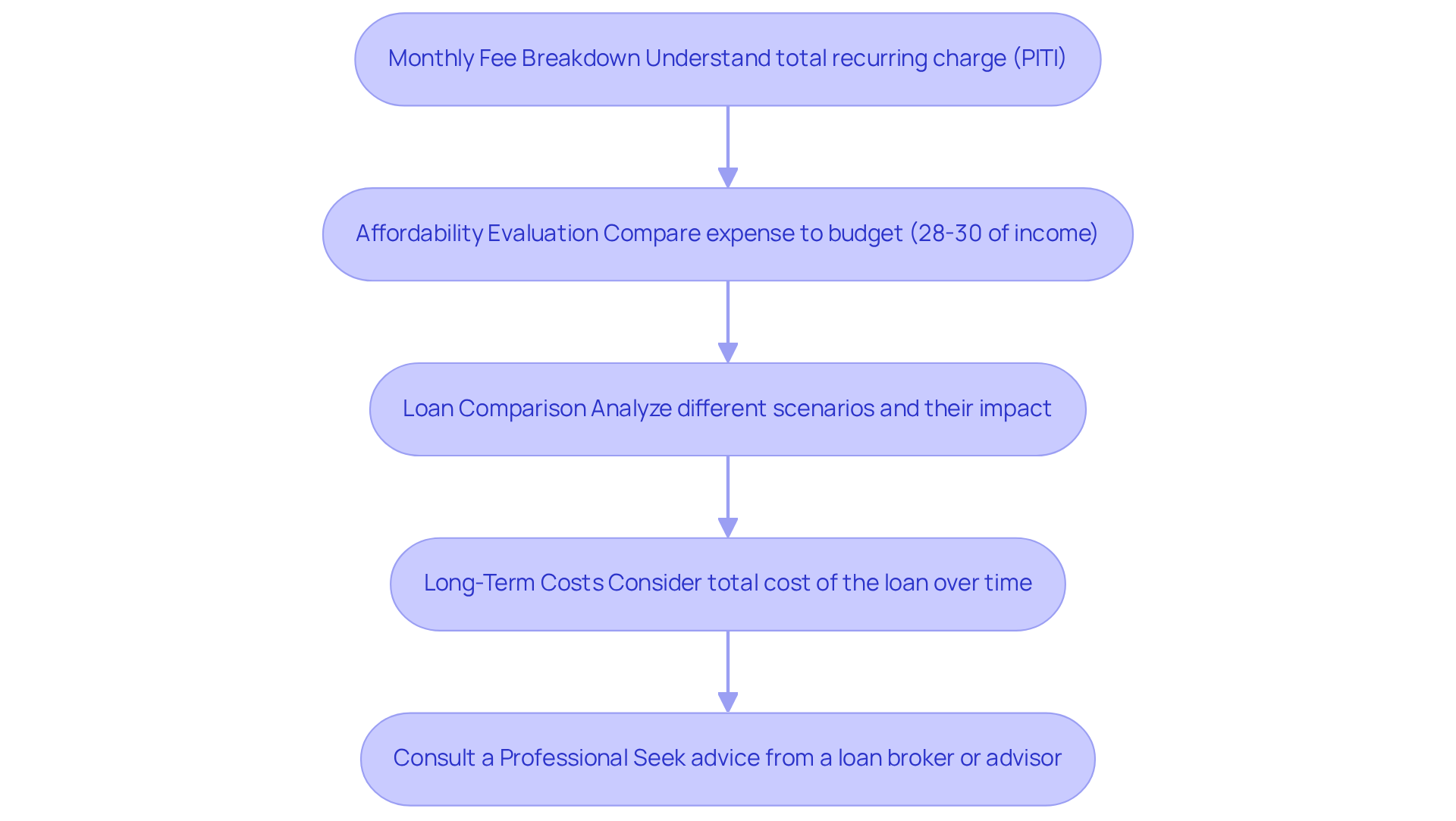

After entering your data and computing your estimated regular charge, it’s essential to analyze the results effectively. We understand how overwhelming this process can be, so here’s how to interpret what the calculator provides:

- Monthly Fee Breakdown: Take a close look at the total recurring charge. This typically includes principal, interest, taxes, and insurance (PITI). By understanding each component, you can see exactly where your money is going.

- Affordability Evaluation: Compare the projected regular expense to your budget. Ideally, this transaction should not exceed 28-30% of your total income each month. For instance, if your monthly income is $5,000, aim for an amount between $1,400 and $1,500. This approach helps ensure your financial stability.

- Loan Comparison: If you’ve explored various scenarios—like different home prices or interest rates—take the time to compare the results. This analysis is crucial for understanding how these changes affect your monthly payment, helping you make informed decisions about what you can realistically afford.

- Long-Term Costs: Think about the total cost of the loan over its duration. The calculator may provide an estimate of total interest paid, which is vital for grasping the long-term financial commitment involved in your loan.

- Consult a Professional: If you have questions or need clarification on the results, don’t hesitate to reach out to a loan broker or financial advisor. Their expertise can offer personalized advice tailored to your unique financial situation.

By effectively interpreting these results, you can empower yourself to make informed decisions about your mortgage options using a mortgage calculator Virginia, enhancing your confidence in financial planning. Remember, we’re here to support you every step of the way.

Conclusion

Using a mortgage calculator in Virginia is an invaluable step for anyone looking to navigate the complexities of home financing. We know how challenging this can be, and this guide aims to equip you with essential knowledge about effectively utilizing this tool. It emphasizes the importance of accurate data input and understanding the various components that influence your monthly payments. By mastering the mortgage calculator, you can gain clarity on your financial commitments and make informed decisions that align with your budget and long-term goals.

Throughout this article, we highlighted key aspects such as:

- Gathering necessary information

- Inputting data accurately

- Interpreting results

Understanding the principal, interest rates, loan terms, and additional costs like property taxes and insurance is crucial for obtaining realistic estimates. Furthermore, we underscored the importance of evaluating affordability and comparing different loan scenarios. This ensures that you can confidently navigate your options and choose what’s best for you.

Ultimately, leveraging a mortgage calculator in Virginia not only simplifies the home buying process but also empowers you to take control of your financial future. As the housing market continues to evolve, staying informed and utilizing these digital tools can lead to more strategic decisions. Embrace this opportunity to enhance your financial literacy and approach home buying with confidence—your future self will thank you for it.

Frequently Asked Questions

What is a mortgage calculator Virginia?

A mortgage calculator Virginia is a digital tool that helps prospective homeowners calculate their monthly mortgage payments based on various inputs such as loan amount, interest rate, loan duration, and additional costs like property taxes and homeowners insurance.

Why is the mortgage calculator becoming more popular among homebuyers?

In 2025, a significant percentage of homebuyers are expected to use mortgage calculators, indicating a growing trend towards online financial solutions that simplify the home buying process.

What key details should I enter into a mortgage calculator?

Key details to enter include the loan amount, interest rate, loan duration (typically 15 or 30 years), and additional costs such as property taxes and homeowners insurance.

How do the components of a mortgage calculator affect my monthly payments?

The principal (total loan amount), interest rate (percentage charged on the loan), loan term (duration for repayment), and additional costs (taxes and insurance) all interact to determine the total monthly payment.

Can you provide an example of how to use a mortgage calculator?

For example, if a family considers a $300,000 loan at a 6.8% interest rate over 30 years, they can use the mortgage calculator Virginia to estimate their monthly costs, including taxes and insurance, which helps them budget effectively.

How does F5 Mortgage support clients in using the mortgage calculator?

F5 Mortgage prioritizes personalized support, ensuring families feel empowered during their home buying and refinancing journey. Their financial consultants emphasize the importance of effectively using the mortgage calculator to gain insights into potential monthly payments and assess affordability.

What is the benefit of understanding how to use a mortgage calculator?

Understanding how to use a mortgage calculator prepares buyers to navigate the financing tool, interpret its results, and ultimately aids them in the home purchasing process.