Overview

Navigating the world of balloon mortgages can be daunting, and we understand how challenging this can be for families looking to secure their homes. This article delves into the essential concepts of balloon mortgages, shedding light on how they function, their advantages, and the potential pitfalls they may pose.

Balloon mortgages can initially seem appealing due to their lower payments and flexibility. However, it’s crucial to recognize the significant risks involved, including the large final payment that could lead to financial strain or even foreclosure. We’re here to support you every step of the way in understanding these risks and planning accordingly.

As you consider your options, it’s important to weigh alternatives such as:

- Fixed-rate mortgages

- Adjustable-rate mortgages

These alternatives may provide a more stable financial path, allowing you to plan for the future with confidence. Remember, careful financial planning is key to making the best decision for your family’s needs.

Introduction

Understanding the intricacies of balloon mortgages is essential for anyone considering this unique financing option. We know how challenging it can be to navigate such decisions. These loans can offer enticing lower initial payments, but they come with the looming threat of a substantial final payment that can catch borrowers off guard. As families weigh the benefits of reduced monthly costs against the risks of potential financial strain, the question arises: is the allure of a balloon mortgage worth the gamble? This article delves into the key concepts, mechanics, and alternatives to balloon mortgages, equipping you with the knowledge needed to make informed decisions about your financial future. We’re here to support you every step of the way.

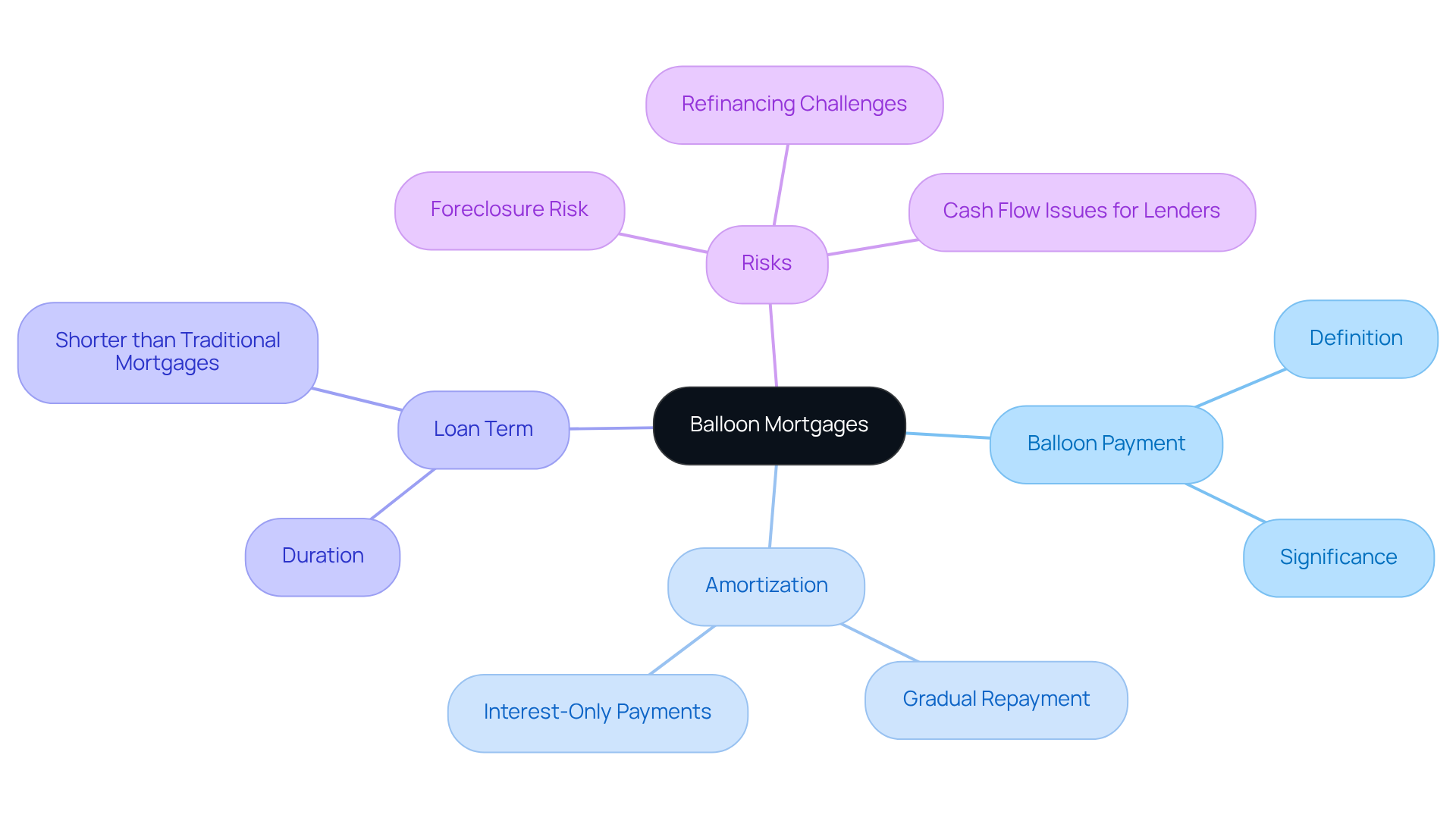

Define Balloon Mortgages: Key Concepts and Terminology

A type of mortgage can be a unique solution for families, offering reduced initial monthly costs for a specific period, typically five to seven years. At the end of this term, however, borrowers face a significant obligation: a lump-sum payment known as a ‘balloon sum’ to settle the remaining balance. This arrangement can be particularly appealing for those who plan to sell or refinance their property before this final payment is due.

Understanding the key terms associated with balloon mortgage is crucial.

- Balloon Payment: This is the substantial final payment required at the end of the loan term, which can be daunting if not anticipated properly.

- Amortization: This refers to the gradual repayment of a debt through regular payments. Yet, in some mortgage types, these payments may not fully cover the principal, leading to that significant final sum.

- Loan Term: The duration of the loan agreement is often shorter than traditional mortgages, which increases the likelihood of needing to make that final payment.

We know how challenging navigating loans can be, especially for those considering adjustable-rate mortgages as a viable short-term option. Although a balloon mortgage can lower monthly expenses, it’s important to recognize the potential risks, such as difficulties with refinancing and the possibility of foreclosure if the balloon payment cannot be met.

With thoughtful financial planning, families can effectively manage these challenges and make informed decisions that support their long-term goals. We’re here to support you every step of the way.

Explain How Balloon Mortgages Work: Payment Structures and Mechanics

Balloon mortgages can appear attractive at first because of their lower monthly costs, which might consist of just interest payments or a fraction of the principal. For example, a borrower might only pay interest for the first five years, after which the entire remaining balance becomes due. Understanding this structure is crucial to avoid unexpected financial strain associated with a balloon mortgage.

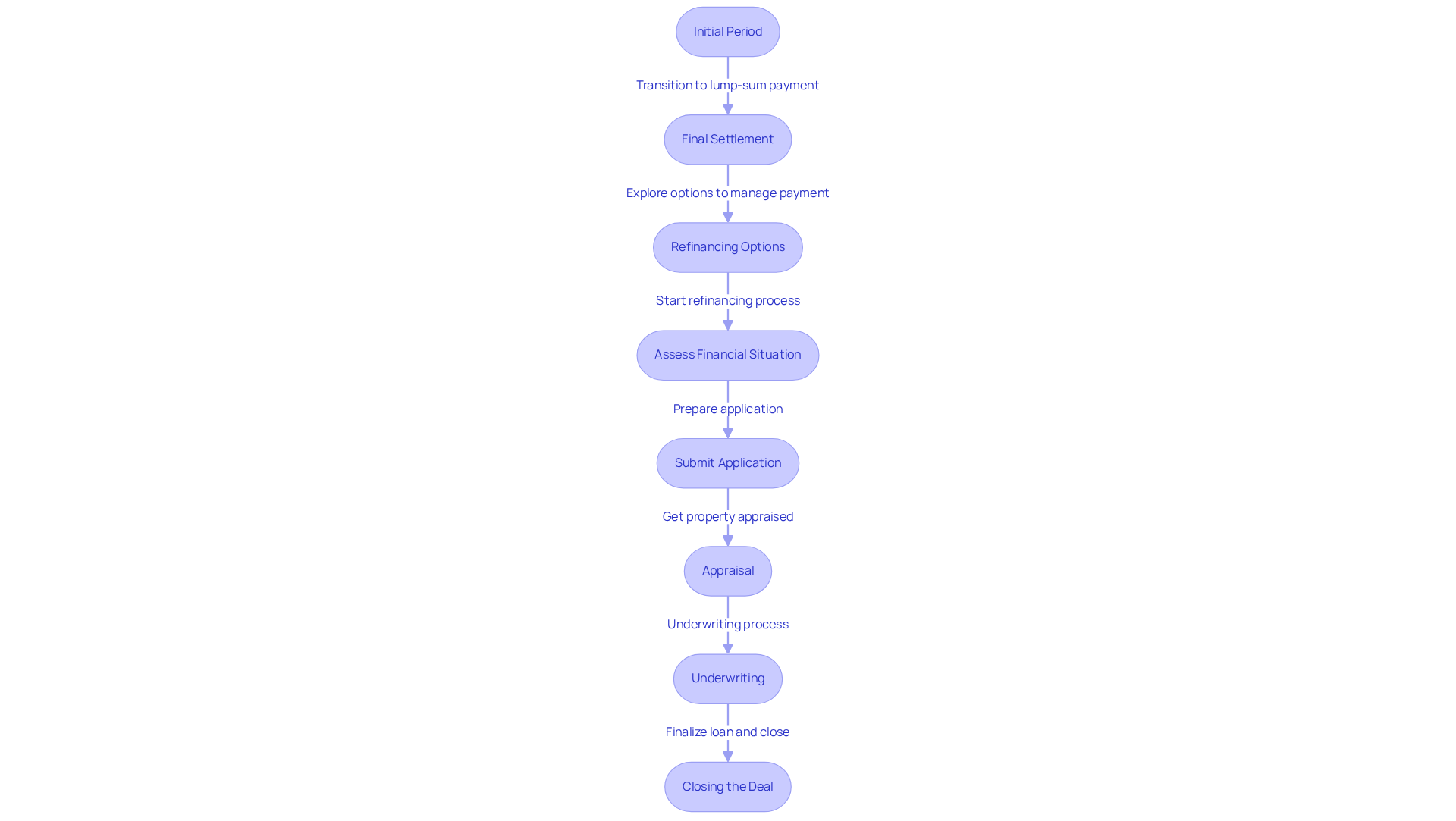

- Initial Period: During this time, borrowers benefit from lower payments, which can be interest-only or include partial principal repayment, typically lasting between 5 to 7 years. We know how challenging it can be to manage finances, especially with a large payment looming.

- Final Settlement: At the end of this term, a lump-sum payment of the remaining balance is required. This can create substantial financial pressure if adequate planning has not been undertaken.

- Refinancing Options: Many borrowers choose to refinance before the balloon payment is due, significantly reducing the risk of financial strain. To start this process, it’s essential to assess your financial situation and explore your refinancing options. While refinancing with your current lender is one option, comparing multiple lenders can help you find the best rates and terms.

Next, you’ll need to submit a refinancing application that includes information about your property and other financial documents. After that, an appraisal will determine your property’s current value. The underwriting process will evaluate your application, credit history, and debt-to-income ratio to finalize the credit approval. Once your application is accepted, you can close the deal, sign the new documents, and pay closing costs. Your new lender will then settle your initial borrowing, and your monthly mortgage payments will be directed to them.

It’s important to aim for a credit score above 650 to qualify for note approval. Understanding the mechanics of large final sums is essential for prospective borrowers. While a balloon mortgage can help lower initial expenses, it requires careful planning to avoid potential pitfalls. Financial specialists emphasize the importance of evaluating your financial stability and future income potential before committing to an adjustable mortgage. The looming final payment can lead to difficulties if not managed effectively.

Additionally, creating a savings strategy from the beginning of the financing period can help alleviate the burden of that large sum due. Remember, we’re here to support you every step of the way as you navigate this process.

Evaluate Pros and Cons of Balloon Mortgages: Weighing Benefits Against Risks

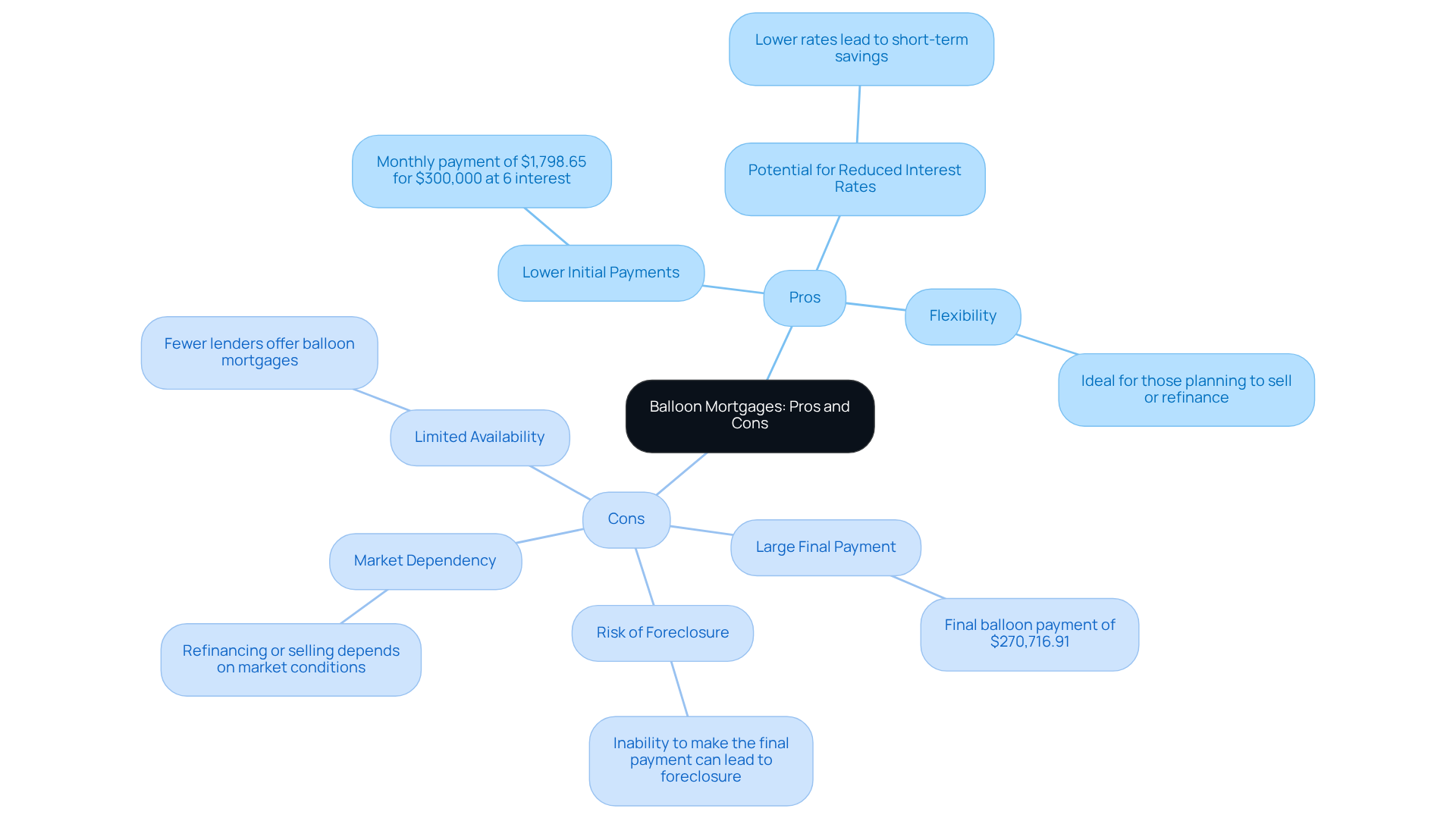

When considering a balloon mortgage, it’s essential to thoughtfully evaluate both the benefits and risks. We know how challenging this decision can be, so let’s explore the key points together:

Pros:

- Lower Initial Payments: Balloon mortgages typically feature lower monthly payments compared to traditional loans. This can be particularly appealing for families with short-term financial needs. For instance, a 7-year financing arrangement of $300,000 at a 6% interest rate results in monthly installments of roughly $1,798.65, enabling individuals to manage their cash flow effectively.

- Potential for Reduced Interest Rates with a Balloon Mortgage: These loans, such as a balloon mortgage, may offer lower interest rates, leading to significant savings in the short term. This is especially beneficial for those planning to sell or refinance before the final amount is due.

- Flexibility: A balloon mortgage can be a strategic choice for borrowers who anticipate selling their property or refinancing before the significant final amount is due. This flexibility allows for better management of financial obligations.

Cons:

- Large Final Payment: The most significant risk associated with balloon mortgages is the large balloon payment due at the end of the term. For example, at the end of a 7-year financing agreement, the remaining balance can reach $270,716.91. Without adequate preparation, this can lead to financial pressure. The overall loan expense totals $420,005.00, underscoring the importance of planning for this final sum.

- Risk of Foreclosure: If individuals cannot make the large final installment on their balloon mortgage, they may face the risk of foreclosure. This situation can have devastating effects on financial stability and credit ratings. Having a solid exit strategy is crucial to mitigate this risk.

- Market Dependency: The ability to refinance or sell the property before the balloon payment is due heavily depends on market conditions, which can be unpredictable. This dependency may create challenges for those without a robust exit strategy.

- Limited Availability: Balloon mortgages are becoming increasingly rare because many lenders opt not to offer balloon mortgages due to the associated risks. This scarcity can limit options for families seeking this type of financing.

In conclusion, while a balloon mortgage can provide reduced initial costs and flexibility, it also comes with considerable risks. It’s vital to thoroughly evaluate these factors and prepare accordingly. Remember, we’re here to support you every step of the way in making the best financial decision for your family.

Explore Alternatives to Balloon Mortgages: Options for Homebuyers

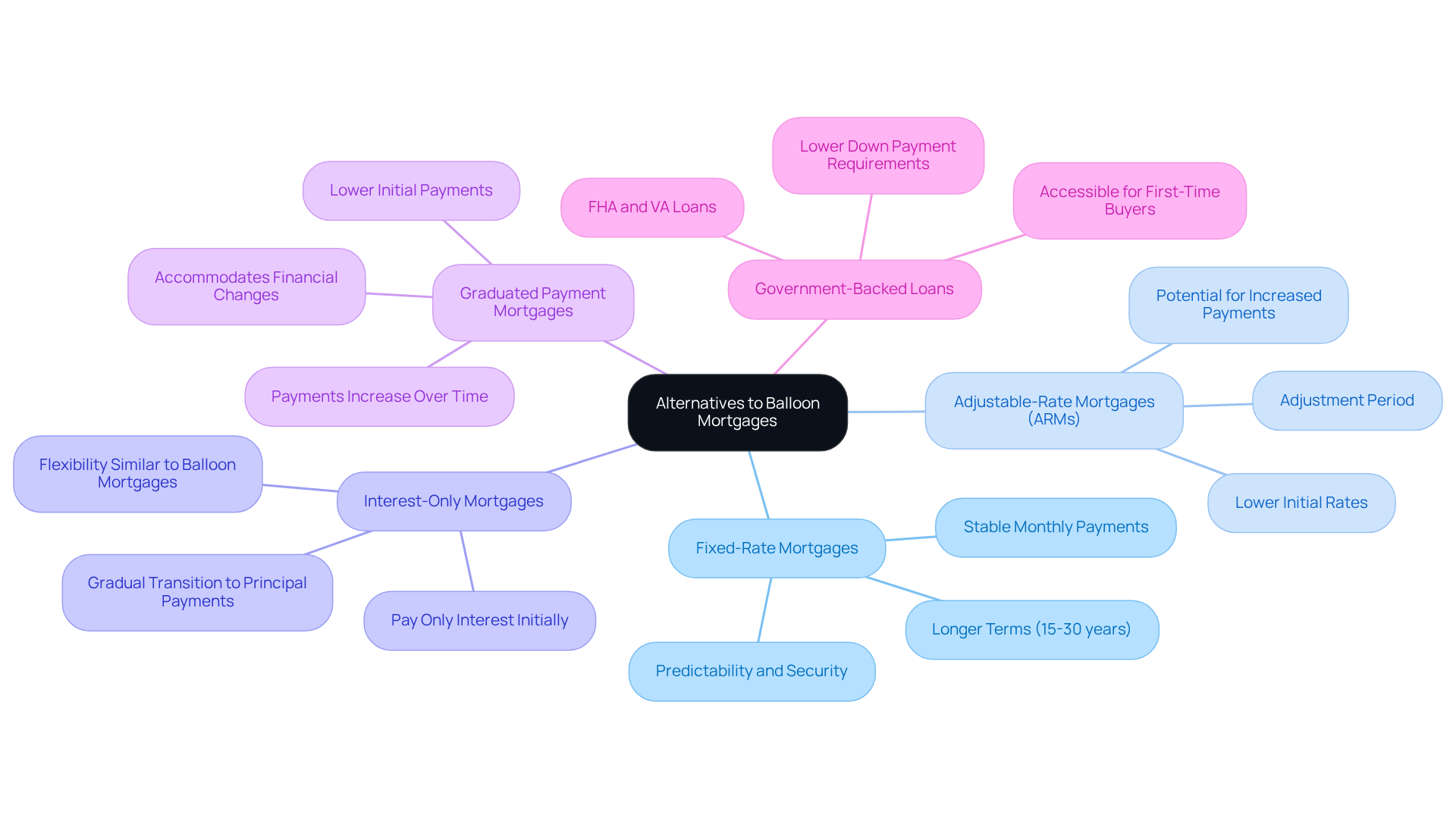

For those who may find balloon mortgages too risky, we understand that navigating your balloon mortgage options can feel overwhelming. Thankfully, several alternatives exist that can provide you with the stability and peace of mind you seek:

-

Fixed-Rate Mortgages: These loans offer stable monthly payments over a longer term, typically ranging from 15 to 30 years. This structure provides predictability and security, making it a popular choice among homebuyers who desire financial stability.

-

Adjustable-Rate Mortgages (ARMs): Starting with lower initial rates, ARMs adjust after a predetermined period. While they can lead to significant savings initially, it’s important to be aware of the potential for increased payments once the adjustment period begins.

-

Interest-Only Mortgages: These financial products allow borrowers to pay only the interest for a designated duration, after which they begin to reduce the principal. This option provides flexibility akin to balloon mortgages, yet allows for a more gradual transition to full repayment.

-

Graduated Payment Mortgages: With these products, payments start at a lower level and progressively increase over time. This structure can help you adjust to rising costs, accommodating changes in your financial circumstances.

-

Government-Backed Loans: FHA and VA loans provide competitive rates and terms, often with lower down payment requirements. These options are especially accessible for many homebuyers, including first-time buyers and those with unique financial situations.

As the landscape of mortgage options evolves, we know how challenging this can be. Understanding these alternatives empowers you to make informed decisions tailored to your financial goals. We’re here to support you every step of the way.

Conclusion

Balloon mortgages offer a unique financing option that many families find appealing due to their lower initial payments and flexibility. However, we understand how crucial it is to grasp the intricacies of this mortgage type to avoid potential pitfalls. The significant balloon payment due at the end of the loan term can pose a considerable risk if borrowers are not adequately prepared. It’s essential to weigh both the advantages and disadvantages before making a commitment.

In this article, we highlight key concepts such as:

- Balloon payments

- Amortization

- How balloon mortgages operate, including their payment structures

We discuss the pros, such as:

- Lower initial costs

- Potential savings

Against the cons, including:

- The risk of foreclosure

- Market dependency

Moreover, we emphasize the importance of thoughtful financial planning and exploring refinancing options to mitigate risks associated with balloon mortgages.

Ultimately, while balloon mortgages can serve as a short-term solution for many families, we encourage you to consider alternative mortgage options that may offer greater stability and predictability. By understanding all available choices, including:

- Fixed-rate mortgages

- Adjustable-rate mortgages

- Government-backed loans

You can make informed decisions that align with your long-term financial goals. Engaging in thorough research and seeking professional advice can pave the way for a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a balloon mortgage?

A balloon mortgage is a type of mortgage that offers reduced initial monthly costs for a specific period, usually five to seven years, after which borrowers must make a large final payment, known as a ‘balloon sum,’ to settle the remaining balance.

What is a balloon payment?

A balloon payment is the substantial final payment required at the end of the loan term, which can be significant and may be daunting if not anticipated properly.

What does amortization mean in the context of a balloon mortgage?

Amortization refers to the gradual repayment of a debt through regular payments. In some mortgage types, these payments may not fully cover the principal, resulting in a significant final payment due at the end of the term.

How does the loan term of a balloon mortgage differ from traditional mortgages?

The loan term for a balloon mortgage is often shorter than that of traditional mortgages, which increases the likelihood of needing to make a final balloon payment.

What are the potential risks associated with balloon mortgages?

Potential risks include difficulties with refinancing and the possibility of foreclosure if the borrower cannot meet the balloon payment at the end of the loan term.

How can families manage the challenges of a balloon mortgage?

With thoughtful financial planning, families can effectively manage the challenges of a balloon mortgage and make informed decisions that support their long-term financial goals.