Overview

Securing mortgage preapproval for purchasing a family home can feel overwhelming, but we’re here to support you every step of the way. This article outlines the essential steps to help you navigate this process with confidence.

- Gather the required documentation, as this is a crucial foundation for your application.

- Apply through a financial institution that aligns with your needs.

- Remember, enhancing your financial profile can significantly improve your chances of obtaining favorable loan terms.

We know how challenging this can be, but thorough preparation and a clear understanding of the mortgage landscape will empower you.

By taking these steps, you can approach the mortgage process with greater assurance, paving the way for a successful home purchase. Let’s embark on this journey together, ensuring you have the tools and knowledge to make informed decisions.

Introduction

Navigating the path to homeownership can often feel overwhelming. We know how challenging this can be, especially when it comes to securing financing. Mortgage preapproval stands out as a pivotal step in this journey. It offers buyers a clearer picture of their financial standing and strengthens their position in competitive markets.

However, many potential homeowners remain uncertain about the intricacies of this process and the documentation required to achieve it. What are the essential steps to successfully secure mortgage preapproval? How can families ensure they are well-prepared to seize their dream home? We’re here to support you every step of the way.

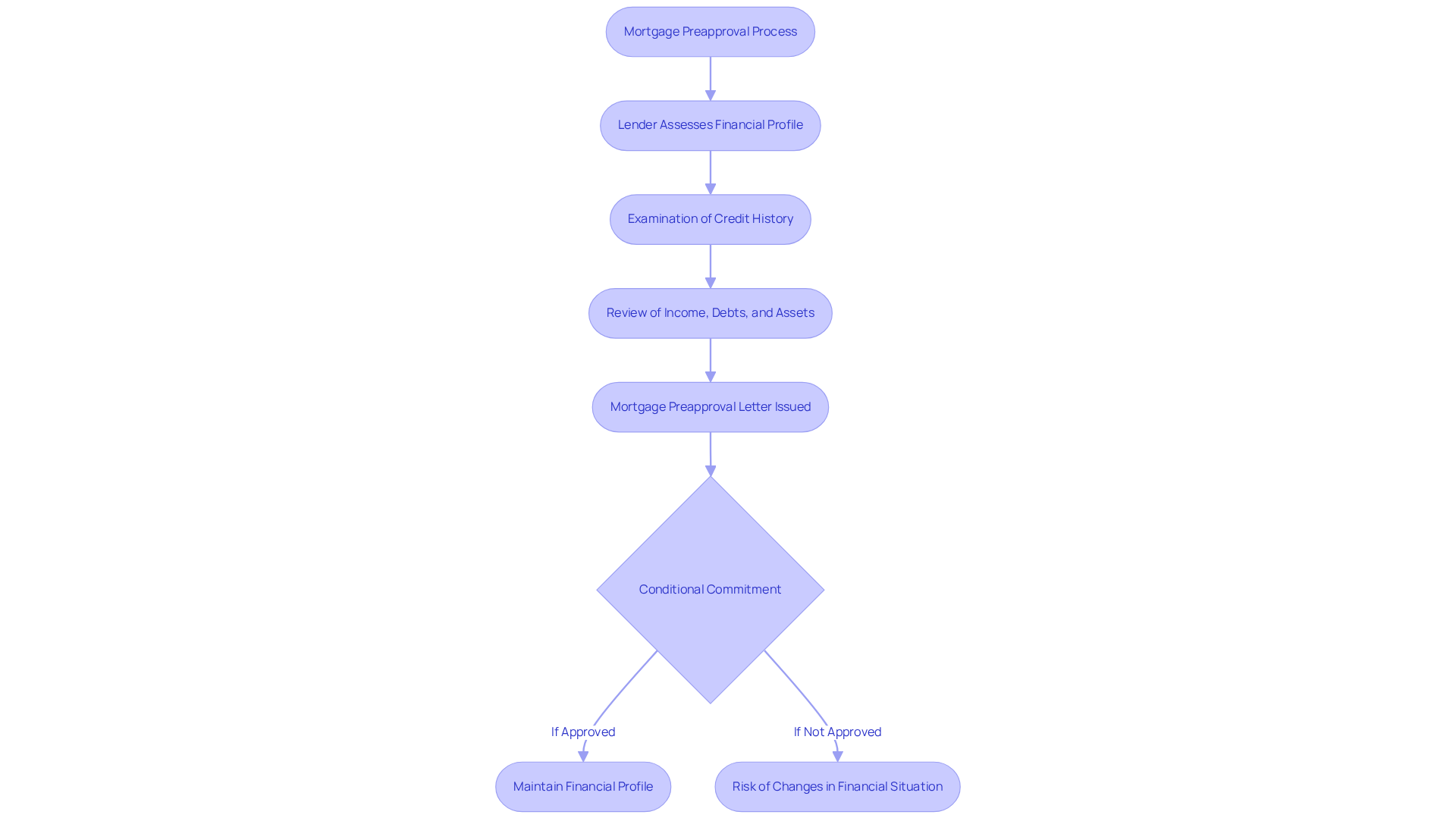

Understand Mortgage Preapproval

Mortgage preapproval is an essential step in . Here, a lender assesses your financial profile to determine how much they are willing to lend for your new home. This process involves a thorough examination of your credit history, income, debts, and assets. In 2025, around 85.76% of mortgage applications received approval, highlighting the significance of mortgage preapproval for securing financing. A mortgage preapproval letter not only indicates that you are a serious buyer but also enhances your position when making an offer on a home. Without this letter, you risk missing out on attractive properties, as many real estate agents will not arrange showings without it in hand.

Understanding the nuances of is crucial. While a mortgage preapproval letter indicates a lender’s willingness to fund your purchase, it is essential to remember that it does not guarantee a loan. This conditional commitment relies on the information provided during your application, meaning any changes in your financial situation could impact the final approval.

Successful stories of families navigating this journey illustrate its effectiveness. For instance, families who secured mortgage preapproval were able to act quickly in a competitive market, often making offers within hours of viewing a home. This agility can be critical, especially in a landscape where sellers may receive multiple offers.

Moreover, F5 Mortgage’s efficient application process guarantees approval in less than an hour, addressing common issues like high-interest rates and complex paperwork. By offering personalized consultations and access to various loan programs, F5 Mortgage empowers clients to make informed decisions, leading to higher satisfaction rates. This commitment to client education and support is evident in the brokerage’s impressive customer satisfaction rate of 94% and its successful track record of helping over 1,000 families achieve their homeownership dreams.

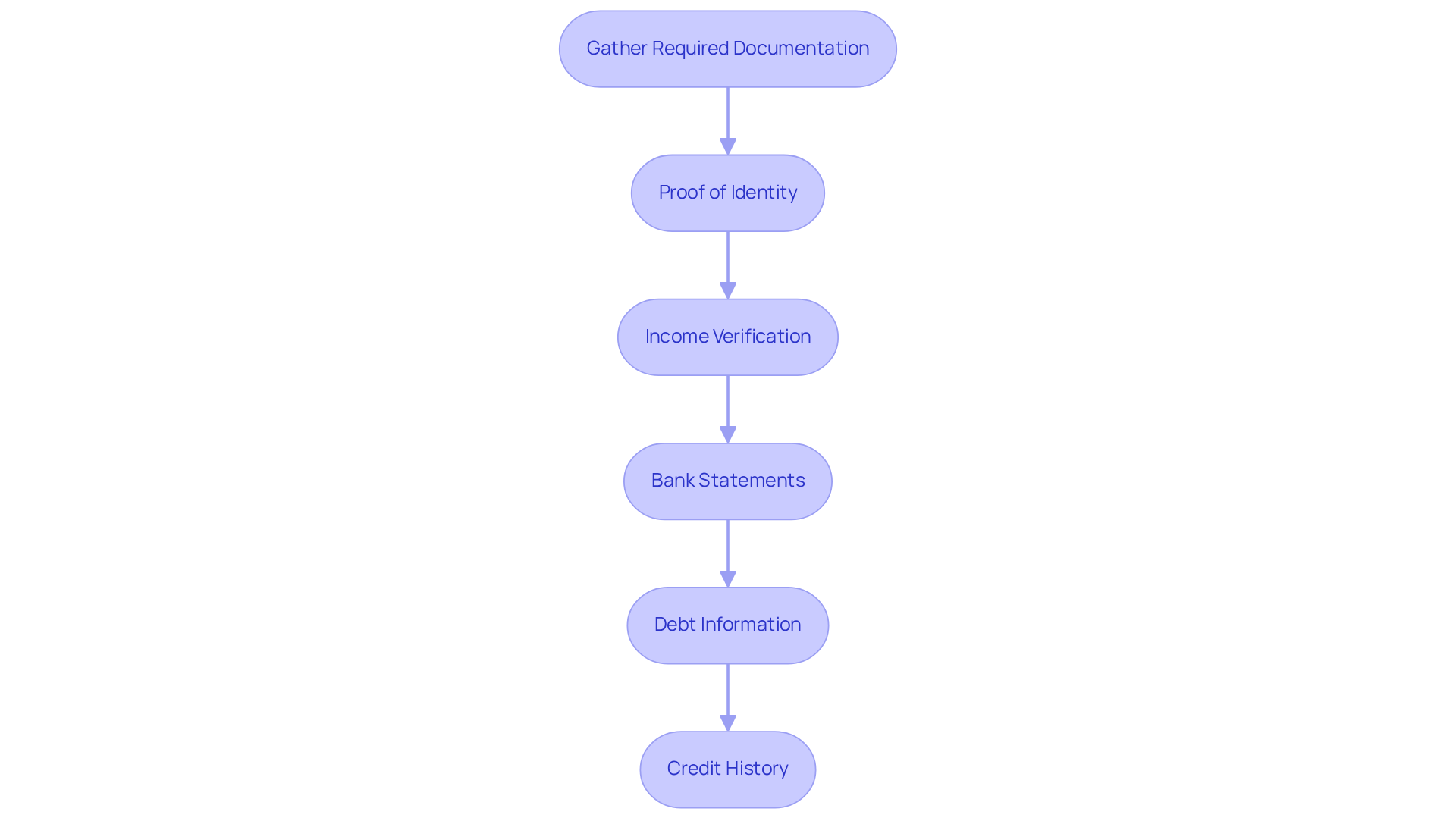

Gather Required Documentation

To obtain mortgage preapproval, we know how essential it is to gather several key documents that demonstrate your financial readiness. The average number of documents required typically includes:

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is necessary to confirm your identity and prevent fraud.

- Income Verification: Lenders require recent pay stubs, W-2 forms, and signed federal tax returns for the past two years to assess your income stability and reliability.

- Bank Statements: At least two months of bank statements are needed to verify your assets and ensure you have sufficient funds for the down payment and closing costs.

- Debt Information: Documentation of existing debts, including credit card statements and loan agreements, is crucial for calculating your debt-to-income ratio, which impacts your mortgage eligibility.

- Credit History: While financial institutions will access your credit report, examining it in advance for any discrepancies can assist you in resolving issues that might impact your approval.

We understand that being organized can feel overwhelming, but having these documents easily accessible can significantly . This preparation allows you to present a clear financial picture to lenders, showing your seriousness as a buyer. Ultimately, it can improve your chances of obtaining favorable loan terms, empowering you on your journey to homeownership.

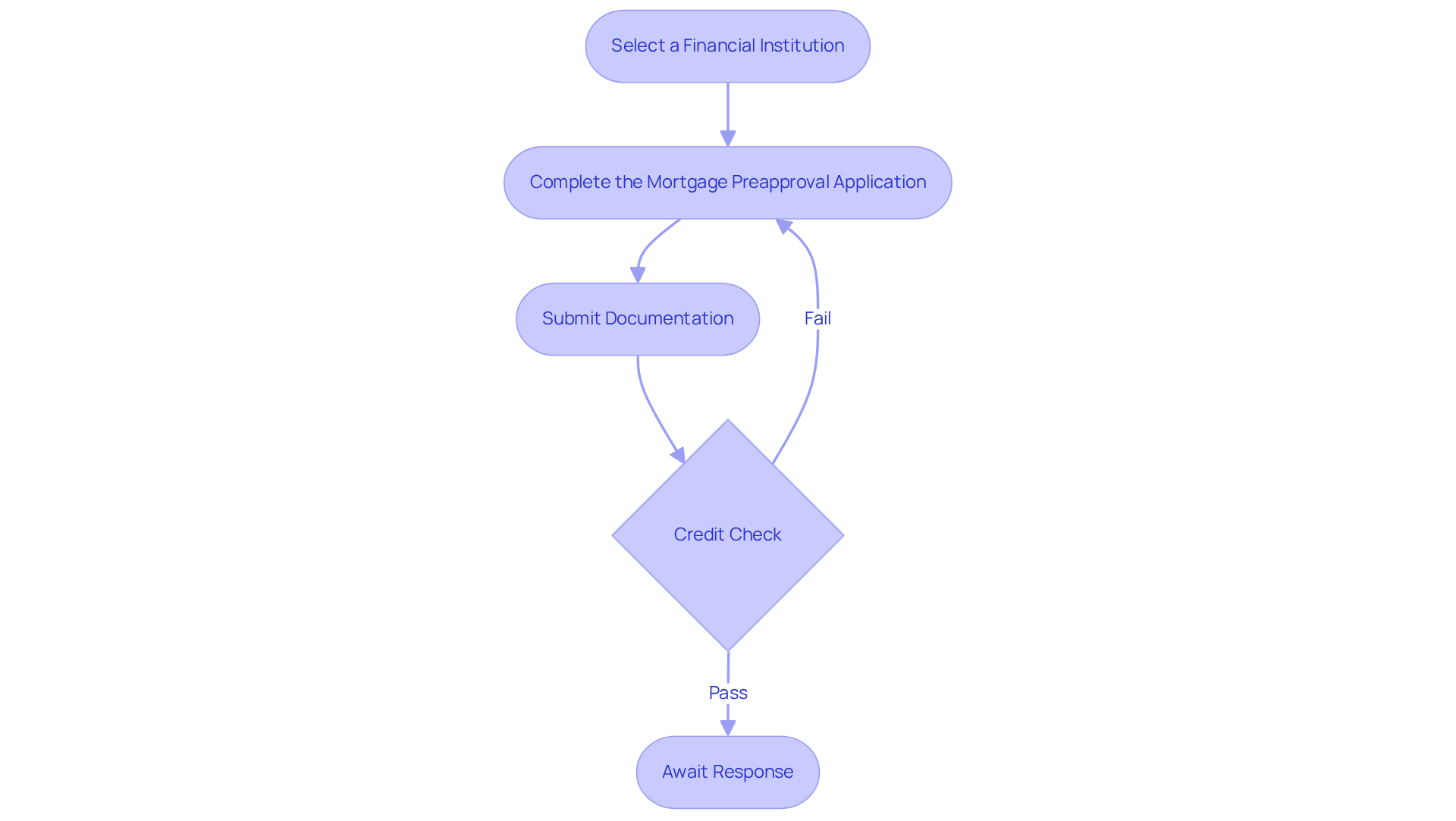

Apply for Mortgage Preapproval

To apply for mortgage preapproval, follow these essential steps:

- Select a Financial Institution: We know how overwhelming this process can be, so start by researching providers that offer competitive rates and favorable terms. Choosing an independent broker like F5 Mortgage can be especially beneficial, as they provide access to a wide range of financing sources, giving you more options.

- Complete the mortgage preapproval application: When filling out the application form, be sure to include accurate details about your financial situation. Honesty and thoroughness are key, as they help ensure a smooth process.

- For your mortgage preapproval, submit documentation by attaching all necessary documents to your application, including proof of income, tax returns, and bank statements. A complete submission can prevent delays, allowing you to move forward with confidence.

- Credit Check: The financial institution will conduct a credit review to assess your creditworthiness. This step is crucial—remember, a higher credit score can lead to better loan terms. To improve your credit score, consider ordering a copy of your credit report to check for errors, paying down existing debts, and making timely payments.

- Await the mortgage preapproval response: After you submit your application, the lender will review your documentation. This process typically takes a few hours to several days, but rest assured, we’re here to support you every step of the way.

Upon approval, you will receive a detailing the amount you are eligible to borrow. This gives you a significant advantage when negotiating with sellers. Our clients absolutely adore us, with 5/5 star reviews on Lending Tree, Google, and Zillow, highlighting the exceptional service provided by F5 Mortgage. This tailored service and varied loan options make collaborating with an independent financing broker a wise decision for your approval process.

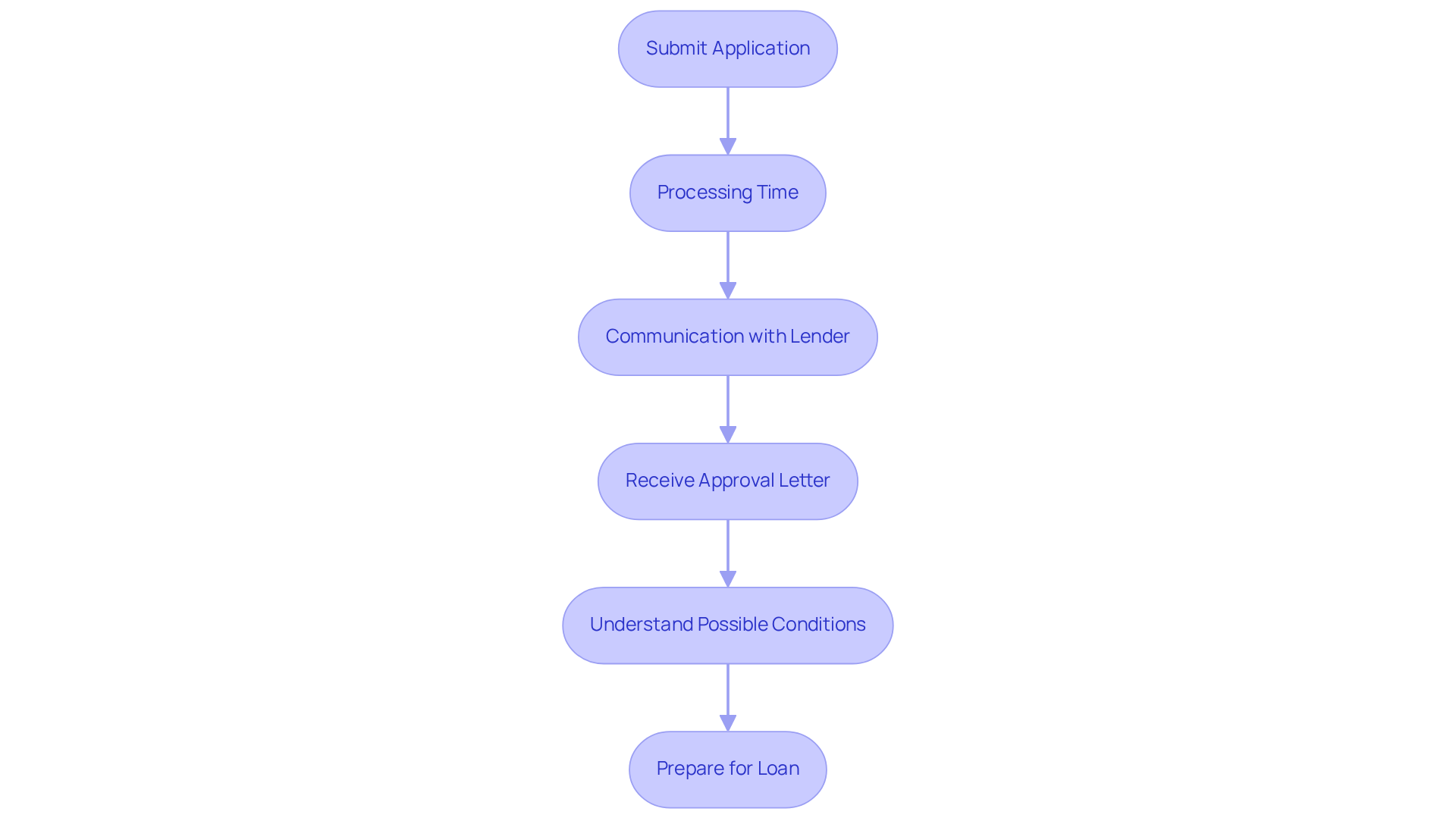

Know What to Expect After Application

After submitting your application for mortgage preapproval, you may wonder what comes next. Understanding the process can alleviate some of your concerns.

Processing Time: Lenders typically review applications within a timeframe that can range from a few hours to several days. This can depend on their current workload and how complete your documentation is. We know how important it is to have clarity during this time.

Communication: Expect the lender to reach out for any additional information or clarification. Timely responses are crucial to prevent delays in the process. Remember, we’re here to support you every step of the way.

Approval Letter: Once you receive approval, you will get a letter detailing the loan amount you qualify for. This letter is generally valid for 60 to 90 days, allowing you to shop for homes with confidence. If you do not get prior approval from one lender, don’t worry; you can still apply with others. It’s important to understand the reasons for any rejection so you can move forward.

Possible Conditions: Your initial approval may come with specific requirements that need to be met before final authorization, such as maintaining your financial status or providing additional documentation. It’s essential to recognize that initial approval does not guarantee complete loan approval, which requires a purchase agreement.

Moreover, reviewing your credit score before seeking prequalification is a vital step in preparing for the loan procedure. Being aware of these elements will empower you to navigate the loan approval process effectively.

At F5 Mortgage, we offer , such as the FL Assist and MI Home Loan programs. These can provide up to $10,000 to help with your down payment or closing costs. Designed to enhance , these programs are tailored to meet your needs. Our clients have expressed their satisfaction with our services, sharing how our team has guided them through the complexities of securing financing. With our support, you can confidently transition into your new home.

Enhance Your Financial Profile

To enhance your before applying for a mortgage preapproval, we recognize that taking the right steps can feel daunting. Here are some thoughtful strategies to consider:

- Improve Your Credit Score: Focus on paying down existing debts and ensuring all payments are made on time. Avoid opening new credit lines prior to applying, as this can negatively impact your score. Setting up automatic payments and monitoring your credit report can help you stay on track and feel more in control.

- Increase Your Income: Explore opportunities for additional income, such as part-time work or freelance projects. This can improve your debt-to-income ratio, making you a more appealing candidate for lenders. Even small increases in income can significantly enhance your overall financial profile.

- Save for a Larger Down Payment: A larger down payment not only reduces your loan amount but also boosts your chances of approval. In January 2025, the median down payment on a home in the U.S. was approximately $54,310, representing about 15% of the median sale price of $362,000. Additionally, in Ohio, you can access down payment assistance programs like YourChoice!, Grant for Grads, and Ohio Heroes. These programs can provide anywhere from a few thousand dollars to over $30,000, with options for loans that may be repaid or forgiven, or grants that require no repayment. This support can help you save more and avoid private mortgage insurance (PMI).

- Maintain Stable Employment: We know how important it is for lenders to see consistent employment histories. Avoid changing jobs during the approval process, as stability can positively influence your chances of being approved. If you are considering a job change, ensure it aligns with your financial goals and does not disrupt your income flow.

By implementing these strategies, you can significantly strengthen your financial profile for mortgage preapproval. Remember, we’re here to support you every step of the way, helping to make you a more attractive candidate for mortgage preapproval.

Conclusion

Securing mortgage preapproval is a pivotal step in your journey toward homeownership. It provides you with a clear understanding of your financial standing and lending potential. This essential process not only enhances your position in a competitive market but also streamlines the home buying experience, allowing you and your family to act swiftly when the right property comes along.

We understand how challenging this can be, so let’s navigate the mortgage preapproval process together. The article outlines five crucial steps to help you effectively manage this journey:

- Grasping the significance of preapproval

- Gathering necessary documentation

- Applying

- Enhancing your financial profile

- Ensuring a successful outcome

Remember, maintaining a stable financial situation, providing accurate documentation, and working with a knowledgeable broker like F5 Mortgage can simplify the process and increase your chances of approval.

Ultimately, taking proactive steps toward mortgage preapproval empowers you as a potential homebuyer. It opens doors to better financing options and favorable terms. By preparing adequately and understanding the nuances of the process, you can confidently embark on your journey to homeownership. This preparation allows you to make informed decisions that will positively impact your financial future. Embracing these strategies is crucial for anyone looking to secure their dream home efficiently and effectively.

Frequently Asked Questions

What is mortgage preapproval?

Mortgage preapproval is a process where a lender assesses your financial profile to determine how much they are willing to lend for a new home. It involves examining your credit history, income, debts, and assets.

Why is mortgage preapproval important?

Mortgage preapproval is important because it indicates you are a serious buyer and enhances your position when making an offer on a home. Without it, you may miss out on attractive properties, as many real estate agents require it before arranging showings.

Does a mortgage preapproval guarantee a loan?

No, a mortgage preapproval does not guarantee a loan. It is a conditional commitment based on the information provided during your application, and any changes in your financial situation could affect final approval.

How can mortgage preapproval benefit buyers in a competitive market?

Buyers with mortgage preapproval can act quickly, often making offers within hours of viewing a home. This agility is crucial in competitive markets where sellers may receive multiple offers.

What documentation is required for mortgage preapproval?

The key documents required for mortgage preapproval typically include: – Proof of Identity (government-issued photo ID) – Income Verification (recent pay stubs, W-2 forms, and tax returns for the past two years) – Bank Statements (at least two months of statements) – Debt Information (documentation of existing debts) – Credit History (reviewing your credit report for discrepancies)

How does being organized help in the mortgage preapproval process?

Being organized with the required documents can significantly speed up the approval process and present a clear financial picture to lenders, improving your chances of obtaining favorable loan terms.

What is F5 Mortgage’s approach to the mortgage preapproval process?

F5 Mortgage offers an efficient application process that guarantees approval in less than an hour, along with personalized consultations and access to various loan programs, leading to higher customer satisfaction rates.