Overview

We understand that managing a mortgage can be overwhelming, but paying it off early can truly enhance your financial well-being. Imagine saving on interest payments, increasing your cash flow, and gaining a sense of financial security. These benefits are not just numbers; they represent a brighter future for you and your family.

To help you navigate this journey, we’ve outlined several compassionate strategies. Consider:

- Making extra payments

- Switching to biweekly installments

- Refinancing to a shorter term

Each of these steps can lead to significant savings and greater financial freedom.

We know how challenging this can be, but with these actionable steps, you can take control of your finances. Remember, you’re not alone in this process; we’re here to support you every step of the way. Let’s work together to achieve the peace of mind that comes with financial stability.

Introduction

Paying off a mortgage early is a financial goal that many homeowners aspire to achieve. We understand how daunting this journey can feel. The benefits of early mortgage payoff extend beyond mere savings; they encompass improved cash flow, enhanced financial security, and even emotional peace. However, navigating the complexities of mortgage management raises critical questions:

- What strategies can effectively accelerate payments?

- What challenges might arise along the way?

This guide delves into the steps necessary to not only pay off a mortgage early but also to enhance your overall financial well-being. We’re here to support you every step of the way.

Understand the Benefits of Early Mortgage Payoff

Paying off mortgage early can bring a wealth of benefits, and we know how important it is to consider these options thoughtfully.

-

Savings on Charges: By lowering your principal balance sooner, you can significantly reduce the total fees over the life of your loan. For instance, a $200,000 loan at a 4% interest rate can lead to savings of thousands if paid off early. In fact, if you pay off your mortgage early, you could save about $6,494.16 in interest and shorten your repayment timeline by 39 months. Most loans don’t impose prepayment penalties, which enables you to pay off mortgage early by making extra payments without incurring fees.

-

Increased Cash Flow: Once your mortgage is settled, you can free up a significant portion of your monthly budget. This newfound cash flow can be redirected towards savings, investments, or other financial goals, improving your overall economic health.

-

Financial Security: Owning your home outright offers a sense of security and stability, especially during uncertain economic times. This financial freedom can protect you from potential foreclosure during tough times, enabling you to face challenges with greater confidence. However, it’s essential to keep in mind that if you pay off mortgage early, it may mean losing tax benefits related to interest deductions.

-

Emotional Peace: The psychological advantages of being debt-free are profound. Many homeowners experience a significant sense of relief and accomplishment when they pay off mortgage early, leading to enhanced well-being and reduced stress. As expert Holly Johnson notes, “While settling our loan early may not be the most favorable mathematical option, it’s the choice that will allow my partner and me to rest peacefully at night.”

-

Adaptability for Future Objectives: Without monthly housing payments, you can allocate your financial resources towards retirement savings, travel, or other personal aspirations. This flexibility can enhance your quality of life and empower you to pursue your dreams without the burden of monthly payments. However, consider that funds used for loan prepayment might yield higher returns if invested wisely. Additionally, be mindful of liquidity issues related to home equity, as tying up funds in your home can limit access to cash for other needs.

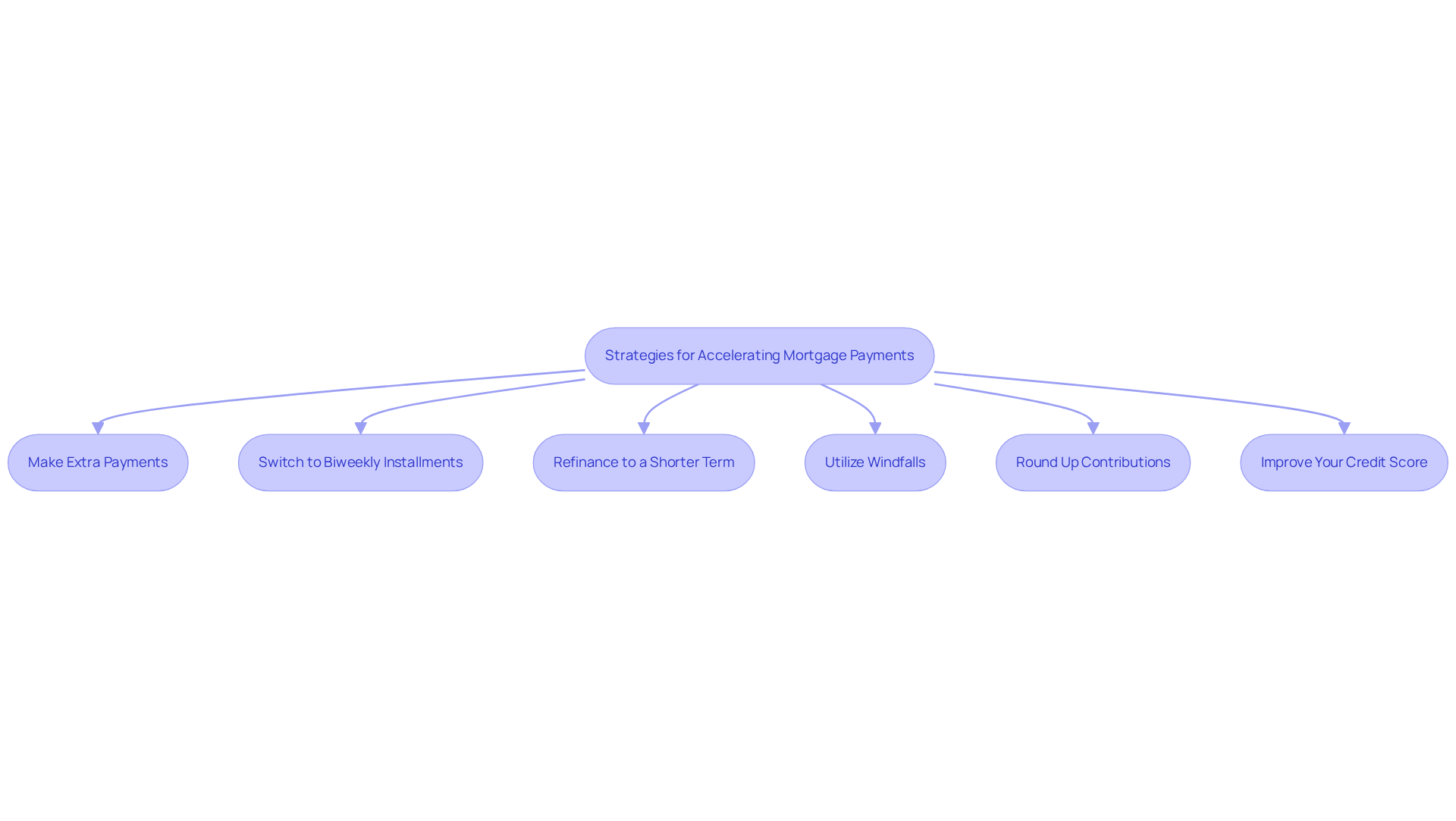

Implement Effective Strategies for Accelerated Payments

We understand how challenging it can be to pay off mortgage early by accelerating your payments. Here are some strategies that may help you on your journey:

-

Make Extra Payments: Whenever feasible, consider allocating any extra funds towards your loan principal. Even minor contributions can lead to significant savings on charges, which can greatly reduce the duration of your loan and help you pay off mortgage early. For instance, making just one additional mortgage contribution each year can save you thousands in interest over the life of the loan.

-

Switch to Biweekly Installments: Shifting from monthly to biweekly installments can truly be a game-changer. This approach results in 13 full payments each year instead of the standard 12, effectively reducing your loan balance faster. Homeowners who embrace this method can pay off mortgage early, which allows them to reduce years from their loan term and save thousands in financing expenses.

-

Refinance to a Shorter Term: If you can secure a lower borrowing rate, refinancing to a 15- or 20-year loan could be beneficial. Shorter-term loans generally feature reduced interest rates, allowing you to save considerably on interest while helping you to pay off mortgage early. Additionally, if you acquired your home with less than 20% down, refinancing might enable you to eliminate private insurance (PMI), further lowering your monthly costs.

-

Utilize Windfalls: Unexpected financial gains, such as tax refunds, bonuses, or inheritances, should be directed towards your mortgage principal. This can dramatically impact your overall loan balance and accelerate your path to homeownership if you choose to pay off mortgage early.

-

Round Up Contributions: Think about increasing your monthly contributions to the nearest hundred. For example, if your payment is $2,661.21, rounding it up to $2,700 means that the additional amount directly decreases your principal, which helps you pay off mortgage early and reduces interest expenses over time.

-

Improve Your Credit Score: To enhance your loan opportunities, request a copy of your credit report to look for errors or discrepancies. Paying down existing debts can reduce your debt-to-income ratio, making you a more attractive candidate for refinancing options. Using credit wisely by avoiding large purchases and making timely payments can also improve your score, potentially leading to better loan terms.

We’re here to support you every step of the way as you work towards your financial goals.

Recognize Common Challenges and Considerations

Paying off your mortgage early can provide significant benefits, but we understand how challenging this decision can be. It’s essential to consider several factors carefully:

-

Prepayment Penalties: Many loan agreements include prepayment penalties. This can reduce the financial benefits of paying off your loan early. In fact, as of Q2 2017, approximately 2.4% of loans were subject to these penalties. We encourage you to examine your loan conditions closely to recognize any provisions that could impact your savings.

-

Opportunity Cost: The funds you plan to use to settle your loan might generate higher returns if invested elsewhere. For instance, paying off a $300,000 loan at a 5% rate after 20 years could save over $40,000 in interest expenses. However, those funds could potentially earn more if invested in other options. It’s important to assess the advantages of paying off mortgage early compared to the returns you might achieve through other investments, especially in a market where loan rates have risen considerably since the early 2020s.

-

Emergency Fund: Before allocating extra funds toward your loan, ensure that you have a robust emergency fund in place. Focusing on loan repayment should not jeopardize your safety net, as unexpected costs can arise at any moment. We’re here to support you in maintaining that balance.

-

Budget Limitations: Increasing your loan installments can impose additional pressure on your finances. It’s crucial to evaluate your financial situation thoroughly to ensure that you can manage increased payments without compromising your ability to meet other essential expenses.

-

Long-Term Monetary Goals: Consider how to pay off mortgage early in alignment with your broader financial objectives, such as saving for retirement or funding education. Finding equilibrium between settling your loan and achieving other monetary goals is vital for preserving your overall financial well-being. If you’re feeling uncertain about your financial journey, we recommend consulting a financial advisor for personalized guidance. Remember, you’re not alone in this process.

Utilize Resources and Tools for Successful Mortgage Management

Managing your mortgage can feel overwhelming, but there are resources that can make the journey easier for you. Here are some tools to consider:

- Loan Payoff Calculators: Online tools are essential for estimating how additional payments can affect your loan term and interest savings. Websites like Ramsey Solutions and Bankrate offer user-friendly interfaces that simplify this process, helping you see the impact of your efforts.

- Budgeting Apps: Implementing budgeting apps such as EveryDollar or Mint can significantly aid in tracking your expenses. These applications help you pinpoint areas where you can allocate extra resources toward your mortgage, keeping your financial goals in focus. Many users of budgeting applications report improved money management, often saving considerable sums over time.

- Financial Advisors: Consulting with a financial advisor can provide personalized insights tailored to your unique situation. They can assist you in developing a strategic plan that aligns with your objectives, simplifying the complexities of financial management.

- Loan Management Applications: Consider using applications like Sprive or Payoff Track, which enable you to monitor your loan balance and progress. These tools make it easier to stay on track with your payoff goals, offering real-time updates and reminders that keep you motivated.

- Educational Resources: Leverage educational materials, such as F5 Mortgage’s comprehensive home buyer’s guide and refinancing guides. These resources enhance your understanding of loan options and strategies that can help you pay off mortgage early, empowering you to make informed choices throughout your financing journey.

- Improve Your Credit Score: Take the time to order a copy of your credit report and check for errors or discrepancies. Paying down existing debts can help reduce your debt-to-income ratio. Use credit wisely by avoiding large purchases and making timely payments. Improving your credit score can significantly enhance your mortgage opportunities, making it easier to secure favorable terms for your home upgrade.

We understand how challenging this process can be, but with these resources, we’re here to support you every step of the way.

Conclusion

Paying off a mortgage early is a strategic financial move that offers numerous advantages, from saving on interest to achieving emotional peace. We know how challenging this can be, but by understanding the benefits and implementing effective strategies, homeowners can take significant steps toward financial freedom. The journey to early mortgage payoff is not just about eliminating debt; it’s about enhancing overall economic well-being and securing a stable future.

Key insights discussed include:

- The importance of making extra payments

- Switching to biweekly installments

- Utilizing unexpected financial gains to reduce principal balances

Additionally, we’re here to support you in considering potential challenges such as:

- Prepayment penalties

- Opportunity costs

These are crucial for making informed decisions. Balancing mortgage repayment with other financial goals is essential, ensuring a holistic approach to personal finance management.

Ultimately, the decision to pay off a mortgage early can lead to a wealth of benefits, fostering a sense of security and freedom. With the right tools and strategies, homeowners can confidently navigate their financial journeys. Embracing this proactive approach not only alleviates the burden of debt but also empowers individuals to pursue their aspirations and achieve lasting financial stability.

Frequently Asked Questions

What are the benefits of paying off a mortgage early?

Paying off a mortgage early can lead to significant savings on interest charges, increased cash flow, enhanced financial security, emotional peace, and greater adaptability for future financial goals.

How much can I save in interest by paying off my mortgage early?

For example, on a $200,000 loan at a 4% interest rate, you could save approximately $6,494.16 in interest and shorten your repayment timeline by 39 months if paid off early.

Are there any penalties for paying off my mortgage early?

Most loans do not impose prepayment penalties, allowing you to make extra payments without incurring fees.

How does paying off my mortgage impact my monthly budget?

Once your mortgage is settled, you can free up a significant portion of your monthly budget, allowing you to redirect funds towards savings, investments, or other financial goals.

What sense of security does owning a home outright provide?

Owning your home outright offers a sense of security and stability, particularly during uncertain economic times, and can protect you from potential foreclosure.

Are there any tax implications to consider when paying off my mortgage early?

Yes, paying off your mortgage early may result in losing tax benefits related to interest deductions.

What psychological benefits come from being debt-free?

Many homeowners experience a significant sense of relief and accomplishment when they pay off their mortgage early, leading to enhanced well-being and reduced stress.

How does paying off a mortgage early affect future financial goals?

Without monthly housing payments, you can allocate resources towards retirement savings, travel, or other personal aspirations, enhancing your quality of life.

Should I consider investing instead of paying off my mortgage early?

Yes, consider that funds used for loan prepayment might yield higher returns if invested wisely, and be mindful of liquidity issues related to home equity.