Overview

The article highlights the steps to secure a $100 down HUD home, emphasizing how this initiative opens doors to affordable housing for qualified buyers. We understand that navigating the homeownership process can be daunting, but this program offers a pathway to your dream home. It outlines the eligibility criteria, application process, and potential challenges, ensuring you are well-informed every step of the way.

This program not only facilitates homeownership for individuals but also plays a vital role in revitalizing communities by filling vacant homes. We know how challenging this can be, but with the right information and support, you can seize this opportunity. Let’s explore how you can take the first steps toward homeownership and contribute to a thriving community.

Introduction

Navigating the path to homeownership can often feel daunting, especially for those seeking affordable housing options. We understand how challenging this can be. The $100 down HUD homes initiative presents a remarkable opportunity for qualified buyers to secure a home with a minimal upfront investment. This makes it particularly appealing for first-time purchasers and those facing financial constraints.

However, as enticing as this program may be, potential buyers encounter challenges such as competitive bidding and the condition of the properties. How can aspiring homeowners effectively maneuver through these obstacles to make their dream of owning a home a reality? We’re here to support you every step of the way.

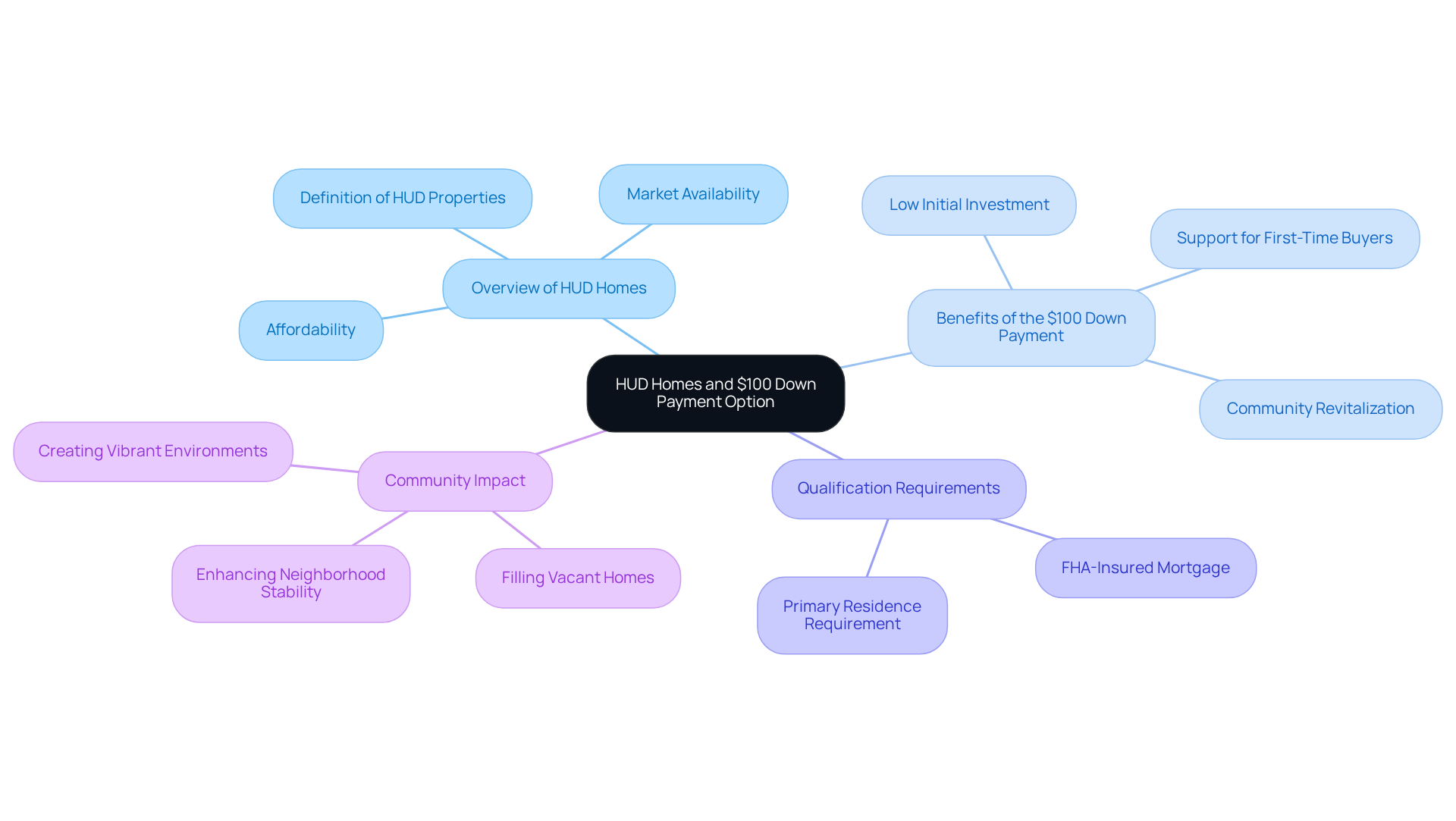

Understand HUD Homes and the $100 Down Payment Option

HUD properties are homes that have been foreclosed and are now in the care of the U.S. Department of Housing and Urban Development (HUD). These residences are often available at below-market prices, making them an excellent option for families seeking affordable housing. One standout initiative is the $100 down HUD homes program, enabling qualified buyers to purchase these homes with a minimal initial investment. This accessibility is especially beneficial for first-time buyers and those facing financial constraints.

To qualify for this program, buyers need to secure an FHA-insured mortgage and plan to live in the property as their primary residence. This initiative not only supports individual homeownership but also plays a vital role in revitalizing communities by filling vacant homes. By doing so, it enhances neighborhood stability and growth, creating a more vibrant environment for all.

Recent data indicates that a significant number of HUD properties are sold below market value, highlighting the program’s impact on making homeownership attainable for countless families. We understand how challenging this journey can be, and we’re here to support you every step of the way in finding a home that fits your needs.

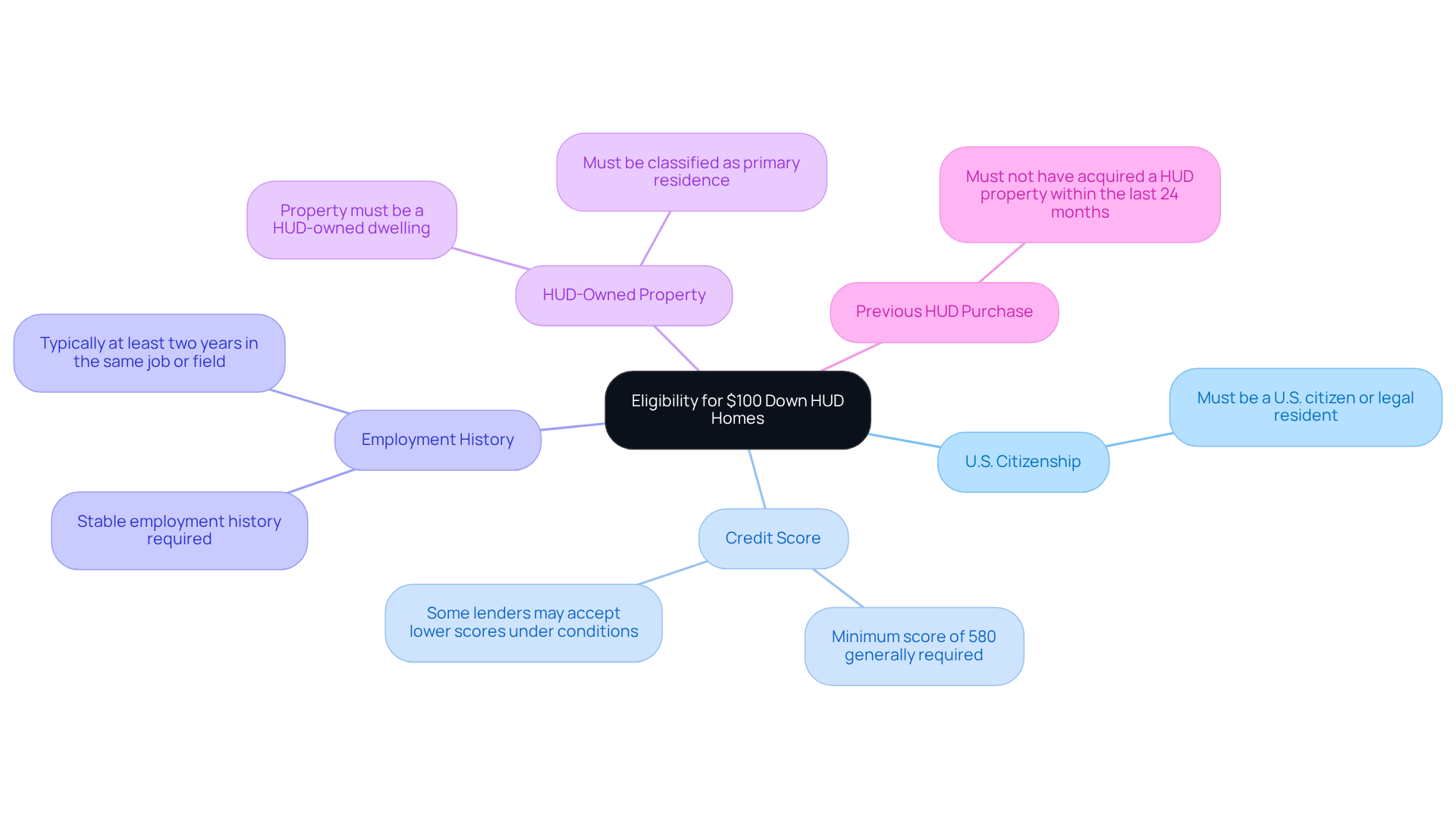

Determine Eligibility for $100 Down HUD Homes

We understand how challenging it can be to navigate the path to homeownership. To help you take that important step, here are the specific criteria to qualify for the $100 down payment program:

- You must be a U.S. citizen or a legal resident.

- A minimum credit score of 580 is generally required, although some lenders may accept lower scores under certain conditions.

- It’s essential to demonstrate a stable employment history, typically needing at least two years in the same job or field.

- The property you wish to purchase must be a HUD-owned dwelling and classified as your primary residence, particularly if you are looking at $100 down HUD homes.

- Lastly, you must not have acquired a HUD property within the last 24 months.

Meeting these requirements is crucial for moving forward in the application process. We’re here to support you every step of the way, ensuring you are well-prepared to take advantage of this affordable homeownership opportunity.

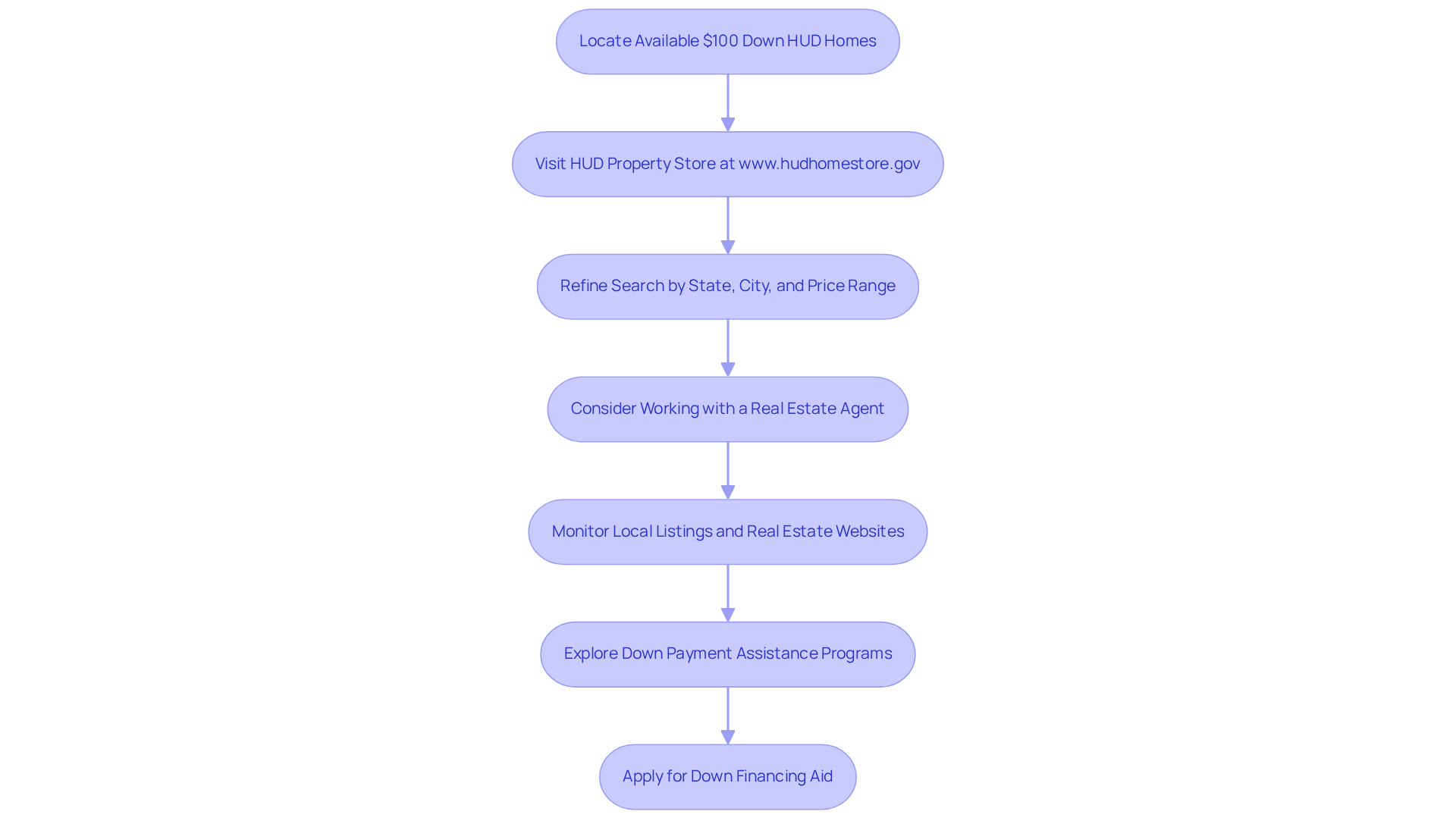

Locate Available $100 Down HUD Homes

Finding $100 down HUD homes eligible for the payment initiative can feel overwhelming, but we’re here to guide you every step of the way. Start by visiting the HUD Property Store website at www.hudhomestore.gov. This platform features a comprehensive list of HUD-owned properties currently available for purchase, allowing you to refine your search by state, city, and price range. In the Charlotte region, you will find HUD properties priced between $10,000 and $275,000, giving you a clear understanding of what to expect.

Working with a real estate agent who specializes in HUD properties can make a significant difference. They can offer valuable insights and assist you throughout the bidding process, ensuring you feel supported. Remember, HUD auctions last for 15 days and prioritize owner-occupant bids, which adds a competitive edge to your purchasing journey.

Stay informed by monitoring local listings and real estate websites, as they frequently showcase HUD properties. This will help you discover new opportunities as they arise. To further enhance your buying capacity, consider exploring down payment assistance initiatives offered by F5 Mortgage. Programs like the Golden State Finance Authority’s Open Doors program can contribute up to 7% of the main financing amount toward closing expenses, making your offer more competitive and lowering your total financing amount.

Take that initial step toward obtaining your ideal residence by applying for down financing aid today! We know how challenging this process can be, but with the right support, you can achieve your homeownership dreams.

Navigate the Application Process for HUD Homes

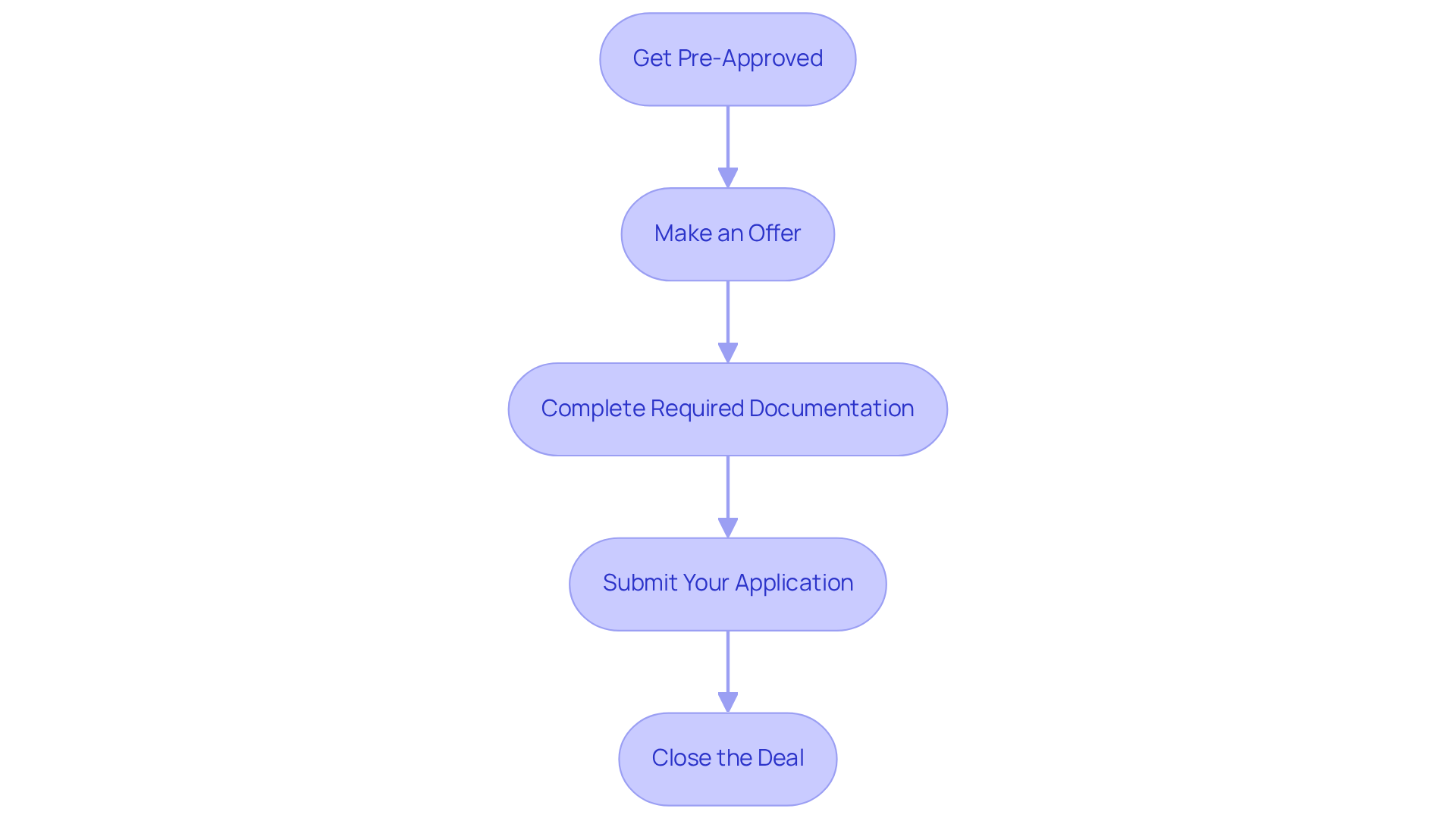

Navigating the application process for $100 down HUD homes can feel overwhelming, but we’re here to support you every step of the way. Here are some essential steps to guide you through this journey:

-

Get Pre-Approved: Start by obtaining pre-approval for an FHA mortgage from a lender. FHA mortgages require a deposit of just 3.5%, making them a budget-friendly choice for many buyers. This step not only clarifies your budget but also strengthens your offer, helping you stand out as a competitive buyer. At F5 Mortgage, we offer options that may allow you to qualify for a property with as little as 3% down or even 0% down for specific financing types.

-

Make an Offer: Once you find a suitable HUD home, submit a full-price offer through your real estate agent, ensuring it includes the $100 down HUD homes option. It’s common to ask the seller for repairs or upgrades as part of your offer, which can be a strategic move in negotiations.

-

Complete Required Documentation: Gather necessary documents such as proof of income, credit history, and employment verification to support your application. We know how challenging this can be, but having everything ready will make the process smoother.

-

Submit Your Application: After your offer is accepted, proceed with the FHA financing application process with your lender. Ensure all required information is accurately provided. Your lender will send you a Loan Estimate outlining the fees and costs of your loan. Keep in mind these numbers could change by up to 10% prior to closing. Before you close, your lender will provide a Closing Disclosure detailing your final numbers, so you can see exactly what you’re paying for.

-

Close the Deal: Upon approval, finalize the closing process, which typically spans a few weeks. Be prepared for inspections and any necessary repairs, as these are crucial to completing your property purchase successfully. Many buyers have successfully navigated this process, demonstrating its effectiveness.

By following these steps, you can confidently maneuver through the HUD housing application procedure and seize the unique opportunity offered by $100 down HUD homes.

Overcome Challenges in Securing $100 Down HUD Homes

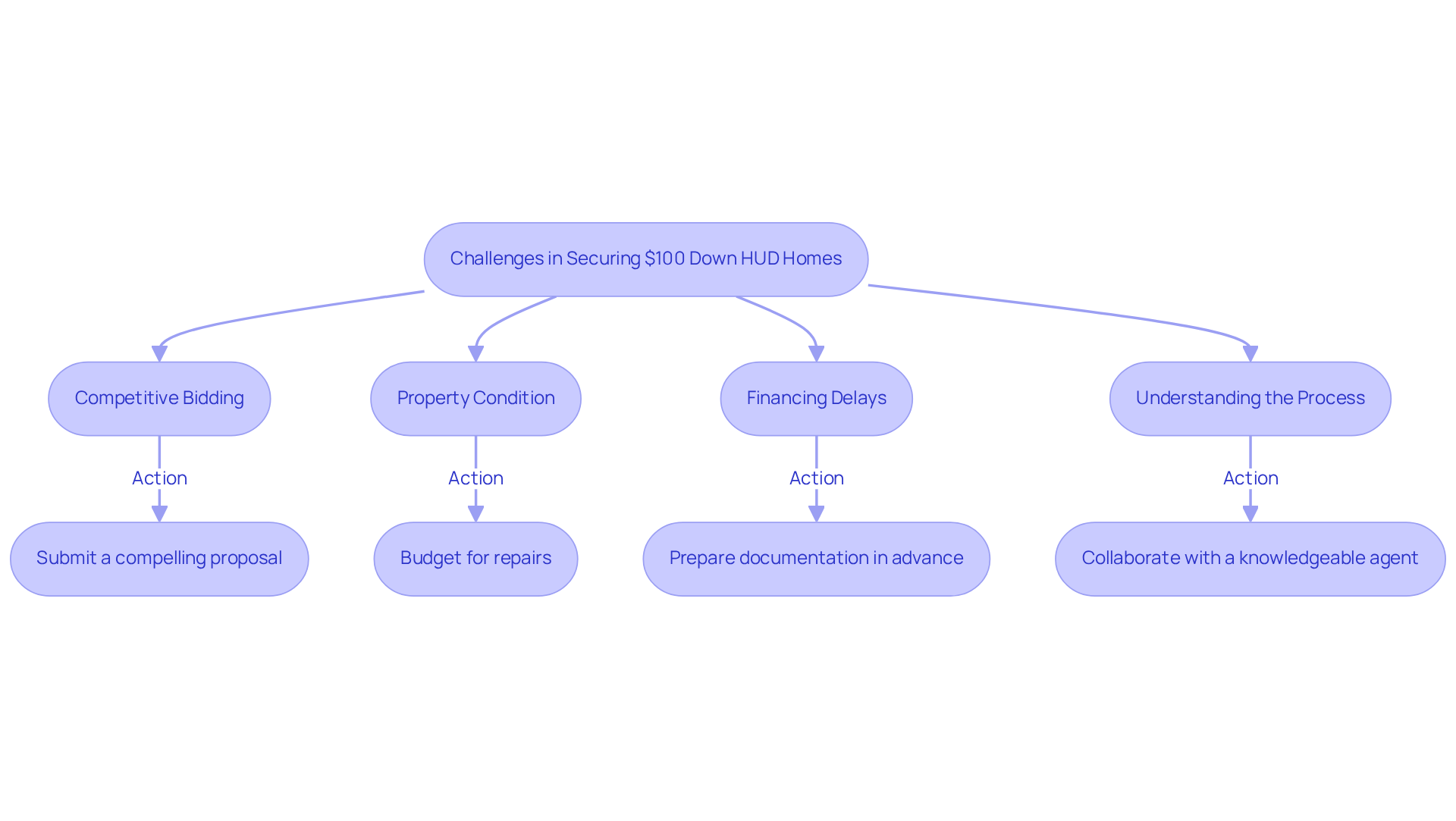

Acquiring a property through the $100 down HUD homes option can indeed be challenging. We understand how overwhelming this process can feel, but with proper preparation, you can navigate these obstacles effectively. Here are some key challenges to consider:

-

Competitive Bidding: HUD properties often attract multiple offers, making it essential to act swiftly. Submitting a compelling proposal can set you apart. In 2025, the median property sales price has risen to $416,900, which has led to increased competition among buyers.

-

Property Condition: Many HUD homes are sold as-is and may require significant repairs. It’s wise to budget for these potential costs. Consider utilizing an FHA 203(k) mortgage, which allows you to finance both the purchase and necessary renovations, making it easier to transform a house into your home.

-

Financing Delays: To prevent holdups in the approval process, ensure that all documentation is prepared in advance. This includes reviewing your credit score and understanding the minimum requirements for FHA loans, which typically require a score of at least 580.

-

Understanding the Process: Collaborate closely with a knowledgeable real estate agent. Their expertise can be invaluable in guiding you through the complexities of purchasing $100 down HUD homes, helping you navigate the bidding process and understand HUD’s specific requirements.

By anticipating these challenges and developing a strategic plan, you can significantly enhance your chances of successfully purchasing your dream home. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the path to homeownership can feel overwhelming, but the $100 down HUD homes program presents a wonderful opportunity for aspiring homeowners to secure affordable housing with minimal upfront costs. This initiative not only makes homeownership more attainable for many families but also plays a vital role in revitalizing communities by filling vacant properties and promoting neighborhood stability.

We understand how challenging this journey can be. Key insights from the article highlight the eligibility criteria for this program, which include:

- The need for an FHA-insured mortgage

- A stable employment history

- The requirement to occupy the home as a primary residence

Additionally, potential buyers are encouraged to leverage resources such as the HUD Property Store and the expertise of real estate agents specializing in HUD properties to find suitable homes. The article also addresses common challenges, such as competitive bidding and property conditions, while providing actionable strategies to help overcome these obstacles.

Ultimately, the $100 down HUD homes program represents a significant step toward making homeownership a reality for many families. By understanding the eligibility requirements, navigating the application process, and preparing for potential challenges, buyers can confidently pursue their dream of owning a home. Taking the initiative to explore this opportunity can lead to personal fulfillment and contribute to the overall health and vibrancy of our communities. We’re here to support you every step of the way.

Frequently Asked Questions

What are HUD homes?

HUD homes are properties that have been foreclosed and are now managed by the U.S. Department of Housing and Urban Development (HUD). They are often available at below-market prices, making them a good option for families seeking affordable housing.

What is the $100 down HUD homes program?

The $100 down HUD homes program allows qualified buyers to purchase HUD properties with a minimal initial investment of $100. This program is especially beneficial for first-time buyers and those facing financial constraints.

What are the eligibility requirements for the $100 down HUD homes program?

To qualify for the program, buyers must be U.S. citizens or legal residents, have a minimum credit score of 580 (though some lenders may accept lower scores), demonstrate a stable employment history (usually at least two years in the same job or field), purchase a HUD-owned dwelling as their primary residence, and not have acquired a HUD property within the last 24 months.

How does the $100 down HUD homes program benefit communities?

The program supports individual homeownership while revitalizing communities by filling vacant homes. This contributes to neighborhood stability and growth, creating a more vibrant environment for all residents.

Why are HUD properties sold below market value?

Recent data indicates that a significant number of HUD properties are sold below market value, which helps make homeownership attainable for many families, thereby enhancing the impact of the program on affordable housing options.