Overview

Home equity loans offer a valuable opportunity for homeowners to access funds by borrowing against the equity they have built in their property. This process provides a lump sum based on the difference between your home’s market value and the outstanding mortgage balance.

We understand how challenging it can be to navigate this process, so let’s explore how you can secure a home equity loan. Start by assessing your property value; knowing what your home is worth is crucial. Next, take a close look at your debt-to-income ratios—this will help you understand how much you can afford to borrow.

Choosing the right lender is also important. We’re here to support you every step of the way, ensuring you find a lender that meets your needs. Additionally, maintaining a good credit score can significantly impact your loan terms. Remember, the better your credit, the more favorable the terms you can secure.

By following these steps, you can empower yourself to make informed decisions about your home equity loan. We’re here to help you through this journey, ensuring that you feel confident and supported as you take this important financial step.

Introduction

Understanding the intricacies of home equity is vital for homeowners looking to leverage their property for financial gain. We know how challenging this can be. Home equity—the difference between a home’s market value and the outstanding mortgage—can unlock opportunities for:

- Funding renovations

- Consolidating debt

- Financing education

But how do home equity loans actually work? What steps must one take to navigate this financial landscape effectively? This guide aims to demystify the process. We’re here to support you every step of the way, offering insights into the mechanics, benefits, and potential pitfalls of home equity loans. Our goal is to empower homeowners to make informed decisions about their financial futures.

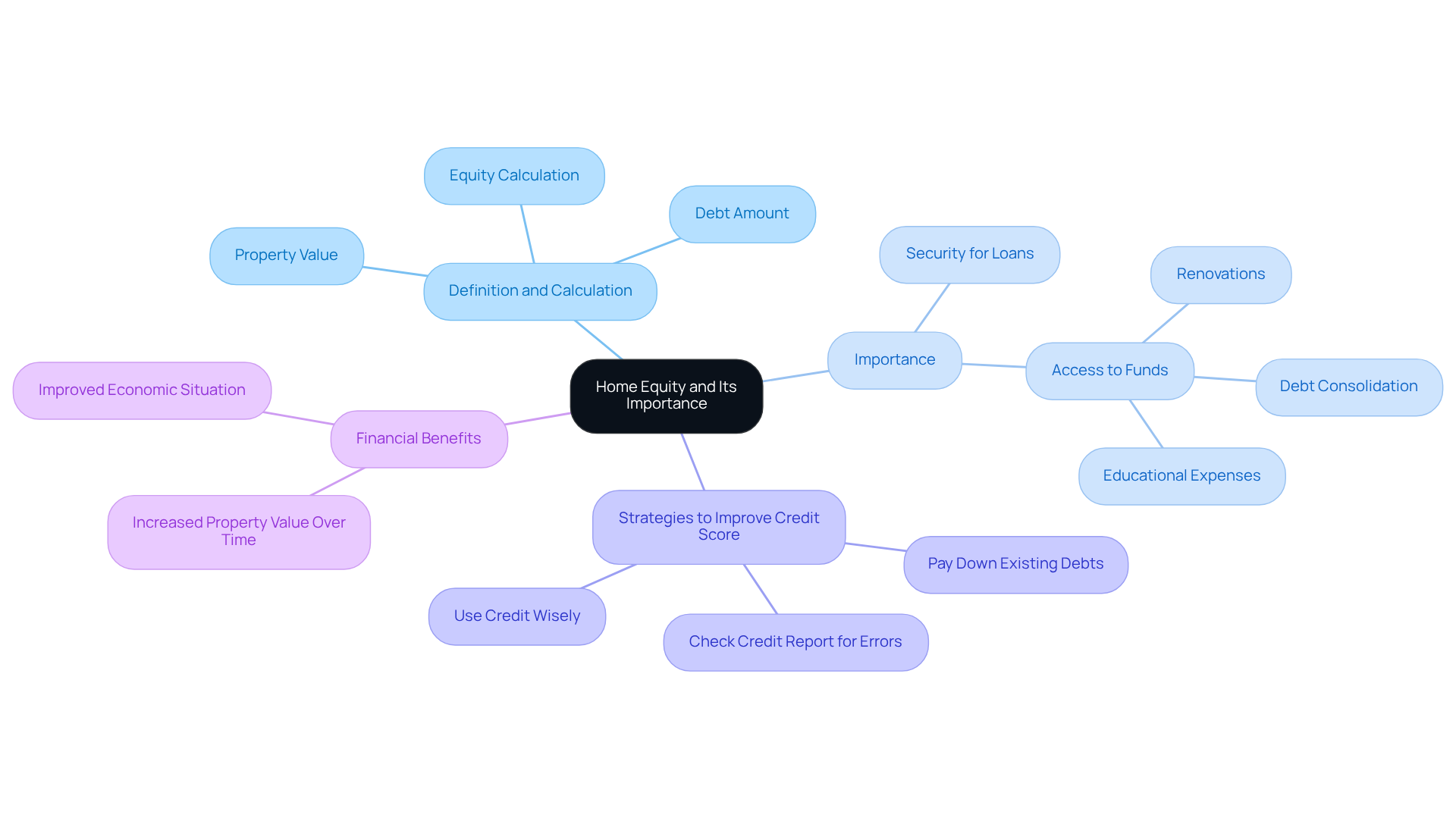

Define Home Equity and Its Importance

Understanding the value of your property is essential, especially when it comes to your financial well-being. It represents the difference between your home’s current market worth and the amount you owe on your loan. For example, if your residence is valued at $300,000 and you owe $200,000, your property value minus debt stands at $100,000. This asset is significant, as it can serve as security for loans, which raises the question of how do home equity loans work, allowing property owners to access funds for various needs, such as renovations, debt consolidation, or educational expenses.

We know how challenging it can be to navigate these financial waters. Typically, it’s advised to hold onto your home for at least five years to truly appreciate its monetary advantages. This period allows you to accumulate value and potentially improve your economic situation. Moreover, understanding your ownership stake is crucial for making informed financial decisions that can enhance your property’s worth.

To further improve your mortgage opportunities, consider taking steps to boost your credit score. Start by:

- Checking your credit report for any errors

- Paying down existing debts

- Using credit wisely

These strategies can significantly influence your ability to secure favorable financing terms. Remember, we’re here to support you every step of the way as you work towards achieving your financial goals.

Explain How Home Equity Loans Work

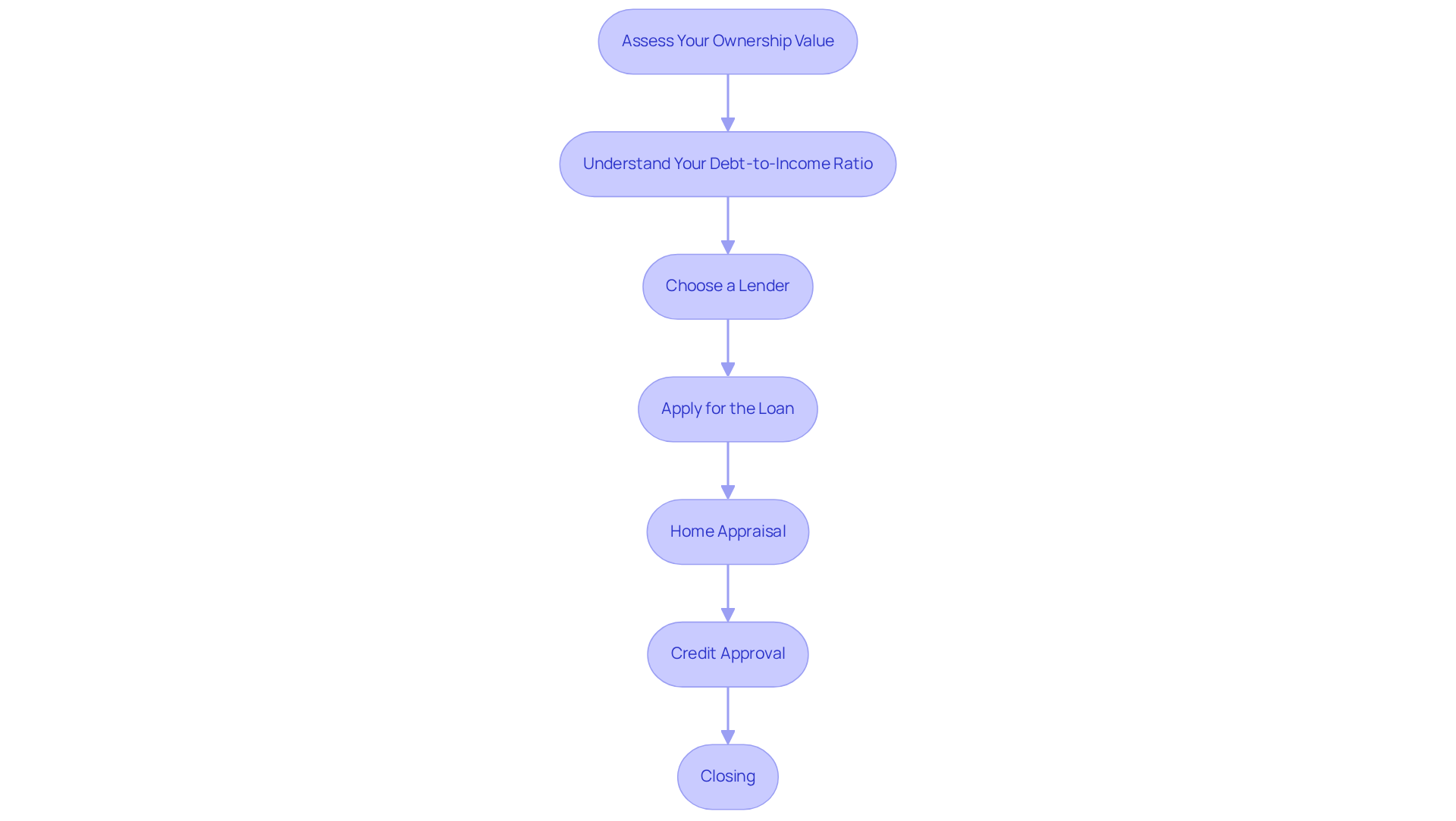

A property value loan, commonly known as a second mortgage, illustrates how home equity loans work by providing property owners the chance to borrow a lump sum based on the equity they have built in their home. As we look ahead to 2025, the interest rates for property collateral financing remain competitive, reflecting the current market landscape and borrowing methods. To help you navigate the home equity loan process with confidence, consider these essential steps:

- Assess Your Ownership Value: Begin by calculating your property value. Subtract your mortgage balance from your home’s current market worth. This figure represents the potential amount you can borrow.

- Understand Your Debt-to-Income Ratio: Typically, a maximum DTI ratio of 43% is necessary for mortgages, including home equity lines. A lower DTI can lead to more favorable mortgage rates, so it’s wise to evaluate your current debts and income before applying.

- Choose a Lender: Take the time to research various lenders, including independent brokers like F5 Mortgage, which collaborates with over two dozen top lenders to provide diverse options. Compare interest rates and terms to find the best fit for your financial situation. Additionally, explore specific refinancing options available in Colorado, such as FHA programs, VA programs, and the Colorado Streamline Refinance option, which can offer extra benefits.

- Apply for the Loan: Complete an application with your chosen lender, ensuring you provide necessary documentation, such as income verification and credit history. A well-prepared application can significantly enhance your chances of approval. Improving your credit score can also open doors to better mortgage opportunities, so make sure your credit report is accurate and consider paying down existing debts to lower your DTI.

- Home Appraisal: The lender will order an appraisal to confirm your home’s value. This step is crucial, as it directly impacts the amount you can borrow.

- Credit Approval: Once authorized, you will receive a financing offer detailing the amount, interest rate, and repayment terms. Financial advisors often emphasize the importance of fully understanding these terms to avoid future financial strain.

- Closing: Sign the closing documents, pay any upfront fees, and receive your funds. Repayment typically occurs over a fixed term with monthly payments, so budgeting accordingly is essential.

Successful property value financing requests often come from borrowers who understand how home equity loans work, along with possessing a substantial amount of ownership, strong credit, and a low debt-to-income ratio. We recommend utilizing property-based borrowing for purposes that enhance your financial stability, such as renovations or debt consolidation, rather than for daily expenses, which can lead to greater debt if not managed carefully. By following these steps and considering professional advice, you can effectively leverage your real estate value to achieve your financial goals. Remember, we’re here to support you every step of the way.

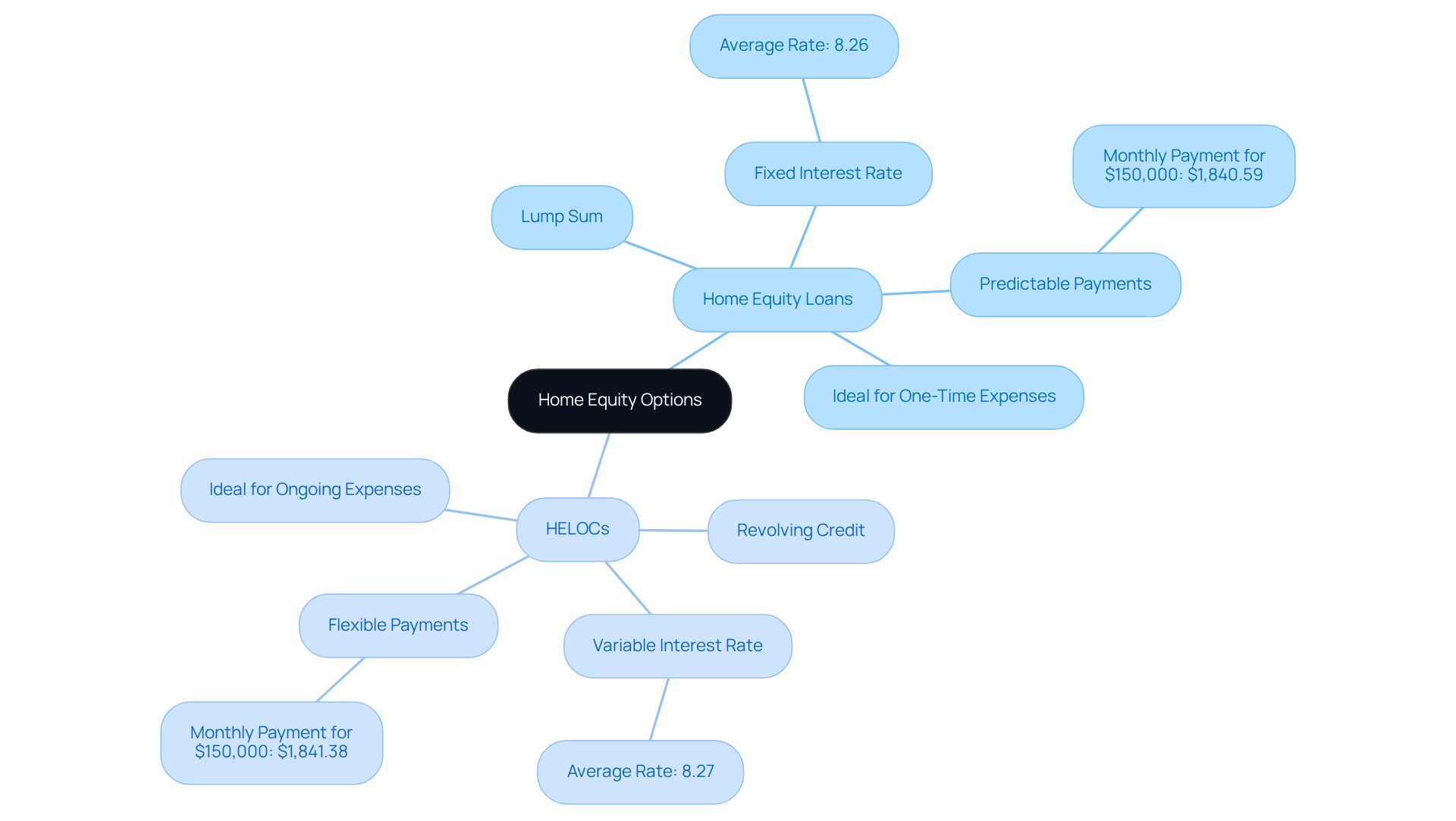

Compare Home Equity Loans with HELOCs

Accessing home equity can feel overwhelming, but understanding your options is the first step toward making the best decision for your financial future. Home equity loans and HELOCs (Home Equity Lines of Credit) each offer unique features and benefits, and understanding how do home equity loans work can help you cater to your specific needs.

Home Equity Loans provide a lump sum of money, usually at a fixed interest rate of around 8.26%. This option is ideal for one-time expenses, such as major renovations or debt consolidation. For instance, if you’re looking to finance a $150,000 property, your monthly payments would be approximately $1,840.59. This predictability can offer peace of mind to borrowers who prefer a structured repayment schedule.

On the other hand, HELOCs function like a revolving line of credit, similar to a credit card. They allow homeowners to borrow as needed, up to a certain limit. Currently, HELOCs feature variable interest rates averaging 8.27%, which can fluctuate based on market conditions. Monthly payments for a $150,000 HELOC are about $1,841.38, but keep in mind that these can change over time. This flexibility makes HELOCs a great choice for ongoing expenses, like renovations or educational costs, giving you the freedom to manage your finances as your needs evolve.

When deciding between a home equity loan and a HELOC, it’s essential to understand how do home equity loans work in relation to your financial situation and how you plan to use the funds. If you have a specific project with a known cost, you might wonder how do home equity loans work as a better fit. Conversely, if you foresee needing funds for various expenses over time, a HELOC could provide the flexibility you desire.

Financial experts stress the importance of aligning these options with your financial goals and risk tolerance, especially in light of current interest rate trends. As Andrew Dehan wisely notes, “Grasping how residential value operates, and how to utilize it, is essential for any property owner.”

Additionally, be mindful of the potential risks associated with HELOCs, such as the temptation to overspend. Remember, the interest on qualified home equity loans and HELOCs used for renovations may be tax-deductible, which can be an added benefit.

We understand how challenging this can be, and we’re here to support you every step of the way as you navigate these important decisions.

Outline Home Equity Loan Requirements

To qualify for a home equity loan, we know how challenging it can be to navigate through the requirements. Here are some key points to consider:

- Adequate Property Value: Most lenders require a minimum of 15% to 20% equity in your property. This means the difference between your property’s current worth and what you owe on your mortgage. Some lenders might allow you to borrow as much as 85% or 90% of your property’s value. If you’re a property owner in California thinking about a cash-out refinance, you can tap into your property value for significant costs like renovations or debt consolidation, which could influence your decision to seek a property-based financial option.

- Credit Score: Typically, a minimum credit score of around 620 is necessary for approval. However, to secure more favorable interest rates and terms, a score of at least 680 is often needed. Improving your credit score can open up more mortgage opportunities for you. To do this, consider ordering a copy of your credit report to check for errors, paying down existing debts, and making timely payments.

- Debt-to-Income Ratio: Lenders generally prefer a debt-to-income (DTI) ratio of 43% or lower. This indicates that your monthly debt payments are manageable compared to your income, which is crucial for your financial health.

- Consistent Earnings: Showing evidence of consistent earnings is essential to demonstrate your ability to repay the financial assistance. Lenders often require documentation such as pay stubs and tax returns to support your application.

- Documentation: Be prepared to provide various documents during the application process, including bank statements and proof of homeowners insurance. This documentation is necessary to protect the lender’s investment, but it also helps you stay organized.

Understanding these criteria can empower you as a prospective borrower to evaluate your eligibility and make informed choices regarding how do home equity loans work in relation to your financial needs. As consumer interest in property value loans increases, especially for reasons like renovations or debt consolidation, considering a cash-out refinance can provide you with the necessary cash for significant expenses. We’re here to support you every step of the way.

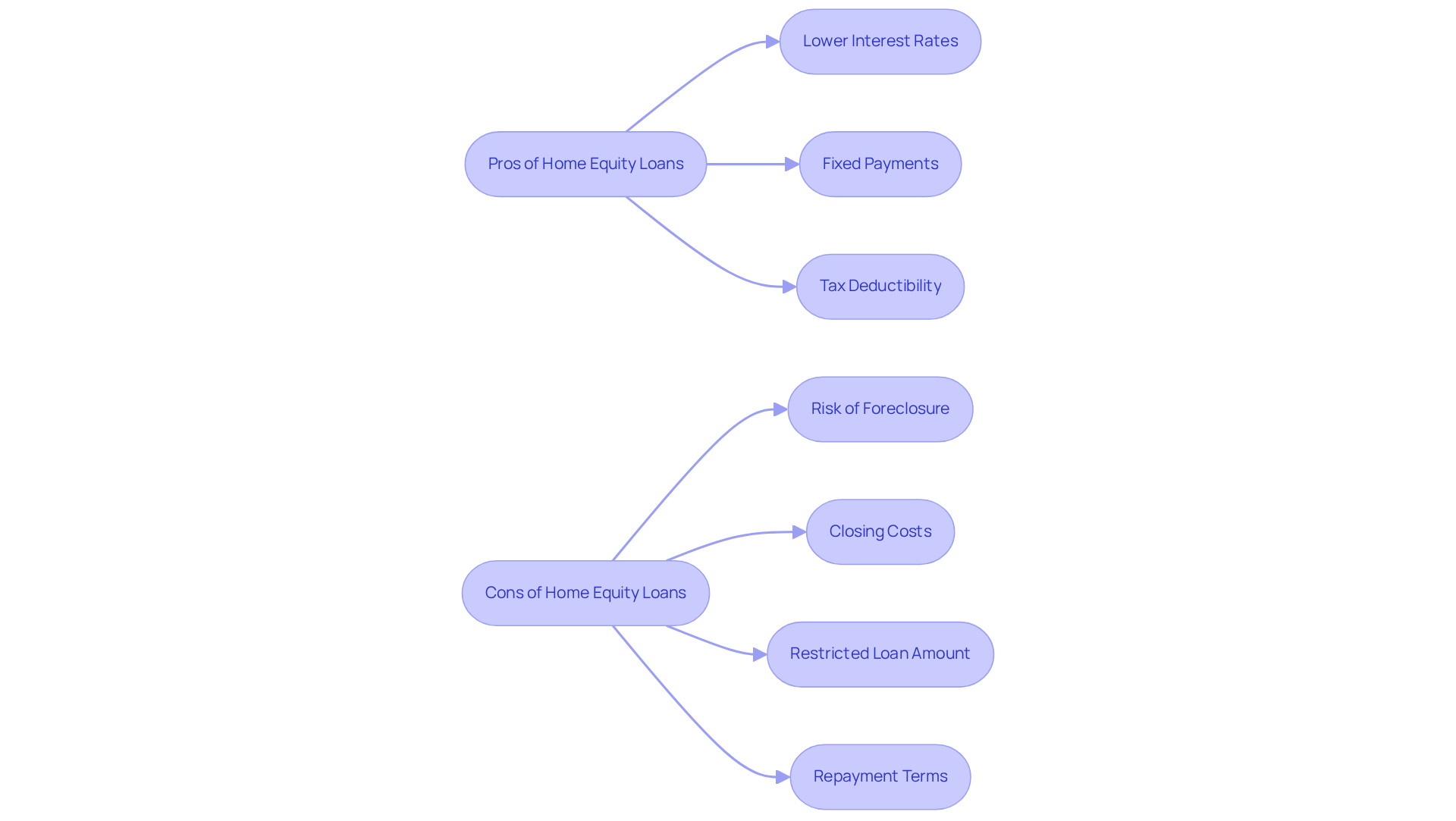

Evaluate the Pros and Cons of Home Equity Loans

When considering a home equity loan, we understand how home equity loans work and how challenging it can be to weigh both the advantages and disadvantages. Let’s explore these factors together:

Pros:

- Lower Interest Rates: Home equity loans typically offer lower interest rates compared to personal loans and credit cards, with an average rate around 8.43%. This can make them a cost-effective borrowing option for homeowners seeking financial relief.

- Fixed Payments: These financial agreements usually feature fixed interest rates, ensuring that your monthly payments stay consistent. This predictability can be a great aid in effective budgeting and financial planning.

- Tax Deductibility: Depending on how you use the funds, the interest paid on residential financing may be tax-deductible, providing potential savings that can ease your financial burden.

Cons:

- Risk of Foreclosure: Since home equity loans are secured by your property, failing to make payments can lead to foreclosure. This poses a significant risk for borrowers. We encourage you to seek guidance from a mortgage expert or advisor before making a decision on property collateral borrowing due to these related risks.

- Closing Costs: It’s important to be aware that property value credit lines often incur closing costs, which can include application, appraisal, and origination fees, adding to the overall expense of the financing.

- Restricted Loan Amount: Typically, property owners can only tap into a fraction of their residence’s value, which may not be sufficient for larger monetary needs, such as major renovations or debt consolidation.

- Repayment Terms: The usual repayment period for a property-backed credit ranges from 5 to 30 years, which is a significant factor to consider for long-term monetary commitments.

By understanding these factors, you can better assess how home equity loans work in alignment with your financial goals and circumstances. We’re here to support you every step of the way.

Conclusion

Understanding how home equity loans work is crucial for homeowners looking to leverage their property’s value for financial needs. We know how challenging this can be, and by tapping into the equity built over time, individuals can access funds for various purposes—from home renovations to debt consolidation. This financial tool offers a way to utilize an asset that may have appreciated significantly, thus enhancing overall financial stability.

Throughout this article, we’ve shared key insights regarding the mechanics of home equity loans. We’ve covered the necessary steps to secure one, compared them with HELOCs, and discussed the pros and cons associated with each option. Important requirements such as:

- Adequate property value

- Credit score

- Debt-to-income ratio

have been highlighted, empowering potential borrowers to evaluate their eligibility effectively. Additionally, understanding the risks involved—such as foreclosure and closing costs—is essential for making informed decisions.

Ultimately, leveraging home equity can be a powerful strategy in personal finance, provided it is approached with careful consideration and planning. Homeowners are encouraged to assess their financial goals and needs, weigh the benefits against the potential risks, and seek professional advice if necessary. By doing so, they can make the most of their home equity and pave the way for a more secure financial future. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is home equity and why is it important?

Home equity is the difference between your home’s current market value and the amount you owe on your mortgage. It represents a significant asset that can be used as security for loans, allowing homeowners to access funds for needs such as renovations, debt consolidation, or educational expenses.

How can I calculate my home equity?

To calculate your home equity, subtract your mortgage balance from your home’s current market worth. For example, if your home is valued at $300,000 and you owe $200,000, your equity would be $100,000.

How long should I hold onto my home to appreciate its value?

It is typically advised to hold onto your home for at least five years to truly appreciate its monetary advantages and accumulate value.

What steps can I take to improve my mortgage opportunities?

To improve your mortgage opportunities, consider boosting your credit score by checking your credit report for errors, paying down existing debts, and using credit wisely.

What are home equity loans and how do they work?

Home equity loans, also known as second mortgages, allow property owners to borrow a lump sum based on the equity they have built in their home. This type of loan is secured by the property and can be used for various financial needs.

What is the maximum debt-to-income (DTI) ratio typically required for home equity loans?

A maximum DTI ratio of 43% is generally necessary for mortgages, including home equity lines. A lower DTI can lead to more favorable mortgage rates.

How do I choose a lender for a home equity loan?

Research various lenders, including independent brokers, to compare interest rates and terms. It’s important to find a lender that offers options suitable for your financial situation.

What documentation do I need to apply for a home equity loan?

When applying for a home equity loan, you will need to provide documentation such as income verification and credit history.

What is the home appraisal process in obtaining a home equity loan?

The lender will order an appraisal to confirm your home’s value, which is crucial as it directly impacts the amount you can borrow.

What happens after I am approved for a home equity loan?

Once approved, you will receive a financing offer detailing the loan amount, interest rate, and repayment terms. After signing the closing documents and paying any upfront fees, you will receive your funds.

What should I use home equity loans for?

It is recommended to use home equity loans for purposes that enhance financial stability, such as renovations or debt consolidation, rather than for daily expenses, which can lead to greater debt if not managed carefully.