Overview

Understanding the average mortgage payment is crucial for families planning their financial future. We know how challenging this can be, and it’s important to recognize the key factors that influence this financial obligation. The average mortgage payment in the U.S. varies widely based on:

- Loan type

- Interest rates

- Regional differences

For instance, significant disparities exist between areas like the Northeast and the Midwest.

These variations underscore the importance of being informed when budgeting for a mortgage. By understanding these factors, prospective homeowners can make better decisions that align with their financial goals. We’re here to support you every step of the way as you navigate this process and plan your budget effectively.

Introduction

Understanding the average mortgage payment is essential for anyone navigating the complex landscape of home financing. We know how challenging this can be, especially as home values rise and interest rates fluctuate. The implications of these payments become increasingly significant, affecting your budget and financial planning.

With regional variations and different loan types influencing costs, how can you, as a prospective homeowner, ensure you make informed decisions that align with your financial goals? Exploring the factors that shape average mortgage payments can provide valuable insights, helping you gain clarity in an ever-evolving market.

We’re here to support you every step of the way.

Define Average Mortgage Payment

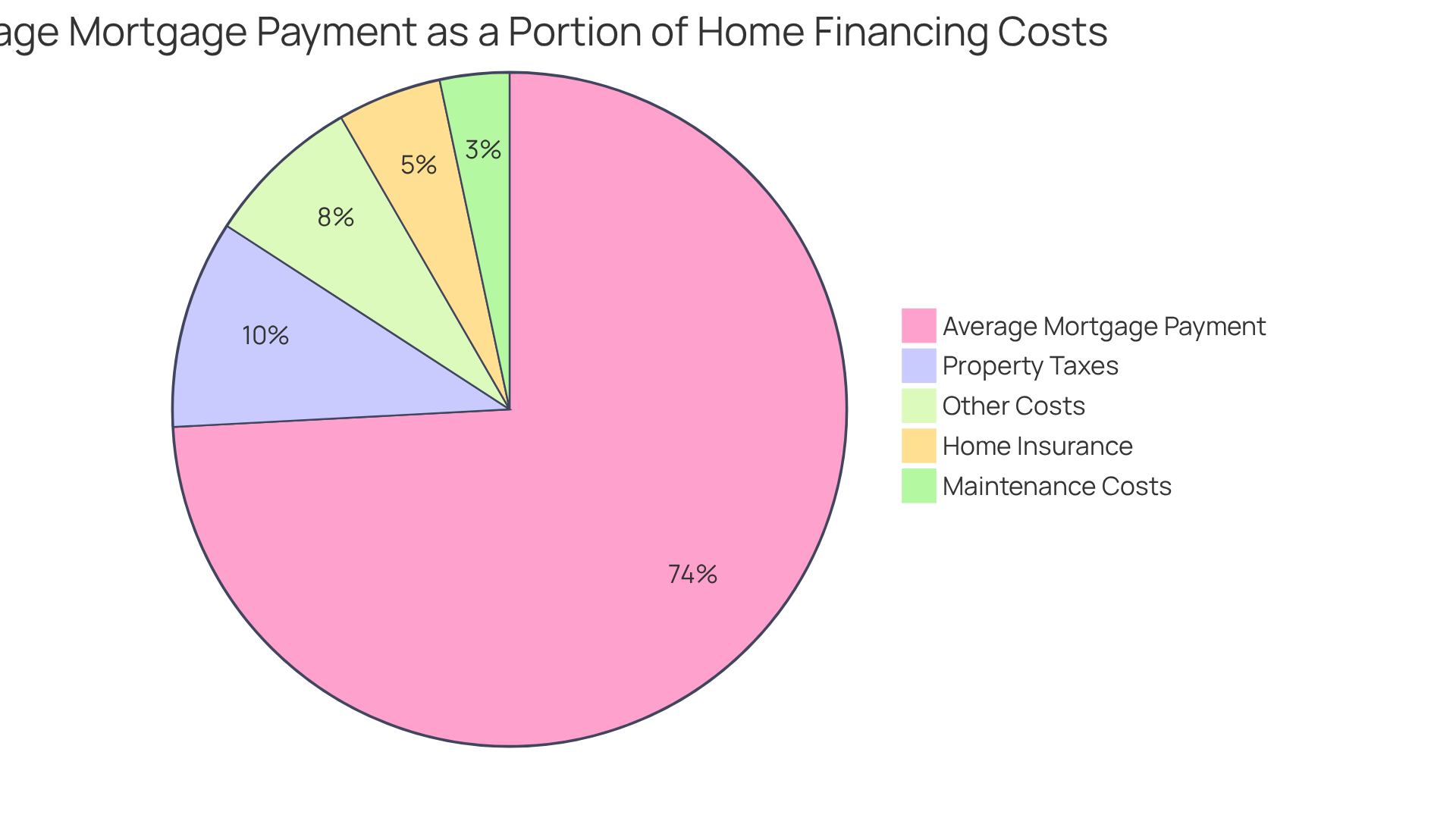

Understanding housing expenses can feel overwhelming, but we’re here to support you every step of the way. A standard housing expense represents the average mortgage payment that homeowners pay to lenders to meet their financial obligations. This payment includes four essential components: principal, interest, property taxes, and homeowners insurance, collectively known as PITI.

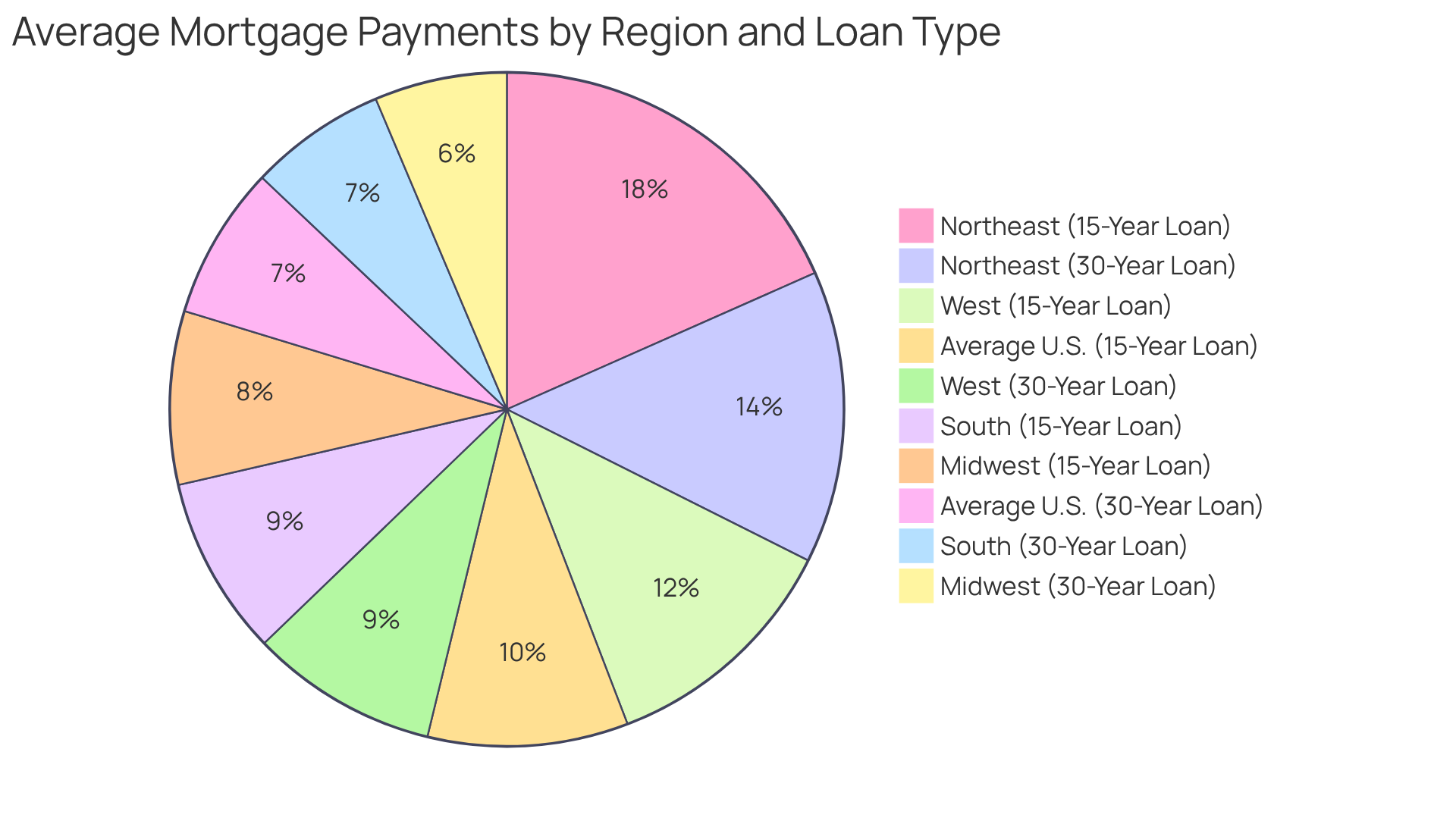

The average mortgage payment for a housing loan can vary significantly based on factors such as the loan amount, interest rate, and loan term. As of July 2025, the average mortgage payment in the U.S. is approximately $2,700 for a 30-year fixed loan and $3,552 for a 15-year fixed loan. However, it’s important to recognize that regional differences can be quite pronounced.

For instance, the Northeast faces the highest average costs, with figures reaching $5,184 for a 30-year loan and $6,782 for a 15-year loan. In contrast, the Midwest offers more affordable options, with an average mortgage payment of $2,348 and $3,072, respectively. Understanding these components and variations is crucial for prospective homeowners, as they directly and financial planning. Remember, we’re here to help you navigate these complexities and find the best path forward.

Contextualize Average Mortgage Payments in Home Financing

The average mortgage payment is a significant factor in home financing, deeply impacting a homeowner’s budget and overall financial plan. For those considering purchasing a home, understanding the average mortgage payment and other associated costs is essential for evaluating affordability and determining borrowing capability. In 2025, the landscape of loan installments has been shaped by rising home values and fluctuating interest rates, leading to a notable increase in the average mortgage payment. For instance, the national median amount for purchase applicants rose to $2,205 in January, reflecting a 3.7% increase from the previous month. This change underscores the importance for buyers to carefully assess their financial situations before committing to a loan.

Understanding typical loan expenses involves more than just the cost of borrowing; it also includes the average mortgage payment and the broader economic context, such as property values and interest levels. As home prices continue to rise, the implications for budgeting, particularly regarding the average mortgage payment, become increasingly clear. When planning their finances, buyers must consider these escalating costs to ensure they can comfortably meet their along with other monthly obligations. The Mortgage Bankers Association’s Purchase Applications Payment Index indicates that the average mortgage payment for conventional applicants grew to $2,225 in January, further emphasizing the impact of current market conditions.

Real-life scenarios illustrate the challenges faced by homebuyers today. For example, despite the hurdles of affordability, F5 Mortgage has successfully helped over 1,000 families, boasting a customer satisfaction rate of 94%. This success is attributed to their commitment to client education and personalized service, empowering buyers to navigate the complexities of financing. As home prices and typical loan costs continue to climb, understanding the average mortgage payment will be vital for effective budgeting and informed decision-making in the home purchasing journey.

Examine Factors Influencing Average Mortgage Payments

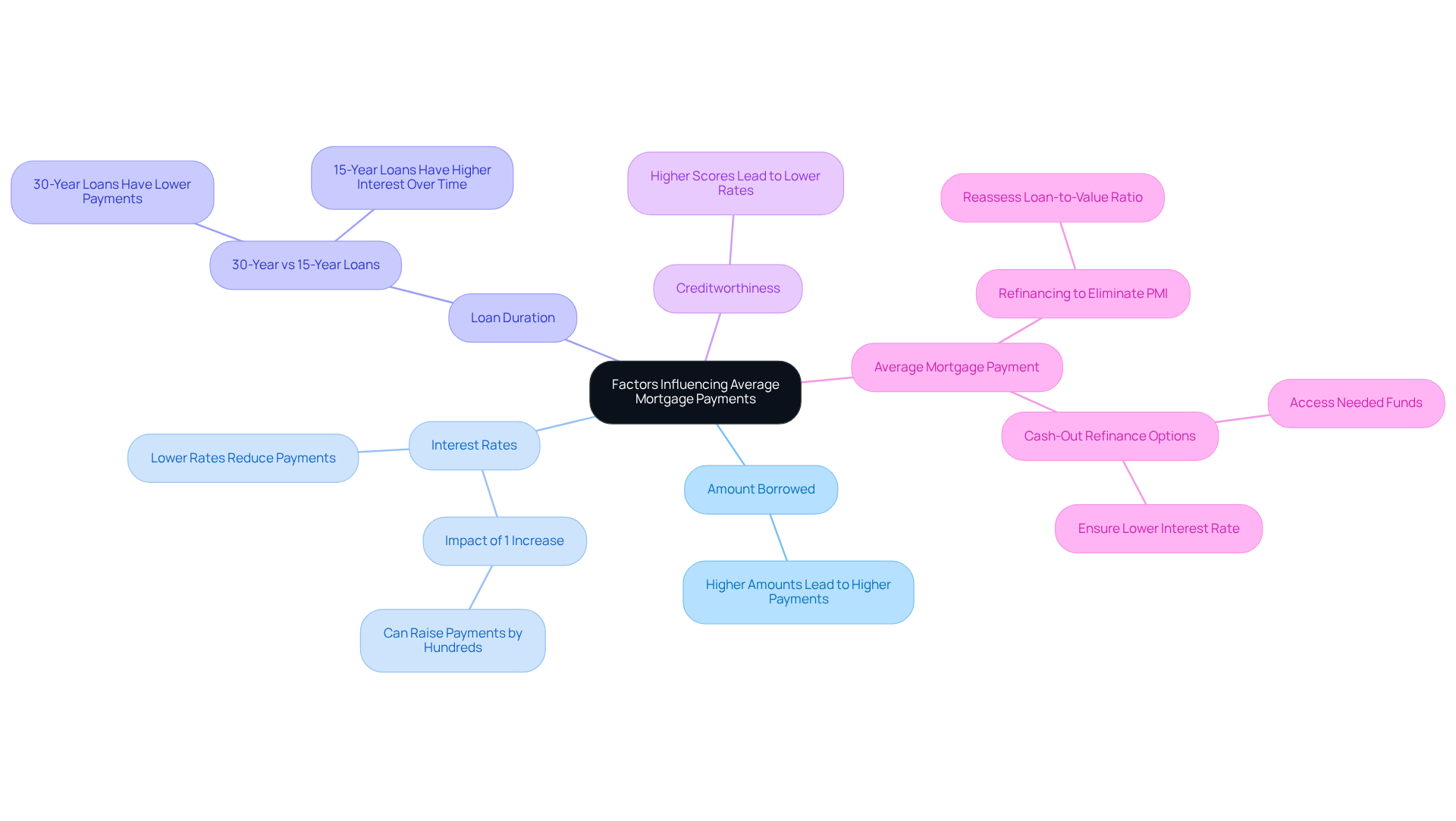

Understanding the factors that affect your average mortgage payment can feel overwhelming, but we’re here to support you every step of the way. Several elements come into play, including:

- The amount borrowed

- Interest rates

- The duration of the loan

- Your creditworthiness

- The average mortgage payment

Typically, larger borrowing amounts lead to higher monthly payments, while lower interest rates can significantly reduce your average mortgage payment. For instance, just a 1% increase in interest can raise your monthly payments by hundreds of dollars.

The length of your loan term is another important consideration. A 30-year mortgage often results in a lower average mortgage payment compared to a 15-year loan, but keep in mind that you’ll pay more interest over the life of the loan. Your credit score plays a crucial role too; higher scores generally lead to lower interest rates, resulting in a reduced average mortgage payment.

If you’re a family in California who initially put down less than 20%, you might want to think about refinancing to eliminate private mortgage insurance (PMI). With home values appreciating significantly, you can reassess your loan-to-value (LTV) ratio by dividing your remaining loan balance by your home’s new value. This could lead to substantial savings on your average mortgage payment each month.

Additionally, if you’re facing financial challenges, a cash-out refinance might provide access to needed funds while reducing your LTV ratio. Just ensure that the new mortgage offers a more affordable interest rate. We know how challenging this can be, but taking these steps can empower you to make informed decisions about your mortgage.

Explore Variations in Mortgage Payments by Loan Type

Navigating the average mortgage payment can feel overwhelming, especially with the variety of financing options available. We understand how challenging this can be, and it’s important to know that traditional financing often comes with higher average costs compared to FHA products. FHA loans are specifically designed to support first-time homebuyers and those with lower credit ratings, making them a valuable resource.

For Colorado residents, FHA refinance options are typically available with a minimum credit score of 580. These options require two insurance premiums:

- An upfront premium of 1.75% at closing

- An annual premium that ranges from 0.45% to 0.85%

As of January 2025, the average mortgage payment for FHA mortgage applicants was around $1,934, while the average mortgage payment for was $2,225.

If you are a veteran or active-duty military personnel, VA financing may be a great option for you, often featuring lower expenses due to favorable conditions and no down payment requirements. Additionally, Colorado homeowners can consider refinancing into a streamlined FHA mortgage, which can significantly reduce interest costs and monthly payments. This can be a convenient choice for those currently holding FHA loans.

Understanding these variations is crucial for making the right decision that aligns with your financial situation and homeownership goals. We’re here to support you every step of the way. Locking in your mortgage rate with F5 Mortgage can enhance your refinancing strategy, ensuring you secure the best possible terms.

Conclusion

Understanding the average mortgage payment is essential for prospective homeowners navigating the complexities of home financing. We know how challenging this can be. This payment encompasses various components, including principal, interest, property taxes, and homeowners insurance, which collectively shape a homeowner’s financial responsibilities. While the average mortgage payment can vary widely based on factors like loan amount, interest rates, and regional differences, grasping these nuances is crucial for making informed decisions.

Key insights reveal that the average mortgage payment in the U.S. can be significantly influenced by geographical location and loan type. For instance, while the Northeast experiences higher average payments, the Midwest offers more affordable options. Additionally, the impact of rising home values and fluctuating interest rates has led to increased monthly payments. This underscores the importance of thorough financial planning. Understanding these factors, such as creditworthiness and loan duration, can empower you to make strategic choices that align with your financial goals.

Ultimately, being well-informed about average mortgage payments not only aids in budgeting but also enhances the overall homebuying experience. As home prices continue to rise and lending conditions evolve, prospective buyers must prioritize their financial education. We’re here to support you every step of the way. Taking the time to explore various loan types, assess personal financial situations, and seek professional guidance can lead to more favorable outcomes in your journey toward homeownership.

Frequently Asked Questions

What is included in the average mortgage payment?

The average mortgage payment includes four essential components: principal, interest, property taxes, and homeowners insurance, collectively known as PITI.

How much is the average mortgage payment in the U.S. as of July 2025?

As of July 2025, the average mortgage payment in the U.S. is approximately $2,700 for a 30-year fixed loan and $3,552 for a 15-year fixed loan.

How do regional differences affect average mortgage payments?

Regional differences can significantly affect average mortgage payments. For example, in the Northeast, the average costs are much higher, reaching $5,184 for a 30-year loan and $6,782 for a 15-year loan, while the Midwest offers more affordable options, with averages of $2,348 for a 30-year loan and $3,072 for a 15-year loan.

Why is it important to understand the components and variations of mortgage payments?

Understanding the components and variations of mortgage payments is crucial for prospective homeowners as they directly influence affordability and financial planning.