Overview

In today’s financial landscape, understanding home equity loan rates is crucial for families navigating their options. While current rates are higher than the record lows we saw in 2021, it’s important to recognize that they still remain significantly lower than the peaks experienced in the 1980s. This context can feel overwhelming, but we’re here to support you every step of the way.

Economic factors, such as Federal Reserve policies and market competition, play a significant role in shaping the lending landscape. We know how challenging this can be, especially when trying to make informed decisions about your family’s financial future. But by staying informed, you can better navigate these waters and find solutions that work for you.

As you consider your options, remember that you’re not alone in this journey. Many families face similar challenges, and understanding the advantages and hurdles of borrowing today can empower you to take the next steps confidently. Together, we can explore the best paths forward for your family’s needs.

Introduction

In today’s ever-changing housing market, many homeowners are feeling the weight of decisions regarding home equity loan rates. With the national average currently around 8.26% as of July 2025, it’s essential to recognize both the opportunities and challenges that lie ahead. We understand how overwhelming it can be to navigate these waters, especially as families weigh the benefits of current rates against historical trends.

As you consider your options, you may find yourself asking: how can you make informed borrowing decisions in a landscape marked by fluctuating interest rates and economic uncertainty? We’re here to support you every step of the way, helping you to understand the complexities and empowering you to take action with confidence.

Current Home Equity Loan Rates: An Overview

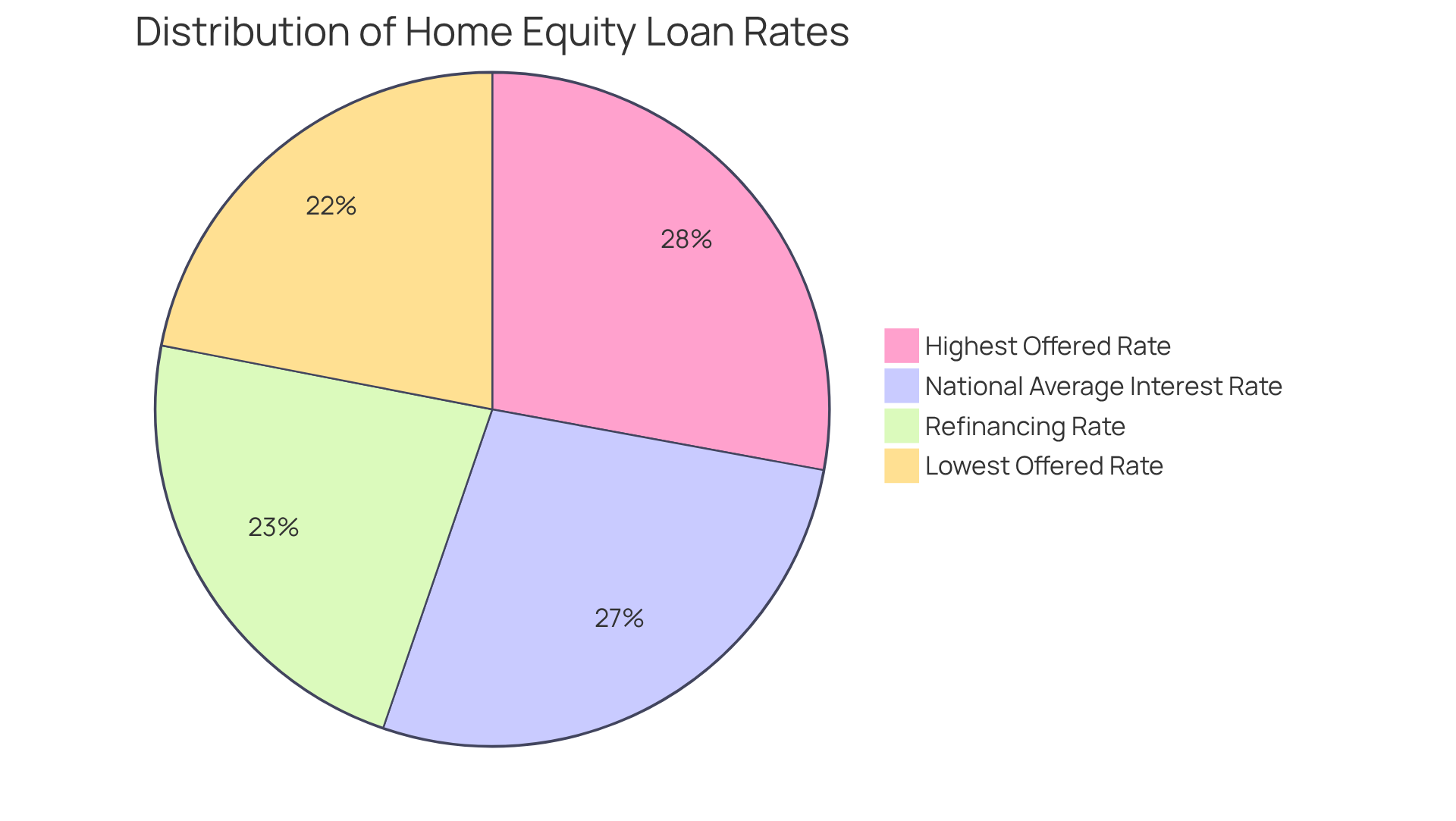

As of July 2025, the national average interest percentage for residential financing is around 8.26%. This indicates a slight decrease from earlier months, suggesting more advantageous borrowing circumstances for families. Some lenders are currently offering terms as low as 6.63% for a $50,000 property financing option, while others may propose terms close to 8.42% for a decade-long period. This variation highlights the importance for borrowers to explore and evaluate proposals from various lenders to secure the most favorable home equity loan rates today.

Additionally, refinancing costs are presently lower than residential property financing interest percentages, averaging 6.88% for a 30-year fixed refinancing. This disparity may greatly influence borrowers’ choices on whether to refinance their current mortgages or select a property value-based option. It’s essential to consider the advantages of utilizing your asset value against the potential savings from refinancing, particularly in light of home equity loan rates today.

Key Considerations for Borrowers:

- Adjustable-Rate Mortgages (ARMs): Consider ARMs as they often start with lower initial rates compared to fixed-rate mortgages, making monthly payments more affordable. This can be beneficial if you plan to sell or refinance before the adjustment period.

- Personal Financial Goals: Understanding your financial aims is crucial before obtaining a mortgage against your property, as it helps in making informed choices.

- Credit Considerations: If you have poor credit, alternatives like acquiring a co-signer or utilizing a trusted bank can enhance your chances of obtaining funding.

- Loan-to-Value (LTV) Ratio: Be aware of the typical maximum LTV ratio for home financing, which generally ranges from 80% to 85%. This is a critical factor in determining how much value you can access.

At F5 Mortgage, we know how challenging this can be. We are dedicated to discovering the best offer for you, ensuring that you have access to competitive pricing and tailored services during the refinancing process. Take the first step toward —apply online or over the phone today!

Historical Trends in Home Equity Loan Rates

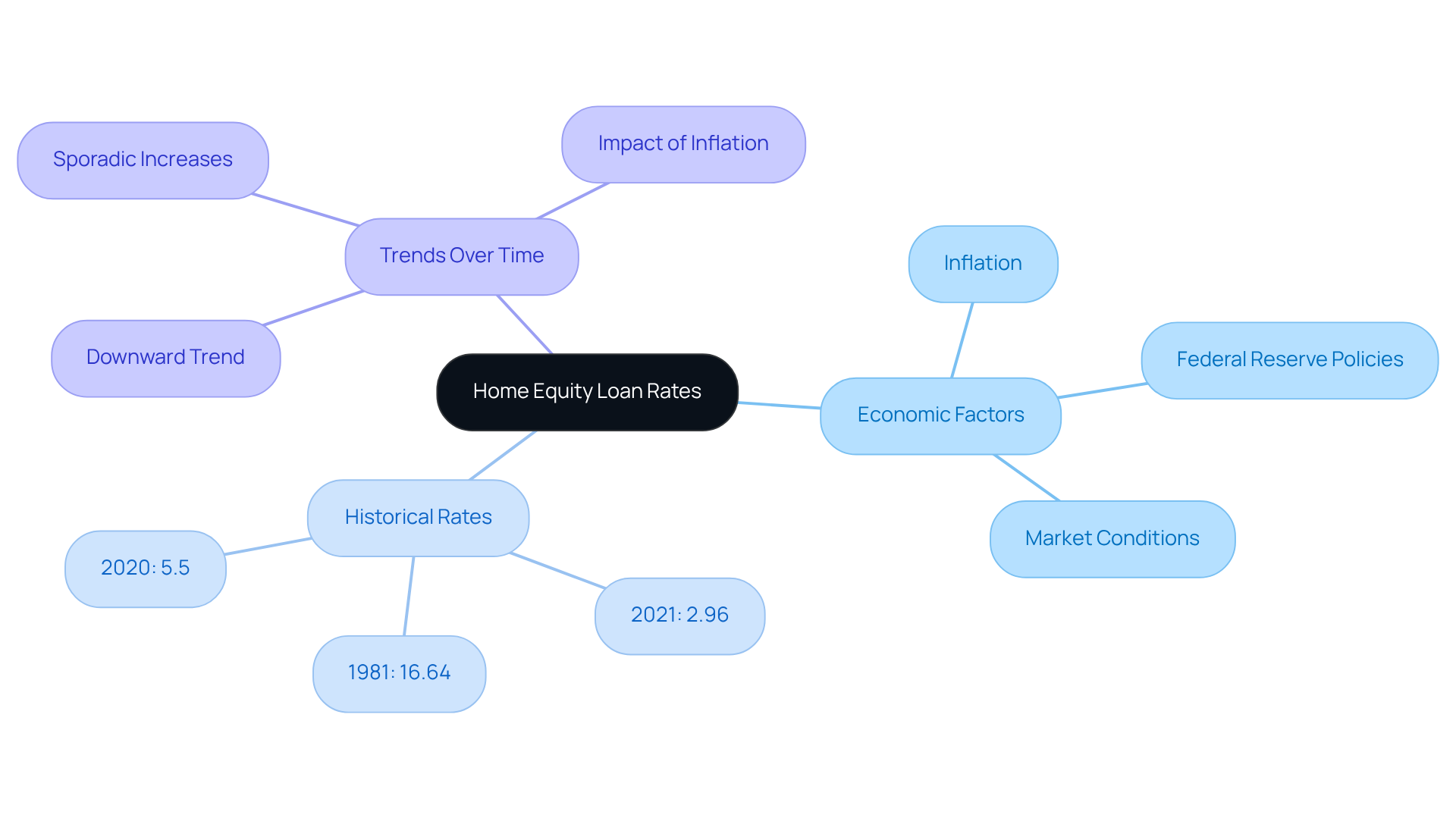

Home equity loan rates today have seen considerable fluctuations over the years, influenced by various economic factors like inflation, Federal Reserve policies, and market conditions. For instance, in 1981, the average interest rate soared to a staggering 16.64%, a reflection of the economic turmoil of that era. Conversely, these figures dropped to a historic low of 2.96% in 2021, highlighting the dramatic changes in the lending environment.

Over the last decade, values have generally trended downward, though they have experienced sporadic increases during times of economic instability. In early 2020, the average cost for home equity loans was approximately 5.5%. However, this figure has risen due to increasing inflation and the subsequent hikes in home equity loan rates today implemented by the Federal Reserve.

Understanding this is crucial for borrowers. We know how challenging it can be to navigate these changes, and recognizing the cyclical nature of interest rates can empower you to make informed borrowing choices. As you consider your options, remember that fluctuations are a normal part of the lending landscape, and we’re here to support you every step of the way.

Key Factors Driving Changes in Home Equity Loan Rates

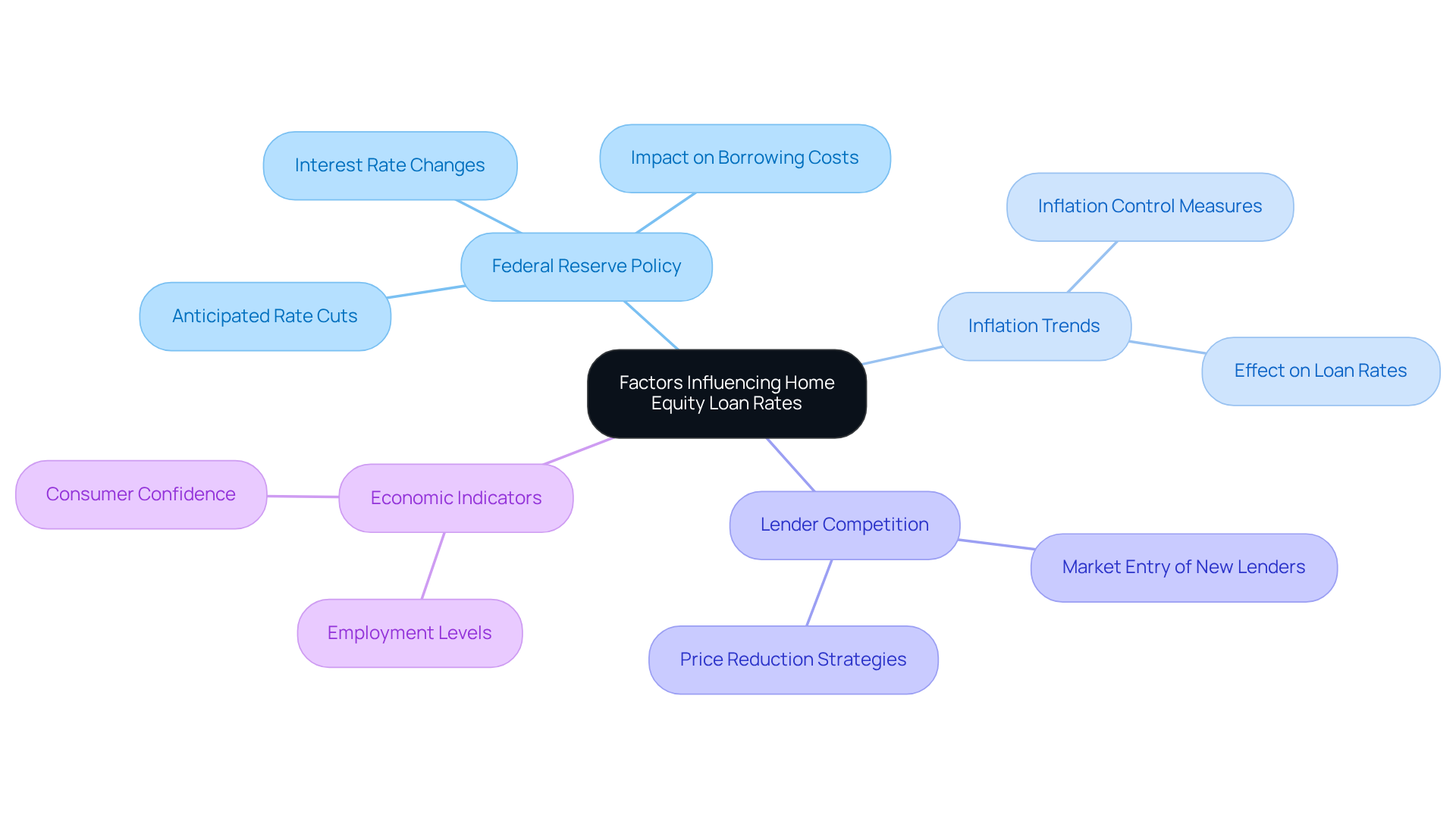

Understanding home financing can feel overwhelming, especially with the various factors at play. We know how challenging this can be, as interest levels are significantly influenced by the Federal Reserve’s monetary policy, inflation trends, and the overall economic landscape. When the Federal Reserve raises interest levels to combat inflation, borrowing expenses typically increase, which affects today. Conversely, recent cuts in the Fed’s interest levels have led to a welcome decline in home equity loan rates today.

Moreover, competition among lenders plays a crucial role in shaping pricing options. As more lenders enter the market, they often reduce prices to attract borrowers like you. It’s important to recognize that economic indicators—such as employment levels and consumer confidence—also significantly impact lenders’ pricing decisions, reflecting both the economy’s health and your repayment capabilities.

Currently, mortgage interest rates hover around 8.25%, with hopes for further drops as the Federal Reserve considers additional reductions. Experts predict that a 25 basis point cut in the federal funds interest could lead to a similar decrease in home equity loan rates today, although substantial reductions may not be observed immediately. This evolving financial landscape underscores the importance of understanding how Federal Reserve policies affect borrowing expenses. We’re here to support you every step of the way as you navigate the strategic timing of your property financing requests.

Comparative Analysis: Pros and Cons of Today’s vs. Yesterday’s Rates

When we look at today’s residential financing terms compared to those of previous years, we recognize both benefits and challenges. On the positive side, although current rates are higher than the record lows we saw in 2021, they are still significantly lower than the peaks of the 1980s. This shift has opened up residential financing options to a broader range of borrowers. Moreover, the competitive environment among lenders has led to , making the borrowing experience more pleasant.

However, it’s important to note that home equity loan rates today are relatively high compared to the last decade, which may discourage some potential borrowers from pursuing equity loans. Additionally, ongoing economic uncertainty and inflation concerns could lead to further rate increases in the future. This highlights the need for strategic decision-making for those looking to navigate their mortgage options.

With American homeowners now averaging about $315,000 in home equity—an increase of nearly $129,000 since 2020—it’s crucial to understand these dynamics. As you consider leveraging your equity, we encourage you to weigh the pros and cons carefully. Making informed financial decisions is key, and we’re here to support you every step of the way.

Conclusion

The current landscape of home equity loan rates reflects a significant evolution in borrowing conditions compared to historical trends. As families navigate the options available, we know how challenging this can be. Understanding the fluctuations in interest rates—from the highs of the 1980s to the lows of recent years—provides essential context for making informed financial decisions. While the present rates are higher than the record lows seen in 2021, they remain more favorable than the extremes of past decades. This emphasizes the importance of strategic planning for potential borrowers.

Key insights reveal that factors such as:

- Federal Reserve policies

- Inflation

- Market competition

play pivotal roles in shaping home equity loan rates today. We encourage borrowers to explore various lending options and consider personal financial goals, credit standings, and the implications of adjustable-rate mortgages. With the current average home equity loan rate hovering around 8.26%, it is crucial for homeowners to weigh the benefits and drawbacks of leveraging their home equity against the backdrop of economic uncertainty.

In light of these insights, it is vital for homeowners to stay informed and proactive in their borrowing strategies. By understanding the historical context and current trends, individuals can make empowered decisions that align with their financial aspirations. As the lending environment continues to evolve, taking the time to assess personal circumstances and market conditions will be key in navigating the complexities of home equity financing.

Frequently Asked Questions

What is the current average interest rate for home equity loans as of July 2025?

The national average interest percentage for residential financing is around 8.26%.

What are some of the specific rates offered by lenders for home equity loans?

Some lenders are offering terms as low as 6.63% for a $50,000 property financing option, while others propose terms close to 8.42% for a decade-long period.

Why is it important for borrowers to evaluate proposals from various lenders?

The variation in rates among lenders highlights the importance of exploring different offers to secure the most favorable home equity loan rates.

How do current refinancing costs compare to home equity loan rates?

Refinancing costs are currently lower than residential property financing interest percentages, averaging 6.88% for a 30-year fixed refinancing.

What factors should borrowers consider when deciding between refinancing and home equity loans?

Borrowers should consider the advantages of utilizing their asset value against the potential savings from refinancing.

What are Adjustable-Rate Mortgages (ARMs) and how can they benefit borrowers?

ARMs often start with lower initial rates compared to fixed-rate mortgages, making monthly payments more affordable, which can be beneficial if you plan to sell or refinance before the adjustment period.

Why is it important to understand personal financial goals before obtaining a mortgage?

Understanding your financial aims is crucial as it helps in making informed choices regarding borrowing against your property.

What should borrowers know about credit considerations when applying for a mortgage?

If you have poor credit, alternatives like acquiring a co-signer or utilizing a trusted bank can enhance your chances of obtaining funding.

What is the typical maximum Loan-to-Value (LTV) ratio for home financing?

The typical maximum LTV ratio generally ranges from 80% to 85%, which is critical in determining how much value you can access.

How can F5 Mortgage assist borrowers in the refinancing process?

F5 Mortgage is dedicated to discovering the best offer for borrowers, ensuring access to competitive pricing and tailored services during the refinancing process.