Overview

Navigating the underwriting process can feel daunting, and we understand how challenging this can be. Typically, it takes anywhere from a few days to several weeks, averaging around 30 to 45 days. This timeline often hinges on several factors:

- The completeness of your application

- The complexity of your financial situation

- The lender’s current workload

Timely documentation is crucial. When you provide everything needed promptly, it can significantly expedite the process. Additionally, maintaining financial stability during this period is essential. We’re here to support you every step of the way, helping you understand these dynamics for a smoother mortgage experience. By recognizing these elements, you can feel more empowered and prepared as you move forward.

Introduction

Navigating the mortgage process can feel overwhelming, especially during the crucial phase of underwriting. We understand how this stage not only shapes the outcome of a loan application but can also vary greatly in duration. This uncertainty often leaves potential borrowers anxious about how long they may have to wait.

By delving into the complexities of underwriting, you can uncover valuable insights into the factors that impact processing times and learn effective strategies to expedite your journey toward homeownership. With so many variables at play, how can you navigate this intricate landscape and ensure a smoother approval process?

We’re here to support you every step of the way.

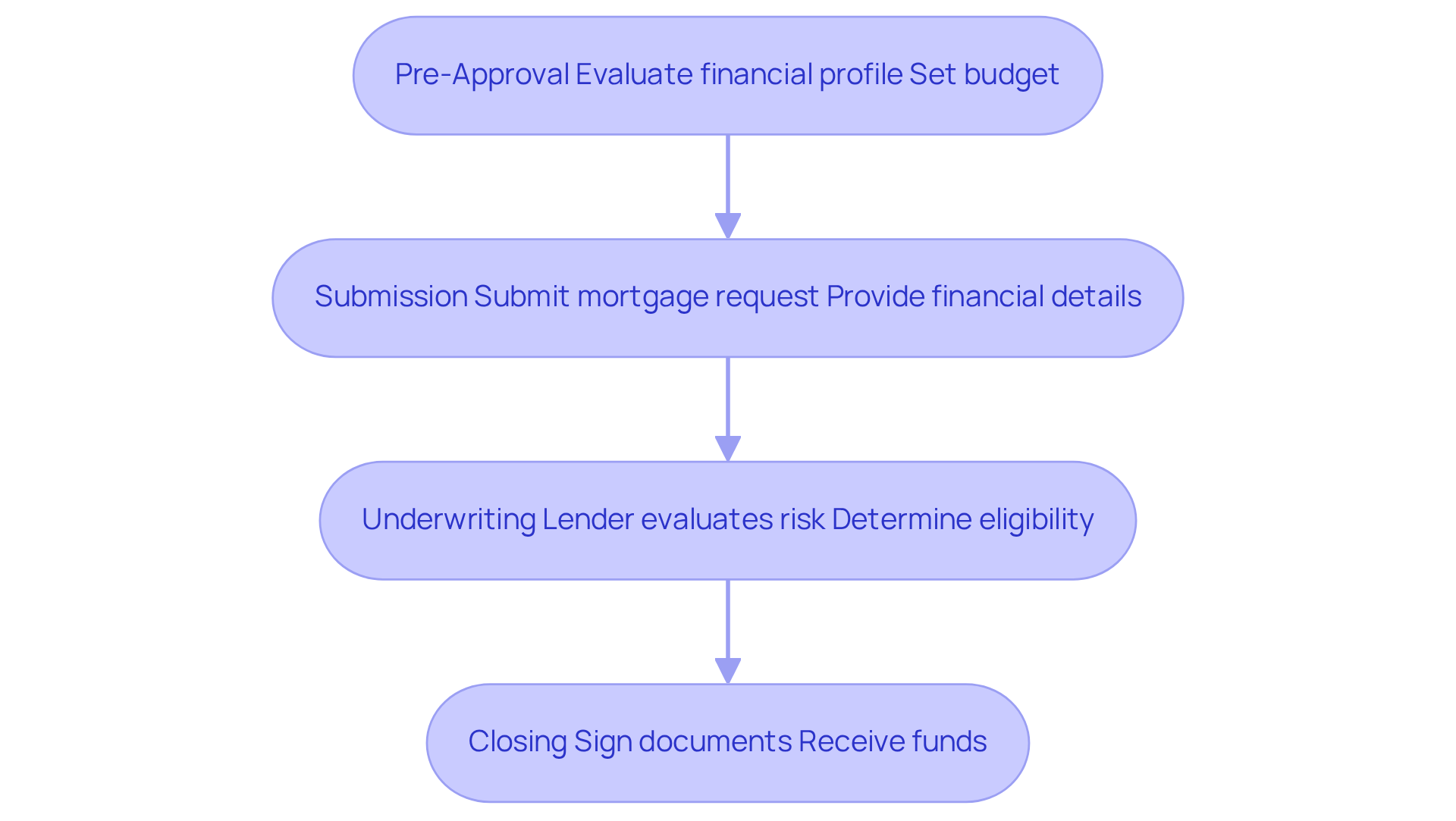

Understand the Mortgage Process Overview

Navigating the loan process can feel overwhelming, but understanding the crucial stages can empower you: pre-approval, submission, underwriting, and closing. Familiarity with these steps allows you to manage the intricacies of obtaining a loan with confidence.

Pre-Approval: This essential first step involves your lender evaluating your financial profile to determine your borrowing capacity. Achieving pre-approval not only helps you set a realistic budget but also signals to sellers that you are a serious contender in the housing market. We know how challenging this can be, and we’re here to support you every step of the way.

Once you’ve identified a property, the next step is to submit a mortgage request, which requires comprehensive financial details. This step is vital for the lender to assess your eligibility further, ensuring you are on the right path.

Underwriting: During this pivotal phase, the lender carefully scrutinizes your application to evaluate risk and determine your eligibility for the loan. The underwriting process can vary in duration, and understanding how long does underwriting take is essential, as it typically lasts from a few days to a couple of weeks, depending on the lender and the complexity of your financial situation.

Closing: Upon approval, you will finalize the loan by signing the necessary documents and receiving the funds to purchase your home. This stage signifies the culmination of your loan journey, bringing you closer to your dream.

Comprehending these phases not only prepares you for what lies ahead but also boosts your confidence during this financial journey. In 2025, the average time for loan pre-approval is expected to remain effective, with many lenders providing pre-approval in less than an hour, simplifying the route to homeownership.

Expert opinions emphasize that securing pre-approval is a critical step, as it can significantly enhance your home-buying experience, making it smoother and more successful. Case studies reveal that families who engage in thorough preparation and understand these stages often enjoy a more advantageous financial journey, leading to successful home upgrades.

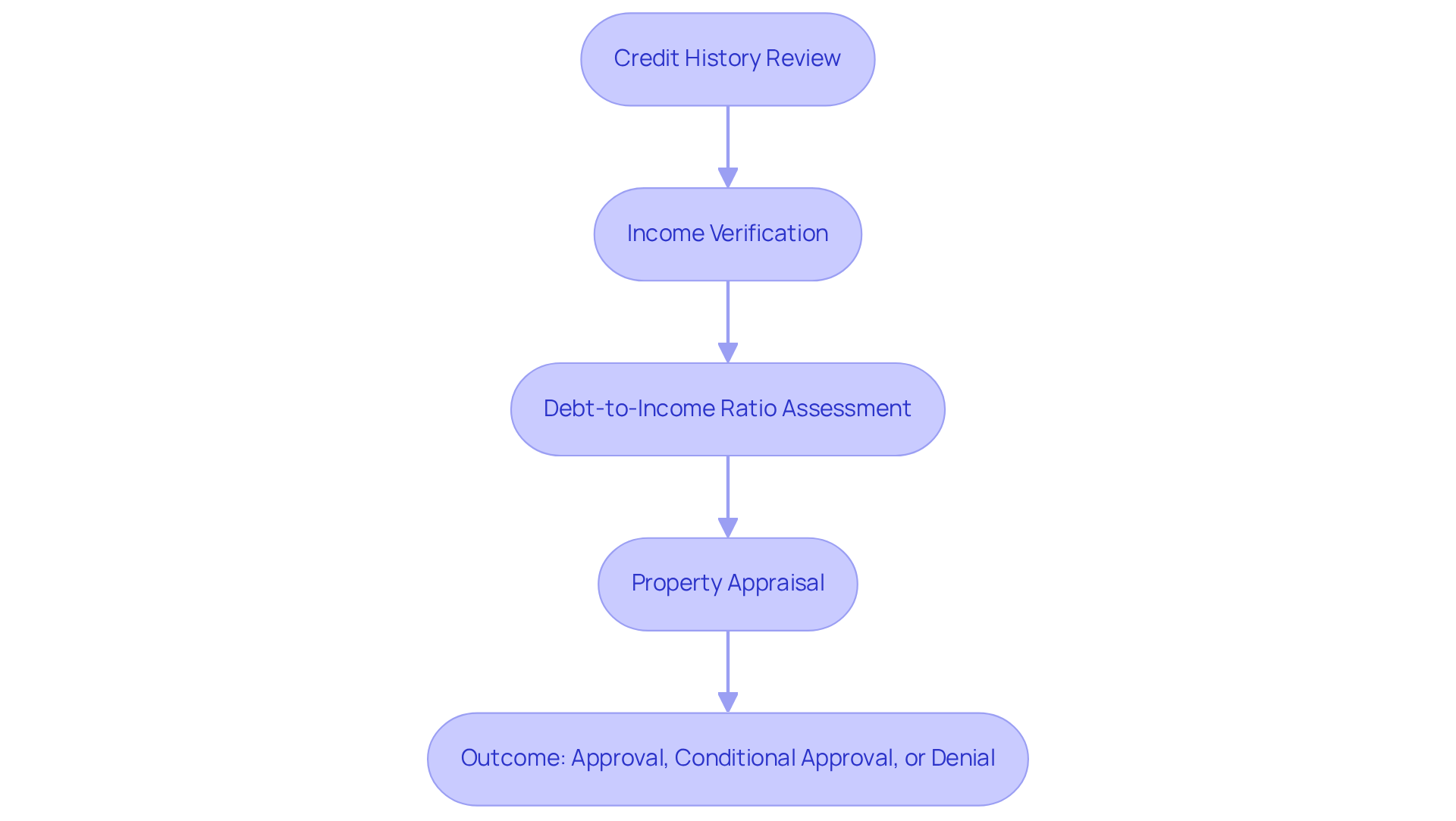

Explore the Role of Underwriting in Mortgage Approval

In the loan approval process, a crucial stage is underwriting, during which lenders assess the risk involved in lending to a borrower, leading to the question of how long does underwriting take. We understand that navigating this process can feel daunting, but knowing how long does underwriting take can help ease your concerns. This assessment involves a thorough review of several critical factors:

- Credit History: The underwriter examines the borrower’s credit score and past borrowing behavior, which are essential indicators of financial responsibility. We know how challenging it can be to maintain a good credit score. Significantly, many lenders demand a minimum credit score of 620 for conventional loans, and a considerable number of prospective homeowners mistakenly believe that outstanding credit is a requirement for loan approval.

- Income Verification: To confirm the borrower’s income, underwriters scrutinize pay stubs, tax returns, and other relevant documentation. This step is crucial, especially as recent updates in underwriting practices allow for more flexible evaluations of income, particularly for recent graduates with student loans. We’re here to support you every step of the way in this process.

- Debt-to-Income Ratio: This ratio compares the borrower’s monthly obligations to their earnings, ensuring they can comfortably handle loan payments. Approval rates for borrowers with a debt-to-income ratio below 20% are notably higher, at 74.58%. In contrast, those exceeding 50% face significantly lower approval rates. We understand that managing debt can be stressful, but knowing these numbers can empower you.

- Property Appraisal: The underwriter ensures that the property’s value aligns with the requested loan amount, safeguarding the lender’s investment. The lender will request a home appraisal to ascertain the current market value of your property, revealing how much equity you possess and directly impacting your loan rates. Knowing your property’s value can be a source of reassurance.

The outcome of this thorough evaluation can lead to one of three decisions: full approval, conditional approval (which may require additional documentation), or outright denial of the loan request, depending on how long does underwriting take. In 2023, the average loan request rejection rate increased to almost 21%, influenced by high sale prices and expenses. This highlights the significance of a robust submission, and we’re here to guide you through it.

Real-world instances demonstrate the effect of evaluation choices on loan applications. For instance, applicants with verified rental payment histories have seen improved approval rates, while those lacking such verification may face denials. As the mortgage landscape changes, comprehending these assessment dynamics is crucial for potential borrowers seeking favorable loan conditions. Remember, you’re not alone in this journey, and understanding these factors can make a significant difference.

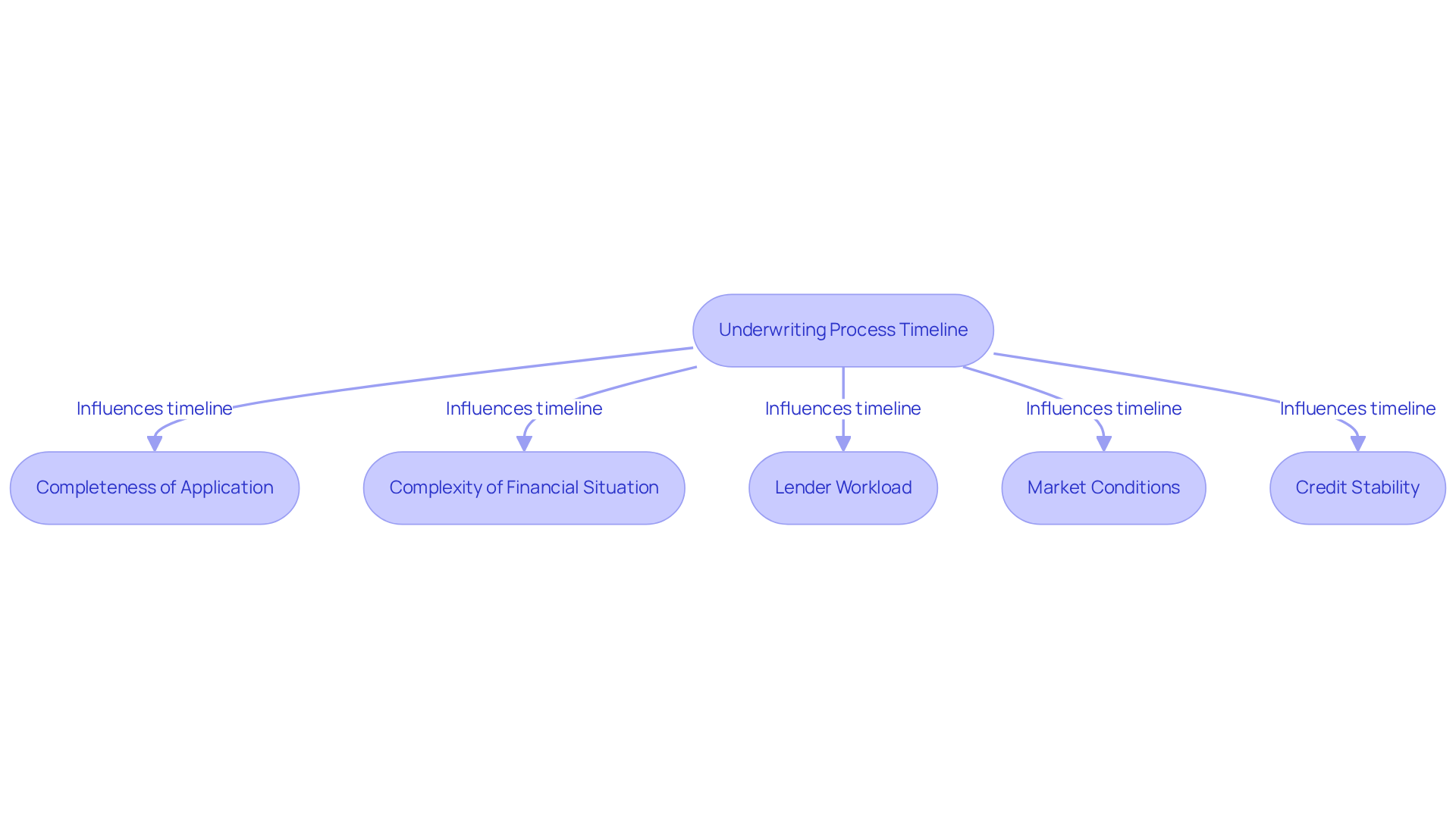

Determine How Long Underwriting Takes and Factors Affecting It

Navigating the underwriting procedure can feel daunting, particularly when wondering how long does underwriting take, with timelines ranging from a few days to several weeks—typically averaging between 30 to 45 days. Understanding the factors that influence how long does underwriting take can help ease your concerns.

-

Completeness of Application: We know how challenging it can be when applications are incomplete. Delays may occur as underwriters request additional information. By promptly providing all necessary documentation, you can help streamline the process, aligning with F5 Mortgage’s commitment to making your experience as stress-free as possible.

-

Complexity of Financial Situation: If you have a unique financial situation, such as being self-employed, more comprehensive evaluations and extra documentation may be required. F5 Mortgage understands these complexities and is here to handle them efficiently, ensuring you feel supported.

-

Lender Workload: The number of requests a lender is managing can impact how quickly your submission is evaluated. During peak times, like active real estate markets, the assessment process might take longer due to increased demand. At F5 Mortgage, we leverage technology to manage workloads effectively, ensuring your application is processed in a timely manner.

-

Market Conditions: In competitive markets, the demand for mortgage approvals can lead to longer processing times as lenders navigate increased application volumes. F5 Mortgage’s innovative approach helps us tackle these challenges, providing you with competitive rates without the hassle of traditional sales tactics.

-

Credit Stability: It’s crucial to maintain strong credit throughout the underwriting period. Significant changes in your credit score, debt-to-income ratio, or employment can complicate matters and lead to delays. Understanding your debt-to-income ratio is essential, and we’re here to support you every step of the way.

By grasping these elements, you can prepare efficiently and possibly accelerate your mortgage application journey with F5 Mortgage, ensuring a smoother transition to your new home.

Implement Strategies to Speed Up the Underwriting Process

To expedite the underwriting process with F5 Mortgage, we understand how long does underwriting take and how challenging this can be. Here are some strategies to help you navigate this journey more smoothly:

- Prepare Documentation Early: We know how overwhelming paperwork can be. Gather all necessary documents—like pay stubs, tax returns, and bank statements—before applying. This proactive step can significantly reduce delays, as the approval process may take anywhere from a couple of days to a few weeks. Essential documents include your Driver’s License, Social Security Card, two years of tax returns, at least two months of bank statements, pay stubs, a list of your debts, and employment history details.

- Be Responsive: We’re here to support you every step of the way, so it’s important to quickly respond to any requests from your lender or underwriter for additional information or clarification. Timely replies can help maintain momentum in the evaluation phase, showcasing F5 Mortgage’s dedication to a hassle-free experience.

- Maintain Financial Stability: Avoid making substantial financial changes, such as acquiring new debt or switching jobs, during the evaluation phase. Stability in your financial situation is crucial for a smooth approval, aligning with F5 Mortgage’s client-focused approach.

- Consider Pre-Underwriting: Utilizing pre-underwriting services can help identify potential issues before the formal underwriting begins. As mentioned by industry specialists, pre-underwriting assessments assist in filtering qualified applications early, enhancing efficiency and minimizing delays.

- Communicate Clearly: Keeping open lines of communication with your lender is vital. This ensures everyone is on the same page and allows you to address any concerns promptly. Clear communication can prevent misunderstandings that may slow down the process, reinforcing F5 Mortgage’s no-pressure guidance philosophy.

By following these strategies, you can facilitate a more efficient and faster underwriting experience with F5 Mortgage, which will help you learn how long does underwriting take, ultimately leading to quicker loan approvals.

Conclusion

Understanding the mortgage process is essential for anyone looking to buy a home. We know how challenging this can be, and the underwriting phase plays a pivotal role in determining the success of your loan application. By grasping the intricacies of underwriting, you can navigate this often daunting process with greater confidence and clarity.

This article highlights the key stages of obtaining a mortgage, from pre-approval through to closing. It emphasizes the importance of thorough preparation and understanding each phase’s requirements. Factors such as:

- credit history

- income verification

- debt-to-income ratios

are critical in the underwriting process, as they directly influence the likelihood of loan approval. Moreover, strategies for expediting underwriting—such as preparing documentation early and maintaining financial stability—can significantly enhance your overall experience.

Ultimately, recognizing the significance of underwriting not only demystifies the mortgage approval process but also empowers you to take proactive steps toward achieving your homeownership dreams. By staying informed and engaged throughout each stage, you can better position yourself for success in the competitive housing market. We’re here to support you every step of the way, ensuring that your journey to homeownership is as smooth and efficient as possible.

Frequently Asked Questions

What are the main stages of the mortgage process?

The main stages of the mortgage process are pre-approval, submission, underwriting, and closing.

What is the purpose of pre-approval in the mortgage process?

Pre-approval involves the lender evaluating your financial profile to determine your borrowing capacity, helping you set a realistic budget and signaling to sellers that you are a serious contender in the housing market.

What happens after obtaining pre-approval?

After obtaining pre-approval, the next step is to submit a mortgage request, which requires comprehensive financial details for the lender to assess your eligibility further.

What is the underwriting process?

The underwriting process is when the lender carefully scrutinizes your application to evaluate risk and determine your eligibility for the loan. This phase can vary in duration, typically lasting from a few days to a couple of weeks.

What occurs during the closing stage of the mortgage process?

During the closing stage, you finalize the loan by signing the necessary documents and receiving the funds to purchase your home, marking the culmination of your loan journey.

How long does pre-approval typically take in 2025?

In 2025, many lenders are expected to provide pre-approval in less than an hour, simplifying the route to homeownership.

Why is securing pre-approval considered critical?

Securing pre-approval is critical because it can significantly enhance your home-buying experience, making it smoother and more successful.

What do case studies reveal about preparation in the mortgage process?

Case studies reveal that families who engage in thorough preparation and understand the mortgage stages often enjoy a more advantageous financial journey, leading to successful home upgrades.