Overview

Navigating the world of Home Equity Line of Credit (HELOC) loan rates can feel overwhelming, but understanding the key factors at play can empower you. Your credit score, the loan-to-value ratio, and current market conditions are crucial elements that significantly influence the interest rates and terms offered by lenders. We know how challenging this can be, and that’s why it’s essential to grasp these factors. By doing so, you can make informed financial decisions that align with your family’s needs.

We’re here to support you every step of the way. A strong credit score can open doors to better rates, while a favorable loan-to-value ratio can enhance your borrowing power. Additionally, staying informed about prevailing market conditions can help you anticipate changes that may affect your financial situation. Remember, understanding these elements not only helps you navigate the loan process but also fosters confidence in your decisions.

Take the time to assess your financial standing and explore your options. By acknowledging these key factors, you can position yourself to secure the best possible terms for your HELOC. Your journey towards financial empowerment starts with knowledge, and we’re here to guide you through it.

Introduction

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is crucial for homeowners like you who are looking to leverage your property’s value. We know how challenging navigating financial options can be, especially with average HELOC rates hovering around 8%. The potential for significant savings compared to higher-interest credit options is enticing, but it’s essential to approach this wisely.

However, the journey to securing the best terms can be fraught with challenges. Various factors—including credit scores, market conditions, and lender policies—play pivotal roles in determining rates. We’re here to support you every step of the way as you navigate this complex landscape. How can you make informed financial decisions that suit your unique needs? Let’s explore this together.

F5 Mortgage: Competitive HELOC Loan Rates and Personalized Service

At F5 Mortgage LLC, we understand how challenging navigating the mortgage sector can be. That’s why we stand out by offering a commitment to personalized service along with competitive HELOC loan rates. As an independent mortgage brokerage, we collaborate with over two dozen top lenders, allowing us to provide a diverse range of loan options tailored specifically to your family’s needs. This strategic partnership not only simplifies the mortgage process but also empowers you to make informed decisions about your home equity borrowing.

Currently, home equity line of credit percentages average around 8%, which is significantly lower than credit card rates that can soar to nearly 22%. This competitive pricing, combined with the flexibility of HELOCs, makes them an appealing choice for homeowners looking to leverage their equity. Furthermore, the average cost to refinance in Colorado typically falls between 2% and 5% of the total loan amount, offering valuable context for those considering their options. Our clients have expressed their appreciation for our exceptional service; for example, Ruth Vest praised our financial expertise and outstanding customer support, while Artie Kamarhie highlighted our team’s patience and attention to detail as a first-time homebuyer.

By prioritizing your needs and ensuring a transparent process, we aim to simplify the complexities of home equity borrowing. We strive to create a supportive environment where you can feel confident in your financial decisions. Additionally, with expectations that HELOC loan rates may slightly decrease by year’s end, now is an excellent time for families to explore their options. Competitors like Truist offer credit lines up to $1 million, and Navy Federal Credit Union is recognized for its high customer satisfaction ratings, illustrating the competitive landscape in which we operate. We’re here to support you every step of the way.

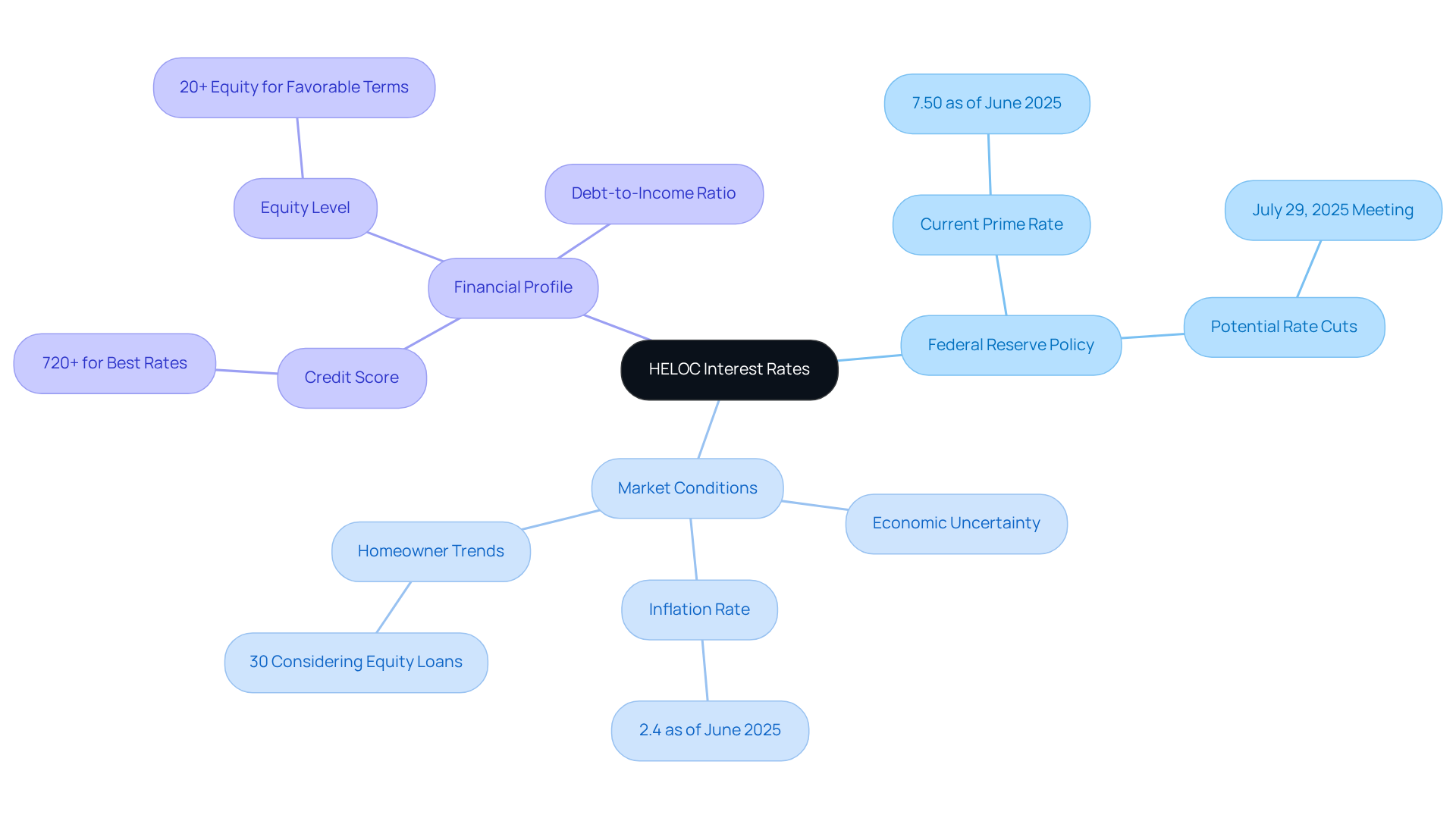

Understanding HELOC Interest Rates: How They Are Determined

Understanding HELOC borrowing costs can feel overwhelming, but we’re here to support you every step of the way. These costs are influenced by several factors, including the Federal Reserve’s monetary policy, current market conditions, and your financial profile. Typically, HELOC loan rates have fluctuating interest levels that vary based on the prime rate set by the Federal Reserve. As of June 2025, the prime interest rate stands at 7.50%. It’s important to be aware that charges can increase after introductory periods.

Lenders consider various key factors when determining your specific fee. These include:

- Your credit score

- Debt-to-income ratio

- The level of equity in your property

For instance, if you have a credit score of 720 or above and at least 20% equity, you are likely to receive the most favorable terms, which currently average around 8.27% for HELOC loan rates. Understanding these dynamics is crucial for you, as it helps you anticipate potential fluctuations in your payments and select the best loan options available.

Moreover, with nearly 30% of property owners considering equity loans during times of economic uncertainty, being informed about these factors can significantly influence your financial choices. We know how challenging this can be, but having this knowledge empowers you to make decisions that best suit your needs.

Pros and Cons of HELOCs: Weighing Your Options

HELOCs present a range of benefits that can truly support homeowners. Their adaptability in borrowing and the favorable HELOC loan rates compared to other credit alternatives make them a compelling choice. Homeowners have the flexibility to draw funds as needed, which is especially useful for home improvements or consolidating debt. For instance, many homeowners have successfully utilized HELOCs to fund renovations that not only enhance their living spaces but also increase property value. Plus, there’s the added potential for tax deductibility when funds are allocated for home-related improvements.

However, it’s important to recognize that there are significant drawbacks to consider. HELOCs typically come with fluctuating interest charges, which can lead to unpredictable monthly payments. As we look ahead to 2025, the anticipated HELOC loan rates are expected to range from 8% to 10%, influenced by factors like credit score and borrowing amount. This variability can complicate budgeting, especially if HELOC loan rates rise, which could potentially increase payments by as much as 18% over time.

Moreover, since the home serves as collateral, there’s a risk of foreclosure if repayment obligations are not met. This reality highlights the necessity of having a solid repayment plan in place. Homeowners should also be mindful of additional costs, such as closing fees, which can range from 2% to 5% of the credit limit, similar to refinancing a mortgage. In California, specific refinancing costs may include:

- Application fees between $75 and $500

- Origination fees of 0.5% to 1.5% of the loan amount

- Appraisal fees that typically fall between $300 and $500

It’s also wise to consider potential penalties for early repayment, as these can add to the overall cost of borrowing.

Determining the break-even point for refinancing can be a valuable exercise; it helps homeowners understand how long it will take to recover expenses through savings in monthly payments or loan costs.

In summary, while HELOCs offer a flexible and often cost-effective financing solution, we urge you to carefully consider their risks and costs. Understanding the implications of refinancing is crucial for homeowners contemplating this option. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

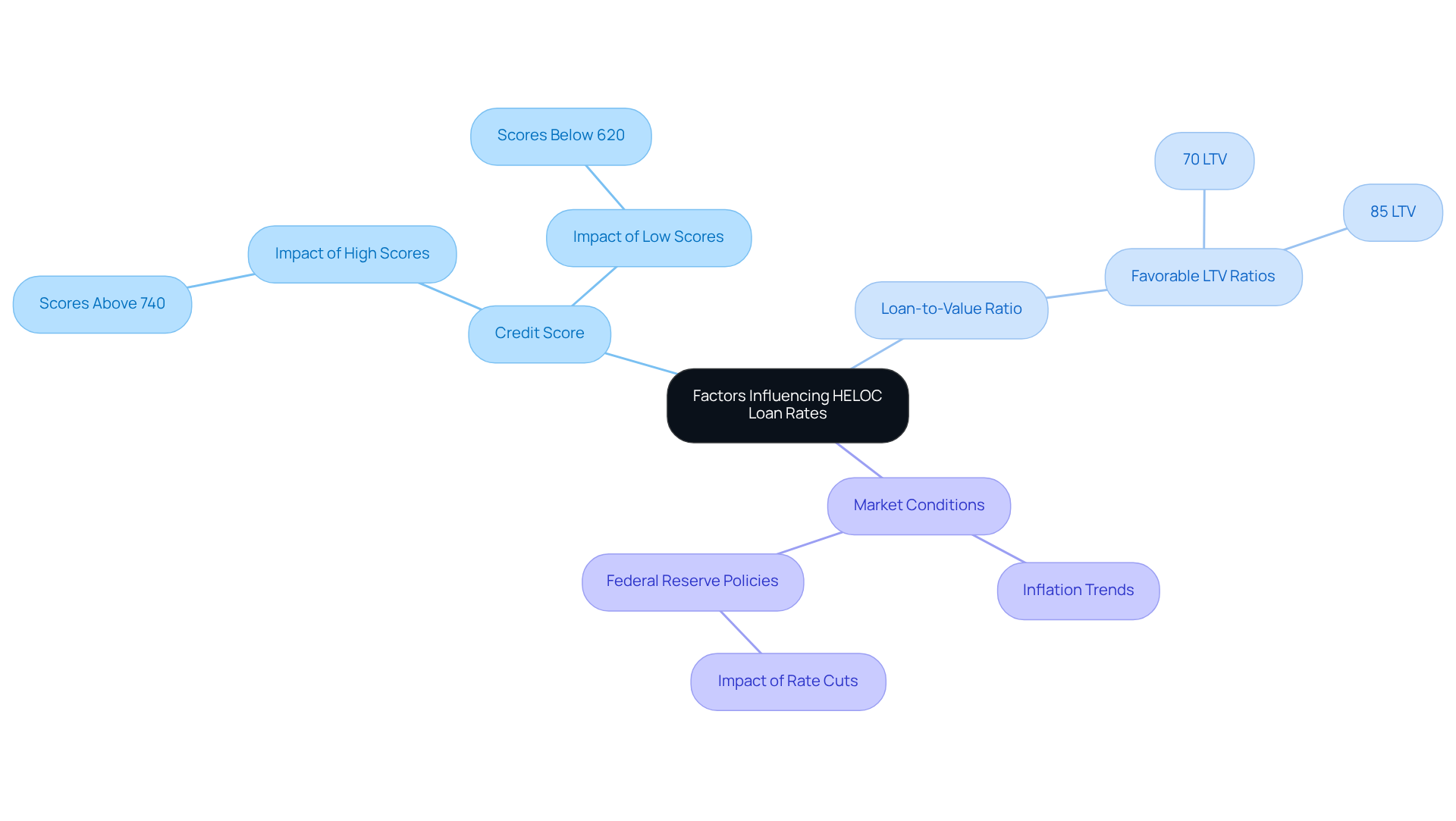

Factors Influencing HELOC Loan Rates: What to Consider

Navigating the world of HELOC loans can feel overwhelming, but understanding a few key elements can make a significant difference. Several crucial factors influence HELOC loan rates, including your credit score, loan-to-value (LTV) ratio, and current market conditions. We know how challenging this can be, but an elevated credit score typically leads to lower interest charges, reflecting a reduced risk for lenders. For instance, borrowers with a credit score above 740 may secure terms significantly better than those with scores below 620.

Equally important is the LTV ratio, which compares the loan amount to the appraised value of your home. A lower LTV ratio often results in more favorable terms. Imagine a borrower with a 70% LTV receiving a better offer than someone with an 85% LTV. Additionally, broader economic conditions, such as inflation trends and the Federal Reserve’s interest policies, play a vital role in shaping overall lending costs.

As of mid-2025, the HELOC loan rates average approximately 8.22%, influenced by these macroeconomic factors. When seeking a home equity line of credit, it’s essential to thoughtfully evaluate these elements to secure the most beneficial terms and prices. We’re here to support you every step of the way, so don’t hesitate to compare prices, fees, and conditions from various lenders. For example, F5 Mortgage is recognized for its competitive offers and personalized service, ensuring you have the best possible outcomes.

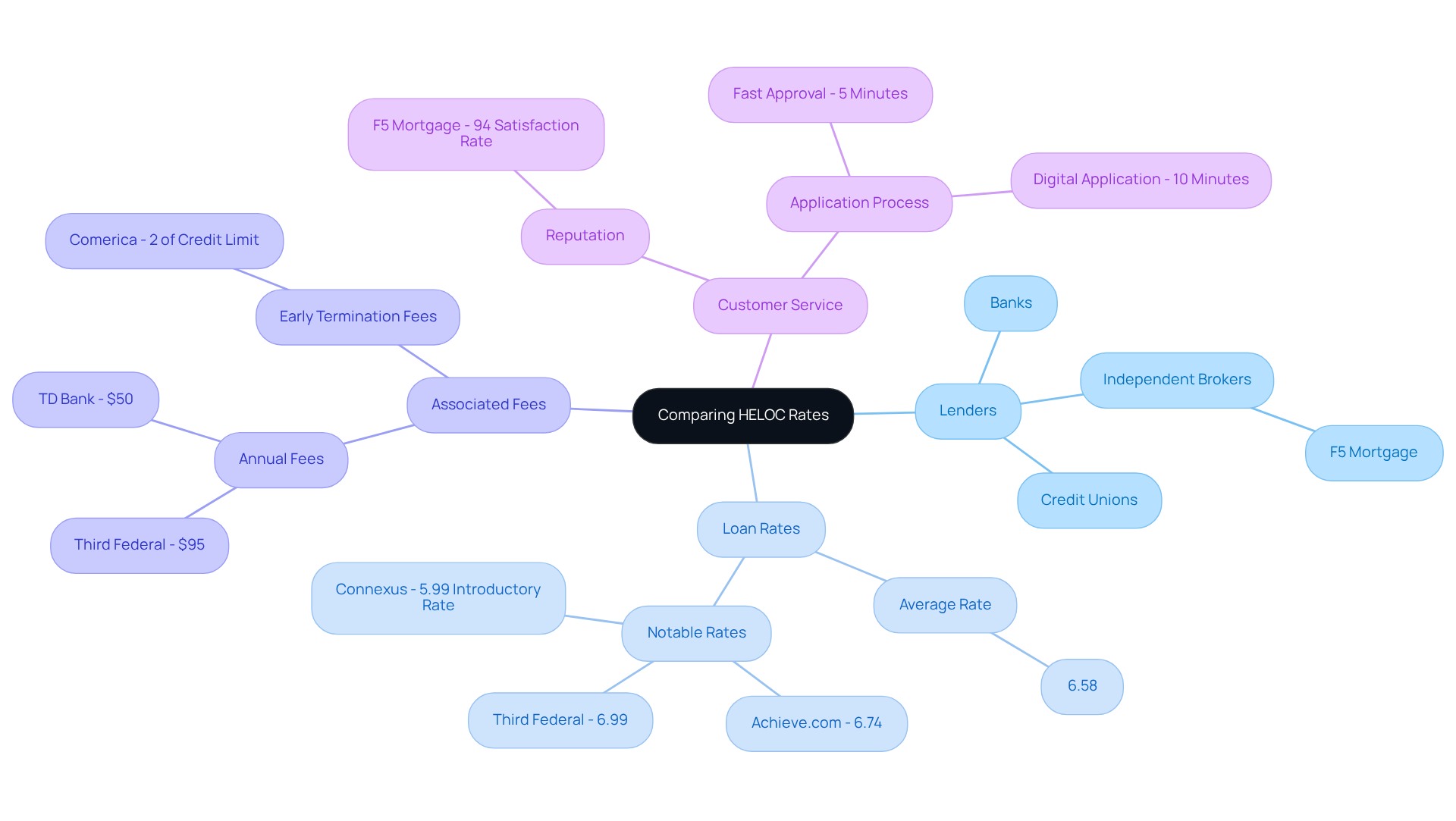

Comparing HELOC Rates: Finding the Best Lender

When considering a Home Equity Line of Credit (HELOC), we understand how important it is to compare HELOC loan rates from different lenders to secure the best deal for your family. Start by gathering quotes from a variety of financial organizations, including banks, credit unions, and independent brokers like F5 Mortgage, known for their competitive pricing and personalized service. Focus on the annual percentage rate (APR), associated fees, and the terms of each offer related to HELOC loan rates.

As of July 3, 2025, the average HELOC loan rates have slightly decreased to 6.58%. This presents a favorable opportunity for borrowers. It’s also essential to assess the lender’s reputation for customer service and their responsiveness during the application process. Before you apply, consider taking steps to improve your credit score. Order a copy of your credit report to check for errors or discrepancies, pay down existing debts to lower your debt-to-income ratio, and use credit wisely by avoiding large purchases while making timely payments.

HELOCs allow homeowners to access their home equity without disturbing the primary mortgage, which can be a significant advantage for those in need of funds. By conducting thorough comparisons, you can choose a lender that aligns with your financial goals, ensuring a positive borrowing experience. In 2025, the best lenders for HELOCs will provide not only attractive HELOC loan rates but also low fees, fixed-rate options, and generous credit lines tailored to your individual needs. Remember, we’re here to support you every step of the way in this important financial decision.

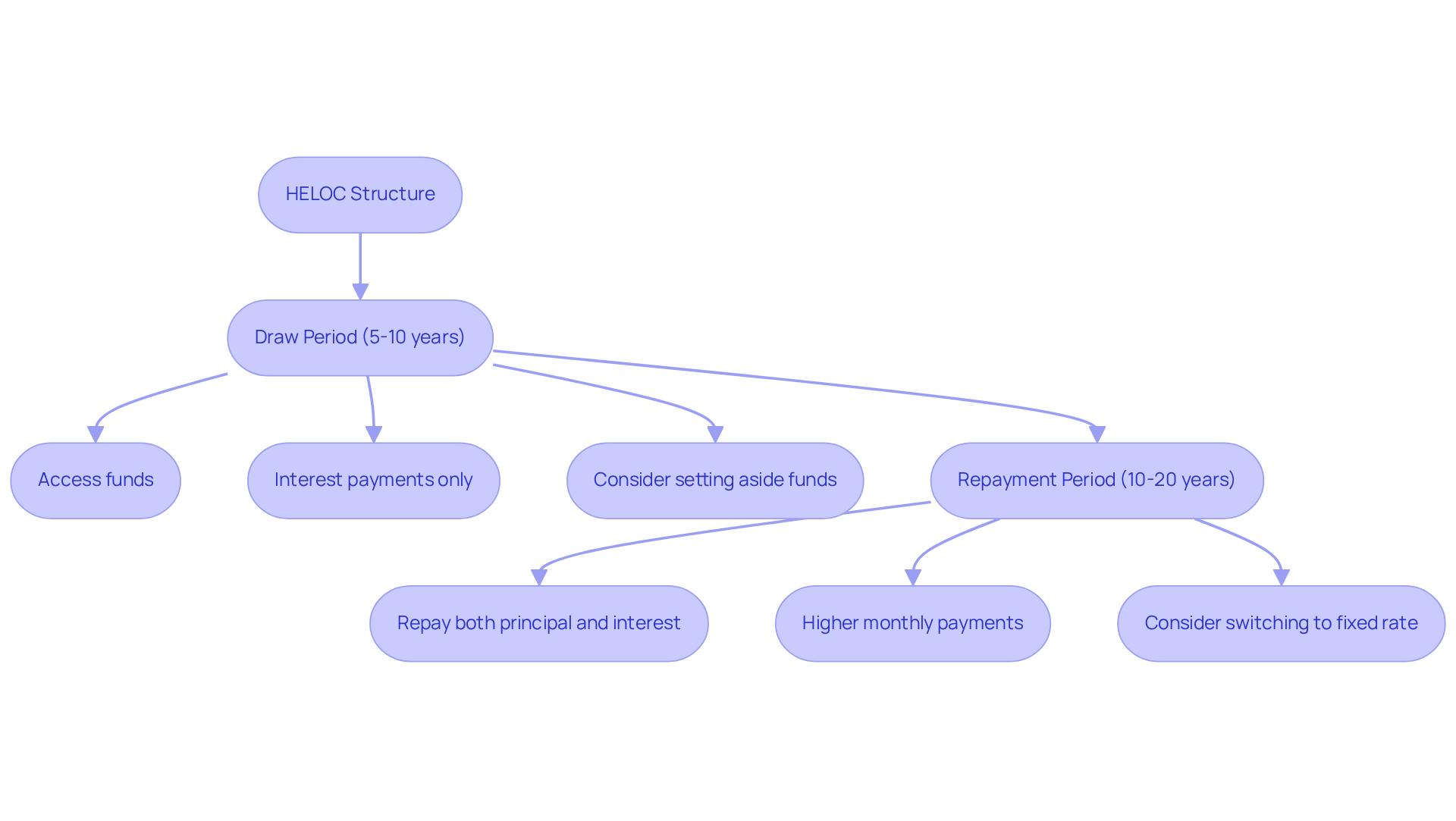

HELOC Repayment Structures: What Borrowers Need to Know

Home Equity Lines of Credit (HELOCs) are structured around two key phases: the draw period and the repayment period. We know how challenging this can be, especially when it comes to managing your finances. The draw period generally lasts between 5 to 10 years, allowing borrowers to access funds as needed, often requiring only interest payments during this time. Following this phase, the home equity line of credit transitions into the repayment period, which typically lasts 10 to 20 years. During this time, borrowers must begin repaying both principal and interest. This shift can lead to significantly higher monthly payments, making it vital for borrowers to budget effectively in advance.

To navigate this transition smoothly, consider setting aside funds during the draw period to cover future payments. This proactive approach can alleviate stress when the repayment phase begins. As highlighted in a case study on home equity line of credit repayment preparation, planning ahead is essential. Additionally, exploring alternatives to switch to a fixed rate can provide predictability and peace of mind.

As Karen Axelton points out, “Once the draw phase concludes, usually between five and 10 years after the home equity line of credit is sanctioned, you must begin repaying both principal and charges.” Regularly reviewing your financial situation and adjusting your budget as necessary is also advisable. Understanding the repayment structures, such as HELOC loan rates, is crucial for avoiding financial strain and ensuring a manageable repayment process.

Moreover, using a home equity line of credit for debt consolidation can reduce interest charges, making it an appealing option for managing financial responsibilities. However, it’s important to be aware of the risks involved, including the potential loss of your home if payments are not made. Remember, we’re here to support you every step of the way.

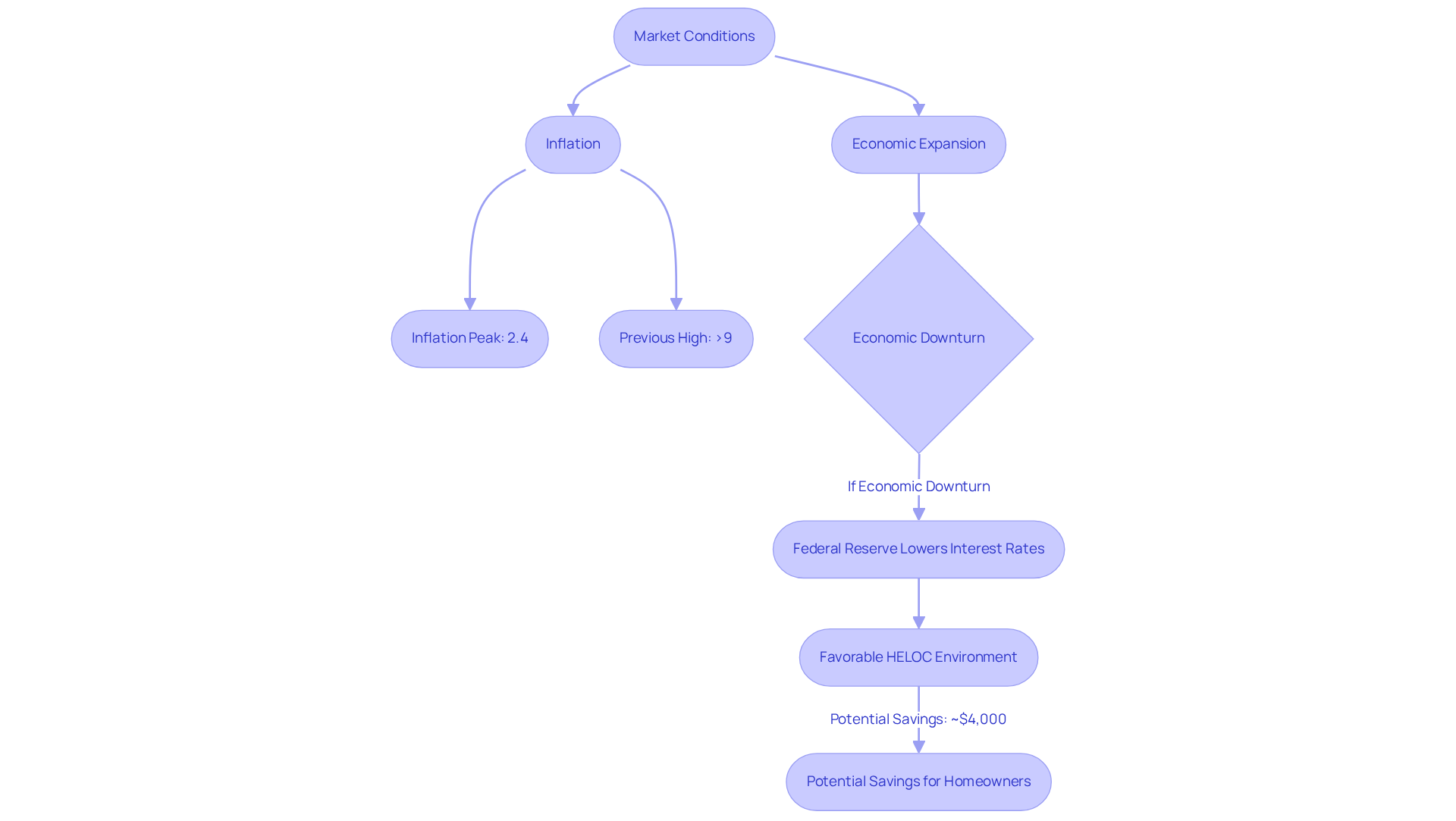

Market Conditions and Their Impact on HELOC Rates

Market conditions can significantly impact HELOC loan rates, and we understand how crucial this is for homeowners. Inflation and economic expansion play vital roles in these fluctuations. When inflation rises, lenders often respond by increasing charges to protect their profit margins. Recently, inflation peaked at 2.4%, a notable decrease from over 9% in mid-2022, leading to a stabilization of HELOC costs.

During economic downturns, the Federal Reserve may lower interest rates to encourage borrowing and spending. This creates a more favorable environment for homeowners seeking access to their equity. Looking ahead to 2025, the Federal Reserve is expected to reduce interest rates by 0.5-1%. This change could positively influence HELOC costs, potentially saving homeowners a significant amount—around $4,000 annually for a $200,000 line of credit if interest rates rise in the future.

Currently, HELOC averages sit at 8.27% for $30,000 lines, presenting a beneficial entry point for borrowers. Grasping these dynamics is essential for property owners. The interplay between inflation, economic growth, and monetary policy can lead to variations in HELOC loan rates and other equity products. Staying informed about these trends empowers homeowners to make strategic financial decisions regarding their home equity borrowing options. Remember, we’re here to support you every step of the way as you navigate these important choices.

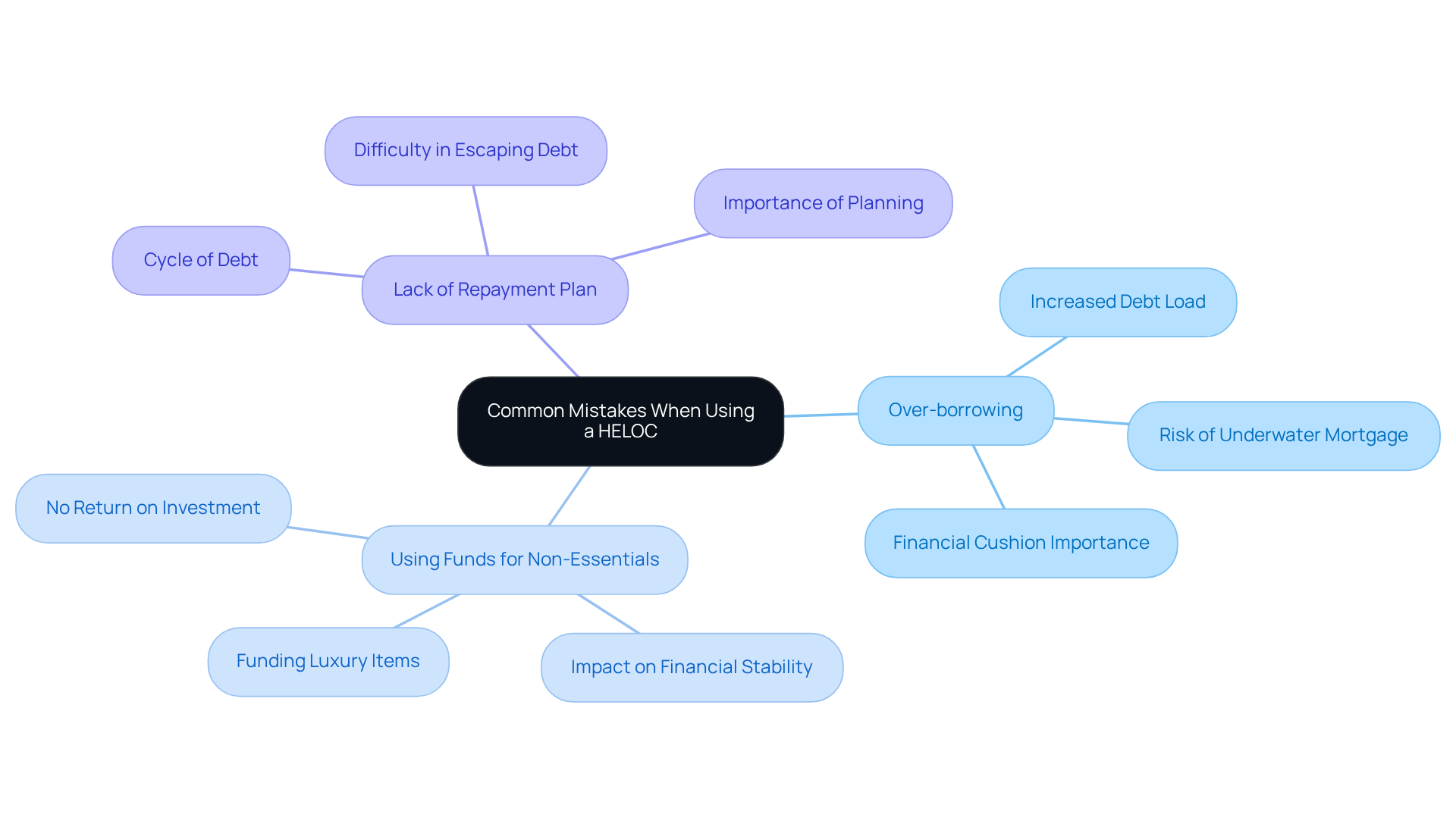

Common Mistakes to Avoid When Using a HELOC

When utilizing a Home Equity Line of Credit (HELOC), we know how challenging it can be to navigate potential pitfalls. One significant risk is over-borrowing; homeowners should only withdraw what is necessary to prevent excessive debt accumulation. In 2025, many families have found themselves under financial pressure due to escalating costs and heightened monthly payments from excessive borrowing on HELOCs. Currently, the average HELOC loan rates are at 8.55%, while equity loan interest rates are slightly lower at 8.40%. This difference highlights the importance of understanding the borrowing landscape.

Furthermore, we want to emphasize that using home equity line funds for non-essential expenses, such as luxury items or vacations, can jeopardize your financial stability. Experts warn that these expenditures do not provide a return on investment and can lead to long-term financial burdens. As Natalie Campisi wisely states, “A home equity line of credit is best saved for tactical actions—such as enhancing your property’s value or addressing urgent costs—not for indulgences or funding poor practices.”

It is crucial for borrowers to have a clear repayment plan in place; without one, they risk falling into a cycle of debt that can be difficult to escape. By being aware of these pitfalls and creating a detailed repayment strategy, we can help you utilize your HELOC more responsibly and safeguard your financial future.

Tax Implications of HELOCs: What You Should Know

Navigating the world of Home Equity Lines of Credit (HELOC) can feel overwhelming, but understanding the potential tax benefits can ease some of that burden. If you use the funds from your HELOC to purchase, construct, or significantly enhance your home, you may find that the amount paid is tax-deductible. We know how challenging this can be, so it’s essential to keep meticulous records of how you utilize these funds to support your eligibility for the deduction.

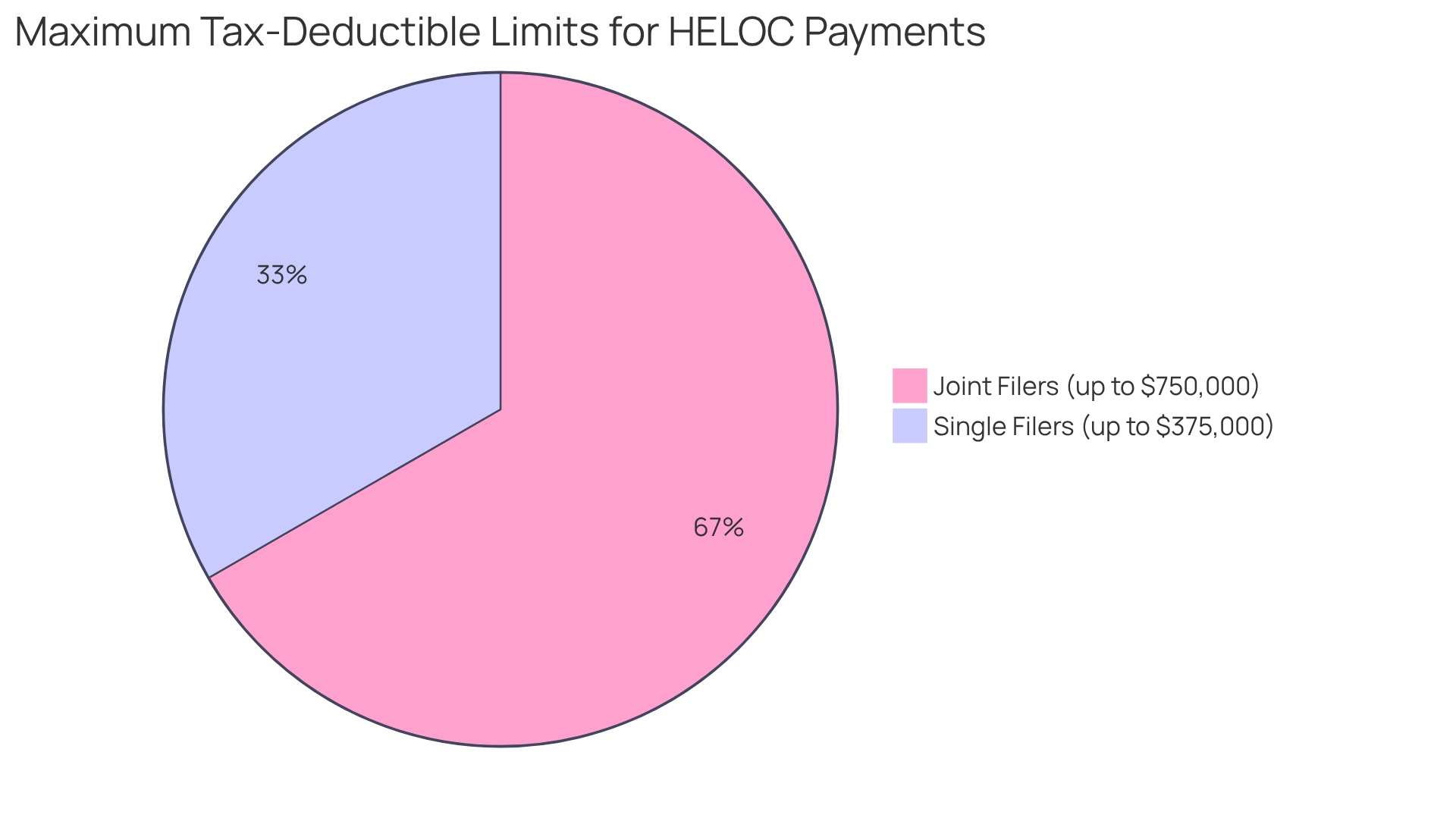

Current tax regulations can be confusing, especially since they change frequently. For loans obtained after December 15, 2017:

- Joint filers can deduct payments on up to $750,000.

- Single filers can deduct payments on up to $375,000.

This can lead to substantial savings, particularly for homeowners undertaking significant renovations or improvements.

However, it’s crucial to consult with a tax professional who can help you navigate the current landscape effectively. They can provide guidance tailored to your situation, ensuring you make the most informed decisions possible. Remember, understanding these tax implications is not just about numbers; it’s about making your home the sanctuary you envision.

Alternatives to HELOCs: Exploring Other Financing Options

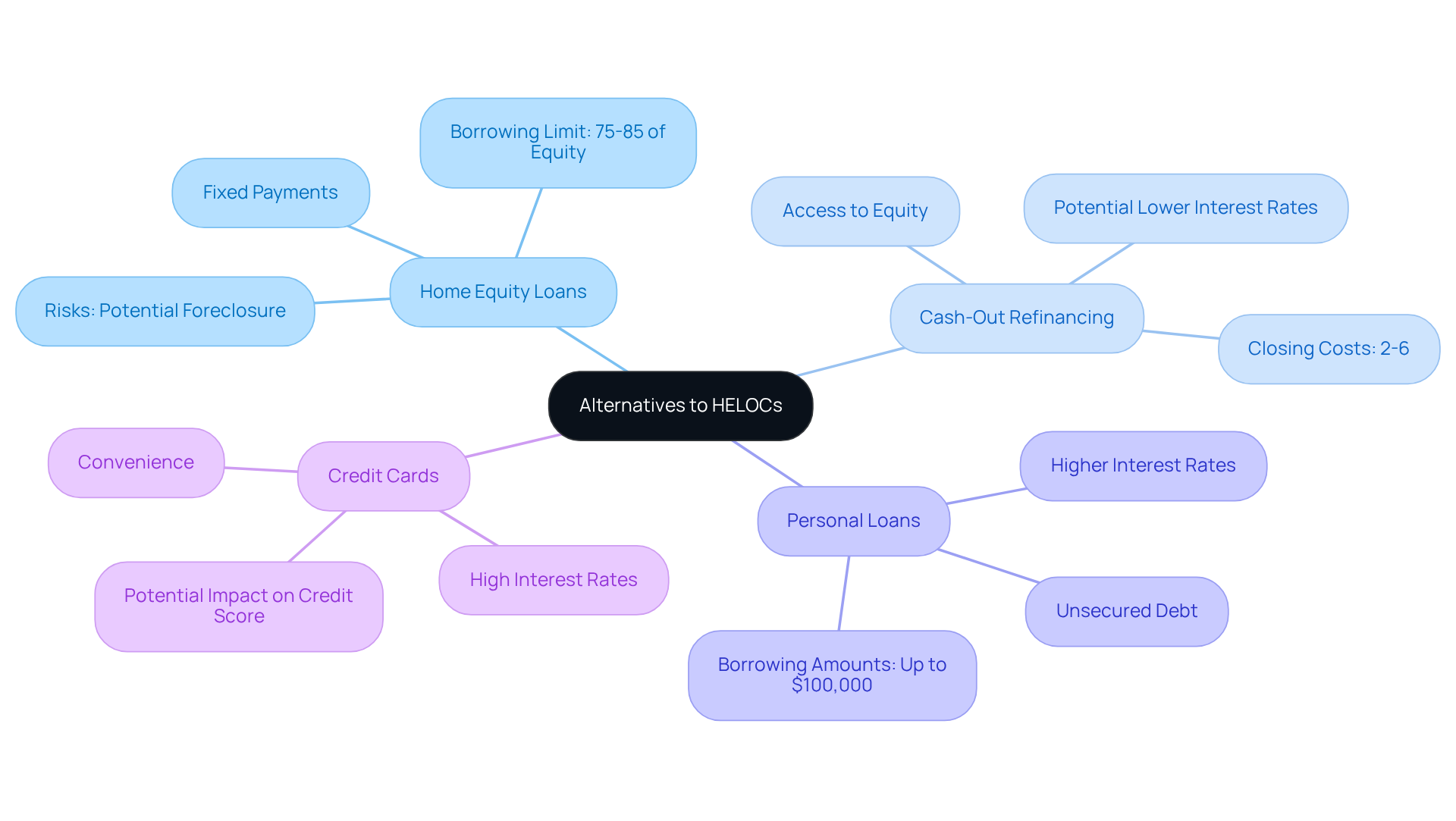

Homeowners exploring financing options beyond HELOCs have several viable alternatives to consider. We know how challenging it can be to navigate these choices, and we’re here to support you every step of the way.

- Home equity loans provide a lump sum with fixed payments, offering predictability that aids in budgeting.

- In contrast, cash-out refinancing allows homeowners to substitute their current mortgage with a larger loan, facilitating access to equity while potentially obtaining a reduced interest charge. This choice can be especially attractive, particularly with current mortgage costs in Colorado being competitive. It’s an excellent moment to refinance.

By consolidating payments into one mortgage, homeowners can simplify their financial management and potentially benefit from tax advantages and lower PMI through F5 Mortgage. F5 Mortgage provides a technology-focused method that guarantees extremely competitive pricing without the inconvenience of aggressive sales strategies, rendering the refinancing process more customer-friendly. Although personal loans and credit cards are options, they typically have higher costs and less advantageous conditions compared to equity products, making them less suitable for property owners.

When evaluating these options, it’s important to consider your financial situation and long-term goals. For example, while equity loans generally permit borrowing up to 85% of available equity, cash-out refinancing through F5 Mortgage can facilitate access to up to 90% of a property’s value, offering greater flexibility. Furthermore, the average interest rates for equity loans and HELOC loan rates in 2025 are anticipated to be competitive. This makes it crucial for borrowers to compare offers meticulously.

Specialist viewpoints indicate that for bigger, organized costs, like residential renovations, a home equity loan might be more appropriate because of its fixed characteristics. Ted Rossman, a Senior Industry Analyst, observes that a property equity loan or line of credit could be a feasible choice for substantial costs such as a new roof. Conversely, for those needing flexibility, a HELOC might be advantageous. However, homeowners should also be aware of the risks associated with home equity loans, such as the potential loss of their home if payments are missed. Ultimately, the choice between these financing options should align with your individual financial needs and risk tolerance.

To explore your refinancing options with F5 Mortgage, consider using our mortgage calculator or applying now to lock in a competitive rate.

Conclusion

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is crucial for homeowners looking to leverage their property equity effectively. We know how challenging this can be, and this article has explored the various factors that influence HELOC loan rates. It’s important to be informed about elements such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

By gaining insight into these components, borrowers can make more strategic decisions and secure favorable terms that align with their financial goals.

Key arguments presented include:

- The impact of economic trends on HELOC rates

- The advantages and disadvantages associated with these loans

We also emphasize the critical need for careful budgeting during the repayment phase. Additionally, comparing rates from different lenders is significant to ensure the best possible deal. Remember, there are potential tax benefits available when funds are used for home improvements.

Ultimately, navigating the HELOC landscape requires diligence and knowledge. Homeowners are encouraged to assess their financial situations and explore various lending options. Consulting with professionals when necessary can provide valuable support. By understanding the nuances of HELOCs and staying informed about current trends, individuals can confidently utilize this financial tool to enhance their homes and manage their finances more effectively. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is an independent mortgage brokerage that offers personalized service and competitive HELOC loan rates by collaborating with over two dozen top lenders to provide a diverse range of loan options tailored to individual needs.

What are the current average rates for home equity lines of credit (HELOC)?

The current average rates for HELOCs are around 8%, which is significantly lower than credit card rates that can reach nearly 22%.

What factors influence HELOC interest rates?

HELOC interest rates are influenced by the Federal Reserve’s monetary policy, current market conditions, and individual financial profiles, including credit score, debt-to-income ratio, and the level of equity in the property.

What are the benefits of using a HELOC?

HELOCs provide flexibility in borrowing and favorable loan rates compared to other credit options. They can be used for home improvements, debt consolidation, and may offer potential tax deductibility for home-related expenses.

What are the drawbacks of HELOCs?

The main drawbacks include fluctuating interest rates that can lead to unpredictable monthly payments, the risk of foreclosure since the home serves as collateral, and additional costs such as closing fees and potential penalties for early repayment.

What should homeowners consider when evaluating HELOCs?

Homeowners should consider their credit score, the amount of equity in their property, and the potential for rising interest rates. It’s also important to have a solid repayment plan and to be aware of costs associated with closing and refinancing.

What are typical costs associated with refinancing a HELOC in Colorado?

The average cost to refinance in Colorado typically falls between 2% and 5% of the total loan amount.

How can homeowners prepare for potential fluctuations in HELOC payments?

Homeowners can prepare by understanding the factors that influence their rates, anticipating potential increases, and selecting loan options that align with their financial situation.

What is the significance of the prime interest rate in relation to HELOCs?

The prime interest rate, which stands at 7.50% as of June 2025, serves as a benchmark for determining HELOC loan rates, meaning fluctuations in the prime rate can directly affect borrowing costs.

How can F5 Mortgage assist homeowners in the HELOC process?

F5 Mortgage aims to simplify the complexities of home equity borrowing by providing personalized service, transparent processes, and support throughout the decision-making journey.