Overview

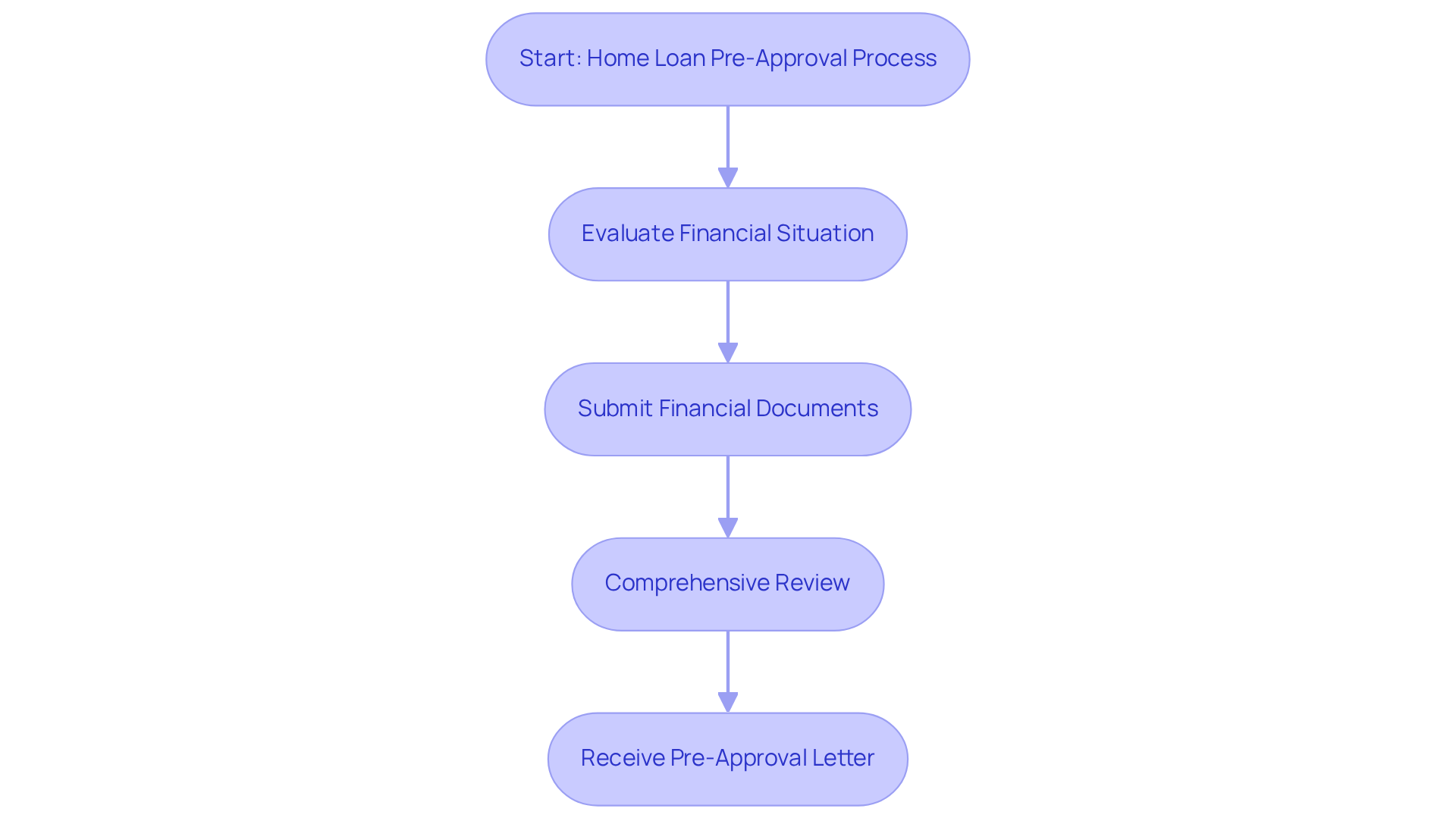

Securing your home loan pre-approval today can feel overwhelming, but understanding the mortgage pre-approval process is the first step. By gathering the necessary documentation and applying through a chosen lender, you can take control of your home-buying journey. We know how challenging this can be, and this article outlines the importance of pre-approval in strengthening your position as a buyer.

We’re here to support you every step of the way. This guide provides a detailed overview of the required documents and steps involved. Remember, preparation and organization can lead to a smoother and faster approval process. As you navigate this journey, take a moment to acknowledge your concerns and know that with the right information, you can move forward confidently.

Introduction

Securing a home loan pre-approval is a pivotal milestone in the journey toward homeownership. We know how challenging this can be, and many potential buyers find the process daunting. Understanding the intricacies of mortgage pre-approval can empower you to navigate this essential step with confidence. This not only enhances your position in a competitive market but also brings you closer to your dream home.

So, what are the key steps to ensure a smooth pre-approval process? How can you avoid common pitfalls that may delay your dream of owning a home? This guide breaks down the five crucial steps to obtaining home loan pre-approval, providing clarity and actionable insights for aspiring homeowners. We’re here to support you every step of the way.

Understand Mortgage Pre-Approval

is a crucial step in the home-buying journey. We understand how overwhelming this process can be, and it’s where a lender carefully evaluates your financial situation to determine the amount they’re willing to lend. Unlike pre-qualification, which offers a rough estimate based on self-reported details, pre-authorization involves a , such as credit history, income, and debts. This thorough process culminates in a letter of intent, outlining the maximum loan amount you can borrow, which significantly boosts your attractiveness to sellers.

In 2025, the is paramount. It not only clarifies your budget but also strengthens your negotiating position. Sellers are more inclined to consider offers from , knowing they possess the financial backing to complete the purchase. In fact, statistics reveal that over 70% of before making an offer, underscoring its vital role in a competitive market.

find success in loan approvals, especially when they recognize their financial limits early on. By obtaining pre-approval, these buyers can streamline their property search, focusing on listings that fit their budget and acting swiftly when they find their dream home. This proactive strategy not only saves time but also positions them favorably against other potential buyers.

When considering financing options, first-time homebuyers should explore various . For example:

- can require as little as 3.5% down

- VA and USDA loans may offer 0% down payment options

- Closing costs can range from 2% to 5% of the home’s value, depending on the loan type

Understanding these options empowers buyers to make informed decisions that align with their financial capabilities.

Ultimately, home loan pre approval is not merely a formality; it serves as a strategic advantage that enables homebuyers to confidently navigate the complexities of the real estate market. F5 Mortgage offers a , enhancing the efficiency of securing financing. With most loans closing in under three weeks, F5 Mortgage promises a , backed by exceptional customer satisfaction and 5-star reviews.

Gather Necessary Documentation

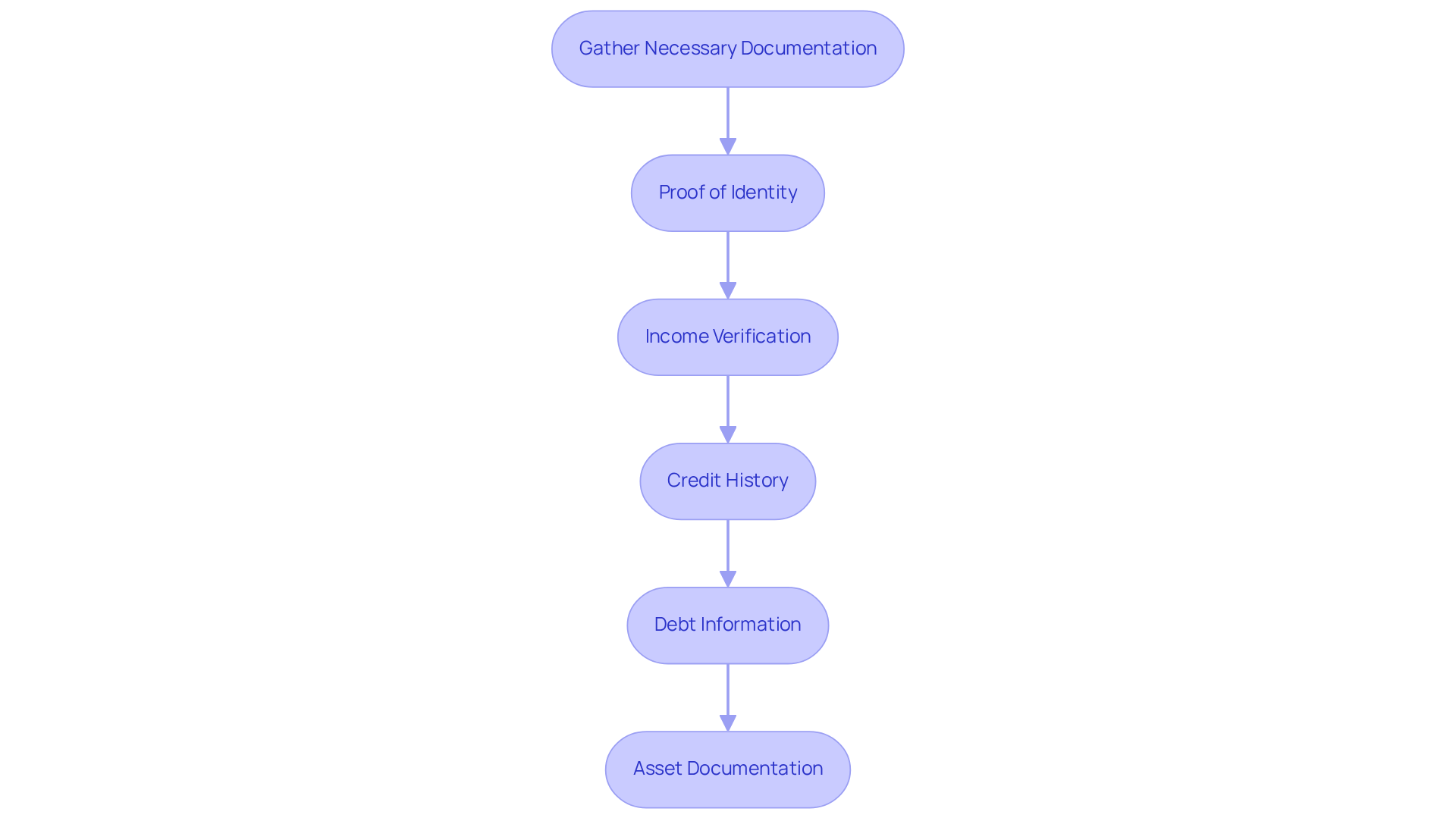

Obtaining your can feel overwhelming, but gathering the right documents can make the process smoother. We know how challenging this can be, so let’s walk through what you’ll need to show your and readiness.

- Proof of Identity: You’ll need a government-issued ID, like a driver’s license or passport, to confirm who you are.

- : Recent pay stubs, W-2 forms from the past two years, and tax returns are essential, particularly if you’re self-employed, to verify your income.

- : While lenders will check your credit report, reviewing your credit score beforehand can help you tackle any potential issues.

- Debt Information: Prepare a detailed list of your , including credit cards, student loans, and any outstanding loans. This will give lenders a clear picture of your obligations.

- Asset Documentation: You’ll need bank statements and investment account statements to demonstrate your savings and assets, showcasing your financial health.

Having these documents organized can significantly streamline your application process. Not only does it expedite the review by lenders, but it also shows that you’re a serious buyer. Many clients who provided complete documentation found their approvals came faster, with loans closing in less than three weeks. As one loan advisor wisely noted, ‘Comprehensive documentation is essential for a seamless approval process; it lays the groundwork for a .’ By preparing these , you enhance your chances of securing and obtaining home loan pre-approval swiftly. Remember, we’re here to support you every step of the way.

Apply for Pre-Approval

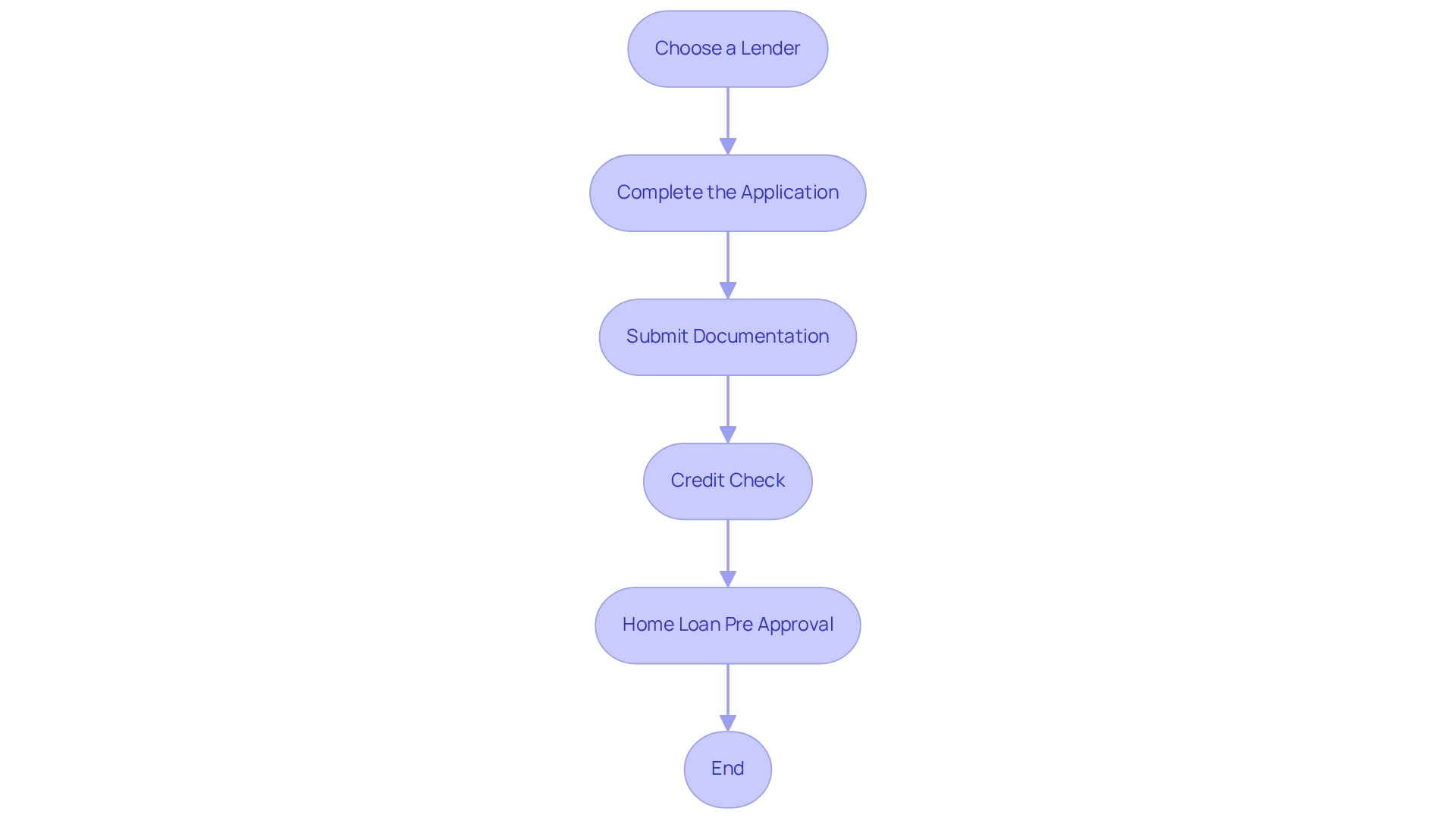

Applying for can feel daunting, but we’re here to support you every step of the way. Follow these simple steps to make the process smoother:

- Choose a Lender: Start by researching and selecting a lender that not only offers competitive rates but also provides excellent customer service. Consider reaching out to an like F5 Mortgage for . They can offer .

- Complete the Application: Next, fill out the lender’s home loan pre approval application form. It’s important to provide accurate details about your economic situation to avoid any hiccups.

- Submit Documentation: Gather and attach the necessary documents. Essential financial documents may include proof of income, tax returns, and bank statements. Ensure everything is complete to prevent .

- Credit Check: The lender will conduct a credit check to assess your creditworthiness. Be prepared for this step, as it may temporarily impact your credit score. To , consider implementing strategies to improve your credit score, such as checking your credit report for errors and paying down existing debts.

- Home loan pre approval: If you receive home loan pre approval, the lender will provide an approval letter outlining the loan amount you are eligible for. This letter will be invaluable when you start submitting bids on properties.

F5 Mortgage is available to assist you during this process, with business hours from Monday to Friday, 8:30 am to 11:00 pm (EST), and Saturday from 8:30 am to 5:00 pm (EST). The convenience of completing this process online makes it even more efficient. Remember, we’re here to help you .

Review Your Pre-Approval Letter

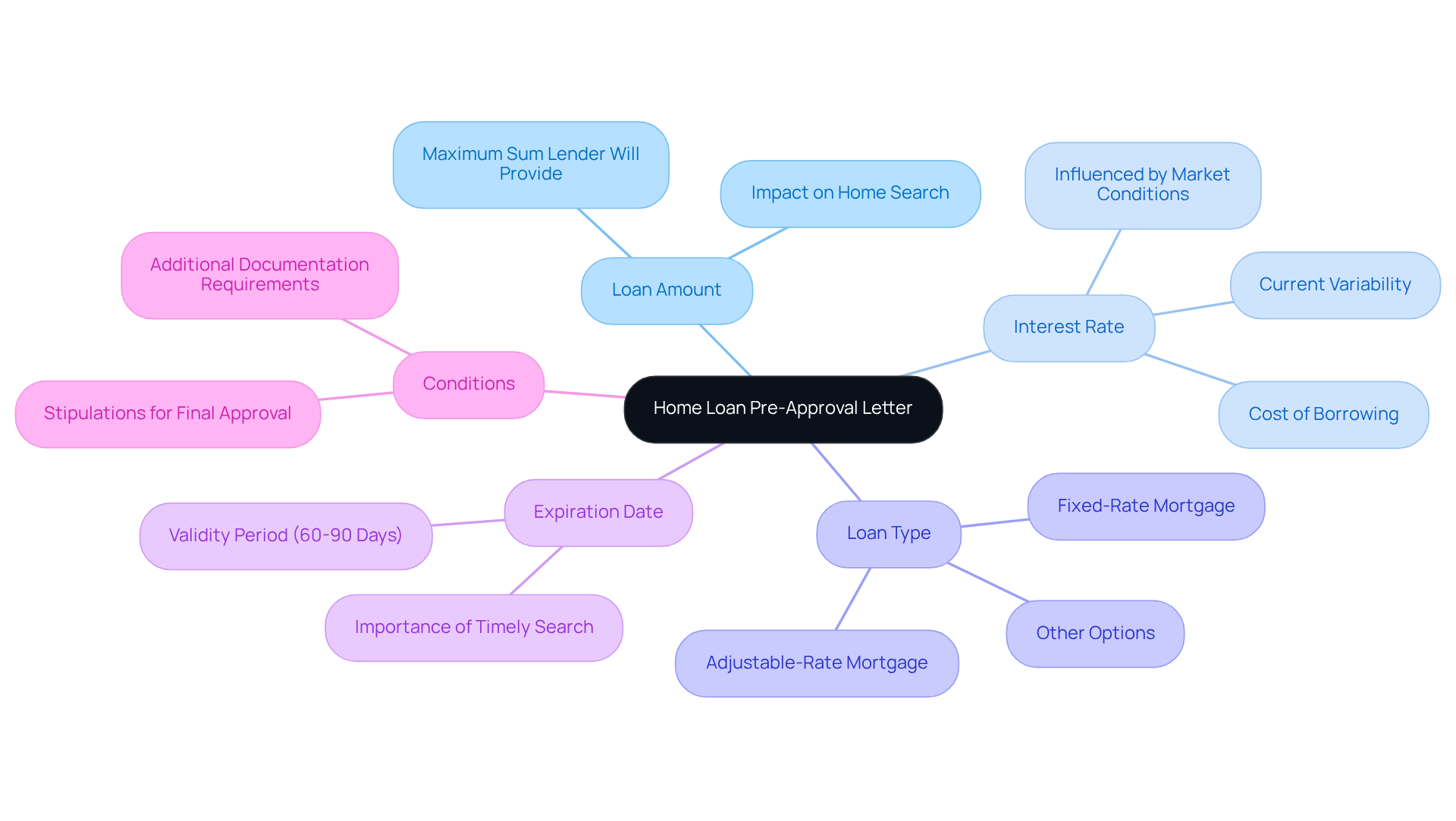

Upon receiving your letter, we understand how crucial it is to review it meticulously. Here are the key components to focus on:

- Loan Amount: This indicates the maximum sum the lender is willing to provide, which directly impacts your home search.

- Interest Rate: This is the cost of borrowing, influenced by market conditions and your credit profile. Current for home loan pre approval can vary, so it’s wise to stay informed.

- : Determine if the pre-approval is for a , adjustable-rate mortgage, or another choice, as this influences your long-term economic planning.

- Expiration Date: Pre-approval letters generally have a . Keep this in mind while you search for your perfect residence to avoid any lapses.

- Conditions: Look for any stipulations that must be fulfilled before , such as submitting additional documentation or meeting specific financial criteria.

Understanding these aspects and obtaining home loan pre approval enables you to make informed decisions during your property search, empowering you and enhancing your negotiating stance with sellers. We’re here to .

Proceed with Home Buying Steps

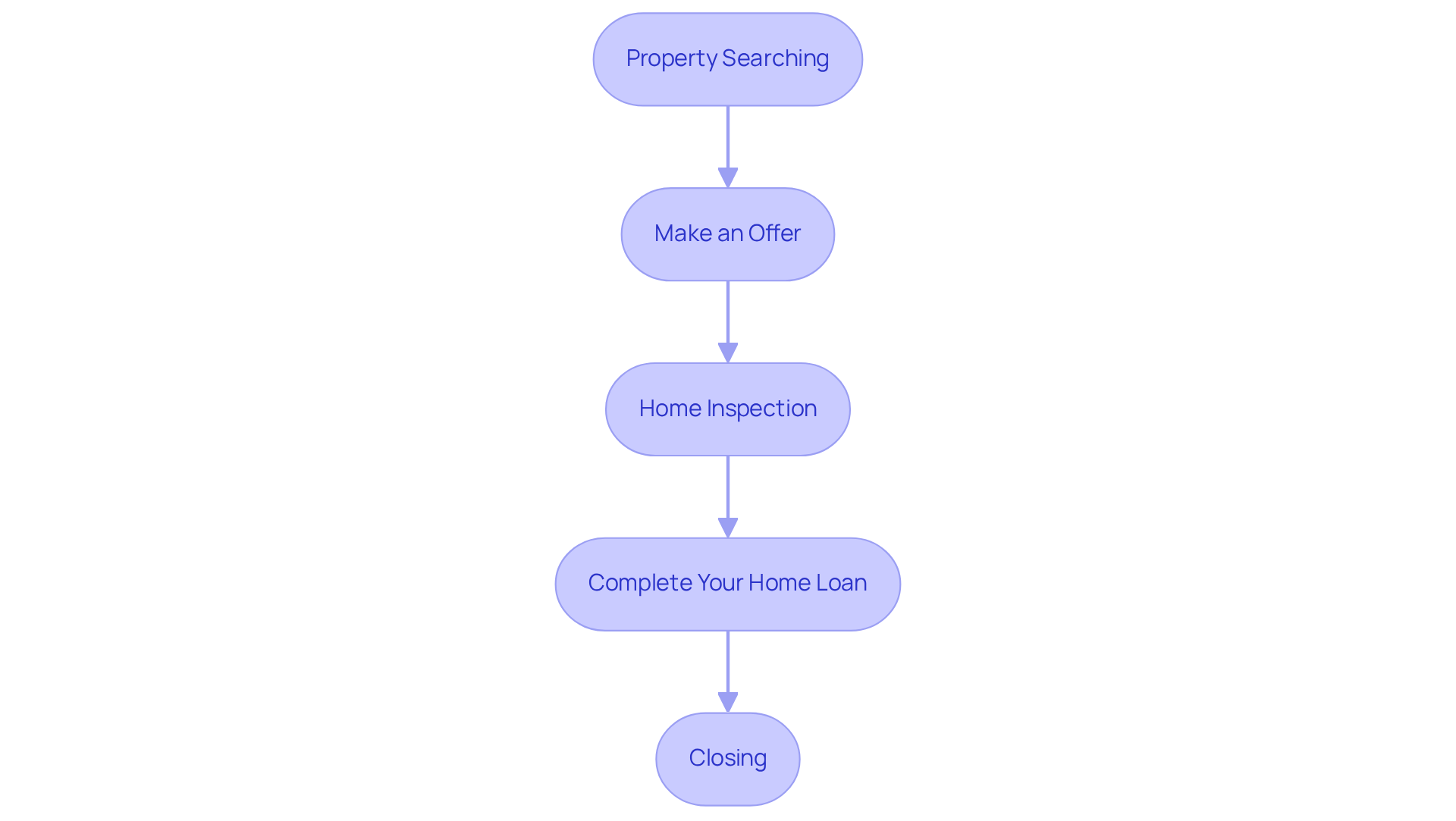

With your in hand, we know how exciting it is to start your . Here’s how to navigate the next steps with confidence:

- Property Searching: Begin your search for homes that align with your budget. Explore online listings, attend open houses, and consider partnering with a knowledgeable real estate agent who understands the market’s nuances.

- : When you discover a property that captivates you, it’s time to make an offer. Your pre-approval letter is a powerful tool, showing sellers that you are a serious and capable buyer. As industry experts suggest, having this letter can significantly enhance your negotiating position, especially when paired with F5 Mortgage’s , making your offer even more competitive.

- : After your offer is accepted, arrange for a home inspection. This step is crucial for uncovering any potential issues with the property, ensuring that you are making a wise investment. Understanding the importance of inspections can protect your investment and ease the loan approval process.

- Complete Your Home Loan: Work closely with your lender to finalize . Be ready to provide any additional documentation they may request, as this will help streamline the process. ensures you receive without the hassle of hard sales tactics.

- Closing: Once all approvals are in place, you will enter the closing phase. This involves signing the final paperwork, officially making you a homeowner. On average, the duration from pre-approval to closing at F5 Mortgage is less than three weeks, allowing you to relocate to your new home swiftly.

By following these steps, you can confidently navigate the property purchasing process, knowing you have the financial support to turn your dream home into a reality. Additionally, consider applying for F5 Mortgage’s down payment assistance loans and utilizing their comprehensive to further support your journey.

Conclusion

Securing home loan pre-approval is a pivotal step in your home-buying journey, providing a solid foundation for prospective buyers like you. We understand how overwhelming this process can be, but by familiarizing yourself with the intricacies of pre-approval, gathering the necessary documentation, and following a structured application process, you can position yourself as a serious contender in a competitive market. This proactive approach not only clarifies your budget but also enhances your negotiating power with sellers, ultimately making the dream of homeownership more attainable.

Throughout this article, we’ve shared key insights, emphasizing the importance of thorough preparation and informed decision-making. From gathering essential documents like proof of identity and income verification to understanding the details of the pre-approval letter, each step is crucial in streamlining your journey toward securing a home loan. With the support of experienced lenders like F5 Mortgage, the process can be efficient and straightforward, with many loans closing in under three weeks.

The significance of obtaining home loan pre-approval cannot be overstated. It empowers you to navigate the real estate landscape with confidence, ensuring you are prepared to act swiftly when you find your ideal home. By prioritizing pre-approval and leveraging available resources, you can transform your aspirations into reality, making informed choices that pave the way for a successful purchase. Embrace the journey ahead, and take the first step toward homeownership today.

Frequently Asked Questions

What is mortgage pre-approval and why is it important?

Mortgage pre-approval is a crucial step in the home-buying journey where a lender evaluates your financial situation to determine the amount they are willing to lend. It is important because it clarifies your budget, strengthens your negotiating position, and makes you more attractive to sellers.

How does mortgage pre-approval differ from pre-qualification?

Unlike pre-qualification, which offers a rough estimate based on self-reported details, pre-approval involves a comprehensive review of your financial documents, such as credit history, income, and debts, culminating in a letter of intent outlining the maximum loan amount you can borrow.

What are the benefits of obtaining mortgage pre-approval for first-time homebuyers?

For first-time homebuyers, obtaining pre-approval helps them recognize their financial limits early on, streamlines their property search to focus on budget-friendly listings, and positions them favorably against other potential buyers, allowing them to act swiftly when they find a suitable home.

What financing options are available for first-time homebuyers?

First-time homebuyers can explore various low down payment programs, such as FHA loans that require as little as 3.5% down, and VA and USDA loans that may offer 0% down payment options. Closing costs can range from 2% to 5% of the home’s value, depending on the loan type.

How quickly can I expect to get pre-approved for a mortgage with F5 Mortgage?

F5 Mortgage offers a streamlined pre-approval process that ensures approval in less than an hour, with most loans closing in under three weeks.

What documents are necessary to gather for home loan pre-approval?

Necessary documents include: – Proof of Identity (government-issued ID) – Income Verification (recent pay stubs, W-2 forms from the past two years, and tax returns) – Credit History (review of your credit score) – Debt Information (detailed list of current debts) – Asset Documentation (bank statements and investment account statements)

How can organizing documentation affect the pre-approval process?

Having the necessary documents organized can significantly streamline the application process, expedite the lender’s review, and enhance your chances of securing favorable loan terms and obtaining home loan pre-approval swiftly.