Overview

Securing a bad credit home equity loan can feel overwhelming, but understanding the qualifications can make a significant difference. We know how challenging this can be, and gathering the right documentation is the first step toward improving your creditworthiness.

To enhance your chances of approval, it’s essential to maintain at least 15-20% equity in your home. This not only strengthens your application but also provides a safety net for your financial future. Additionally, having a stable income is crucial; it demonstrates your ability to repay the loan, even if your credit history isn’t perfect.

In some cases, involving a co-signer can also be beneficial. This person can provide additional security for the lender, increasing your likelihood of securing the loan. Remember, we’re here to support you every step of the way as you navigate this process.

Introduction

Securing a home equity loan can feel overwhelming, especially for homeowners seeking cash while grappling with the challenges of bad credit. We understand how daunting this situation can be. Many lenders place significant weight on credit scores, leaving those with scores below 620 at a disadvantage, often facing higher interest rates or even denials. But what if there were practical steps you could take to improve your financial standing?

Imagine transforming this intimidating process into an achievable goal. By understanding the qualifications and exploring strategic actions, you can enhance your chances of approval and potentially secure better loan terms, even with a less-than-perfect credit history. We’re here to support you every step of the way, helping you navigate this journey with confidence.

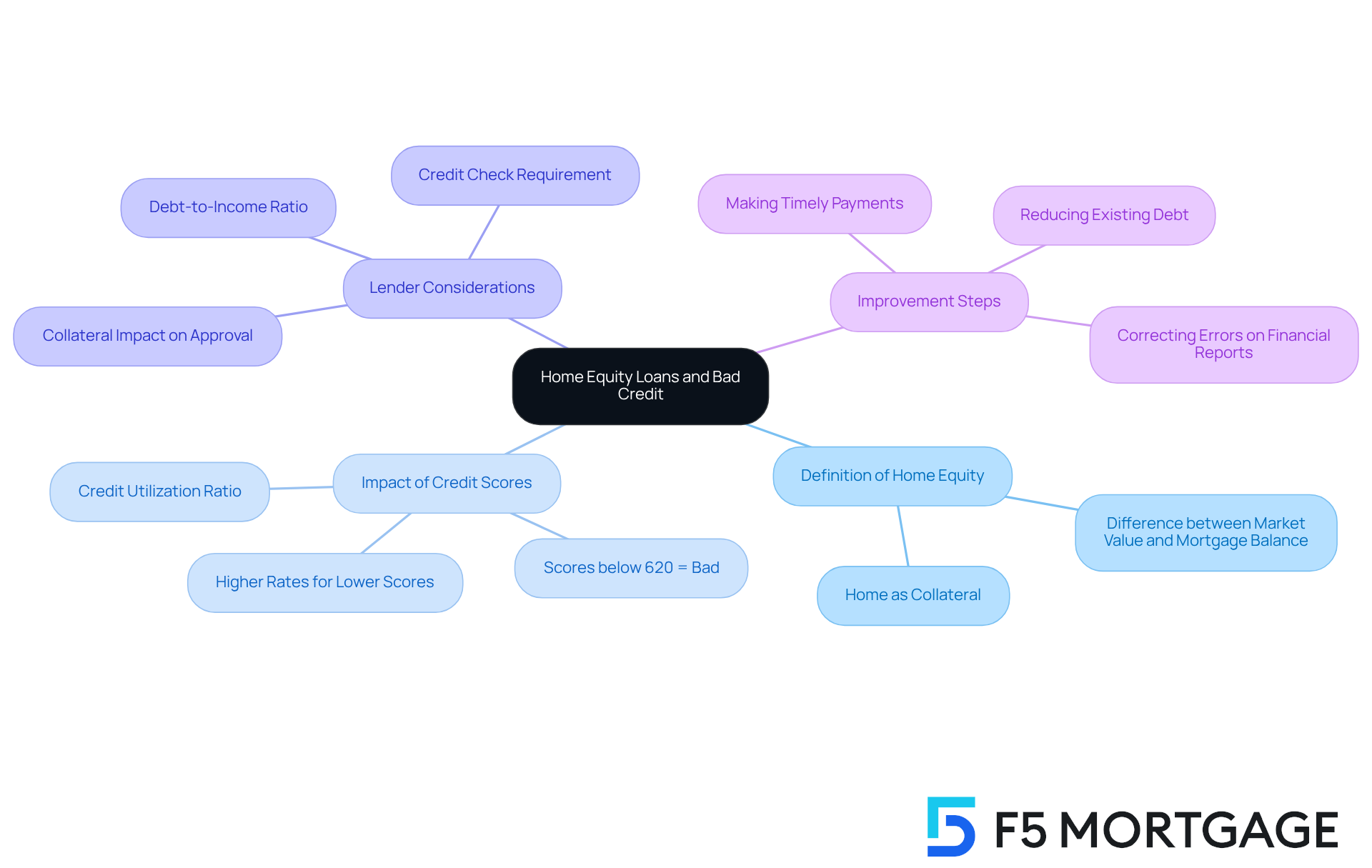

Understand Home Equity Loans and Bad Credit

Home equity financing can be a valuable resource for homeowners, allowing them to borrow against the equity in their property. This equity is defined as the difference between the home’s current market value and the outstanding mortgage balance. However, we know how challenging it can be for individuals with poor financial histories to secure a bad credit home equity loan. Lenders typically review credit scores to assess risk, and a score below 620 is often classified as ‘bad.’ This can result in higher interest rates or even a complete rejection of credit applications.

The impact of a poor financial history on the approval rates for a bad credit home equity loan is significant. Lower credit scores not only limit borrowing opportunities but also increase the costs associated with loans. Lenders consider various factors, including financial history, income, and debt-to-income ratios when reviewing applications. For instance, a borrower with a score in the 500s may struggle to qualify, while those with scores above 700 are generally viewed more favorably.

Financial consultants emphasize the importance of understanding your financial situation before applying for a mortgage. There are steps you can take to improve your credit score, such as:

- Reducing existing debt

- Correcting errors on your financial reports

These actions can enhance your chances of securing more favorable terms. Ultimately, while a poor financial history presents challenges, it doesn’t completely eliminate the possibility of securing a bad credit home equity loan against your property. Just be prepared for potentially higher costs and limited options. Remember, we’re here to support you every step of the way.

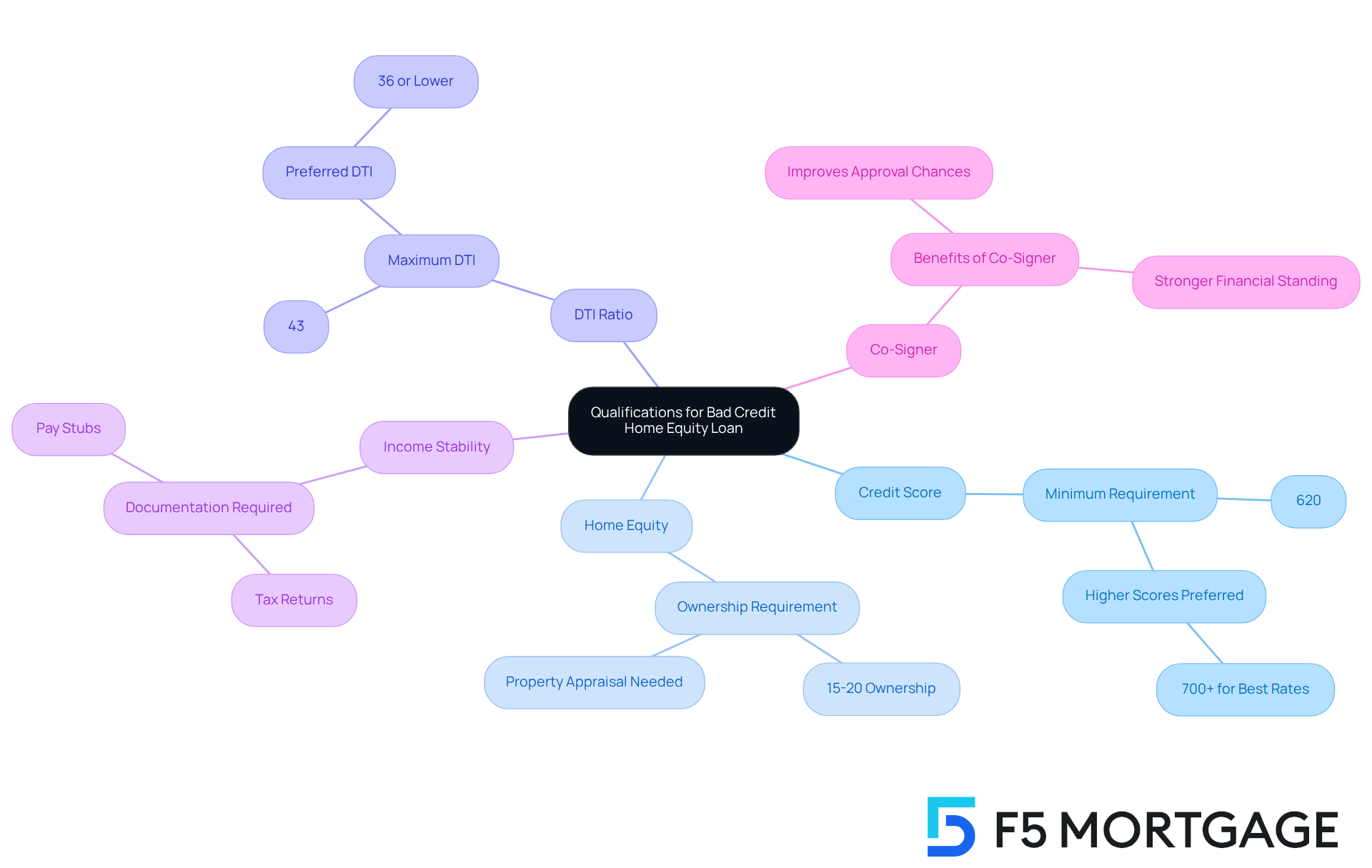

Identify Qualifications for a Bad Credit Home Equity Loan

If you’re considering a bad credit home equity loan but are worried about your credit situation, you’re not alone. Many families face similar challenges, and there are ways to navigate this process successfully. To qualify for a home equity loan, there are several key criteria that you typically need to meet:

-

Minimum Credit Score: Most lenders usually require a minimum credit score of around 620. However, some may be willing to accept lower scores, especially if other financial factors are looking positive.

-

Ownership in the Residence: It’s important that you hold at least 15-20% ownership in your home. The lender will arrange for a property appraisal to determine the current market value of your asset, which helps assess how much equity you have. For instance, if your home is valued at $250,000, your mortgage balance should be no more than $212,500 to meet the 15% ownership requirement. Generally, lenders prefer a minimum of 20% equity to secure financing.

-

Debt-to-Income Ratio: A lower debt-to-income (DTI) ratio is crucial, with a target of below 43%. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. Lenders often favor a DTI of 36% or lower to improve your chances of approval.

-

Stable Income: Demonstrating a consistent income is vital to prove your ability to repay the loan. Lenders will typically ask for documentation such as pay stubs or tax returns.

-

Co-Signer Option: If your credit score is significantly low, having a co-signer with better credit can greatly enhance your chances of approval. As Linda Bell from Bankrate highlights, ‘If your score is making it difficult for you to obtain a second mortgage, bringing in a co-signer with stronger financial standing could help you secure an approval.’

In summary, here are the qualifications you should keep in mind:

- Credit Score: Minimum of 620.

- Home Equity: At least 15-20%.

- DTI Ratio: Below 43%.

- Income Stability: Documented proof required.

- Co-Signer: Optional but beneficial.

We know how challenging this can be, but we’re here to support you every step of the way. Understanding these requirements is the first step toward achieving your home equity loan goals.

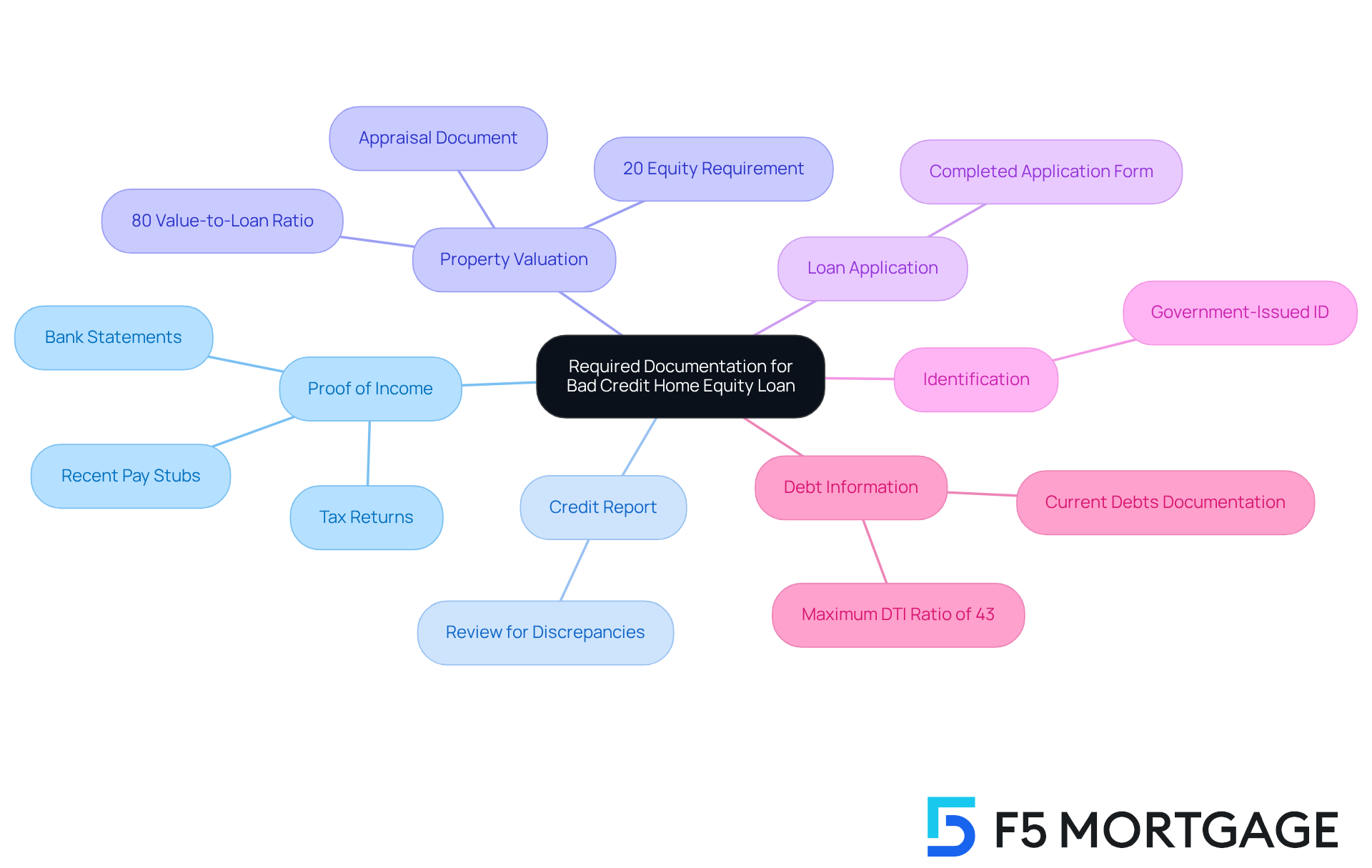

Gather Required Documentation for Your Application

When seeking a bad credit home equity loan, especially with a challenging financial history, we understand how crucial it is to have the right documentation to enhance your chances of approval. Here’s a helpful list of commonly required documents that can make a difference:

- Proof of Income: Recent pay stubs, tax returns, or bank statements are necessary to verify your income.

- Credit Report: A copy of your credit report allows you to review any discrepancies that may affect your application.

- Property Valuation: An appraisal document is required to establish the present worth of your residence, which is essential for evaluating your ownership stake. Maintaining at least 20% equity in your residence is typically required to qualify for a property equity line of credit, and many lenders require an 80% value-to-loan ratio.

- Loan Application: A completed application form provided by the lender must be submitted.

- Identification: A government-issued ID, such as a driver’s license or passport, is required for identity verification.

- Debt Information: Documentation outlining current debts, encompassing cards and other borrowings, assists lenders in assessing your financial condition, with a maximum debt-to-income (DTI) ratio of 43% typically necessary for home financing.

Statistics indicate that a significant number of credit applications are rejected due to insufficient documentation, underscoring the importance of thorough preparation. Mortgage experts stress that offering transparent evidence of income can greatly improve your application’s trustworthiness, particularly for individuals applying for a bad credit home equity loan. For instance, successful candidates frequently provide comprehensive financial records that illustrate their capacity to repay the debt, even when they are dealing with a bad credit home equity loan. Furthermore, cash-out property financing options might have greater ownership prerequisites. By gathering these crucial documents, you can simplify the application process and enhance your likelihood of obtaining property financing. We’re here to support you every step of the way.

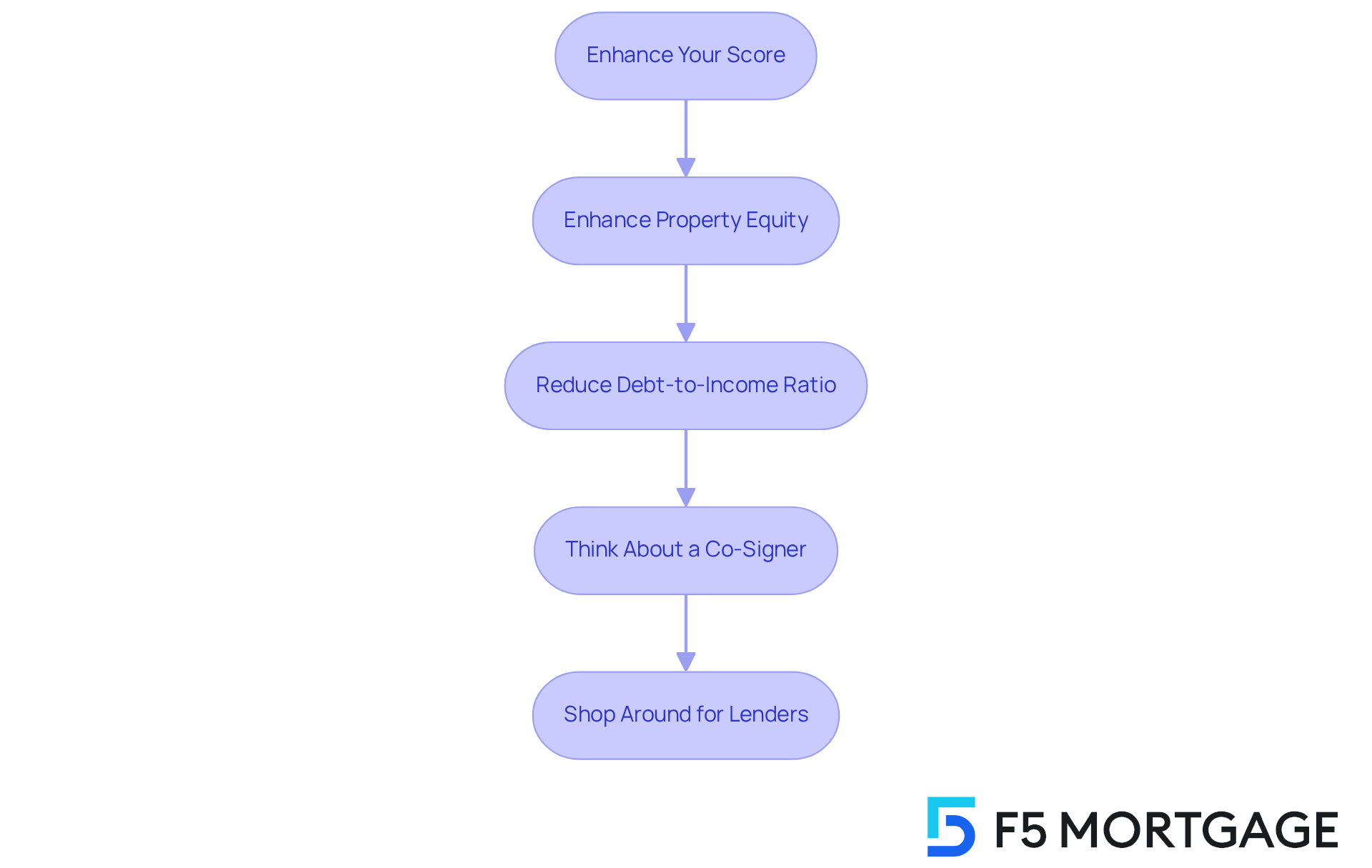

Enhance Your Approval Chances with Strategic Actions

Securing a bad credit home equity loan can feel overwhelming, but there are several strategic actions you can take to enhance your chances of approval. We know how challenging this can be, and we’re here to support you every step of the way.

-

Enhance Your Score: Focus on reducing current debts, making timely payments, and contesting any errors on your credit report. A higher credit score can open doors to better loan terms, giving you more options.

-

Enhance Property Equity: Consider undertaking renovations that can elevate your property value. Research shows that strategic upgrades can lead to an average increase in property value of 10% to 15%. This improvement can make you a more attractive option for lenders.

-

Reduce Debt-to-Income Ratio: Work on lowering your DTI ratio by paying off smaller debts. Lenders typically prefer a DTI ratio of 43% or lower, so reducing your monthly obligations can significantly improve your appeal as a borrower.

-

Think About a Co-Signer: If you have a relative or friend with strong financial standing, asking them to co-sign your loan can enhance your application and boost your likelihood of approval.

-

Shop Around for Lenders: Different lenders have varying criteria for approval. By comparing offers, you may find lenders who are more lenient with their requirements. For competitive rates and personalized service, consider choosing F5 Mortgage to help you navigate your options, ensuring the terms match your needs.

By applying these strategies, you can improve your chances of obtaining a bad credit home equity loan, even with poor credit. Financial consultants suggest focusing on these aspects to enhance your overall borrowing terms and conditions.

Navigate the Application Process for Your Home Equity Loan

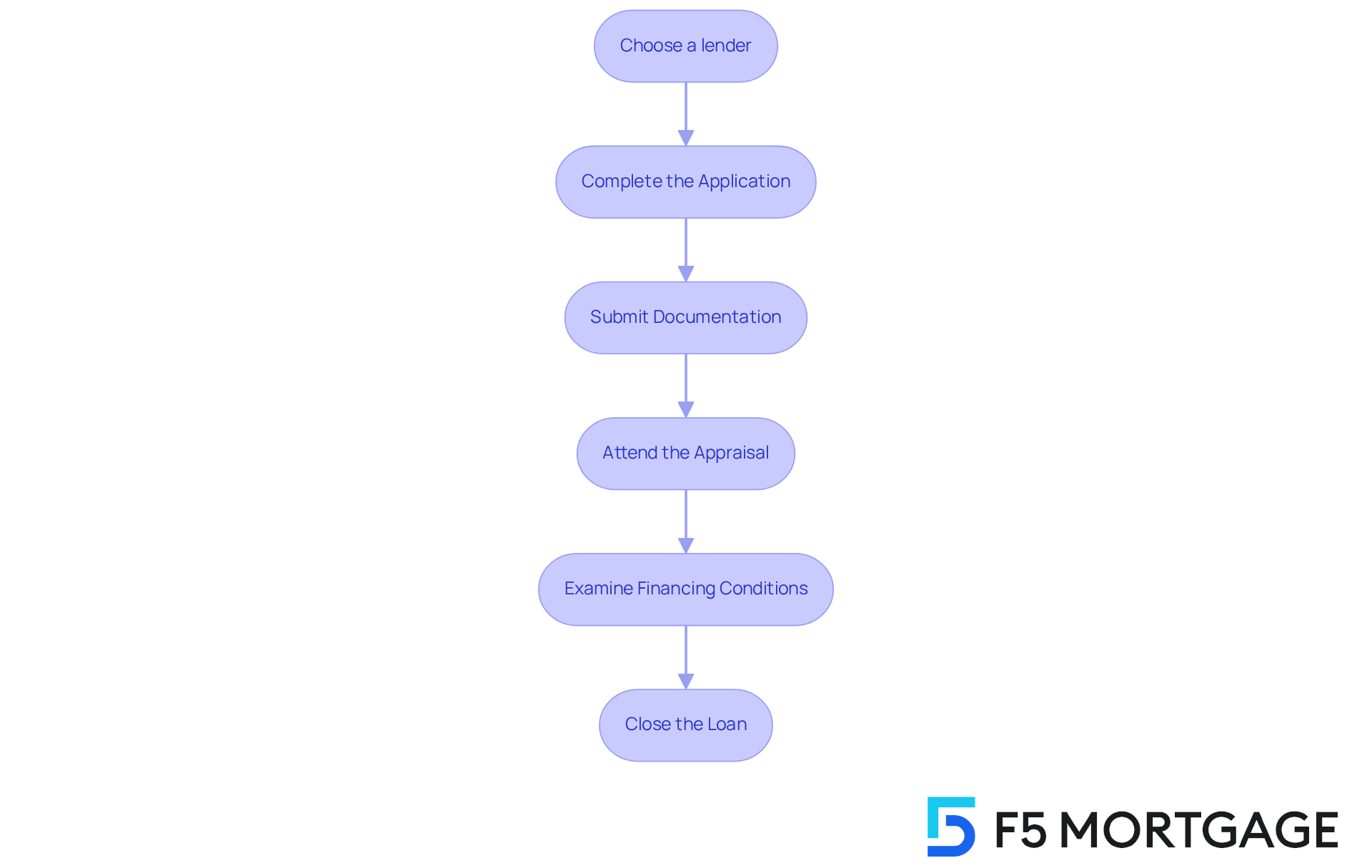

Navigating the application process for a home equity loan can feel overwhelming, but with a little guidance, it can be straightforward. Here are some essential steps to help you along the way:

-

Choose a lender: We understand how challenging it can be to find the right lender, especially when seeking a bad credit home equity loan. Research lenders that specialize in offering favorable terms for borrowers like you. Look for those with a history of approving applications from individuals in similar financial situations.

-

Complete the Application: Take your time to fill out the application form accurately. Ensure that all required information is provided, including personal details, income, and existing debts. We know that this can feel daunting, but being thorough will help your application shine.

-

Submit Documentation: Gather and submit all necessary documents, such as proof of income, tax returns, and information about your current mortgage. This documentation is crucial for the lender to assess your financial situation and make informed decisions.

-

Attend the Appraisal: Be prepared for a home appraisal, which the lender will schedule to evaluate your property’s value. This step is vital, as it determines how much equity you can access. Remember, this is an opportunity to showcase your home’s worth.

-

Examine Financing Conditions: Once authorized, take the time to thoroughly assess the financing terms, including interest rates and repayment schedules. Understanding these details is essential to avoid surprises later. We’re here to support you as you navigate these important choices.

-

Close the Loan: Finally, sign the closing documents and receive your funds. The typical duration to finalize mortgage financing is about three weeks, so prepare accordingly. This is an exciting step towards achieving your financial goals.

By following these steps, you can streamline the process and increase your chances of securing a bad credit home equity loan. Consulting with a lender can provide clarity on the best options available to you, ensuring that you make informed decisions throughout your borrowing journey. Remember, we’re here to support you every step of the way.

Conclusion

Securing a home equity loan with bad credit may feel overwhelming, but it’s certainly possible with the right understanding and preparation. We recognize the challenges that a low credit score brings, and by taking proactive steps to improve your financial standing, you can navigate the lending landscape more effectively. The journey to obtaining a bad credit home equity loan involves not only meeting basic qualifications but also enhancing your financial profile to attract potential lenders.

Key strategies include:

- Understanding the necessary qualifications, such as maintaining a minimum credit score

- Demonstrating stable income

- Managing your debt-to-income ratio

- Gathering comprehensive documentation

- Considering options like co-signers

These actions can significantly strengthen your application. Additionally, taking strategic actions to boost your credit score and property equity can lead to better loan terms and increased chances of approval.

While the road to obtaining a bad credit home equity loan requires diligence and planning, the right mindset and approach can unlock valuable financial opportunities. We encourage homeowners to take charge of their financial health, explore various lending options, and remain persistent in their efforts. By doing so, you can transform the challenges of bad credit into stepping stones toward achieving your financial goals.

Frequently Asked Questions

What is a home equity loan?

A home equity loan allows homeowners to borrow against the equity in their property, which is the difference between the home’s current market value and the outstanding mortgage balance.

How does bad credit affect the ability to secure a home equity loan?

Individuals with poor financial histories, typically defined as having a credit score below 620, may face challenges in securing a home equity loan. This can result in higher interest rates or rejection of credit applications.

What credit score is generally required for a bad credit home equity loan?

Most lenders require a minimum credit score of around 620, but some may accept lower scores if other financial factors are favorable.

What ownership percentage is needed in the home to qualify for a home equity loan?

Borrowers typically need to hold at least 15-20% ownership in their home, with lenders preferring a minimum of 20% equity.

How is the debt-to-income (DTI) ratio calculated, and what is the target for approval?

The DTI ratio is calculated by dividing total monthly debt payments by gross monthly income. A target DTI ratio below 43% is crucial, with lenders favoring a DTI of 36% or lower for better approval chances.

Why is stable income important for securing a home equity loan?

Demonstrating a consistent income is vital to prove the ability to repay the loan, and lenders typically require documentation such as pay stubs or tax returns.

Can having a co-signer help in securing a home equity loan with bad credit?

Yes, having a co-signer with better credit can enhance the chances of approval for a home equity loan, especially if the primary borrower’s credit score is significantly low.

What steps can individuals take to improve their chances of securing a home equity loan?

Individuals can improve their chances by reducing existing debt and correcting errors on their financial reports to enhance their credit score.