Overview

The main focus of this article is to guide you through the steps necessary for successfully navigating a cash-out refinance VA loan. We understand how challenging this process can be, and we’re here to support you every step of the way. This comprehensive guide will help you:

- Grasp the eligibility requirements

- Follow the application process

- Explore potential uses for the funds

- Evaluate the pros and cons

By equipping veterans with this knowledge, we aim to empower you to make informed financial decisions that suit your needs.

Introduction

Navigating the complexities of cash-out refinancing can feel overwhelming, particularly for veterans eager to tap into their home equity. We understand how important it is to access substantial funds for home improvements, debt consolidation, or unexpected expenses. This makes grasping the VA cash-out refinance process essential.

However, the journey isn’t without its challenges. Determining eligibility, managing new loan terms, and weighing potential risks against benefits can be daunting. So, what steps can veterans take to ensure a successful refinancing experience while maximizing their financial resources?

We’re here to support you every step of the way, guiding you through these important decisions with care and compassion.

Understand Cash-Out Refinancing for VA Loans

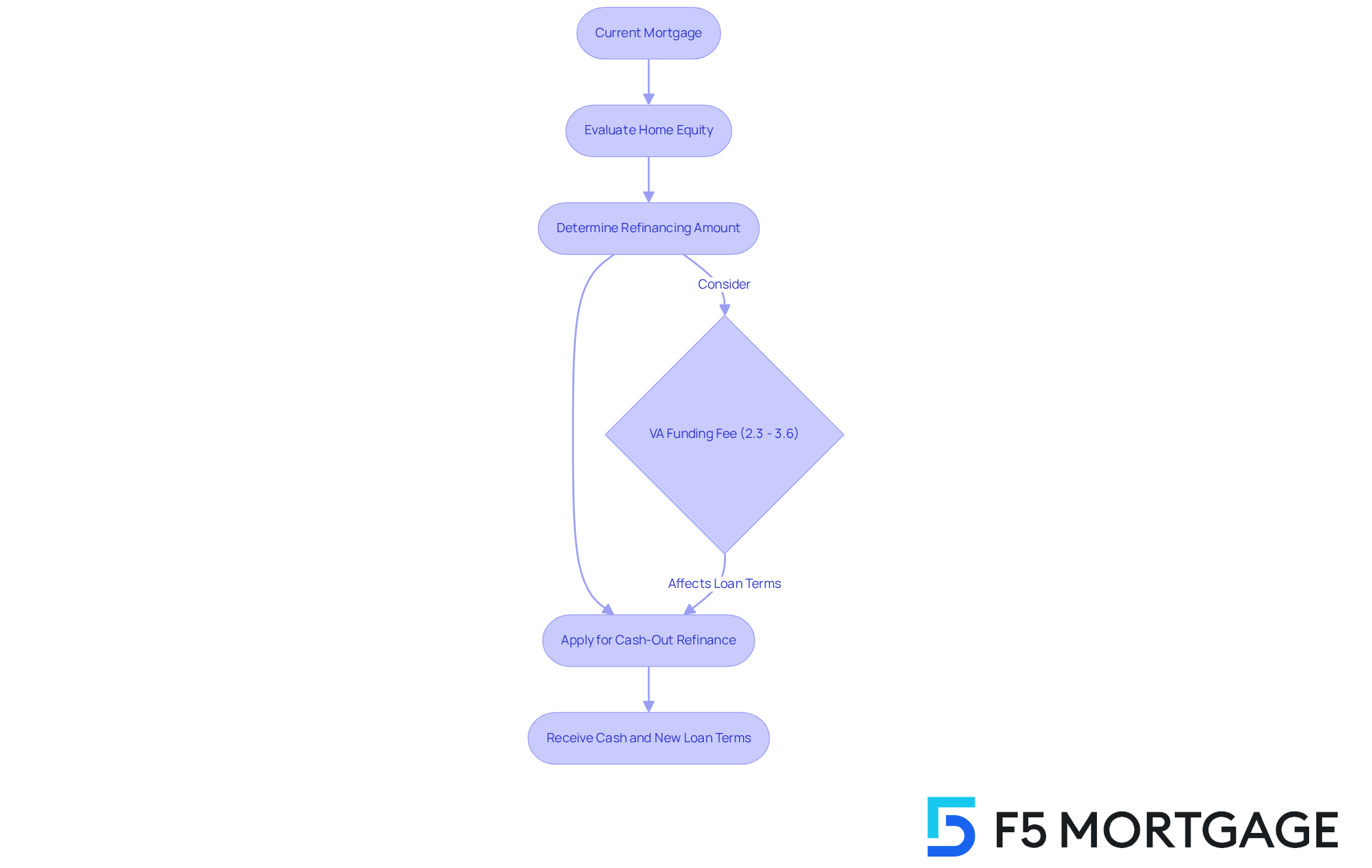

Cash-out refinance VA loan programs provide a valuable opportunity for qualified veterans and service personnel. A cash out refinance VA loan allows them to replace their current mortgage with a new, larger amount, enabling access to the equity they have built in their homes. This process involves a cash out refinance VA loan to pay off the existing mortgage, allowing the borrower to receive the difference in cash. These funds can be used for various purposes, such as home improvements, debt consolidation, or covering unexpected expenses.

In 2025, veterans can refinance up to 100% of their home’s appraised value, depending on lender guidelines. This makes it an appealing option for those who need substantial support. For example, if a veteran’s home is valued at $300,000 and they owe $150,000, they could refinance for $200,000, receiving $50,000 in cash to meet their needs.

It’s important to recognize that cash-out refinancing typically comes with a new interest rate and loan terms, which may differ from the original mortgage. This change can impact monthly payments and overall financial obligations. Therefore, we know how challenging it can be, and we encourage veterans to carefully assess their financial situation and consider how these changes will affect their long-term budgeting.

The advantages of a cash out refinance VA loan are significant, especially for veterans with strong financial profiles. It allows them to consolidate high-interest debts into one lower-interest mortgage payment, potentially easing economic pressure. Moreover, the cash received can be tax-exempt, offering greater financial flexibility. However, it’s essential to be aware of the VA funding fee for withdrawing equity, which ranges from 2.3% to 3.6%, depending on whether it is the first or subsequent use. As of 2025, many veterans are taking advantage of this option, as evidenced by a significant rise in refinancing applications, illustrating its growing appeal among those looking to enhance their financial resources.

Determine Your Eligibility for VA Cash-Out Refinancing

Qualifying for a VA cash-out refinance can feel overwhelming, but we’re here to guide you through the essential eligibility criteria with care and understanding:

-

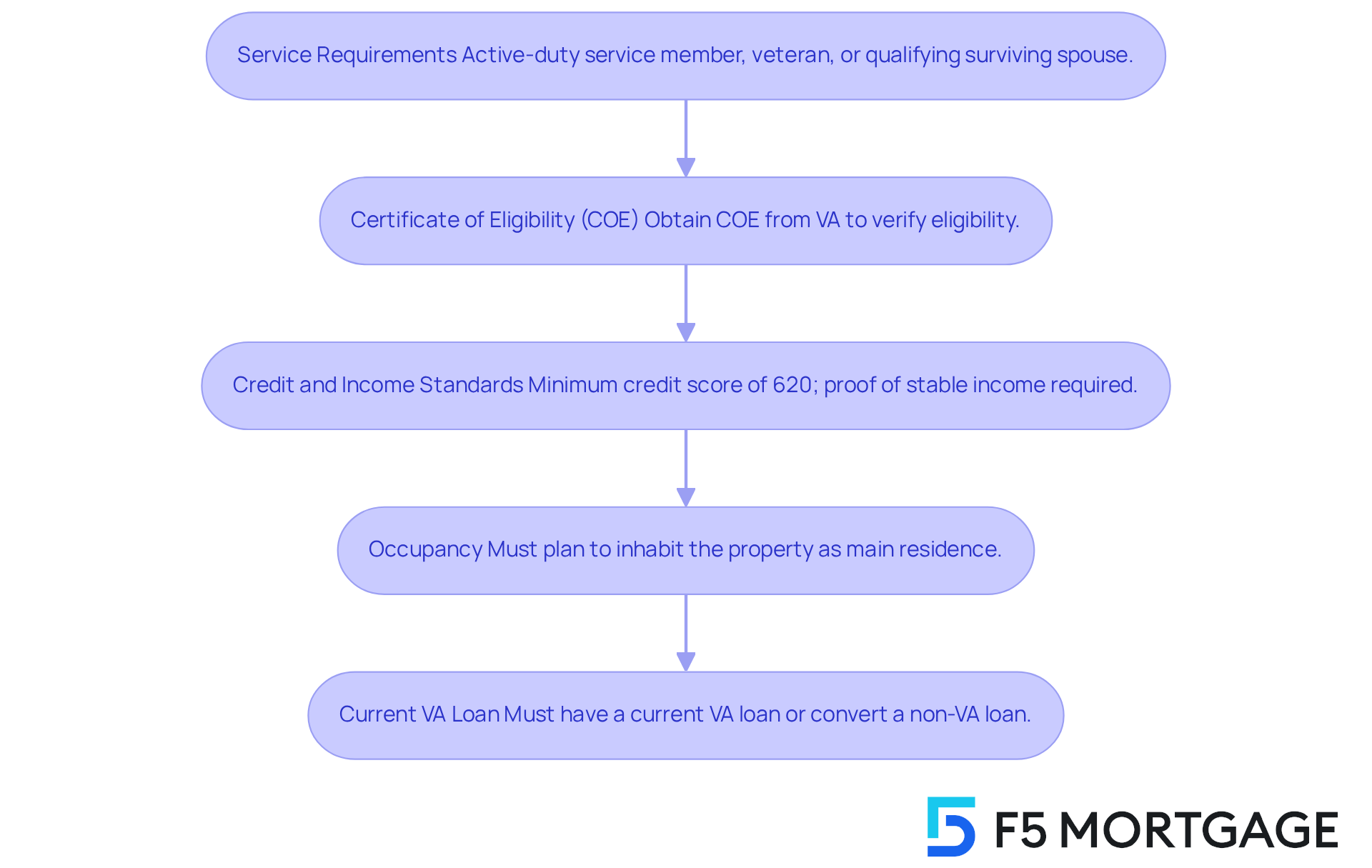

Service Requirements: You must be an active-duty service member, a veteran, or a qualifying surviving spouse. We know how important this is for you and your family.

-

Certificate of Eligibility (COE): It’s crucial to acquire your COE from the VA, which verifies your eligibility for VA benefit programs. This certificate is essential for the loan restructuring process, and we’re here to help you obtain it.

-

Credit and Income Standards: Generally, lenders require a minimum credit score of around 620, along with proof of stable income. Some lenders may allow scores as low as 580 depending on the loan-to-value ratio and other factors. We understand how challenging financial requirements can be, and we’re here to support you.

-

Occupancy: You must confirm that you plan to inhabit the property as your main residence, which is a condition for VA financing. This step is vital for ensuring you can enjoy your home fully.

-

Current VA Loan: You must either possess a current VA loan or be converting a non-VA loan into a VA loan. This transition can be a significant step, and we’re here to assist you.

Gathering all necessary documentation is important to demonstrate your eligibility before proceeding with the application. In 2025, a substantial portion of veterans are expected to qualify for a cash out refinance VA loan, making it a viable option for many. For those looking to obtain their COE, it can be requested online, through a lender, or by mail using VA Form 26-1880. Remember, we’re here to support you every step of the way.

Follow the Application Process for VA Cash-Out Refinancing

Navigating the application process for a cash out refinance VA loan can feel overwhelming, but we’re here to support you every step of the way. By following these essential steps, you can ensure a smoother experience:

-

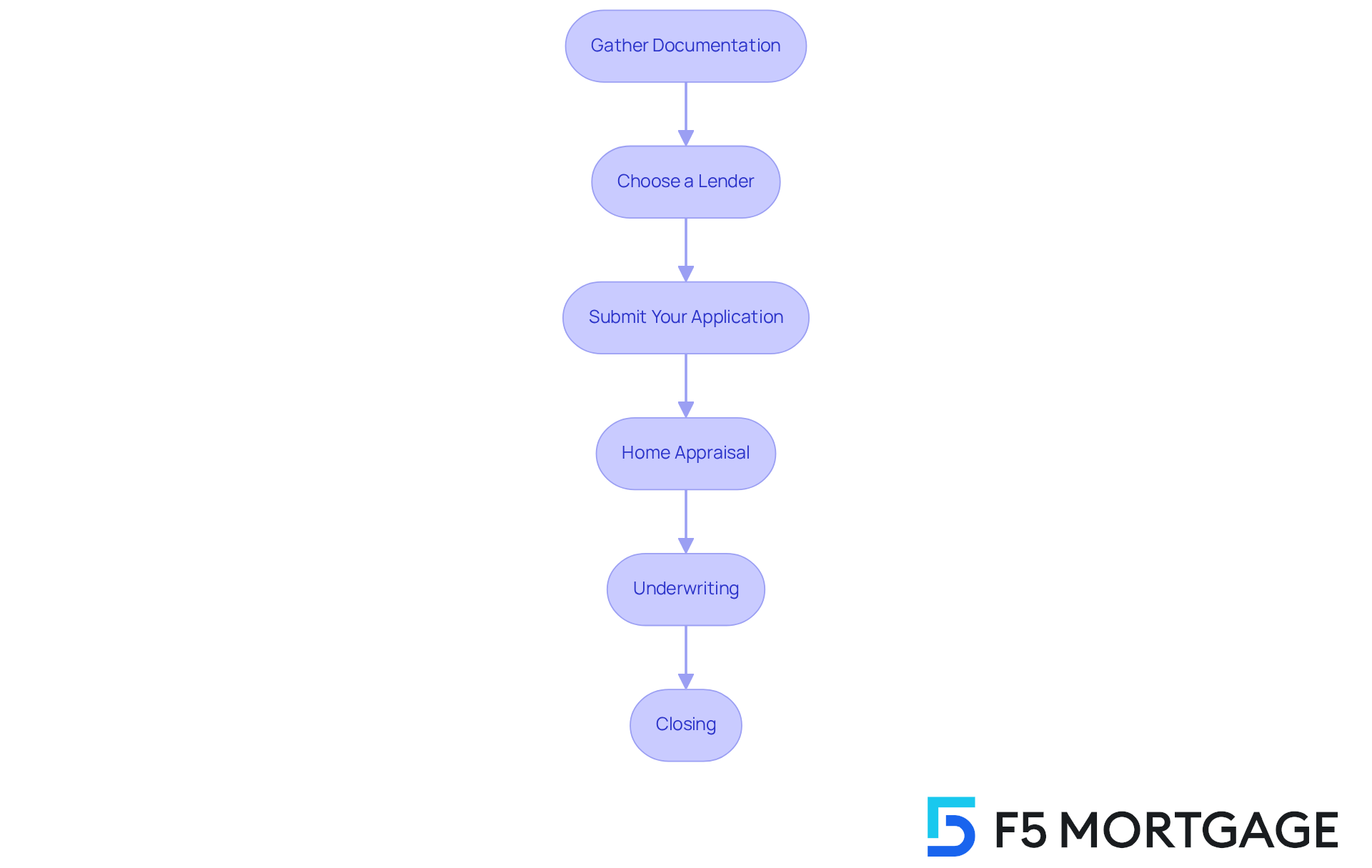

Gather Documentation: Start by collecting the necessary documents. This includes your Certificate of Eligibility (COE), proof of income such as recent pay stubs and W-2 forms, and your credit history. Remember, most lenders will ask for W-2 forms from the past two years and federal income tax returns for the same period.

-

Choose a Lender: Take your time to research and select a VA-approved lender that offers competitive rates and favorable terms. It’s a good idea to gather quotes from at least three lenders. This way, you can identify the best options available for your situation.

-

Submit Your Application: Once you’ve chosen your lender, complete the application form they provide. Make sure all the information is accurate and comprehensive. This step is crucial as it lays the foundation for your refinancing process.

-

Home Appraisal: Your lender will arrange for a home appraisal to determine the current market value of your property. This assessment is key to understanding your equity and ensuring you meet the highest loan-to-value ratio, which can reach up to 100% for VA refinances.

-

Underwriting: During underwriting, the lender will review your application, credit history, appraisal results, and your debt-to-income ratio. This assessment helps establish your eligibility and the conditions of your new financial agreement.

-

Closing: If your application is approved, you’ll move on to the closing stage. Here, you will sign the new financing documents and receive your withdrawal funds. Be prepared for potential closing costs, which typically range from 2% to 5% of the loan amount and can vary by lender.

By adhering to these steps and ensuring you have the necessary documentation, you can confidently navigate the cash out refinance VA loan process and utilize your home equity to meet your financial needs.

Explore Uses for Your Cash-Out Refinance Funds

Upon receiving your cash-out refinance funds, you have several strategic options to consider that can truly make a difference in your financial journey:

-

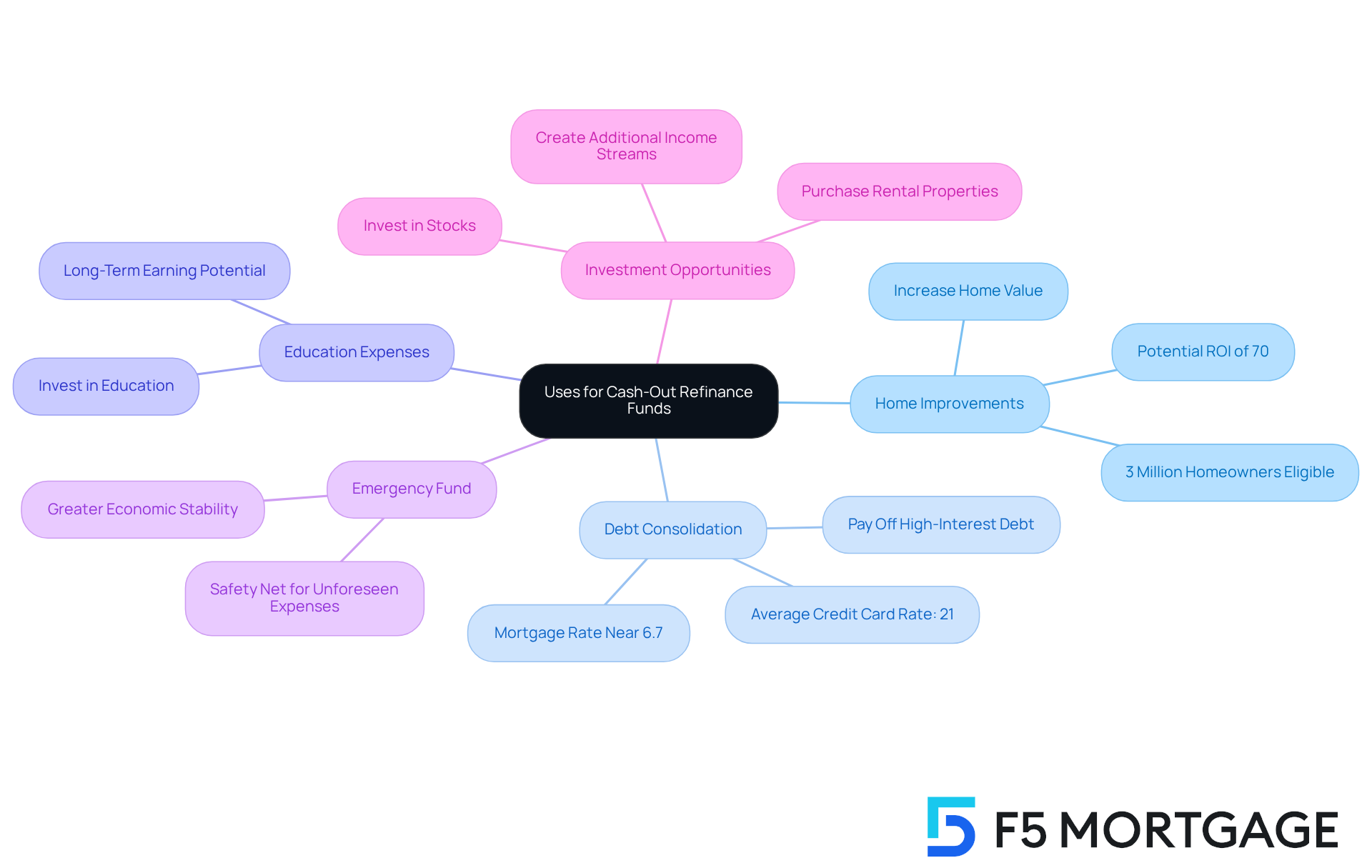

Home Improvements: Investing in renovations can significantly enhance your home’s value and improve your living environment. We know how challenging it can be to find the right improvements, but statistics indicate that well-planned home enhancements can yield returns of up to 70% on investment. This makes it a wise choice for many homeowners. Furthermore, around 3 million homeowners might gain from a cash out refinance va loan at present interest rates, emphasizing the potential market for equity refinancing.

-

Debt Consolidation: Utilizing cash-out refinance funds to pay off high-interest debts, such as credit cards, can lead to substantial savings on interest payments. Imagine combining credit card debt averaging over 21% interest with a mortgage rate near 6.7%—you can lessen your monthly monetary burden significantly. As expert Debra Shultz advises, ‘Anyone with a rate over 7% should start preparing for a cash out refinance va loan.’

-

Education Expenses: These funds can also be allocated towards educational costs, whether for yourself or your children. This investment in education can provide long-term benefits and potentially increase earning potential, which is something we all aspire to achieve.

-

Emergency Fund: Creating or improving an emergency fund with your refinance proceeds can offer a safety net for unforeseen expenses. This ensures greater economic stability, allowing you to face unexpected challenges with confidence.

-

Investment Opportunities: Consider using the funds for investment purposes, such as purchasing rental properties or stocks. This approach can help grow your wealth over time, leveraging the equity in your home to create additional income streams.

Financial planners often emphasize the importance of aligning these expenditures with your long-term financial goals. As Taylor Getler observes, “Utilizing equity withdrawal for home enhancements can not only improve your living environment but also boost your property’s market worth, creating a dual advantage approach.” However, it is essential to be mindful of the risks linked to a cash out refinance va loan. Raising your mortgage balance can result in greater overall debt and possible foreclosure risks if payments are overlooked. By thoughtfully evaluating these choices, you can enhance the benefits of your refinance and navigate this process with confidence.

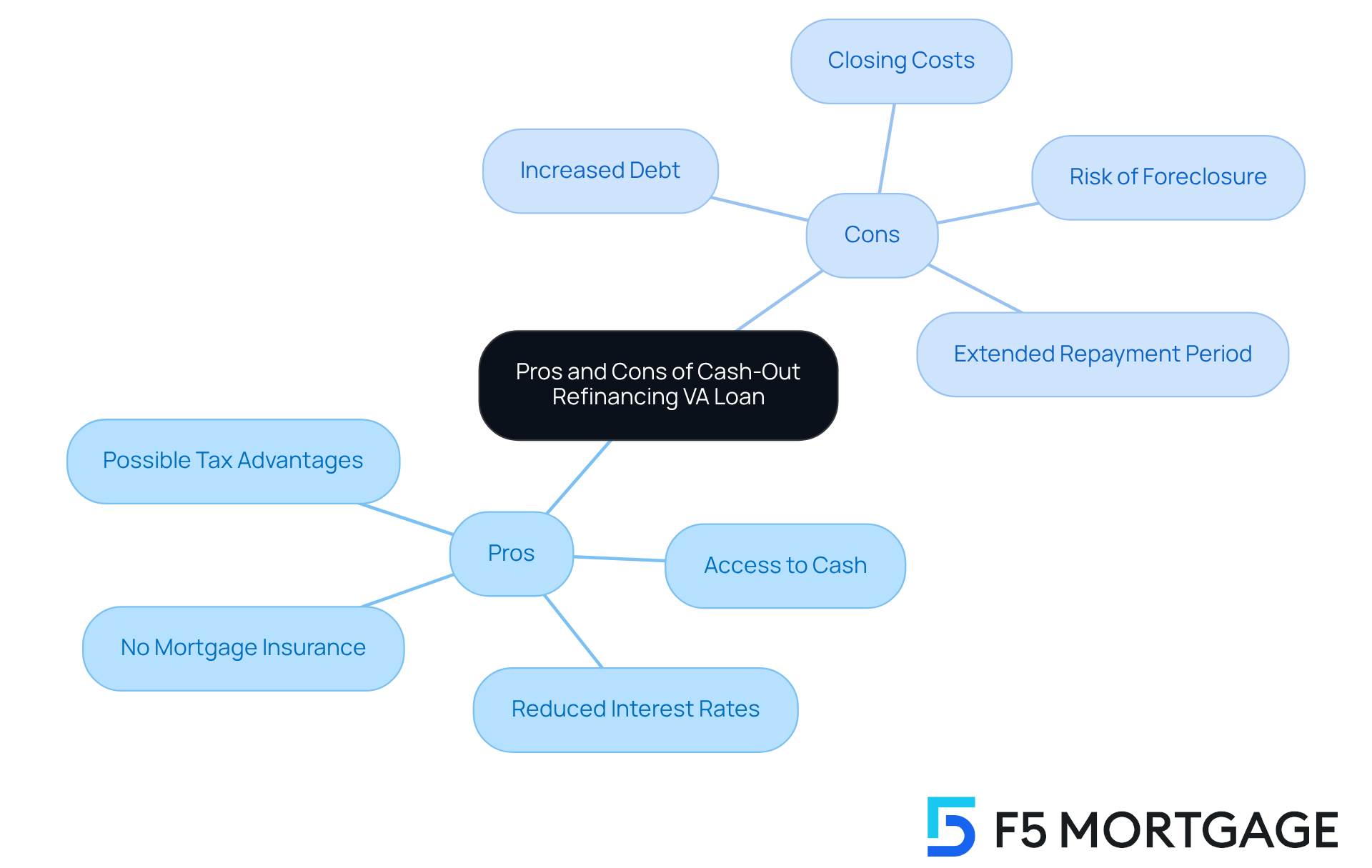

Evaluate the Pros and Cons of Cash-Out Refinancing

Before proceeding with a cash out refinance VA loan, we know how important it is to weigh the advantages and disadvantages carefully. Let’s explore these together:

Pros:

- Access to Cash: A cash out refinance VA loan allows homeowners to unlock significant cash from their home equity, providing immediate funds for various needs, such as home improvements or debt consolidation.

- Reduced Interest Rates: VA mortgages generally provide lower interest rates compared to traditional options, making them a desirable choice for refinancing.

- No Mortgage Insurance: Unlike traditional financing options, VA programs do not necessitate private mortgage insurance (PMI), which can lead to considerable savings over time.

- Possible Tax Advantages: The interest paid on mortgage financing may be tax-deductible, potentially lowering your overall tax obligation.

Cons:

- Increased Debt: By increasing your mortgage balance, you may face higher monthly payments, which can strain your budget.

- Closing Costs: Cash-out refinancing often involves considerable closing costs, generally ranging from 2% to 5% of the borrowed amount, which can increase your total expenses by thousands.

- Risk of Foreclosure: If you fail to make payments on the new credit, you risk losing your home to foreclosure, as the property serves as collateral.

- Extended Repayment Period: Lengthening your repayment duration can lead to paying more interest throughout the life of the debt, possibly raising your overall economic burden.

In 2025, the average interest rate for VA loans remains competitive, often lower than conventional loans, making them a viable option for many homeowners. However, it’s essential to consider the monetary implications of increasing your mortgage balance through a cash out refinance VA loan. This can lead to a longer repayment period and higher overall interest costs.

We’re here to support you every step of the way. Consulting with a financial expert can provide tailored guidance to help you navigate these complexities and make an informed decision.

Conclusion

Navigating a cash-out refinance VA loan can indeed open doors to financial opportunities for veterans and service members. This process not only grants access to home equity but also presents a chance to consolidate debts, fund home improvements, or invest in future needs. By understanding the intricacies of eligibility, the application process, and the potential uses for the funds, borrowers can feel empowered to make informed decisions that align with their financial goals.

Key insights from this guide highlight the importance of thorough preparation. Gathering necessary documentation and selecting a qualified lender are essential steps. Understanding eligibility requirements, completing the application accurately, and evaluating the pros and cons are crucial for a successful refinancing experience. Moreover, being aware of potential risks—such as increased debt and the implications of closing costs—ensures that veterans can navigate this financial tool wisely.

Ultimately, a cash-out refinance VA loan can serve as a valuable resource when approached with careful consideration and planning. It is essential for veterans to reflect on their long-term financial objectives and consult with financial experts if needed. By doing so, they can leverage this opportunity to enhance their financial stability and improve their quality of life. This way, the equity in their homes can become a strategic asset for the future.

Frequently Asked Questions

What is a cash-out refinance VA loan?

A cash-out refinance VA loan allows qualified veterans and service personnel to replace their current mortgage with a new, larger amount, enabling them to access the equity built in their homes. This process involves paying off the existing mortgage and receiving the difference in cash, which can be used for purposes like home improvements or debt consolidation.

How much equity can veterans access through cash-out refinancing in 2025?

In 2025, veterans can refinance up to 100% of their home’s appraised value, depending on lender guidelines. This means they can potentially receive significant cash based on their home’s equity.

What are the potential uses for the cash received from a cash-out refinance?

The cash received from a cash-out refinance can be used for various purposes, including home improvements, debt consolidation, or covering unexpected expenses.

What should veterans consider before opting for a cash-out refinance?

Veterans should consider that cash-out refinancing typically comes with a new interest rate and loan terms, which may differ from the original mortgage. This can affect monthly payments and overall financial obligations, so it’s important to assess their financial situation and long-term budgeting.

What are the advantages of a cash-out refinance VA loan?

Advantages include the ability to consolidate high-interest debts into a lower-interest mortgage payment, potential tax-exempt cash received, and increased financial flexibility.

Is there a VA funding fee associated with cash-out refinancing?

Yes, there is a VA funding fee for withdrawing equity, which ranges from 2.3% to 3.6%, depending on whether it is the first or subsequent use of the benefit.

What are the service requirements for qualifying for a VA cash-out refinance?

To qualify, you must be an active-duty service member, a veteran, or a qualifying surviving spouse.

What is a Certificate of Eligibility (COE) and why is it important?

A Certificate of Eligibility (COE) verifies your eligibility for VA benefit programs and is essential for the loan restructuring process. It must be obtained from the VA.

What are the credit and income standards for VA cash-out refinancing?

Generally, lenders require a minimum credit score of around 620, although some may allow scores as low as 580 depending on the loan-to-value ratio and other factors. Proof of stable income is also required.

What occupancy requirement must be met for VA cash-out refinancing?

You must confirm that you plan to inhabit the property as your main residence to qualify for VA financing.

What type of loan must you have to qualify for a VA cash-out refinance?

You must either possess a current VA loan or be converting a non-VA loan into a VA loan.

How can veterans obtain their Certificate of Eligibility (COE)?

Veterans can request their COE online, through a lender, or by mail using VA Form 26-1880.