Overview

Home loans with zero down are a real possibility for many families, thanks to specific programs like VA and USDA financing. These programs are designed to help eligible families and individuals purchase homes without needing an initial cash outlay. We know how challenging this can be, and that’s why understanding the steps to qualify is so important.

To enhance your chances of successful homeownership, start by:

- Checking your credit scores

- Verifying your income

- Gathering the required documentation

Remember, informed preparation can significantly boost your confidence as you navigate this journey. We’re here to support you every step of the way, ensuring you have the resources you need to make your dream of homeownership a reality.

Introduction

Navigating the path to homeownership can often feel overwhelming, especially for families who are trying to save for a down payment. We know how challenging this can be. Fortunately, zero-down mortgages present a viable solution, offering families the chance to secure a home without the financial strain of an initial investment. This option can make homeownership more accessible, but it also comes with unique challenges and considerations.

So, what steps can families take to effectively leverage zero-down mortgage options? By understanding these challenges and exploring solutions, you can ensure a smoother journey toward owning your dream home. We’re here to support you every step of the way.

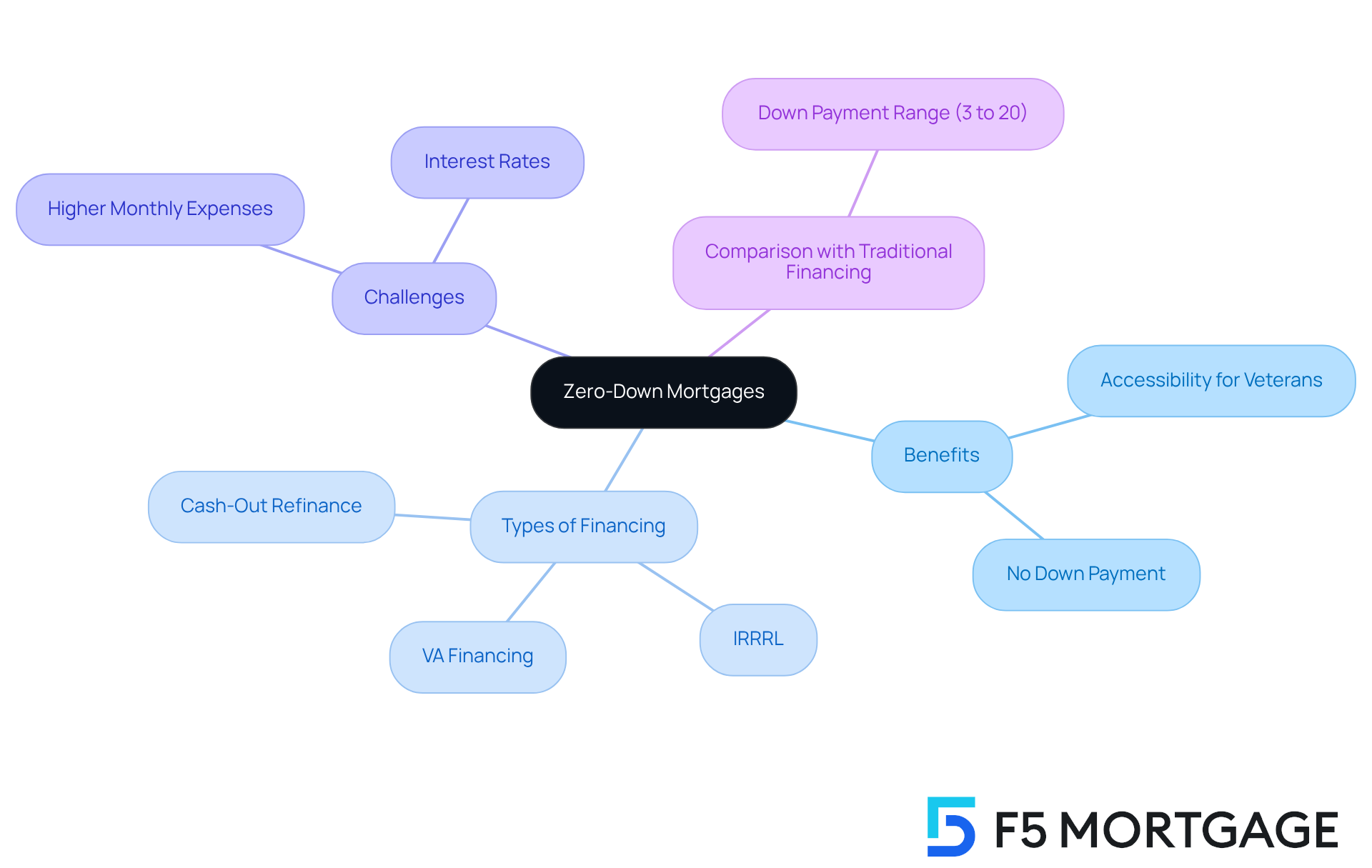

Understand Zero-Down Mortgages

Home loans with zero down, such as California VA options, offer a unique opportunity for families looking to purchase a home without the burden of a down payment. We understand how challenging it can be for first-time homebuyers or families with limited savings. This type of financing can be especially beneficial, as home loans with zero down, such as VA financing, typically cover 100% of the property’s purchase price, meaning you won’t need to provide any initial cash.

One of the standout features of VA programs is their accessibility to qualified veterans, active-duty service members, and certain members of the National Guard and Reserves. This provides a significant advantage in home financing for those who have served our country. After building some equity in your home, you can also explore refinancing options, such as the VA Interest Rate Reduction Refinance Program (IRRRL) to lower your rate and monthly costs, or a VA cash-out refinance for varying financial needs.

While home loans with zero down can make homeownership more attainable, it’s important to recognize that they may come with higher monthly expenses and interest rates compared to traditional financing that requires a down payment. For instance, conventional financing often necessitates a down payment ranging from 3% to 20%, which can lead to lower monthly payments.

By familiarizing yourself with the terms and requirements of no-down payment financing, especially VA options, you’ll be better equipped to make informed decisions throughout your home buying journey. Remember, we’re here to support you every step of the way.

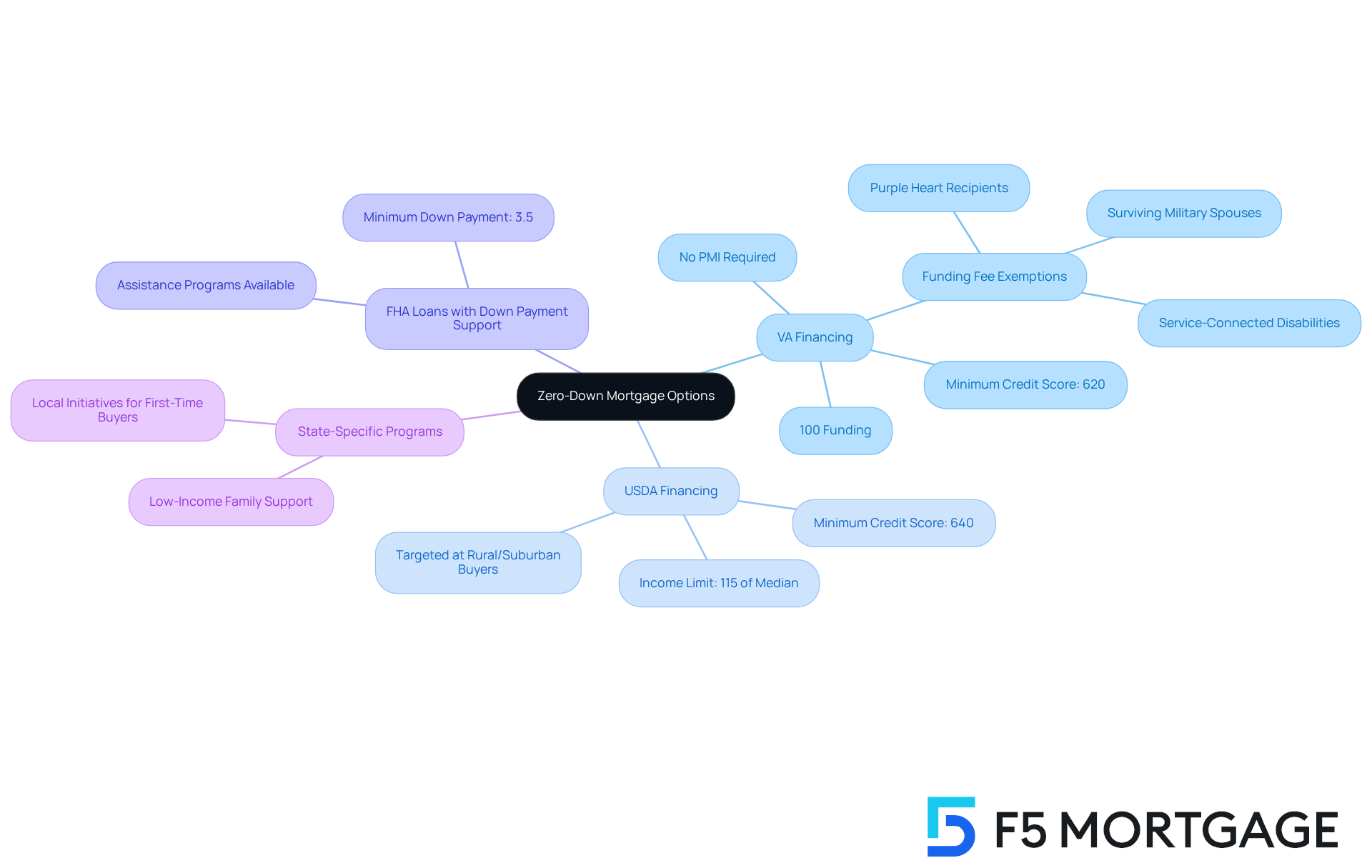

Explore Types of Zero-Down Mortgage Options

Several home loans with zero down options cater to diverse needs and circumstances, making homeownership more accessible for families. We know how challenging this can be, and we’re here to support you every step of the way.

-

VA Financing: Exclusively for veterans and active-duty military personnel, VA financing provides 100% funding with no down payment necessary. These financial products, such as home loans with zero down, offer competitive interest rates and remove the requirement for private mortgage insurance (PMI). This makes them a cost-effective option for qualified borrowers.

-

USDA Financing: Targeted at rural and suburban homebuyers, USDA financing offers home loans with zero down for eligible applicants. To qualify, your earnings must not surpass 115% of the median household income for your locality. This ensures that these financial aids assist low- to moderate-income families looking to buy homes in qualifying areas.

-

FHA Loans with Down Payment Support: While FHA loans generally necessitate a minimum contribution, several programs provide assistance that can fulfill this requirement. This effectively enables financing without an initial investment, which is especially advantageous for first-time homebuyers who may find it difficult to save for a deposit.

-

State-Specific Programs: Numerous states have created their own no-down payment loan initiatives targeted at first-time homebuyers or low-income families. Researching local options can reveal additional financing opportunities like home loans with zero down, further enhancing accessibility to homeownership.

By exploring these options, families can identify the program that best aligns with their financial situation and homeownership goals. This paves the way for a successful home-buying journey.

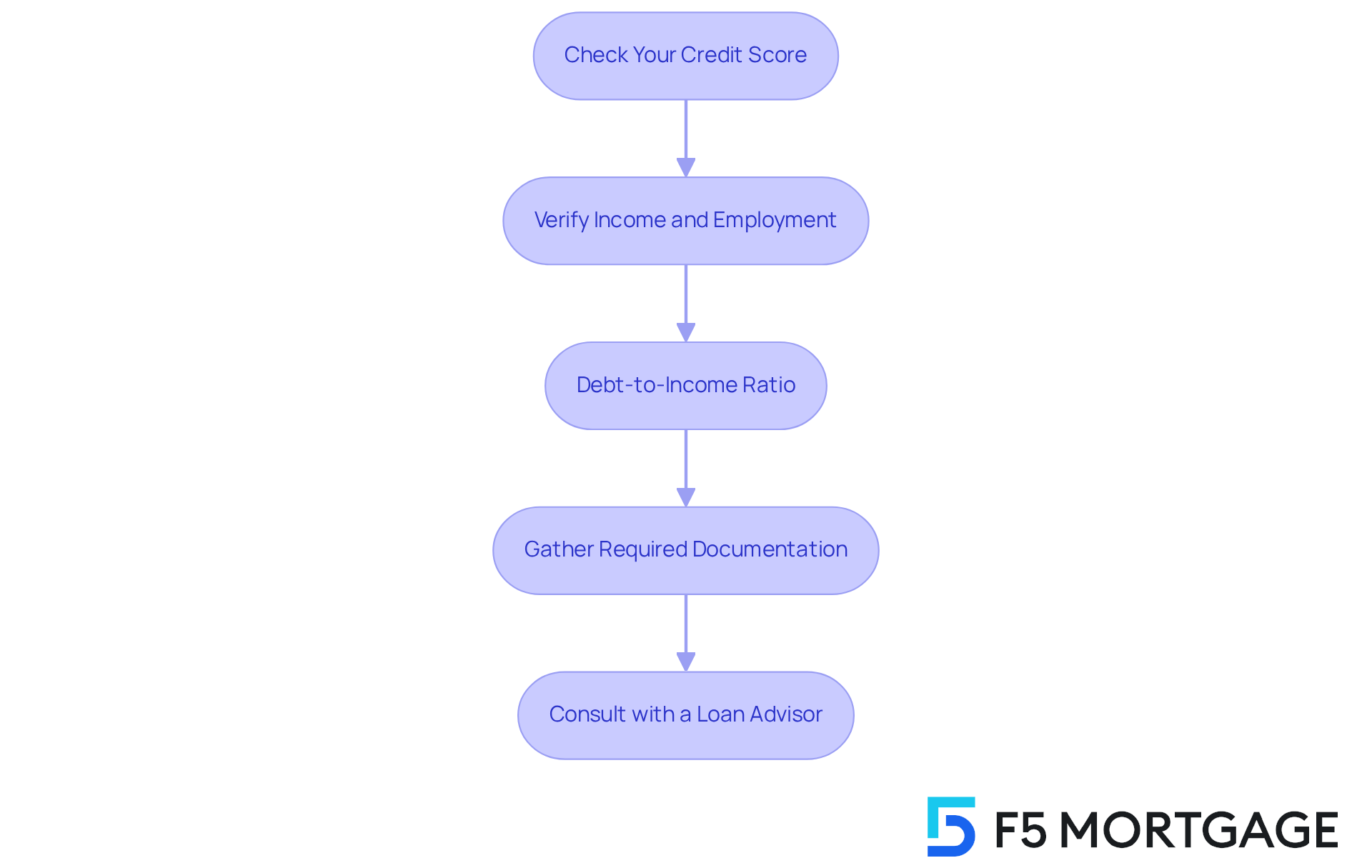

Qualify for a Zero-Down Mortgage

To qualify for home loans with zero down, we understand that families face specific standards that vary by the type of financing. Here are the essential steps to help you navigate this process:

-

Check Your Credit Score: We know how challenging it can be, but most lenders require a minimum credit score for zero-down mortgages. For VA loans, a score of 620 is often needed, while USDA loans typically require a score of 640 or higher. Regularly reviewing your credit report for errors and taking proactive steps to improve your score can significantly enhance your eligibility for home loans with zero down.

-

Verify Income and Employment: Lenders will assess your income stability and employment history. Ensure you have documentation such as pay stubs, tax returns, and W-2 forms ready for submission to demonstrate your financial reliability. This preparation can make a world of difference.

-

Debt-to-Income Ratio: Calculate your debt-to-income (DTI) ratio, which should ideally be below 43%. This ratio compares your monthly debt payments to your gross monthly income. By decreasing current debt, you can enhance your DTI, which will make you a more appealing candidate for home loans with zero down. Remember, statistics indicate that applicants with a DTI below this threshold have a higher approval rate for home loans with zero down.

-

Gather Required Documentation: Prepare necessary documents, including proof of income, bank statements, and identification. Having these ready will streamline the application process and show lenders that you are prepared.

-

Consult with a Loan Advisor: Collaborating with an experienced loan advisor can offer you tailored assistance and help you navigate the qualification process more efficiently. Their expertise can be invaluable in identifying the best loan options tailored to your financial situation.

By following these steps, families can place themselves in a better position to qualify for home loans with zero down, paving the way toward homeownership. We’re here to support you every step of the way.

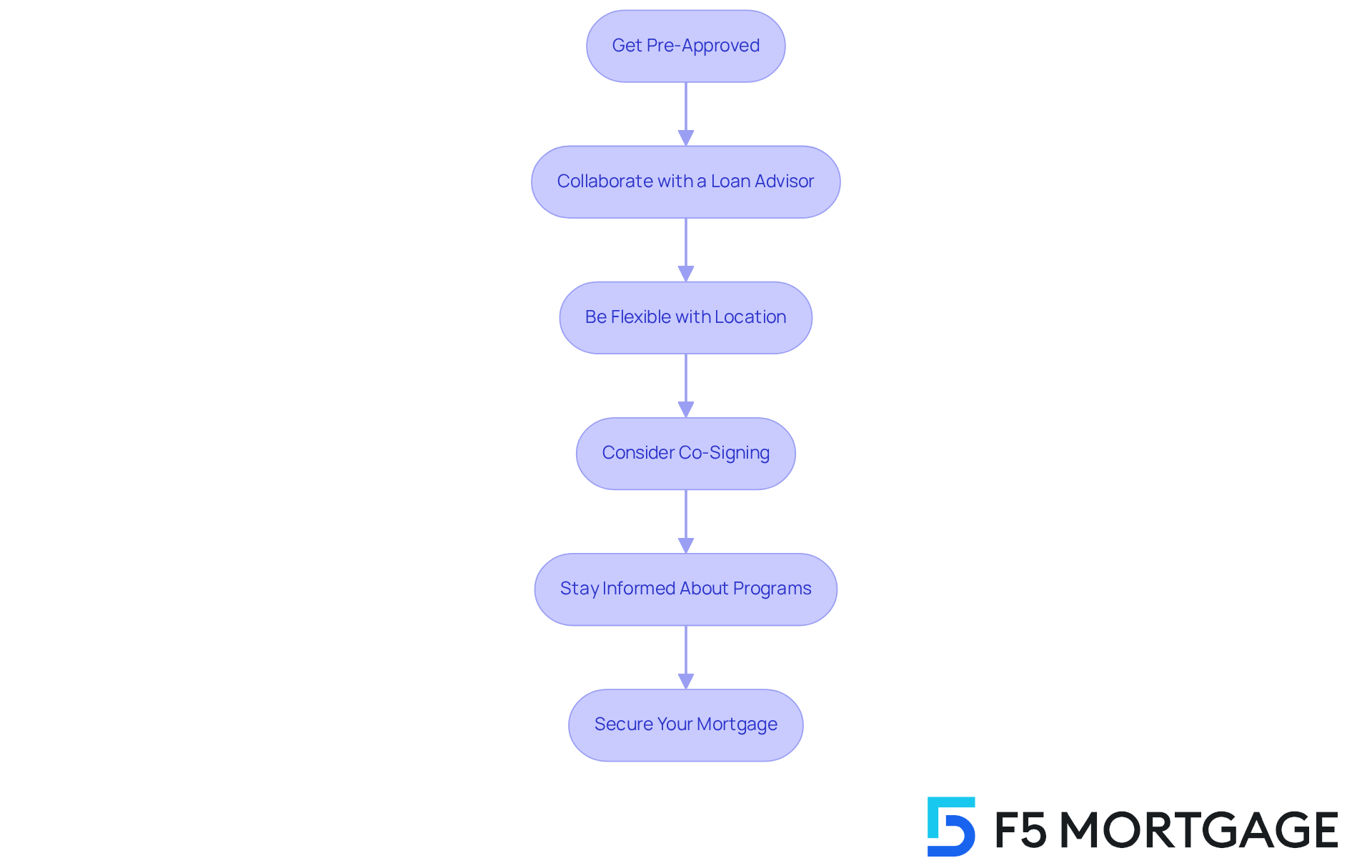

Implement Strategies to Secure Your Mortgage

Securing home loans with zero down can feel daunting, but with the right strategies, it’s entirely achievable. Here are some thoughtful steps to guide you through the process:

-

Get Pre-Approved: Before diving into house hunting, obtaining pre-approval from a lender is essential. This step not only clarifies your budget but also signals to sellers that you are a serious buyer. Most sellers are more inclined to consider offers from pre-approved buyers, as it demonstrates your financial readiness.

-

Collaborate with a Loan Advisor: Working alongside a loan advisor can make the financing process smoother. Brokers have access to a variety of lenders and can negotiate favorable terms on your behalf. Their expertise can help you navigate the complexities of different financing options, including no-down-payment programs, enhancing your chances of approval.

-

Be Flexible with Location: Expanding your search to include regions that qualify for USDA financing or other zero-down payment programs can open up more opportunities for homeownership. This flexibility can be key, especially in areas where such financing options are accessible.

-

Consider Co-Signing: If you’re facing challenges due to your credit score or income, asking a family member or friend to co-sign your loan application can significantly improve your approval prospects. A co-signer adds an extra layer of financial security, which may lead to better loan terms.

-

Stay Informed About Programs: It’s important to regularly check for updates on no-down payment financing programs and incentives from local and state authorities. By being proactive about available opportunities, you can seize new financing options as they become available.

By thoughtfully implementing these strategies, families can enhance their chances of securing home loans with zero down, thereby bringing them closer to realizing their dreams of homeownership. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Securing a home loan with zero down payment can transform the dream of homeownership into a reality for many families. We understand how challenging this can be, and by recognizing the unique advantages of zero-down mortgages, such as VA and USDA financing, families can navigate the complexities of home buying without the burden of an initial cash investment. This financing option not only opens the door to homeownership but also empowers families to invest in their future without the stress of accumulating a significant down payment.

Throughout this article, we’ve discussed key insights, including:

- The various types of zero-down mortgage options available

- The qualifications needed to secure such loans

- Effective strategies to enhance approval chances

From checking credit scores and verifying income to collaborating with loan advisors and exploring flexible locations, each step plays a crucial role in the home-buying journey. Additionally, understanding the potential higher costs associated with these loans allows families to make informed financial decisions.

Ultimately, the journey toward homeownership should not be hindered by financial constraints. We encourage families to explore the myriad of zero-down mortgage options available and utilize the strategies outlined to increase their chances of securing a loan. By taking proactive steps and staying informed about evolving financing programs, families can seize the opportunity to create a stable and fulfilling home environment. Embracing this path can lead to the rewarding experience of owning a home, fostering not just shelter, but a place where memories are made and futures are built.

Frequently Asked Questions

What are zero-down mortgages?

Zero-down mortgages are home loans that allow borrowers to purchase a home without making a down payment, meaning they can finance 100% of the property’s purchase price.

Who can benefit from zero-down mortgages like VA financing?

Qualified veterans, active-duty service members, and certain members of the National Guard and Reserves can benefit from zero-down mortgages, as these financing options are specifically designed for them.

What are the advantages of VA financing?

VA financing offers significant advantages, including no down payment requirement, making homeownership more accessible for eligible individuals.

What refinancing options are available after building equity in a home purchased with a zero-down mortgage?

After building equity, homeowners can explore refinancing options such as the VA Interest Rate Reduction Refinance Program (IRRRL) to lower their rate and monthly costs, or a VA cash-out refinance for various financial needs.

Are there any drawbacks to zero-down mortgages?

Yes, zero-down mortgages may come with higher monthly expenses and interest rates compared to traditional financing, which typically requires a down payment ranging from 3% to 20%, leading to lower monthly payments.

How can potential homebuyers prepare for zero-down financing?

Potential homebuyers should familiarize themselves with the terms and requirements of no-down payment financing, especially VA options, to make informed decisions during their home buying journey.