Overview

Navigating the mortgage application process can feel overwhelming, but we’re here to support you every step of the way. This article outlines a comprehensive four-step process designed to help you effectively manage your mortgage application. It emphasizes the importance of:

- Assessing your financial readiness

- Gathering necessary documentation

- Understanding the steps involved in the application

We know how challenging this can be, which is why each section provides actionable insights. For instance, evaluating your income and checking your credit scores are crucial steps that lay the groundwork for a successful application. Additionally, preparing for potential challenges can significantly enhance your chances of securing a mortgage.

By recognizing your concerns and offering practical solutions, we aim to empower you. With this guidance, you can approach the mortgage application process with confidence and clarity, making informed decisions that align with your family’s needs.

Introduction

Navigating the mortgage application process can often feel like traversing a labyrinth, filled with complex requirements and daunting challenges. We know how challenging this can be, and understanding the essential steps to prepare financially can empower you to approach this journey with confidence and clarity. What if there were a straightforward guide that not only outlined these steps but also addressed common pitfalls along the way? This article delves into the four critical stages of the mortgage application process, offering insights that can transform anxiety into assurance as you pursue your dream of homeownership. We’re here to support you every step of the way.

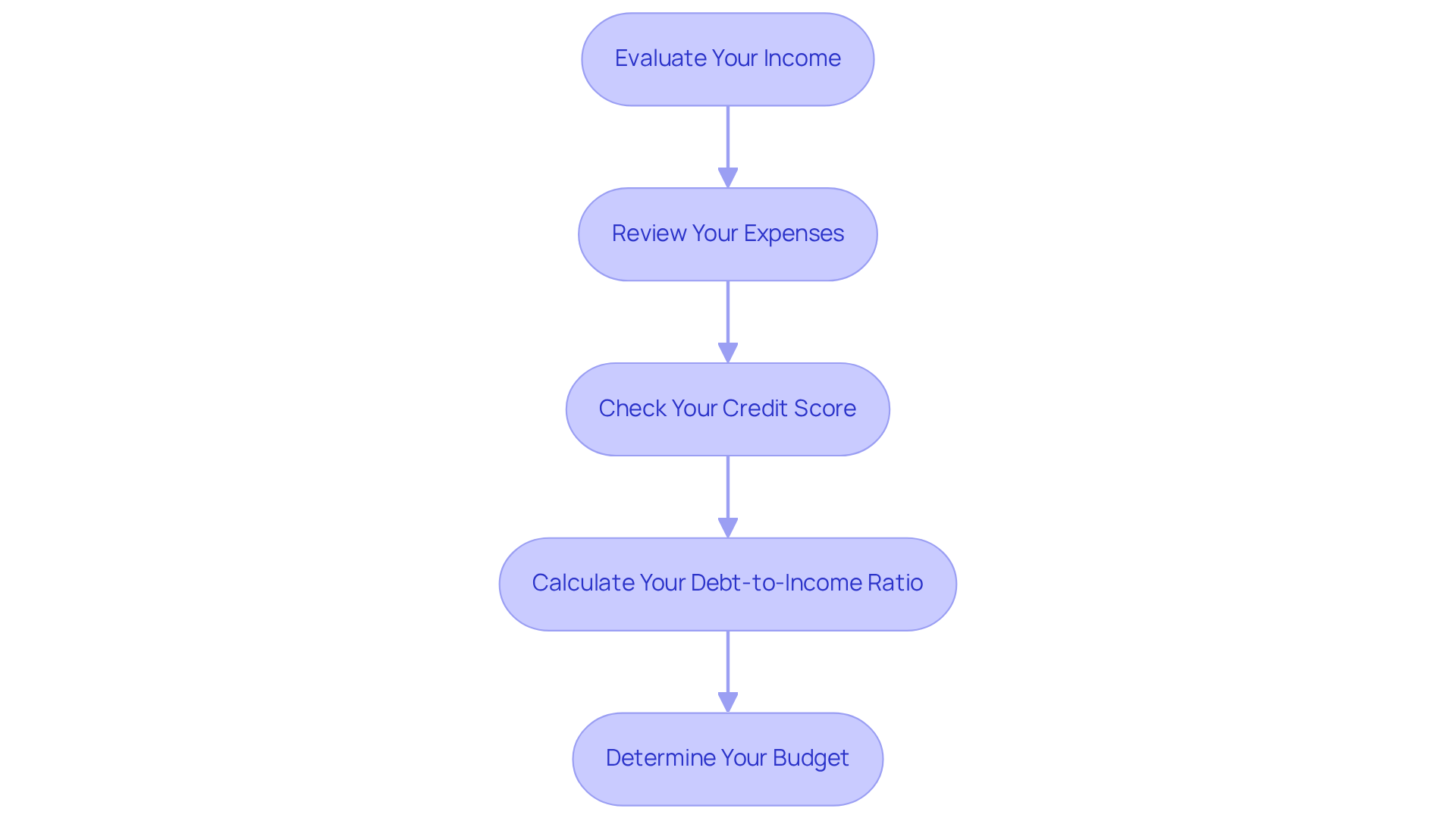

Assess Your Financial Readiness

To assess your financial readiness for a mortgage application, we recognize that the process can feel overwhelming. Here are some essential steps to guide you through the process:

-

Evaluate Your Income: Start by calculating your total monthly income, including your salary, bonuses, and any additional sources of income. This comprehensive perspective will help you grasp your monetary capacity and feel more confident.

-

Review Your Expenses: Create a detailed list of all monthly expenses, covering debts, utilities, groceries, and other recurring costs. This exercise will clarify your cash flow and highlight areas where you might adjust spending, making it easier to manage your finances.

-

Check Your Credit Score: Obtain your credit report and score from a reputable source. A higher credit score is essential; it can significantly affect the interest rates you qualify for, potentially saving you thousands over the duration of your loan.

-

Calculate Your Debt-to-Income Ratio (DTI): To determine your DTI, divide your total monthly debt payments by your gross monthly income. Lenders typically prefer a DTI below 43%, as this indicates a manageable level of debt relative to your income.

-

Determine Your Budget: Based on your monetary evaluation, establish a realistic budget for your home purchase. Consider how much you can afford for a down payment and what monthly loan payments align with your financial plan.

By following these steps, families can make knowledgeable choices about their preparedness to enter the housing market, ensuring a smoother mortgage application process. We know how challenging this can be, especially when considering the transition from an ARM to a fixed-rate loan. Fixed-rate loans offer stability and predictability in monthly payments, which can be especially advantageous during turbulent market times. Additionally, be aware of any prepayment penalties that may apply if you decide to switch.

At F5 Mortgage, we have successfully helped over 1,000 families navigate these challenges. We’re here to support you every step of the way, reinforcing the importance of thorough financial preparation. We provide competitive rates and customized service, ensuring that families can discover the best financing options suited to their needs. F5 Mortgage also connects clients with top realtors, further supporting your journey toward homeownership.

Gather Necessary Documentation

Navigating the mortgage application can feel overwhelming, but gathering the necessary documentation is a vital first step in the process. We know how challenging this can be, so here’s a comprehensive list to help you prepare:

- Proof of Identity: You’ll need a government-issued photo ID, such as a driver’s license or passport, to verify your identity.

- Income Verification: If you’re a salaried employee, recent pay stubs from the last 30 days and W-2 forms from the past two years are essential. For self-employed individuals, tax returns for the last two years and 1099 forms are necessary to substantiate your income.

- Bank Statements: Lenders typically request recent bank statements for all accounts, usually covering the last two months, to assess your financial stability.

- Debt Information: It’s important to document any existing debts, including credit card statements, student loans, and other loans. This gives lenders a complete picture of your obligations.

- Property Information: If applicable, include details about the property you wish to purchase, such as the purchase agreement and any relevant disclosures.

- Additional Documentation: Depending on your unique circumstances, you may need to provide further documents, such as divorce decrees or bankruptcy filings, to clarify your financial situation.

Accurate income verification is crucial, especially for self-employed borrowers. Lenders often require detailed documentation to ensure consistency and reliability in income reporting. By collecting these documents in advance, you can simplify the process and enhance your appeal to lenders.

F5 Mortgage is here to support you every step of the way, leveraging technology to ensure competitive rates and a stress-free experience.

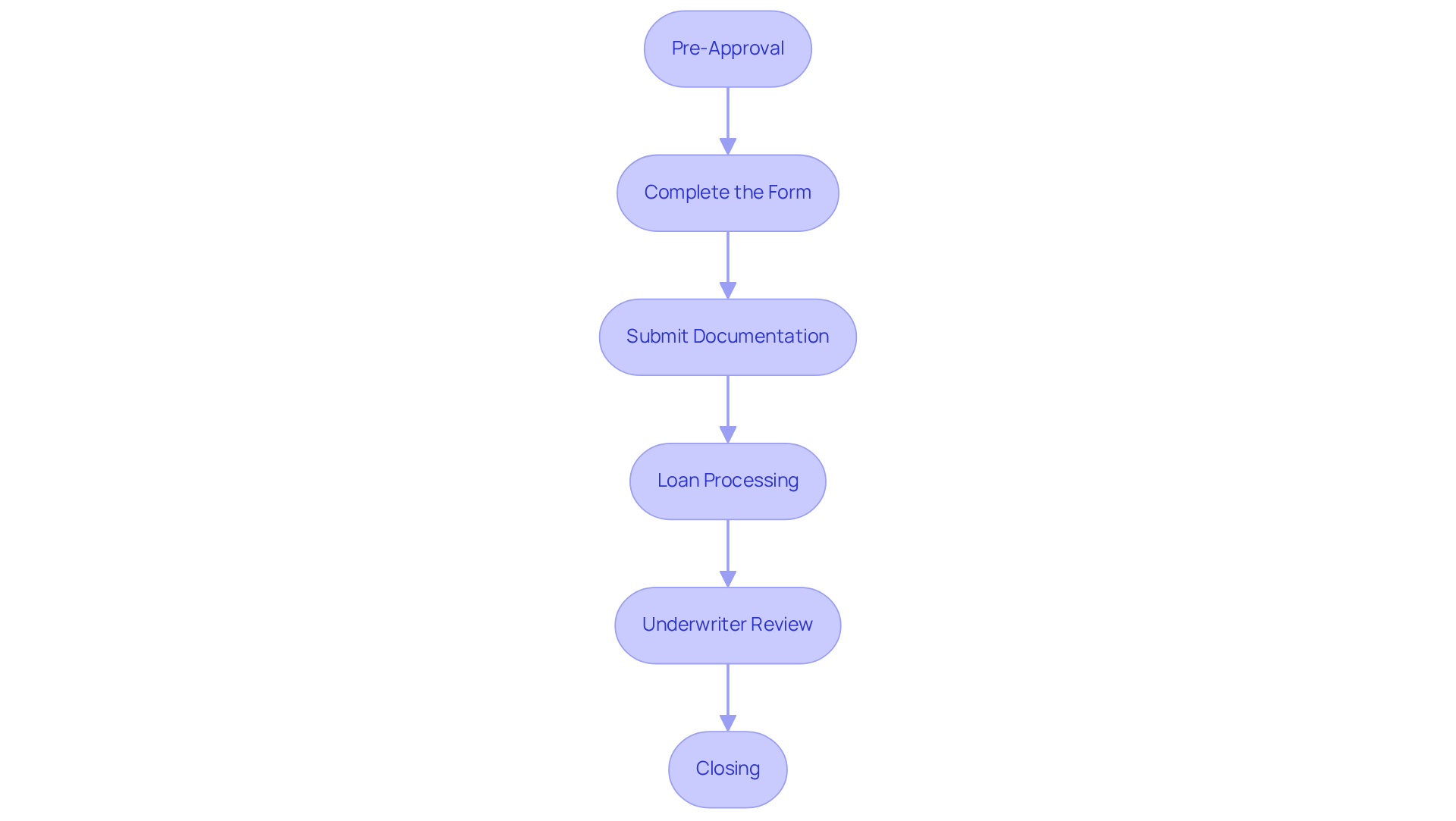

Navigate the Mortgage Application Process

Navigating the mortgage application process in 2025 can feel overwhelming, but we’re here to assist you every step of the way. Follow these essential steps to simplify your journey:

- Pre-Approval: Start by obtaining a mortgage pre-approval. This involves submitting your financial details to a lender, who will evaluate your eligibility and issue a pre-approval letter. This letter is crucial, as it demonstrates your commitment to sellers and can expedite your home-buying journey. With the average refusal rate for loan requests nearing 21% in 2024, careful preparation during this phase is vital to avoid potential challenges. At F5 Mortgage, our team of experts is dedicated to guiding you through this process, ensuring you understand your options and feel confident in your decisions. Our clients have praised us for our exceptional service, evident in our 5-star reviews on Lending Tree, Google, and Zillow.

- Complete the Form: Take your time to accurately fill out the mortgage request form. Be prepared to provide detailed information about your financial history, including income, debts, and the property you wish to purchase. Accuracy is essential in a mortgage application, as mistakes can lead to delays or rejections. Industry specialists emphasize that ensuring your mortgage application is complete and accurate can significantly enhance your chances of approval. Clients often commend F5 Mortgage for our seamless submission process, noting how our team clarifies any confusion that arises.

- Submit Documentation: Gather and submit all necessary documentation to your lender, including proof of income, tax returns, bank statements, and any other relevant financial information. Ensuring that all documents are complete and accurate is crucial to avoid processing delays. At F5 Mortgage, we stress the importance of the mortgage application step, as it can greatly affect your approval timeline.

- Loan Processing: After submitting your request, the lender will begin processing it. This stage involves verifying your information and assessing your creditworthiness. In 2024, the average rejection rate for mortgage requests reached nearly 21%, highlighting the need for thorough preparation. F5 Mortgage’s commitment to customer satisfaction is reflected in our 94% satisfaction rate, ensuring that clients feel supported throughout this stage.

- During the mortgage application process, the underwriter reviews your submission and supporting documents to determine if you meet the lender’s criteria. They may request additional information or clarification, so be ready to respond promptly to any inquiries. Our expert team at F5 Mortgage is here to assist you with any questions that may arise during this process.

- Closing: If your application is approved, you will receive a closing disclosure outlining the final terms of your loan. Take the time to thoroughly examine this document before signing the closing papers to ensure you understand all elements of your loan agreement. F5 Mortgage prides itself on a quick and efficient closing method, with most loans concluding in under three weeks, leading to a dependable and stress-free experience for our clients.

By following these steps, you can simplify your loan request process and enhance your chances of a favorable outcome. Additionally, F5 Mortgage offers various down payment assistance programs in states like Florida and Texas, which can broaden your home-buying opportunities. Our commitment to exceptional client satisfaction makes us a trusted partner in your home-buying journey. To further improve your chances of securing better loan rates, consider taking steps to enhance your credit score, such as checking your credit report for errors and paying down existing debts.

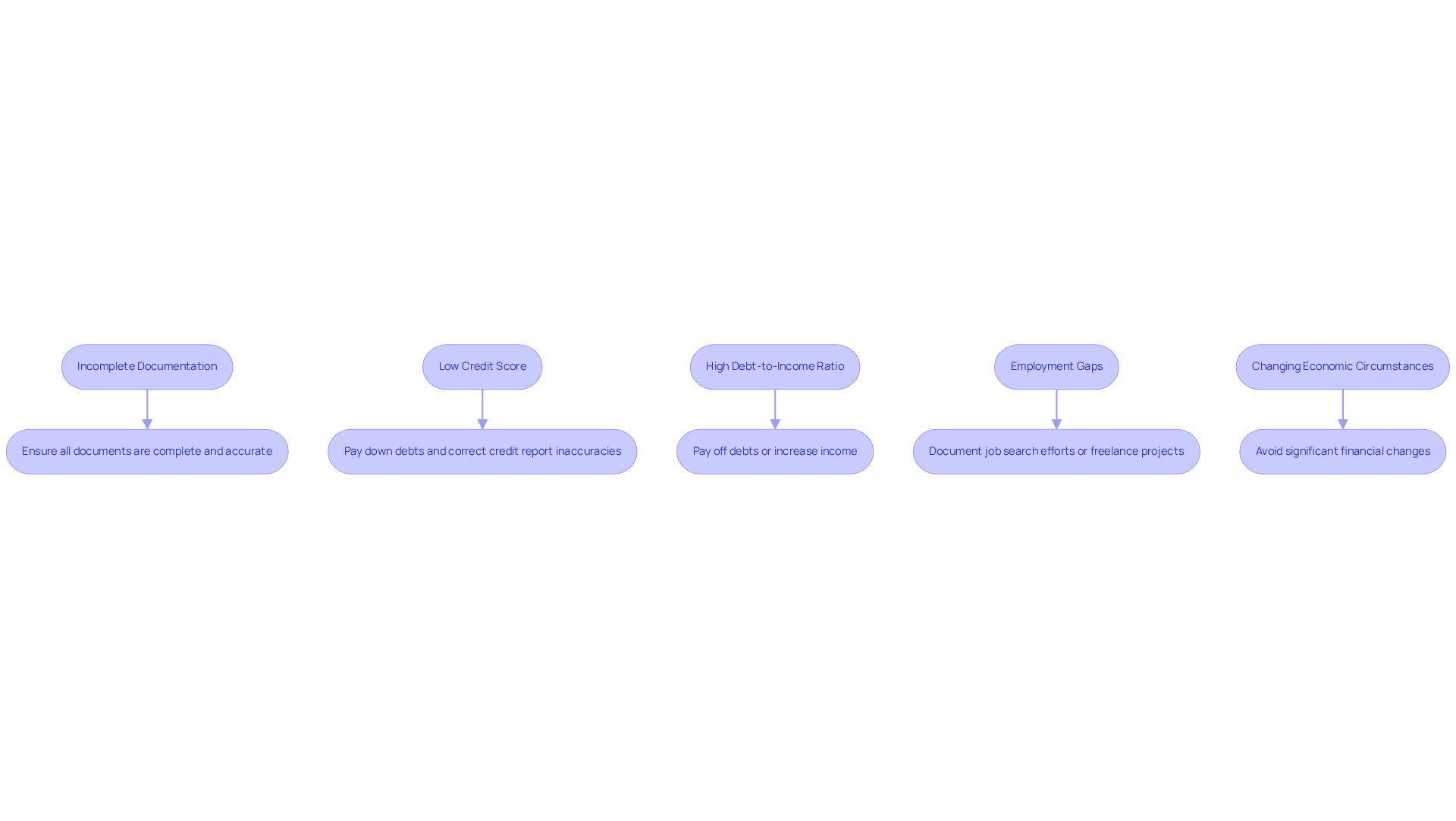

Overcome Common Mortgage Application Challenges

Navigating the mortgage application process can be daunting; however, with the right strategies, you can overcome common challenges and move closer to achieving your homeownership dreams. Here are some key areas to focus on:

-

Incomplete Documentation: We know how frustrating it can be to deal with missing paperwork. To avoid delays or potential denials, ensure that all required documents are complete and accurate before submission. Take the time to review your application thoroughly, identifying any gaps that need to be addressed.

-

Low Credit Score: If your credit score is below the desired threshold, don’t worry—you can take steps to improve it before applying. Consider paying down existing debts, avoiding new credit accounts, and correcting any inaccuracies on your credit report. Remember, in 2025, the median credit score among new loan borrowers is 758, highlighting the importance of maintaining a strong credit profile. Financial experts agree that a solid credit score is crucial for securing favorable loan terms.

-

High Debt-to-Income Ratio: A high debt-to-income (DTI) ratio can make it harder to get approved. To enhance your chances, think about paying off some debts or exploring ways to increase your income, such as taking on side projects. This proactive approach can significantly improve your loan request prospects. Keep in mind that the average mortgage application rejection rate climbed to nearly 21% in 2024, making it essential to address this issue.

-

Employment Gaps: If you have gaps in your employment history, be prepared to discuss these with your lender. Documenting your job search efforts or any freelance projects can demonstrate your commitment to economic stability.

-

Changing Economic Circumstances: During the application process, it’s best to avoid making significant financial changes, like switching jobs or incurring new debts. Such actions can negatively impact your approval status, as lenders assess your economic stability based on your current situation.

By addressing these common obstacles with focused strategies, you can enhance your chances of a successful loan request. It’s also important to consider that the median down payment for a house in 2025 is approximately 18%, which should be factored into your financial planning. With 80% of home buyers opting for mortgages in 2024, overcoming these mortgage application hurdles is more critical than ever. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the mortgage application process can feel overwhelming, but it is a crucial step toward achieving your dream of homeownership. We understand how challenging this can be. By grasping the key steps—assessing your financial readiness, gathering necessary documentation, and addressing common challenges—you can approach this journey with confidence and clarity.

Throughout this article, we highlighted several critical insights. Evaluating your income and expenses, checking your credit score, and calculating your debt-to-income ratio are foundational steps that empower you to make informed decisions. Additionally, compiling the right documentation and proactively addressing common hurdles can significantly enhance your chances of a successful application. With the average rejection rate for mortgage requests hovering around 21%, thorough preparation is essential.

Ultimately, securing a mortgage is not just about paperwork; it is a strategic endeavor that can lead to lasting stability and fulfillment. With resources like F5 Mortgage available to guide you through this process, you have support every step of the way. Embracing these strategies not only prepares you for your mortgage application but also helps you realize your dream of homeownership. Taking action today can pave the way for a brighter tomorrow, making the dream of owning a home an attainable reality.

Frequently Asked Questions

How can I assess my financial readiness for a mortgage application?

To assess your financial readiness, evaluate your income, review your expenses, check your credit score, calculate your debt-to-income ratio (DTI), and determine your budget for the home purchase.

What should I include when evaluating my income?

You should calculate your total monthly income, including your salary, bonuses, and any additional sources of income to get a comprehensive understanding of your monetary capacity.

Why is it important to review my expenses?

Reviewing your expenses helps clarify your cash flow and highlights areas where you might adjust spending, making it easier to manage your finances effectively.

How can I check my credit score?

You can obtain your credit report and score from a reputable source. A higher credit score is essential as it significantly affects the interest rates you qualify for.

What is the debt-to-income ratio (DTI) and why is it important?

The DTI is calculated by dividing your total monthly debt payments by your gross monthly income. Lenders typically prefer a DTI below 43%, indicating a manageable level of debt relative to your income.

How do I determine my budget for a home purchase?

Based on your financial evaluation, establish a realistic budget considering how much you can afford for a down payment and what monthly loan payments fit within your financial plan.

What advantages do fixed-rate loans offer compared to adjustable-rate mortgages (ARMs)?

Fixed-rate loans offer stability and predictability in monthly payments, which can be especially beneficial during turbulent market times.

Are there any penalties for switching from an ARM to a fixed-rate loan?

Yes, there may be prepayment penalties that apply if you decide to switch from an ARM to a fixed-rate loan, so it’s important to be aware of these before making a decision.

How can F5 Mortgage assist me in the mortgage application process?

F5 Mortgage provides competitive rates, customized service, and connects clients with top realtors, supporting families in navigating the mortgage application process and finding the best financing options.