Overview

Navigating a home equity refinance can feel overwhelming, but we’re here to support you every step of the way. This article outlines four essential steps that can make this journey smoother for you:

-

Assess Your Financial Situation: Understanding your equity is the first step. We know how challenging this can be, but taking a close look at your finances will empower you to make informed decisions.

-

Research Financial Institutions: Explore your options for better loan terms. This is where you can find institutions that align with your goals and needs, ensuring you get the best possible support.

-

Gather Necessary Documentation: Preparing your paperwork can seem daunting, but it’s crucial for a seamless application process. Organizing your documents in advance can save you time and stress.

-

Submit Your Application: Finally, submitting your application is a significant milestone. With all your preparation, you can approach this step with confidence.

Each of these steps is vital in guiding you through the refinancing process. By following them, you’ll not only understand your equity better but also open doors to potential savings. Remember, we’re here to help you navigate this process and make choices that benefit your financial future.

Introduction

Navigating the world of home equity refinancing can often feel like a complex maze, filled with financial jargon and daunting procedures. We understand how challenging this can be. Understanding the concept of home equity is crucial; it not only represents the portion of your home that you own but also serves as a powerful tool for accessing funds for various needs.

This article offers a clear, step-by-step guide to successfully maneuver through the refinancing process. We’ll highlight essential qualifications and common challenges along the way, ensuring you feel supported every step of the way. But what happens when the potential benefits of refinancing collide with the realities of closing costs and fluctuating credit scores?

Exploring these dynamics can empower homeowners to make informed decisions that enhance their financial future. We’re here to support you as you navigate this journey.

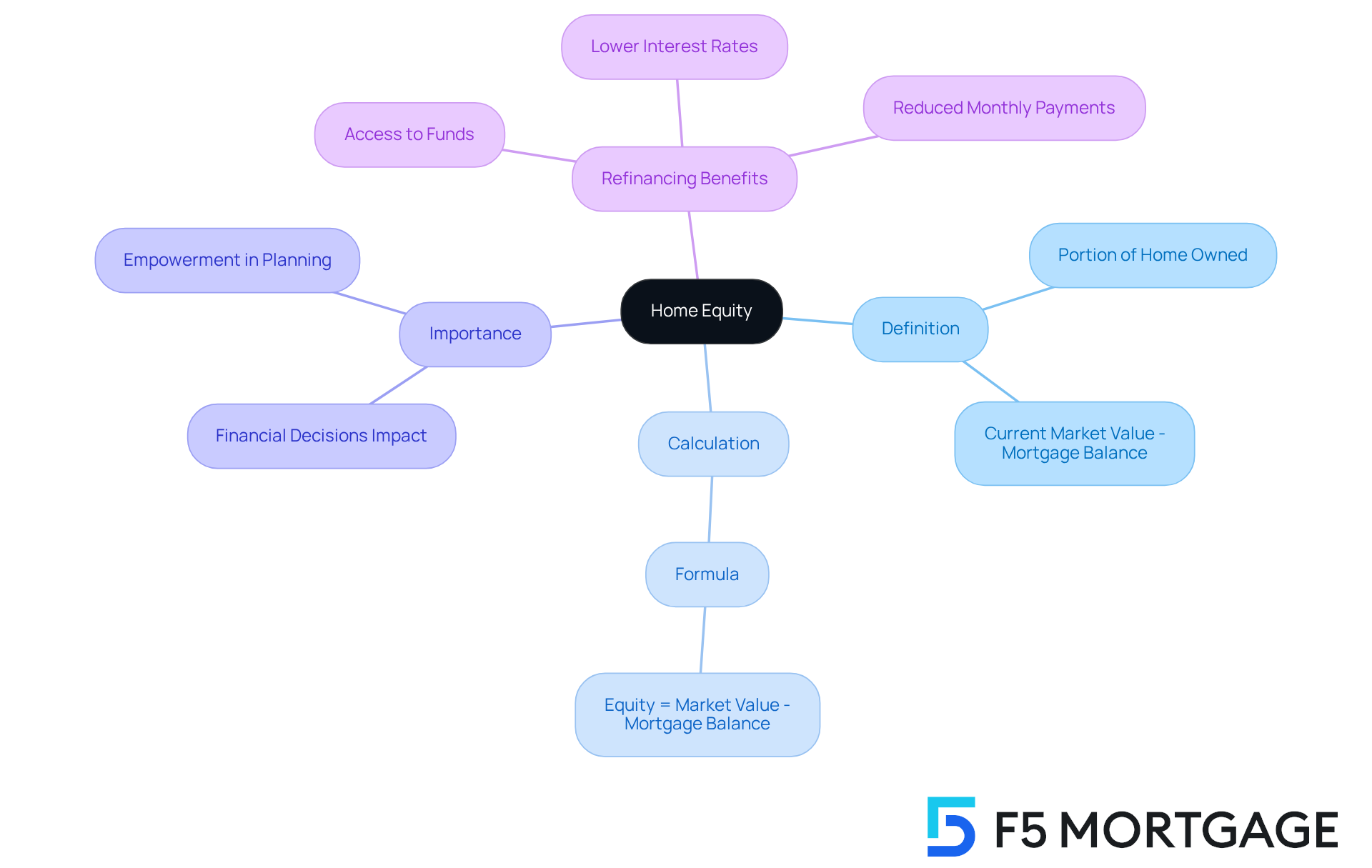

Define Home Equity and Its Importance

Equity in property is more than just a financial term; it represents the portion of your home that you truly own. It’s calculated by taking the current market value of your property and subtracting any remaining mortgage balances. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your equity stands at $100,000.

Understanding your property equity is essential, especially when navigating financial decisions related to a home equity refinance. It can be a valuable resource for home equity refinance, enabling you to access funds for renovations, debt consolidation, or other pressing financial needs.

Moreover, having a greater equity in your property can lead to better options for home equity refinance. This might mean lower interest rates and reduced monthly payments, which can significantly ease your financial burden.

We know how challenging financial planning can be, and understanding your equity is a crucial part of your overall strategy. By staying informed about your property’s value and your mortgage balance, you empower yourself to make decisions that can positively impact your family’s future.

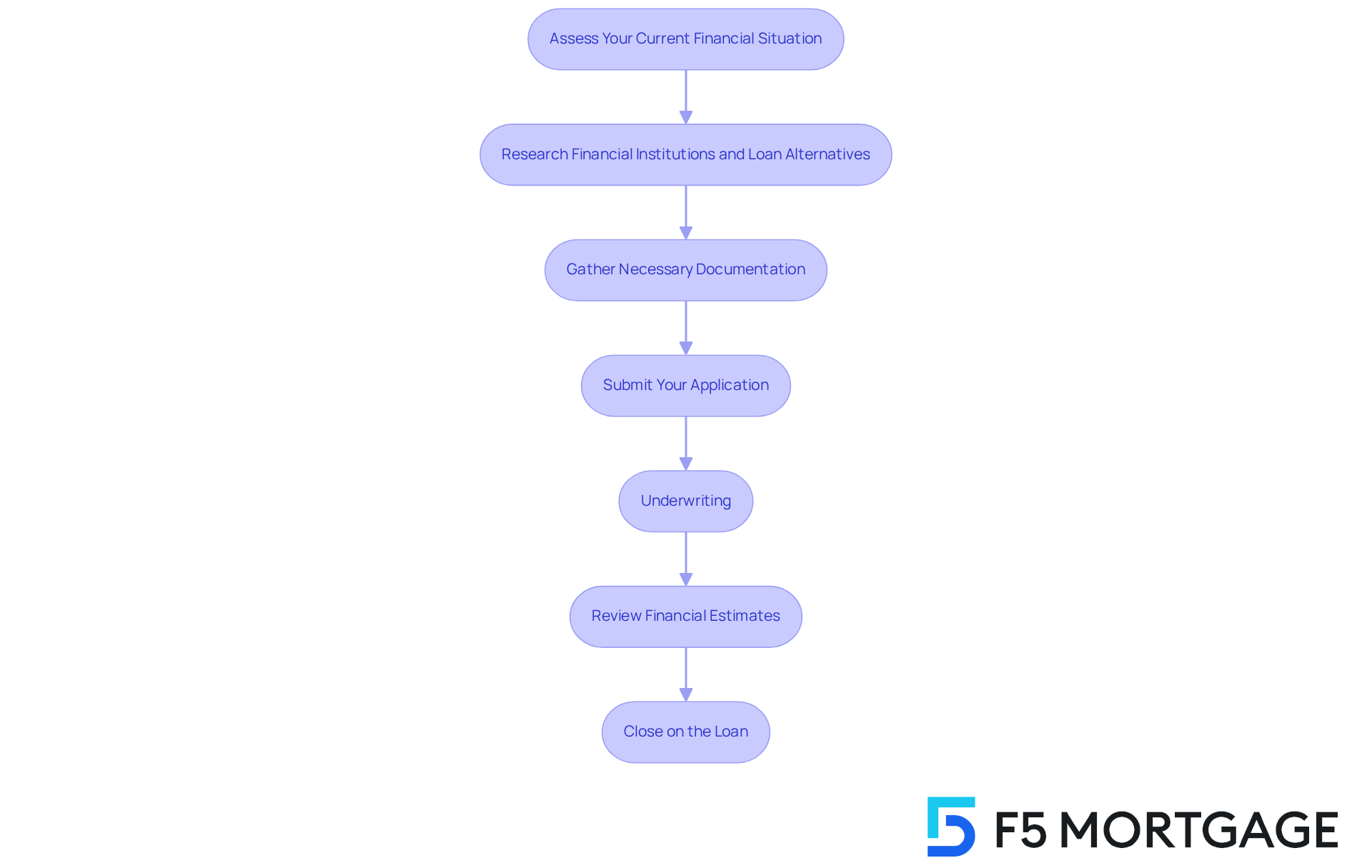

Outline the Home Equity Refinance Process

The process of home equity refinance can feel overwhelming, but we’re here to support you every step of the way. It typically involves several important steps:

-

Assess Your Current Financial Situation: Begin by reviewing your existing mortgage terms, interest rates, and current home equity. We know how challenging this can be, and it’s important to note that homeowners typically require a minimum of 20 percent equity to be eligible for a loan modification. This can greatly affect your choices and potential savings. Aim for a reduction of at least one full percentage point in your interest rate to ensure the process is advantageous for you.

-

Research Financial Institutions and Loan Alternatives: Investigate different financial institutions and their loan options. While refinancing your mortgage with your existing provider is an option, exploring various institutions can help you find the best rates and terms that align with your financial goals. Shopping around can maximize savings, as different financial institutions may offer varying rates and fees. Some may even provide lower rates for enrolling in autopay, which is worth considering.

-

Gather Necessary Documentation: Prepare essential documents such as income verification, tax returns, and details about your current mortgage. Having these documents ready can streamline the application process, which usually takes 30 to 45 days to complete. Remember that closing costs can range from 2 to 6 percent of the loan amount, so it’s wise to factor this into your financial planning.

-

Submit Your Application: Complete the application with your selected financial institution, ensuring all required documentation is included. Be prepared for a credit check and a home appraisal to determine your property’s market value. After submitting your application, you will undergo an appraisal process where the financial institution will evaluate your property’s current value. Keep in mind that refinancing can temporarily decrease your credit score, mainly due to credit inquiries and the transition of accounts.

-

Underwriting: The financial institution will assess your credit request, credit history, debt-to-income ratio, assets, and additional criteria to finalize the credit approval process. This step is crucial in determining your eligibility for the refinance.

-

Review Financial Estimates: After your application is processed, carefully examine the financial estimates provided by the lender. Pay close attention to interest rates, closing costs, and monthly payments to ensure they meet your financial needs. Understanding the difference between a home equity refinance and acquiring a second mortgage is essential; a home equity refinance replaces your existing mortgage with a new loan, while a second mortgage adds an additional monthly payment.

-

Close on the Loan: If you agree to the terms, schedule a closing date. During this meeting, you will sign the necessary paperwork, and the new financing will pay off your existing mortgage, ideally resulting in lower monthly payments or better terms. For certain loans, such as FHA loans, a waiting period of six months is necessary before obtaining a new loan after closing.

By following these steps, you can navigate the refinancing process with confidence and make informed decisions that benefit your financial future.

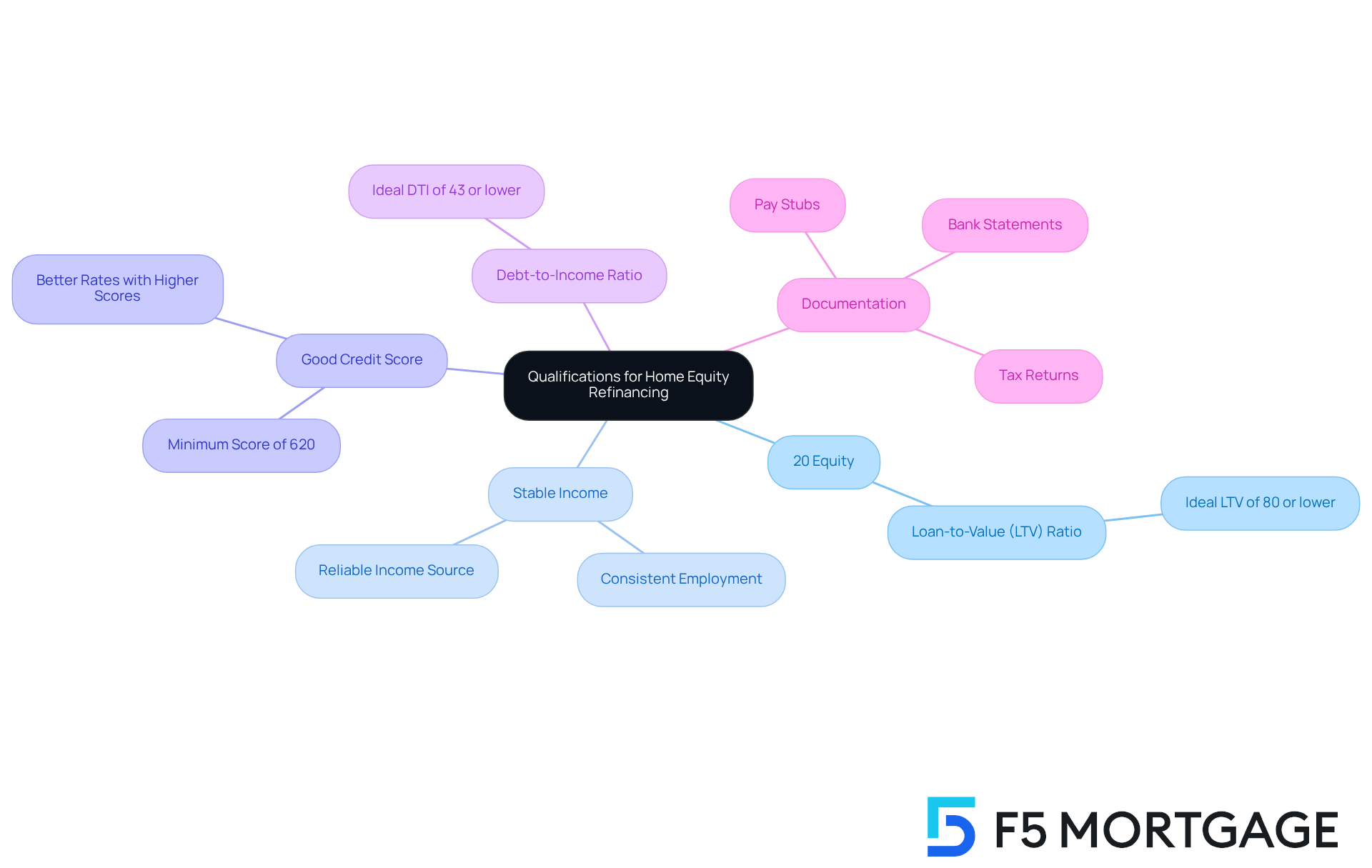

Identify Qualifications for Home Equity Refinancing

If you’re considering home equity refinance, it’s important to know what criteria you typically need to meet. We understand how overwhelming this process can feel, and we’re here to support you every step of the way.

- Most financial institutions require at least 20% equity in your home to qualify for a home equity refinance. This means your loan-to-value (LTV) ratio should ideally be 80% or lower.

- Stable Income: Lenders will assess your income to ensure you can afford the new mortgage payments. Consistent employment and a reliable income source are crucial for peace of mind.

- Good Credit Score: A credit score of 620 or above is typically favored, although some financial institutions may accept lower scores. A higher score can lead to better interest rates, which is always a plus.

- Debt-to-Income Ratio: Lenders typically look for a debt-to-income (DTI) ratio of 43% or lower. This ratio compares your monthly debt payments to your gross monthly income, ensuring you’re not overextended.

- Documentation: Be prepared to provide documentation such as pay stubs, tax returns, and bank statements to verify your financial situation. Gathering these documents can feel daunting, but it’s a necessary step.

Understanding the approval process is crucial. It shows that a financial institution has concluded you are a suitable candidate for a mortgage based on your financial details. This approval, often referred to as ‘preapproval’ or ‘prequalification’ by certain institutions, typically encompasses an estimate of your loan amount, interest rate, and possible monthly payments. Remember, the approval process can differ among financial institutions, so it’s vital to evaluate your options carefully.

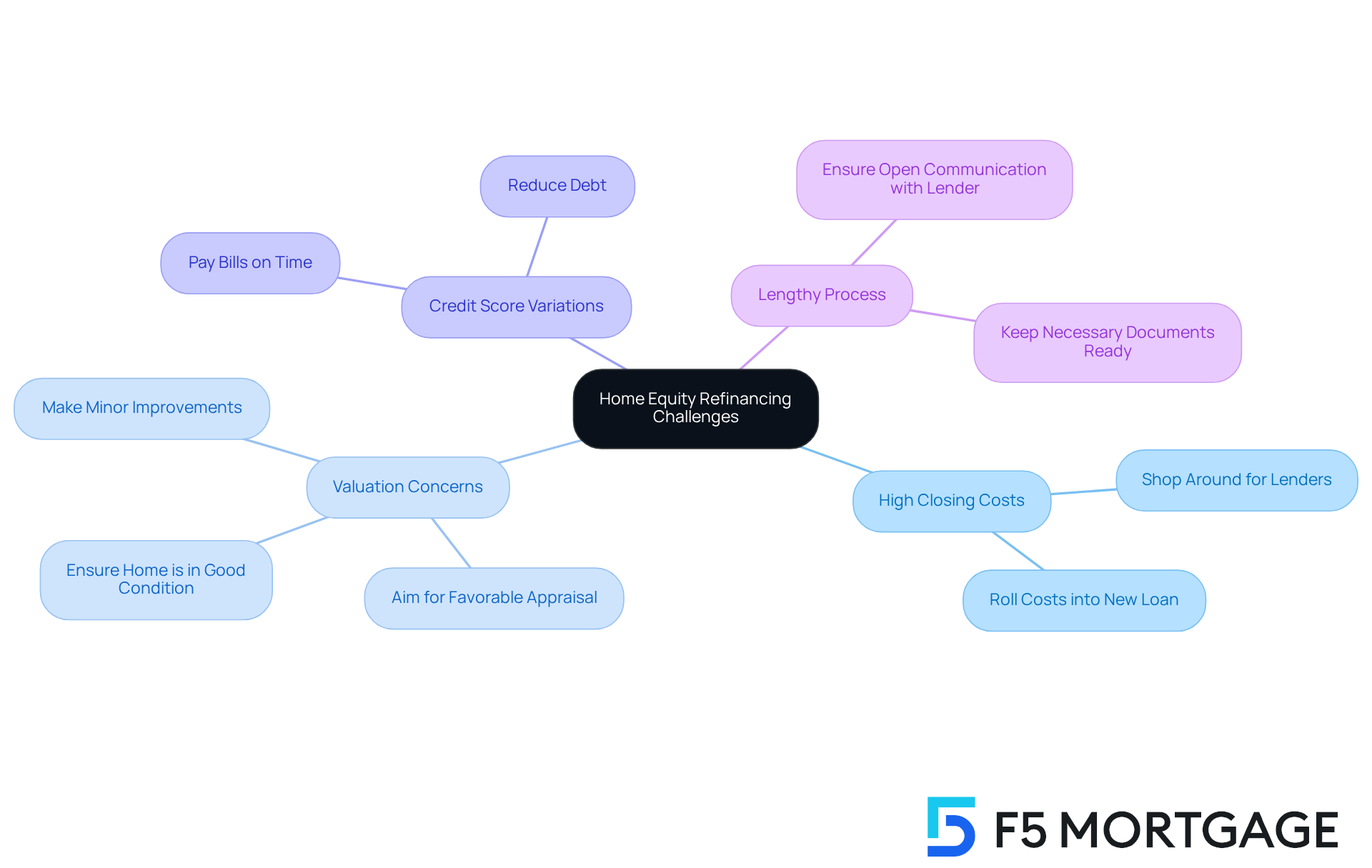

Highlight Common Challenges and Solutions in Refinancing

Home equity refinance can present several challenges, and we know how daunting this process can feel. However, being aware of these challenges can help you prepare and navigate them more smoothly:

-

High Closing Costs: Refinancing often comes with closing costs that can be significant. To ease this burden, consider shopping around for lenders that offer lower fees, or think about a home equity refinance to roll the costs into your new loan. This way, you can manage your home equity refinance expenses more effectively.

-

Valuation Concerns: If your property values lower than anticipated, it can influence your loan modification choices. To address this, ensure your home is in good condition and consider making minor improvements before pursuing a home equity refinance. Remember, a favorable appraisal can enhance your terms for a home equity refinance, giving you more options.

-

Credit Score Variations: A decrease in your credit score can affect your eligibility for a loan. To maintain stability, focus on good credit habits, such as paying bills on time, and reducing debt. We’re here to support you every step of the way in keeping your score healthy.

-

Lengthy Process: The refinancing process can be time-consuming, and we understand that this can be frustrating. Stay organized by keeping all necessary documents ready for a home equity refinance, including Social Security numbers, bank statements, tax returns, and pay stubs. This preparation will help expedite the home equity refinance process and ensure open communication with your lender, making the journey smoother for you.

Conclusion

Understanding the intricacies of home equity refinance is vital for homeowners seeking to leverage their property value for financial gain. We know how challenging this can be, but by grasping the concept of home equity and its significance, individuals can make informed choices that align with their financial goals. The refinancing process can feel complex, yet it can be navigated successfully with careful planning and awareness of the necessary steps.

Key arguments explored throughout this article include:

- The importance of assessing one’s financial situation

- Researching various loan options

- Gathering essential documentation

- Understanding qualifications for refinancing

Additionally, recognizing common challenges—such as high closing costs, valuation concerns, and credit score variations—allows homeowners to prepare effectively and mitigate potential setbacks during the refinancing journey.

Ultimately, taking proactive steps to understand home equity and the refinancing process can lead to significant financial benefits. By staying informed and organized, homeowners can unlock the potential of their equity, paving the way for a more secure financial future. Embracing this knowledge not only empowers individuals but also positions them to make strategic decisions that can enhance their overall financial health and well-being. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is home equity?

Home equity is the portion of your home that you truly own, calculated by subtracting any remaining mortgage balances from the current market value of your property.

How is home equity calculated?

Home equity is calculated by taking the current market value of your property and subtracting any remaining mortgage balances. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your equity is $100,000.

Why is understanding home equity important?

Understanding your home equity is essential for making informed financial decisions, especially when considering options like home equity refinancing, which can provide access to funds for renovations, debt consolidation, or other financial needs.

How can greater home equity benefit homeowners?

Having greater equity in your property can lead to better refinancing options, such as lower interest rates and reduced monthly payments, which can ease your financial burden.

What role does home equity play in financial planning?

Home equity is a crucial part of financial planning, as staying informed about your property’s value and mortgage balance empowers you to make decisions that can positively impact your family’s future.