Overview

Improving your credit score is a crucial step toward achieving home loan success. We know how challenging this can be, and understanding the factors that influence your score is essential. By implementing effective strategies, such as:

- Making timely bill payments

- Reducing credit card balances

you can take control of your financial future.

Monitoring your credit regularly is vital. Correcting any inaccuracies you find can significantly enhance your creditworthiness. Imagine the peace of mind that comes with knowing you’re on the right path—this can lead to better mortgage conditions and rates.

We’re here to support you every step of the way. Start by taking small, actionable steps today. You have the power to improve your credit score and open the door to your dream home.

Introduction

Navigating the complexities of securing a home loan often begins with a crucial yet frequently overlooked factor: credit scores. We know how challenging this can be, and these numerical indicators not only reflect an individual’s creditworthiness but also play a pivotal role in determining loan eligibility and interest rates.

By understanding the components that influence credit scores and implementing effective strategies for improvement, potential homeowners can significantly enhance their chances of obtaining favorable financing. Yet, with so much information available, how can one effectively prioritize actions to elevate their credit score in a competitive mortgage landscape?

We’re here to support you every step of the way.

Understand Credit Scores and Their Importance for Home Loans

serve as numerical indicators of your creditworthiness, typically ranging from 300 to 850. We understand how important these ratings are, as lenders use them to of providing funds. A higher rating reflects a lower risk, which can lead to more favorable borrowing conditions, including lower interest rates. For residential financing, a rating of 620 or higher is generally seen as satisfactory. However, higher ratings can significantly expand your . In fact, 24.7% of Americans had a FICO rating of 800 or higher in 2024, highlighting how excellent financial standing can unlock premium loan conditions.

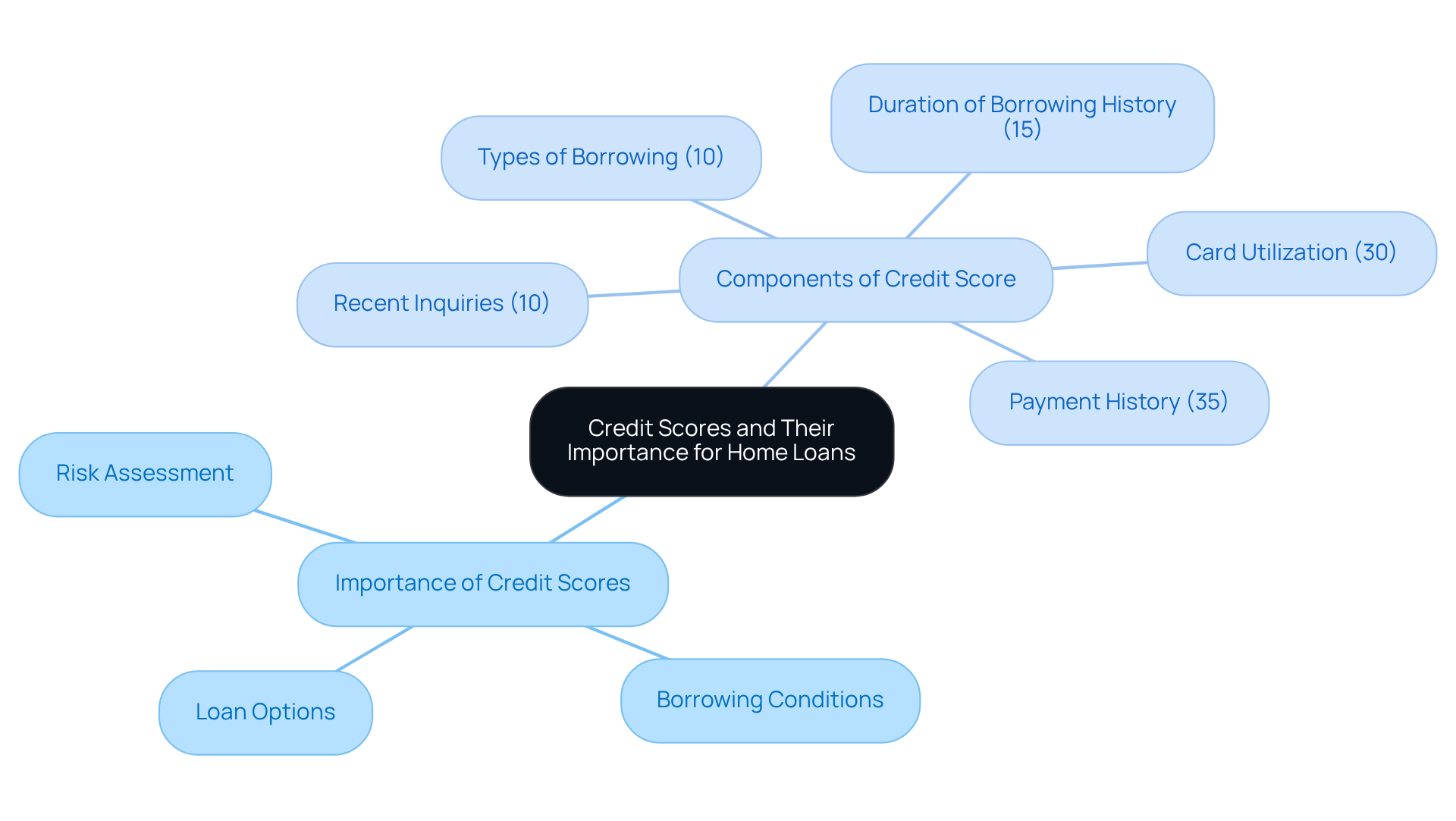

Understanding the is crucial for improvement:

- Payment History (35%): Consistently making can significantly enhance your score. Remember, missed payments reported after 30 days can severely impact your .

- Card Utilization (30%): It’s advisable to maintain your card balances below 30% of your limit. Consumers with the highest ratings often keep their utilization in the low single digits.

- Duration of Borrowing History (15%): A longer borrowing history is typically advantageous, as it provides lenders with more insight into your repayment behavior.

- Types of Borrowing (10%): A diverse mix of borrowing types, such as revolving accounts and installment loans, can positively influence your rating.

- Recent Inquiries (10%): We recommend limiting new loan applications, as multiple inquiries can lead to short-term declines in your rating.

As of July 2025, the on a is around 6.76% APR. Remember, rates are influenced by individual borrower risk, assessed through financial ratings and debt levels. By comprehending these elements, you can take practical steps to boost your score, ultimately increasing your chances of securing a . We’re here to support you every step of the way.

Assess Your Current Credit Situation

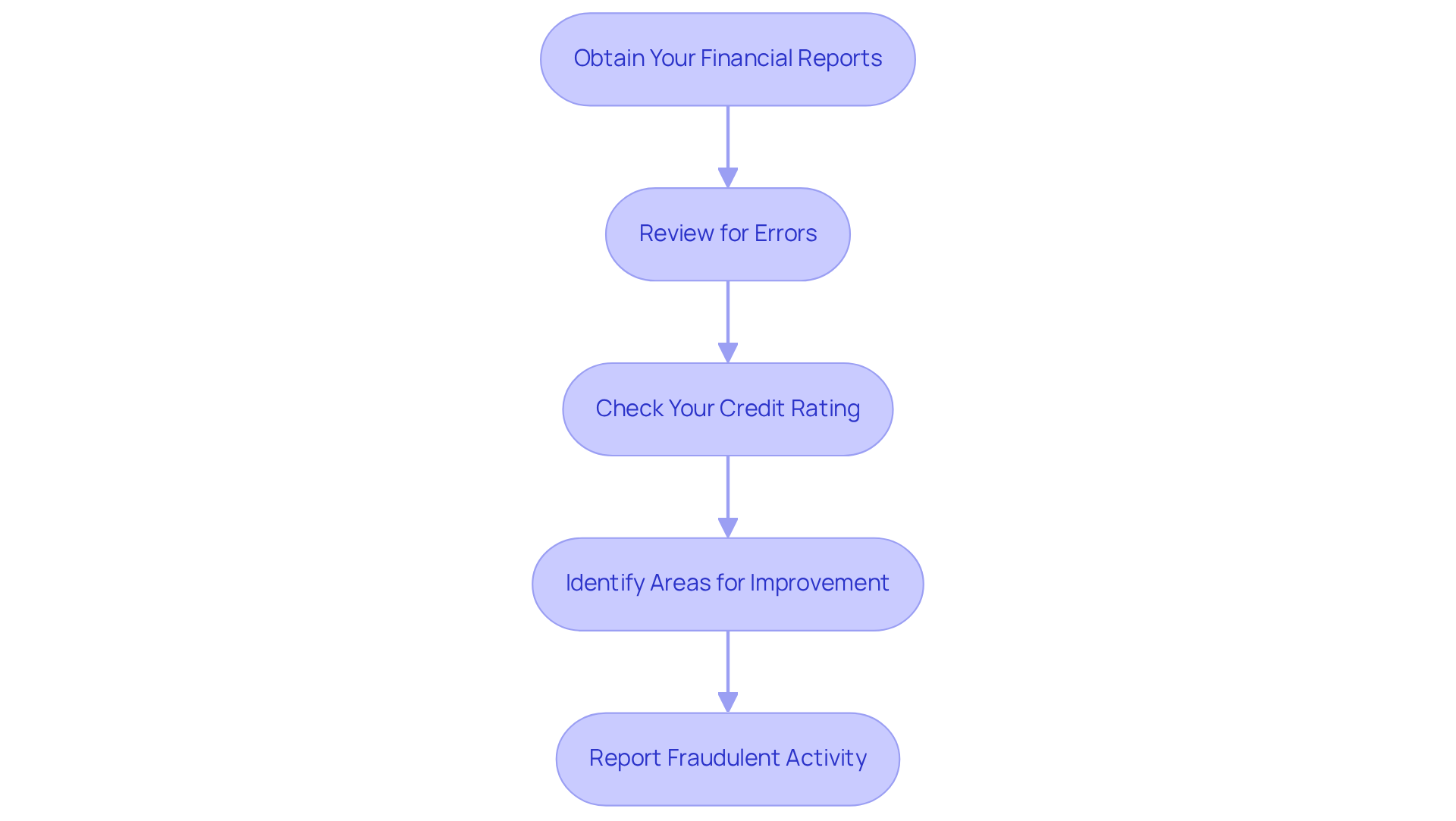

Start by acquiring your financial report from the three leading agencies: Experian, TransUnion, and Equifax. You can access one free report from each bureau annually through AnnualCreditReport.com. Additionally, Americans now enjoy permanent access to free weekly online from these bureaus, enabling more regular monitoring of your financial status. We know how challenging it can be to keep track of your finances, and consistently examining your reports is crucial. Research indicates that many consumers do not assess their reports annually, often overlooking opportunities to correct errors that could impact their ratings.

Carefully or negative items, such as late payments or collections. If you spot mistakes, challenging them can lead to , which is essential for securing . For instance, successful disputes have been known to enhance loan eligibility, allowing borrowers to access better rates and terms. You can (CFPB), which will investigate and provide updates on your complaint.

Furthermore, verify your rating through different financial organizations or monitoring services, which frequently offer complimentary access. for and the factors influencing it will help you prioritize your improvement efforts effectively. Be vigilant about identity theft; if you suspect any fraudulent activity, report it immediately to protect your credit health.

Steps to Assess Your Credit:

- Obtain Your Financial Reports: Visit AnnualReport.com.

- Review for Errors: Look for inaccuracies and negative items.

- Check Your : Use free services to obtain your current rating.

- Identify Areas for Improvement: Focus on factors that need attention.

Implement Strategies to Improve Your Credit Score

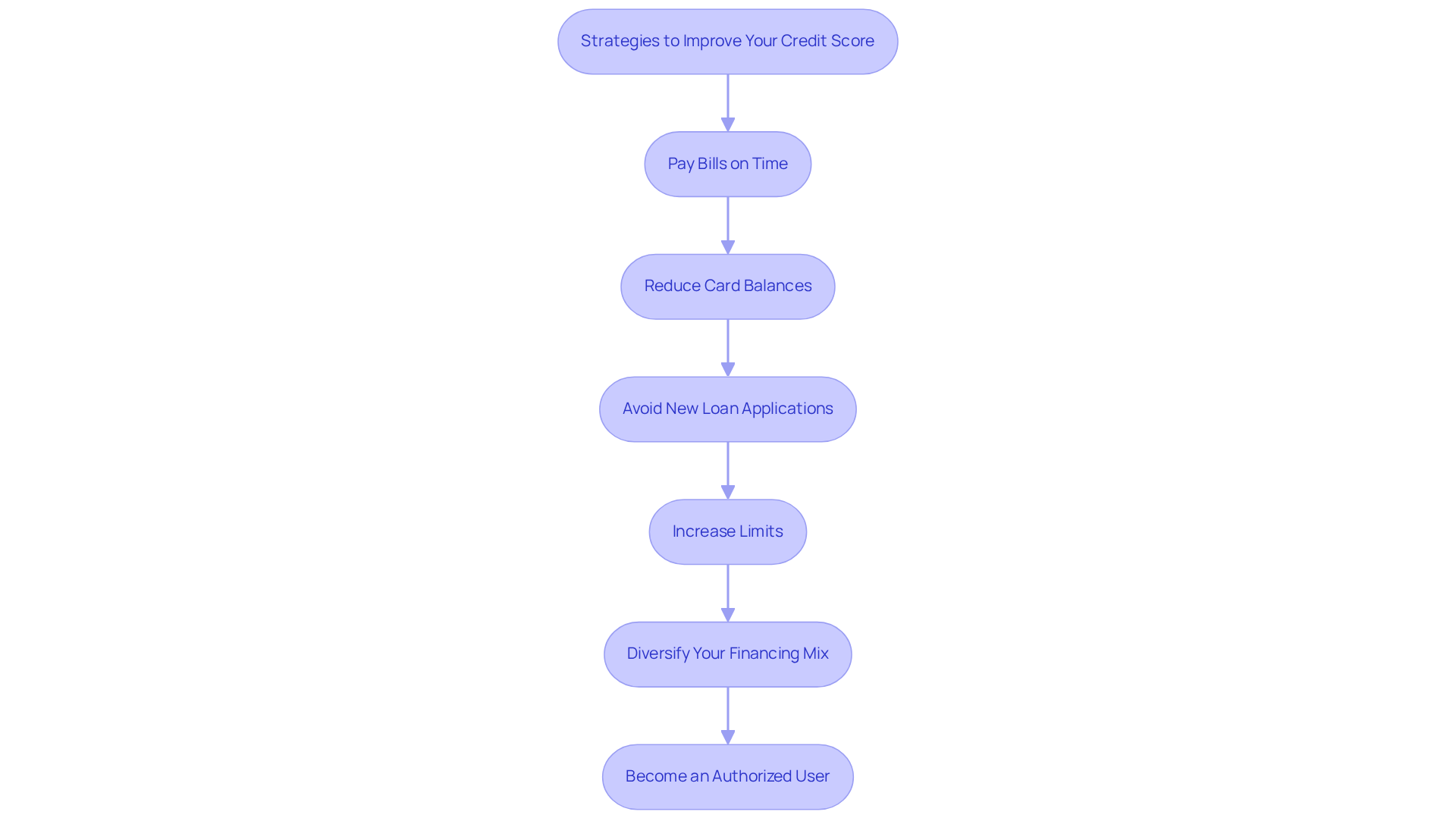

To and increase your chances of securing a favorable , we understand how crucial it is to implement . Here are some steps you can take:

- Pay Bills on Time: We know how challenging it can be to keep track of payments. Prompt bill payments are essential for preserving a healthy . Setting up reminders or automatic payments can help ensure you never overlook a due date. This is particularly important today, as many consumers are making only minimum payments on their cards, contributing to rising debt levels. In fact, the portion of cardholders making only the minimum monthly payment is at a 12-year peak, highlighting the need for proactive .

- Reduce Card Balances: Concentrating on settling current debt, especially , can significantly improve your financial situation. Strategies like the snowball method (paying off the smallest debts first) or the avalanche method (addressing the highest interest debts first) can effectively decrease your overall debt load and enhance your credit rating.

- Avoid New Loan Applications: Each new loan request can temporarily reduce your score. To maintain your financial well-being, we recommend limiting the number of new inquiries you make, especially when preparing to improve your credit score for a home loan application.

- Increase Limits: If possible, consider requesting higher limits on your current cards. This can help reduce your utilization ratio, which is a key factor in scoring. However, be cautious not to increase your spending as a result. Understanding the typical card utilization rate among U.S. consumers is important, as reduced utilization can positively impact your rating.

- Diversify Your Financing Mix: If your profile consists solely of charge cards, think about adding an installment loan, such as a personal loan. A varied loan combination can positively influence your score.

- Become an Authorized User: If you have a family member with a solid financial history, ask if you can be added as an authorized user on their card. This can help you benefit from their favorable payment history, further enhancing your financial profile.

By adopting these strategies, you can effectively manage your finances and enhance your . At F5 Mortgage, our client-centric approach, which includes and , is here to support you in navigating the complexities of mortgage financing. As financial counselor Charlestien Harris wisely notes, “By February, a person has a chance to settle down. You can begin to focus more and name a goal or two,” highlighting the importance of setting clear financial goals.

Monitor Your Credit Score Progress Regularly

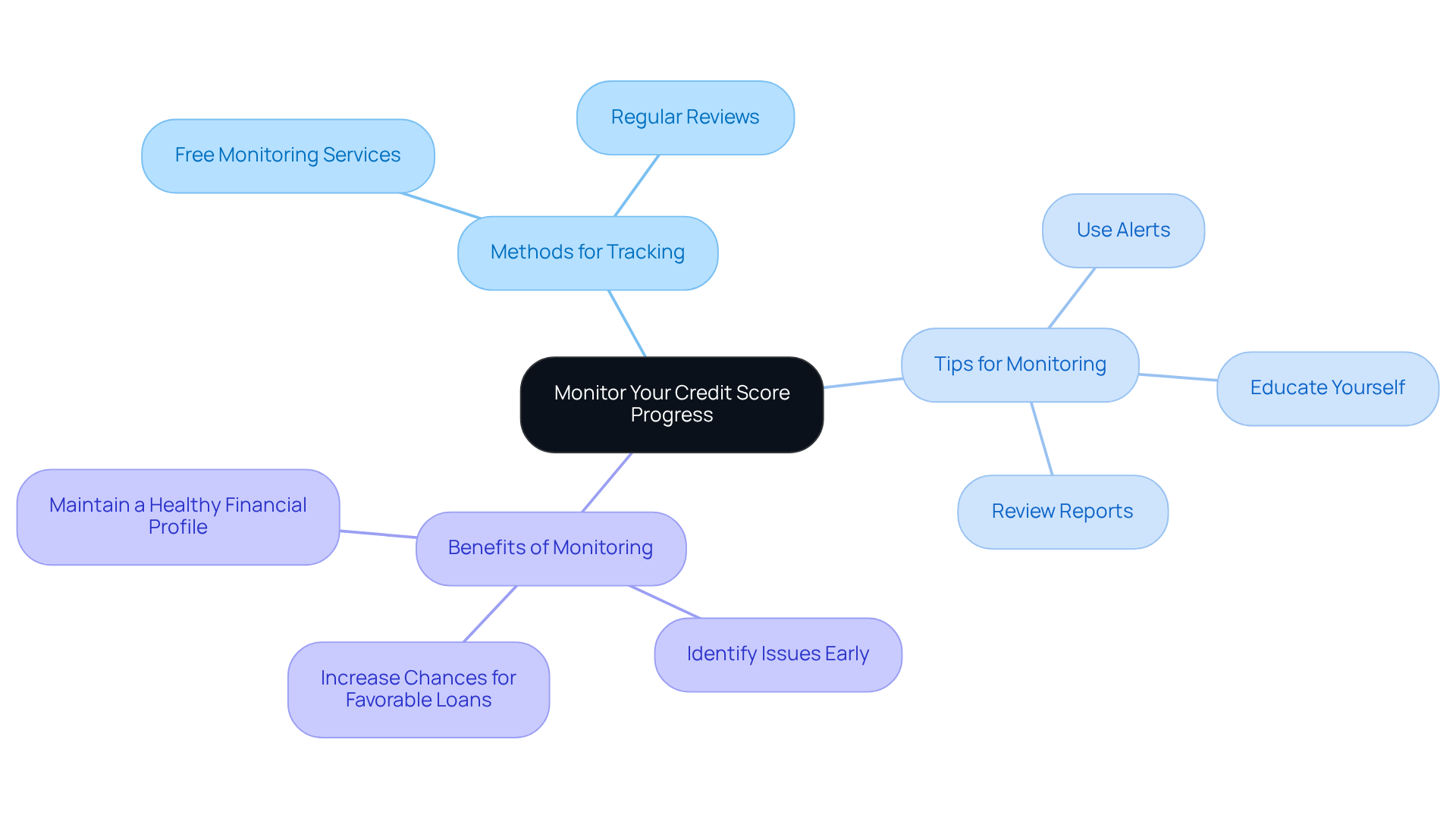

After applying methods to enhance your rating, it’s essential to track your advancement. We know how challenging this can be, so consider utilizing that offer notifications for changes in your report, such as new accounts or inquiries. Many financial institutions and card issuers provide complimentary tracking tools for your rating, making it easier for you to stay informed.

Consistently examining your will assist you in recognizing any possible problems promptly. Aim to check your score at least once a month to see the impact of your efforts and adjust your strategies as necessary. Remember, you are entitled to one free annually from each credit bureau, which can help you stay informed without incurring costs.

Tips for Monitoring Your Credit:

- Use Free : Sign up for services that provide alerts and updates.

- Review Your Financial Reports Regularly: Check for mistakes or changes that could impact your rating.

- Stay Informed About Financial Trends: Educate yourself on factors that influence ratings to make informed decisions.

Studies show that about 30% of consumers consistently track their ratings, which can greatly assist in preserving a healthy financial profile. Furthermore, a limited group of people could observe their ratings rise by 40 points or higher, enabling smoother access to funding and financing. By actively for , you can better position yourself and increase your chances of obtaining favorable funding terms. As credit reporting expert John Ulzheimer states, “Monitoring your credit score for home loan is essential to understanding your and ensuring you are in the best position for loan applications.

Conclusion

Improving your credit score is an essential step toward achieving home loan success. We know how challenging this can be, but by understanding the intricacies of credit ratings and their impact on borrowing conditions, you can take proactive measures to enhance your financial profile. A strong credit score not only opens the door to better loan terms but also empowers you with greater financial flexibility.

Key strategies discussed in this guide include:

- Maintaining timely payments

- Managing credit card utilization

- Regularly monitoring credit reports for inaccuracies

By focusing on these essential elements, you can significantly improve your credit score, thereby increasing your chances of securing favorable mortgage rates. Additionally, leveraging tools like credit monitoring services can help track your progress and identify areas needing attention, ensuring that your financial goals remain within reach.

Ultimately, taking charge of your credit health is not just about securing a home loan; it’s about building a solid financial foundation for the future. Implementing these strategies can lead to a more robust credit profile and better financial decisions down the line. Embrace the journey of improving your credit score, and watch as opportunities for favorable financing unfold.

Frequently Asked Questions

What is a credit score and why is it important for home loans?

A credit score is a numerical indicator of your creditworthiness, typically ranging from 300 to 850. Lenders use credit scores to assess the risk of providing funds, with higher scores reflecting lower risk and leading to more favorable borrowing conditions, such as lower interest rates.

What is considered a satisfactory credit score for residential financing?

For residential financing, a credit score of 620 or higher is generally seen as satisfactory. However, higher scores can significantly expand borrowing options.

What percentage of Americans had a FICO rating of 800 or higher in 2024?

In 2024, approximately 24.7% of Americans had a FICO rating of 800 or higher, indicating excellent financial standing and the ability to unlock premium loan conditions.

What are the main components that affect a credit score?

The main components that affect a credit score include:

- Payment History (35%): Timely payments enhance the score, while missed payments after 30 days can severely impact it.

- Card Utilization (30%): Keeping card balances below 30% of the limit is advisable; those with high ratings often maintain low utilization.

- Duration of Borrowing History (15%): A longer borrowing history is generally advantageous.

- Types of Borrowing (10%): A diverse mix of borrowing types can positively influence the score.

- Recent Inquiries (10%): Limiting new loan applications is recommended, as multiple inquiries can lead to short-term declines in the score.

What is the average interest rate on a 30-year fixed-rate mortgage as of July 2025?

As of July 2025, the average interest rate on a 30-year fixed-rate mortgage is around 6.76% APR. Rates are influenced by individual borrower risk, which is assessed through credit ratings and debt levels.

How can understanding credit scores help in securing a favorable mortgage?

By comprehending the components of credit scores, individuals can take practical steps to improve their scores, ultimately increasing their chances of securing a more favorable mortgage.