Overview

Determining the right time to buy a house can feel overwhelming, but we’re here to help you navigate this journey. First, it’s essential to assess your financial readiness. This means taking a close look at your credit score and debt-to-income ratio, as these factors play a significant role in your purchasing power.

Next, analyzing current housing market trends is crucial. Understanding local market conditions can empower you to make informed decisions. We know how challenging this can be, but identifying key indicators for timing your purchase can make a world of difference.

As you consider your long-term goals and housing needs, remember that you are not alone. Many families face similar challenges, and it’s important to evaluate what truly matters to you. By focusing on your personal objectives, you can align your financial capabilities with the right market opportunities.

Ultimately, this comprehensive approach will guide you toward making decisions that feel right for you and your family. Take that first step with confidence, knowing that we’re here to support you every step of the way.

Introduction

Navigating the intricate journey of home buying can feel overwhelming, especially as market conditions shift and personal circumstances change. We understand how challenging this can be. Identifying the right time to purchase a house requires a thoughtful evaluation of your financial readiness, current market trends, and long-term aspirations.

What if you had a clear roadmap to guide you in determining the best moment to buy? This guide explores essential steps and indicators designed to empower you, ensuring you can seize the right opportunity in a competitive market.

We’re here to support you every step of the way.

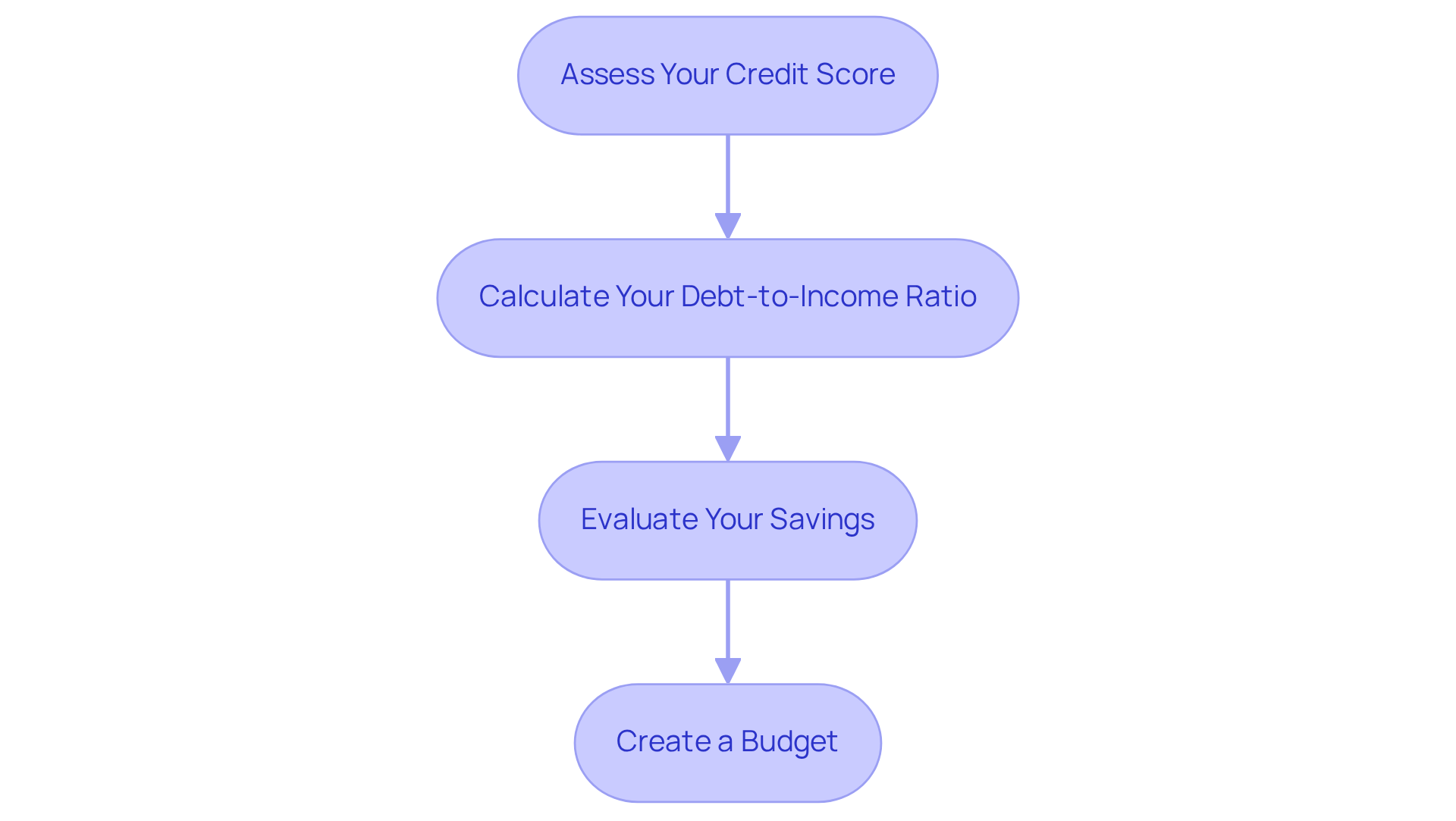

Assess Your Financial Readiness for Homeownership

-

Assess Your Credit Score: We understand how important your credit score is in determining your loan eligibility and the interest rates available to you. Start by examining your score, aiming for at least 620 for conventional loans. Remember, higher scores often lead to better rates. In 2025, the median credit score among new loan borrowers is 758, reflecting the increasing standards in the market.

-

Calculate Your Debt-to-Income Ratio: This ratio is crucial for lenders, as it compares your monthly debt obligations to your gross monthly income. Ideally, you want this ratio to be below 43%, though some lenders may allow up to 49%. To calculate, simply use the formula:

(Total Monthly Debt Payments / Gross Monthly Income) x 100.

By managing this ratio effectively, you can significantly enhance your chances of securing a loan. -

Evaluate Your Savings: It’s essential to ensure you have adequate savings for a down payment, which usually ranges from 3% to 20% of the property’s purchase price. Additionally, be prepared for closing costs, typically between 2% and 5% of the loan amount. In 2025, the median down payment for a house is approximately 18%, with first-time buyers averaging around 9%. We know how overwhelming this can feel, but being prepared can make a big difference.

-

Create a Budget: Take the time to develop a comprehensive budget that outlines your current expenses alongside potential mortgage payments. This exercise will help you understand what you can afford without compromising your financial stability. Financial advisors often emphasize that grasping your budget is vital for successful homeownership, as it equips you to handle both expected and unexpected expenses. We’re here to support you every step of the way.

Analyze Current Housing Market Trends

-

Research Local Market Conditions: We understand how overwhelming it can be to navigate the real estate market. Start by examining average property prices in your desired area. As of July 2025, the typical property value in North Carolina is approximately $331,971, while in New York, it stands at around $484,942. Additionally, homes in Georgia are priced at about $329,919, and in Indiana, the typical home value is around $244,114. Websites like Realtor.com and Zillow can provide valuable insights into current listings and price trends, helping you feel more confident in gauging the market.

-

Monitor Interest Levels: Staying informed about loan interest levels is crucial, as they can vary significantly. As of late May 2025, the average cost for a 30-year fixed loan was just below 7 percent. Experts anticipate that mortgage costs may decrease slightly during 2025, potentially creating favorable opportunities for buyers. A lower interest rate can save you thousands over the life of your loan, making it essential to utilize resources like Bankrate to monitor these changes. Consider partnering with F5 Mortgage for competitive rates and personalized service, ensuring you secure the best possible deal.

-

Evaluate Inventory Levels: We know how important it is to understand market dynamics. Assessing inventory levels can provide valuable insights into your buying power. A higher inventory often signals a buyer’s market, where you may find better deals. Conversely, limited inventory can lead to bidding wars and increased costs. Recent trends indicate that housing inventories improved to a 4.4-month supply at the end of April 2025, suggesting a slight easing in competition, which is beneficial for buyers like you.

-

Consider Seasonal Trends: Understanding seasonal trends can significantly enhance your timing strategy for a successful purchase. Historically, the spring and summer months see an influx of listings, while fall and winter typically present less competition. For instance, winter, especially in November and December, is frequently recognized as the best time to buy a house because of lower prices and decreased buyer activity. Additionally, improving your credit score can enhance your mortgage opportunities. We encourage you to order a copy of your credit report to check for errors or discrepancies, and pay down existing debts to reduce your debt-to-income ratio. We’re here to support you every step of the way.

Identify Key Indicators for Timing Your Purchase

-

Watch Economic Indicators: We know how challenging it can be to navigate the housing market. Paying close attention to employment statistics and regional economic growth is essential. A robust job market typically signals increased housing demand, making it the best time to buy a house and a crucial factor in your buying decision. For instance, the current unemployment rate is at 4.10%, indicating a stable labor market that can sustain property value stability.

-

Monitor Housing Cost Trends: Keeping an eye on housing value fluctuations is vital for your decision-making. Recent data shows that home values in the U.S. rose by 3.9% in February, suggesting a trend of gradual appreciation. If you notice a decline in prices, it may indicate that this is the best time to buy a house and negotiate a favorable deal.

-

Assess Loan Interest Trends: With loan interest easing from 7.04% in January to 6.76% by the end of February, it’s important to consider acting swiftly if interest rates are expected to rise again. Securing a lower rate with F5 Mortgage can represent the best time to buy a house, as they offer competitive rates and personalized service tailored to your needs.

-

Consider Local Development Plans: Investigating upcoming infrastructure projects or community developments in your target area can greatly benefit your investment. Such initiatives often enhance property values over time, indicating that it could be the best time to buy a house. For example, new transportation links or commercial developments can make neighborhoods more desirable, leading to increased home prices. Researching these developments can provide valuable insights into future market trends. Additionally, improving your credit score can enhance your mortgage opportunities. It’s beneficial to order a copy of your credit report and address any discrepancies before applying for a mortgage. Remember to compare rates, costs, and terms from various lenders, including F5 Mortgage, to ensure you find the best fit for your needs.

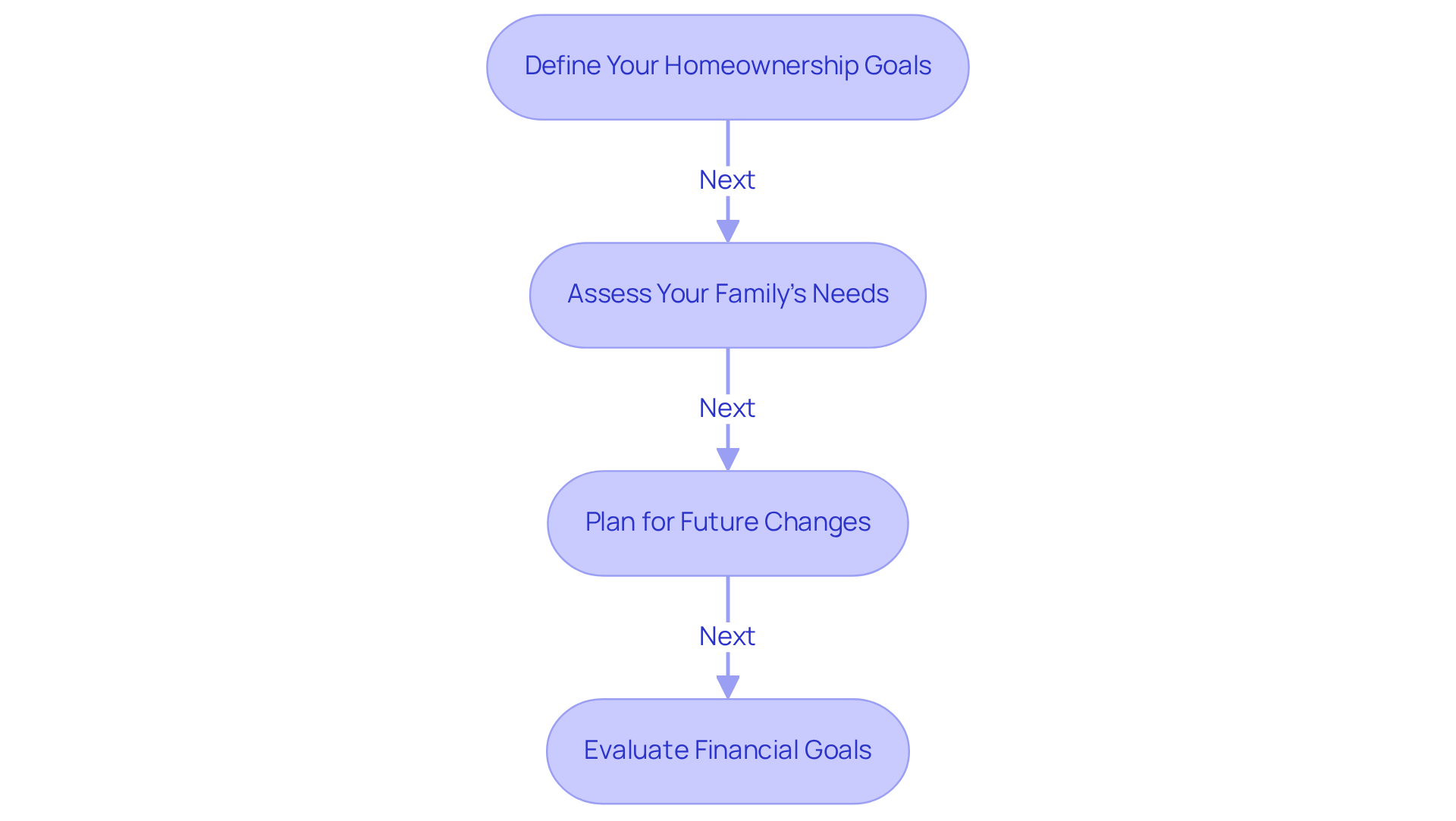

Evaluate Your Long-Term Goals and Housing Needs

- Define Your Homeownership Goals: Start by clarifying your homeownership objectives. Are you seeking a starter home, a permanent residence, or perhaps an investment property? Understanding your long-term vision is essential, as it will guide your decisions moving forward. Additionally, consider negotiating with sellers for repairs or upgrades as part of your purchase strategy. This can significantly enhance the value and comfort of your new home.

- Assess Your Family’s Needs: Take a moment to evaluate your current and anticipated family size. With trends indicating a shift towards smaller households, ensure that your chosen residence has adequate space and amenities to support your lifestyle. Reflect on factors such as the number of bedrooms, bathrooms, and communal areas that will comfortably accommodate your family. Notably, the average age of first-time homebuyers has reached 38 in 2024, highlighting changing demographics that may influence your housing needs. Moreover, exploring down payment assistance programs, like those offered through F5 Mortgage, can provide valuable financial support to help you secure a home that meets your family’s requirements. Many clients have shared their positive experiences with F5 Mortgage, emphasizing how easy it was to navigate these programs.

- Plan for Future Changes: Anticipate potential life changes that could impact your housing needs, such as job relocations, the addition of children, or even retirement. It’s crucial to select a type of residence that will remain suitable as your situation evolves. For instance, homes located near quality schools or with convenient access to public transportation may become increasingly appealing as your family grows. Remember, if negotiations with the seller do not meet your expectations, it’s perfectly acceptable to walk away and explore other opportunities.

- Evaluate Financial Goals: Reflect on how homeownership aligns with your broader financial strategy. Are you looking to build equity, generate rental income, or simply secure a stable living environment? With hidden homeownership expenses averaging over $14,000 annually, aligning your purchase with your financial objectives is vital for ensuring long-term satisfaction and stability. Additionally, 62% of homebuyers prioritized finding an affordable home in 2025, underscoring the significance of affordability in today’s market. To enhance your mortgage opportunities, consider improving your credit score by checking for errors, paying down debts, and making timely payments. Many satisfied clients of F5 Mortgage have successfully navigated these financial evaluations, leading to positive outcomes.

Conclusion

Determining the optimal time to buy a house can feel overwhelming, but it’s essential to approach this journey with care and understanding. By assessing your financial readiness, analyzing current housing market trends, identifying key indicators for timing your purchase, and evaluating your long-term goals, you can make informed decisions that truly align with your personal and financial circumstances.

We know how challenging this can be, which is why we outline essential steps such as:

- Checking your credit score

- Calculating your debt-to-income ratio

- Monitoring local market conditions

- Considering seasonal trends

Each of these points plays a critical role in shaping your overall home buying experience, leading to a more strategic approach to purchasing a property. Furthermore, recognizing economic indicators and assessing your future housing needs can significantly enhance your likelihood of making a sound investment.

In summary, the journey to homeownership requires a thoughtful blend of financial preparation and market awareness. By leveraging the insights shared in this guide, you can navigate the complexities of the housing market more effectively. Embracing this proactive approach empowers you to make better decisions and reinforces the importance of long-term planning in achieving your homeownership goals. Taking the time to evaluate your personal circumstances and market dynamics today can pave the way for a more secure and fulfilling future in your new home.

Frequently Asked Questions

Why is my credit score important for homeownership?

Your credit score is crucial as it determines your loan eligibility and the interest rates available to you. Aiming for a score of at least 620 is advisable for conventional loans, with higher scores typically leading to better rates.

What is the median credit score for new loan borrowers in 2025?

In 2025, the median credit score among new loan borrowers is 758, indicating increasing standards in the market.

How do I calculate my debt-to-income ratio?

To calculate your debt-to-income ratio, use the formula: (Total Monthly Debt Payments / Gross Monthly Income) x 100. Ideally, you want this ratio to be below 43%, though some lenders may allow up to 49%.

What should my savings look like for homeownership?

You should have adequate savings for a down payment, which typically ranges from 3% to 20% of the property’s purchase price. Additionally, be prepared for closing costs, which usually range from 2% to 5% of the loan amount.

What is the median down payment for a house in 2025?

The median down payment for a house in 2025 is approximately 18%, with first-time buyers averaging around 9%.

Why is creating a budget important for homeownership?

Creating a budget helps you understand your current expenses alongside potential mortgage payments, ensuring you can afford homeownership without compromising your financial stability. It prepares you for both expected and unexpected expenses.