Introduction

Navigating the path to homeownership can feel overwhelming. We know how challenging this can be, especially when it comes to understanding how much house you can truly afford. With rising housing costs and fluctuating incomes, it’s essential to have a clear grasp of your personal finances before making such a significant investment.

This article outlines a structured approach to help you assess your financial situation. We’ll guide you through:

- Calculating your monthly income and expenses

- Evaluating your debt-to-income ratios

- Considering additional affordability factors

By taking these steps, you can feel more confident in your decisions.

However, the real question remains: how can potential homebuyers ensure they strike the right balance between their dreams and their financial reality? We’re here to support you every step of the way.

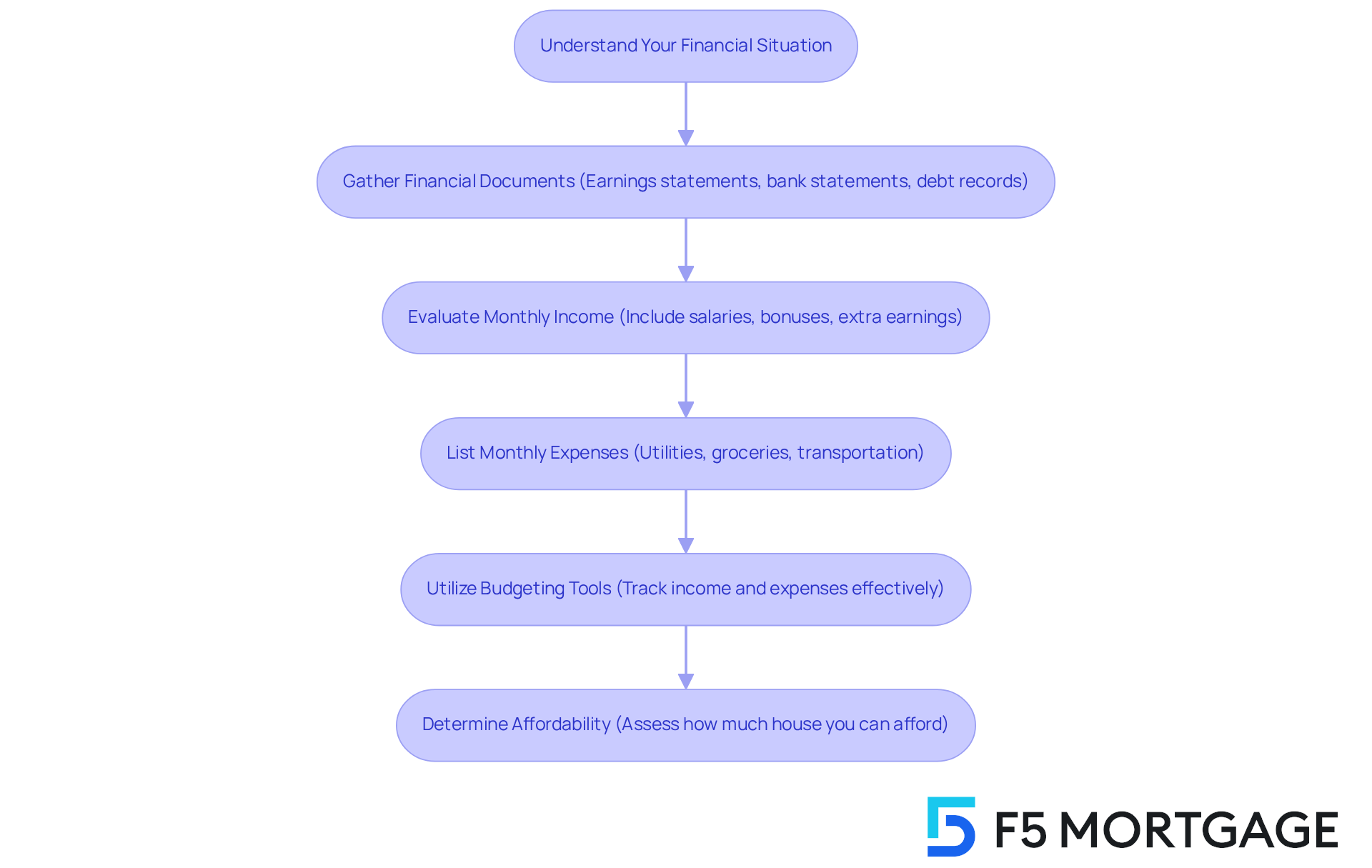

Understand Your Financial Situation

Gathering crucial financial documents is the first step on your journey to homeownership. We know how challenging this can be, but having your earnings statements, bank statements, and records of any existing debts in order will set a solid foundation. Take a moment to evaluate your overall income for the month, including salaries, bonuses, and any extra sources of earnings. This will give you a clearer picture of your financial situation.

Next, create a detailed list of your monthly expenses. Think about:

- Utilities

- Groceries

- Transportation costs

This thorough summary will help you understand your financial circumstances and assist in determining how much house can I afford based on income. Remember, every little detail counts!

Utilizing a budgeting tool or spreadsheet can significantly enhance your ability to track income and expenses effectively. This approach not only visualizes your financial landscape but also highlights potential areas for cost-cutting. Imagine being able to save for a down payment or other home-buying expenses! In 2025, the average expenses per month for families in the U.S. reached approximately $6,440, with housing costs alone averaging $2,120. This underscores the importance of careful financial planning.

By prioritizing your financial documents and employing strategic budgeting techniques, you can position yourself for successful homeownership. We’re here to support you every step of the way!

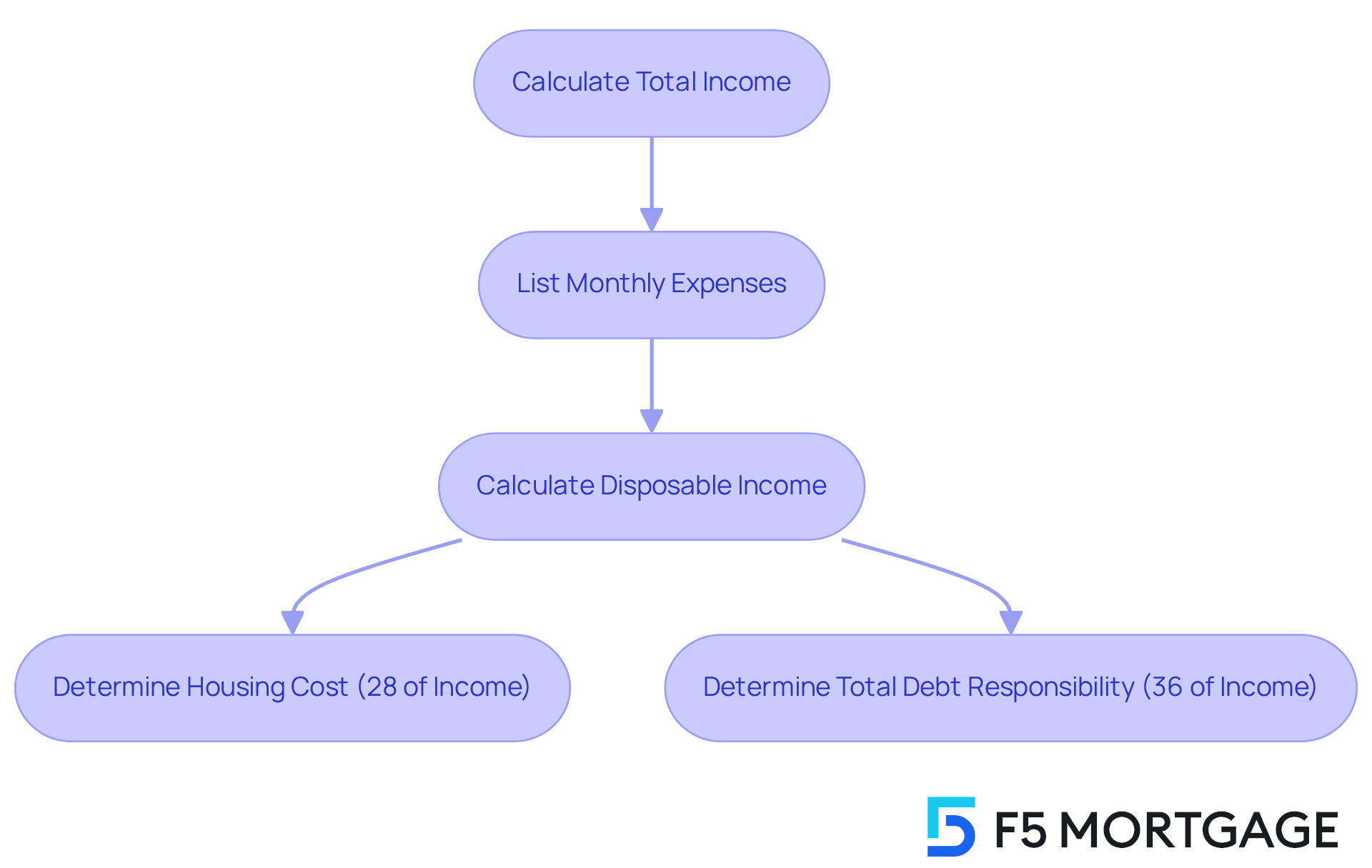

Calculate Your Monthly Income and Expenses

Understanding your monthly earnings is the first step toward financial stability. Start by adding up all your sources of revenue – this includes your salary, bonuses, and any side jobs. For example, if your salary is $5,000 and you earn an extra $500 from freelance work, your total income comes to $5,500.

Next, let’s take a look at your expenses for the month. It’s important to list all your fixed costs, like mortgage payments, utilities, and insurance, alongside your variable expenses, such as groceries and entertainment. If your total monthly expenses amount to $3,000, subtracting this from your earnings leaves you with a disposable amount of $2,500. This is the money you can allocate towards your mortgage payment and other housing costs.

Understanding your disposable earnings is essential for figuring out how much house can I afford based on income. Financial advisors often suggest that to determine how much house can I afford based on income, no more than 28% of your total earnings should be allocated to housing costs. In this case, that means keeping your mortgage cost around $1,400. This approach helps you maintain a balanced budget and avoid financial strain.

Moreover, lenders typically prefer that your total debt payments do not exceed 36% of your gross earnings. In this scenario, that would allow for a maximum total debt responsibility of $1,980. According to recent data, the average disposable income for families in the U.S. in 2025 is projected to be around $3,000. This highlights the importance of budgeting effectively.

As financial advisor Edward Seiler wisely states, “Controlling your regular expenses is essential for homebuyers to make sure they do not become house poor.” We know how challenging this can be, but with careful planning and understanding, you can navigate this process successfully.

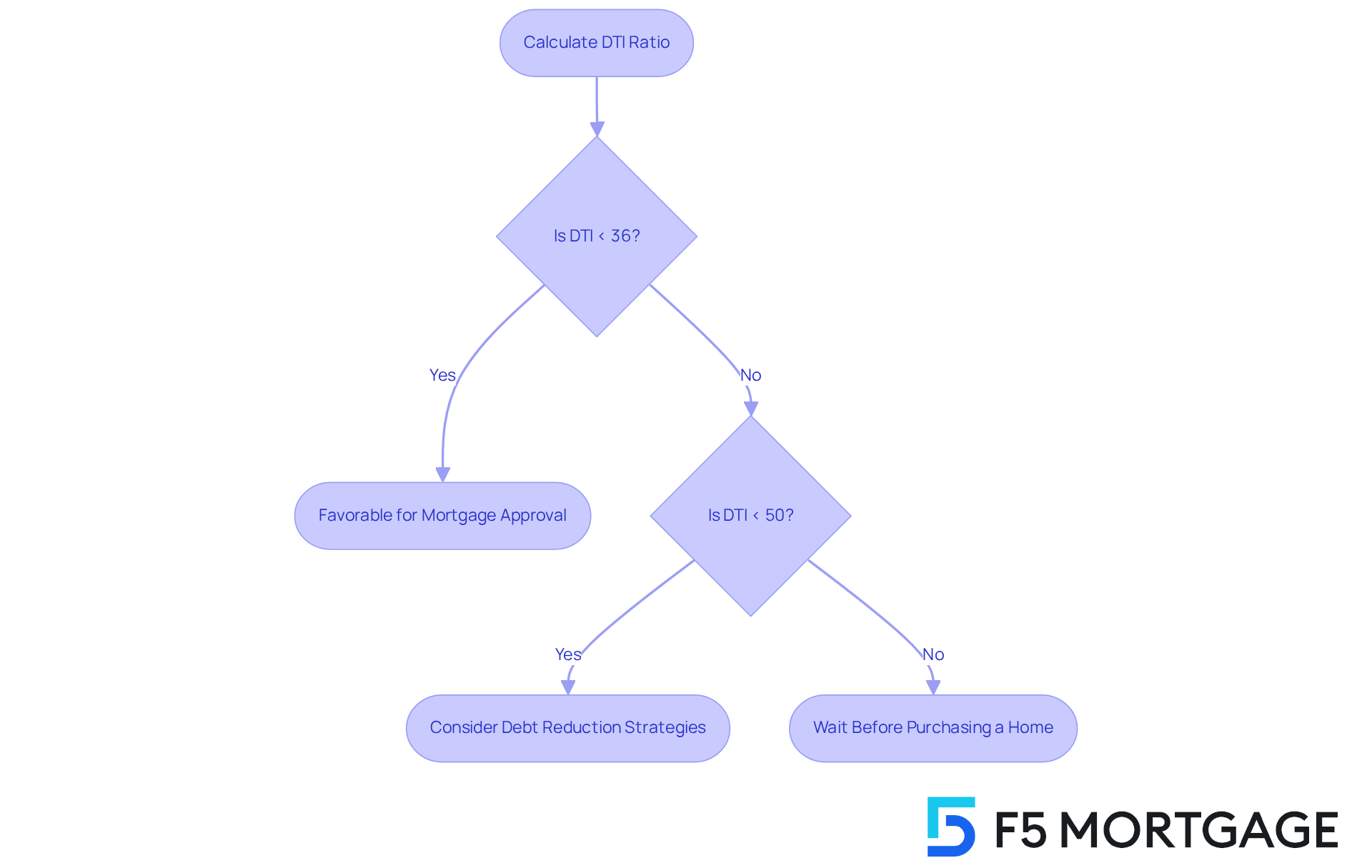

Evaluate Debt-to-Income Ratios

Understanding your debt-to-income (DTI) ratio is crucial for your financial health, particularly when assessing how much house can I afford based on income. We know how challenging this can be, so let’s break it down together. Start by adding up all your recurring debt obligations – think credit cards, student loans, and car loans. For example, if your total monthly debt payments are $1,500 and your gross monthly income is $5,500, you can calculate your DTI ratio like this:

DTI = (Total Monthly Debt / Gross Monthly Income) × 100

DTI = (1500 / 5500) × 100 = 27.27%

A DTI ratio below 36% is generally seen as favorable by lenders, indicating that your debt level is manageable compared to your income. If your DTI is higher than this, it might be wise to consider strategies to reduce your debt before applying for a mortgage. Financial experts often recommend aiming for a front-end DTI ratio under 28% and a back-end DTI under 36% to improve your chances of mortgage approval.

Families facing higher DTI ratios can find success by focusing on effective debt repayment strategies. Prioritizing high-interest debts and exploring refinancing options with F5 Mortgage can make a significant difference. Refinancing may lower your monthly payments and help you manage your DTI more effectively, especially with the competitive rates and customizable loan options available in Colorado.

As we look ahead to 2025, it’s important to note that many lenders will consider DTI ratios in their mortgage approval processes. This highlights the need for maintaining a healthy DTI to determine how much house can I afford based on income if you’re planning to buy a home. Currently, the average DTI for conventional loans is 37%, while FHA loans allow a maximum DTI of 57%. For VA loans, lenders tend to scrutinize applications more closely when DTI exceeds 41%.

If your DTI ratio is exceptionally high – 50% or more – it may be best to wait before purchasing a home until you’ve lowered that ratio. The good news? You can start making progress in just 1 to 2 months by paying down a credit card balance or refinancing a loan. Remember, we’re here to support you every step of the way as you navigate this journey.

Consider Additional Affordability Factors

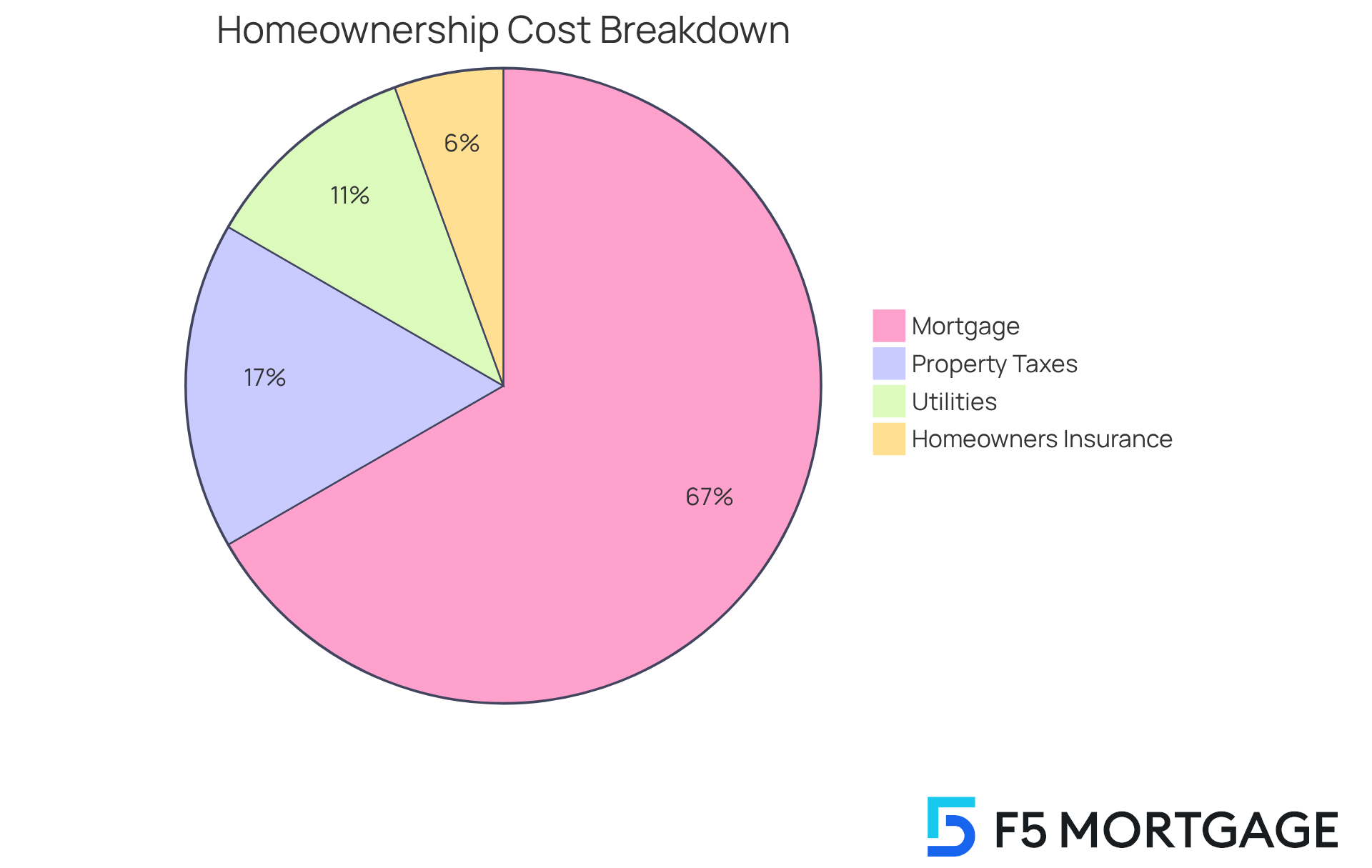

When you’re thinking about your mortgage, it’s essential to consider other costs that come with owning a home. We know how challenging this can be, so let’s break it down together. Here are some key expenses to keep in mind:

- Property Taxes: These are usually calculated as a percentage of your home’s assessed value, and they can vary quite a bit depending on where you live.

- Homeowners Insurance: This is crucial for protecting your home and belongings, and lenders often require it.

- Maintenance and Repairs: It’s wise to budget for ongoing maintenance, which can average about 1% of your home’s value each year.

- Utilities: Don’t forget to include costs for electricity, water, gas, and internet.

To get a clearer picture of your overall housing expenses, it’s important to factor in these costs when estimating your mortgage payment. For instance, if your mortgage is $1,200, and you add $300 for property taxes, $100 for insurance, and $200 for utilities, your total monthly housing cost would be $1,800. This comprehensive view will empower you to make informed decisions about how much house can I afford based on income. Remember, we’re here to support you every step of the way!

Conclusion

Understanding how much house you can afford based on your income is a journey that requires a thoughtful look at your personal finances and a bit of strategic budgeting. We know how challenging this can be, but by taking the time to assess your financial documents, calculate your monthly income and expenses, and evaluate your debt-to-income ratios, you can set yourself up for success in home buying. This structured approach not only clarifies your financial standing but also empowers you to make informed decisions.

Key insights emphasize the importance of:

- Gathering your financial information

- Maintaining a balanced budget

- Understanding what your debt-to-income ratio means for you

By keeping your housing costs within a manageable percentage of your income and considering additional expenses like property taxes and maintenance, you can avoid the pitfalls of becoming “house poor.” This guidance ensures that you are well-equipped to navigate the complexities of homeownership.

Ultimately, your journey to homeownership begins with a solid financial foundation. By taking the necessary steps to evaluate your personal finances and plan effectively, you can confidently embark on this significant investment. Remember, we’re here to support you every step of the way, ensuring that the dream of owning a home becomes a sustainable reality rather than a financial burden.

Frequently Asked Questions

What is the first step in preparing for homeownership?

The first step is gathering crucial financial documents such as earnings statements, bank statements, and records of existing debts.

Why is it important to evaluate overall income?

Evaluating overall income, including salaries, bonuses, and extra earnings, provides a clearer picture of your financial situation, which is essential for determining how much house you can afford.

What should be included in a list of monthly expenses?

A list of monthly expenses should include utilities, groceries, and transportation costs, among other expenses.

How can a budgeting tool or spreadsheet help in financial planning?

A budgeting tool or spreadsheet can help track income and expenses effectively, visualize your financial landscape, and highlight potential areas for cost-cutting.

What was the average monthly expense for families in the U.S. in 2025?

In 2025, the average monthly expenses for families in the U.S. reached approximately $6,440, with housing costs averaging $2,120.

How can careful financial planning aid in homeownership?

Careful financial planning, including prioritizing financial documents and employing budgeting techniques, can position you for successful homeownership by helping you save for a down payment and other expenses.