Overview

We understand how challenging it can be to navigate the world of home equity loans. To compare home equity loan rates effectively, homeowners should follow a structured process. This journey begins with:

- Gathering your financial information

- Researching potential lenders

- Requesting quotes

It’s essential to evaluate these offers based on interest rates and fees, ensuring you make informed decisions.

Understanding key factors, such as your credit score, loan-to-value ratio, and current market conditions, is crucial. These elements play a significant role in your comparisons and can greatly influence your financial outcomes. By taking the time to educate yourself, you empower yourself to make better financial decisions when leveraging your home equity.

Remember, we’re here to support you every step of the way. Taking these steps can lead to a more confident and informed approach to your home equity loan journey.

Introduction

Homeowners often find themselves sitting on a goldmine of equity—a financial resource that can be leveraged for various needs, from home improvements to education expenses. With the current average home equity loan rates hovering around 8.45%, these loans present a more affordable alternative compared to personal loans and credit cards.

However, we know how challenging it can be to compare rates from multiple lenders to ensure the best deal. What key factors should homeowners consider in this process? How can they navigate the complexities of loan terms to maximize their financial benefits? We’re here to support you every step of the way.

Understand Home Equity Loans and Their Purpose

Property loans offer a valuable opportunity for homeowners to tap into the equity they’ve built in their properties. This can be a significant financial resource for important expenses like renovations, debt consolidation, and education costs. The amount you can borrow largely depends on your property’s value, which is determined by the difference between its current market worth and the remaining mortgage balance.

In 2025, the average residential property value is around $320,000, providing homeowners with considerable borrowing potential. With currently averaging 8.45%, these loans are a more budget-friendly option compared to personal loans, which are about five percentage points higher, and credit cards, which can have rates nearing 23%. This means that property value loans are almost three times less expensive than credit card debt, presenting a smart way to manage high-interest obligations.

Real-life stories highlight how residential financing can be effectively utilized. Many homeowners have successfully used these funds to cover educational expenses, allowing them to invest in their children’s futures while managing their financial responsibilities. Financial advisors often recommend property-backed financing due to their fixed rates, which provide stability against potential future interest rate increases. This makes them a wise choice for those looking to secure funding.

However, it’s crucial to approach borrowing with caution. Overborrowing can lead to being ‘underwater,’ meaning you owe more than your property’s value. Additionally, consider potential tax deductions associated with property financing, which can enhance its financial benefits.

Understanding the purpose of property value financing is essential for assessing whether it aligns with your financial goals. With current favorable rates and the potential for rising property values, now is an opportune moment for homeowners to compare home equity loan rates and consider how these options can improve their financial situation. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

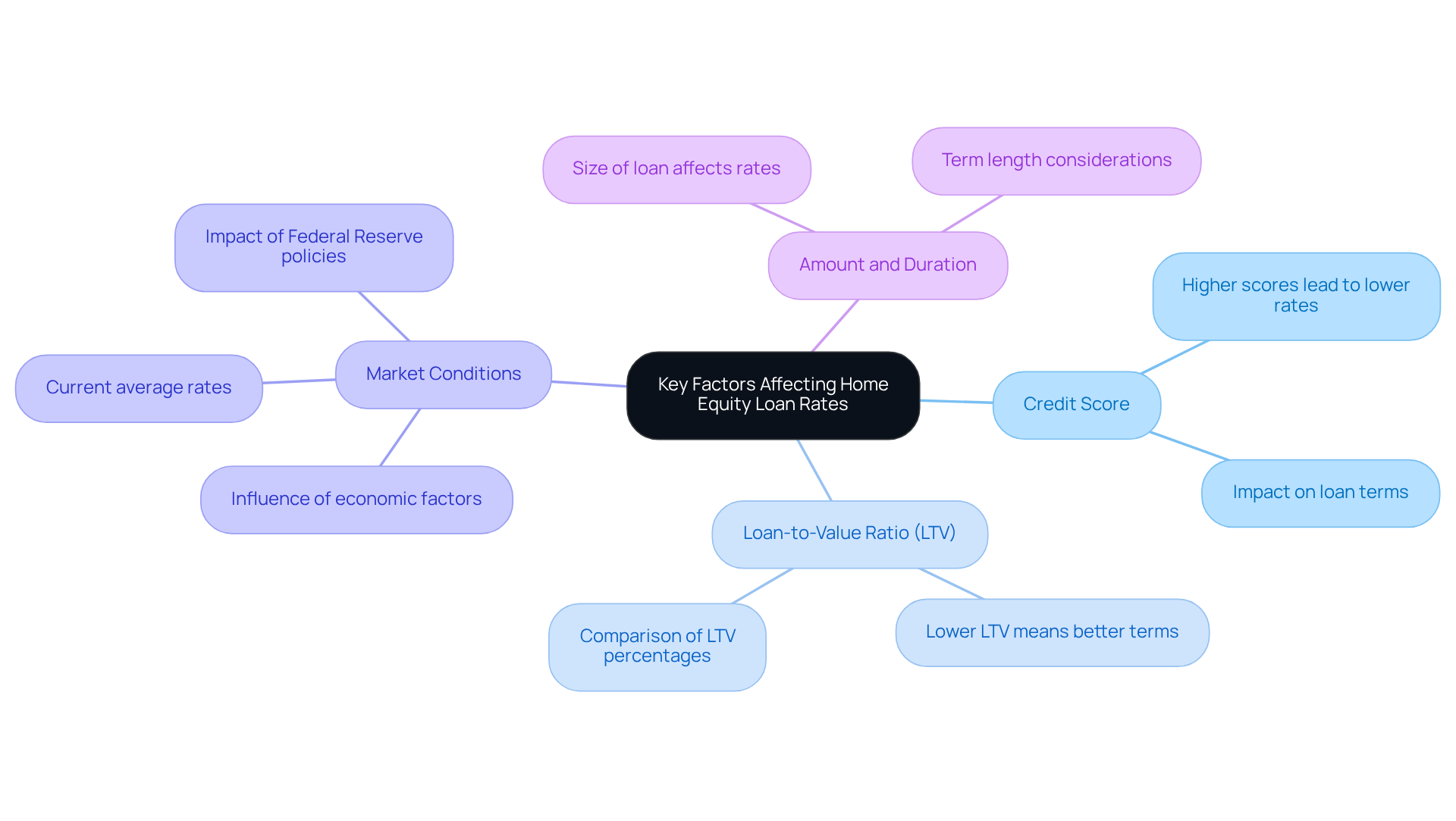

Identify Key Factors Affecting Home Equity Loan Rates

Several key factors influence how to compare home equity loan rates, and understanding them can help you make informed decisions. We know how challenging navigating these options can be, so let’s break it down.

- Credit Score: A higher credit score typically results in lower interest rates. This is because it signals to lenders that you are a less risky borrower. For instance, individuals with outstanding credit may obtain terms that are considerably better than those with average or poor credit. This difference can lead to significant savings over the life of the loan.

- Loan-to-Value Ratio (LTV): The LTV ratio compares your loan amount to the appraised value of your home. Generally, a lower LTV means better terms for you, as it shows that you have more equity in your property. For example, a homeowner with a 70% LTV may enjoy more favorable terms than someone with an 85% LTV, reflecting reduced risk for lenders.

- Market Conditions: Economic factors, including inflation and the Federal Reserve’s interest rate strategies, can greatly influence lending fees. As of early 2025, the average rate for home equity financing is around 8.25%. This rate is influenced more by the trading of mortgage bonds than by the Fed’s monetary policy. Experts anticipate potential reductions in HELOC values, which could further affect home equity financing rates. Most HELOCs have variable interest rates, meaning your monthly payments can fluctuate.

- Amount and Duration: The size of your loan and the length of the term can also impact your rates. For instance, a $50,000 home equity loan might have different terms compared to a $100,000 loan. This reflects how lenders assess risk based on the amount borrowed and the repayment schedule. Debra Shultz, Vice President of Lending, notes that your interest rate might decrease by 0.25% once or twice in 2025, which could influence your choices. Understanding these factors can empower you to position yourself advantageously when you for financing.

Compare Rates from Multiple Lenders: A Step-by-Step Process

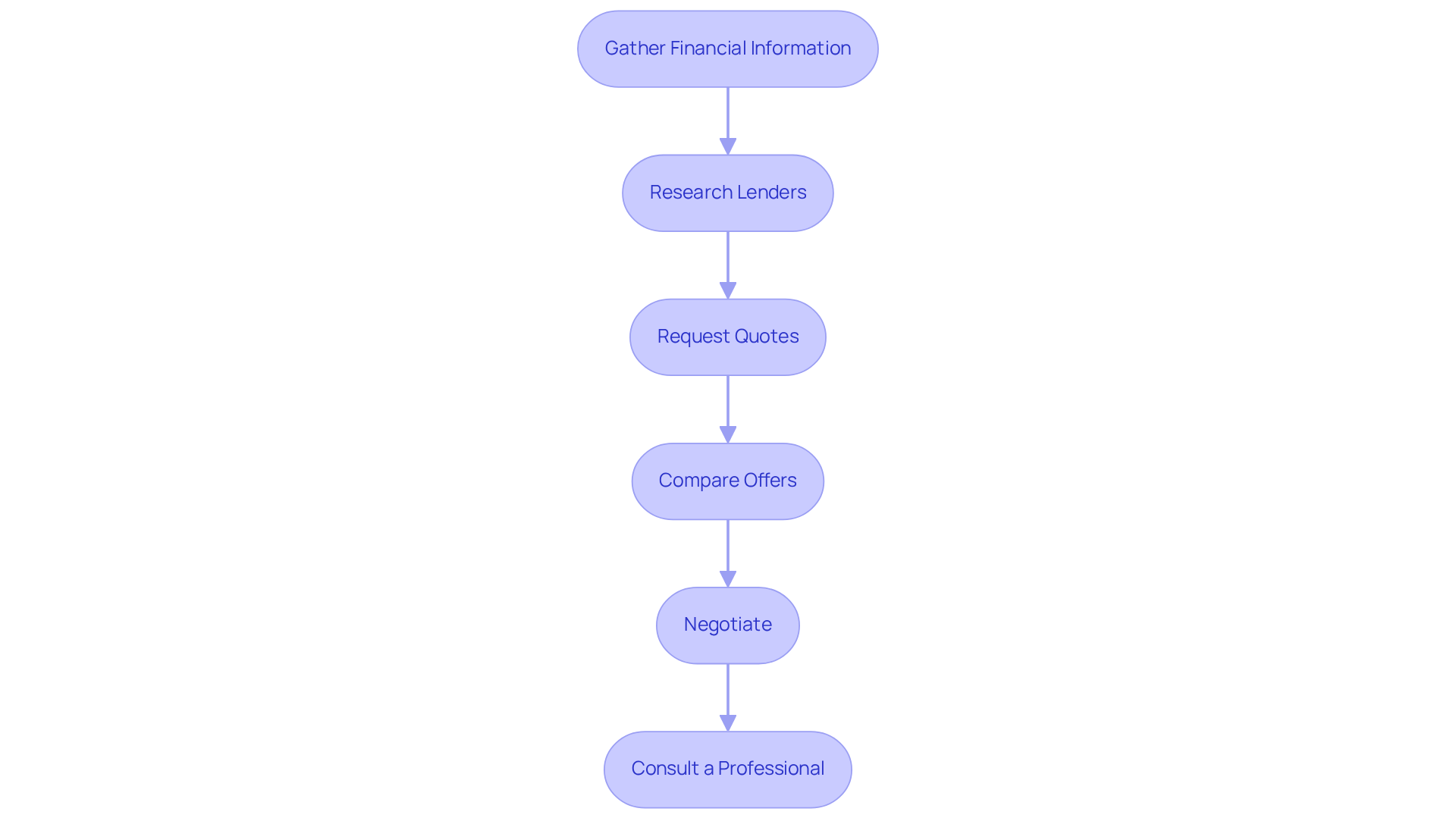

To effectively compare home equity loan rates, we understand how important it is to follow these essential steps:

- Gather Financial Information: Start by collecting your financial details, including your credit score, income, and existing debts. This information is essential for providing a clear overview to lenders and can greatly affect the terms you are presented with.

- Research Lenders: Identifying trustworthy financiers that offer property-backed financing is crucial. Use online resources and comparison tools to discover up-to-date prices and feedback. As of the second quarter of 2025, average home equity borrowing costs vary from 8.28% to 9.04%, which can help you compare home equity loan rates.

- Request Quotes: Reach out to multiple lenders to request quotes. Ensure you provide the same financial information to each lender. This consistency is vital for making accurate comparisons.

- Compare Offers: Examine the quotes based on interest percentages, fees, and terms. Pay special attention to the Annual Percentage Rate (APR), which includes both the interest charge and any related fees. Understanding the overall expense of borrowing, especially when you beyond merely the interest figures, is crucial for making informed choices.

- Negotiate: Don’t hesitate to negotiate with lenders. If you receive a more favorable offer from one lender, share it with others to see if they can match or improve upon it. This proactive approach can lead to better terms and savings. As Matt Richardson, Senior Managing Editor for CBSNews.com, observes, ‘Interest levels on HELOCs and residential financing options are currently low and may drop further soon, providing property owners in need of additional funding something to consider.’

- Consult a Professional: Consider consulting a trusted mortgage professional to discuss your options and clarify any fees. This step can assist you in balancing short-term savings with long-term financial stability, particularly when assessing the risks linked to HELOCs, such as the possibility for fluctuating costs to rise over time.

By adhering to these procedures, you can navigate the property leverage financing terrain more efficiently, ensuring you obtain the most favorable conditions and terms tailored to your financial circumstances. We know how challenging this can be, and we’re here to support you every step of the way.

Evaluate Terms and Conditions of Home Equity Loans

When evaluating home equity loans, we know how crucial it is to consider several key terms and conditions that can impact your financial journey:

- Interest Rate Type: It’s important to assess whether the loan offers a fixed or variable interest rate. Fixed pricing provides predictability and stability in monthly payments, while variable pricing can change according to market conditions, potentially leading to increased expenses over time. Currently, residential asset financing costs are predicted to average approximately 8.10 percent until the conclusion of 2025, while HELOC charges are anticipated to average 8 percent, which highlights the importance to compare home equity loan rates. Understanding how these figures can influence your overall financial strategy is essential, especially when you compare home equity loan rates. As Greg McBride, Chief Financial Analyst at Bankrate, observes, ‘The Fed may reduce rates three times in 2025, which will allow consumers to compare home equity loan rates that could average 7.90 percent by the year’s conclusion.’

- Fees and Closing Costs: Be mindful of various fees associated with home equity financing, which can significantly affect the total cost. Typical closing expenses range from 1-5% of the mortgage amount and may include origination charges, appraisal costs, and title search fees, which can vary from $100 to $450. Additionally, HELOCs may incur application fees ranging from $15 to $75 and annual fees between $5 and $250. Understanding these costs upfront can help you budget effectively, ensuring you’re prepared for what lies ahead.

- Repayment Terms: Familiarize yourself with the repayment schedule, including the duration of the borrowing and any penalties for early repayment. Knowing the terms can help you avoid unexpected charges and plan your finances accordingly. For instance, early cancellation fees for HELOCs can be 3-5% of the borrowed amount or a flat fee of $200 to $500. This is essential to consider if you anticipate needing to pay off the debt early.

- Credit Features: Assess the characteristics of the credit, such as the flexibility to withdraw funds as needed with a HELOC or possibilities for future refinancing. These features can be vital in meeting your financial needs and adapting to changing circumstances.

By thoroughly assessing these aspects, you can ensure that the home equity loan aligns with your financial goals and provides the best value for your investment. Remember, we’re here to support you every step of the way.

Conclusion

Home equity loans offer a valuable opportunity for homeowners to tap into the equity of their properties for various financial needs. We understand how navigating these loans can feel overwhelming, but by grasping their purpose, benefits, and the factors that influence rates, you can make informed decisions that align with your financial goals.

It’s essential to compare home equity loan rates thoughtfully. Consider key factors such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

By taking a systematic approach—gathering your financial information, researching lenders, requesting quotes, and evaluating terms—you can navigate the lending landscape with confidence. This method not only helps you secure favorable rates but also provides clarity on the total cost of borrowing, including interest rates and associated fees.

Ultimately, being proactive in comparing home equity loan rates enhances your financial stability and empowers you to utilize your property’s value effectively. As the economic landscape changes, staying informed and using the right tools can lead to better financial decisions. Remember, you are not alone in this journey. We encourage you to take charge of your financial future by exploring your options, consulting professionals, and making comparisons that could yield significant savings over time.

Frequently Asked Questions

What is a home equity loan?

A home equity loan allows homeowners to borrow against the equity they have built in their properties, providing a financial resource for expenses such as renovations, debt consolidation, and education costs.

How is the borrowing amount for a home equity loan determined?

The amount you can borrow is determined by the difference between your property’s current market value and the remaining mortgage balance.

What is the average residential property value in 2025?

The average residential property value in 2025 is around $320,000.

How do financing rates for home equity loans compare to personal loans and credit cards?

Financing rates for residential properties average 8.45%, which is lower than personal loans by about five percentage points and significantly lower than credit cards, which can have rates nearing 23%.

What are some common uses for home equity loans?

Home equity loans are commonly used for covering educational expenses, home renovations, and consolidating high-interest debts.

Why do financial advisors recommend property-backed financing?

Financial advisors recommend property-backed financing due to their fixed rates, which provide stability against potential future interest rate increases.

What risks should homeowners be aware of when borrowing against their home equity?

Homeowners should be cautious of overborrowing, which can lead to being ‘underwater’ (owing more than the property’s value).

Are there any tax benefits associated with home equity loans?

Yes, there may be potential tax deductions associated with property financing, which can enhance its financial benefits.

Why is it important to understand the purpose of property value financing?

Understanding the purpose of property value financing is essential for assessing whether it aligns with your financial goals and to make informed borrowing decisions.

What should homeowners consider before taking out a home equity loan?

Homeowners should compare home equity loan rates, consider their financial situation, and evaluate how these options can improve their financial circumstances, especially with current favorable rates and the potential for rising property values.