Overview

Navigating the mortgage process can feel overwhelming, but we’re here to support you every step of the way. This article outlines a three-step process designed to help you lower your mortgage interest rate, focusing on the 3-2-1 buydown strategy. This approach temporarily reduces your payments in the initial years, easing financial burdens during a critical time.

Imagine starting your homeownership journey with significantly lower payments. This strategy allows you to gradually increase your payments over time, giving you the opportunity to adjust to the costs of homeownership without feeling overwhelmed. It’s a thoughtful option that many buyers find beneficial.

We know how challenging this can be, and we want you to feel empowered in your decision-making. By considering the 3-2-1 buydown strategy, you can take a proactive step towards managing your mortgage effectively. Explore this option and see how it can work for you.

Introduction

Navigating the complexities of mortgage financing can be daunting, especially when interest rates seem to climb higher by the day. We know how challenging this can be. However, the 3-2-1 buydown strategy offers a compelling way to temporarily lower those rates and ease the financial strain for new homeowners. By understanding this approach, individuals can significantly reduce their monthly payments during the critical early years of homeownership, allowing for better financial management.

But how does one effectively implement this strategy? What are the hidden costs and benefits that come with it? We’re here to support you every step of the way.

Understand the 3-2-1 Buydown Mortgage Concept

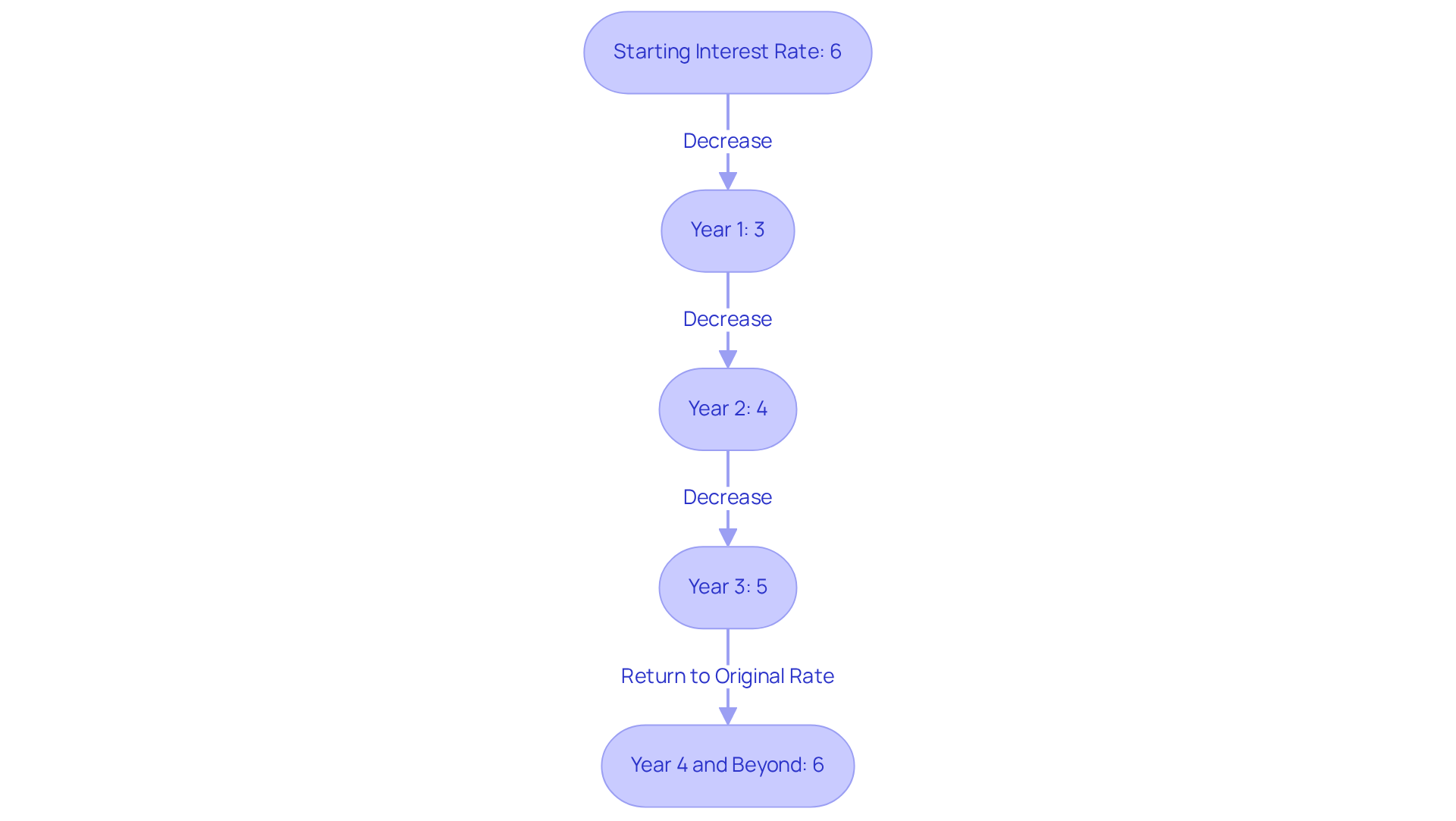

Navigating mortgage financing can feel overwhelming, but a 3-2-1 buydown can help you buy down the interest rate and might be just the solution you need. This tactical choice allows you to buy down interest rate temporarily for the first three years of your loan, easing your financial burden as you settle into your new home. In the first twelve months, your interest rate drops by 3%. In the second year, it decreases by 2%, and in the third year, it’s reduced by 1%. After this initial period, your rate will return to the original fixed rate for the remainder of the loan term.

Imagine starting with a 6% interest rate. With a 3-2-1 buy down interest rate, your payments would start at 3% for the first year, then 4% for the second, and 5% for the third, before reverting to 6%. This structure can be particularly beneficial for first-time homebuyers or those facing high-interest rates. It allows you to allocate those savings toward other essential expenses during those crucial early years of homeownership.

We know how challenging this can be, and is essential for easing your financial strain as you adapt to your new residence. By exploring this option, you can take proactive steps towards a more manageable financial future. Remember, we’re here to support you every step of the way.

Follow the Step-by-Step Process to Buy Down Your Rate

To successfully buy down your mortgage rate, follow these compassionate steps:

Consult with : Begin by discussing your options with a mortgage broker who truly understands your financial situation. They can clarify the advantages and expenses related to a price reduction, including any refinancing charges like closing fees and costs.

Determine the Type of Subsidy: Consider whether you want a temporary reduction (like the 3-2-1) or a permanent reduction. A temporary reduction in interest can be particularly beneficial for those anticipating a rise in income or a shift in financial conditions.

Calculate the Costs: Use a payment reduction calculator to estimate how much you will need to pay upfront to achieve your desired interest rate decrease. Typically, each discount point costs 1% of the loan amount and lowers the interest rate by about 0.25%. Additionally, think about calculating your break-even point to discover how long it will take to recover the expenses through savings in monthly installments, especially if you consider strategies to buy down interest rate. To do this, follow these steps:

- Determine the total costs of the buydown, including any upfront payments and refinancing costs.

- Calculate your monthly savings by comparing your new payment to your current payment.

- Divide your total reduction expenses by your monthly savings to find out how many months it will take to recoup.

Discuss with the Seller or Lender: If you are buying a home, consider negotiating with the seller to buy down interest rate and cover some or all of the cost reductions. This can be an appealing option for sellers eager to close a deal.

Finalize the Agreement: Once you have reached an agreement on the terms, ensure that the discount is documented in your loan agreement. Review all terms carefully before signing, as we know how important this step is.

Track Your Contributions: After closing, keep an eye on to ensure they align with the agreed-upon reduction structure. Adjust your budget accordingly to accommodate the changes in expenses over the years.

Ready to take the next step? Apply for your mortgage with F5 Mortgage today, and let our caring team guide you through the process!

“Awesome work. I enjoyed getting help with my loan through F5 Mortgage. Highly recommend to anyone who is looking for true experts.” – Bryce Leonard, Google Review

![]()

Evaluate the Costs and Benefits of a Buydown

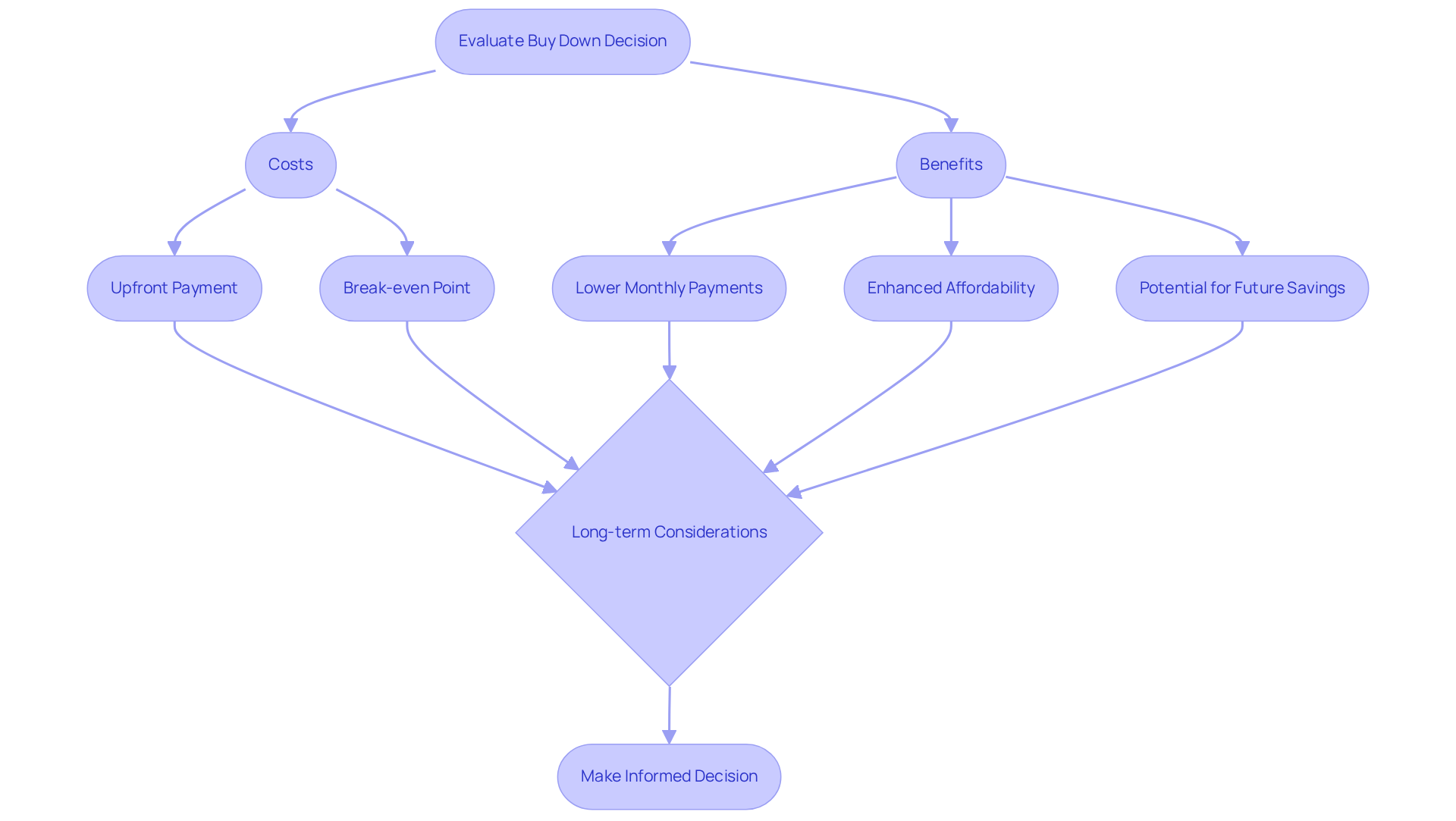

When considering a mortgage, we understand how important it is to evaluate both the costs and benefits of a . This decision can feel overwhelming, but we’re here to support you every step of the way.

Costs:

- Upfront Payment: The primary cost of a buydown is the upfront payment for discount points. This can range from 0.25% to 1% of the loan amount for each 0.25% reduction in the interest rate.

- Break-even Point: It’s essential to determine the duration required to recover the initial expenses through reduced monthly charges. If you plan to stay in your home beyond this break-even point, you may find it beneficial to buy down the interest rate.

Benefits:

- Lower Monthly Payments: The most immediate benefit is reduced monthly payments, which can ease financial strain, especially in the early years of homeownership.

- Enhanced Affordability: A reduced initial cost can facilitate qualifying for a mortgage, enabling you to buy a home that may otherwise be unattainable.

- Potential for Future Savings: If you anticipate an increase in income or financial stability, the temporary relief from higher payments can provide a buffer during the transition.

Long-term Considerations:

Assess your long-term plans. If you anticipate refinancing or selling the home within a few years, a rate reduction may not justify the initial expense. Conversely, if you plan to stay long-term, the savings can accumulate significantly over time.

By carefully weighing these factors, you can make a more informed decision about whether you should buy down interest rate on a mortgage to align with your financial goals. Remember, we’re here to help you navigate this process with confidence.

Conclusion

Navigating the complexities of mortgage financing can feel overwhelming. However, understanding the 3-2-1 buydown concept offers a strategic advantage for homebuyers seeking to temporarily lower their interest rates. This approach not only eases initial financial pressure but also facilitates a smoother transition into homeownership, making it a valuable option for many families.

In this article, we have outlined a step-by-step process for buying down a mortgage rate. It’s crucial to:

- Consult with a knowledgeable mortgage broker

- Evaluate subsidy options

- Calculate costs

- Negotiate with sellers or lenders

By thoughtfully considering these steps, potential homeowners can make informed decisions that truly align with their financial goals.

Ultimately, choosing to buy down a mortgage interest rate can lead to significant long-term savings and enhanced affordability. As the housing market evolves, exploring options like the 3-2-1 buydown could be the key to unlocking a more manageable financial future. We know how challenging this can be, but taking proactive steps today can pave the way for a more secure tomorrow. It’s essential for buyers to consider this strategy when planning their home financing.

Frequently Asked Questions

What is a 3-2-1 buydown mortgage?

A 3-2-1 buydown mortgage is a financing option that temporarily reduces the interest rate for the first three years of the loan, easing the financial burden for homebuyers.

How does the interest rate change over the first three years with a 3-2-1 buydown?

In the first year, the interest rate drops by 3%, in the second year it decreases by 2%, and in the third year it is reduced by 1%. After this period, the rate reverts to the original fixed rate for the remainder of the loan term.

Can you provide an example of how payments would work with a 3-2-1 buydown?

For a loan starting with a 6% interest rate, the payments would be 3% in the first year, 4% in the second year, and 5% in the third year, before reverting to the original 6% rate.

Who might benefit from a 3-2-1 buydown mortgage?

This option can be particularly beneficial for first-time homebuyers or those facing high-interest rates, as it allows them to allocate savings towards other essential expenses during the early years of homeownership.

How can understanding the 3-2-1 mortgage arrangement help homebuyers?

Understanding this arrangement is essential for easing financial strain as buyers adapt to their new residence, allowing for a more manageable financial future.