Introduction

Navigating the competitive real estate market can be overwhelming, especially when it comes to understanding earnest money checks. We know how challenging this can be, but grasping the nuances of these upfront deposits can truly be a game-changer for homebuyers. Typically ranging from 1% to 3% of a home’s purchase price, these checks not only signal a buyer’s commitment but also play a crucial role in negotiations.

However, the stakes are high. Failing to understand the conditions under which earnest money can be forfeited could lead to significant financial loss. Imagine putting down a deposit only to lose it because of a misunderstanding! It’s essential to be informed and prepared.

So, what strategies can buyers employ to protect their investments? By being proactive and informed, you can stand out in a crowded marketplace. We’re here to support you every step of the way, ensuring you feel confident in your decisions.

F5 Mortgage: Your Partner for Competitive Mortgage Solutions

F5 Mortgage LLC stands out as a caring independent mortgage brokerage, dedicated to providing competitive mortgage solutions that truly meet your needs. We understand how overwhelming the mortgage process can be, which is why we prioritize personalized consultations. This way, you can explore a wide range of loan programs, including fixed-rate, FHA, VA, and jumbo loans. Our goal is to simplify your home buying and refinancing journey, empowering you to make informed decisions every step of the way.

In today’s complex mortgage landscape, many borrowers seek personalized financial guidance. F5 Mortgage is here to help. Our tailored consultations address your unique financial situation, enhancing your overall experience. Just ask Ruth Vest, one of our satisfied clients, who praised our exceptional service and attention to detail. Stories like hers highlight how our bespoke approach leads to high satisfaction rates and successful outcomes. Many clients have reported closing their loans in under three weeks, thanks to our dedicated support.

As the mortgage market evolves, F5 Mortgage stays ahead of the curve, continuously refining our services to meet the needs of modern homebuyers. With a customer satisfaction rate of 94% and over 1,000 families helped, we’re committed to supporting you throughout your journey. We know how challenging this can be, and we’re here to guide you. If you’re considering your home financing options, we encourage you to reach out to F5 Mortgage. Let’s explore your possibilities together.

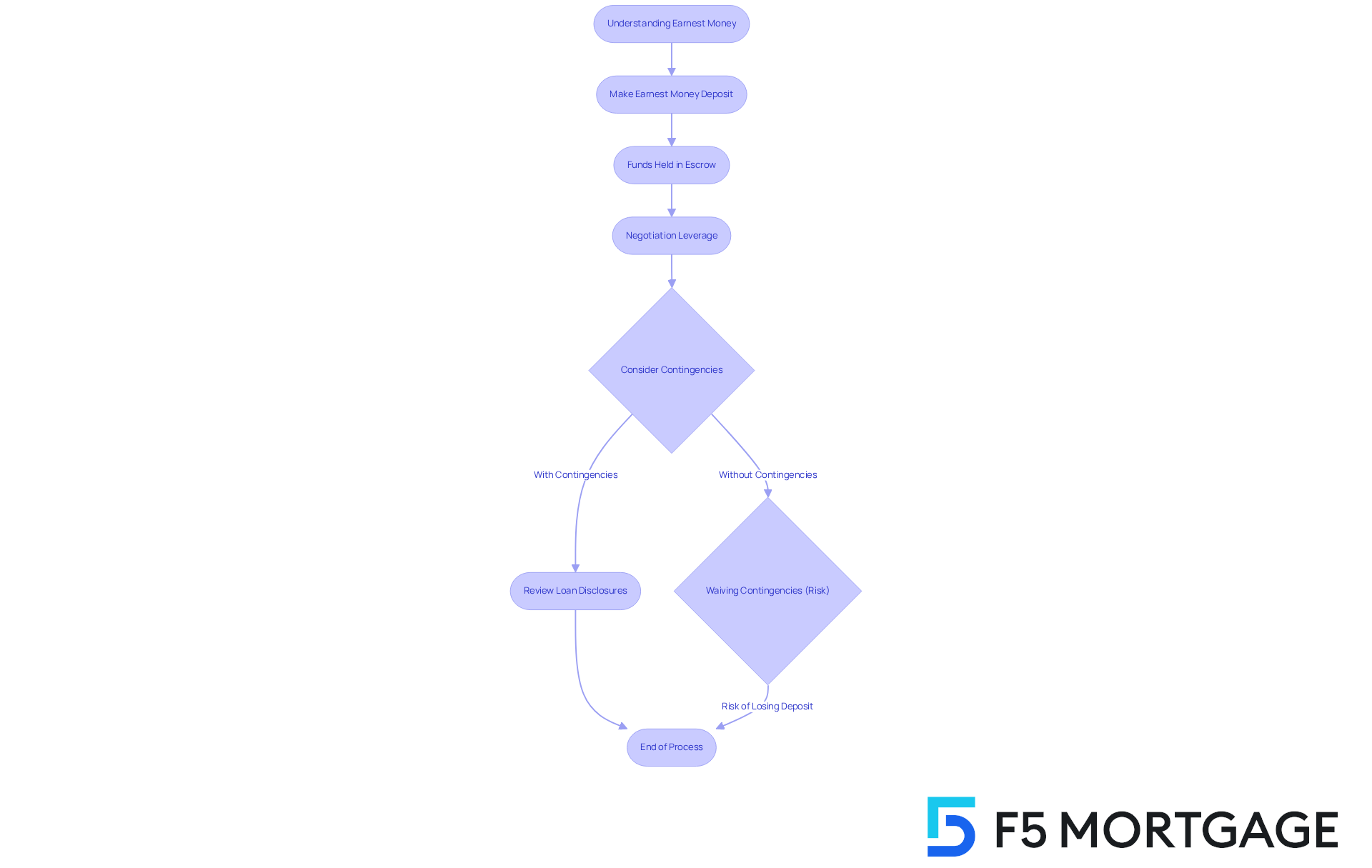

Understanding Earnest Money: Purpose and Importance

When it comes to buying a home, an earnest money check plays a crucial role in demonstrating your genuine intention to make that purchase. Typically, this upfront payment ranges from 1% to 3% of the home’s price. Think of it as a good faith gesture that reassures sellers of your commitment. In competitive markets, offering a larger earnest deposit can make your offer stand out among others, which is so important when you’re trying to secure your dream home.

This earnest money check is held in an escrow account until closing, at which point it’s applied toward your down payment or closing costs. This highlights just how significant it is in the homebuying journey. For instance, if you propose a $25,000 deposit on a million-dollar home, it not only demonstrates your commitment but also gives you leverage in negotiations.

You might also consider asking sellers to make repairs or enhancements as part of your offer. This can really shift the dynamics of negotiations in your favor. Additionally, incorporating contingencies – like financing or inspection contingencies – can protect your earnest money. This means you could receive a full refund if certain conditions aren’t met.

However, waiving contingencies can put you at risk. If you decide to withdraw without a valid reason, you could lose your deposit. It’s essential to understand the role of loan disclosures in this process. Your lender will provide a Loan Estimate that outlines fees and costs, which can change before closing. The Closing Disclosure will give you the final figures, ensuring you’re fully informed about your financial commitments.

Understanding the function and implications of an earnest money check, as well as the importance of using an escrow account to safeguard these funds, is vital as you navigate the complexities of real estate transactions. We know how challenging this can be, but we’re here to support you every step of the way.

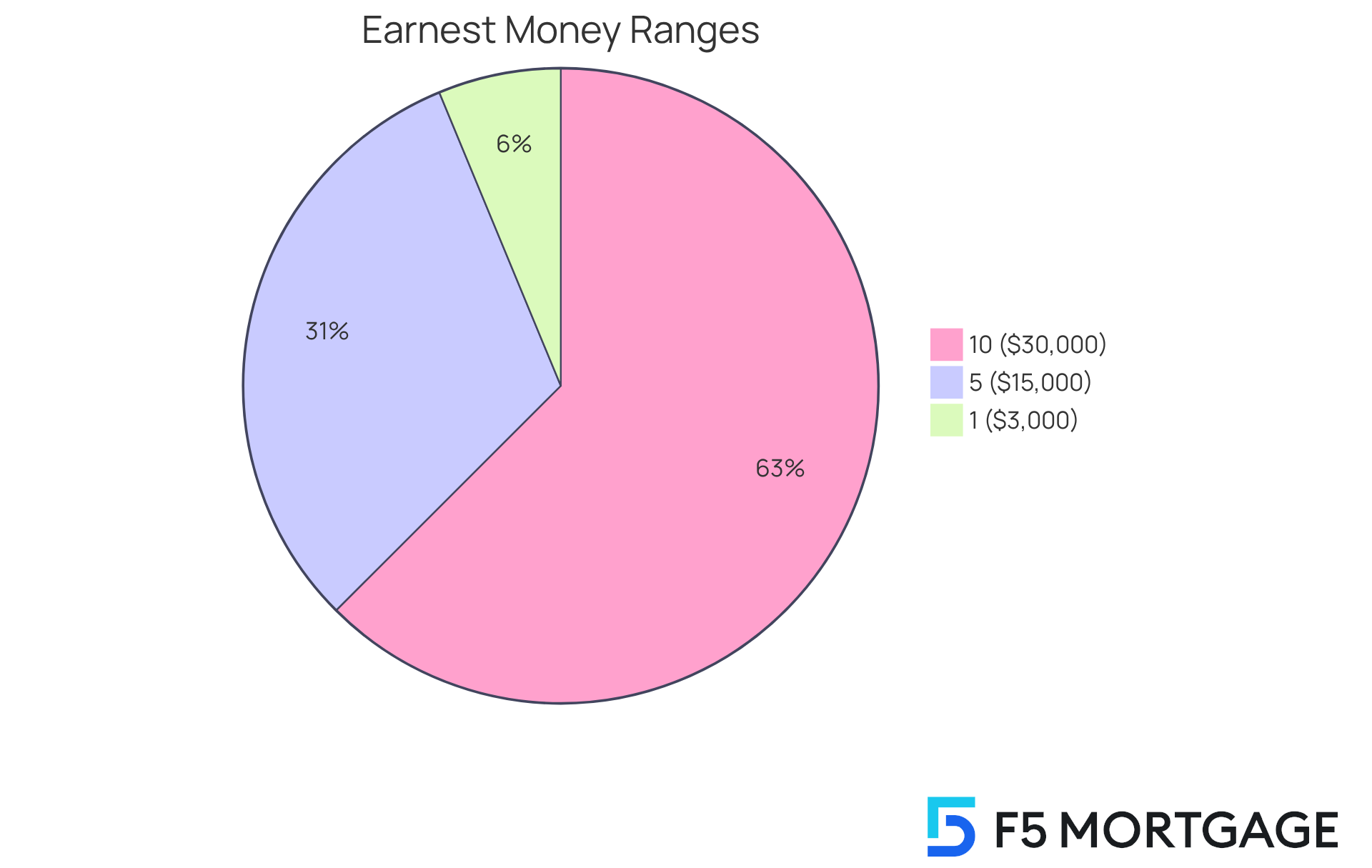

Typical Earnest Money Amounts: What to Expect

In many real estate markets, good faith funds typically range from 1% to 10% of the home’s purchase price. But in competitive situations, buyers often increase their deposits to 5% or more to strengthen their offers. For instance, on a $300,000 home, deposit amounts could vary from $3,000 to $30,000. This range reflects the buyer’s commitment and strategy in a bidding war.

We know how challenging this can be, especially when homes in competitive markets attract multiple offers. Buyers are encouraged to submit larger deposits to stand out. Statistics reveal that in these environments, a bigger initial payment can significantly boost a buyer’s chances of securing their dream home, showcasing their dedication and financial readiness.

However, it’s crucial for buyers to tread carefully when it comes to waiving contingencies. Doing so might mean losing their deposit if they can’t secure financing or if unexpected issues arise. To navigate this complex landscape, we recommend consulting with a REALTOR®. They can help you understand the terms of the earnest money check and the implications of contingencies, ensuring you protect your investment throughout the home-buying journey.

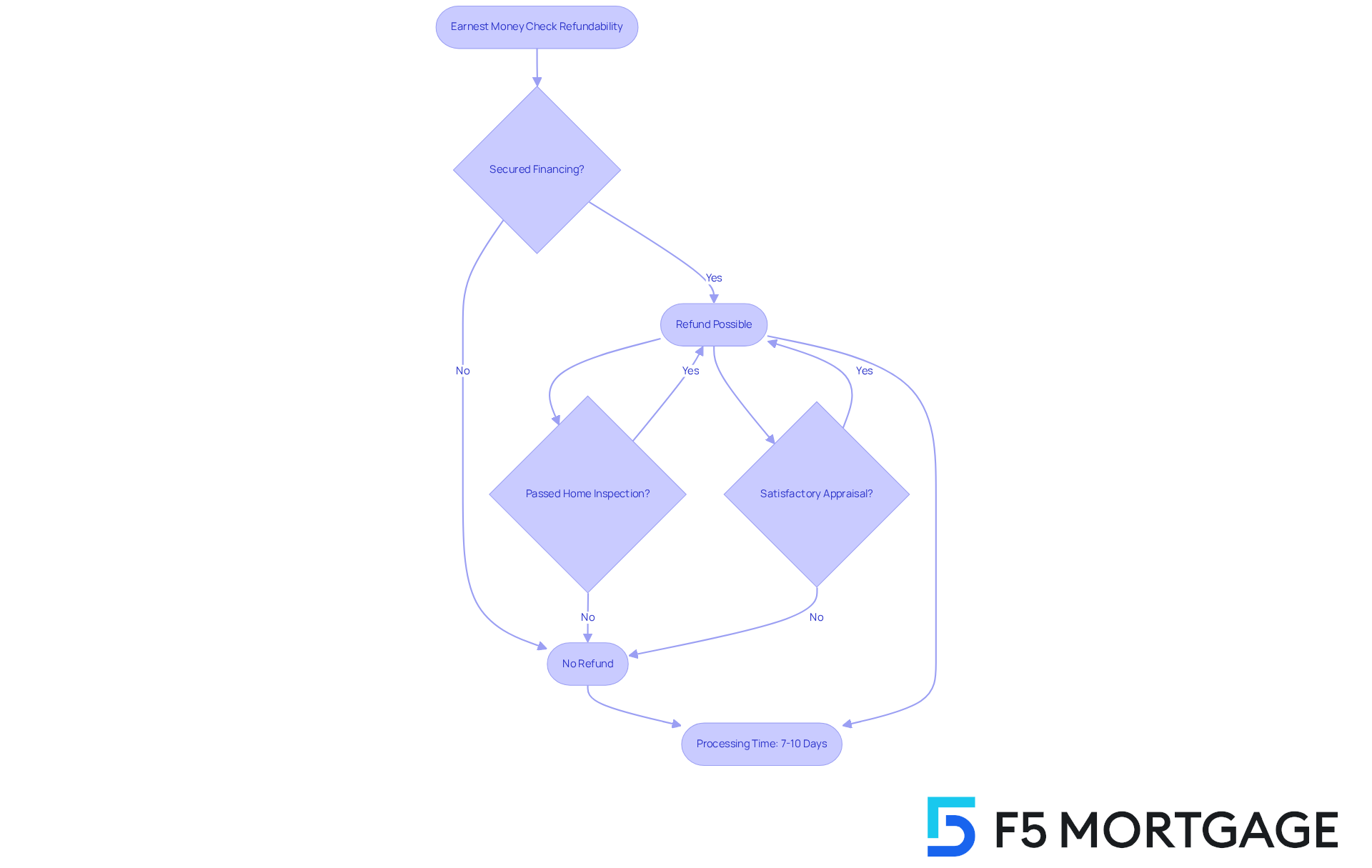

Refundability of Earnest Money: Key Conditions

Understanding the earnest money check can feel overwhelming, but we’re here to support you throughout the process. The earnest money check is usually refundable when certain conditions are met, especially if you need to withdraw due to contingencies outlined in your purchase agreement. Common contingencies that protect you as a purchaser include:

- Securing financing

- Passing home inspections

- Achieving satisfactory appraisal results

For instance, if you can’t secure a mortgage, the financing contingency allows you to withdraw and receive a full refund of your deposit. Similarly, if a home inspection reveals significant issues, you can terminate the agreement and get your payment back. It’s crucial to understand these contingencies because missing deadlines or skipping necessary steps can jeopardize your ability to reclaim your earnest money check.

Typically, good faith deposits range from 1% to 3% of the purchase price. Once both parties sign a release agreement, it usually takes about 7-10 days to process your refund. By ensuring that all contingencies are clearly outlined and followed, you can protect your financial interests throughout the transaction. Always ensure that your contract includes clear contingencies to protect your earnest money check.

Once your application is approved, locking in your mortgage rates with F5 Mortgage is essential. This step helps protect you from market fluctuations during the processing period, giving you peace of mind as you navigate this journey.

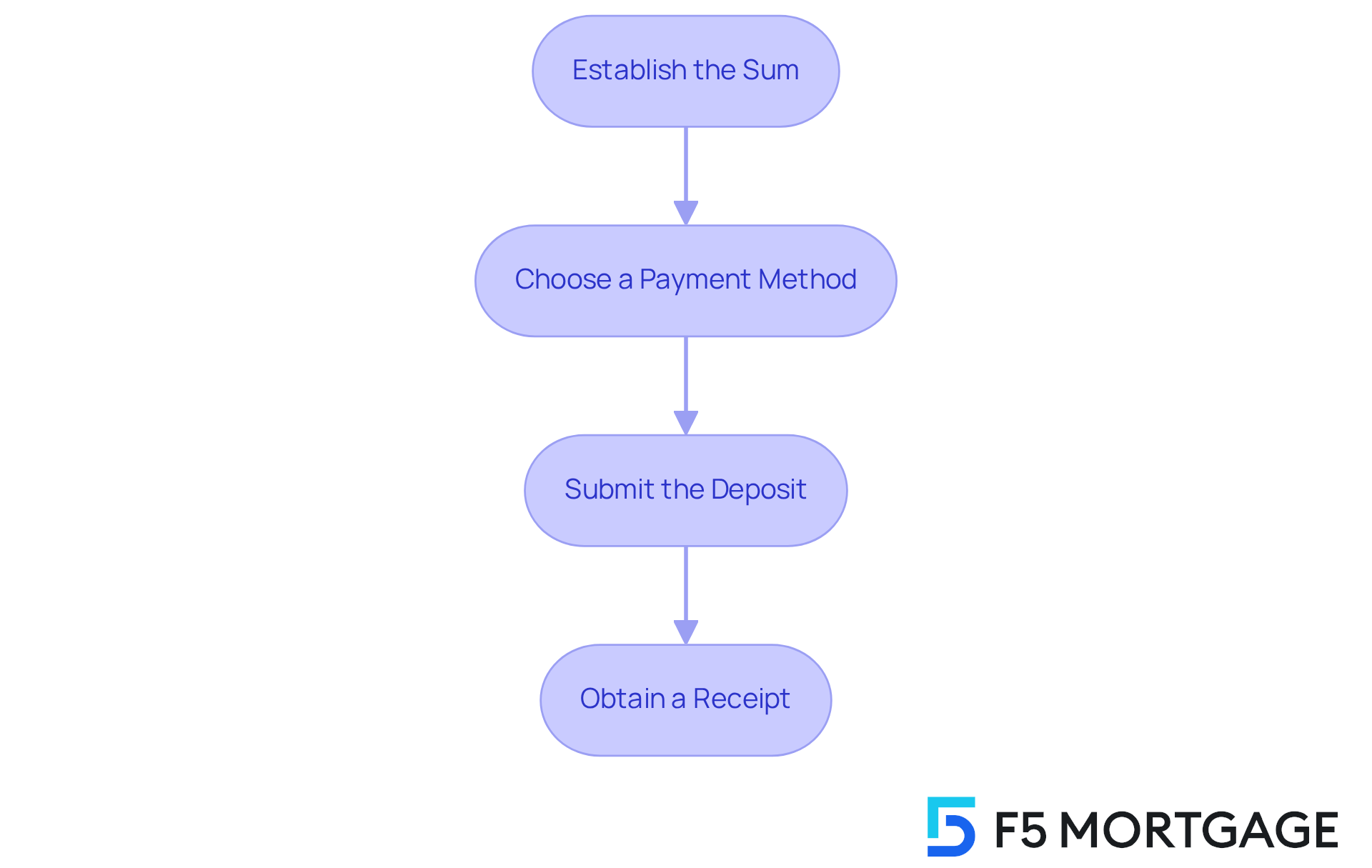

How to Pay Earnest Money: A Step-by-Step Guide

Paying an earnest money check can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps to ensure a smooth transaction:

Establish the Sum: The initial payment typically ranges from 1% to 5% of the home’s purchase price. This amount can vary based on market conditions and how competitive your offer is. For example, if you’re looking at a $300,000 home, your deposit could be anywhere from $3,000 to $15,000.

Choose a Payment Method: When it comes to submitting your deposit, you have a few options. Cashier’s checks and wire transfers are often preferred for their reliability, while personal checks may not be accepted as frequently due to the risk of insufficient funds. Just a heads-up: be cautious of wire transfer fraud. Always verify the instructions in person or over the phone before sending any money.

Submit the Deposit: Make sure to submit your initial payment to the escrow agent or title company within the timeframe specified in your purchase agreement-usually within 1 to 3 business days after signing. This prompt action shows your commitment to the purchase. Remember, while deposit funds aren’t legally required, an earnest money check is a common practice in real estate transactions.

Obtain a Receipt: Always ask for a receipt or written confirmation of your good faith payment. This documentation is essential for your records and serves as proof of your financial commitment.

It’s crucial to understand that whether your deposit is refundable depends on the terms outlined in your purchase agreement and any contingencies included. If you decide to withdraw from the purchase for personal reasons unrelated to these contingencies, you might risk losing your good faith payment. Real estate professionals stress the importance of following these steps. As one expert noted, “Utilizing reliable escrow services and adhering to timelines guarantees the funds stay safe during real estate dealings.”

Additionally, a significant deposit can strengthen your negotiating position, signaling to sellers that you are a serious buyer. By following these guidelines and reviewing contract terms with a real estate agent or attorney, you can navigate the process of handling the earnest money check with confidence and clarity.

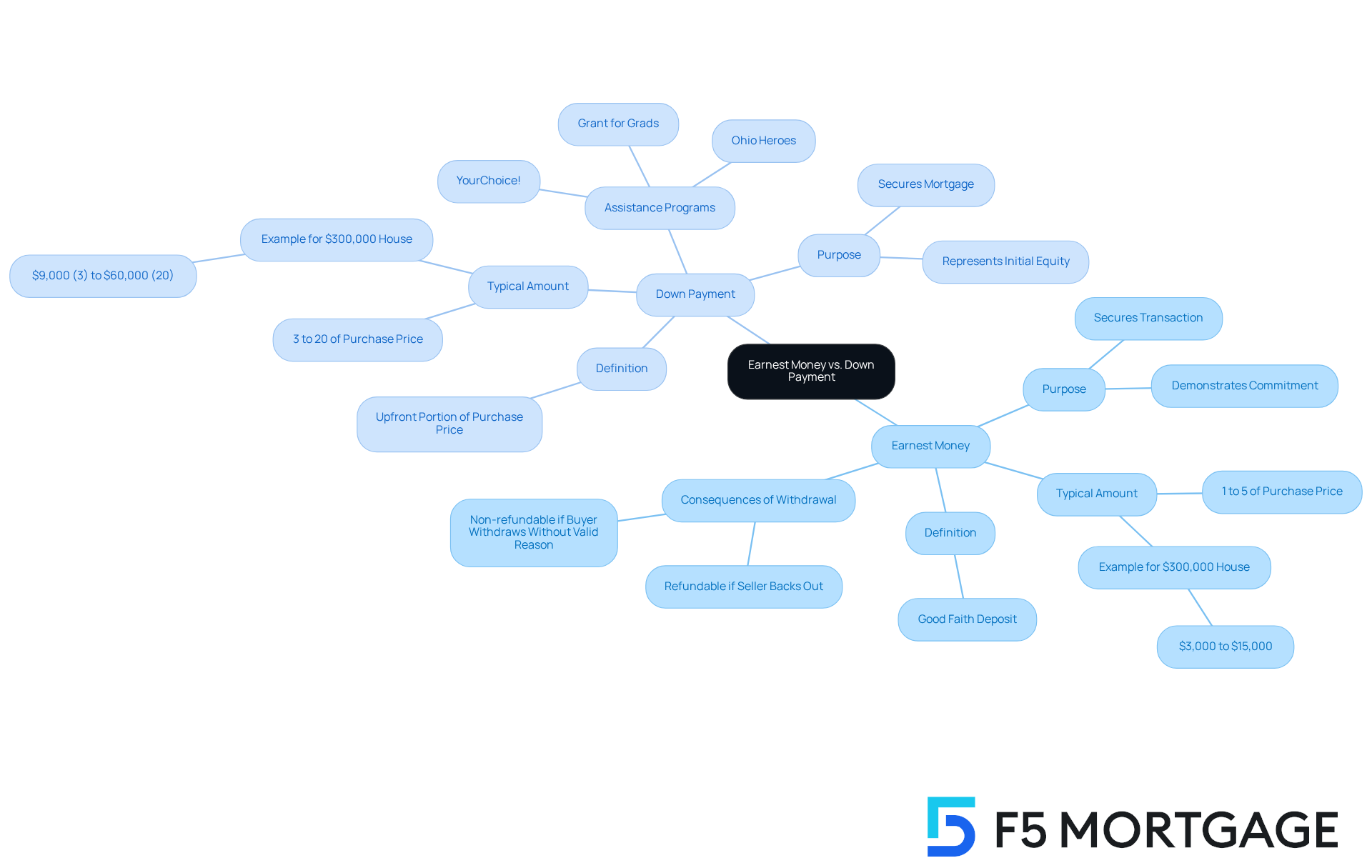

Earnest Money vs. Down Payment: Key Differences

When it comes to buying a home, understanding the earnest money check and down payments is crucial. We know how challenging this can be, and it’s important to recognize that while both are essential, they serve different purposes.

An earnest money check serves as a good faith assurance, demonstrating your commitment to the transaction. Typically, the earnest money check is submitted when you make an offer and ranges from 1% to 5% of the home’s purchase price. For instance, if you’re looking at a $300,000 house, your good faith deposit could be anywhere from $3,000 to $15,000, held in escrow until closing.

On the other hand, the down payment is a larger sum, usually between 3% and 20% of the home’s price, paid at closing to secure your mortgage. For example, a traditional loan on that same $300,000 home would require a minimum down payment of $9,000 (3%). If you’re considering an FHA loan, you might need $10,500 (3.5%), depending on your credit score.

It’s essential to understand that while an earnest money check contributes to your down payment, it is not the same. An earnest money check serves to demonstrate your intention to complete the purchase, providing reassurance to the seller. If the agreement falls through due to the seller’s actions, you typically get your earnest money check back. However, if you decide to back out without a valid reason, you may lose the earnest money check that you submitted as a deposit.

For families in Ohio looking to upgrade their homes, exploring down payment assistance programs like YourChoice!, Grant for Grads, and Ohio Heroes can be a game-changer. These programs can ease the financial burden of your down payment, often covering a portion of the home’s purchase price. By understanding these differences and the available assistance, you can navigate the complexities of the homebuying process with greater confidence. Remember, we’re here to support you every step of the way.

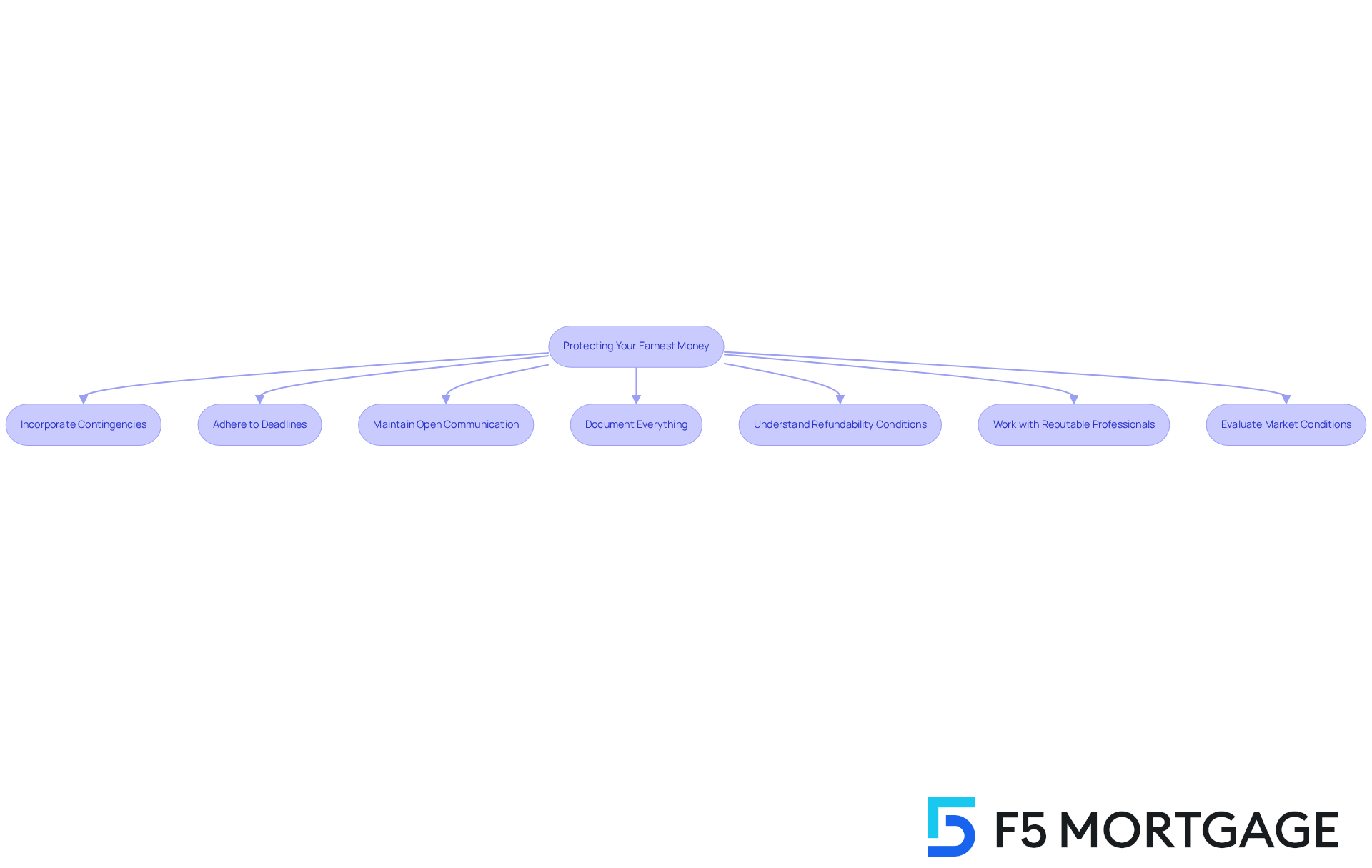

Protecting Your Earnest Money: Essential Strategies

To effectively safeguard your earnest money, consider these compassionate strategies:

Incorporate Contingencies: We know how challenging it can be to navigate the homebuying process. Ensure your offer includes contingencies like financing and home inspection. These provisions allow you to recover your deposit if major issues arise, providing a safety net during the transaction. You can also ask the seller to make repairs as a contingency for your purchase, a common practice in real estate negotiations.

Adhere to Deadlines: Familiarize yourself with the critical deadlines outlined in the purchase agreement. Missing these deadlines can lead to forfeiting your deposit, so staying organized is essential. Remember, we’re here to support you every step of the way.

Maintain Open Communication: Regularly communicate with your real estate agent and lender. Keeping everyone informed helps ensure alignment and can prevent misunderstandings that might jeopardize your earnest money check. If the seller counters your offer or rejects it, your agent can negotiate on your behalf, which is crucial for maintaining clarity and direction in the process.

Document Everything: Keep detailed records of all communications and agreements related to the transaction. This documentation can be invaluable if disputes arise, as it provides a clear account of the terms and conditions agreed upon.

Understand Refundability Conditions: Be aware of the specific terms under which your deposit can be refunded. Common contingencies include financing, home inspections, and appraisal results. Understanding these can assist you in navigating the process more efficiently and steering clear of typical pitfalls that result in losing funds.

Work with Reputable Professionals: Engage experienced real estate professionals, including agents and attorneys, who can guide you through the process and help protect your interests. Their knowledge can be vital in guaranteeing that your deposit is safe.

Evaluate Market Conditions: In competitive markets, providing a larger good faith amount can improve your trustworthiness with sellers. However, ensure that you still have adequate contingencies in place to protect your investment.

By adhering to these tactics, such as comprehending the negotiation process for repairs and keeping clear communication with your lender, you can greatly diminish the chance of losing your deposit and guarantee a more seamless homebuying experience.

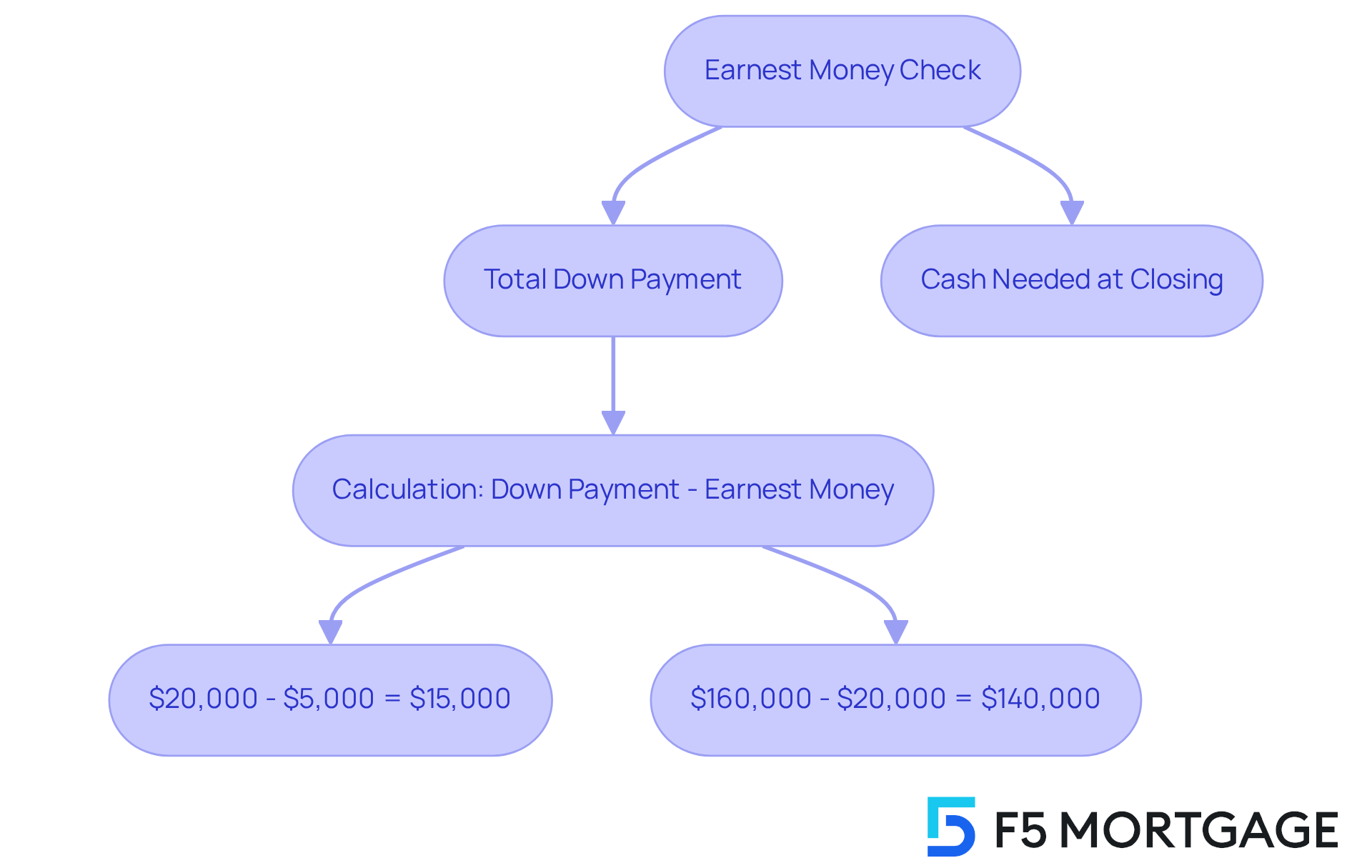

What Happens to Earnest Money at Closing?

When it comes to closing, understanding how an earnest money check can help is crucial. These contributions go directly toward your down payment or closing expenses, which means you’ll need less cash upfront. For instance, if you put down $5,000 as a good faith deposit and your total down payment is $20,000, you’ll only need to bring an additional $15,000 to the closing table. This not only demonstrates your commitment to the purchase but also alleviates some of the financial pressure at closing with an earnest money check.

In competitive markets, where buyers often feel the need to make substantial deposit offers, grasping this process becomes essential. Real estate experts emphasize that an earnest money check serves as a good faith assurance, giving sellers confidence in your commitment while reducing the cash you need at closing. Imagine buying an $800,000 home with a $160,000 down payment and a $20,000 deposit; you would only need to bring $140,000 plus closing costs.

This strategic use of good faith deposits can significantly simplify the closing process and enhance your purchasing power. We know how challenging this can be, but with the right approach, you can navigate these financial waters with greater ease. Remember, we’re here to support you every step of the way.

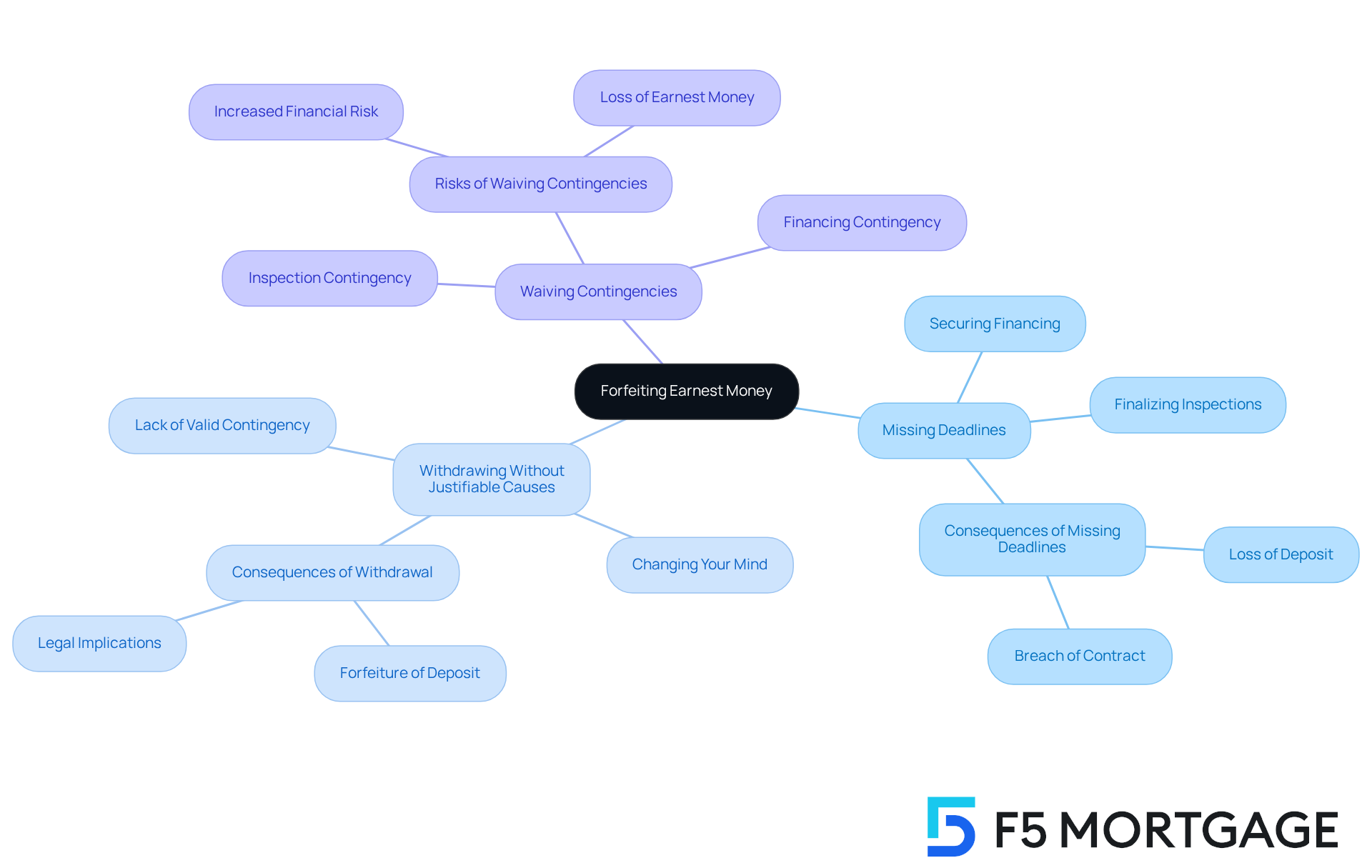

Forfeiting Earnest Money: Common Scenarios to Know

Understanding the potential pitfalls of the earnest money check is essential for buyers navigating the home buying process. We know how challenging this can be, and being aware of these scenarios can help you protect your financial interests.

Missing Deadlines: One common reason buyers may forfeit their deposit is missing deadlines outlined in the purchase agreement. For instance, if you don’t finalize inspections or secure financing within the agreed timeframe, you risk losing your deposit. It’s crucial to stay on top of these timelines to avoid unnecessary losses.

Withdrawing Without Justifiable Causes: Another situation to be mindful of is canceling the agreement without a valid reason or contingency. Simply changing your mind isn’t enough to justify a cancellation, and doing so could lead to forfeiting your deposit. Understanding the terms of your agreement can help you make informed decisions.

Waiving Contingencies: In competitive markets, many buyers choose to waive contingencies to strengthen their offers. While this can make your offer more appealing, it also increases the risk of losing your deposit if issues arise with the property or financing. For example, waiving an inspection contingency means that if significant problems are discovered later, you may not be able to withdraw without facing penalties.

Not following through on financing can result in losing your earnest money check, as specified in your contract. A financing contingency can be a safety net, allowing you to cancel the contract without penalty if you’re unable to obtain a mortgage.

By recognizing these risks and taking proactive steps, such as consulting with real estate experts and ensuring all contingencies are clearly defined, you can safeguard your initial financial commitments. Remember, we’re here to support you every step of the way.

The Bottom Line on Earnest Money: Essential Takeaways

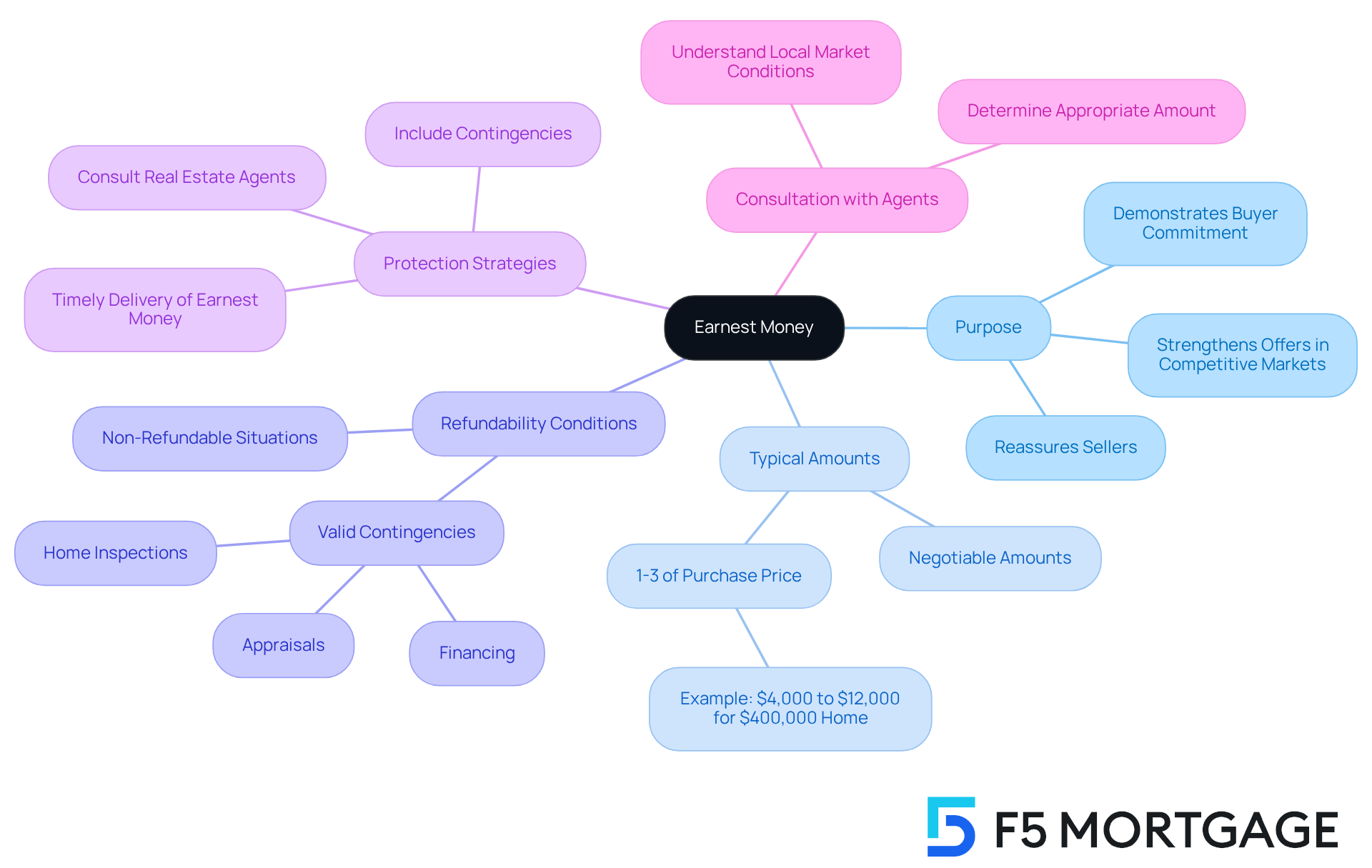

When it comes to buying a home, we know how challenging this can be. One crucial aspect to consider is the earnest money check. This deposit, typically ranging from 1% to 3% of the home’s purchase price, acts as a good faith assurance, showing your commitment to the seller. It not only reassures sellers but also strengthens your offer in competitive markets.

Understanding the usual amounts, refundability conditions, and strategies for protection can empower you to navigate the complexities of real estate transactions with confidence. Remember, the timely delivery of the earnest money check is essential; it must be deposited within two business days after mutual acceptance of the offer to avoid potential disputes.

Incorporating typical contingencies like financing, home inspections, and appraisals in your proposals can safeguard your deposit. This way, you can withdraw without financial loss if needed. By being informed and proactive, you can protect your interests and ensure a smoother path to homeownership.

We’re here to support you every step of the way. Consulting with a real estate agent to determine an appropriate earnest money check amount can further enhance your negotiating position.

Conclusion

Understanding the role of earnest money checks is vital for homebuyers navigating the complexities of real estate transactions. We know how challenging this can be, and these deposits not only signify a buyer’s commitment but also play a crucial role in negotiations, especially in competitive markets. By offering a substantial earnest money check, buyers can enhance their offers and reassure sellers of their intent to complete the purchase.

Key insights discussed include:

- The typical amounts for earnest money, which generally range from 1% to 3% of the home’s price.

- The importance of including contingencies to safeguard these funds.

- Awareness of the conditions under which earnest money is refundable.

- The potential pitfalls that could lead to forfeiting this deposit.

- The necessity of maintaining clear communication with real estate professionals and adhering to deadlines.

Ultimately, being informed and proactive about earnest money can significantly ease the path to homeownership. We’re here to support you every step of the way. It is essential for buyers to consult with knowledgeable agents to determine appropriate deposit amounts and strategies for protection. Empowering yourself with this knowledge not only enhances your negotiation position but also fosters a smoother, more confident homebuying experience.

Frequently Asked Questions

What is F5 Mortgage and what services do they provide?

F5 Mortgage LLC is an independent mortgage brokerage that offers competitive mortgage solutions, including personalized consultations and a variety of loan programs such as fixed-rate, FHA, VA, and jumbo loans.

How does F5 Mortgage ensure a personalized experience for clients?

F5 Mortgage prioritizes personalized consultations to address each client’s unique financial situation, enhancing their overall experience and ensuring they make informed decisions throughout the mortgage process.

What is the customer satisfaction rate of F5 Mortgage?

F5 Mortgage has a customer satisfaction rate of 94% and has helped over 1,000 families with their mortgage needs.

What is earnest money and why is it important in the home buying process?

Earnest money is an upfront payment, typically ranging from 1% to 3% of the home’s price, that demonstrates a buyer’s genuine intention to purchase a home. It reassures sellers of the buyer’s commitment and can strengthen their offer in competitive markets.

How is earnest money handled during the home buying process?

The earnest money check is held in an escrow account until closing, at which point it is applied toward the buyer’s down payment or closing costs.

What are typical amounts for earnest money deposits?

Earnest money deposits typically range from 1% to 10% of the home’s purchase price. In competitive situations, buyers may increase their deposits to 5% or more to strengthen their offers.

What risks are associated with waiving contingencies in an earnest money agreement?

Waiving contingencies can put buyers at risk of losing their deposit if they withdraw from the agreement without a valid reason, especially if they are unable to secure financing or encounter unexpected issues.

How can buyers protect their earnest money during negotiations?

Buyers can protect their earnest money by incorporating contingencies, such as financing or inspection contingencies, which allow for a full refund if certain conditions are not met.

What documents should buyers be aware of regarding their mortgage?

Buyers should be aware of the Loan Estimate, which outlines fees and costs, and the Closing Disclosure, which provides final figures before closing, ensuring they are fully informed about their financial commitments.