Overview

Debt consolidation home equity loans can truly make a difference for families facing financial challenges. We know how overwhelming high-interest debts can feel, but these loans offer numerous benefits, including significantly lower interest rates and simplified monthly payments. This can alleviate the financial stress that many families experience.

By consolidating high-interest debts into a single, lower-interest loan, families can save money and improve their financial stability. Case studies illustrate this impact, showing how families have achieved reduced monthly payments and overall interest expenses.

We’re here to support you every step of the way as you consider this option. Taking action towards financial relief is a journey, and understanding your choices is the first step. Let’s explore how debt consolidation can empower your family’s financial future.

Introduction

Families today often find themselves weighed down by numerous financial obligations, leading to stress and confusion as they manage various payments. We know how challenging this can be. With rising interest rates, debt consolidation home equity loans have emerged as a viable solution, enabling families to streamline their debts into a single, manageable payment.

This article explores the many benefits of these loans, showing how they can lower interest rates and simplify financial management, ultimately paving the way for a more stable economic future. However, with potential risks involved, we must ask: is a debt consolidation home equity loan the right choice for every family?

F5 Mortgage: Tailored Home Equity Loan Solutions for Debt Consolidation

At F5 Mortgage, we understand how challenging it can be for families to manage their financial obligations. That’s why we excel in providing tailored residential financing options designed specifically for those looking to combine their commitments. Our process puts you in control, ensuring that every client receives the red carpet treatment they deserve. By tapping into a vast network of lenders, we guarantee competitive rates and terms that align with your unique financial circumstances.

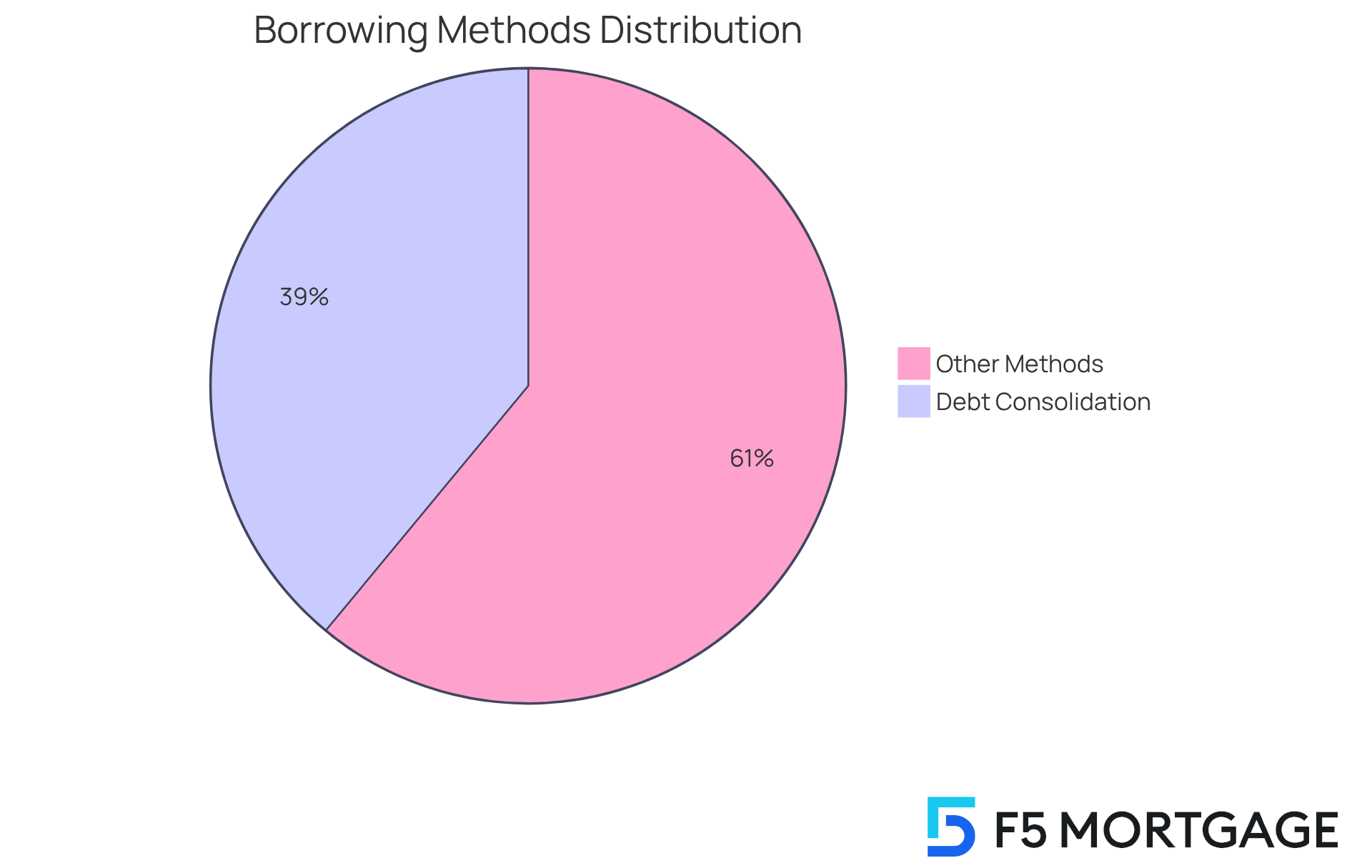

Recent trends show that around 39% of borrowers are utilizing a debt consolidation home equity loan for consolidating their liabilities. This reflects a notable rise in demand as households navigate the complexities of managing various financial responsibilities. Property-backed financing, such as a debt consolidation home equity loan, offers a practical alternative, allowing families to merge elevated-interest commitments into one manageable installment.

Case studies reveal that families who have chosen property-backed loans have successfully lowered their total interest payments, leading to improved financial stability. Financial consultants emphasize the importance of understanding residential value as a valuable asset, which can be effectively utilized for liability management. With the typical mortgage-holding homeowner possessing approximately $302,000 in value, the opportunity to utilize this resource for a is significant.

As we approach 2025, home financing options are increasingly recognized for their advantages to families, with a significant rise in originations. By selecting F5 Mortgage, you can confidently embark on your financial consolidation journey, supported by our expert guidance and commitment to achieving your monetary goals through a stress-free and transparent mortgage process. We’re here to support you every step of the way.

Lower Interest Rates: Save Money on Debt Payments with Home Equity Loans

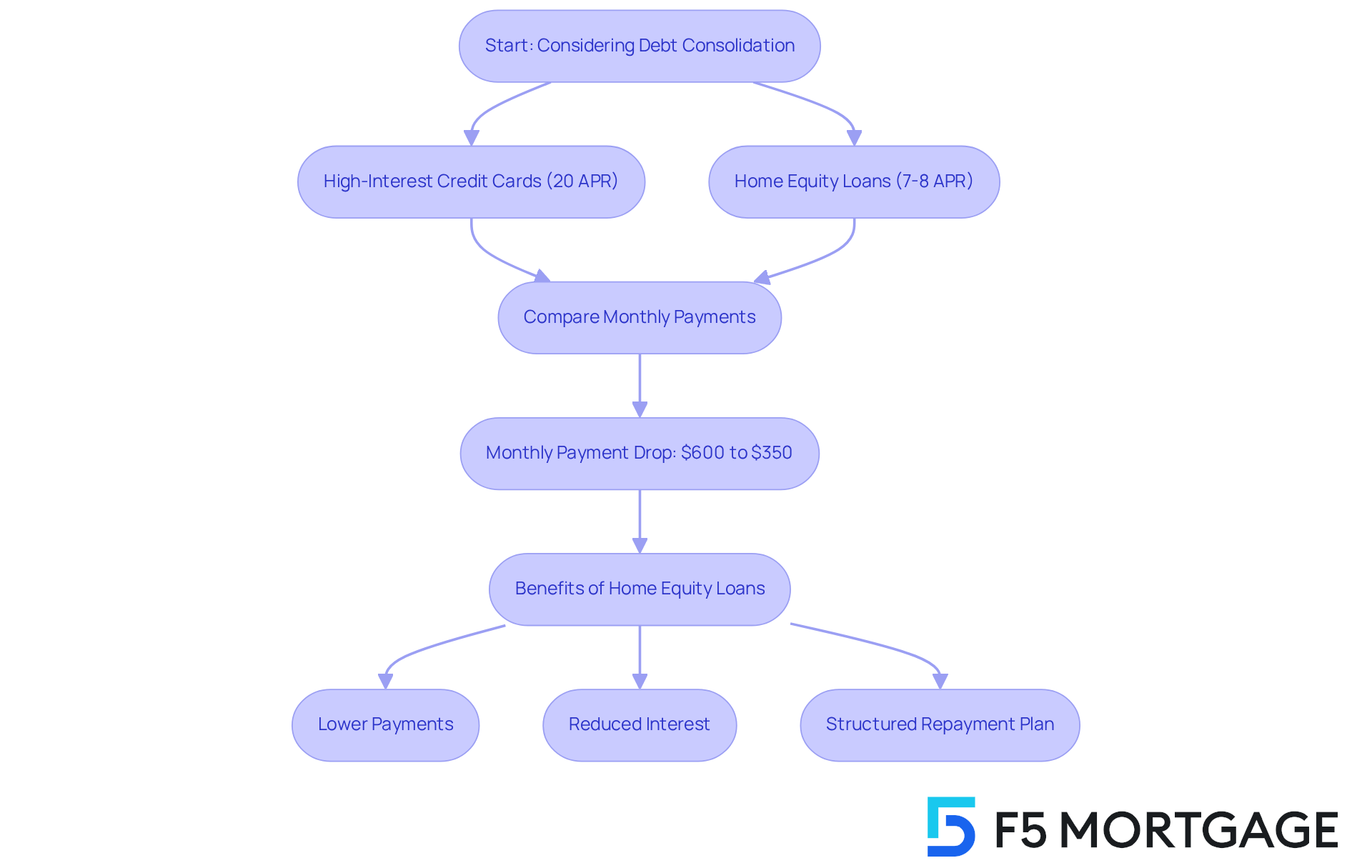

Home value financing through a debt consolidation home equity loan often provides lower interest rates compared to unsecured debts like credit cards, making it a compassionate choice for families looking to consolidate high-interest obligations. By shifting credit card balances, which frequently carry rates near 20%, to a property-backed financing option with an interest rate as low as 7%, families can realize significant savings. For example, a household with $30,000 in credit card balances at 20% APR could see their monthly payments drop from around $600 to about $350 with a property-backed financing option at 7%. This change not only lightens monthly payments but also reduces the total interest paid over the financing period.

Moreover, financial specialists emphasize that a debt consolidation home equity loan can be a wise strategy for consolidating obligations, especially for those burdened by high-interest credit card balances. With currently around 8%, nearly three times lower than typical credit card rates, families can benefit from predictable fixed payments and a structured repayment plan. This approach not only alleviates immediate financial pressure but also helps in managing long-term obligations more effectively.

Additionally, while refinancing a mortgage in Colorado typically involves upfront fees averaging between 2% and 5% of the total amount borrowed, F5 Mortgage provides access to down payment assistance programs that can help reduce some of these costs. This support makes it easier for families to explore refinancing options and compare rates, ensuring they find the most affordable solutions for their financial needs.

In conclusion, a debt consolidation home equity loan allows families to consolidate their obligations through property-backed financing, offering reduced interest rates and paving a clearer path to financial security, enabling them to save money and lessen their overall financial burden.

Streamlined Payments: Simplify Your Finances with One Monthly Payment

Using a debt consolidation home equity loan for financial consolidation can be a significant step for families looking to simplify their financial lives. We know how challenging it can be to juggle multiple payments, and consolidating them into one monthly responsibility not only makes budgeting easier but also that could harm credit scores. By managing just one payment instead of several, families often find a newfound sense of organization in their financial lives.

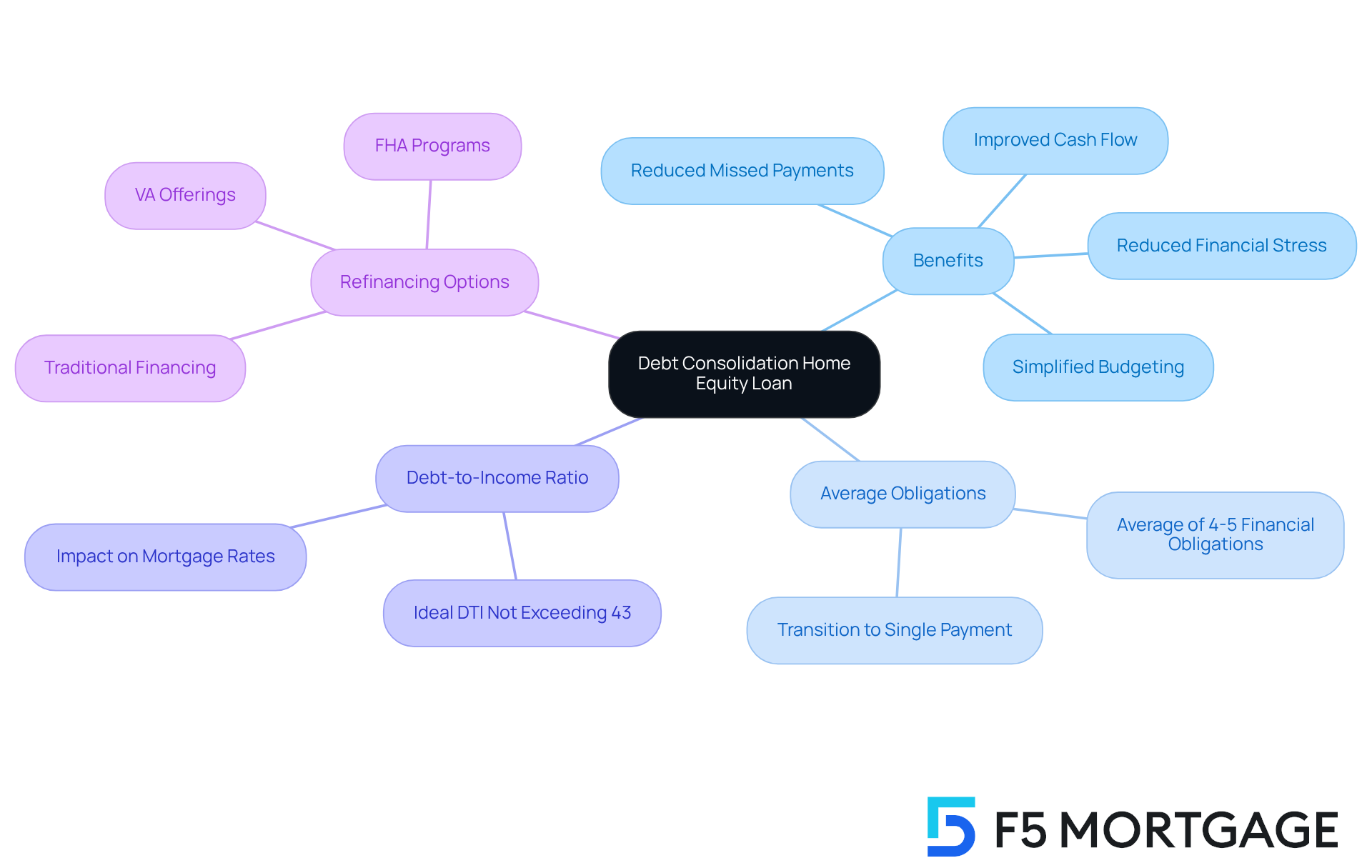

In fact, many families typically manage an average of four to five financial obligations before they consider consolidation. Making the switch to a single payment can truly be a life-changing experience. This merging of obligations allows families to focus their financial efforts more effectively, leading to improved cash flow and reduced stress.

Additionally, it’s important to maintain a good Debt-to-Income (DTI) ratio, ideally not exceeding 43%, to secure competitive mortgage rates. This is especially relevant when exploring refinancing options available through F5 Mortgage. These options include:

- Traditional financing

- FHA programs

- VA offerings

All designed to provide tailored solutions for families eager to improve their financial situations.

As one financial expert notes, simplifying finances through a debt consolidation home equity loan can empower families to regain control over their financial circumstances. This newfound control enables them to allocate resources more efficiently and plan for future goals. Remember, we’re here to support you every step of the way as you navigate these important decisions.

Reduced Monthly Payments: Alleviate Financial Stress with Debt Consolidation

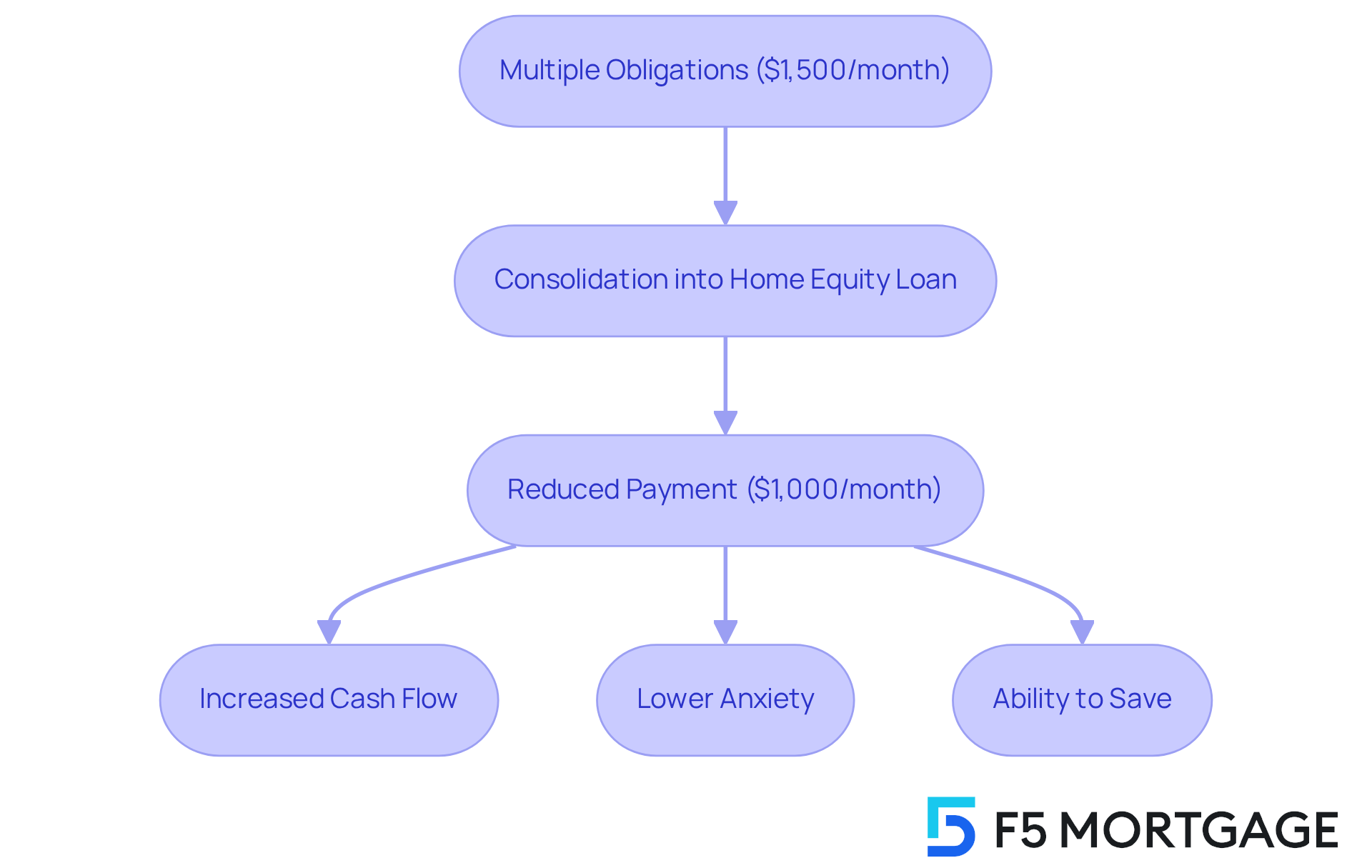

Combining obligations into a home equity loan can significantly ease the financial burden for families, providing crucial relief. Imagine a family juggling multiple obligations totaling $1,500 each month; by consolidating, they could see their payments drop to around $1,000. This $500 reduction not only alleviates immediate financial stress but also empowers families to redirect funds towards savings or other essential expenses.

We know how challenging managing finances can be, and statistics show that families who consolidate their debts often notice a marked improvement in their overall situation. Many report enhanced cash flow and reduced anxiety about monthly payments. For instance, a $30,000 property financing option offers monthly payments ranging from $290 to $369 for eligible borrowers, showcasing the affordability of this choice. Debt management experts emphasize that leveraging property value for consolidation can be a strategic decision, especially in a lower interest rate environment where current residential financing costs are more favorable than in previous years.

However, it’s important for families to recognize the potential risks associated with these financial relief programs. While merging high-interest obligations into a single, can simplify finances and improve the overall ratio of liabilities to income, it’s crucial to thoughtfully evaluate all available options.

Real-life examples illustrate this trend: families utilizing property value financing for consolidation have effectively eased monetary pressures, allowing them to focus on long-term financial goals. By merging high-interest debts into a single, lower-interest mortgage, families not only streamline their finances but also pave the way for a more secure financial future. Remember, we’re here to support you every step of the way as you navigate these important decisions.

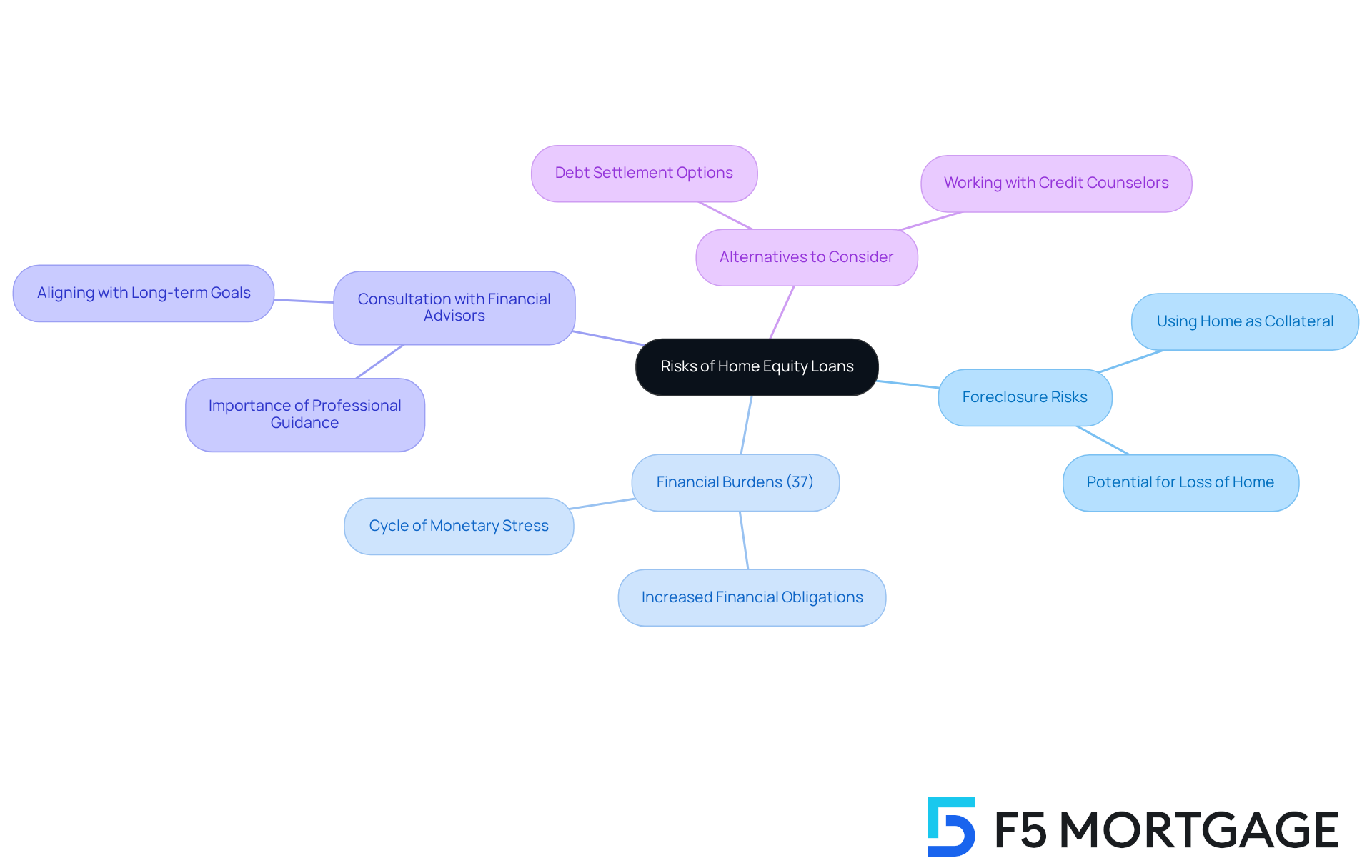

Consider Potential Drawbacks: Weighing Risks of Home Equity Loans for Debt Consolidation

While residential equity financing can offer significant advantages, it’s important to recognize the involved. Using your home as collateral means that failing to repay the loan could lead to foreclosure, which can deeply affect your family’s financial well-being. We know how challenging this can be; studies show that about 37 percent of families face increased financial burdens after such consolidations. Moreover, many families find themselves taking on additional financial obligations post-consolidation, creating a cycle of monetary stress.

Therefore, it’s crucial to critically assess your financial habits and ensure that the consolidation truly addresses the underlying issues of your financial challenges. Consulting with a financial advisor can provide valuable insights into the possible downsides of using your property’s value as collateral. This guidance can help you make informed choices that align with your long-term financial goals.

As Timi Joy Jorgensen wisely points out, “Creditors aim to recover their funds as swiftly as possible, so if you are overdue on payments or seeking to halt debt calls, don’t rush directly to borrowing against your equity—you have numerous alternatives. Investigate and determine what is most suitable for you.

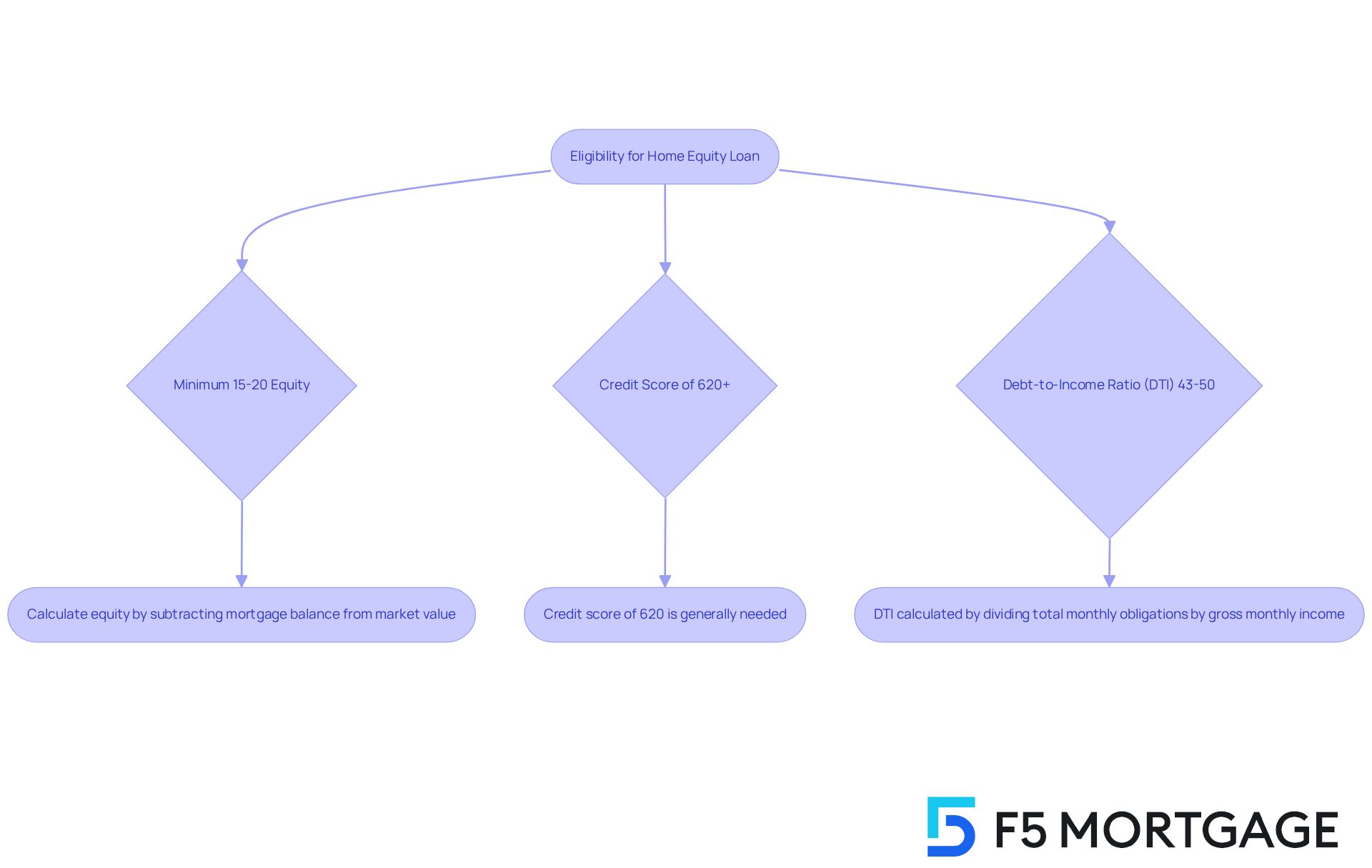

Eligibility Requirements: Know What It Takes to Qualify for a Home Equity Loan

Navigating the world of property value loans can feel overwhelming for families, but understanding the requirements is the first step toward achieving your goals. Most lenders typically ask homeowners to have at least 15-20% equity in their property. This equity is calculated by taking the current market value of your home and subtracting any outstanding mortgage balances.

A credit score of 620 or higher is generally necessary, but if you can reach a score of 700 or more, your chances of approval significantly improve. Additionally, lenders will look closely at your debt-to-income (DTI) ratio, which should ideally fall between 43% and 50%. This ratio is calculated by dividing your total monthly payment obligations by your gross monthly income, ensuring that you can comfortably manage your monthly responsibilities.

For instance, if your family’s monthly earnings are $5,000 and your total payment obligations amount to $1,500, your DTI would be 30%. This suggests a favorable stance for approval, giving you hope as you move forward. We know how challenging this can be, and is crucial for families looking to navigate the application process successfully.

We’re here to support you every step of the way. Consulting with financial advisors can provide tailored insights and strategies to enhance your eligibility and secure the best possible terms. Taking these actionable steps can empower you on your journey to homeownership.

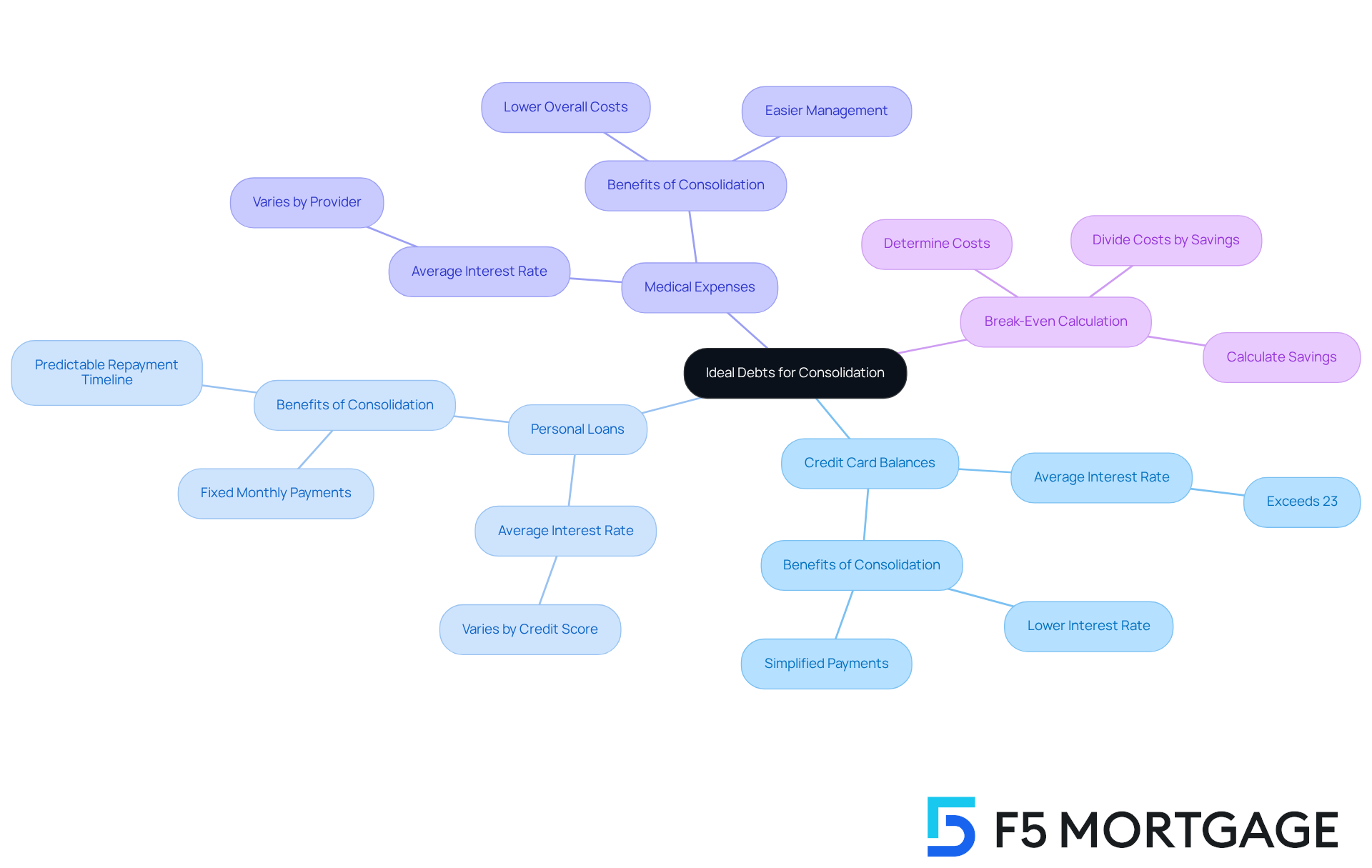

Ideal Debts for Consolidation: Which Liabilities to Combine with Home Equity Loans

Home value financing options can be a lifeline for families struggling with high-interest financial obligations, such as credit card balances, personal loans, and medical expenses. We know how overwhelming these liabilities can feel, especially when they typically carry interest rates exceeding 23%. By utilizing a debt consolidation home equity loan as a property financing option, families can significantly lower their total interest expenses and simplify their financial responsibilities.

For instance, families burdened with multiple credit card debts can benefit from the typical home equity interest rate of around 8.5%. This rate is a breath of fresh air compared to the average credit card rate, which often exceeds 23%. Additionally, it’s essential to understand the costs associated with refinancing in California. Typically, the expense of finalizing a mortgage refinance ranges from 2% to 5% of the amount borrowed. So, if your new borrowing amount is $300,000, you might expect to pay between $6,000 and $15,000 in closing costs. These costs encompass application fees, origination fees, appraisal fees, and more.

Financial advisors often suggest that families evaluate their overall liabilities in relation to their income. Ideally, total obligations should be less than half of annual earnings to ensure manageable repayment. Merging financial obligations through a debt consolidation home equity loan can provide a stable monthly installment and a straightforward repayment timeline, which is often more predictable than the fluctuating rates associated with credit cards. Starting in 2024, 39% of borrowers reported pursuing property-based credit specifically for consolidating loans. This indicates a growing trend among households seeking to restore their financial stability.

To calculate your break-even point, you can follow three simple steps:

- Determine your refinancing costs, which include all closing fees and expenses associated with refinancing, such as origination fees, appraisal costs, and any discount points.

- Calculate your monthly savings by subtracting your new monthly payment from your current monthly payment.

- Divide your refinancing costs by your monthly savings to find out how many months it will take to break even. For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months).

In summary, high-interest obligations like credit card balances and personal loans are well-suited for consolidation using a debt consolidation home equity loan. This approach provides families with a pathway to reduced interest rates and simplified financial management. However, we must also consider the risks involved, such as the potential loss of one’s residence if payments are not maintained. Consulting with a financial advisor can offer valuable insights into whether this strategy aligns with your individual financial goals. We’re here to support you every step of the way.

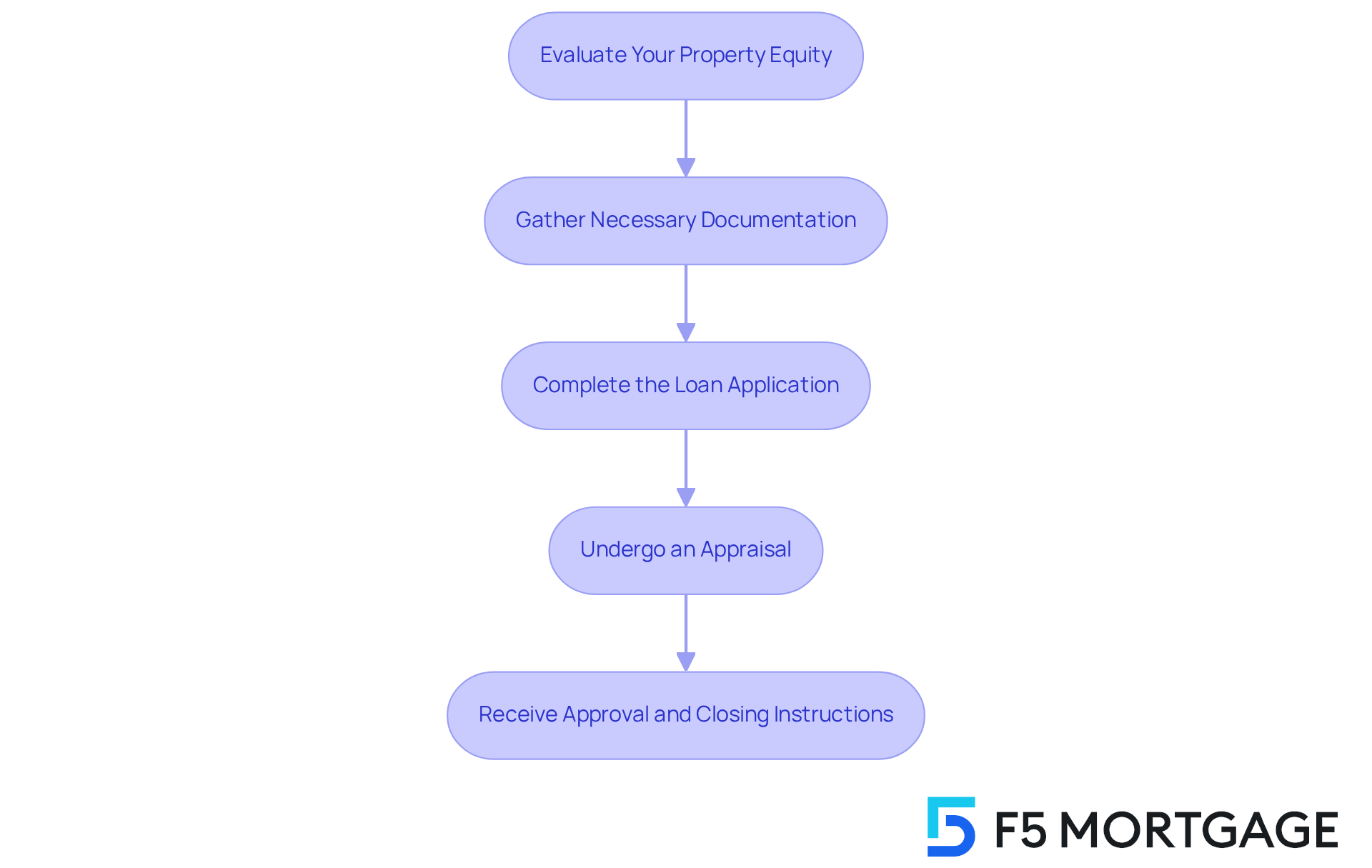

Application Process: Steps to Secure a Home Equity Loan for Debt Consolidation

Obtaining a debt consolidation home equity loan can be a significant step towards easing financial burdens for families. We understand how challenging this can be, and a methodical strategy can greatly alleviate the strain. The process typically unfolds in several key steps:

- Evaluate Your Property Equity: Start by determining how much equity you have in your home. This is calculated by subtracting your outstanding mortgage balance from your property’s current market value. Generally, homeowners can borrow up to 80% of their home’s worth, minus any remaining mortgage obligations.

- Gather Necessary Documentation: Prepare essential documents, including income statements, tax returns, and details about your current financial obligations. Lenders often require proof of income and a reasonable debt-to-income ratio, typically below 43%, to assess your financial health.

- Complete the Loan Application: Fill out the application form from your chosen lender. This step may involve a credit check to evaluate your creditworthiness, with a minimum score of around 620 generally required.

- Undergo an Appraisal: After submitting your application, the lender will arrange for an to assess your property’s value. This step is crucial, as it influences the amount you can borrow.

- Receive Approval and Closing Instructions: Once your application is approved, you will receive a closing date and instructions for the closing process, where you will sign documents and receive the funds.

Families have effectively utilized a debt consolidation home equity loan for consolidating obligations, which allows them to eliminate higher-interest liabilities and simplify their finances. For instance, many have shared their experiences of merging credit card debts, which often carry interest rates significantly higher than those of residential property financing. This strategic move not only simplifies monthly payments but also has the potential to save thousands in interest over time.

By grasping these stages and preparing appropriately, families can navigate the property value borrowing process with confidence, ultimately leading to improved financial outcomes. We’re here to support you every step of the way.

Home Equity Loan vs. HELOC: Choosing the Right Option for Debt Consolidation

Families considering a debt consolidation home equity loan often face a tough decision between a property-backed financing option and a property-backed credit line (HELOC). We understand how challenging this can be. Home value loans provide a lump sum with fixed monthly installments, making them a comforting choice for those who prefer consistent budgeting. On the other hand, HELOCs operate as a revolving line of credit with variable interest rates, offering the flexibility that can be crucial for ongoing expenses or projects.

For families needing a significant sum upfront—like for a debt consolidation home equity loan to consolidate high-interest debts—a property-based financing option might be the best fit. Conversely, if you anticipate fluctuating financial needs or prefer to draw funds as necessary, a HELOC could serve you better. Currently, the typical interest rate for HELOCs has fallen below 8%, making them an appealing option compared to property-backed financing, which is closer to 8.50%. Lenders are actively promoting home value financing in light of expected Federal Reserve interest rate reductions, which could further influence your borrowing choices.

However, it’s important to be aware that 48% of HELOC applications were denied in Q4 2024, highlighting potential challenges in securing this type of credit. Ultimately, we encourage families to , future cash flow, and specific needs to determine which option aligns best with their consolidation objectives. Remember, we’re here to support you every step of the way.

Comprehensive Benefits: Why a Home Equity Loan is a Smart Choice for Debt Consolidation

Home financing options, particularly a debt consolidation home equity loan, can be a comforting solution for families seeking to consolidate their obligations, offering numerous benefits that can significantly improve their financial situation. One of the primary advantages is the reduced interest rates associated with these financial products, which typically average below 9%. This stands in stark contrast to credit card rates that often exceed 20%. Such a difference can lead to substantial savings. For instance, refinancing $20,000 in credit card debt at a 24% APR could result in around $400 in monthly interest, whereas a property-backed financing option at 7% would considerably ease that burden.

By consolidating multiple high-interest obligations into a single monthly payment, families can also simplify their financial management. This streamlined approach not only reduces the number of bills to keep track of but can also by lowering overall credit utilization. In fact, many households report saving over $500 each month after restructuring their high-interest obligations with residential financing, which allows for better cash flow management.

Financial consultants stress the importance of addressing the root causes of financial obligations before securing property-backed credit. Tayne advises that without a clear strategy, families may risk becoming further entrenched in financial difficulties. For families with stable incomes and at least 20% equity in their properties, considering a debt consolidation home equity loan can be a smart financial choice. They provide an opportunity to regain financial control, especially for those who have struggled with high-interest credit card debt. A case study illustrates how families who utilized a debt consolidation home equity loan for financing not only improved their financial conditions but also regained peace of mind.

Moreover, the typical interest rate on a debt consolidation home equity loan currently ranges from 8 to 8.5 percent, making it an attractive option for families looking to consolidate their financial obligations. However, it’s crucial to consider the upfront fees associated with these loans, which can reach up to 5% of the principal. With the right guidance and a clear strategy, families can effectively navigate the complexities of debt consolidation. By leveraging their home equity, they can save money and pave the way for a more secure financial future.

Conclusion

Utilizing a debt consolidation home equity loan offers families a compassionate way to manage their financial obligations. By tapping into the equity in their homes, families can combine high-interest debts into a single, more manageable payment with lower interest rates. This financial tool not only simplifies budgeting but also fosters long-term financial stability, making it an appealing option for those seeking relief from the pressures of multiple debts.

Throughout this article, we’ve highlighted key benefits of debt consolidation home equity loans, including:

- Lower interest rates compared to traditional credit obligations

- Streamlined payment processes

- Reduced monthly financial burdens

Families can save significantly on interest payments while enjoying the convenience of a single monthly payment, which nurtures better financial organization and less stress. However, we know how challenging this can be, so potential risks and eligibility requirements should be carefully considered to ensure this option aligns with individual financial goals.

As families navigate the complexities of debt management, embracing a debt consolidation home equity loan can be a transformative step toward financial freedom. By understanding the advantages and thoughtfully assessing their unique circumstances, families can take control of their finances, reduce stress, and pave the way for a more secure financial future. We’re here to support you every step of the way, and exploring these options with expert guidance can empower families to make informed decisions that lead to lasting financial well-being.

Frequently Asked Questions

What is F5 Mortgage’s primary service?

F5 Mortgage specializes in providing tailored home equity loan solutions for debt consolidation, helping families manage their financial obligations by combining multiple debts into one manageable payment.

How prevalent is the use of debt consolidation home equity loans?

Recent trends indicate that around 39% of borrowers are utilizing debt consolidation home equity loans to manage their financial responsibilities, reflecting a growing demand for such solutions.

What are the benefits of using a debt consolidation home equity loan?

Debt consolidation home equity loans typically offer lower interest rates compared to unsecured debts like credit cards, allowing families to save money on interest payments and simplify their finances by merging multiple payments into one.

How can families save money with a debt consolidation home equity loan?

By transferring high-interest credit card balances (often around 20% APR) to a property-backed financing option with lower rates (as low as 7%), families can significantly reduce their monthly payments and total interest paid over time.

What is the typical home value for mortgage-holding homeowners?

The typical mortgage-holding homeowner possesses approximately $302,000 in home value, which can be utilized for a debt consolidation home equity loan.

What financing options does F5 Mortgage offer?

F5 Mortgage provides various financing options, including traditional financing, FHA programs, and VA offerings, all designed to support families in improving their financial situations.

How does consolidating debts affect a family’s financial management?

Consolidating debts into one monthly payment simplifies budgeting, reduces the risk of missed payments, and can lead to improved cash flow and reduced financial stress for families.

What is the recommended Debt-to-Income (DTI) ratio for securing competitive mortgage rates?

It is recommended to maintain a Debt-to-Income (DTI) ratio ideally not exceeding 43% to secure competitive mortgage rates when exploring refinancing options.

What support does F5 Mortgage provide during the loan process?

F5 Mortgage offers expert guidance and support to clients throughout the mortgage process, ensuring a stress-free and transparent experience as they work towards their financial goals.