Overview

When it comes to upgrading your home, 1st lien HELOCs offer wonderful benefits that can truly make a difference. Imagine having flexible funding options at your fingertips, allowing you to tackle those renovations you’ve always dreamed of. Plus, the potential tax deductibility of interest payments can ease some financial burdens, making it easier to invest in your home.

We understand that navigating financial decisions can feel overwhelming. That’s why it’s important to know that these HELOCs often come with lower interest rates compared to traditional loans. This means you can finance your renovations efficiently and manage your finances with confidence.

Ultimately, taking advantage of these features can enhance your property’s value and empower you to make strategic monetary decisions. We’re here to support you every step of the way, helping you turn your vision into reality while ensuring your financial well-being.

Introduction

Unlocking the full potential of home equity can truly transform the lives of property owners eager to enhance their living spaces. We understand how overwhelming it can be to navigate financial options, especially with the rise of first-lien home equity lines of credit (HELOCs). These flexible funding solutions are now at your fingertips, allowing you to finance renovations, consolidate debt, and manage cash flow more effectively. But as you explore these financial tools, you may wonder: How can a first-lien HELOC not only simplify your renovation journey but also offer significant long-term benefits?

In this article, we will delve into ten compelling advantages of first-lien HELOCs for home upgrades. Our goal is to empower you with insights that help you make informed decisions about your financial future, ensuring that you feel supported every step of the way.

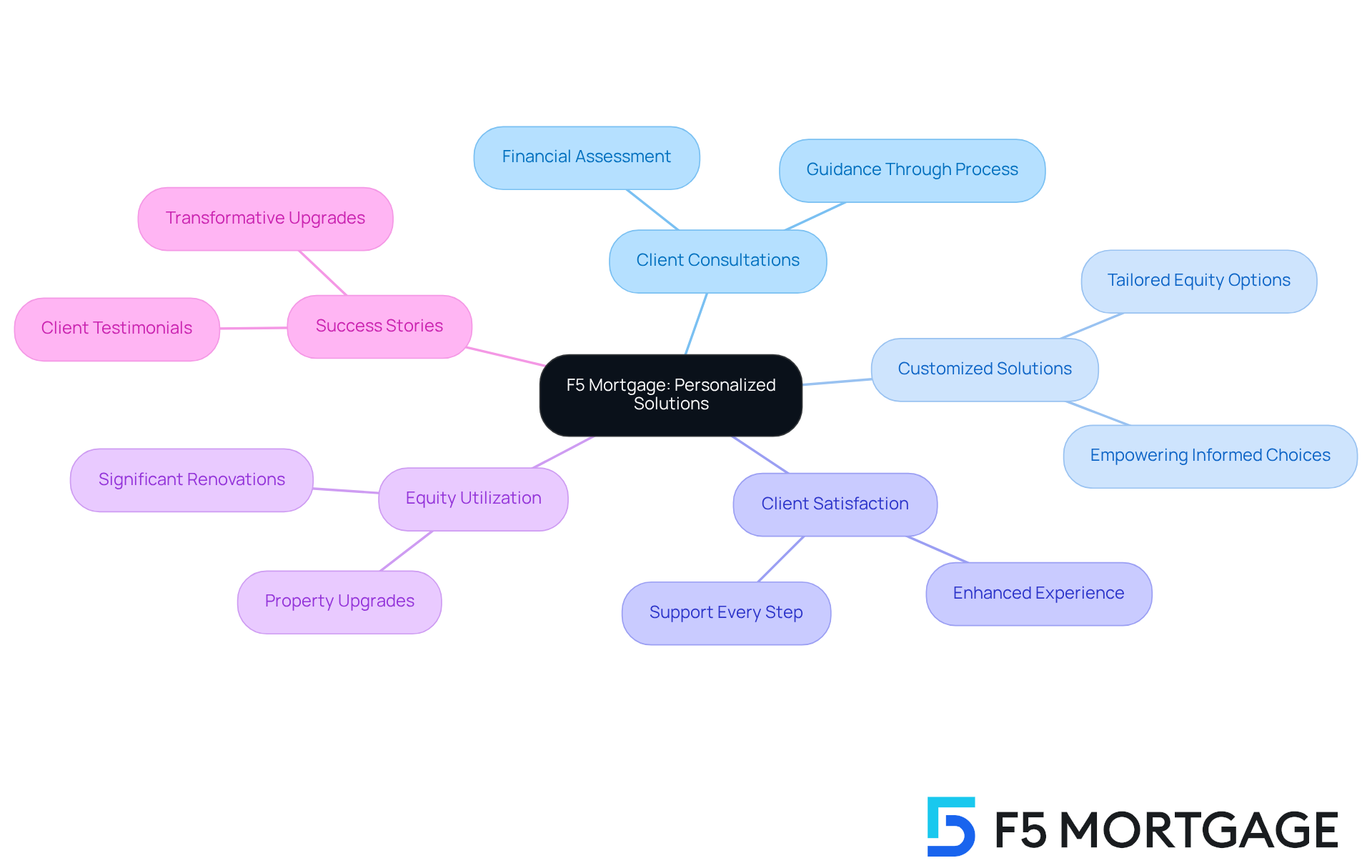

F5 Mortgage: Personalized Solutions for First-Lien HELOCs

At F5 Mortgage, we understand how challenging it can be to navigate the complexities of a 1st lien heloc. That’s why we excel in providing personalized consultations that guide our clients through each step of the process. By thoroughly assessing your financial situation, we create customized solutions tailored to your specific needs, empowering families to make informed choices about their equity options.

This caring approach not only enhances client satisfaction but also allows property owners to effectively utilize their equity for significant upgrades and renovations. With the typical property owner possessing around $212,000 in tappable equity, the potential for meaningful property enhancements is substantial. As many property owners begin to consider leveraging their equity—approximately 25% are contemplating a 1st lien heloc or equity loan in the coming year—F5 Mortgage stands out by ensuring you are well-equipped to navigate these 1st lien heloc opportunities.

Our successful client stories illustrate how the strategic application of a 1st lien HELOC has enabled transformative property upgrades. We know how important it is to achieve your ownership objectives, and we are here to support you every step of the way. Let us help you unlock the potential of your home and create the space you’ve always dreamed of.

Access to Flexible Funding with First-Lien HELOCs

1st lien heloc provides property owners with a flexible financing option for home improvements, allowing them to obtain funds as needed. Unlike traditional loans that require a lump sum payment upfront, home equity lines of credit empower borrowers to withdraw from their credit line at their convenience. This adaptability is particularly beneficial for property owners undertaking renovation projects, where costs can fluctuate and budgets may need to be adjusted as work progresses.

For instance, many homeowners utilize HELOCs to finance ongoing renovations, withdrawing funds incrementally to ensure they only pay interest on the amount used. This method not only helps manage cash flow efficiently but also supports strategic monetary planning, especially as property equity financing gains popularity. We know how challenging it can be to navigate these financial decisions, and we’re here to support you every step of the way.

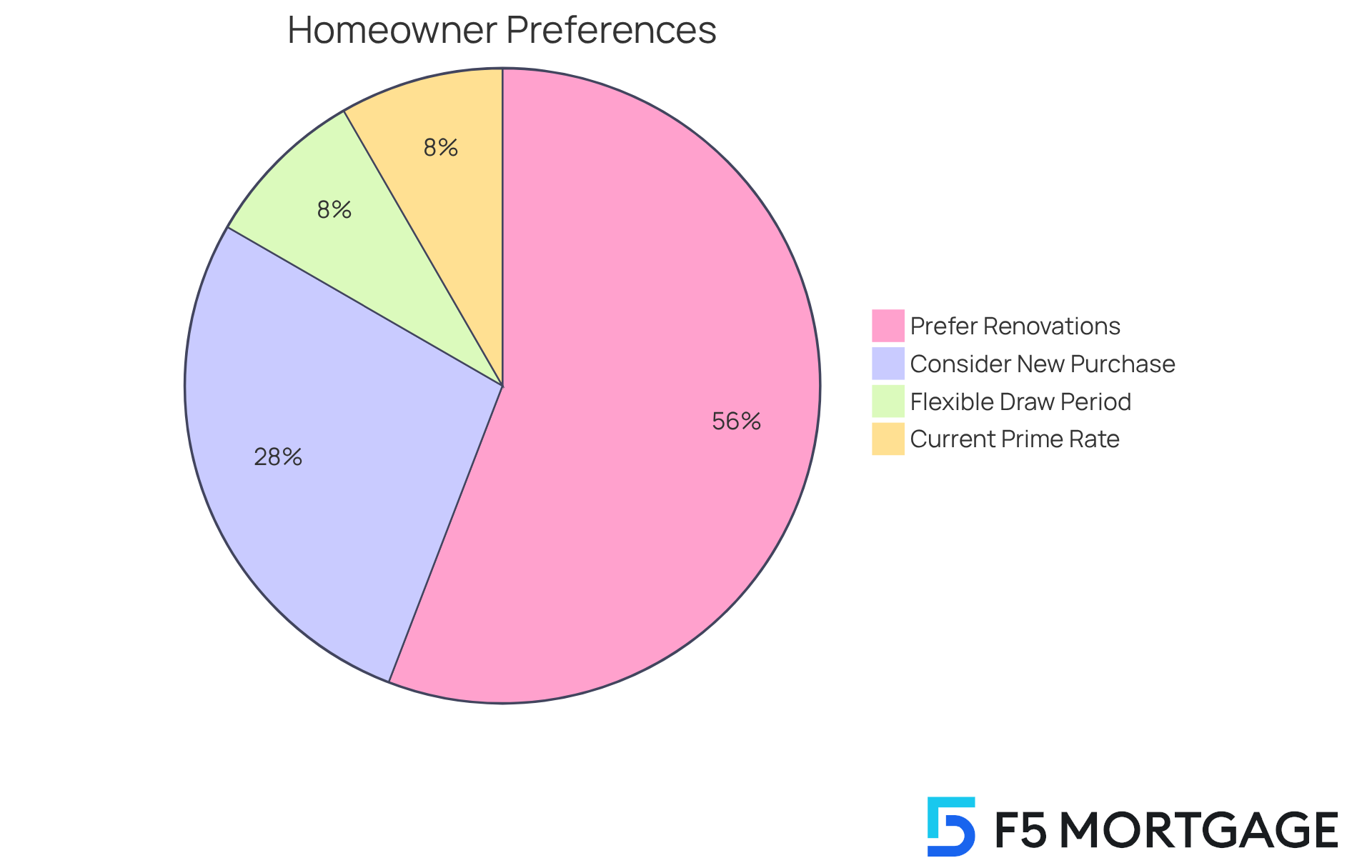

Financial advisors emphasize the importance of maintaining control over cash flow during renovations. The ability to draw funds as needed can significantly alleviate financial strain. As trends indicate that 67% of property owners prefer renovating their current residence over acquiring a new one, a 1st lien heloc stands out as a practical option for individuals looking to enhance their living spaces while managing their finances wisely.

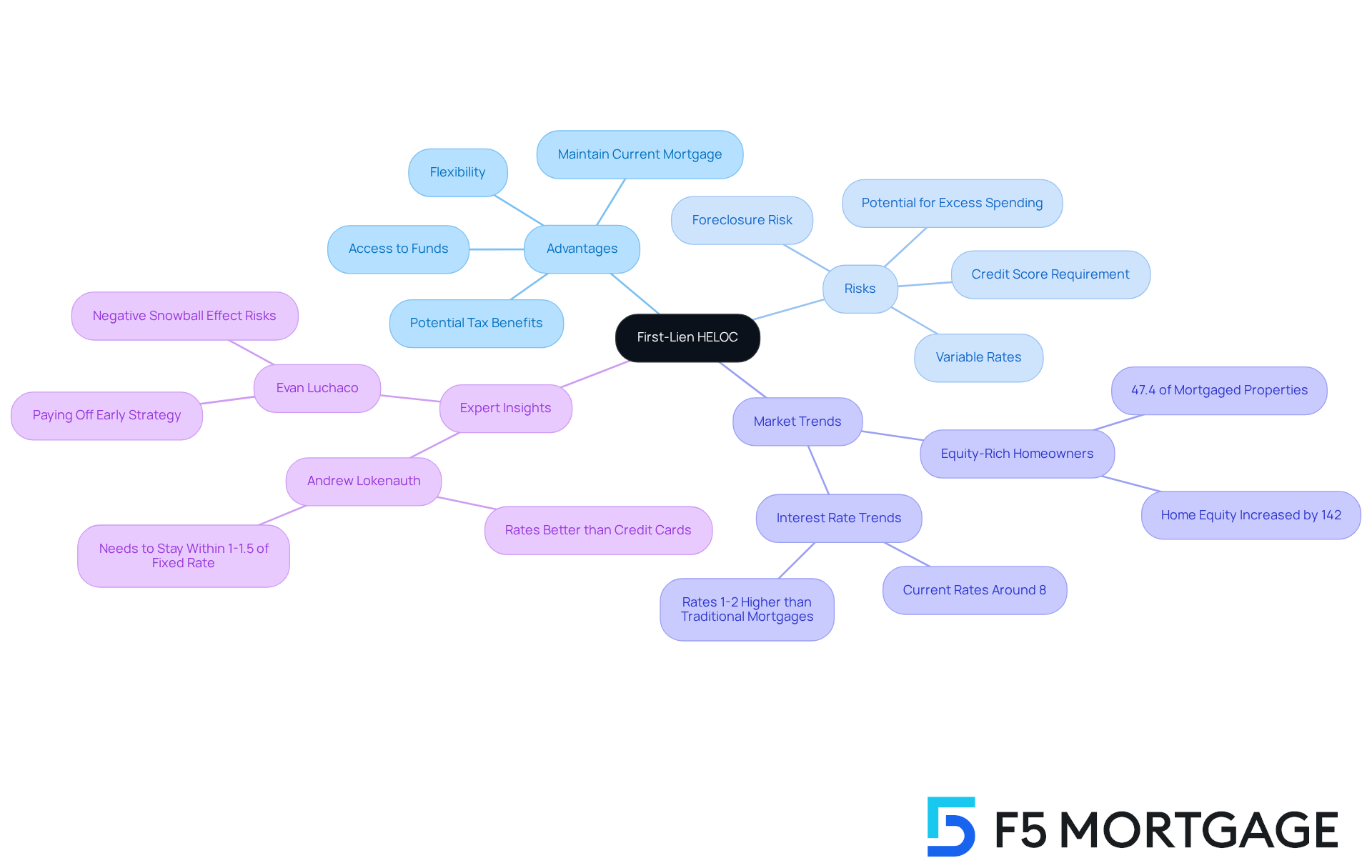

Furthermore, the draw period for certain 1st lien heloc can vary from three to 10 years, offering sufficient time for property owners to finish their projects. With the prime rate currently at 7.5%, understanding the borrowing costs linked to home equity lines of credit is crucial for making informed decisions. As mortgage expert Evan Luchaco observes, diligent property owners can settle their loans much earlier than a typical 30-year term mortgage by utilizing HELOCs effectively.

However, property owners should also be aware of potential penalties for early repayment of excess funds, which can impact their overall financial strategy.

Key Takeaways:

- Access funds as needed for ongoing renovations.

- Draw period typically ranges from 3 to 10 years.

- Current prime rate is 7.5%, affecting borrowing costs.

- 67% of property owners favor renovations instead of buying new residences.

- Be mindful of potential penalties for early repayment.

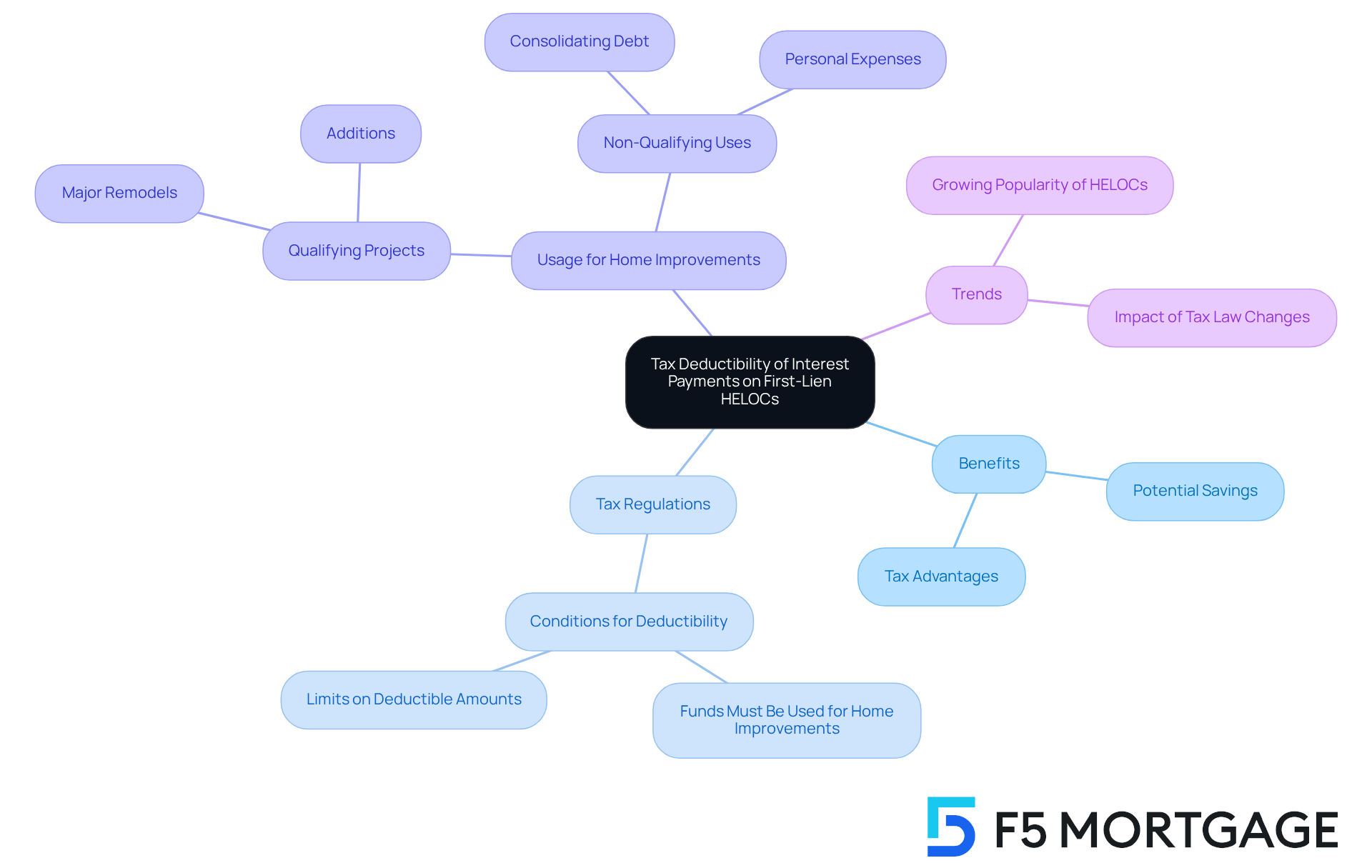

Tax Deductibility of Interest Payments on First-Lien HELOCs

1st lien heloc can be a valuable resource for homeowners, particularly due to the potential tax deductibility of interest payments. We understand how important it is to find ways to save, especially during tax season. If you use funds from a HELOC for renovations, you may often deduct the interest, leading to significant savings. For example, imagine utilizing $10,000 from your HELOC for home improvements; that amount might qualify for a tax deduction, making it a wise financial choice for those looking to enhance their properties.

Recent changes in tax regulations have clarified that interest on equity loans is deductible only when the funds are allocated toward qualifying projects, like major remodels or additions that boost your property’s value. This is crucial information for homeowners, as tax experts point out that this tax advantage can significantly reduce the overall cost of home improvements. It empowers you to invest in your home while potentially benefiting from tax deductions.

In fact, many property owners are turning to a 1st lien heloc for tax-deductible enhancements. This trend highlights the growing popularity of this financing option. As tax laws continue to evolve, we know how challenging it can be to navigate these changes. Understanding how to maximize these benefits is essential for homeowners looking to make the most of their investments. We’re here to support you every step of the way.

Lower Interest Rates Compared to Traditional Loans

If you’re a property owner, you might be exploring options to manage your finances effectively. 1st lien heloc often present a wonderful opportunity, as they typically offer lower interest rates than conventional loans. This advantage arises from the reduced risk for lenders, since these lines of credit take precedence over other liens.

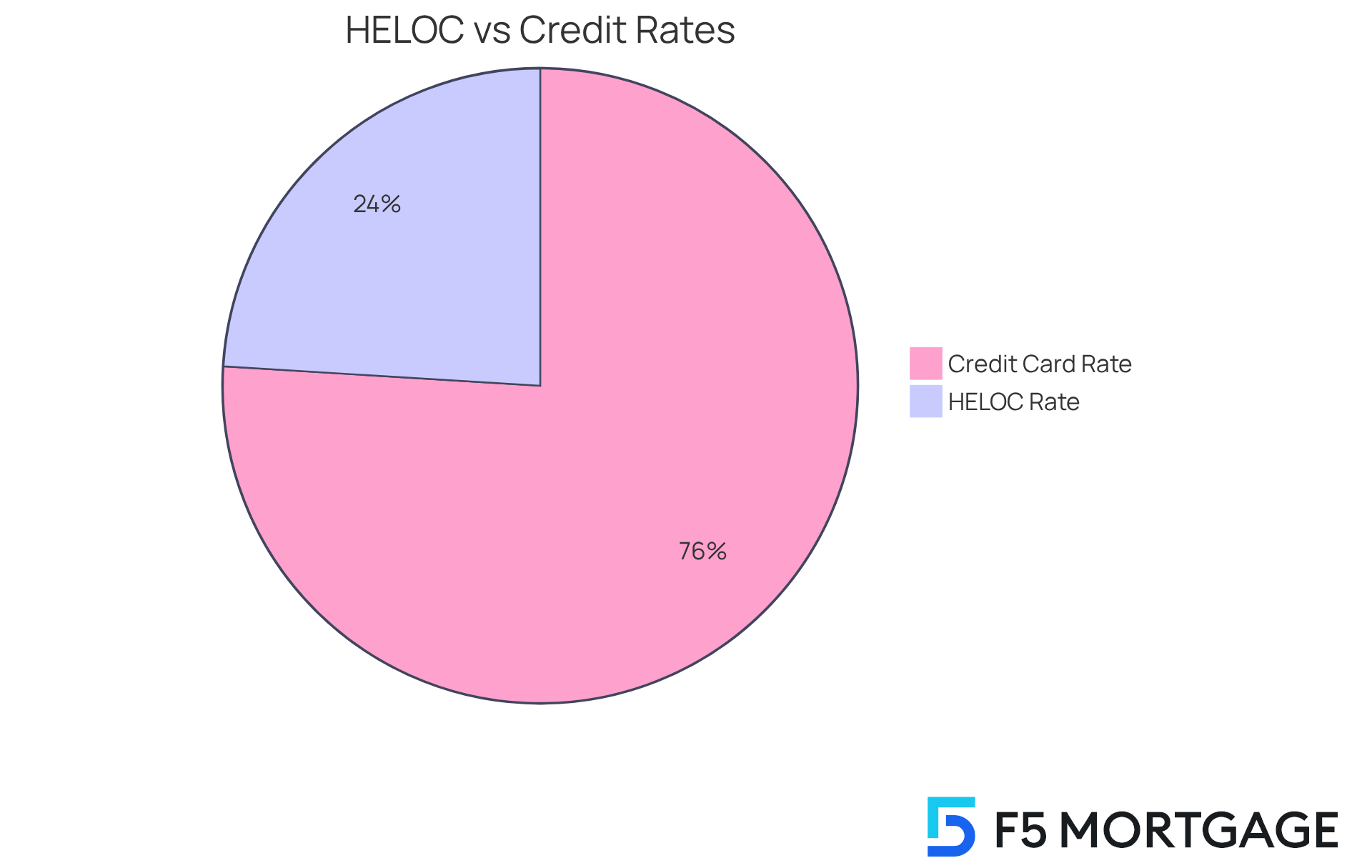

We understand how important it is to save money, especially when it comes to interest payments. Currently, the average HELOC rate stands at 6.64%, which is significantly lower than credit card interest rates that can exceed 21%. By securing a 1st lien heloc, you can save on interest payments, which allows you to allocate more funds toward those renovation projects you’ve been dreaming about.

For example, if you refinance $50,000 in credit card debt at a 10% HELOC rate, you could potentially save around $6,000 in annual interest. This kind of financial flexibility not only helps with property enhancements but also supports you in managing your current debt more efficiently.

As financial analysts point out, the cost-effectiveness of a 1st lien heloc makes it a viable choice for homeowners like you who are looking to enhance their living spaces while maintaining financial stability. We know how challenging this can be, and we’re here to support you every step of the way.

Borrow Against Home Equity Without a Traditional Mortgage

If you’re a property owner looking to tap into your home’s equity, a first-lien HELOC might be just what you need. This option allows you to borrow against your equity without the hassle of taking out a traditional mortgage. It’s especially appealing for those who have built significant equity in their homes but wish to avoid refinancing their existing mortgage. By choosing a first-lien HELOC, you can access funds for renovations or other expenses while keeping your current mortgage terms intact.

Additionally, first-lien HELOCs can be a smart strategy for mortgage prepayment, helping you reduce your principal more quickly while still having access to funds when you need them. This flexibility is particularly beneficial in today’s market, where nearly half (47.4%) of mortgaged residential properties are equity-rich. This trend highlights a growing number of homeowners using their equity strategically.

Mortgage experts emphasize that this financial tool is perfect for homeowners wanting to manage their cash flow effectively. For instance, Andrew Lokenauth points out that lenders perceive less risk with first-lien home equity lines of credit, which can lead to more favorable rates compared to other borrowing options. However, it’s essential to note that a FICO credit score of at least 680 is typically required to qualify for a first-lien HELOC.

While first-lien home equity lines of credit offer unique advantages over traditional mortgages—such as the flexibility to access funds without refinancing—they do come with risks. Homeowners should be mindful of the possibility of variable rates increasing during repayment and the risk of foreclosure if payments are missed. It’s also wise to consult with tax advisors to understand any applicable requirements regarding the HELOC.

In summary, first-lien home equity lines of credit can be a compelling solution for property owners looking to leverage their equity while maintaining their current mortgage structure. They offer both financial flexibility and the potential for significant savings, and we’re here to support you every step of the way.

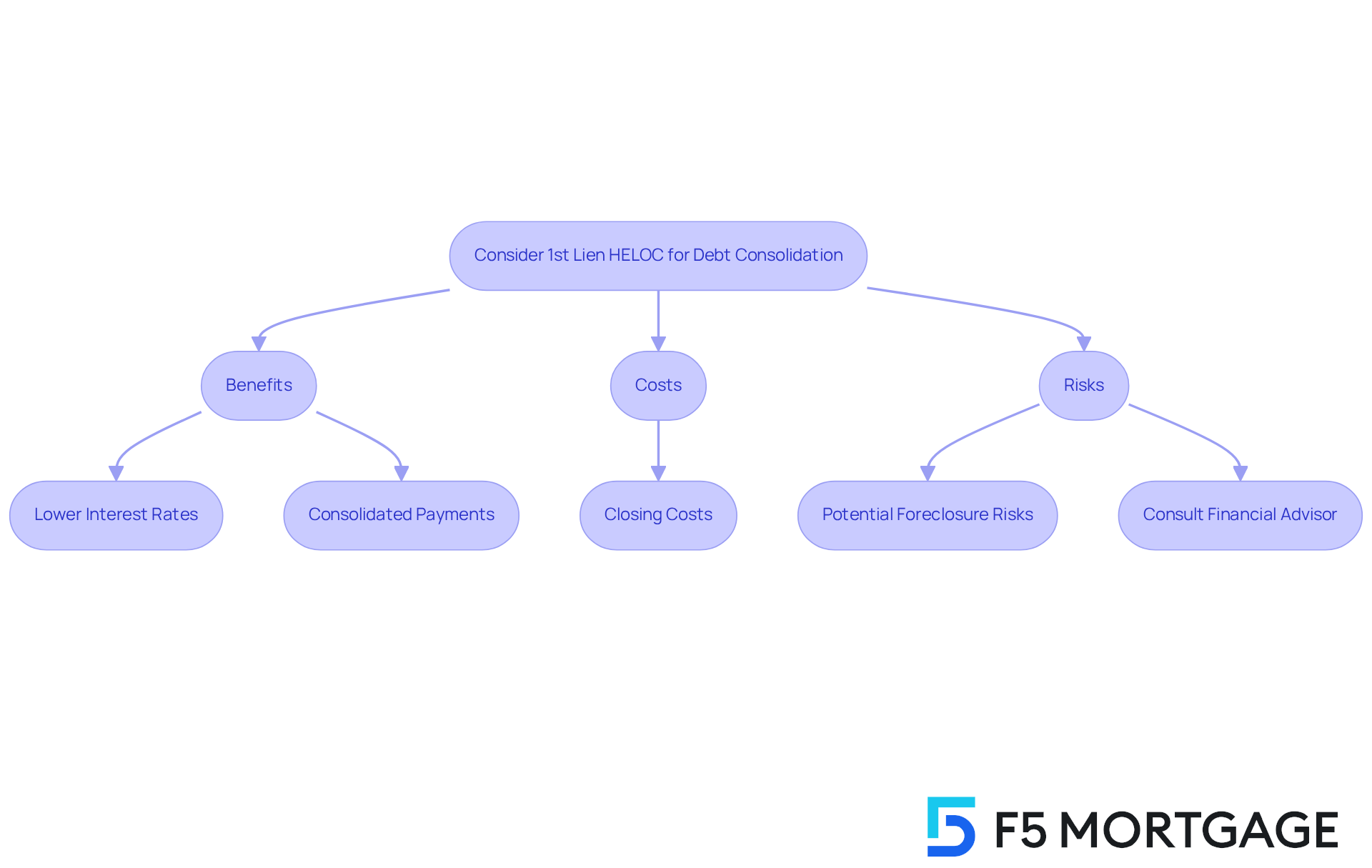

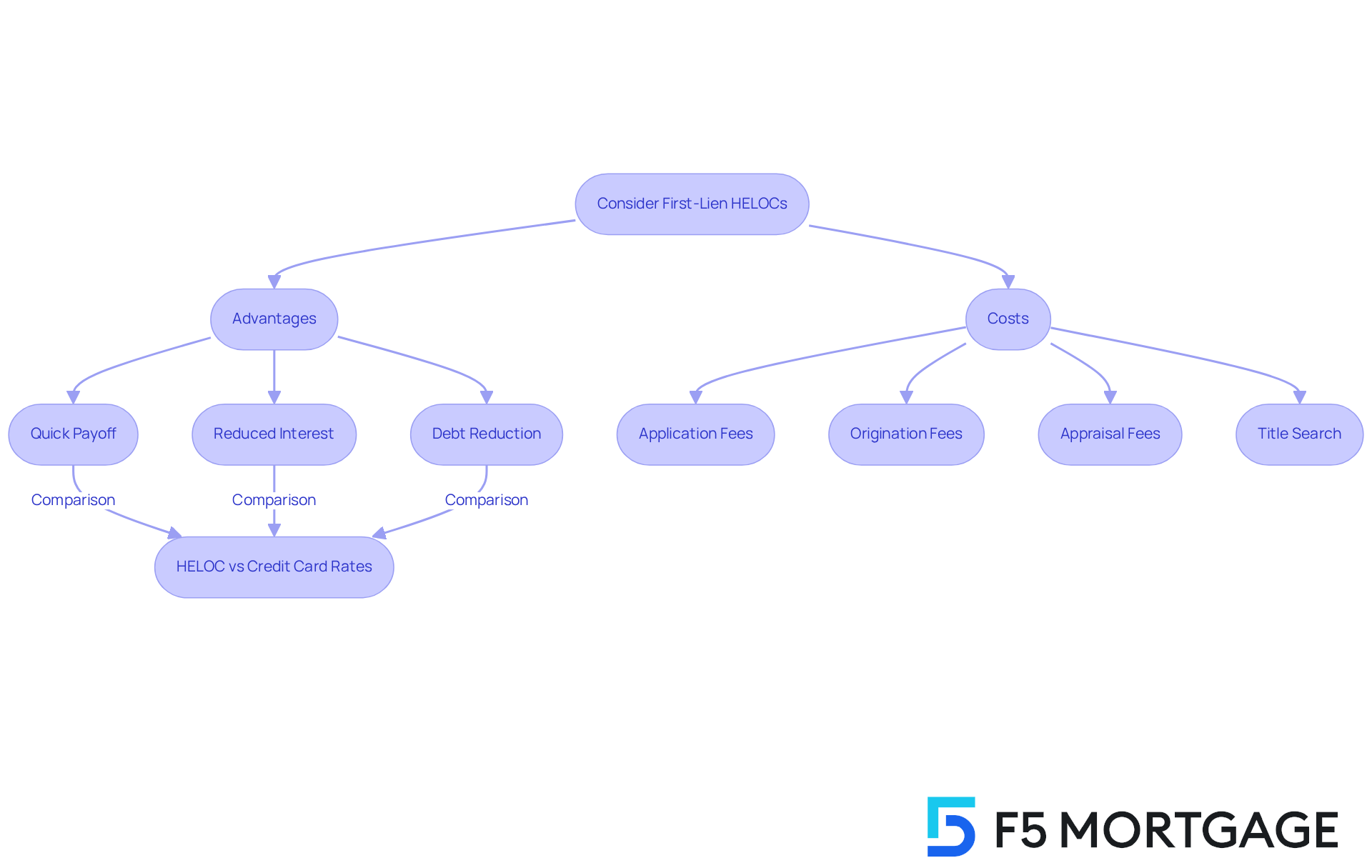

Debt Consolidation Opportunities with First-Lien HELOCs

1st lien heloc can be a valuable solution for property owners looking to consolidate debt. By tapping into the equity of their homes, borrowers have the opportunity to pay off high-interest debts, such as credit cards and personal loans, which often carry rates exceeding 20%. This strategic move allows homeowners to benefit from significantly lower interest rates associated with HELOCs, which average around 8% as of March 2025. Consolidating several debts into a single HELOC not only simplifies management with one monthly payment but also has the potential to save borrowers thousands in interest expenses over time.

For example, homeowners who choose to consolidate their debts through a HELOC can reduce their monthly payments, making it easier to manage their finances. We know how challenging this can be, and money managers emphasize that this approach can enhance cash flow, enabling individuals to direct savings towards other financial goals or investments. Additionally, by lowering high credit card balances, borrowers can improve their credit utilization ratios, which may positively impact their credit scores.

However, it’s essential to approach this option with caution. Homeowners should ensure they have a realistic repayment plan in place, as failing to manage HELOC payments can lead to increased long-term debt and potential foreclosure risks. As advisor Dre Torres observes, “Any time you are going to pay off debt and consolidate it into a loan that has one payment, that will place you in a better monetary position.”

Understanding the costs associated with refinancing in California is also crucial. Closing expenses for refinancing typically range from 2% to 5% of the loan amount, which can significantly influence your overall financial strategy. Here’s a breakdown of the fees you can expect to pay when refinancing your home:

- Application fees: Between $75 and $500

- Origination fees: Between 0.5% and 1.5% of the loan amount

- Credit report fees: Around $35

- Appraisal fees: Usually between $300 and $500, depending on location and property type

- Title search and title insurance: Between 0.5% and 1% of the loan amount

- Discount points: 1% of the loan amount for a 0.25% interest rate reduction

- Attorney fees: $500 or more

- Survey fee: $150 to $400

Homeowners should calculate their break-even point by determining their refinancing costs, calculating monthly savings, and understanding how long it will take to recoup those costs through savings in monthly payments or interest rates. Consulting with a financial advisor can provide valuable insights into whether a HELOC is the right choice for your personal circumstances, especially if you have fluctuating incomes or existing financial challenges. Moreover, property owners ought to consider the possible tax deductions linked to home equity lines of credit, which can further enhance their financial advantages. Overall, when used wisely, a 1st lien heloc can serve as a powerful tool for debt consolidation, allowing homeowners to regain control over their financial health.

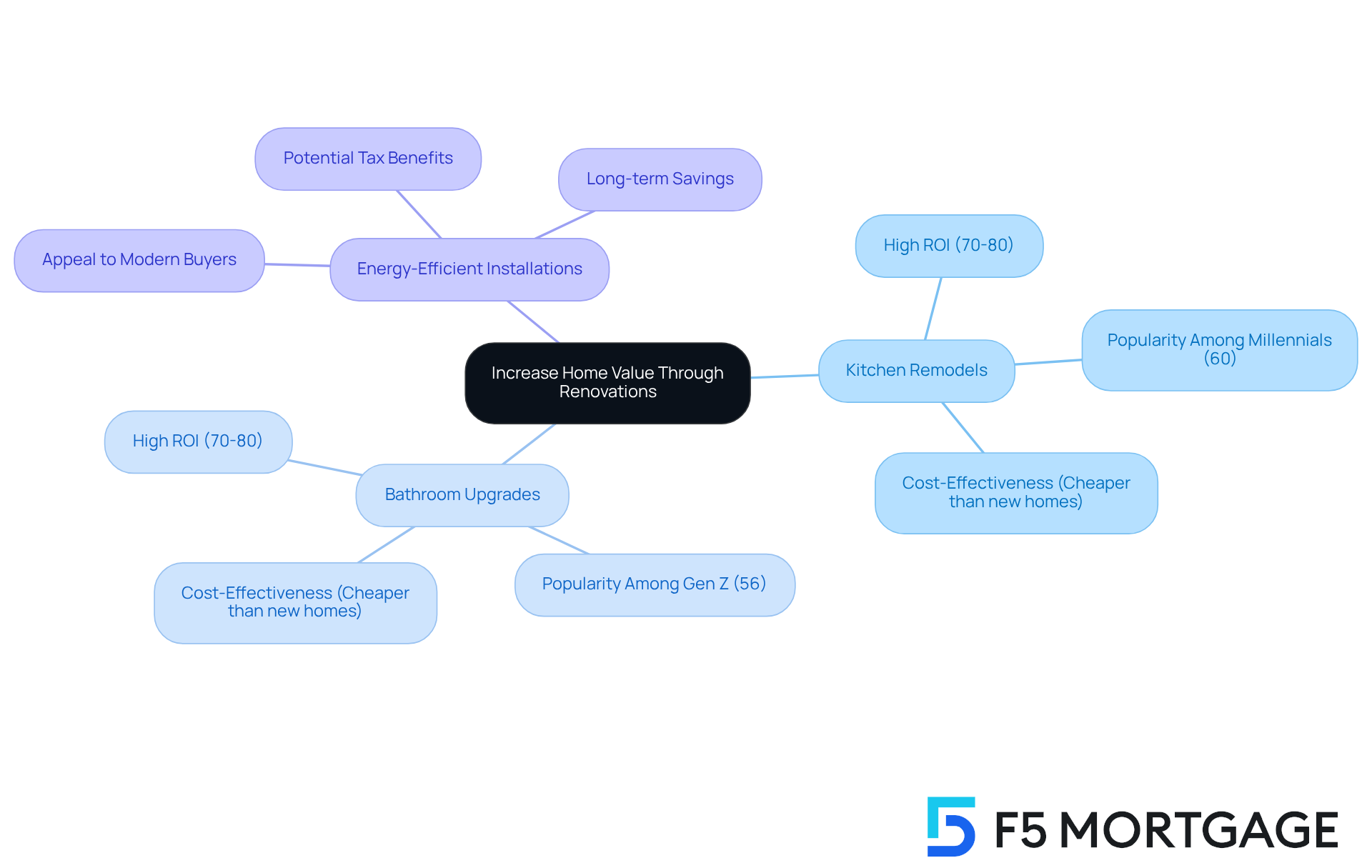

Increase Home Value Through Renovations Funded by HELOCs

If you’re considering renovations, utilizing a 1st lien heloc can be a wonderful way to significantly increase your property’s market value. We know how important it is to create a welcoming home, and strategic enhancements—like kitchen remodels, bathroom upgrades, and energy-efficient installations—can truly enhance your living experience while also appealing to potential buyers. Notably, kitchen and bathroom renovations often yield the highest return on investment, recouping a significant portion of costs upon resale. Homeowners utilizing a 1st lien heloc for these upgrades can expect an average ROI of around 70% to 80%.

With 60% of millennial property owners and 56% of Gen Z property owners planning renovations this year, the demand for homes with modern features is on the rise. This trend can further drive up your market value, making it an exciting time to invest in your property. However, it’s essential to consider the potential risks associated with using a 1st lien heloc, such as an increased overall debt load and the risk of foreclosure if payments are not maintained.

By investing wisely in property enhancements through a 1st lien heloc, you can position your asset favorably in a competitive market. This can lead to higher selling prices and quicker sales. As real estate experts note, “Well-executed renovations that add square footage, improve functionality, and enhance aesthetic appeal can result in a higher appraised value.”

The lender will request a property appraisal to ascertain your asset’s current market value, revealing how much equity you possess and influencing your rates. Additionally, it’s worth noting that it is $49,000 cheaper on average to renovate an existing home than to buy a new one, making renovations a financially sound choice. We’re here to support you every step of the way as you navigate these important decisions.

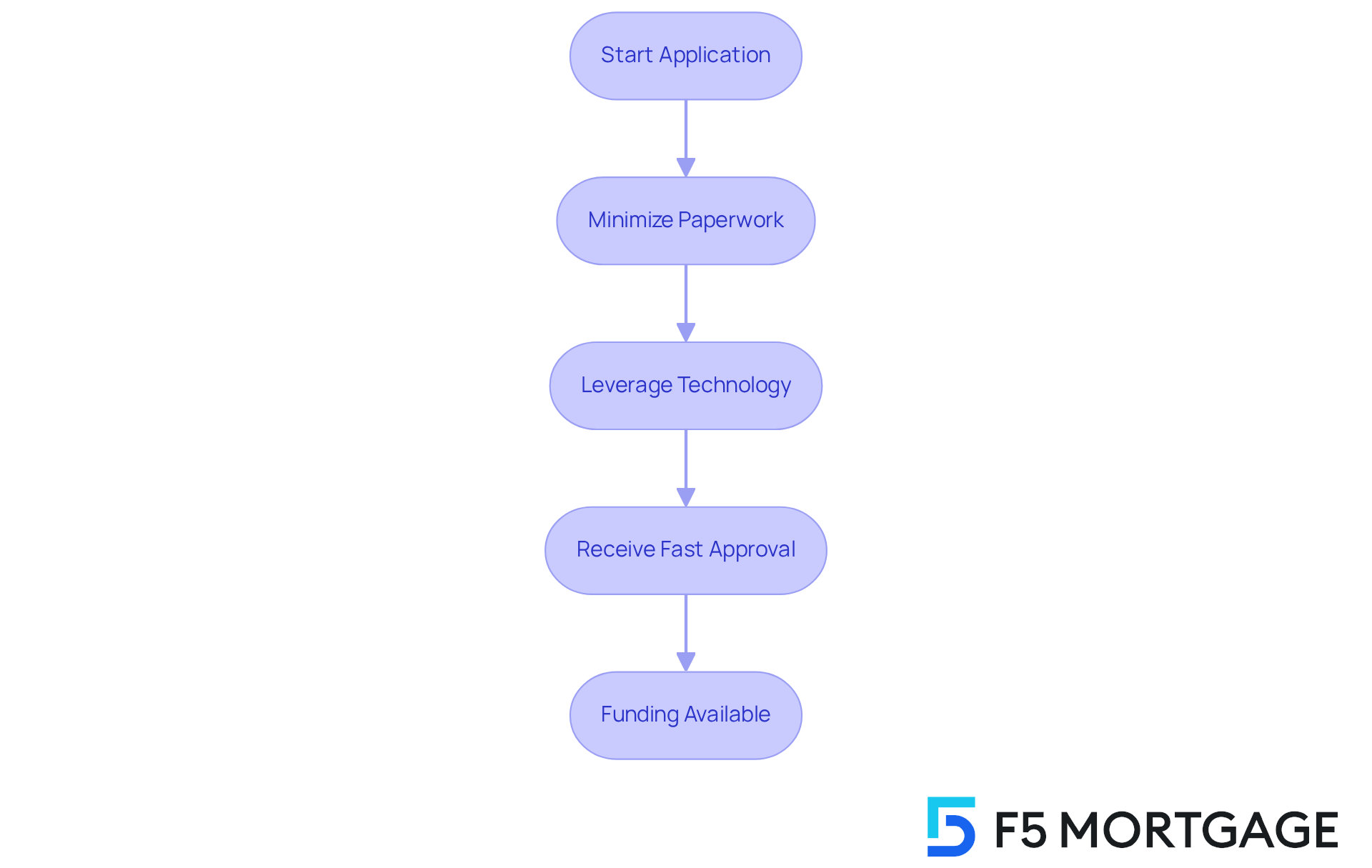

Streamlined Application Process for First-Lien HELOCs

At F5 Mortgage, we understand how important it is for homeowners to access funds quickly and efficiently. That’s why we excel in providing a streamlined application process for a 1st lien HELOC. Imagine being able to start your renovations without unnecessary delays—our average time for HELOC approvals has significantly decreased. Some lenders even offer same-day approvals, with funding available within five to seven days. This rapid turnaround is crucial for families eager to enhance their homes.

We know how challenging this can be, which is why we minimize paperwork and leverage technology to ensure a hassle-free experience for our applicants. Our automated systems and online applications simplify the process, making it easier for you to secure the financing you need for your property upgrades. Moreover, we’re here to support you every step of the way by linking you with leading realtors in your vicinity, further assisting your property upgrade journey.

This commitment to speed and simplicity positions F5 Mortgage as a caring leader in the competitive landscape of 1st lien HELOC lending. Let us help you turn your dreams into reality.

Quick Payoff Potential with First-Lien HELOCs

One of the significant advantages of first-lien HELOCs is the potential for quick payoff. We know how challenging it can be to manage debt, and homeowners can use their income and savings to make additional payments toward their HELOC balance. This approach not only reduces the principal faster than traditional mortgages but also alleviates interest expenses, paving the way to becoming debt-free with a 1st lien HELOC. For financially astute individuals, this strategy is quite appealing. With average HELOC rates around 8.05%, property owners can enjoy reduced interest expenses compared to credit cards, which often exceed 21%.

However, it’s important to note that HELOCs typically have variable rates, which may lead to unpredictable payments over time. Yet, the duration to settle a HELOC can often be significantly less than that of a conventional mortgage, especially when individuals proactively manage their payments and maintain healthy cash flow. Financial advisors emphasize that prioritizing extra payments on a 1st lien HELOC can significantly reduce one’s overall debt burden.

Consider this: refinancing $50,000 in credit card debt at a 22% interest rate to a HELOC at 10% could save approximately $6,000 annually in interest. This highlights the financial advantages of utilizing a 1st lien HELOC strategy. Furthermore, understanding the costs associated with refinancing in California—typically ranging from 2% to 5% of the loan amount—can empower property owners to make informed decisions.

The breakdown of refinancing costs includes:

- Application fees (between $75 and $500)

- Origination fees (0.5% to 1.5% of the loan amount)

- Appraisal fees (around $300 to $500)

- Title search and insurance (0.5% to 1% of the loan amount)

Calculating the break-even point after refinancing can also provide clarity on how long it will take to recoup those costs through savings in monthly payments. To maximize these benefits, we encourage property owners to consult a tax professional regarding potential tax advantages of using HELOC funds for improvements. We’re here to support you every step of the way.

Financial Empowerment Through First-Lien HELOCs

1st lien heloc empower property owners by unlocking the potential of their home equity. This enables them to make strategic monetary decisions that can significantly impact their lives. We know how challenging it can be to navigate financial options, and by utilizing this resource, property owners can finance renovations, consolidate debt, or effectively manage cash flow.

Refinancing a mortgage in California can be an essential step in this journey. It allows homeowners to swap their existing mortgage for new terms that better align with their monetary objectives. The refinancing procedure typically includes:

- Evaluating your current mortgage

- Establishing your financial goals

- Collecting necessary documentation

- Applying for a new loan

This monetary adaptability not only enables homeowners to take charge of their economic futures but also enhances the value of their most important asset—property.

Money coaches often stress the significance of using home equity wisely. One insightful coach states, ‘Leveraging your home equity can be a game-changer for economic stability and growth.’ As homeowners navigate their financial journeys, 1st lien helocs serve as a vital resource for enhancing their financial stability and achieving their aspirations. This is particularly true for self-employed borrowers and small business owners who may benefit from the flexibility these products offer.

We’re here to support you every step of the way as you explore these options. Remember, you have the power to make informed decisions that can lead to a more secure financial future.

Conclusion

1st lien HELOCs offer a wonderful opportunity for homeowners who want to enhance their properties while managing their finances effectively. By tapping into home equity, property owners can access flexible funding options tailored to their renovation needs. This approach not only helps in consolidating debt but may also provide tax deductions, all while enjoying lower interest rates compared to traditional loans. This financial tool empowers homeowners to make strategic upgrades and positions them to significantly increase their property value.

The article highlights several key advantages of utilizing a 1st lien HELOC:

- You can access funds as needed.

- Benefit from potential tax-deductible interest payments.

- Experience a streamlined application process that minimizes delays.

- Consolidating high-interest debts into a single, lower-rate HELOC can lead to substantial savings and improved financial management.

These insights remind us of the importance of making informed decisions when considering home equity options.

Ultimately, embracing the potential of a 1st lien HELOC can transform your financial future. We encourage homeowners to explore this financing avenue not only for immediate renovations but also for long-term economic stability and growth. By understanding the benefits and carefully navigating the associated risks, property owners can unlock the full potential of their home equity, leading to a more secure and empowered financial journey. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage’s approach to 1st lien HELOCs?

F5 Mortgage provides personalized consultations to guide clients through the complexities of 1st lien HELOCs, creating customized solutions based on individual financial situations to empower families in making informed equity choices.

How does a 1st lien HELOC benefit property owners?

A 1st lien HELOC offers flexible financing for home improvements, allowing property owners to withdraw funds as needed rather than requiring a lump sum payment. This flexibility helps manage cash flow efficiently during renovation projects.

What are the typical draw periods for a 1st lien HELOC?

The draw period for a 1st lien HELOC typically ranges from three to ten years, providing property owners with sufficient time to complete their projects.

What is the current prime rate and how does it affect borrowing costs for HELOCs?

The current prime rate is 7.5%, which affects the borrowing costs associated with home equity lines of credit, making it important for homeowners to understand these costs when considering a HELOC.

Can interest payments on a 1st lien HELOC be tax-deductible?

Yes, interest payments on a 1st lien HELOC can be tax-deductible if the funds are used for qualifying projects, such as major renovations that enhance the property’s value.

What should homeowners be aware of regarding early repayment of HELOC funds?

Homeowners should be cautious of potential penalties for early repayment of excess funds, as this can impact their overall financial strategy.

What trends are emerging among property owners regarding renovations and HELOCs?

Approximately 67% of property owners prefer renovating their current residence over purchasing a new one, indicating a growing trend towards utilizing HELOCs for home enhancements.